Liquidity mismatch in open-ended funds: trends, gaps and policy implications

Published as part of the Financial Stability Review, November 2022.

Liquidity mismatch between assets and liabilities continues to be a key vulnerability in open-ended investment funds.[1] A mismatch arises if funds give their investors the option of short-term redemptions, while at the same time investing in assets that cannot easily be liquidated at short notice. Existing evidence suggests that a larger liquidity mismatch makes it more difficult for funds to meet sudden, large redemption requests from investors, increasing the risk of procyclical asset sales and fund suspensions in response. This can adversely affect other investors and underlying markets.[2]

In 2017 the Financial Stability Board (FSB) responded to the growing size of the investment fund sector and the concern that financial stability risks had increased by publishing policy recommendations to address structural vulnerabilities related to asset management activities.[3] The recommendations aim to reduce liquidity mismatch and enable funds to better deal with liquidity shocks by tying the liquidity of fund assets to the redemption terms offered to fund investors. Specifically, FSB Recommendation 3 encourages authorities to enact requirements or guidance stating that funds’ assets and investment strategies should be consistent with the terms and conditions governing fund unit redemptions, including in periods of stress.

This box assesses the recent development of liquidity mismatch for a broad sample of euro area open-ended bond funds which offer daily redemptions and invest in less liquid assets to varying degrees. In particular, the box aims to shed light on whether liquidity mismatch and associated vulnerabilities have declined since the FSB recommendations were published in 2017, with a particular focus on the coronavirus (COVID-19) crisis.

During the pandemic, many open-ended bond funds, especially those with a relatively large structural liquidity mismatch and higher exposures to credit risk, faced substantial redemption pressures. Chart A (panel a) shows that funds invested in less liquid bonds, such as high-yield or emerging market bonds, faced more severe outflows in March 2020 than sovereign bond funds which are considered more liquid. In response to the market-wide shock, investment funds engaged in procyclical asset sales that in many cases exceeded outflows, thereby contributing to the wider market stress.[4]

Mixed bond funds can also contribute to market-wide stress if they invest in less liquid assets, suggesting it is important to broaden monitoring of liquidity mismatch to a wider set of funds. At the end of 2021, the euro area bond mutual fund sector comprised €2.3 trillion in total net assets, of which around €170 billion was held by sovereign funds, €330 billion by investment-grade corporate funds, €240 billion by high-yield funds and €220 billion by emerging market bond funds.[5] Mixed bond funds accounted for approximately €1.3 trillion in total net assets – more than half the assets managed by all euro area open-ended bond funds. At first sight, mixed bond funds faced somewhat milder outflows at the onset of the pandemic than other (non-sovereign) bond funds (Chart A, panel a). However, mixed bond funds with bigger corporate bond weights experienced large redemption pressures as well (Chart A, panel b). In addition, a large share of mixed bond funds’ assets is held by funds investing predominantly in corporate bonds (Chart B, panel a, green bars). This suggests that mixed bond funds can also be exposed to significant liquidity and credit risk despite their potential broader diversification across asset classes.

Chart A

The onset of the pandemic led to major outflows from bond funds during March 2020, with funds invested in less liquid bonds facing larger outflows

Source: Refinitiv Lipper IM.

Notes: Panel a: cumulative outflows from 1 March 2020 for different types of euro area bond funds. Panel b: cumulative outflows for mixed bond funds, divided into terciles based on their corporate bond allocation. The universe of funds is somewhat smaller in panel b), as holdings data are not available for a subset of funds. In both panels, the vertical line refers to the start of the pandemic emergency purchase programme (PEPP) purchases.

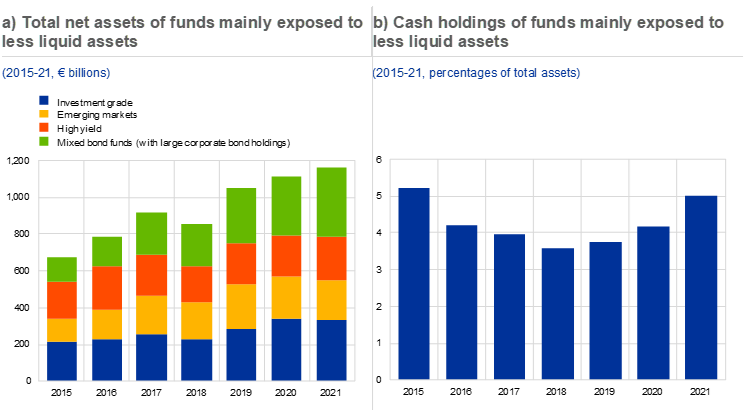

The total assets of funds that mainly invest in less liquid assets increased from 2015 to 2021 while their cash holdings decreased until 2018, contributing to increased liquidity mismatch during this period. Total net assets of funds predominantly invested in less liquid assets almost doubled to nearly €1.2 trillion between 2015 and 2021, now accounting for more than half of euro area bond funds’ total net assets (Chart B, panel a). Meanwhile, the share of cash in those funds decreased between 2015 and the end of 2018 (Chart B, panel b). This suggests that their liquidity mismatch increased during this period, given that the majority of funds continue to offer daily redemptions. When comparing cash levels at the end of February 2020 with funds’ outflows in March 2020, roughly half of the funds that predominantly invest in less liquid assets experienced outflows that exceeded the level of their cash holdings.[6] Following the beginning of the pandemic, funds that were primarily exposed to less liquid assets materially increased their cash holdings in 2020 and 2021, suggesting procyclical behaviour in liquidity management among fund managers.

Chart B

Total assets of funds that are mainly exposed to less liquid assets have increased, while their cash holdings decreased up to the end of 2018 and increased materially after the pandemic started

Source: Refinitiv Lipper IM.

Notes: Panel a: total net assets at year-end of funds that are mainly exposed to less liquid assets. Panel b: cash holdings as a share of total net assets at year-end of funds that are mainly exposed to less liquid assets. The funds in the sample comprise corporate, high-yield and emerging market bond funds, as well as mixed bond funds that invested at least 71% of their portfolio in corporate bonds (which corresponds to the third tercile among mixed bond funds in terms of their average corporate bond allocation between 2015 and 2021).

Liquidity mismatch is prevalent in euro area open-ended bond funds and has not declined since the FSB recommendations were published in 2017. The findings in this box illustrate that the asset composition of euro area bond funds is a key factor influencing the level of redemptions during periods of market stress. Asset composition is also an important factor in determining a fund’s ability to meet large redemptions under stressed market conditions. Although most funds that mainly invest in less liquid assets did not have sufficient cash to meet their March 2020 outflows with cash, funds with lower asset liquidity generally tend to hold higher levels of cash than funds investing in more liquid assets. But asset managers do not necessarily have incentives to maintain sufficient levels of liquid assets, as suggested by the procyclical response to the pandemic shock. Policies that aim to better align redemption terms with asset liquidity and investment strategy would thus help to enhance the resilience of open-ended funds, especially in stressed market conditions. Such measures could include notification periods or lower redemption frequencies on the liabilities side and larger liquidity buffers on the assets side, which could be complemented by anti-dilution tools like swing pricing.[7]

See, for instance, Section 5.2 entitled “Addressing both liquidity mismatch and leverage in the non-bank financial sector”, Financial Stability Review, ECB, May 2022.

See, for instance, Chen. Q., Goldstein, I. and Jiang, W., “Payoff complementarities and financial fragility: Evidence from mutual fund outflows”, Journal of Financial Economics, Vol. 97, Issue 2, 2010, pp. 239-262; Goldstein, I., Jiang, H. and Ng, D.T., “Investor flows and fragility in corporate bond funds”, Journal of Financial Economics, Vol. 126, Issue 3, 2017, pp. 592-613; Jiang, H., Li, Y., Sun, Z. and Wang, A., “Does mutual fund illiquidity introduce fragility into asset prices? Evidence from the corporate bond market”, Journal of Financial Economics, Vol. 143, Issue 1, 2022, pp. 277-302; and Grill, M., Molestina Vivar, L. and Wedow, M., “Mutual fund suspensions during the COVID-19 market turmoil – asset liquidity, liquidity management tools and spillover effects”, Finance Research Letters, Vol. 50, 2022.

FSB, Policy Recommendations to Address Structural Vulnerabilities from Asset Management Activities, 12 January 2017.

See the box entitled “Investment funds’ procyclical selling and cash hoarding: a case for strengthening regulation from a macroprudential perspective”, Financial Stability Review, ECB, May 2021.

The classification by Refinitiv Lipper IM is closely in line with the funds’ actual investment focus. Merging the holdings data from Lipper (as of 31 December 2020) with bond-level data from the Centralised Securities Database, we find that 86% of the total net assets of high-yield bond funds is invested in high-yield bonds and that 93% of the total net assets of emerging market bond funds is invested in emerging market bonds.

The average level of cash held by funds investing predominantly in less liquid assets was 3.8% at the end of February, whereas the average outflow between 1 and 26 March was equal to 4.1%. Note that outflows are likely an underestimate of potential liquidity needs during the March 2020 turmoil, given the margin calls that some investment funds faced.

For an analysis of macroprudential liquidity buffers, see di Iasio, G., Kaufmann, C. and Wicknig, F., “Macroprudential regulation of investment funds”, Working Paper Series, No 2695, ECB, August 2022.