Published as part of the ECB Economic Bulletin, Issue 3/2022.

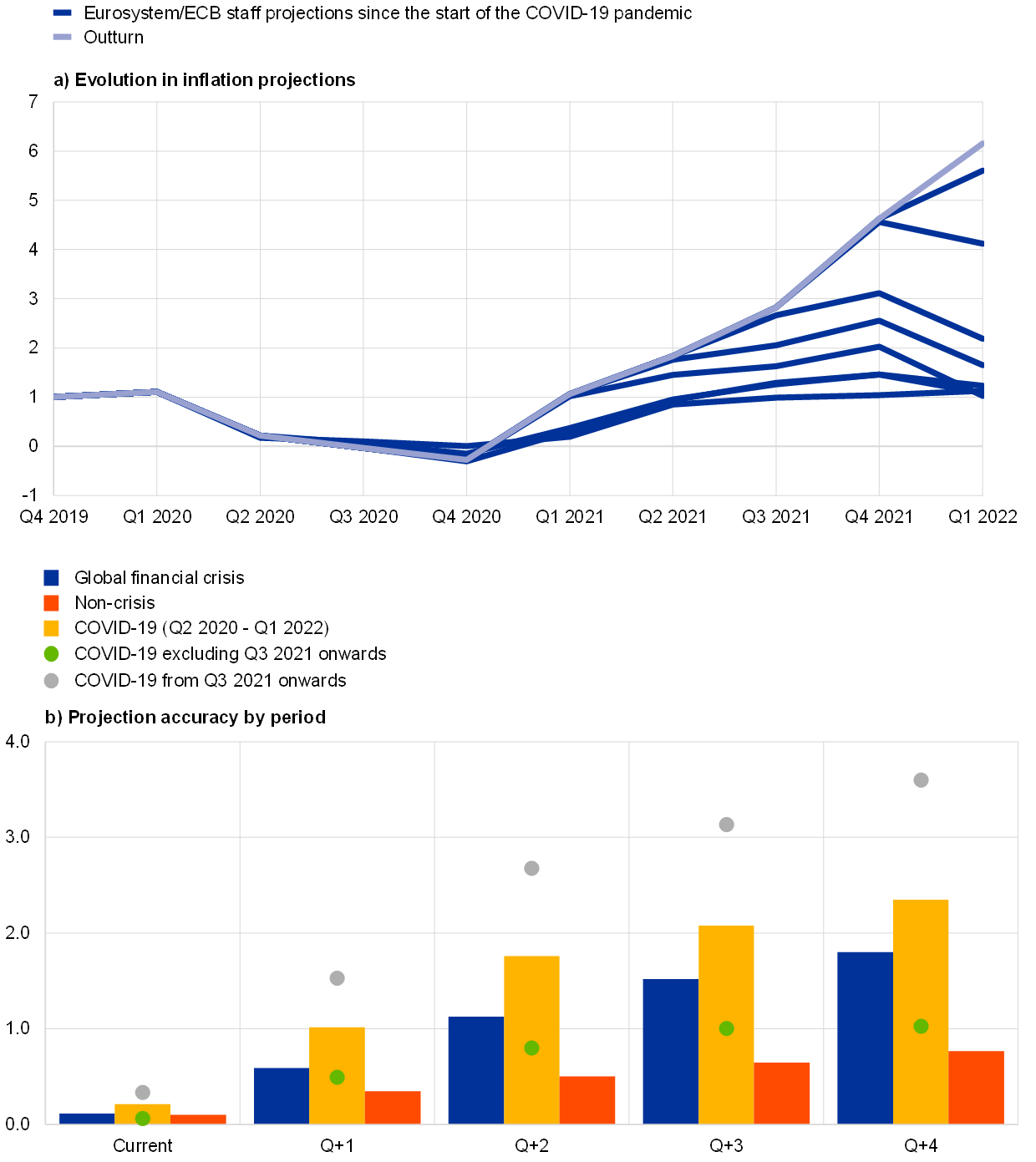

Recent projections by Eurosystem and ECB staff have substantially underestimated the surge in inflation, largely due to exceptional developments such as unprecedented energy price dynamics and supply bottlenecks. Although headline HICP inflation projections for 2020 were fairly accurate despite the emergence of the coronavirus (COVID-19) pandemic, some underestimation began to occur in the first quarter of 2021, and this has become more pronounced since the third quarter of 2021. The underestimate for the first quarter of 2022 marked the largest one-quarter-ahead error for inflation since the first staff projections in 1998 – a 2.0 percentage point difference between the outturn and the December 2021 projection (Chart A, panel a). The accuracy of HICP projections, measured by the root mean squared forecast error, has declined significantly during the COVID-19 crisis (Chart A, panel b), although up to the second quarter of 2021 (green dots) the projections were still, on average, more accurate than those made during the global financial crisis, despite that period seeing smaller fluctuations in activity than during the COVID-19 period. The deterioration of projection accuracy has mainly occurred since the third quarter of 2021, when unexpected developments in energy prices, coupled with both the effects of reopening following the removal of coronavirus-related restrictions and the effects of global supply bottlenecks, led to unprecedented increases in HICP inflation (grey dots).

Chart A

Evolution and accuracy of recent HICP inflation projections

(panel a): annual percentage change; panel b): root mean squared forecast error in percentage points)

Sources: Eurostat, and Eurosystem/ECB staff macroeconomic projections for the euro area.

Notes: In panel a) the dark blue lines refer to the projections successively published between June 2020 and March 2022. In panel b) the x-axis refers to projection horizons; “Non-crisis” covers the period from the fourth quarter of 1999 to the first quarter of 2008 and the period from the first quarter of 2014 to the first quarter of 2020, “Global financial crisis” covers the period from the second quarter of 2008 to the fourth quarter of 2009, and “COVID-19” covers the period from the second quarter of 2020 to the first quarter of 2022; periods are identified based on the work of the Euro Area Business Cycle Network.

Inflation projections throughout 2021 and the first quarter of 2022 were conducted in the midst of skyrocketing energy prices. Wholesale prices for gas and electricity and crude oil prices all reached exceptionally high annual growth rates over recent quarters (Chart B, panel a). For wholesale gas and electricity prices in particular, annual growth rates in the fourth quarter of 2021 (540% and 390% respectively) were around four times their previous maximum during the period from 2005 to 2020, and all observations since the second quarter of 2021 were well above all previous historical values. Russia’s invasion of Ukraine caused energy commodity prices to increase even further in the first quarter of 2022. In Eurosystem and ECB staff projections, assumptions for energy commodity prices are set according to market-based futures, which is common practice across central banks and international institutions.[1] The exceptional increase in energy prices was largely unanticipated by market participants (Chart B, panel b).

Chart B

Developments in energy commodity prices

(panel a): annual percentage changes; panel b): USD per barrel)

Sources: Eurostat, Bloomberg, Refinitiv, and Fraunhofer ISE.

Notes: In panel a) box plots refer to distributions between the second quarter of 2005 and the first quarter of 2021, boxes span from the first to the third quartile and horizontal dashes represent minimum and maximum values; wholesale electricity prices are a weighted average (using electricity generation as weights) of prices in the “big five” euro area markets. In panel b) the dark blue lines refer to the assumptions used in the projections successively published between June 2020 and March 2022. Oil prices refer to the price of Brent crude. Data are shown at quarterly frequency.

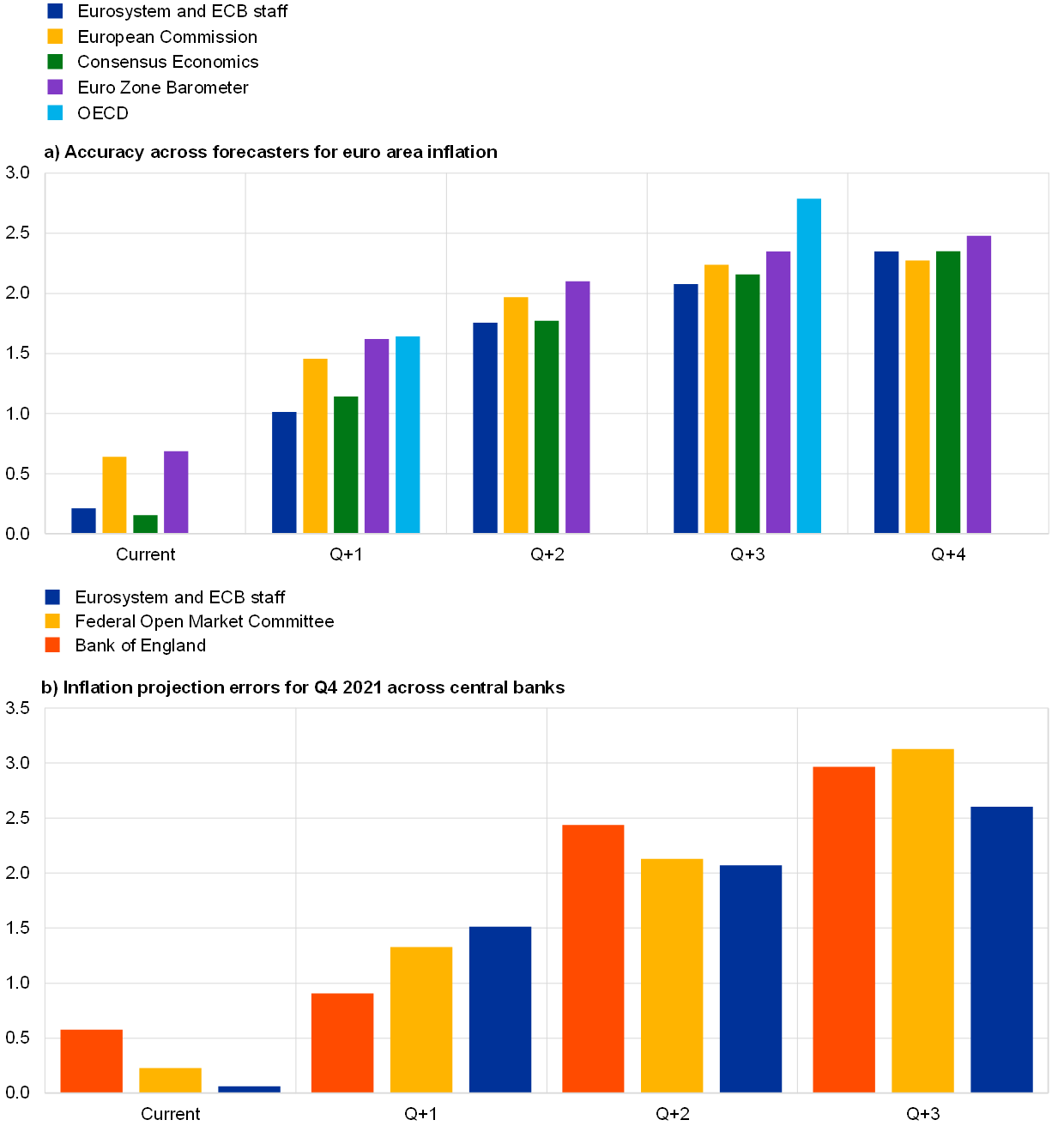

International institutions and private forecasters have recently made similarly large errors in their projections for euro area inflation. On average over the COVID-19 period, the accuracy of inflation forecasts has been comparable across forecasters (Chart C, panel a). With respect to 2021 and the first quarter of 2022, all forecasters significantly underestimated inflation. This illustrates the significant challenges in forecasting inflation in a period characterised by extreme volatility in economic developments, and in energy commodity prices in particular. Eurosystem and ECB staff underperformed some other forecasters in projecting HICP inflation for the first quarter of 2021, but the relative performance of the Eurosystem and ECB staff projections increased for the remaining quarters of 2021 and the first quarter of 2022.

The accuracy of Eurosystem and ECB staff projections for headline inflation is similar to that of the projections published by the Federal Open Market Committee and the Bank of England for their own economies. Chart C, panel b compares four projection vintages published in 2021 and reports errors for inflation in the fourth quarter of 2021 – a period when inflation surprises were significant. Eurosystem and ECB staff projections and the Federal Open Market Committee projections have a small information advantage over the Bank of England projections, as their later cut-off dates generally allow them to have one more monthly observation of inflation available. The surge in headline inflation across economies in 2021 was not foreseen by any of the central banks, and the large errors made for the fourth quarter were broadly comparable.[2]

Chart C

Comparative accuracy of Eurosystem and ECB staff projections for inflation since the start of the COVID-19 period

(panel a): root mean squared forecast error in percentage points; panel b): percentage points)

Sources: Both panels – ECB and Eurosystem staff macroeconomic projections for the euro area and ECB staff calculations. Panel a) – Consensus Economics, European Commission, Euro Zone Barometer, OECD and Eurostat. Panel b) – ECB, Federal Open Market Committee and Bank of England.

Notes: The COVID-19 period relates to projections for the second quarter of 2020 to the first quarter of 2022. Panel a) – for the monthly Euro Zone Barometer, the survey closest to the Eurosystem/ECB staff cut-off date is used for each quarter. For the OECD, projections at current quarter, Q+2, and Q+4 are not included due to comparability issues. Panel b) – a projection error is defined as the outturn minus the projection. The median inflation projections are reported for the FOMC.

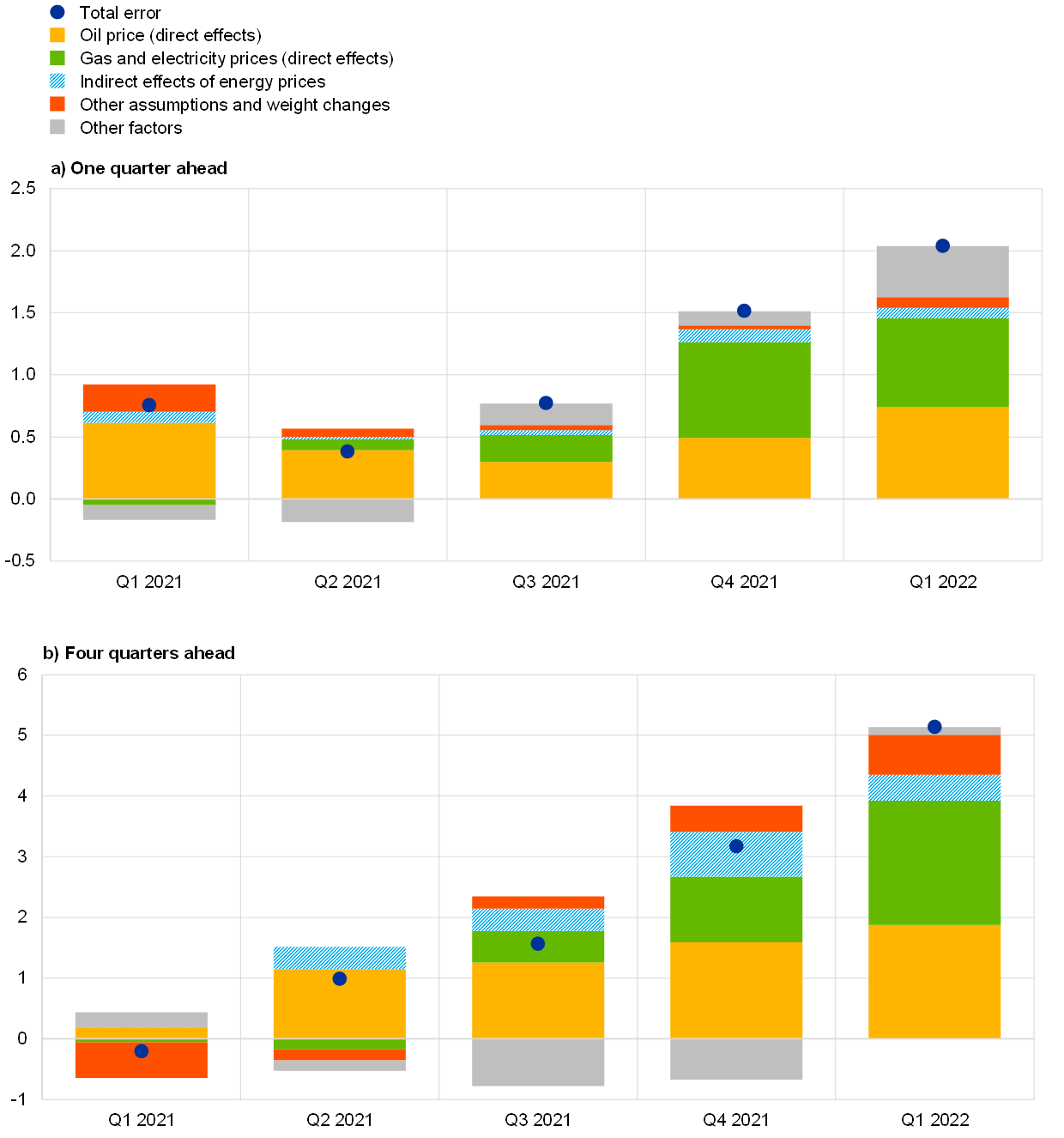

Errors in the conditioning assumptions, particularly for energy prices, explain about three-quarters of the recent Eurosystem and ECB staff projection errors for inflation, on average (Chart D). As mentioned above, these projections are, by design, conditional on a set of assumptions for commodity prices as well as on exchange rates and interest rates that, in most cases, originate from financial market data. Oil price assumption errors have been the most regular and prominent contributor to inflation errors (yellow bars), in particular for longer horizons. At the same time, the underestimation of gas and electricity price rises – in the context of a historically unprecedented decoupling of oil and gas prices – explains most of the errors for short horizons from the third quarter of 2021 onwards (green bars).[3] These errors might also relate to the swifter than expected pass-through from wholesale to consumer energy prices, as is suggested by the recent surge in the correlation between contemporaneous gas prices for the wholesale and consumer markets.[4] For electricity, wholesale prices were passed on to consumers almost immediately in some countries, despite this pass-through historically having taken three to twelve months.[5] In addition to their direct impact on consumer prices for energy, these assumption errors have also had indirect effects on the projections for non-energy inflation (shaded blue bars). Aside from energy, the fact that both inflation and the recovery in economic activity in the euro area’s main trading partners were stronger than expected also contributed to the errors, notably for the four-quarter-ahead horizon (red bars). Overall, technical assumptions and the related energy inflation errors played an important role in recent inflation underestimations. This is particularly true for the one-quarter-ahead horizon where, in absolute terms, these errors contributed 1.6 percentage points to the overall error in the first quarter of 2022 – a historic high. In comparison, their impact was usually more subdued in the pre-COVID-19 period (0.2 percentage points in absolute terms).

Chart D

Decomposition of HICP projection errors at different horizons

(percentage points)

Source: ECB calculations based on elasticities derived from the macroeconomic models used to produce the Eurosystem staff macroeconomic projections for the euro area.

Notes: “Total error” is the outturn minus the projection. “One quarter ahead” and “Four quarters ahead” refer to the projection horizon, e.g. the one quarter ahead projection error for Q1 2021 represents the error made in the December 2020 Eurosystem staff projections in projecting inflation for the first quarter of 2021. “Other assumptions and weight changes” represents the assumptions for short and long-term interest rates, stock market prices, foreign demand, competitors’ export prices, food prices and the exchange rate, as well as the effect of changes in HICP weights. “Gas and electricity prices (direct effects)” is the error in estimating energy inflation that is not explained by the impact of oil and exchange rate errors. “Indirect effects of energy prices” is the sum of the indirect effects of oil, gas and electricity prices (for oil, these are based on the elasticities derived from the Eurosystem staff macroeconomic models, and for gas and electricity these are computed assuming an elasticity proportional to the oil price shock).

Other factors that are likely to have contributed to the inflation projection errors include unanticipated effects from protracted supply bottlenecks and the reopening of the economy, lower than expected slack in the labour market, and the rise in energy prices possibly being transmitted more strongly than usual. These exceptional developments have been challenging to forecast. In particular, supply bottlenecks, which reflect both the rapid recovery in global demand for goods and supply chain disruptions, proved to be much tighter than anticipated, especially in the second half of 2021.[6] For non-energy industrial goods inflation, ECB staff simulations suggest that supply bottlenecks were a major contribution to its dynamics (about 0.5 percentage points in the second half of 2021).[7] Errors in services inflation were mainly driven by stronger than expected price increases in contact-intensive sectors following the reopening of the economy. However, the rise in services prices was broad-based, with upward pressures also emerging in some less-contact-intensive sectors (e.g. maintenance and repair of the dwelling, and communication). A further factor likely also relates to lower than expected slack in the labour market, as the projections for unemployment were successively revised downward over this period. This partly reflects the successive upward revisions to real GDP projections between late 2020 and late 2021. The underpredictions of GDP growth are, however, estimated to have contributed only marginally to errors in forecasting HICP inflation excluding energy and food. Finally, the stronger than usual transmission of energy commodity prices to non-energy inflation might have induced higher indirect effects than the rather muted model-based estimates shown in the shaded blue bars in Chart D.[8] The uncertainty surrounding the elasticities used to assess the model-based impact should be generally acknowledged, but in the case of the indirect effect of energy commodity prices underestimation could possibly stem from strong non-linearities in the context of record price hikes and limited scope for companies to absorb these increases given compressed margins.

Eurosystem and ECB staff regularly review the performance of their projections and adapt their set of assumptions and overall modelling processes to account for the most recent developments.[9] Errors are inherent to the nature of Eurosystem and ECB staff projections, which are conditioned on a set of assumptions, mainly stemming from market-based information including on energy prices. However, recent experience provides some guidance for further improvements to make the projections more robust. The set of technical assumptions used to condition the projections are regularly reviewed and are being modified. In particular, recent developments imply the need for a more detailed assessment of the energy market. This is taken into account by the recent inclusion of assumptions for wholesale gas and electricity prices, as well as for the EU Emissions Trading System.[10] Moreover, the staff models used for the projections are state of the art and continuously being refined. As has been the case with the COVID-19 period, the workhorse projection models are being complemented with special purpose satellite models to take into account specific shocks.[11] Nevertheless, the current context of volatile price movements in energy commodities, compounded by the uncertainty caused by the war in Ukraine and reopening effects following the removal of pandemic-related restrictions, means that inflation developments are likely to remain very challenging to forecast in the near term. In this context, complementing the Eurosystem and ECB staff baseline projections with scenario and sensitivity analyses can help provide a richer representation of the inflation outlook.[12]

Energy commodity price assumptions are set according to oil price futures in the projections by the IMF, European Commission and many central banks, including the Federal Reserve System and the Bank of Japan. An alternative approach (used by the OECD and the Reserve Bank of Australia) is to assume constant oil prices, while the Bank of England uses futures prices for the first six months followed by a constant oil price thereafter. Over the recent period, as oil price futures have suggested somewhat declining prices, a constant oil price assumption would have reduced the underestimations of inflation. Nevertheless, the size of the observed increase in oil prices implies that this reduction would have been minimal in relation to the size of the errors. To tackle the uncertainty surrounding the oil price assumptions, the Eurosystem and ECB staff projections are regularly complemented by sensitivity analyses showing the impact of alternative paths based on the risk-neutral option-implied densities for oil price futures, among other factors.

Owing to a lack of available data, we have omitted inflation projections by the Bank of Japan’s Policy Board members from this comparison, as these are published as annual averages and for fiscal years only. However, when considering inflation outturns published to date, the Bank of Japan’s projections seem to have overestimated inflation in the fiscal year 2021, which ended in March 2022. Consumer price inflation remained subdued in the fiscal year 2021 also due to sizeable cuts in mobile phone charges, which according to Bank of Japan estimates subtracted around 1.1 percentage points from inflation measured by the consumer price index excluding fresh food (see Bank of Japan, “Outlook for Economic Activity and Prices”, January 2022).

The complex setting of electricity prices across euro area countries also contributed to difficulties in forecasting consumer electricity prices. See Box 3 of “Eurosystem staff macroeconomic projections for the euro area, December 2021”, published on the ECB’s website on 16 December 2021.

The 24-month rolling correlation between the contemporaneous movements in the two series increased from 0.36, on average, between 2005 and 2021, to 0.92 in the second half of 2021.

See Task Force of the Monetary Policy Committee of the European System of Central Banks, “Energy markets and the euro area macroeconomy”, Occasional Paper Series, No 113, ECB, June 2010.

See, for instance: Lane, P.R., “Bottlenecks and monetary policy”, The ECB Blog, ECB, 10 February 2022; Panetta, F., “Patient monetary policy amid a rocky recovery”, speech at Sciences Po, Paris, 24 November 2021; and the boxes entitled “The semiconductor shortage and its implication for euro area trade, production and prices”, Economic Bulletin, Issue 4, ECB, 2021, and “The impact of supply bottlenecks on trade”, Economic Bulletin, Issue 6, ECB, 2021.

Non-energy industrial goods inflation averaged 2.1% during the same period. Estimations follow the approach in the box entitled “Supply chain disruptions and the effects on the global economy”, Economic Bulletin, Issue 8, ECB, 2021, using VAR models with non-energy industrial goods inflation, producer prices, industrial production, export and import volumes, and a PMI-based bottleneck proxy (estimated PMI supply shock and PMI supply delivery times indicator) that does not control for the effect of energy prices. However, the derived bottleneck effects could also be affected by oil price developments. Preliminary estimates suggest that the effect of bottlenecks is marginally lower when including (and conditioning on) oil prices.

The estimates of the impact of different assumptions on the projection errors for inflation are based on the models used to construct the Eurosystem staff projections. See the notes to Chart D for further details.

See, for instance, the article entitled “The performance of the Eurosystem/ECB staff macroeconomic projections since the financial crisis”, Economic Bulletin, Issue 8, ECB, 2019.

Until recently the close co-movement of oil and gas prices meant that a single assumption for oil was considered sufficient and the price of emissions permits implied little impact on overall inflation.

See, for instance, Work stream on Eurosystem modelling, “Review of macroeconomic modelling in the Eurosystem: current practices and scope for improvement”, Occasional Paper Series, No 267, ECB, September 2021. Further, in its climate change action plan, the ECB committed to accelerating the development of new models – as well as conducting theoretical and empirical analyses – aimed at monitoring the implications of climate change and related policies (see, for instance, “EU emissions allowance prices in the context of the ECB’s climate change action plan”, Economic Bulletin, Issue 6, ECB, 2021). In addition, satellite models have also been developed to address the impact of supply bottlenecks on the economy (see, for instance, the boxes entitled “What is driving the recent surge in shipping costs?”, Economic Bulletin, Issue 3, ECB, 2021, “Sources of supply chain disruptions and their impact on euro area manufacturing”, Economic Bulletin, Issue 8, ECB, 2021, and “Supply chain bottlenecks in the euro area and the United States: where do we stand?”, Economic Bulletin, Issue 2, ECB, 2022).

For a longer-term perspective, statistical tests covering all observations between 1999 and 2022 suggest that Eurosystem and ECB projections for both HICP headline inflation and HICP inflation excluding food and energy are unbiased, efficient and directionally accurate, and that these properties are not significantly affected by the large recent errors. Tests have been conducted following the methodology outlined in Kontogeorgos, G. and Lambrias, K., “An analysis of the Eurosystem/ECB projections”, Working Paper Series, No 2291, ECB, June 2019. Over such a long period, the results of these tests also relate, to some extent, to a past period of successive overpredictions of inflation, mostly between 2013 and 2016 (see “The performance of the Eurosystem/ECB staff macroeconomic projections since the financial crisis”, Economic Bulletin, Issue 8, ECB, 2019).