- 23 NOVEMBER 2022 · RESEARCH BULLETIN NO. 101

Financial stability and macroprudential regulation under diagnostic expectations

Recent empirical findings (Bordalo et al., 2018, 2019; Greenwood et al., 2022) have vindicated the view that systemic risk in financial markets is also influenced by cognitive misperceptions about future economic developments in addition to being influenced by financial frictions. Most of the literature on macroprudential regulation, nonetheless, has omitted those misperceptions and instead has derived policy implications assuming rational expectations. In this article (which is based on Camous and Van der Ghote, 2021), we examine the joint implications of external financing frictions and extrapolative expectations for the stability of the financial system and the appropriate conduct of macroprudential regulation. We find that interactions between those two elements exacerbate financial instability relative to the rational benchmark. This calls for tighter macroprudential regulation, even when the regulator is also subject to cognitive misperceptions. Disagreement about the appropriate macroprudential regulation among potential regulators with differing degrees of misperception is stronger during booms, when risk-taking in financial markets and in real investments is more aggressive.

The role of cognitive misperception in financial market fluctuation

Traditionally, the literature has highlighted the role of external financing frictions as the key reason why fluctuations in the aggregate capitalisation of financial intermediaries matter for asset prices, aggregate credit, and economic activity. The prevailing argument is that when financial intermediaries are poorly capitalised, new credit to households and businesses is curtailed. This happens because financial companies with high leverage either have poor incentives to repay their financial obligations (Bernanke and Gertler, 1989; Hart and Moore, 1990; Kiyotaki and Moore, 1997) or are vulnerable to sudden stops in the refinancing of their obligations by speculative creditors (Diamond and Dybvig, 1983), or both (Gertler and Kiyotaki, 2015; Gertler et al., 2020). The opposite naturally happens when the intermediaries are instead well capitalised.

More recent empirical evidence (Bordalo et al., 2018, 2019; Greenwood et al., 2022) has vindicated the view that cognitive misperceptions about the prospects of new technologies or the evolution of asset prices may also influence fluctuations in aggregate credit and economic activity (Kindleberger 1978 and Minsky 1986). According to this alternative view, after a sequence of positive events, economic actors become overoptimistic about economic fundamentals or asset prices, which then leads to unsustainable developments in financial risk-taking, investment, and consumption. When those excesses become apparent – for example, after a subsequent sequence of disappointing events – a panic ensues, leading to a crash in asset prices and a sharp contraction in aggregate output. The cycle eventually starts again, after a sufficiently long sequence of positive events has erased the bad memories associated with the earlier collapse.

At the time of writing, consensus is emerging in both academic and policy circles (Bernanke et al., 2019) that both the frictions and the misperceptions need to be considered to understand fluctuations in financial markets, aggregate credit, and economic activity.

Joint implications of financial frictions and cognitive misperceptions for financial stability

In this article, we examine the joint implications of external financing frictions and cognitive misperceptions for the stability of the financial system and the appropriate conduct of macroprudential regulation. To do so, we use a dynamic stochastic general equilibrium (DSGE) model economy with a financial intermediary sector, in which episodes with poorly and well capitalised intermediaries periodically recur. Frictions to external financing are modelled as restrictions to short-term debt issuance and cash collateral limits on issued debt. The misperceptions in the model do not originate from departures from full information, but instead originate from deviations from a process for forming rational expectations (“RE”). The modelled deviations are consistent with those usually referred to as “representativeness heuristic” (Kahneman and Tversky, 1972) or, alternatively, “diagnostic expectations” (Bordalo et al., 2018). These are extrapolative expectations that assign relatively more likelihood to events in the future that are reminiscent of those realised in the recent past. As such, relative to the rational benchmark, these expectations tend to overreact to recent information. The model uses this type of expectations because their associated forecast errors on asset returns are consistent with those empirically documented by Bordalo et al., (2018, 2019).[2]

Relative to the rational benchmark, diagnostic expectations and their interactions with financing frictions exacerbate instability in financial markets and economic activity. There are two reasons why this happens.

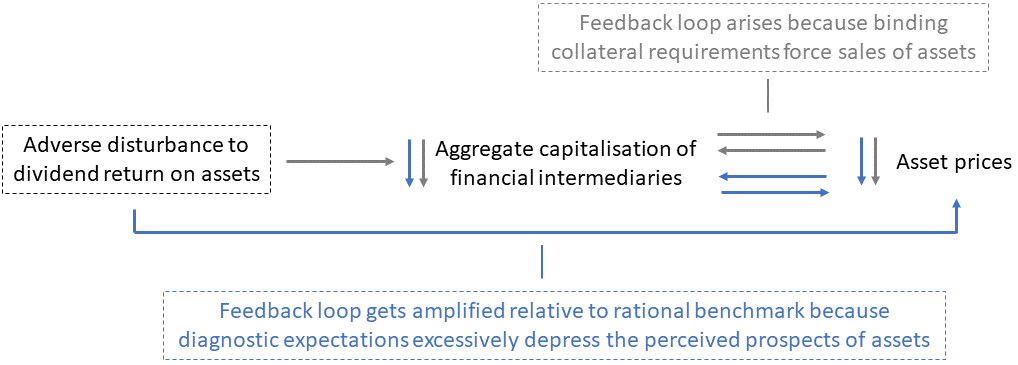

Chart 1

Financial implications of financing frictions and diagnostic expectations (1/2)

Notes: The chart illustrates interactions between fluctuations in financial net worth (i.e. aggregate capitalisation of financial intermediaries) and fluctuations in asset prices. Blue ink indicates additional effects over a world with rational expectations that stem from diagnostic expectations. The additional effects are stronger the larger are (absolute) forecast errors on asset returns. Those errors are indeed larger during booms, when risk-taking in financial markets and in real investments is more aggressive.

First, diagnostic expectations intensify a positive interaction between fluctuations in financial net worth and fluctuations in asset prices (Chart 1). When adverse disturbances to asset returns hit the economy, for instance, financial intermediaries lose net worth, and to meet binding collateral requirements, they are forced to sell their assets, even at discounted prices. These sales in turn exert downward pressure on asset prices, which further deteriorates financial net worth, leading to a vicious circle of asset sales at increasingly distressed prices. This interaction is a natural consequence of the financing frictions, and arises even under rational expectations. It also has amplification effects on key macroeconomic aggregates, such as aggregate credit and aggregate output. Under diagnostic expectations, however, asset prices fall further, strengthening the interaction and the amplification effects. This happens because under those expectations, economic actors become overly pessimistic after the adverse disturbances.

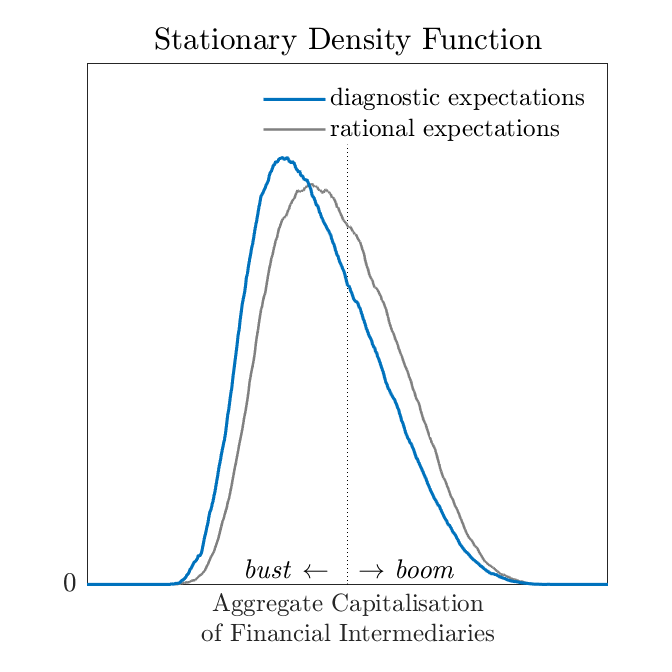

Second, diagnostic expectations generate negative forecast errors on asset returns during booms (when financial intermediaries are well capitalised) and positive forecast errors during busts (when the intermediaries are poorly capitalised). Negative forecast errors ultimately hurt the net worth of the intermediaries because those errors shape asset valuations that are excessively high relative to underlying fundamentals. Positive forecast errors naturally have the opposite effects. But because risk-taking in financial markets and in real investments is more aggressive during booms than during busts, any beneficial effects of the errors are more than outweighed by their adverse effects. This asymmetry then reduces the unconditional average aggregate net worth of financial intermediaries. It also increases the frequency of episodes with poorly capitalised intermediaries, low aggregate credit, and curtailed economic activity (Chart 2).

Chart 2

Financial implications of financing frictions and diagnostic expectations (2/2)

Notes: The chart reports stationary density functions of the aggregate capitalisation of financial intermediaries under rational and diagnostic expectations. A leftward shift of the function means that financial distress and its associated depressed macroeconomic conditions occur more often or are more pronounced.

Implications for macroprudential regulation

The aforementioned financial and real fluctuations are generally excessive from a social point of view. This is because financial intermediaries do not internalise the collective effects of their individual risk-taking and leverage decisions on asset prices, asset returns, or the individual return on financial net worth. In other words, the model features pecuniary externalities in financial markets that, for instance, influence deleveraging needs following adverse disturbances to asset returns. These externalities motivate appropriate restrictions on financial leverage or on new credit to the nonfinancial sector as a mean to improve financial stability and social welfare compared to a policy regime of laissez faire.

Relative to the rational framework, under diagnostic expectations, appropriate macroprudential restrictions on new credit to the nonfinancial sector are tighter, even when the regulator is subject to the same expectations as the private sector. This is a consequence of stronger amplification effects which, in turn, strengthen the joint sensitivity of asset prices and financial net worth to disturbances to asset returns as well as the pecuniary externalities. A regulator that instead forms rational expectations in a world with diagnostic private actors prefers to further tighten during booms but to soften the tightening during busts. This is because that regulator is aware of the countercyclicality in forecast errors. These results naturally reveal disagreements among potential regulators with differing degrees of diagnostic expectations about the appropriate regulation. This dissonance is more pronounced during booms, when there is more aggressive risk-taking in financial markets and in real investments.

Conclusion

We examine the joint implications of external financing frictions and diagnostic cognitive misperceptions about economic fundamentals or asset prices for the stability of the financial system and the appropriate conduct of macroprudential regulation. The key result is that diagnostic expectations exacerbate financial instability relative to the benchmark of rational expectations. This finding calls for tighter macroprudential regulation even when the regulator is also subject to misperceptions.

References

Bernanke, B., and Gertler, M. (1989), “Agency Costs, Net Worth, and Business Fluctuations”, The American Economic Review, 79(1), 14–31.

Bernanke, B. S., Gertler, M., and Gilchrist, S. (1999), “The financial accelerator in a quantitative business cycle framework”, Handbook of macroeconomics, 1, 1341-1393.

Bernanke, B. S., Geithner, T. F., and Paulson Jr, H. M. (2019), “Firefighting: the financial crisis and its lessons”, Penguin.

Bordalo, P., Gennaioli, N., Porta, R. L., and Shleifer, A. (2019), “Diagnostic expectations and stock returns”, The Journal of Finance, 74(6), 2839-2874.

Bordalo, P., Gennaioli, N., and Shleifer, A. (2018), “Diagnostic expectations and credit cycles”, The Journal of Finance, 73(1), 199-227.

Dell’Ariccia, G., Igan, D., and Laeven, L. U. (2012), “Credit booms and lending standards: Evidence from the subprime mortgage market”, Journal of Money, Credit and Banking, 44(2‐3), 367-384.

Diamond, D. W., and Dybvig, P. H. (1983), “Bank runs, deposit insurance, and liquidity”, Journal of political economy, 91(3), 401-419.

Gertler, M., and Kiyotaki, N. (2015), “Banking, liquidity, and bank runs in an infinite horizon economy”, American Economic Review, 105(7), 2011-43.

Gertler, M., Kiyotaki, N., and Prestipino, A. (2020), “A macroeconomic model with financial panics”, The Review of Economic Studies, 87(1), 240-288.

Greenwood, R., Hanson, S. G., Shleifer, A., and Sørensen, J. A. (2022), “Predictable financial crises”, The Journal of Finance, 77(2), 863-921.

Hart, O., and Moore, J. (1990), “Property Rights and the Nature of the Firm”, Journal of Political Economy, 98(6), 1119-1158.

Kahneman, D., and Tversky, A. (1972), “Subjective probability: A judgment of representativeness”, Cognitive psychology, 3(3), 430-454.

Kindleberger, C. P. (1978), “Manias, panics, and crashes: A history of financial crises”, Macmillan.

Kiyotaki, N., and Moore, J. (1997), “Credit cycles”, Journal of Political Economy, 105(2), 211-248.

Maxted, P. (forthcoming), “A macro-finance model with sentiment”, Review of Economic Studies.

Mian, A., and Sufi, A. (2009), “The consequences of mortgage credit expansion: Evidence from the US mortgage default crisis”, The Quarterly journal of economics, 124(4), 1449-1496.

Minsky, H. (1986), “Stabilizing an unstable economy”, McGraw-Hill Professional, New York.

This article was written by Antoine Camous (University of Mannheim) and Alejandro Van der Ghote (Senior Economist, Directorate General Research, European Central Bank). The authors gratefully acknowledge the comments of Gareth Budden, Michael Ehrmann, and Alexander Popov. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

The model in this article builds on Maxted (forthcoming), who adapts the diagnostic process for expectation formation to a continuous-time setup. A central difference to Maxted (forthcoming) is that the present model features multiple production technologies with different return and risk profiles. This richer production structure allows for risk-taking in real investments as well, which is a salient feature in historical accounts of financial booms and busts (Kindleberger, 1978) as well as in empirical evidence related to the build-up of the Global Financial Crisis (Mian and Sufi, 2009; Dell’Ariccia et al., 2012).