The structural impact of the shift from defined benefits to defined contributions

Published as part of the ECB Economic Bulletin, Issue 5/2021.

Retirement provision in euro area countries typically consists of three pillars: government sponsored pay-as-you-go plans (pillar 1), occupational (funded) pension schemes (pillar 2) and private pensions/life insurance (pillar 3). The latter two receive contributions from either employers or employees, providing an important supplement to pillar 1 in some euro area countries, notably the Netherlands, where occupational pension fund assets exceed 200% of GDP.

With over €10 trillion of total assets, the portfolio allocation of insurance corporations and occupational pension funds (ICPFs) can have a significant impact on financial markets. This box focuses on occupational pension funds and life insurers, as these play an important role in providing long term capital to the economy and contribute to the development of capital markets as a whole.[1] Of the two, the life insurance sector is larger, accounting for around 70% of assets under management.[2]

The secular decline in interest rates since the late 1980s could leave a lasting footprint on the structure of the financial system through ICPFs’ move towards defined contribution (DC) products. In DC pension fund schemes and unit-linked life insurance products, returns are not guaranteed and the investment risk is borne by the policyholders. By contrast, the traditional type of ICPF products – defined benefit (DB) pension fund schemes and guaranteed life insurance products – promise fixed future pay-outs to policyholders.[3] The present value of future pay-outs is calculated on the basis of discount rates, which are typically derived from market rates. Lower rates lead to higher present values, while increases in the present value of liabilities are usually only partially offset by increases in asset values. The decline in rates over the past decades poses challenges to ICPFs and may have contributed to their shift towards DC products (Chart A, panel a).[4] This shift is likely to continue, notably as Dutch pension funds – the largest in the euro area – are expected to fully move to a DC scheme by 2027 (striped area, Chart A, panel b).[5] This box discusses the potential impact of such a transition on yield curves and the structure of the financial system.[6]

Chart A

Decline ininterest rates since the mid-1980s; ICPF shift from DB to DC products

a) Interest rates

(percentages)

b) Size of DB and DC liabilities

(percentages)

Source: OECD (2021), Main Economic Indicators - complete database; European Insurance and Occupational Pensions Authority, pension fund balance sheet data, ECB calculations.

Notes: The striped part refers to Dutch DB schemes, which are expected to fully move to DC schemes by 2027. Hybrid pension products are included under DC products.

ICPFs with DB products on their balance sheets are exposed to interest rate risk owing to the negative duration gap. In DB products, ICPFs receive periodic payments (premia/contributions) from households and invest them in assets (e.g. bonds), while policyholders are promised pre-defined pay-outs (benefits) at a later point in time. The present value of both ICPF assets and liabilities increases when interest rates (discount rates) fall. This sensitivity to interest rates, also called duration, tends to be greater on the liability side than on the asset side, resulting in a negative “duration gap”. Therefore, the financial position of ICPFs with a negative duration gap weakens when interest rates fall along the maturity spectrum.

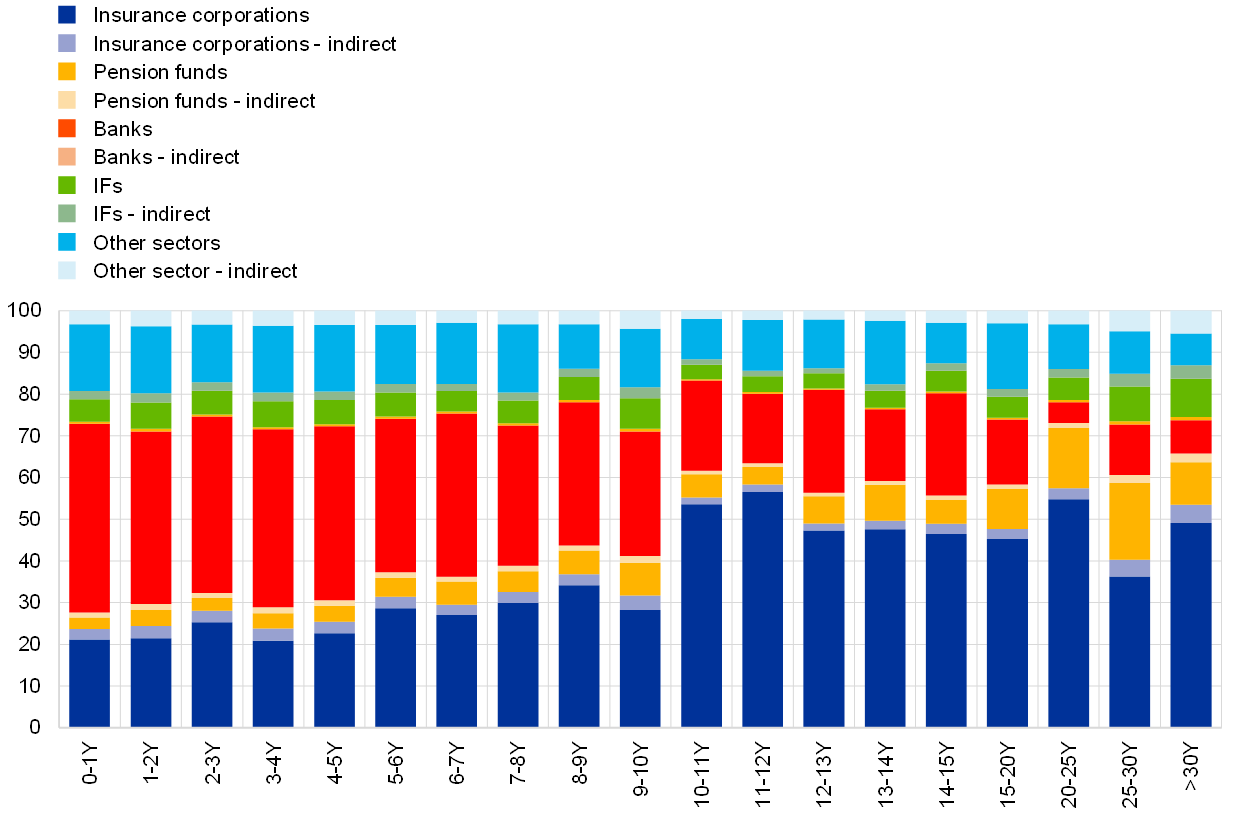

If ICPFs want to reduce their negative duration gap, they can increase the duration of their assets.[7] This can be done through purchases of long-duration bonds or by entering into interest rate swaps (swap overlay) whereby they receive a fixed rate and pay a floating rate.[8] As a result, ICPFs are major players in the market for both long-duration government bonds and receive-fixed interest rate swaps. Specifically, at the longer end of the maturity spectrum, ICPFs’ holdings account for up to two-thirds of all euro area holdings of government bonds and almost half of the receive-fixed interest rate swaps, the majority of which are held by Dutch pension funds (Chart B).

Chart B

ICPFs in long maturity segments of bond and interest rate swap markets

a) Euro area government bond holdings: breakdown by sector and maturity buckets

(percentages; Q4 2020)

b) Euro area interest rate swap market shares by maturity buckets

(EUR trillions; percentages; Q4 2020)

Source: EMIR data, Securities Holdings Statistics, ECB calculations.

Notes: Panel a): Foreign and Eurosystem holdings are not included. Indirect holdings are estimated as the holdings of euro area investment fund (IF) shares, through which investment is channelled into euro area government bonds. The portfolio allocation to government bonds is based on an overall portfolio allocation of the euro area investment fund sector, owing to the unavailability of granular data for individual euro area sectors. Panel b): The reference date is 18 December 2020. Data reflect the notional outstanding for receive-fixed interest rate swaps. Exposures are netted for each institution for each maturity bucket. Central counterparties are excluded.

ICPFs can also accept a certain amount of interest rate risk, as closing the duration gap could come at the expense of profitability. ICs have increased their investments in riskier asset classes such as equities, real estate and alternative assets,[9] which can boost their investment income. Insurers’ median return on common equity has only declined mildly in recent years, despite ICs’ challenges in the current environment, and continues to hover around 8% (Chart C). More recently, the positive sentiment on stock markets that started to resurface in November 2020 boosted insurance stock prices.[10]

Chart C

Insurers’ return on common equity and exposures to riskier asset classes

(percentages)

Source: Bloomberg L.P., European Insurance and Occupational Pensions Authority, ECB calculations.

Notes: The return on common equity (ROCE) is based on a sample of up to 25 large euro area insurers offering life and non-life products. Equity and real estate exposures consider the whole euro area insurance sector. Exposures are in percentage of total assets and are available only from Q4 2017 due to data availability limitation from the EIOPA exposure data.

Alternatively, ICPFs can reduce the negative duration gap by changing their liability structure. In particular, they can increase the share of products with lower or no guaranteed returns – such as in the case of DC pension schemes and unit-linked insurance products. Insurance corporations offered more of these products and there has been a gradual trend in this direction (Chart A, panel b), whereby the stock of liabilities adjusts more slowly than new premiums written (which is a flow variable).[11] Occupational pension funds can also adapt, but less flexibly, since the nature of a pension system is often anchored in law.[12]

The largest occupational pension fund system in the euro area – the Dutch pension fund system – is expected to transition to a DC scheme. The Dutch pension fund sector currently operates under a DB scheme and is by far the largest in the euro area, with over €1.7 trillion of assets under management. In 2019, a landmark agreement for a new system was reached. The plan stipulates that the system will no longer be based on defined benefits. The new system is expected to enter into force by 2023, with a transition period ending in 2027. With the transition of Dutch pension funds, the share of DC pension fund schemes in the euro area is expected to increase from around 17% to 77% (Chart A, panel b).

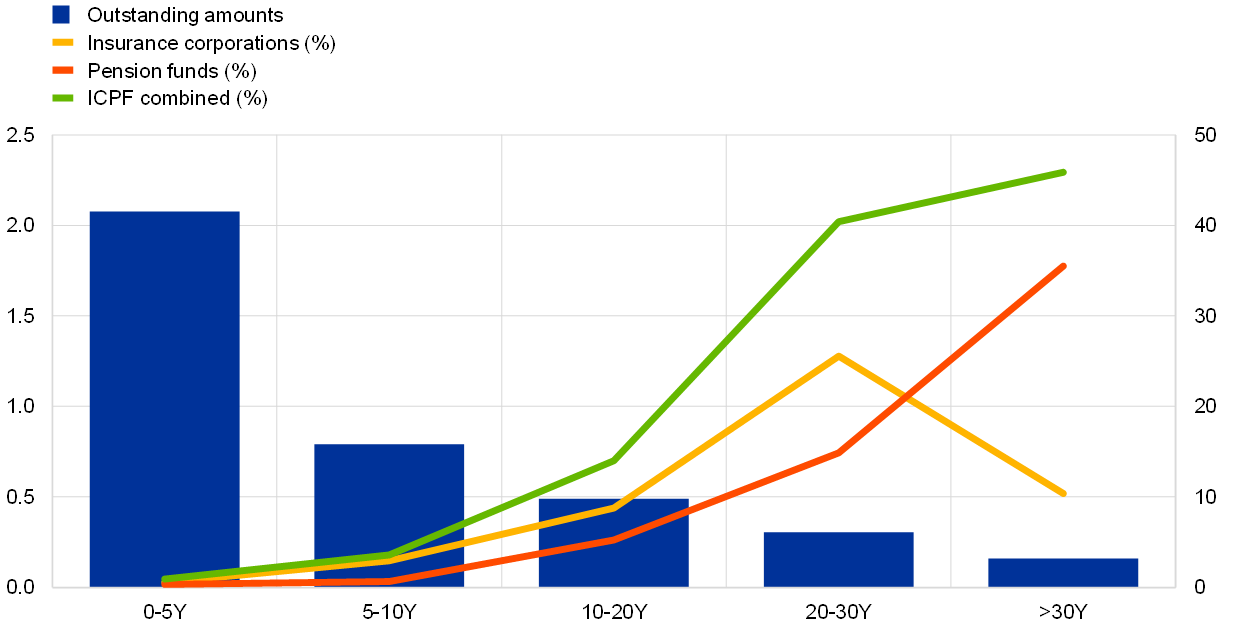

The DB to DC transition can alter the demand for certain asset classes as the two schemes have different risk and investment profiles. Most importantly, certain regulatory constraints are more binding for DB schemes, and this affects the portfolio allocation.[13] DB schemes face a lower bound on their expected returns through statutory minimum funding ratios, and face interest rate risk exposure through their liabilities. This offers them more incentive to reduce negative duration gaps.[14] Therefore, fixed income portfolios linked to DB products tend to have longer maturities (Chart D, panel a). In addition, portfolios tied to DB products are underweight equities, while the opposite is true of portfolios related to DC products (Chart D, panel b). Portfolios linked to DC products also show a strikingly large allocation to investment fund shares.

Chart D

DB-type products are overweight long-term debt securities; DC-type products are heavily invested in equity and investment fund shares

a) Maturity of ICPFs’ government bond portfolios and share of DB products – country level

(percentages; years; Q4 2020)

b) ICPFs’ portfolio mix by type of product: DB versus DC products

(percentages; Q4 2020)

Source: EIOPA data, Securities Holdings Statistics, insurance company and pension fund balance sheet data, ECB calculations.

Notes: Panel a): Defined benefit type liabilities for insurance corporations include only non-unit-linked life insurance as a percentage of the total liabilities. Panel b): Asset class exposures are calculated using the look-through approach. Specifically, debt securities include government bonds and corporate bonds. Other fund shares include all shares that are not debt or equity fund shares.

In particular, a shift towards DC products could structurally lower the demand for long-duration bonds and swaps. According to the preferred-habitat model,[15] the preference of market participants for certain maturity segments has an impact on the shape of the yield curve. Empirical evidence provides support for ICPFs’ preferred-habitat demand for long-duration bonds. First, spreads between 30-year and 10-year government bond yields were found to be negatively related to the ratio of ICPFs’ assets to GDP.[16] Second, the impact of past changes to ICPF regulatory regimes further points to this preferred-habitat demand. The incentive to adopt duration-matching strategies is stronger when they are valued under market-based reference rates.[17] Shifts towards market-based reference rates tended to be associated with the flattening and inversions of yield curves, as was the case with the UK pension fund reform of 2004.[18] Conversely, temporary decoupling between market rates and reference rates led to sell-offs in the underlying market. This empirical evidence suggests that a shift towards DC products could lead to yield curve steepening.

The dynamics of yield curves can also be affected. An ICPF’s negative duration gap typically widens when interest rates decline owing to the negative convexity of the balance sheet. Negative convexity arises mostly due to a size effect: the amount of interest-bearing assets tends to be a fraction of the total liabilities. Moreover, the (longer) duration of the liabilities reacts more to a decline in rates than the (shorter) duration of the assets. To counter the widening of the duration gap, ICPFs can further increase their exposure to long-duration bonds and swaps when interest rates decline. This “hedging demand” can effectively amplify shocks to rates.[19] In a world of DC products, this amplification mechanism could become weaker.

A shift towards DC products could also boost equity financing and support further growth of the investment fund sector. The larger equity allocation for unit-linked products suggests that a shift towards DC products could increase the demand for equities. Such a shift would be in line with the capital markets union 2020 action plan, which aims to encourage institutional investors to invest more in equity financing. Furthermore, a continued shift towards unit-linked products could bolster the importance of the investment fund sector and increase the interconnectedness between non-bank financial institutions.

The structural change is also shifting investment risk from ICPFs to households. Under DC schemes, the build-up of retirement savings depends more directly on the performance of markets and ultimately on the performance of the economy. Therefore, households’ retirement savings can become more uncertain, and retirement income could be more unequally distributed.[20]

- See Scharfstein, D. S., “Presidential Address: Pension Policy and the Financial System”, Journal of Finance, Volume 73, Issue 4, 2018.

- According to the ECB’s insurance corporations’ and pension funds’ balance sheet data, as of Q4 2020, the total assets held by euro area ICPFs amounted to €12.2 trillion, but this includes €1.3 trillion of assets held by non-life insurers and €0.7 trillion held by reinsurers, which are outside the scope of this box.

- For simplicity, this box sometimes uses the terms DB and DC products to refer to non-unit-linked and unit-linked/index-linked life insurance products respectively. Similarly, no distinction is made between unit- and index-linked products and they are sometimes referred to as unit-linked products only.

- The impact of declining interest rates on the ICPF sector is discussed in a number of sources including Holsboer, J., “The Impact of Low Interest Rates on Insurers”, The Geneva Papers on Risk and Insurance - Issues and Practice, Volume 25, 2000, pp. 38-58; Berdin, E., Kok, C., Mikkonen, K., Pancaro, C. and Vendrell Simon, J. M., “Euro area insurers and the low interest rate environment”, Special Feature B, Financial Stability Review, ECB, November 2015; European Systemic Risk Board, “Lower for longer - macroprudential policy issues arising from the low interest rate environment”, June 2021.

- See Parliamentary Paper 32043 No 457 on the Future of the Pension System (in Dutch), 5 June 2019. More structure was given to the plan in 2020. See Parliamentary Letter on the Implementation of the Pension Agreement (in Dutch), 6 July 2020.

- The potential impact is considered based on all other things being equal, i.e. regardless of other developments such as the phasing out of transitional measures under Solvency II or possible changes to regulatory curves. Some of these developments may provide further incentives to shift towards DC products at an accelerated pace.

- ICPFs’ portfolio allocation decisions take into account many factors, including interest rate risk. To boost investment income, ICPFs tend to increase their allocations to riskier assets, including equities.

- The use of interest rate swaps does not require an upfront investment and is particularly attractive for underfunded schemes. See Klingler, S. and Sundaresan, S., “An Explanation of Negative Swap Spreads: Demand for Duration from Underfunded Pension Plans”, BIS Working Papers, No 705, 2018.

- Fache Rousová, L. and Giuzio, M., “Insurers’ investment in alternative assets”, Box 9, Financial Stability Review, ECB, May 2019.

- Chapter 4, Financial Stability Review, ECB, May 2021.

- See Bank for International Settlements, “Fixed income strategies of insurance companies and pension funds”, CGFS Papers, No 44, July 2011. See also European Insurance and Occupational Pensions Authority (EIOPA), “Impact of Ultra Low Yields on the Insurance Sector, Including First Effects of Covid-19 Crisis”, 17 July 2020.

- In addition to a move from DB to DC products, pension funds can also be mandated or instructed by regulatory bodies to increase their premia/contributions, suspend inflation indexation or cut benefits.

- In addition, compared to individual households, ICPFs benefit from efficiencies due to the pooling of risks across and within generations, but this risk pooling is possibly less efficient for DC products. See also Bodie, Z., Marcus, A.J. and Merton, R.C., “Defined Benefit versus Defined Contribution Pension Plans: What are the Real Trade-offs?”, in Bodie, Z., Shoven, J.B. and Wise, D.A., eds., “Pensions in the U.S. Economy”, University of Chicago Press, 1988.

- Incentives of this kind are particularly present for DB schemes and insurers operating under market-based regimes, where the valuation of assets and liabilities is linked to market rates.

- For a term structure implementation of the preferred-habitat model, see Culbertson, J.M., “The Term Structure of Interest Rates,” The Quarterly Journal of Economics, 1957, Volume 71, Issue 4, pp. 485-517; Modigliani, F. and Sutch, R., “Innovations in Interest Rate Policy” The American Economic Review, Volume 56, No 1/2, 1966, pp. 178-197; Vayanos, D. and Vila, J-L., “A Preferred‐Habitat Model of the Term Structure of Interest Rates”, Econometrica, Volume 89, Issue 1, 2021, pp. 77-112.

- See Greenwood, R and Vissing-Jorgensen, A., “The Impact of Pensions and Insurance on Global Yield Curves”, Harvard Business School, Working Paper 18-109, 2018.

- Under fully market-based reference rates, an ICPF could theoretically eliminate its interest rate risk by duplicating the maturity structure of its liabilities by investing in the market instruments that form the constituents of the reference curve.

- See Greenwood, R. and Vayanos, D., “Price Pressure in the Government Bond Market”, The American Economic Review, Volume 100, No 2, 2010.

- Evidence from the German insurance sector is found to be consistent with such an amplification mechanism. See Domanski, D., Hyun Song Shin and Sushko, V., “The Hunt for Duration: Not Waving but Drowning?”, IMF Economic Review, Volume 65, 2017, pp. 113-153.

- Piirits, M. and Võrk, A., “The effects on intra-generational inequality of introducing a funded pension scheme: A microsimulation analysis for Estonia”, International Social Security Review, Volume 72, Issue 1, 2019, pp. 33-57.