Published as part of the Financial Stability Review, November 2022.

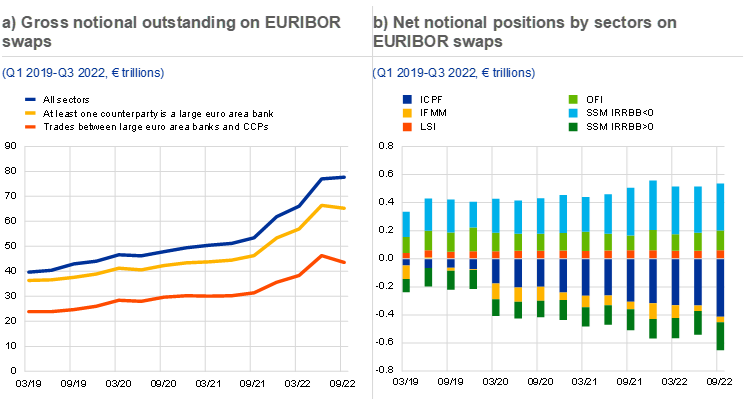

Euro area interest rate swap activity has risen sharply since 2021, reflecting the critical role of derivatives in managing interest rate risk as monetary policy expectations have shifted. Interest rate swaps (“swaps”) account for the largest share of the euro area derivatives market. Between March 2021 and September 2022, gross notional on EURIBOR swaps – the most traded and liquid derivatives used to hedge interest rate risk for euro-denominated exposures – increased by around 50% (Chart A, panel a). While earlier work has identified how euro area banks are using swaps in part to manage their interest rate risk (IRR),[1] this box uses trade repository data on individual EURIBOR swap trades between 2019 and 2022 to identify how the risk is being shared across sectors in the swaps market or, in other words, who would pay margins to whom should rates change.[2]

Euro area banks are among the most active counterparties on EURIBOR swaps, due to either their role as market-makers or their need to hedge interest rate risk. Banks are generally net buyers of floating rate payments, hedging the risk from their fixed-rate assets (Chart A, panel b). Due to the clearing obligation for EURIBOR swaps, a large share of trades is intermediated by significant institutions that are in some cases also clearing members of central clearing counterparties (CCPs). Almost all euro area banks are active in the EURIBOR swaps market; and we define as market-makers 26 larger banks that jointly intermediate roughly 90% of the gross notional held by significant institutions.[3]

Chart A

EURIBOR swap trading by euro area market participants started intensifying in 2021 as ECB monetary policy normalisation was priced in

Sources: EMIR and ECB calculations.

Notes: Panel a: intragroup trades and trades reported with central clearing counterparties (CCPs) are included. Panel b: EMIR sector classification based on Lenoci and Letizia*. SSM IRRBB<0 (SSM IRRBB>0) are ECB-supervised significant institutions with negative interest rate risk in the banking book (IRRBB) and positive duration gap (positive IRRBB and negative duration gap) excluding derivatives. OFI stands for other financial institutions; ICPF stands for insurance companies and pension funds; IFMM stands for investment funds and money market mutual funds; LSI stands for less significant institutions. Net positions of market-makers, CCPs, governments, non-financial corporations, NCBs and non-identifiable sectors are excluded. Market-makers and non-euro area CCPs are excluded as, due to the perimeter of EMIR reporting, their net positions would be unbalanced towards net sellers and net buyers respectively, in this way biasing their structural characteristics of net-zero positions. Non-euro area banks are also removed due to the perimeter of EMIR reporting.

*) Lenoci, F.D. and Letizia, E., “Classifying Counterparty Sector in EMIR Data”, in Consoli, S., Reforgiato Recupero, D. and Saisana, M. (eds.), Data Science for Economics and Finance, Springer, Cham, 2021.

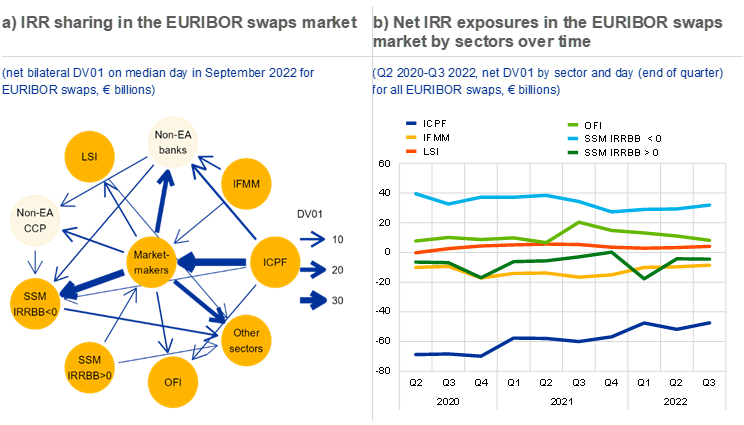

On aggregate, banks use swaps to hedge their interest rate risk exposures.[4] The derivatives positions of ECB-supervised banks negatively exposed to IRR on aggregate appreciate in value vis-à-vis market-makers, non-euro area CCPs and ECB-supervised banks positively exposed to IRR following an increase in interest rates.[5] Market-makers are the main counterparty to SSM banks negatively exposed to IRR (Chart B, panel a). A parallel shift of 100 basis points in the yield curve[6] leads to a wealth transfer (equivalent to a margin payment) of around €33 billion from market-makers to banks negatively exposed to IRR.[7] Accordingly, the derivatives positions of ECB-supervised banks positively exposed to IRR on aggregate depreciate in value vis-à-vis ECB-supervised banks negatively exposed to IRR, non-euro area banks and other entities following an increase in interest rates.

Chart B

Net IRR swap exposures mostly reflect business model-related hedging needs

Sources: EMIR, STE, RIAD and ECB calculations.

Notes: The DV01 is the derivative of the price of an interest rate swap with respect to a 100 basis point parallel shift of the underlying floating interest rate curve. Panel a: this chart is a stylised representation of risk-sharing in the swaps market. It provides information on the direction (arrows) and size (thickness) of the wealth transfers across sectors arising from a 100 basis point parallel upward shift in the yield curve approximated by the DV01. Non-euro area sectors are in lighter yellow, highlighting that we do not observe all their exposures as they are outside of the EMIR reporting perimeter. The sample comprises all entities reporting under EMIR and all ECB-supervised banks excluding their intragroup exposures. SSM stands for banks supervised by the ECB and IRRBB for interest rate risk on the banking book without derivatives, giving– 52 significant institutions with IRRBB<0 and 25 with IRRBB>0; LSI stands for less significant institutions; “Market-makers” are SSM banks which have large gross but relatively small net positions and interact with CCPs; “Other sectors” are governments, non-financial corporations and national central banks (including outside the euro area); “Non-EA CCP” are central clearing counterparties outside the euro area; “Non-EA banks” are banks outside euro area; OFI stands for other financial institutions; ICPF stands for insurance companies and pension funds; IFMM stands for investment funds and money market mutual funds. Panel b: market-makers and non-euro area CCPs are excluded as, due to the perimeter of EMIR reporting, their net positions would be unbalanced towards net sellers and net buyers respectively, thus biasing their structural characteristics of net-zero positions. Non-euro area banks are also removed due to the perimeter of EMIR reporting.

Investment funds, insurance companies and pension funds would need to make margin payments in the event of rising interest rates. This is consistent with the latter sectors having a maturity mismatch due to long-dated liabilities and relatively short-dated assets, meaning that they use swaps to hedge the underlying interest rate risk. These sectors are net payers to mainly market-makers and banks. In line with the over-the-counter nature of the swaps market, insurers and pension funds are mainly exposed to market-makers. Foreign banks and CCPs[8] are also important players in the swaps market. Large net transfers from market-makers to foreign banks would take place following an increase in interest rates. Market-makers and CCPs ought to be market-neutral, but the former are relatively large and hedge their banking-related exposures.

Stable sectoral IRR exposures reflect specific features of each sectors’ business model, but large margin payments in times of low liquidity could pose financial stability risks. This finding seems to suggest that most sectors use swaps to hedge their IRR. ECB-supervised banks negatively or positively exposed to IRR (in their banking book without derivatives) have been hedging accordingly, while insurers and pension funds hold a negative net exposure to IRR, having longer-dated liabilities and relatively shorter-dated assets (Chart B, panel b). Abrupt shifts in interest rates triggering margin payments could pose financial stability concerns in times of low market liquidity and if exposed entities do not have access to sufficient liquidity.

See the box entitled “Interest rate risk exposures and hedging of euro area banks’ banking books”, Financial Stability Review, ECB, May 2022. This analysis shows that banks’ overall IRR exposure appears moderate on aggregate, although wide variations exist across individual institutions.

This exercise is carried out building on Hoffmann P., Langfield S., Pierobon, F. and Vuillemey, G., “Who Bears Interest Rate Risk?”, Review of Financial Studies, Vol. 32, Issue 8, 2019.

Market-makers are defined as banks that, in at least one quarter between 2019 and 2022, had a gross notional outstanding above the 75th percentile and a net/gross notional ratio between -4% and +4%. Intragroup transactions are excluded for the computation of market-makers. Net notional is computed as bank-level buying-selling positions abstracting from the sector/ID of the other counterparty.

The net bilateral IRR exposures and net IRR exposures take into account the duration of the exposure while the net notional does not. Bilateral netting means that we take the sum of all exposures of the combination of one sector vis-à-vis another sector. Netting at the sector level means we net all exposures where a counterparty is classified as belonging to a given sector.

Banks positively (negatively) exposed to IRR are defined in this box as banks whose banking books’ duration gaps, excluding derivatives, are negative (positive), meaning that their economic value of equity (EVE) increases following a parallel upward shift of the yield curve.

A 100 basis point move in interest rates is extremely unlikely to occur within a day but is more likely over longer time horizons.

This wealth transfer is offset by the gains in the EVE on the underlying market-makers’ balance sheet positions.

Foreign CCPs will have offsetting contracts in non-euro area jurisdictions, which are not part of the dataset we use in our analysis. Therefore, it is not the case that CCPs bear interest rate risk. The same goes for other foreign entities.