Economic, financial and monetary developments

Overview

Economic activity

The global economy remains on a recovery path, although persisting supply bottlenecks, rising commodity prices and the emergence of the Omicron variant of the coronavirus (COVID-19) continue to weigh on the near-term growth prospects. Recent surveys of economic activity suggest that growth momentum remained weak at the start of the fourth quarter, particularly in the manufacturing sector owing to the above-mentioned supply bottlenecks, whereas the services sector benefited from the reopening of large economies. Compared with the previous projections, the growth outlook for the global economy in the December 2021 Eurosystem staff macroeconomic projections has been revised downwards for 2021, remained unchanged for 2022 and been revised upwards for 2023. Global real GDP growth (excluding the euro area) is estimated to increase to 6.0% in 2021, before slowing to 4.5% in 2022, 3.9% in 2023 and 3.7% in 2024. Euro area foreign demand is projected to expand by 8.9% in 2021, 4.0% in 2022, 4.3% in 2023 and 3.9% in 2024. However, foreign demand has been revised downwards for 2021 and 2022 compared with the previous projections. This reflects the adverse impact of the ongoing supply bottlenecks on global imports. Supply bottlenecks are expected to start easing from the second quarter of 2022 and to fully unwind by 2023. The export prices of euro area competitors have been revised upwards for 2021 and 2022 amid the confluence of higher commodity prices, supply bottlenecks and recovering demand. The future course of the pandemic remains the key risk affecting the baseline projections for the global economy. Other risks to the growth outlook are judged to be tilted to the downside, whereas the balance of risks to global inflation is more uncertain.

The euro area economy continues to recover. Growth is moderating, but activity is expected to pick up again strongly in the course of this year. The continued economic recovery is foreseen to be driven by robust domestic demand. The labour market is improving, with more people having jobs and fewer in job retention schemes. This supports the prospect of rising household income and consumption. The savings built up during the pandemic will also support consumption. Economic activity moderated over the final quarter of last year and this slower growth is likely to extend into the early part of this year. We now expect output to exceed its pre-pandemic level in the first quarter of 2022. To cope with the current pandemic wave, some euro area countries have reintroduced tighter containment measures. This could delay the recovery, especially in travel, tourism, hospitality and entertainment. The pandemic is weighing on consumer and business confidence and the spread of new virus variants is creating extra uncertainty. In addition, rising energy costs are a headwind for consumption. Shortages of equipment, materials and labour in some sectors are hampering production of manufactured goods, causing delays in construction and slowing down the recovery in some parts of the services sector. These bottlenecks will persist for some time, but they should ease during 2022.

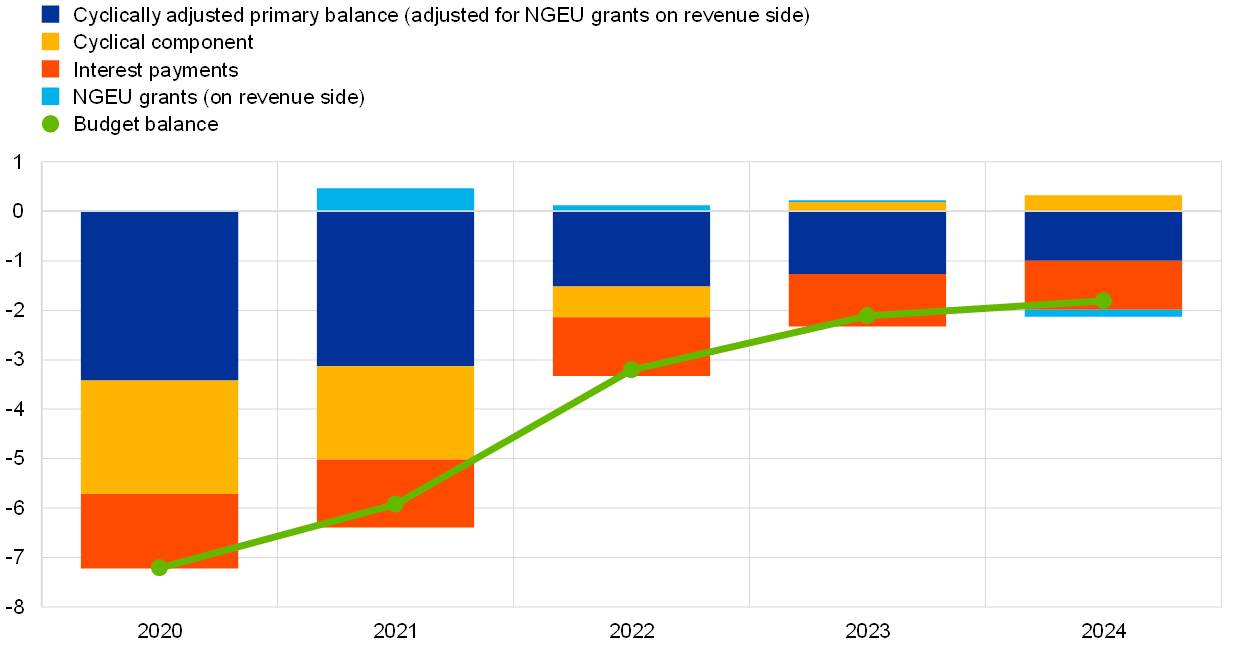

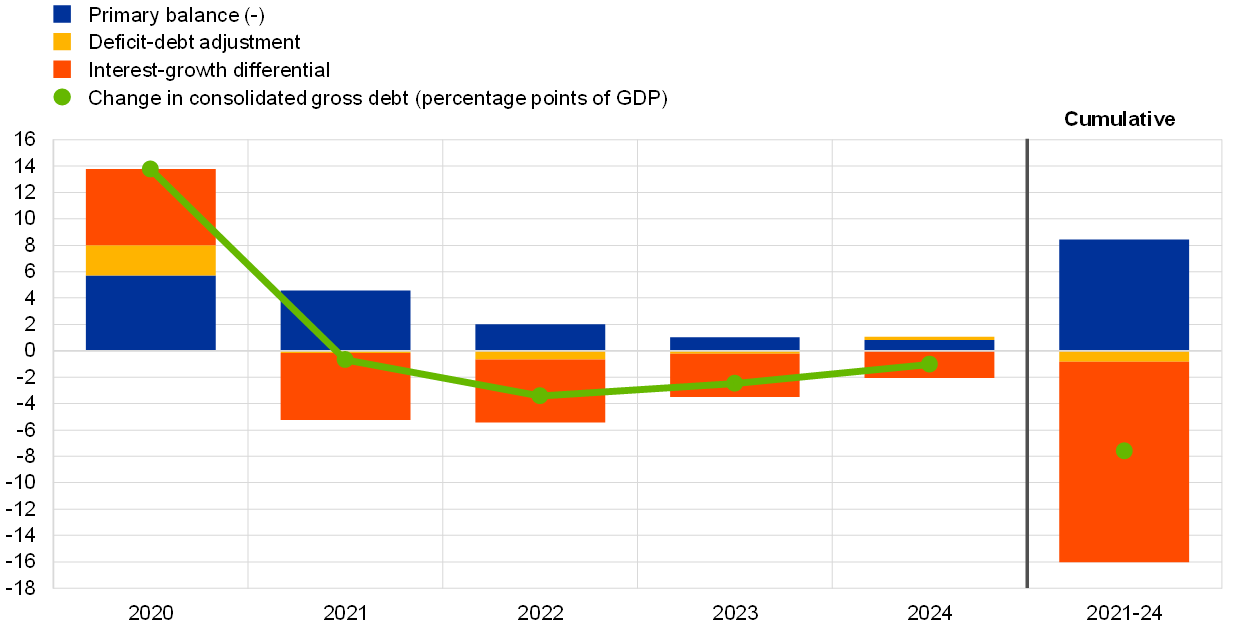

Although the COVID-19 crisis continued to weigh heavily on public finances in 2021, the December Eurosystem staff macroeconomic projections show that the fiscal balance is already on a path to improvement. Having peaked at 7.2% of GDP in 2020, the deficit ratio is estimated to have fallen to 5.9% in 2021 and is projected to fall further to 3.2% in 2022 and to stabilise just below 2% by the end of the forecast horizon in 2024. These improvements are due to a combination of higher cyclically adjusted primary balances and, particularly from 2022, a significantly larger contribution from the economic cycle. In terms of the euro area fiscal stance, a strong expansion in 2020 was followed by only a marginal tightening in 2021 once adjusted for Next Generation EU (NGEU) grants. In 2022, the stance is projected to tighten considerably, albeit much less than forecast previously, mainly owing to a reversal of a significant part of crisis emergency support. The tightening is projected to continue over the remainder of the forecast horizon, but to a much smaller extent, as significant support to the economy will remain in place over the coming years. Targeted and growth-friendly fiscal measures should continue to complement monetary policy. This support will also help the economy adjust to the structural changes that are under way. An effective implementation of the NGEU programme and the “Fit for 55” package will contribute to a stronger, greener and more even recovery across euro area countries.

Growth is expected to rebound strongly over the course of 2022. The December Eurosystem staff macroeconomic projections foresee annual real GDP growth at 5.1% in 2021, 4.2% in 2022, 2.9% in 2023 and 1.6% in 2024. Compared with the September staff projections, the outlook has been revised down for 2022 and up for 2023.

Inflation

Inflation increased further to 4.9% in November. It will remain above 2% for most of 2022. Inflation is expected to remain elevated in the near term, but to decline in the course of this year. The upswing in inflation primarily reflects a sharp rise in prices for fuel, gas and electricity. In November, energy inflation accounted for more than half of headline inflation. Demand also continues to outpace constrained supply in certain sectors. The consequences are especially visible in the prices of durable goods and those consumer services that have recently reopened. Base effects related to the reversal of the VAT cut in Germany are still contributing to higher inflation, but only until the end of 2021. There is uncertainty as to how long it will take for these issues to resolve. But, in the course of 2022, energy prices are expected to stabilise, consumption patterns to normalise, and price pressures stemming from global supply bottlenecks to subside. Over time, the gradual return of the economy to full capacity and further improvements in the labour market should support faster growth in wages. Market and survey-based measures of longer-term inflation expectations have remained broadly stable since the October monetary policy meeting. But overall, these have moved closer to 2% in recent months. These factors will help underlying inflation to move up and bring headline inflation up to the ECB’s 2% target over the medium term.

The December 2021 Eurosystem staff macroeconomic projections foresee annual inflation at 2.6% in 2021, 3.2% in 2022, 1.8% in 2023 and 1.8% in 2024 – significantly higher than in the previous projections in September. Inflation excluding food and energy is projected to average 1.4% in 2021, 1.9% in 2022, 1.7% in 2023 and 1.8% in 2024, also higher than in the September projections.

Risk assessment

The Governing Council sees the risks to the economic outlook as broadly balanced. Economic activity could outperform the ECB’s expectations if consumers become more confident and save less than expected. By contrast, the recent worsening of the pandemic, including the spread of new variants, could be a more persistent drag on growth. The future path of energy prices and the pace at which supply bottlenecks are resolved are risks to the recovery and to the outlook for inflation. If price pressures feed through into higher than anticipated wage rises or the economy returns more quickly to full capacity, inflation could turn out to be higher.

Financial and monetary conditions

Market interest rates have remained broadly stable since the October Governing Council meeting. Over the review period (9 September to 15 December 2021), euro area financial markets were predominantly influenced by shifts in the inflation outlook and renewed uncertainty about further COVID-19-related economic repercussions. The news of the new Omicron variant created volatility, but the strong initial negative impact, especially on risk assets, partly reversed towards the end of the review period.

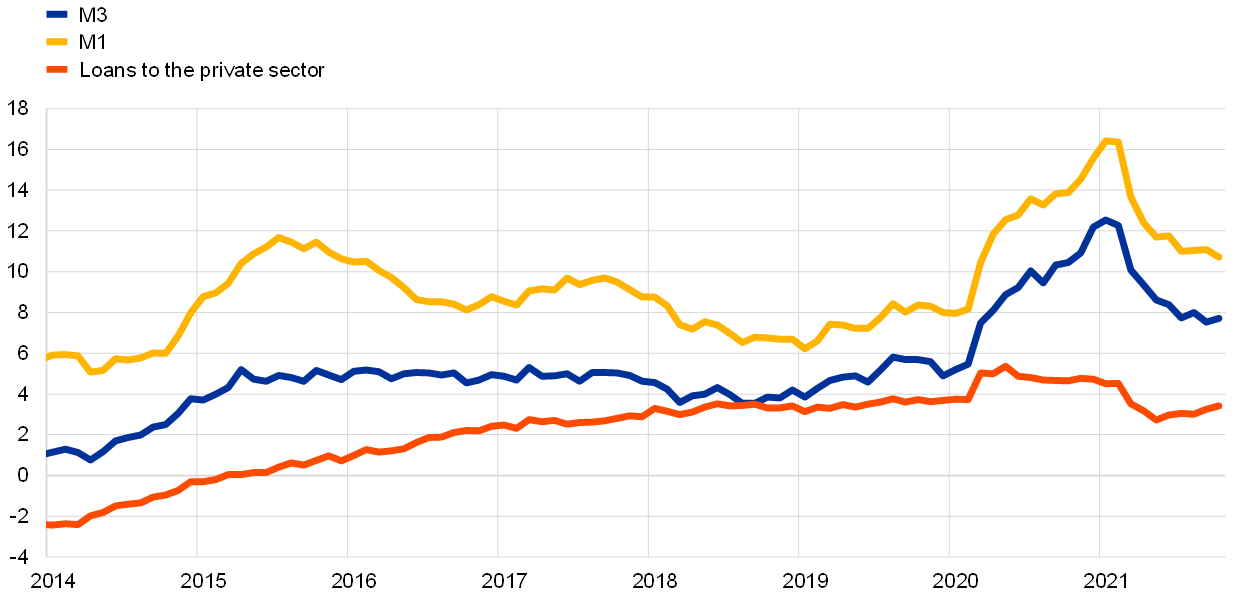

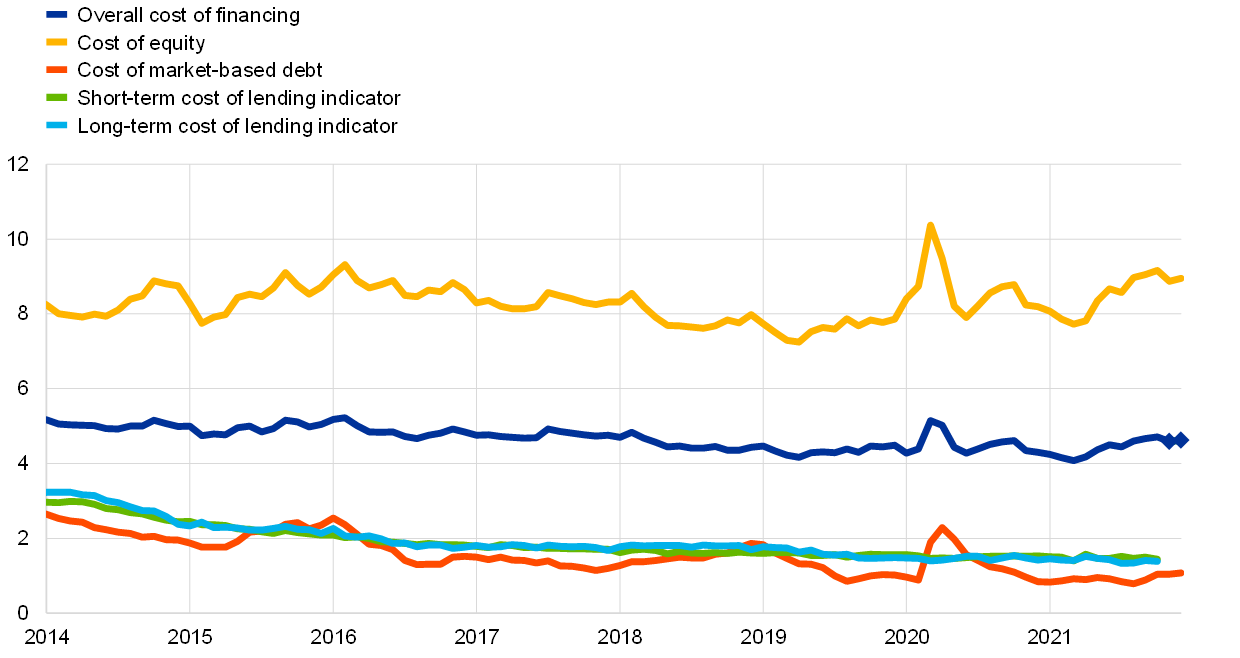

Money creation in the euro area edged up in October 2021, reflecting greater uncertainty related to the COVID-19 pandemic and policy support measures. Eurosystem asset purchases remained the dominant source of money creation. Bank lending rates for firms and households remained at historically low levels. Overall, financing conditions for the economy remain favourable. Lending to firms is partly driven by short-term funding needs stemming from supply bottlenecks that increase their expenses for inventory and working capital. At the same time, corporate demand for loans remains moderate because of retained earnings and generous cash holdings, as well as high debt. Lending to households remains robust – driven by demand for mortgages. Euro area banks have further strengthened their balance sheets thanks to higher capital ratios and fewer non-performing loans. Banks are now as profitable as they were before the pandemic. Bank funding conditions remain favourable overall.

In line with the new monetary policy strategy, twice a year the Governing Council assesses in-depth the interrelation between monetary policy and financial stability. An accommodative monetary policy underpins growth, which supports the balance sheets of companies and financial institutions, as well as preventing risks of market fragmentation. At the same time, the impact of accommodative monetary policy on property markets and financial markets warrants close monitoring as a number of medium-term vulnerabilities have intensified. Still, macroprudential policy remains the first line of defence in preserving financial stability and addressing medium-term vulnerabilities.

Monetary policy decisions

At its monetary policy meeting in December, the Governing Council judged that the progress on economic recovery and towards the ECB’s medium-term inflation target permits a step-by-step reduction in the pace of its asset purchases over the coming quarters. But monetary accommodation is still needed for inflation to stabilise at the ECB’s 2% inflation target over the medium term. In view of the current uncertainty, the Governing Council needs to maintain flexibility and optionality in the conduct of monetary policy. With this is mind, the Governing Council took the following decisions.

First, in the first quarter of 2022, the Governing Council expects to conduct net asset purchases under the pandemic emergency purchase programme (PEPP) at a lower pace than in the previous quarter. Net asset purchases under the PEPP will be discontinued at the end of March 2022.

Second, the Governing Council decided to extend the reinvestment horizon for the PEPP. It now intends to reinvest the principal payments from maturing securities purchased under the PEPP until at least the end of 2024. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

Third, the pandemic has shown that, under stressed conditions, flexibility in the design and conduct of asset purchases has helped to counter the impaired transmission of the ECB’s monetary policy and made the efforts to achieve the Governing Council’s goal more effective. Within the ECB’s mandate, under stressed conditions, flexibility will remain an element of monetary policy whenever threats to monetary policy transmission jeopardise the attainment of price stability. In particular, in the event of renewed market fragmentation related to the pandemic, PEPP reinvestments can be adjusted flexibly across time, asset classes and jurisdictions at any time. This could include purchasing bonds issued by the Hellenic Republic over and above rollovers of redemptions in order to avoid an interruption of purchases in that jurisdiction, which could impair the transmission of monetary policy to the Greek economy while it is still recovering from the fallout of the pandemic. Net purchases under the PEPP could also be resumed, if necessary, to counter negative shocks related to the pandemic.

Fourth, in line with a step-by-step reduction in asset purchases and to ensure that the monetary policy stance remains consistent with inflation stabilising at the ECB’s 2% target over the medium term, the Governing Council decided on a monthly net purchase pace of €40 billion in the second quarter and €30 billion in the third quarter under the asset purchase programme (APP). From October 2022 onwards, net asset purchases under the APP will be maintained at a monthly pace of €20 billion for as long as necessary to reinforce the accommodative impact of the policy rates. The Governing Council expects net purchases to end shortly before it starts raising the key ECB interest rates.

The Governing Council also confirmed its other measures to support the ECB’s price stability mandate, namely the level of the key ECB interest rates and the forward guidance on the future path of policy rates. This is crucial for maintaining the appropriate degree of accommodation to stabilise inflation at the ECB’s 2% inflation target over the medium term.

The Governing Council will continue to monitor bank funding conditions and ensure that the maturing of operations under the third series of targeted longer-term refinancing operations (TLTRO III) does not hamper the smooth transmission of its monetary policy. It will also regularly assess how targeted lending operations are contributing to its monetary policy stance. As announced, the Governing Council expects the special conditions applicable under TLTRO III to end in June this year. It will also assess the appropriate calibration of its two-tier system for reserve remuneration so that the negative interest rate policy does not limit banks’ intermediation capacity in an environment of ample excess liquidity.

The Governing Council stands ready to adjust all of its instruments, as appropriate and in either direction, to ensure that inflation stabilises at the ECB’s 2% target over the medium term.

1 External environment

The December 2021 Eurosystem staff macroeconomic projections suggest that the global economy remains on a recovery path, although headwinds relating to supply bottlenecks and high commodity prices and the emergence of the Omicron variant of the coronavirus (COVID-19) continue to weigh on near-term growth prospects. Recent surveys of economic activity suggest that growth momentum remained weak at the start of the fourth quarter, particularly in the manufacturing sector owing to supply bottlenecks, whereas the services sector has benefited from the reopening of large economies. Compared with the previous projections, the growth outlook for the global economy has been revised downwards for 2021, remained unchanged for 2022 and been revised upwards for 2023. Global (excluding the euro area) real GDP growth is estimated to increase to 6.0% in 2021, before slowing to 4.5% in 2022, 3.9% in 2023 and 3.7% in 2024. Euro area foreign demand is projected to expand by 8.9% in 2021, 4.0% in 2022, 4.3% in 2023 and 3.9% in 2024. However, foreign demand has been revised downwards in 2021 and 2022 compared with the previous projections. This reflects the adverse impact of ongoing supply bottlenecks on global imports. Supply bottlenecks are expected to start easing from the second quarter of 2022 and to fully unwind by 2023. The export prices of the euro area’s competitors have been revised upwards for 2021 and 2022 amid the confluence of higher commodity prices, supply bottlenecks and recovering demand. The future course of the pandemic remains the key risk affecting the baseline projections for the global economy. Other risks to the growth outlook are judged to be tilted to the downside, whereas the balance of risks to global inflation is more uncertain.

Global economic activity and trade

In 2021 the recovery in global economic activity and trade was less smooth than previously expected. Pandemic developments dented consumer confidence, even in the absence of strong containment measures. More recently, the emergence of the Omicron variant, has threatened an intensification of the pandemic on a global scale and further raised uncertainty about its future evolution. Meanwhile other headwinds weighed on activity and trade and put upward pressure on prices. Strains on global production networks have intensified in the course of 2021 and particularly affected large advanced economies and the manufacturing sector (especially the automotive industry). The turmoil in China’s residential property market and a tightening of monetary policy in some emerging market economies (EMEs) have further capped the speed of recovery. Finally, rising commodity prices have led to the build-up of inflationary pressures across the globe. Compared with the September 2021 ECB staff macroeconomic projections, real GDP growth in the third quarter disappointed in a number of countries, including the United States, China and the United Kingdom. The global picture is, however, influenced by India, where a strong resurgence of COVID-19 infections in the second quarter of last year caused a sharp contraction in economic activity, followed by a V-shaped recovery in the third quarter – in contrast to several other economies that were facing new spikes in the number of infections at that time. The sheer size of the decline and subsequent recovery of activity in India entails an increase in global real GDP growth (excluding the euro area) in the third and fourth quarters; however, this is not supported by developments in other large economies.

Survey indicators confirm weak momentum in activity going into the fourth quarter of 2021 amid persisting supply-side disruptions. Global industrial production stalled in August amid continued chip shortages, with the automotive sector exerting a significant drag. The global composite output Purchasing Managers’ Index (PMI) for November confirms weak dynamics in the manufacturing sector, while the services sector remained comparatively stronger amid the gradual reopening of large economies. Overall, recent PMI data suggest a two-speed recovery across sectors at the start of the fourth quarter (Chart 1).

Chart 1

Global (excluding the euro area) output PMI by sectors

(diffusion indices)

Sources: Markit and ECB calculations.

Note: The latest observations are for November 2021.

Global financial conditions were stable until news about the Omicron variant sparked a sell-off in risky assets and increased volatility. Financial conditions feeding into the December 2021 Eurosystem staff macroeconomic projections remained accommodative and broadly stable compared with the previous projection round. This stability reflected a steady increase in equity prices supported by buoyant earnings outcomes, which were broadly offset by increasing expectations of a tighter monetary policy stance against the backdrop of rising inflation, as well as a renewed surge in COVID-19 infections in Europe. Following the Federal Open Market Committee (FOMC) communication in November, financial markets started to price in expectations of an accelerated tapering of asset purchases and the earlier and steeper tightening path implied by the federal funds futures curve rate. Concerns about property developer Evergrande in China were largely confined to local financial markets. Sovereign and corporate bond spreads in other EMEs remained broadly stable. After the cut-off date for the December projections, news about the Omicron variant sparked a sell-off in risky assets, resulting in tighter financial conditions across advanced economies and EMEs. Since then global equity markets have recouped part of their losses and the upward trend in the federal funds futures curve has continued.

The near-term outlook for global economic activity and trade will be shaped by the evolution of the pandemic and the pace at which supply bottlenecks unwind. Pandemic developments intensified in some regions, particularly Europe, while improving across others. A resurgence of containment measures could materially cloud the near-term global outlook and increase the dispersion of growth outcomes across countries. Global trade in goods continues to be constrained by supply bottlenecks, while global demand for goods remains strong.[1] This is reflected, for instance, in semiconductor production and shipping volumes, which are well above their respective pre-pandemic trends. Strains in global production networks might indeed be further amplified by a precautionary hoarding of intermediary goods in some industries as firms seek to build buffers against possible shortages.

Global (excluding the euro area) real GDP growth is estimated at 6.0% for 2021 and is projected to gradually moderate over the projection horizon. This is slightly weaker (by 0.3 percentage points) than forecast in the September 2021 ECB staff macroeconomic projections. The weaker activity is due to the resurgence of COVID-19 infections, the detrimental impact of supply bottlenecks and weaker growth in China. Supply bottlenecks are projected to continue weighing on activity across advanced economies in 2022, although to a lesser extent than on trade, as consumers may substitute unavailable foreign products with domestic ones. Moreover, the progressive rotation of consumption demand from goods back to services is also expected to mitigate the impact of bottlenecks on goods consumption. Looking ahead, global (excluding the euro area) real GDP growth is projected to reach 4.5% in 2022, before moderating to 3.9% in 2023 and 3.7% in 2024. Compared with the September 2021 ECB staff macroeconomic projections, growth remains unchanged for 2022 and has been revised slightly upwards for 2023 (by 0.2 percentage points). While global (excluding the euro area) real GDP had surpassed its pre-pandemic level in late 2020, it is projected to remain somewhat below its pre-pandemic path over the projection horizon. In fact, while advanced economies and China have returned to their pre-crisis trajectories, the recovery continues to lag behind in other EMEs and will weigh on the level of global activity going forward.

In the United States, economic activity is recovering following subdued growth in the third quarter caused by a resurgence of COVID-19 infections. Activity data for October has generally rebounded, suggesting solid short-term growth expectations. Since April, consumer demand has rotated towards services, away from durable goods, which were also subject to supply bottlenecks amid strong demand. In recent weeks, the waiting times and costs of shipping between China and the United States have declined. However, volumes of durable goods inventories remain below pre-pandemic levels, which should support growth once current bottlenecks fully unwind. Annual headline consumer price index (CPI) inflation increased to 6.8% in November. Energy prices accelerated, to 33% in annual terms, while annual food price inflation further increased to 6.1%. Excluding food and energy, annual core inflation increased to 4.9% in November from 4.6% in the previous month. Price pressures were more visible in goods, amid persistent supply chain bottlenecks, while remaining generally more contained in services. Overall, inflationary pressures are expected to remain high in the coming months, with annual headline CPI inflation forecast to only start gradually decreasing from its currently elevated levels from early 2022. Meanwhile wage pressures are rising, as suggested by the employment cost index, which increased by close to 4% in annual terms in the third quarter. This increase was substantially stronger and also broader across industries compared with outturns from earlier in the year.

In China, activity decelerated sharply owing to energy shortages, the turmoil in the residential property sector and renewed COVID-19 outbreaks. Consumer confidence surveys provided mixed signals regarding private consumption, while production and investment are possibly being constrained by supply bottlenecks. Energy demand remains elevated, but there have been recent signs of easing pressure, partly owing to the policies to boost coal supply and the use of national stockpiles in an effort to bring domestic oil prices down and ensure energy security. The turmoil in the residential property sector continued, as the real estate developer Evergrande was declared to be in “restricted default” by a rating agency. The default was largely expected and follows those of smaller firms. Evergrande had already entered a managed restructuring process, with government representatives joining a risk management committee to oversee Evergrande, maintain its operations and restructure its debts. Authorities have provided policy support, with the People’s Bank of China cutting the banks’ reserve requirement ratio in December and the central government signalling a more supportive stance towards the property sector. These policy actions are aimed at managing the slowdown and avoiding a sharper contraction in both the residential sector and the broader economy. Headline year-on-year CPI inflation increased to 2.3% in November from 1.5% in October, largely owing to base effects, fuel price rises and food price increases amid disruptions to harvests caused by adverse weather conditions.

In Japan, the economy slowed in the third quarter in the face of supply bottlenecks and the resurgence in COVID-19 infections. Economic activity is expected to rebound in the fourth quarter, reflecting a gradual easing of containment measures, progress in vaccinations and continued policy support. These factors should also support a more solid recovery in early 2022. Annual CPI inflation is projected to return to positive territory and further rise over the projection horizon, while remaining below the central bank’s target.

In the United Kingdom, incoming data suggest that activity remains subdued following a weak outturn in the third quarter of 2021. A combination of supply chain disruptions and labour shortages, driven by global conditions and Brexit, led to a moderation in growth to 1.3% in the third quarter (down from 5.5% in the previous quarter).[2] Private consumption remained a driver of real activity as COVID-19 restrictions eased further, while investment, by contrast, continued to be very weak. The factors that weighed on activity over the summer months are expected to continue into the coming months. As a result, economic activity in the United Kingdom is expected to reach its pre-pandemic levels in the first quarter of 2022, somewhat later than previously expected. Employment and participation in the workforce have been slowly rising over recent months, whereas vacancies have increased strongly, contributing to a sharp tightening in the labour market. This tightness is a result of both a lower supply of EU workers and still below pre-pandemic participation of national workers in the workforce. Shortages are particularly pronounced in industries such as hospitality, construction and food. Headline CPI inflation picked up to 4.2% in October from 3.1% in September. The rise in annual headline inflation was mostly driven by energy prices, reflecting the increase in the household energy price cap, a regulatory measure reset every April and October. While underlying inflation remains more contained, inflationary pressures started to broaden and are expected to remain sustained in the short run, mainly on account of ongoing supply chain disruptions and rising energy prices. Inflation is expected to peak in April 2022 owing to the scheduled adjustment of the energy price cap, which will most likely be sizeable, as it will absorb energy price increases from the second part of 2021.

In central and eastern EU Member States, activity remained solid in the third quarter, but is expected to moderate. This moderation reflects a significant deterioration of the epidemiological situation and persistent supply bottlenecks. Rising energy prices are expected to put additional pressure on CPI inflation, which is projected to peak in 2022 before gradually declining over the rest of the projection horizon.

In large commodity-exporting countries, economic activity hinges on the ability to tackle the COVID-19 outbreaks and the amount of policy space available. In Russia, sharply increasing numbers of COVID-19 infections have led to tighter containment measures, while rising global demand for oil and gas and the associated positive terms of trade effect should support economic activity. Food prices and demand pressures are projected to keep inflation high in the near term; however, it is projected to return to the central bank’s target in the medium term. In Brazil, economic activity is constrained by a tighter monetary policy stance and limited fiscal space. CPI inflation, which continues to increase and recently reached double digits, is expected to decline over the projection horizon.

In Turkey, economic activity has decelerated amid weakening domestic demand. A supportive external environment was the main driver of growth in 2021. Inflation has increased and is expected to remain at double digits over the forecast horizon as a result of an overly expansive monetary policy stance which pushed the lira to record lows against the US dollar, notwithstanding the central bank’s interventions.

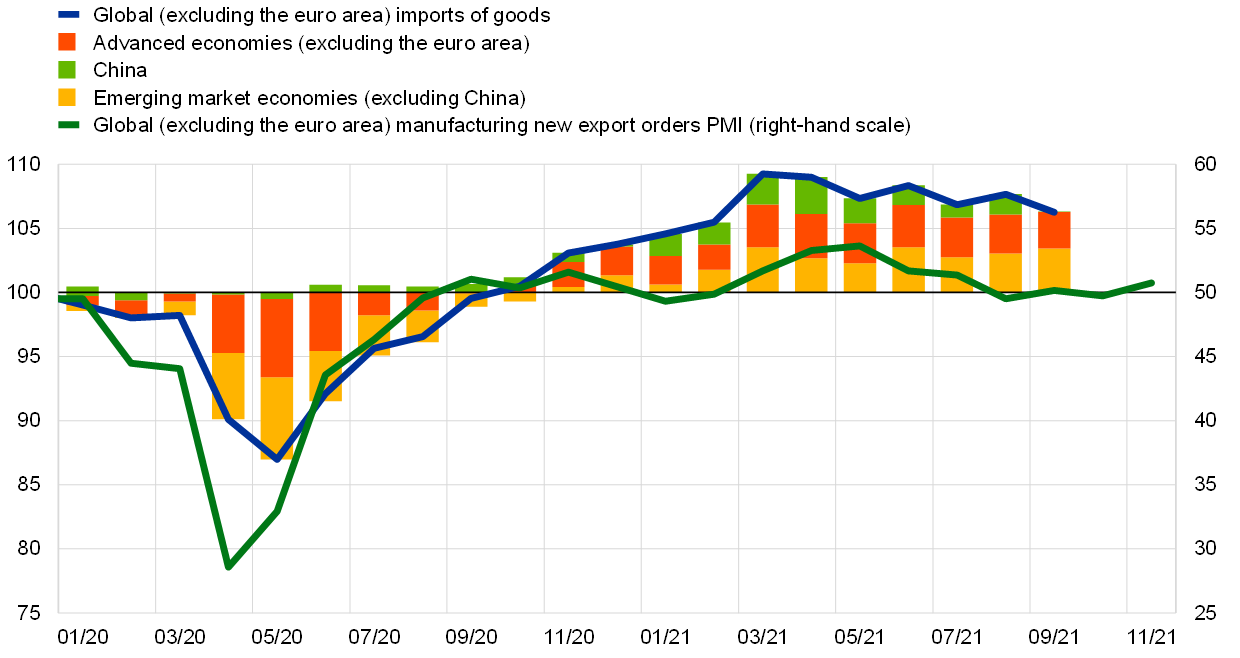

Global (excluding the euro area) trade growth moderated in 2021, reflecting intensifying supply bottlenecks. The strong rebound in global trade that materialised after the reopening of the global economy in mid-2020 started to moderate in 2021. Global trade in goods peaked in March and has since progressively decelerated, while remaining well above its pre-pandemic levels (Chart 2). Incoming data on global (excluding the euro area) merchandise trade in the third quarter point to downside risks to global trade estimates, mainly on account of persisting supply bottlenecks, which are evident in lengthening supplier delivery times. Furthermore, the weakness in the logistics sector affects trade more than industrial production, as a shift towards domestic goods and suppliers helps cushion the impact on industrial production. The impact of contracting merchandise trade on global trade is somewhat mitigated by the growth in services trade, which has been gathering momentum following the relaxation of international travel restrictions.

Chart 2

Global (excluding the euro area) imports of goods and new export orders

(left-hand scale: index, December 2019 = 100; right-hand scale: diffusion index)

Sources: Markit, CPB Netherlands Bureau for Economic Policy Analysis and ECB calculations.

Note: The latest observations are for November 2021 for the PMI data and September 2021 for global imports of goods.

Strains in global production networks, also referred to as supply bottlenecks, are a multifaceted phenomenon. They reflect a combination of demand and supply imbalances, resulting in shortages of intermediate inputs that are particularly felt in large advanced economies and in the manufacturing sector (especially the automotive industry).[3] In the December 2021 Eurosystem staff macroeconomic projections, supply bottlenecks are expected to affect a larger number of countries and sectors than was forecast in the previous projection round. According to survey data, these bottlenecks have intensified further in recent months and are assumed to gradually start easing as of the second quarter of 2022, before fully unwinding by 2023.

These factors are weighing on euro area foreign demand, which was revised downwards for 2021 and 2022 compared with the previous projections. The unwinding of supply bottlenecks is then expected to lead to somewhat stronger euro area foreign demand in the outer years of the projection horizon. Euro area foreign demand growth is estimated to reach 8.9% in 2021 before decreasing to 4.0% in 2022, 4.3% in 2023 and 3.9% in 2024, respectively. The level of euro area foreign demand is expected to initially remain below the level projected in the September 2021 ECB staff macroeconomic projections, before gradually converging back to the previously forecast level by the end of the projection horizon. The projected path for global (excluding the euro area) imports resembles that of euro area foreign demand: it is estimated to increase by 11.1% in 2021, 3.9% in 2022, 4.4% in 2023 and 4.0% in 2024.

Risks around the baseline projections relate primarily to the evolution of the pandemic. The baseline projections for the global economy are complemented by two alternative pandemic scenarios – one mild and one severe. Key parameters in these scenarios are the evolution of the pandemic, the associated path of containment measures and the vaccine rollout. The severe scenario assumes that, in EMEs, the first two parameters are more adverse and the vaccine rollout slower than in advanced economies.[4] The outcomes for global activity and euro area foreign demand as a result of the two alternative pandemic scenarios are broadly comparable to those presented in the September 2021 ECB staff projections. The emergence of the Omicron variant is likely to induce higher volatility in global growth, but at this stage its exact impact is highly uncertain.

The balance of other risks around the global (excluding the euro area) growth outlook is tilted to the downside. An earlier and faster tightening of monetary policy in large advanced economies may have spillover effects on financial conditions in EMEs and would represent a downside risk to growth. In China, a stronger slowdown in the real estate sector than currently expected would pose downside risks to the outlook for global activity. Upside risks to growth include the possibility that the US fiscal package has a larger fiscal multiplier than currently assumed and that the stock of excess savings unwinds faster than expected in advanced economies.

Global price developments

High energy prices remain a headwind for the global economy. Energy prices have increased since the September 2021 ECB staff macroeconomic projections, with the rise in oil prices reflecting both recovering demand and supply-side developments. Oil demand rebounded as more countries reopened their economies, including their borders to international travel, which led mobility levels to increase. Oil demand has also been supported by the surge in gas prices, which has led to substitution to other energy sources, including oil. Supply factors have also contributed to the higher oil prices, as OPEC+ failed to reach its production targets and Hurricane Ida caused extended supply disruptions in the United States. At the end of November energy prices moderated somewhat amid a sharp drop in oil prices caused by the emergence of the Omicron variant, reflecting concerns that a resurgence in COVID-19 cases may weigh on global oil demand. Non-energy commodity prices decreased over the review period. This was due to a decline in metal commodity prices, driven by a marked drop in iron ore prices, partly reflecting falling steel demand from China. In contrast, food commodity prices increased owing to tightness in the coffee and wheat markets.

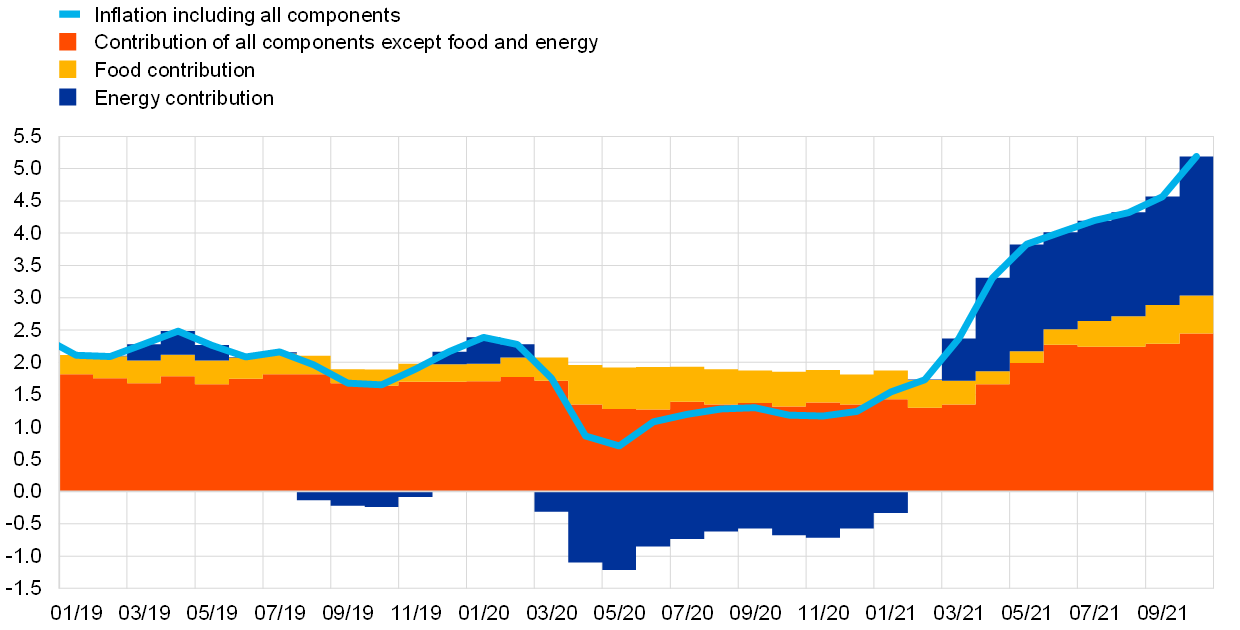

Incoming data point to ongoing inflationary pressures. Strains on global logistics and production networks – as well as labour market frictions in key advanced economies – point to continued pipeline price pressures, as signalled by rising global producer prices.[5] CPI inflation across advanced economies remained elevated and well above its historical average over the last two decades. In EMEs, CPI inflation has also increased, but developments have been more diverse and, on average, less pronounced. The impact of positive base effects from suppressed price levels during the peak of pandemic lockdowns in 2020 has been significant for advanced economies, as shown by the difference in inflation rates calculated over 12 and 24 months. For EMEs, this effect seems less pronounced. Looking ahead, the rise in global CPI inflation is expected to be more persistent than previously anticipated and to gradually moderate only in the course of 2022. Across member countries of the Organisation for Economic Co-operation and Development (OECD), annual headline CPI inflation increased to 5.2% in October from 4.6% in September (Chart 3). This steep increase was driven by the surge of energy price inflation to the highest level observed over the last four decades (24.2%), with base year effects still playing a role. OECD core CPI inflation also increased in October to 3.5%, up from 3.2% in the previous month.

Chart 3

OECD consumer price inflation

(year-on-year percentage changes; percentage point contributions)

Sources: OECD and ECB calculations.

Note: The latest observations are for October 2021.

Inflationary pressures are expected to remain elevated until mid-2022 and ease thereafter as the underlying drivers fade. While the factors supporting inflationary pressures, such as supply bottlenecks and labour shortages, are proving less transitory than predicted in the September 2021 ECB staff macroeconomic projections, these are assumed to start dissipating as of mid-2022. Over the projection horizon, the expected rise in headline inflation globally will be reflected in higher euro area competitor export prices. This increase is to a large extent explained by rising global commodity prices, which in part reflect the base effects from the pandemic shock in spring 2020.

2 Financial developments

Over the review period (9 September to 15 December 2021), euro area financial markets have been predominantly influenced by shifts in the inflation outlook and renewed uncertainty about further economic repercussions relating to the coronavirus (COVID-19). Specifically, the information about the new Omicron variant induced significant intra-period volatility, but the strong initial impact, especially on risk assets, partly reversed towards the end of the review period. The short end of the benchmark euro short-term rate (€STR) forward curve increased markedly until the end of October before falling back somewhat, signalling overall a significant repricing by market participants towards an earlier rate hike compared to the start of the review period. In line with short-term rates, risk-free long-term overnight index swap (OIS) rates also followed a sawtooth pattern, increasing slightly overall. Sovereign spreads over the OIS rate widened marginally in some jurisdictions and tightened slightly in others, in the context of intra-period volatility. Equity markets advanced globally until end-November, supported by a strong earnings season, but thereafter suffered the worst setback in more than a year amid a sharp deterioration in risk sentiment. Euro area corporate bond spreads widened slightly over the period, but remained broadly unchanged overall. The euro depreciated against most major currencies.

The benchmark €STR averaged -57 basis points over the review period. Excess liquidity increased by approximately €26 billion to around €4,430 billion, mainly reflecting asset purchases under the pandemic emergency purchase programme (PEPP) and the asset purchase programme (APP), as well as the €97.57 billion take-up of the ninth operation under the third series of targeted longer-term refinancing operations (TLTRO III). At the same time, the growth in excess liquidity was curtailed substantially by early repayments amounting to €79.24 billion of funds borrowed under previous TLTRO III operations and by a net decline in other assets of around €246 billion over the review period. This net decline in other assets was predominantly driven by an increase of around €201 billion in Eurosystem liabilities to non-euro area residents denominated in euro over the review period.

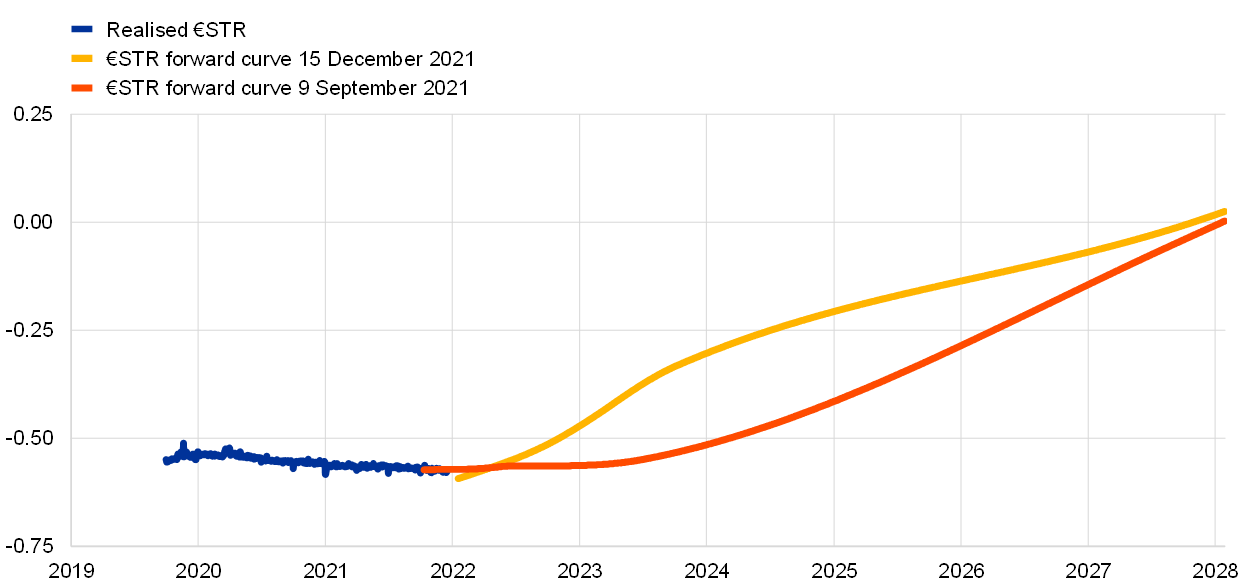

The short end of the €STR forward curve has shifted up markedly compared to the September Governing Council meeting, suggesting a significant repricing of rate hike expectations by market participants (Chart 4).[6] The short end of the €STR forward curve moved up during the first half of the review period in an environment of increasing market-based inflation-compensation measures and stronger expectations of a tightening of monetary policy at the global level. In the second half of the review period, the curve moved down following the monetary policy communication after the October Governing Council meeting and amid intensifying coronavirus-related concerns. Overall, the market-implied rate lift-off date – defined as the time when the €STR forward curve surpasses the current level of the €STR plus 10 basis points – has shifted forward by about a year, to late December 2022. However, the expected rate path and lift-off timing has been surrounded by a high level of uncertainty, as reflected in money markets’ elevated volatility.

Chart 4

€STR forward rates

(percentages per annum)

Sources: Bloomberg and ECB calculations.

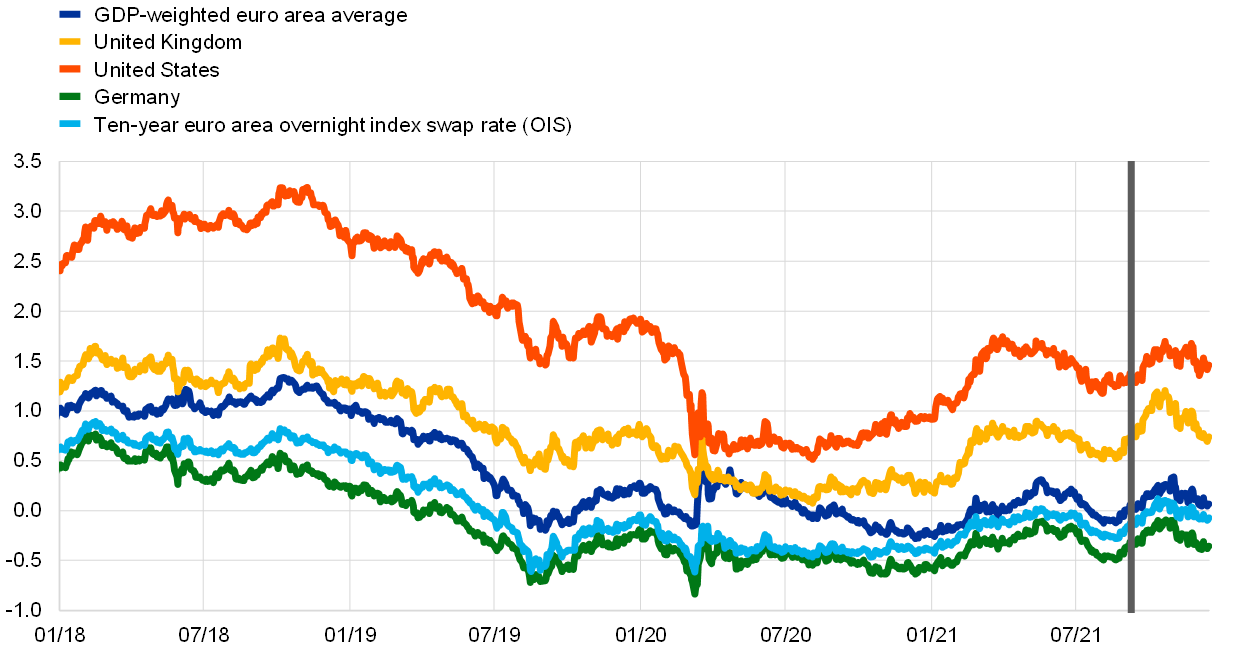

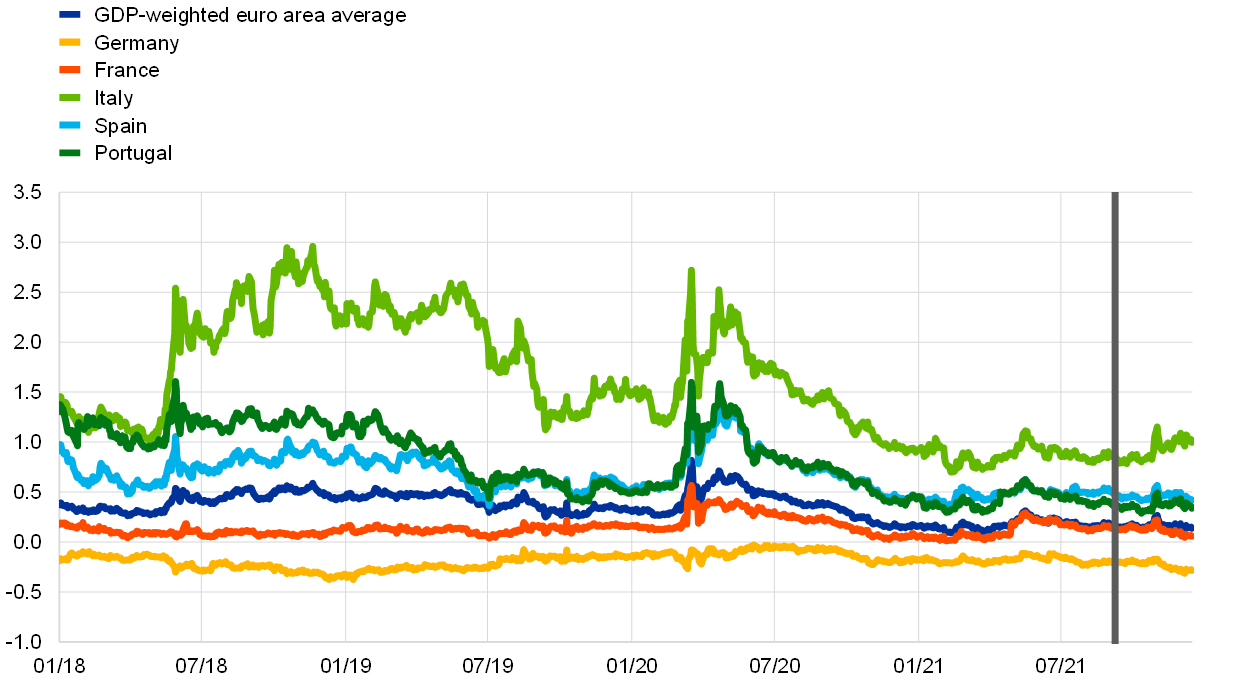

Long-term average euro area sovereign bond yields continued to follow risk-free rates closely and stood slightly higher at the end of the review period amid some intra-period volatility (Chart 5). In the context of improving medium-term economic prospects at the global level, long-term euro area sovereign yields increased between early September and the end of October. However, these subsequently declined, following central bank communication and reflecting perceived downside risks for the economic outlook amid fears about the impact of new coronavirus-related restrictions, fuelled in particular by news about the Omicron variant. Overall, both the GDP-weighted euro area ten-year sovereign bond yield and the ten-year risk-free OIS rate based on the €STR increased by almost 10 basis points, to 0.06% and -0.07% respectively. Developments were fairly similar in the United States, where the ten-year sovereign bond yield initially increased before partially reversing that trend to stand 16 basis points higher at 1.46% at the end of the review period.

Chart 5

Ten-year sovereign bond yields and OIS rate based on the €STR

(percentages per annum)

Sources: Refinitiv and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 9 September 2021. The latest observation is for 15 December 2021.

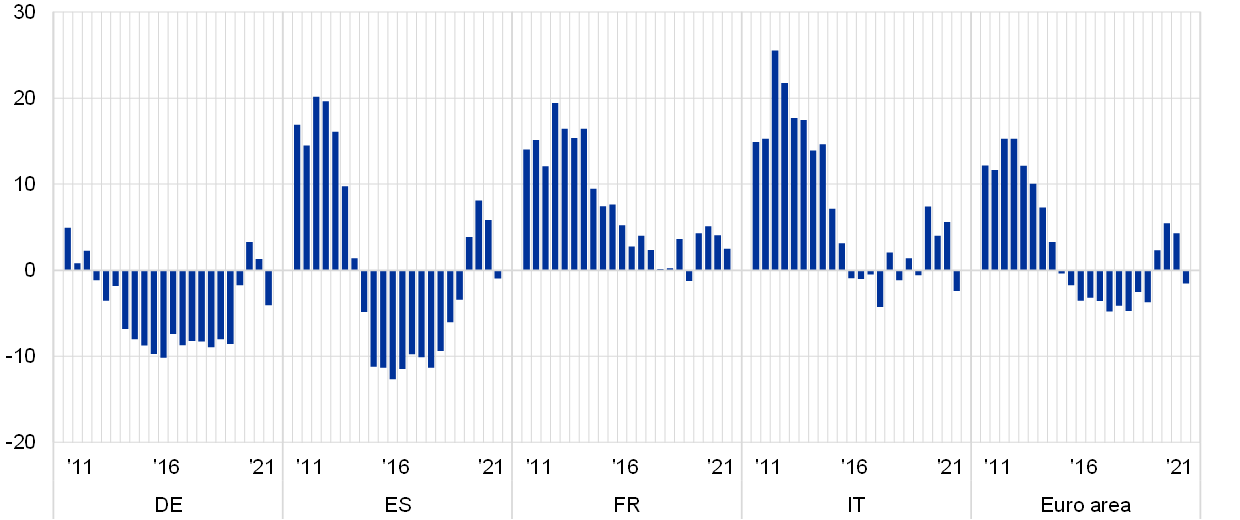

Long-term euro area sovereign spreads relative to OIS rates widened in some jurisdictions and tightened slightly in others amid the increased uncertainty (Chart 6). Sovereign bond markets displayed significant but temporary spread increases in the last week of October (e.g. 32 basis points in Italy, 18 basis points in Portugal and 14 basis points in Spain). As of November, long-term sovereign spreads decreased somewhat in Germany and France, overall standing lower by around 10 basis points, driven by high demand for safe bonds amid thin sovereign market liquidity, and to some extent exhibiting a typical year-end pattern. Overall, spreads remained relatively stable in Portugal and Spain but increased in Italy by around 15 basis points over the review period.

Chart 6

Ten-year euro area sovereign bond spreads vis-à-vis the €STR OIS rate

(percentage points)

Sources: Refinitiv and ECB calculations.

Notes: The spread is calculated by subtracting the ten-year €STR OIS rate from the ten-year sovereign bond yield. The vertical grey line denotes the start of the review period on 9 September 2021. The latest observation is for 15 December 2021.

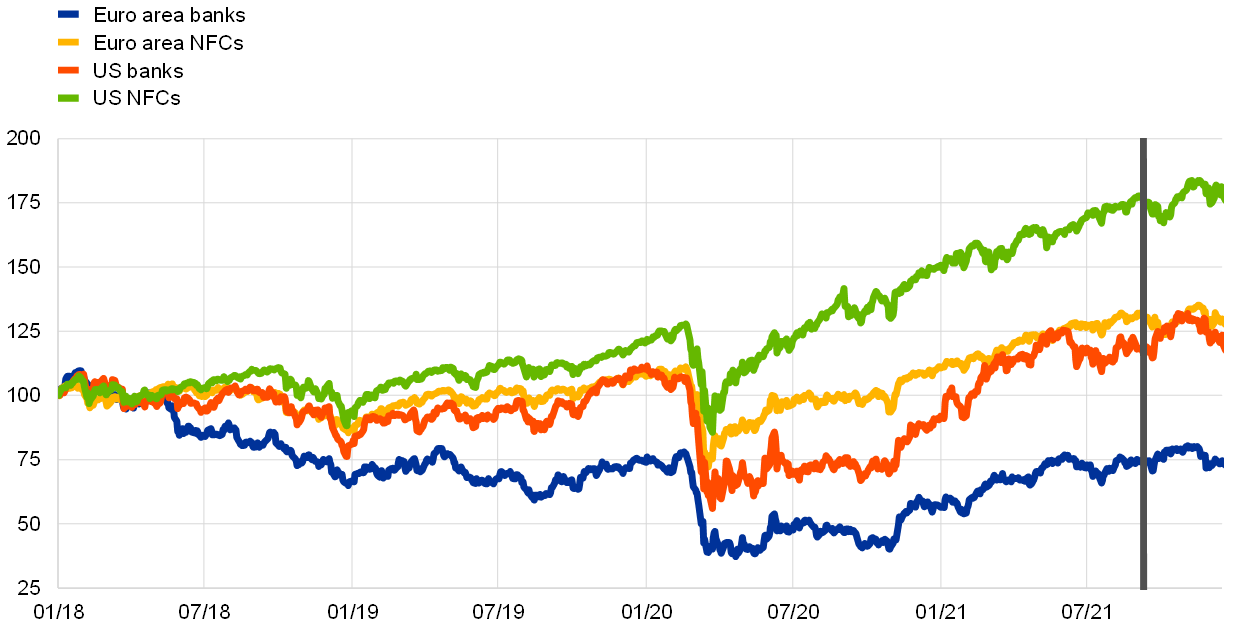

Supported by a strong corporate earnings season, global equity markets continued their rise in the first part of the review period, before dropping sharply in response to news about the recently discovered Omicron variant (Chart 7). For most of the review period, solid earnings growth expectations supported the overall positive evolution of euro area equity prices, which by 25 November had risen by 2% overall. From the end of November, however, uncertainty about the rapid spread of the Omicron variant and its impact on the global economy put a stop to the continued strong rise in equity prices on both sides of the Atlantic and prices decreased sharply, largely reflecting a rise in the equity risk premium. The market impact of this new, potentially faster-spreading coronavirus variant was larger in the euro area than in the United States. Equity prices of euro area non-financial corporations (NFCs) edged down by 1.1% while they increased by 3.0% in the United States. US bank equity prices recorded an increase of 3%, while in the euro area they edged up by just 0.2%.

Chart 7

Euro area and US equity price indices

(index: 1 January 2018 = 100)

Sources: Refinitiv and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 9 September 2021. The latest observation is for 15 December 2021.

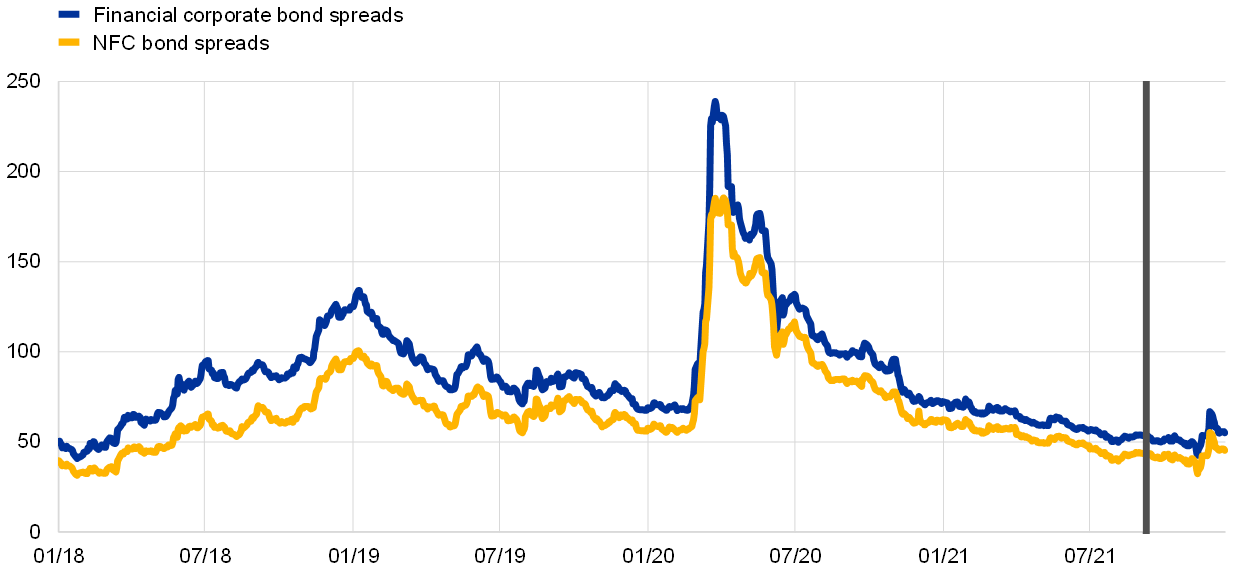

Mirroring the developments in equity prices, euro area corporate bond spreads widened slightly on the news of the Omicron variant and displayed some volatility thereafter (Chart 8). Over the review period as a whole, the investment-grade NFC bond spread and the financial sector bond spread (relative to the risk-free rate) remained broadly unchanged. Taking a longer-term view, the continued declining trend in recent months can largely be attributed to excess bond premia, i.e. the component of euro area corporate bond spreads that is unexplained by economic, credit and uncertainty-related factors.

Chart 8

Euro area corporate bond spreads

(basis points)

Sources: Markit iBoxx indices and ECB calculations.

Notes: The spreads are the difference between asset swap rates and the risk-free rate. The indices comprise bonds of different maturities (with at least one year remaining) with an investment-grade rating. The vertical grey line denotes the start of the review period on 9 September 2021. The latest observation is for 15 December 2021.

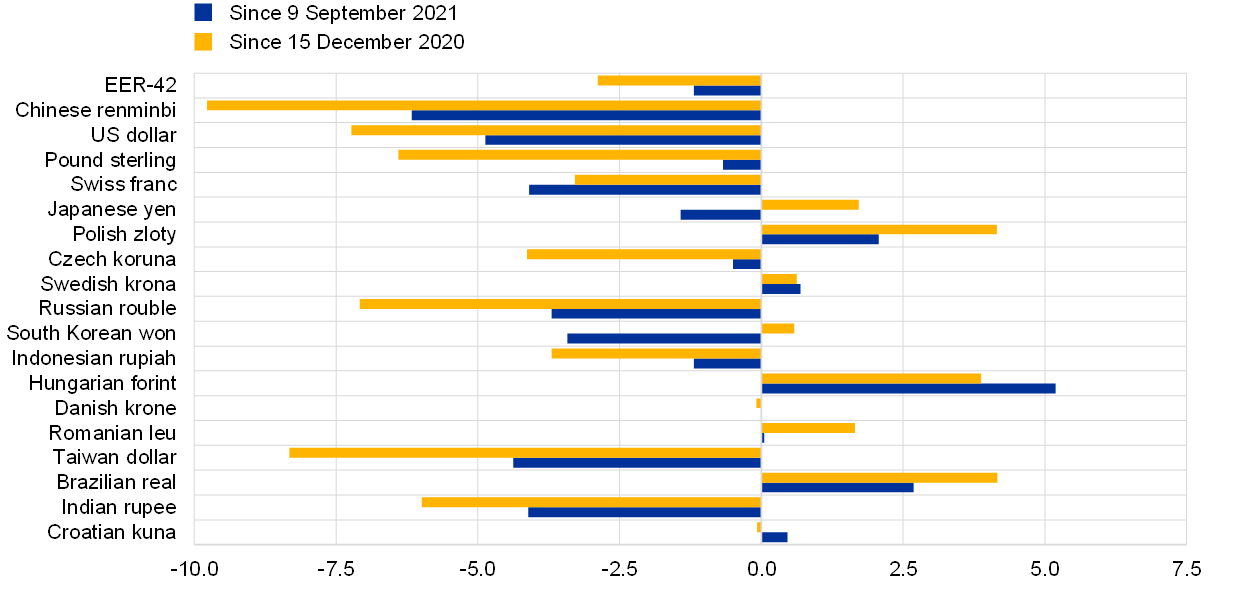

In foreign exchange markets, the euro depreciated in trade-weighted terms (Chart 9), reflecting a broad-based weakening against the US dollar in particular as well as against most other major currencies. Over the review period, the nominal effective exchange rate of the euro, as measured against the currencies of 42 of the euro area’s most important trading partners, weakened by 1.2%. The euro depreciated markedly against the US dollar (by 4.9%), reflecting the widening of the short-term interest rate expectations differential between the euro area and the United States, driven by the faster rebound in economic activity and higher inflation in the United States and the path of US monetary policy. The euro also weakened against other major currencies, including the Chinese renminbi (by 6.2%), the Swiss franc (by 4.1%), the Japanese yen (by 1.4%) and the pound sterling (by 0.7%). Over the same period, the euro strengthened against the currencies of several non-euro area EU Member States, including the Hungarian forint (by 5.2%) and the Polish zloty (by 2.1%).

Chart 9

Changes in the exchange rate of the euro vis-à-vis selected currencies

(percentage changes)

Source: ECB.

Notes: EER-42 is the nominal effective exchange rate of the euro against the currencies of 42 of the euro area’s most important trading partners. A positive (negative) change corresponds to an appreciation (depreciation) of the euro. All changes have been calculated using the foreign exchange rates prevailing on 15 December 2021.

3 Economic activity

The euro area recovery continued in the third quarter of 2021, with activity strengthening further to stand close to the pre-pandemic level of output. Private consumption was the main driver of third-quarter growth, with a further modest contribution from net trade. A further substantial increase in services activity was a major contributor, particularly in the hospitality and leisure segments, which benefited from the progressive loosening of restrictions over the course of the summer. Meanwhile, industry and construction detracted from headline growth amid deepening supply shortages over the summer months.

Supply disruptions, energy price increases and further restrictions on activity related to a resurgence of the pandemic in some euro area countries are estimated to have weighed on activity in the final quarter of the year. The surge in coronavirus (COVID‑19) infection rates since late November, a reintroduction of containment measures in several euro area countries and growing concerns about the Omicron variant are likely to weigh further on near-term confidence and activity.

Near-term disruptions and uncertainties notwithstanding, the basis for the ongoing euro area recovery remains intact. The medium-term outlook continues to envisage a further strengthening of domestic demand, alongside an improving labour market, strengthening global growth and ongoing policy support from both monetary and fiscal policy in the transition to self-supporting growth. This assessment is broadly reflected in the baseline scenario of the December 2021 Eurosystem staff macroeconomic projections for the euro area, which envisages annual real GDP growth of 5.1% in 2021, 4.2% in 2022, 2.9% in 2023 and 1.6% in 2024, with a return to pre-pandemic quarterly levels of activity expected by the first quarter of 2022. Compared with the September 2021 ECB staff macroeconomic projections, the outlook for economic activity has been revised downward for 2022, largely on account of the recent intensification of global supply bottlenecks and tighter pandemic-related restrictions in some euro area countries. In the medium term, however, the unwinding of these headwinds is expected to lead to a strong upward revision to growth in 2023 and increasingly self-sustaining growth thereafter.

Overall, the risks surrounding the outlook for euro area GDP growth are assessed as being broadly balanced. On the one hand, growth could underperform if the recent worsening of the pandemic, and the spread of new variants, results in a more persistent drag on growth. On the other hand, a faster recovery could be expected if the pandemic-driven increase in the stock of household savings unwinds more quickly, or current supply-side bottlenecks ease faster, than is currently envisaged.

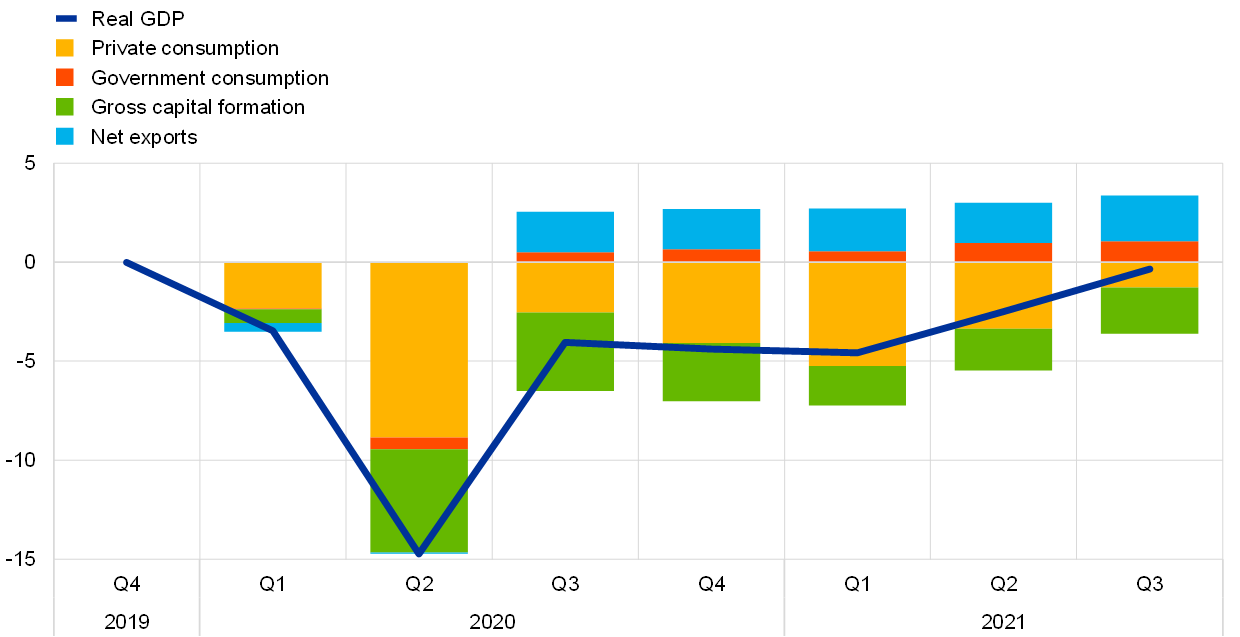

Euro area economic activity grew by a further 2.2% in the third quarter of 2021, confirming that a strong mid-year recovery was under way despite intensifying supply chain disruptions. After the technical recession at the start of 2021, real GDP growth was robust in the second and third quarters – growing at a quarter-on-quarter rate of 2.2% in both quarters – as pandemic containment measures were progressively relaxed. The outcome is broadly in line with the profile envisaged in the September 2021 ECB staff macroeconomic projections, with quarterly activity just 0.3% below the pre-pandemic level seen at the end of 2019 (Chart 10). Third-quarter growth continued to be driven largely by a strong rebound in private consumption, with a further small positive contribution from net trade. After a strong showing in the second quarter, investment contracted in the third quarter, particularly in the machinery and equipment segment. Inventories also detracted modestly from headline growth.

Chart 10

Euro area real GDP and components

(percentage changes since the fourth quarter of 2019; percentage point contributions)

Sources: Eurostat and ECB calculations.

Supply chain bottlenecks continued to constrain output in the manufacturing sector in the fourth quarter (Chart 11). Shortages of materials, equipment and space have risen to record levels since the second quarter, with widespread reports of supply bottlenecks for semiconductors, metals and plastics, alongside ongoing transport disruptions. Shortages have been particularly acute in the industrial sector, restricting growth to just 0.1% quarter on quarter in industry excluding construction and contributing significantly to a 0.6% contraction in the construction sector in the third quarter.[7] By contrast, contact-intensive consumer-facing services grew strongly, supported by the continued relaxation of containment measures and high levels of consumer confidence.[8]

Chart 11

Factors limiting activity in the euro area

(percentages of respondents; difference relative to long-term average)

Source: European Commission.

Notes: The long-term average is computed for the period between 2003 and 2019. Quarterly surveys are carried out in the first month of each quarter. The latest observations are for the fourth quarter of 2021 (October).

Euro area GDP growth is estimated to have slowed significantly in the fourth quarter, amid high levels of short-term uncertainty. While a normalisation of growth rates was expected following the strong rebound seen during the summer, the current slowdown is likely to be amplified by the combined effects of the intensification of supply chain disruptions, sharp increases in energy prices, a renewed surge in COVID-19 infection rates and further concerns related to the Omicron variant. The average of the composite output Purchasing Managers’ Index (PMI) for October and November was lower than the third-quarter average (at 54.8, down from 58.4), although the index still pointed to growth. The decline was broad‑based, but slightly stronger in manufacturing than in services. The European Commission’s Economic Sentiment Indicator (ESI) worsened slightly in November, but the average for the first two months of the fourth quarter remained in line with its third-quarter average. Importantly, however, the latest surveys for the PMI and ESI were largely concluded before the recent strong rises in COVID-19 cases and the subsequent reintroduction of restrictions on activity in some euro area countries, as well as being conducted before the first cases of the Omicron variant were identified in Europe. Consumer confidence had already declined – from high levels – over the first two months of the fourth quarter, following a resurgence of the pandemic and strong increases in energy prices, which have constrained households’ purchasing power. The European Commission’s quarterly business survey for the fourth quarter pointed to intensifying shortages of materials and – increasingly – labour compared with the third quarter (Chart 11). These shortages are likely to constrain near-term activity through trade and investment to a stronger degree than was previously envisaged. While near-term uncertainty about the degree and duration of these challenges remains high, renewed progress with vaccination campaigns, learning effects from earlier waves of the pandemic, the continuing favourable demand and lending conditions for firms[9], and direct support for households to offset much of the recent surge in energy prices are expected to contain the impact of recent adverse developments on activity.

The euro area labour market continued to improve in the third quarter of 2021. Labour demand increased further in the third quarter, as evidenced by higher job vacancy rates. Employment grew by 0.9% quarter on quarter in the third quarter of 2021 (Chart 12). While this was the second highest quarterly increase since 1999, employment remained 0.2% below its pre-pandemic level. The unemployment rate declined further to stand at 7.3% in November, albeit it was still supported in part by workers in job retention schemes. These workers were estimated to account for 2.0% of the labour force at the end of the third quarter of 2021, a share that declined to 1.8% in October. This is a substantial decrease relative to the average of 6.3% in the first five months of the year, reflecting the easing of pandemic-related restrictions. Moreover, the labour force has continued to increase, steadily recovering to stand just 0.5% below its pre-pandemic level in the third quarter of 2021.

Chart 12

Euro area employment, the PMI assessment of employment and the unemployment rate

(left-hand scale: quarter-on-quarter percentage changes, diffusion index; right-hand scale: percentages of the labour force)

Sources: Eurostat, Markit and ECB calculations.

Notes: The PMI employment indicator and the unemployment rate are shown at a monthly frequency, while employment is shown at a quarterly frequency. The PMI is expressed as a deviation from 50 divided by 10. The latest observations are for the third quarter of 2021 for employment, November 2021 for the PMI and October 2021 for the unemployment rate.

Short-term indicators point to a further strengthening of the labour market. The monthly composite PMI employment indicator, which encompasses both industry and services, decreased slightly to stand at 55.3 in November, down from 55.5 in October, but remains well above the threshold of 50 that indicates growth in employment. The PMI employment indicator has fully recovered from its all-time low in April 2020 and is still close to its July 2021 level – the highest level since March 2000.

Private consumption continued its rebound in the third quarter, driven by the consumption of services. Private consumption increased by 4.1% quarter on quarter in the third quarter of 2021. However, retail trade increased by just 0.8% over the same period. Strong aggregate consumption and subdued goods consumption suggest that the rebound was mainly on account of contact-intensive services, in line with the strong recovery in tourism activities during the summer months. By contrast, the more subdued dynamics of goods consumption continued at the start of the fourth quarter, as revealed by October data for retail trade (0.2% month on month) and car registrations (-3.1% month on month).

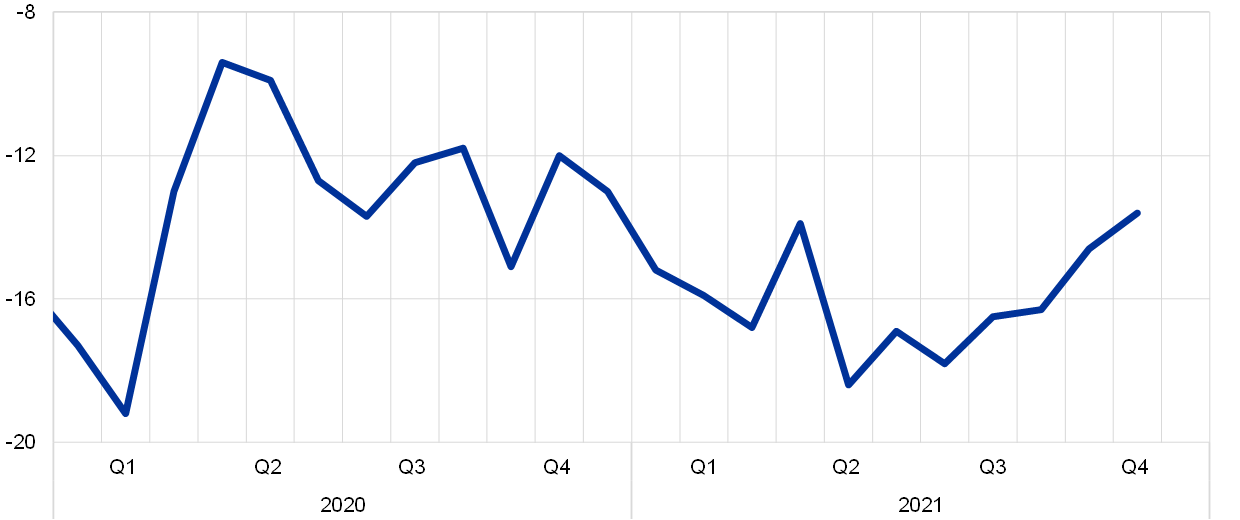

New pandemic-related risks are again causing concern for households. Consumer confidence fell to -6.8 in November, its lowest level since April 2021, seemingly reflecting growing concerns about the recent evolution of the pandemic. Since the summer, respondents to the European Commission’s monthly consumer survey have become increasingly uncertain about their future financial situation (Chart 13). As news concerning the pandemic worsened further in November and December, monthly consumer confidence figures may still understate the current situation. Adverse pandemic-related developments during the winter months are expected to weigh on the consumption of contact-intensive services over the next few quarters.

Chart 13

Uncertainty among euro area households about their future financial situation

(percentage balances)

Source: European Commission.

Notes: Since the spring of 2019, the European Commission’s monthly consumer survey has included an additional question that explicitly asks about the ease with which households are able to predict their future financial situation. The latest observation is for November 2021.

Corporate (non-construction) investment fell back in the third quarter of 2021, despite strong demand for capital goods. Euro area non-construction investment (excluding Ireland[10]) declined by 0.6% quarter on quarter in the third quarter of 2021, offsetting an expansion in the previous quarter and remaining slightly below the pre‑pandemic level seen in the last quarter of 2019. Among the largest euro area countries, non-construction investment increased in Italy and Spain, while it declined in Germany and the Netherlands and remained roughly unchanged in France. As for the components of non-construction investment, investment in transport equipment contracted strongly in the euro area for a third consecutive quarter, mostly related to input shortages as a result of the ongoing supply chain bottlenecks.[11] By contrast, investment in non-transport equipment and intellectual property products continued to expand. Alongside the reported shortages of equipment and labour, which are seen as key factors limiting production in the euro area, short-term indicators for the fourth quarter of 2021 suggest continued strong demand for capital goods. New orders of capital goods continue to rise, with the October PMI clearly pointing to growth. Information from the euro area bank lending survey[12] is also in line with upbeat expectations regarding firms’ investment activities, as banks expect demand for long-term loans (typically used in the financing of investment) to increase in the fourth quarter of 2021.[13]

Housing investment declined in the third quarter of the year and is likely to remain subdued on account of continuing supply bottlenecks and pandemic‑related uncertainties. Housing investment in the third quarter fell by 1.2% relative to its second-quarter level. The European Commission’s indicator of recent trends in construction activity declined significantly, on average, in the first two months of the fourth quarter, although it remained well above its long-term average. The PMI for housing activity increased somewhat, rising further into expansionary territory. On the household side, European Commission survey data show buoyant demand, with consumers’ short-term intentions to buy or build a home reaching their highest level since early 2002, while intentions to renovate were at their highest level ever in the fourth quarter of 2021. Favourable demand is also reflected in data for firms, where confidence has improved again, driven by a further increase in firms’ assessments of order book levels. However, supply concerns have also increased again, with companies reporting a further increase in material and labour shortages, which were already at an all-time high in the third quarter. These supply bottlenecks are also reflected in the latest PMI surveys, which show very long delivery times for suppliers, and are likely to have contributed to construction companies’ somewhat less optimistic assessment of business activity over the next 12 months.

Although net trade contributed positively to GDP growth in the third quarter, goods exports were held back by the ongoing supply disruptions. In the third quarter of 2021, euro area exports increased by 1.2% quarter on quarter while imports expanded by 0.7%, resulting in a 0.3 percentage point contribution to GDP growth. Trade in goods and services had divergent outcomes. Exports and imports of goods declined (by 1.0% and 0.9% respectively quarter on quarter) as global demand softened and supply disruptions persisted. By contrast, exports and imports of services expanded strongly (by 7.3% and 5.9% respectively quarter on quarter), with exports driven by double-digit growth rates in countries that are summer tourist destinations. Looking ahead, order-based indicators for goods exports signal a moderation in demand. Moreover, the renewed intensification of the pandemic threatens the recovery in services exports, particularly travel-related services. Passenger and flight data show a deceleration in the recovery as of September 2021, while forward-looking indicators based on orders and expectations point to momentum slowing in the coming months.

Near-term uncertainties notwithstanding, euro area activity is expected to exceed pre-crisis levels in the course of 2022. The medium-term outlook envisages a further strengthening of domestic demand alongside an improving labour market and strengthening global growth as near-term disruptions subside, as well as ongoing policy support from both monetary and fiscal policy in the transition to self-supporting growth. Furthermore, progress with the implementation of the Next Generation EU programme is an additional factor helping to support the recovery. This is reflected in the December 2021 Eurosystem staff macroeconomic projections for the euro area, which foresee annual real GDP growth of 5.1% in 2021, 4.2% in 2022, 2.9% in 2023 and 1.6% in 2024 (Chart 14). Compared with the September 2021 ECB staff macroeconomic projections, the growth profile has been revised downward in 2022, but upward in 2023. The downward revisions in the near term reflect the recent intensification of global supply bottlenecks and tighter pandemic‑related restrictions in the face of a resurgence in COVID-19 case numbers in some euro area countries, which are now expected to continue into 2022. As a consequence, quarterly euro area activity is now expected to return to pre-pandemic levels by the first quarter of 2022, one quarter later than was envisaged in the September 2021 projections. However, growth is expected to rebound strongly towards the end of 2022 as these headwinds gradually dissipate. Consequently, euro area GDP is now expected to rise above the level foreseen in the September 2021 projections by the end of 2022, resulting in substantial carry-over effects into 2023 and an upward revision to annual growth in that year.[14]

Chart 14

Euro area real GDP (including projections)

(index; fourth quarter of 2019 = 100; seasonally and working day-adjusted quarterly data)

Sources: Eurostat and the article entitled “Eurosystem staff macroeconomic projections for the euro area, December 2021”, published on the ECB’s website on 16 December 2021.

Note: The vertical line indicates the start of the December 2021 projections and follows the last observation for euro area real GDP, which relates to the third quarter of 2021.

4 Prices and costs

Euro area annual inflation rose to a record high of 4.9% in November 2021 according to Eurostat’s flash estimate. The upswing in inflation primarily reflects a sharp rise in energy prices. In November, energy inflation accounted for more than half of headline inflation. Demand also continued to outpace constrained supply in certain sectors. The consequences are especially visible in the prices of durable goods and those consumer services that have recently reopened. Base effects related to the end of the VAT cut in Germany are still contributing to higher inflation, but only until the end of 2021. Inflation is expected to remain elevated in the near term, but to decline in the course of 2022. Over time, the gradual return of the economy to full capacity and further improvements in the labour market should support faster growth in wages, underpinned by an upward movement of inflation expectations towards the target. These factors should help underlying inflation to move up and bring headline inflation up to the target over the medium term. These developments are reflected in the December 2021 Eurosystem staff macroeconomic projections for the euro area, which foresee annual inflation at 2.6% in 2021, 3.2% in 2022, 1.8% in 2023 and 1.8% in 2024 – revised up from the September 2021 ECB staff macroeconomic projections. Inflation excluding food and energy is projected to average 1.4% in 2021, 1.9% in 2022, 1.7% in 2023 and 1.8% in 2024, also higher than in the September 2021 projections.

HICP inflation reached a record high in November 2021 (Chart 15). According to Eurostat’s flash estimate for November, HICP inflation increased sharply again, rising from 3.4% in September to 4.1% in October and 4.9% in November. This is the highest level of HICP inflation since the start of Economic and Monetary Union in 1999. The increase was driven by a further rise in energy inflation, which accounted for just over half of headline inflation in November, hitting an all-time high of 27.4% after 17.6% in September. However, HICP inflation excluding food and energy (HICPX) also increased substantially, up from 1.9% in September to 2.0% in October and 2.6% in November – a record high since 1999. This surge reflects sharp increases in both services inflation (which went up from 1.7% in September to 2.7% in November) and non-energy industrial goods inflation (which rose from 2.1% in September to 2.4% in November).[15] The euro area inflation rate also continued to be affected by the changes in both the VAT rate in Germany in 2020 – affecting inflation until the end of 2021 – and HICP weights[16]. Excluding the upward impact on annual rates of change from the reversal of the temporary cut in the German VAT rate in January 2021 would reduce headline inflation by 0.35 percentage points for the period since July. Additionally, while the change in HICP weights had a dampening impact in October, it made no difference in November. Net of the impact of the VAT cut and HICP weight changes, both the level of inflation and the upward movement between October and November would be somewhat less significant.

Chart 15

Headline inflation and its components

(annual percentage changes; percentage point contributions)

Sources: Eurostat, ECB staff calculations and the Narrow Inflation Projection Exercise.

Notes: Components highlighted with * exclude both the impact of the changes in HICP weights in 2021 and the temporary reduction in VAT in Germany in 2020. The impact of the changes in HICP weights is estimated by the ECB and the impact in November may change depending on Eurostat’s full release for that month. The latest observations are for November 2021 (flash estimates).

The surge in energy inflation to a historical high largely reflected the sharp pick-up in global commodity prices. Oil price developments gave rise to a large contribution from the fuel component of the HICP. However, the recent increases in consumer prices for gas and electricity also resulted in larger contributions from those components in November, accounting for more than 0.8 percentage points of headline inflation (Chart 16) for the first time since 1999. The greater contribution from the gas component was driven by the rise in global and European wholesale gas prices, which, in turn, pushed up EU wholesale electricity prices, as electricity prices are based on the short-run marginal costs of power plants. Higher allowance prices under the EU Emissions Trading Scheme also had an upward impact, albeit a much smaller one. For a discussion of the energy inflation outlook in relation to these factors, see the box entitled “Developments in energy commodity prices and their implications for HICP energy price projections” in the December 2021 Eurosystem staff macroeconomic projections for the euro area.

Chart 16

Energy inflation decomposition

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: “Fuel” refers to the HICP component “liquid fuels and fuels and lubricants for personal transport equipment”. “Other” includes the items “solid fuels” and “heat energy” at the COICOP 5-digit level of aggregation. COICOP stands for classification of individual consumption according to purpose. The latest observations are for October 2021 for COICOP subcomponents and for November 2021 for energy inflation.

Indicators of underlying inflation continued to increase (Chart 17). HICPX increased to 2.6% in November (estimated at 2.5% when excluding the effects of changes in HICP weights, and at 2.2% when also taking into account the VAT cut in Germany in 2020). Data for other indicators of underlying inflation are only available up to October. HICP inflation excluding energy, food, travel-related items, clothing and footwear (HICPXX) rose from 1.9% in September to 2.1% in October, while the model-based Persistent and Common Component of Inflation (PCCI) went up from 1.8% to 1.9% over the same period. The Supercore indicator, which comprises cyclically sensitive items, increased for the fourth consecutive month, edging up to 2.0% in October from 1.6% in September. The distribution of inflation rates across HICP items is currently very broad, and 46% of the items included in HICPX recorded inflation rates above 2%. This implies that exclusion-based indicators of underlying inflation, especially the so-called trimmed means, derived from the items in the HICP basket, still include a number of items with relatively high and volatile growth rates, which in recent months have pushed up the corresponding measures into the upper end of the range of indicators of underlying inflation.[17]

Chart 17

Indicators of underlying inflation

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Notes: The range of indicators of underlying inflation includes HICP excluding energy, HICP excluding energy and unprocessed food, HICPX (HICP excluding energy and food), HICPXX (HICP excluding energy, food, travel-related items, clothing and footwear), the 10% and 30% trimmed means and the weighted median. The latest observations are for November 2021 for HICPX and for October 2021 for all other indicators.

Pipeline pressures on prices for non-energy industrial goods continued to build up in October (Chart 18). At the earlier input stages, the annual rate of change in producer prices for domestic sales of intermediate goods rose sharply, up from 14.3% in August to 15.2% in September and 16.8% in October, while the annual rate of change in import prices for intermediate goods increased from 16.0% in August to 16.2% in September and 17.2% in October. Pipeline pressures have extended to the later stages of the pricing chain: producer price inflation for domestic sales of non-food consumer goods continued to rise, up from 2.2% in August to 2.3% in September and 2.8% in October – a new historical high – while import price inflation for non-food consumer goods rose from 2.4% in August to 2.8% in September and 3.1% in October, which is also attributable to the recent depreciation in the nominal effective exchange rate of the euro. This increase in pipeline price pressures is taking place in an environment where surges in global commodity prices (reinforced by the depreciation in the euro) and supply bottlenecks are affecting firms’ production costs, raising the question of the extent to which these pressures will ultimately be passed through to consumer goods prices. Recent findings from the Corporate Telephone Survey show that companies anticipated a higher pass-through of input costs not only to other businesses, but also to consumers.[18] However, under the current pandemic circumstances, there remains considerable uncertainty about the degree of pass-through of these pipeline pressures to consumer goods prices.

Chart 18

Indicators of pipeline pressures

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for October 2021.

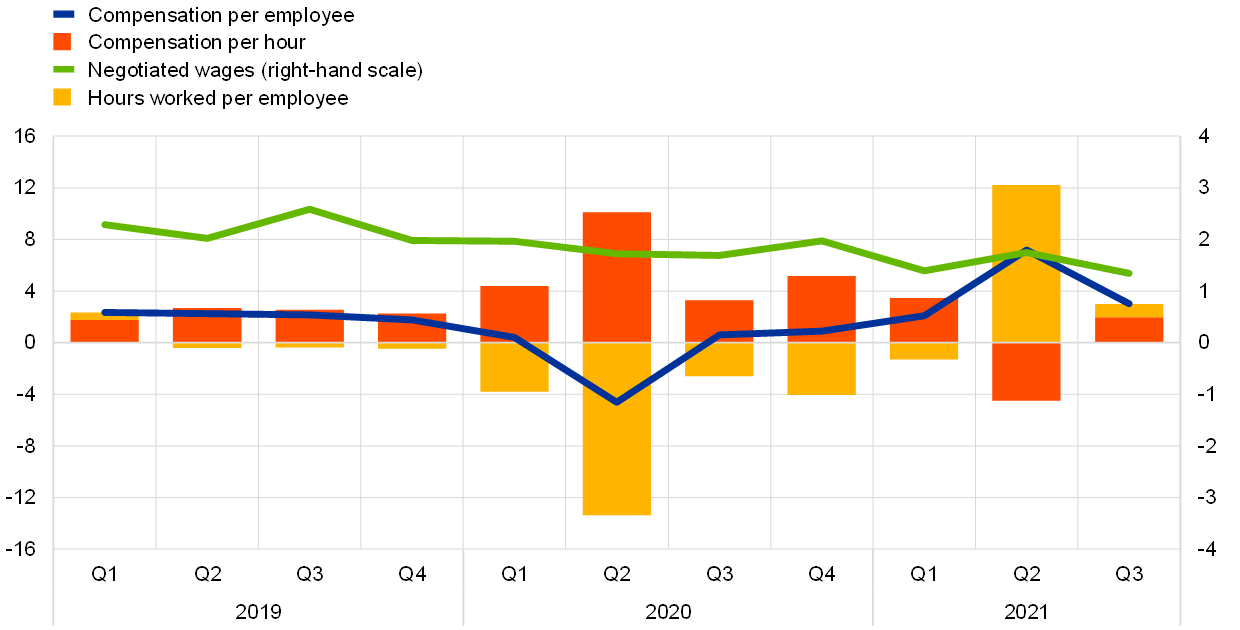

Wage pressures have remained moderate so far, but measures of wage growth continue to be blurred by pandemic-related developments. Growth in compensation per employee and compensation per hour converged in the third quarter of 2021, after a large gap between the two measures in the second quarter, with annual growth in compensation per employee moderating to 3.0% in the third quarter, down from 7.2% in the second quarter, and compensation per hour rising to 2.0% in the third quarter, up from -4.5% in the second quarter (Chart 19). These large movements in the year-on-year growth rates mainly reflect base effects associated with developments in 2020, when short-time work and temporary lay-off schemes meant that people retained their employment status but worked fewer hours. However, policy measures remain in place and are still distorting measures of wage growth to some degree. Negotiated wages, which are not directly affected by developments in hours worked or the recording of benefits from job retention schemes, declined to 1.3% in the third quarter of 2021, down from 1.8% in the second quarter.[19] Although this measure is more stable than actual wage growth, it does also entail some volatility, as it includes some special pandemic-related one-off payments. While negotiated wages suggest that wage growth is only moderate, the data probably cover negotiations that were concluded before the recent surge in inflation.

Chart 19

Decomposition of compensation per employee into compensation per hour and hours worked

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the third quarter of 2021.

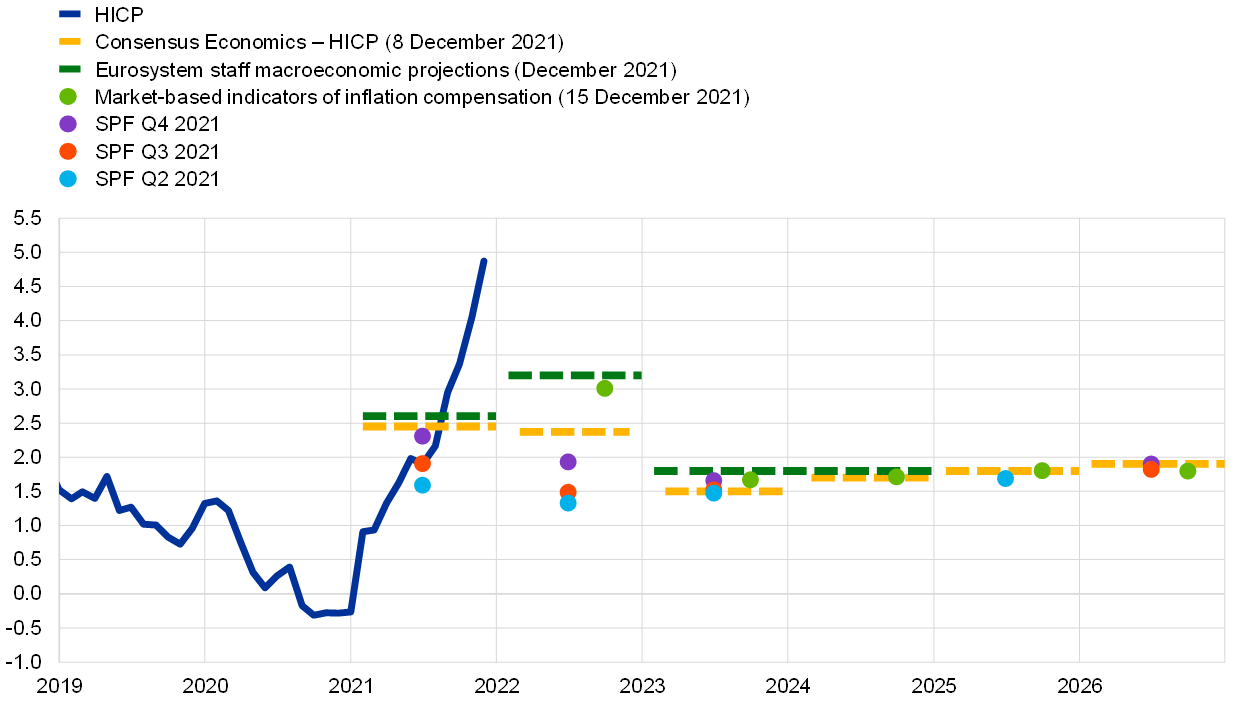

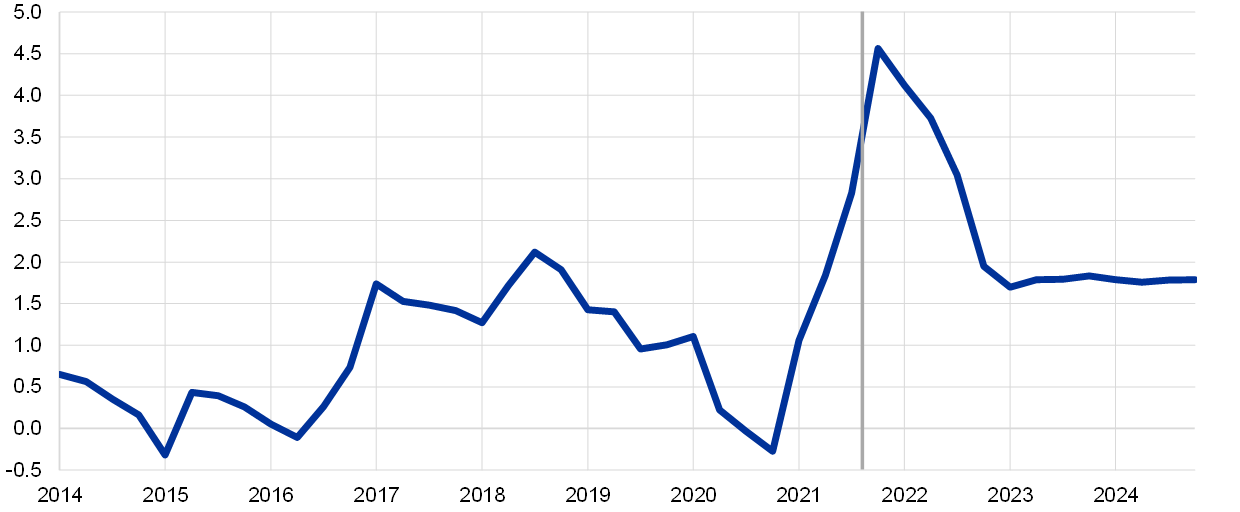

Market-based indicators of inflation compensation displayed significant intra-period volatility, rising strongly in the first half of the review period and reversing only some of those increases in the second half, while survey-based measures of inflation expectations went up in the second half of 2021. Sustained supply chain tensions, rising energy prices and positive euro area inflation surprises continued to exert upward pressure on euro area inflation-linked swap (ILS) rates in the first part of the review period. ILS forward rates peaked towards the end of October at levels above 2% for horizons beyond five years. For instance, the five-year forward ILS rate five years ahead reached 2.1%, a level last seen during the summer of 2014. Reversing some of those increases, market-based indicators of inflation compensation have declined since late October on both sides of the Atlantic, amid falling prices for energy, in particular for oil. Overall, markets are pricing in a rise in euro area inflation over the short term, and the increase being priced in is sharper and more persistent than previously anticipated. At the same time, they are still pricing in the rise in inflation as transitory, with the one-year forward ILS rate one year ahead standing at around 1.7% and the five-year forward ILS rate five years ahead slightly higher at 1.8%. However, inflation options are signalling an increasing risk that average inflation will exceed levels well above 2% over the next five years, while the risk of inflation surpassing the 3% mark remains low. From a longer-term perspective, model-based estimates show that the significant rise in market-based measures of inflation compensation since mid-2020 is attributable mainly to inflation risk premia (for more details, see the box entitled “Decomposing market-based measures of inflation compensation into inflation expectations and risk premia” in this issue of the Economic Bulletin). Over the summer there was an uptick in survey-based indicators of inflation expectations, which – similarly to the December 2021 Eurosystem staff macroeconomic projections for the euro area – support the notion of a hump-shaped profile for inflation. According to the ECB Survey of Professional Forecasters for the fourth quarter of 2021, which was conducted in the first week of October, as well as the October Consensus Economics forecasts, longer-term inflation expectations increased to 1.9% (Chart 20).

Chart 20

Survey-based indicators of inflation expectations and market-based indicators of inflation compensation

(annual percentage changes)

Sources: Eurostat, Refinitiv, Consensus Economics, ECB Survey of Professional Forecasters, Eurosystem staff macroeconomic projections for the euro area, December 2021 and ECB calculations.