Foreword

As the end of 2020 approaches, the disruption caused by the coronavirus COVID-19 pandemic remains the predominant force shaping both the current economic and financial environment and the future prospects for euro area financial stability. In turn, efforts to mitigate the economic damage to corporates and households from the pandemic remain the primary focus of policymakers in the euro area and elsewhere.

While the signs of recovery in economic activity over the summer and recent progress on vaccines give cause for some optimism, governments continue their efforts to contain the spread of the virus. So there is a long road ahead, and authorities will have to make difficult decisions on whether and how to extend policy measures and, eventually, deal with the debt they create. At the same time, global risks, particularly from climate change, cannot be forgotten and are also becoming more pressing issues as time goes on.

Against this backdrop, the November 2020 Financial Stability Review assesses the implications of the ongoing pandemic and the associated change in prospects for financial market functioning, debt sustainability, bank profitability and the non-bank financial sector. It also sets out policy considerations for both the near term and the medium term. It does so to promote awareness of systemic risks among policymakers, the financial industry and the public at large, with the ultimate goal of promoting financial stability. By providing a financial system-wide assessment of risks and vulnerabilities, the Review also provides key input to the ECB’s macroprudential policy stance.

The Review has been prepared with the involvement of the ESCB Financial Stability Committee, which assists the decision-making bodies of the ECB in the fulfilment of their tasks.

Luis de Guindos

Vice-President of the European Central Bank

Overview

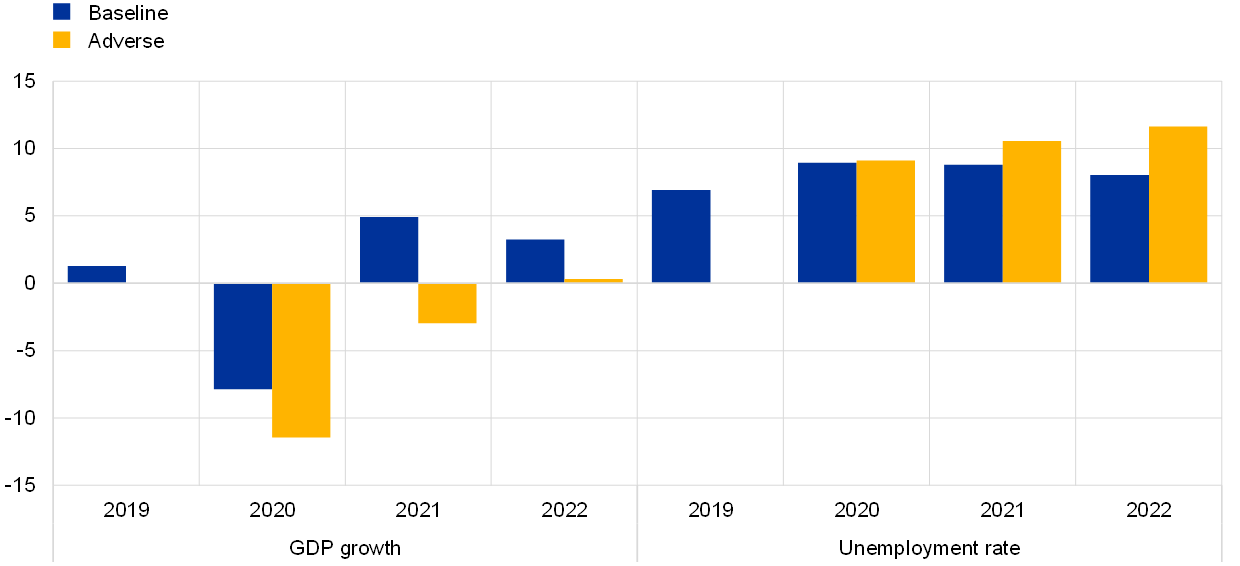

The euro area economy faces a fragile and uneven recovery, notwithstanding considerable policy support

The coronavirus (COVID-19) pandemic continues to weigh on the outlook for economic activity and financial stability in the euro area as well as globally. Economic activity contracted sharply in all euro area countries in the second quarter of 2020, with countries more affected by the pandemic and associated containment measures facing the sharpest GDP falls (see Chart 1, left panel). The easing of measures as of late spring brought about a rebound in economic activity. Nevertheless, with the recent resurgence in new infection rates and the related reimplementation of social distancing measures in many countries, the economic recovery in the euro area has lost momentum more rapidly than expected. Professional forecasters now expect that the euro area economy will not exceed pre-pandemic GDP levels until 2023 (see Chart 1, right panel). Downside risks remain significant, including from an adverse outcome of Brexit negotiations (see Section 1.1). On the upside, the availability of a vaccine in the near future may help the euro area return to pre-pandemic levels of economic activity faster.

Chart 1

The euro area economy has been hit hard by the pandemic amid continued uncertainty surrounding its overall economic impact and the path of the recovery

Sources: ECB, Hale et al. (2020), Johns Hopkins University (CSSE COVID-19 data) and ECB calculations.

Notes: Left panel: the Oxford COVID-19 Government Response Tracker (OxCGRT) is based on 18 indicators, ranging from information on containment and closure policies (e.g. school closures, restrictions on movement) to economic (e.g. income support to citizens) and health system (e.g. coronavirus testing regime or emergency investments in health care) policies. The stringency index shown here reports the strictness of lockdown-style policies that primarily restrict people’s behaviour, as well as numbers between 1 and 100, giving the average index value per country between 1 March and 30 June 2020. See Hale, T., Webster, S., Petherick, A., Phillips, T. and Kira, B., “Oxford COVID-19 Government Response Tracker”, Blavatnik School of Government, 2020. For data on coronavirus deaths, see Dong, E., Du, H. and Gardner, L., “An interactive web-based dashboard to track COVID-19 in real time”, The Lancet Infectious Diseases, Vol. 20, Issue 5, May 2020, pp. 533-534. Right panel: the shaded areas indicate GDP paths based on growth rates that are one standard deviation above/below the average ECB Survey of Professional Forecasters forecast.

The economic impact of the pandemic has been highly uneven. This is reflected by the record high dispersion of value-added growth across sectors of economic activity and euro area countries (see Chart 2, left panel). Looking ahead, at the sector level, manufacturing is expected to rebound earlier than several segments in the services sector, such as catering, arts and entertainment, and travel services. Meanwhile, countries that were more affected by the ramifications of the pandemic and have less (fiscal) policy space to deal with them are projected to recover more slowly than others. That said, alongside the asset purchases carried out by the Eurosystem under the pandemic emergency purchase programme (PEPP), the recently launched European initiatives, such as the SURE and the Next Generation EU (NGEU) instruments, should help ensure a more balanced economic recovery across EU countries and avoid the economic and financial fragmentation risks observed during the euro area sovereign debt crisis. The impact of the NGEU, and in particular of the Recovery and Resilience Facility, will depend on its timely operationalisation and effective use.

Chart 2

Economic and financial market developments have been strikingly uneven across countries and sectors of economic activity

Sources: Eurostat, Bloomberg Finance L.P. and ECB calculations.

Notes: Left panel: the dispersion of growth across countries is measured as the weighted standard deviation of year-on-year growth in value added in the euro area. Ireland and Malta are excluded because of data consistency and availability issues respectively. The dispersion of growth across sectors is measured as the weighted standard deviation of year-on-year growth in euro area value added in the main NACE economic activities.

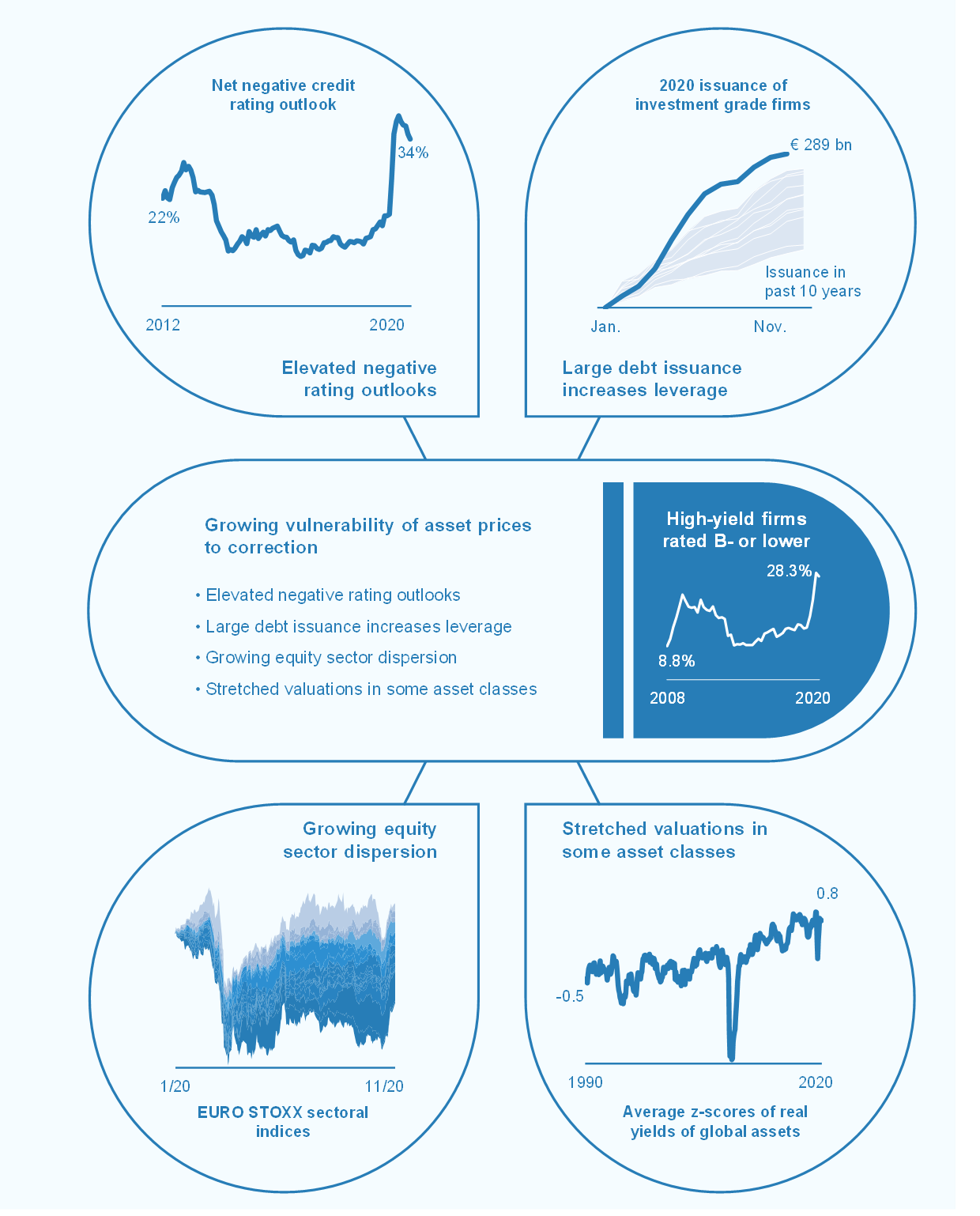

Strength in asset prices and renewed risk-taking make some markets increasingly susceptible to corrections

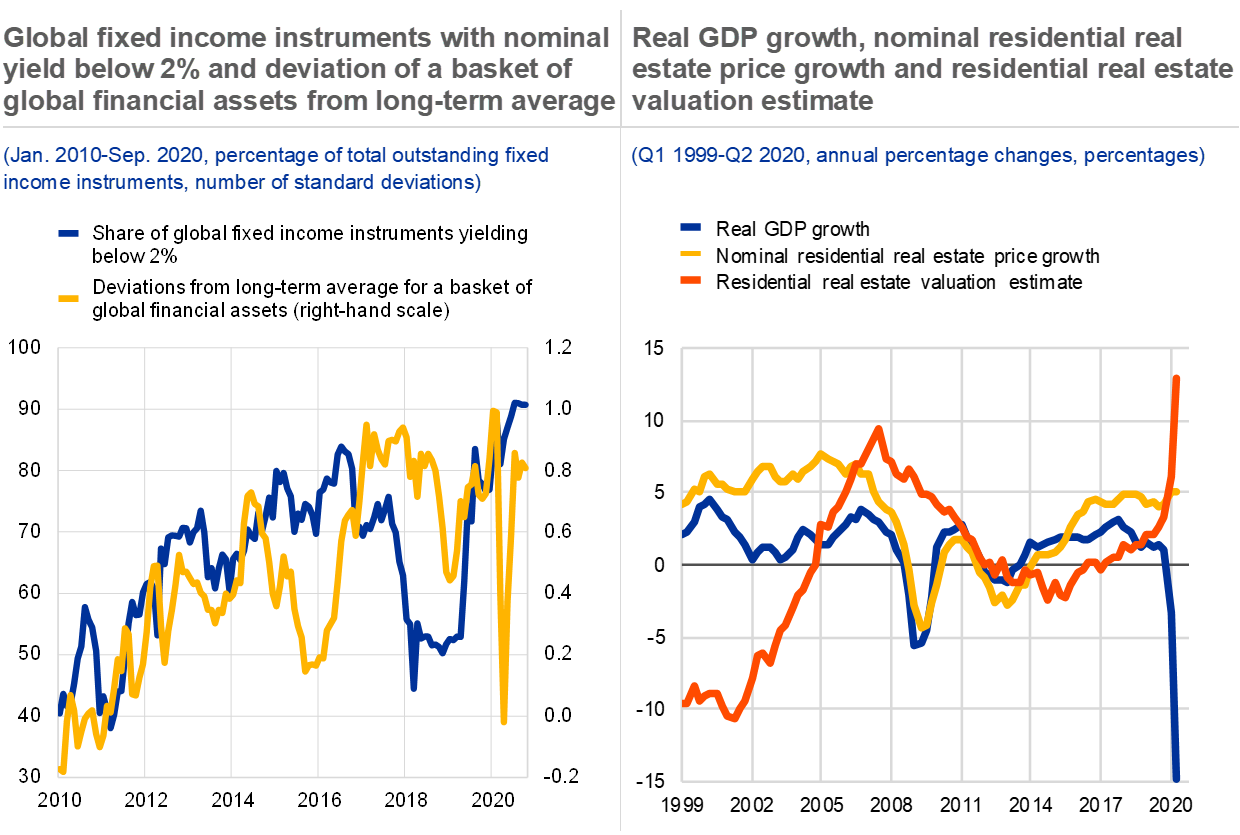

A notable rebound in financial markets over the summer has contrasted with weak economic fundamentals – increasing the risk of a correction. There was a remarkable recovery in financial asset prices over the summer, reflecting historically loose financial conditions and confidence in the monetary and fiscal policy response. In particular, the buoyancy of some equity markets has led to some concern about a disconnect from underlying economic fundamentals. That said, advances in equity markets have varied across both countries and sectors, with the largest rebounds concentrated in the United States and the technology sector (see Chart 2, right panel), reflecting a large dispersion of sectoral earnings expectations (see Chapter 2). Credit spreads have fallen back to pre-pandemic levels across the rating spectrum and appear tight in view of the near-term economic outlook, particularly for the high-yield segment of the corporate bond market. Globally, rising asset prices have resulted in 90% of outstanding fixed income securities offering nominal yields of 2% or less and the average real yield of a basket of 17 global financial assets stands at 0.8 standard deviations away from its long-term average (see Chart 3, left panel). Taken together, equity and credit valuations seem increasingly contingent on, and sensitive to, changes in the benchmark yield curve, and investors could reassess asset valuations swiftly if the course of the pandemic were to lead to materially weaker economic outcomes.

Chart 3

Risk-taking resumed in a prolonged low interest rate environment amid signs of stretched valuations in some asset classes

Sources: IHS Markit, Refinitiv, Eurostat, national central banks, Bank for International Settlements, ECB and ECB calculations.

Notes: Left panel: the basket of global financial assets used to compute the valuation metric includes: real yields on Japanese, US, UK and euro area ten-year government bonds; US and euro area investment-grade and high-yield bonds; Japanese, US, UK and euro area equity; US real estate investment trusts and mortgage-backed securities; and emerging market sovereigns and equity. Right panel: the valuation estimate is the simple average of the price-to-income ratio and an estimated Bayesian vector autoregression (BVAR) model. For details of the methodology, see Box 3 in Financial Stability Review, ECB, June 2011, and Box 3 in Financial Stability Review, ECB, November 2015. Overall, estimates from the valuation models are subject to considerable uncertainty and should be interpreted with caution. Alternative valuation measures can point to lower/higher estimates of overvaluation.

The risk of correction in tangible asset markets – namely residential and commercial property markets – has also increased. Euro area residential real estate markets have proved resilient to the pandemic so far, as the low interest rate environment has continued to underpin demand, while loan moratoria and job protection schemes have helped to sustain household debt servicing capacity. Even so, signs of overvaluation are increasingly visible for the euro area as a whole (see Chart 3, right panel). By contrast, the pandemic has led to an abrupt and sustained drop in activity in commercial real estate (CRE) markets, with a disproportionate drop in activity by more flighty foreign investors. A longer than expected economic shock, coupled with preference shifts arising from the pandemic (e.g. lower demand for office space), could prompt an extended decline in the euro area CRE market.

Chart 4

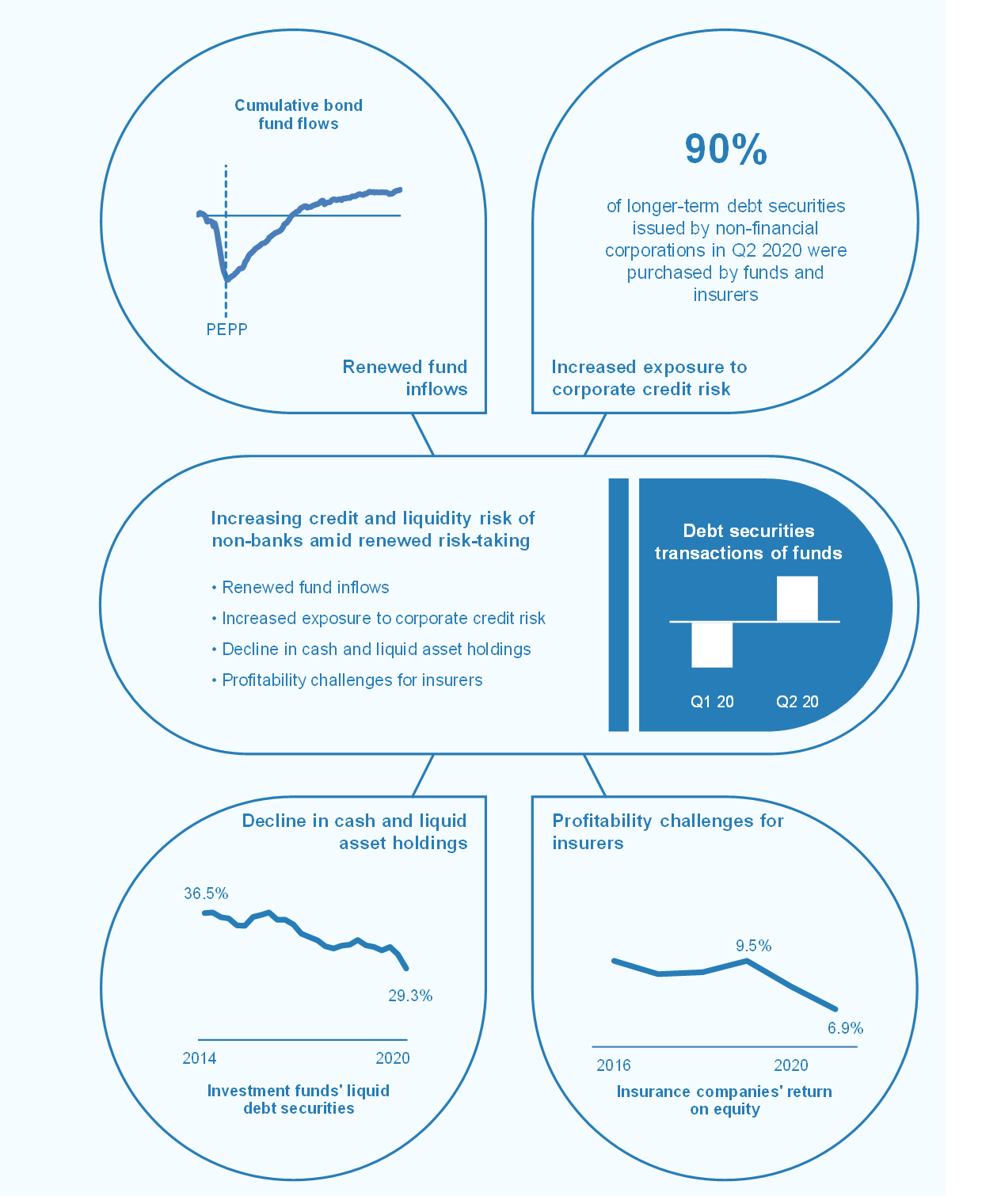

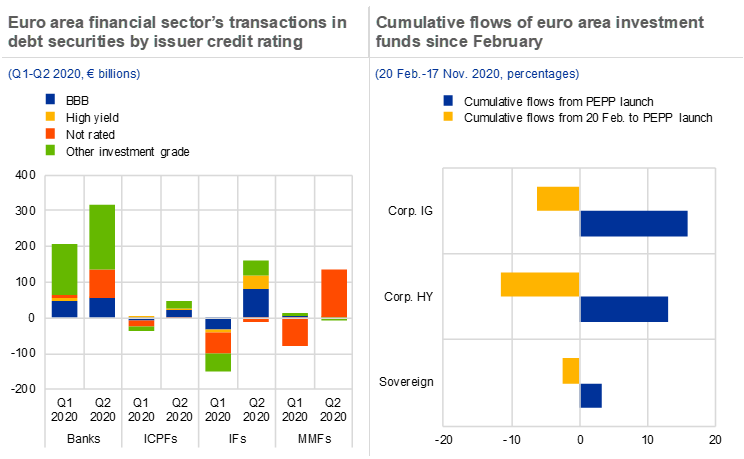

Following a risk-off period during the March turmoil, non-banks resumed increasing their credit and liquidity risk

Sources: ECB securities holdings statistics, Refinitiv and ECB calculations.

Notes: Left panel: the chart covers all debt securities purchased or sold by euro area banks, insurers, pension funds and investment funds, including those issued by financial and non-financial corporations as well as sovereigns, in the euro area and globally. ICPFs: insurance corporations and pension funds; IFs: investment funds. Right panel: liquid holdings comprise Level 1 high-quality liquid assets (the concept from Basel III banking regulation) consisting of euro-denominated bonds issued by EU governments and non-euro-denominated bonds issued by foreign governments, rated at least AA. Data refer to euro area-domiciled bond funds and money market funds only. High-yield bond funds refer to euro area-domiciled funds which primarily invest in high-yield bonds. This sample is distinct from the corporate bond fund sample, which has a broader investment focus.

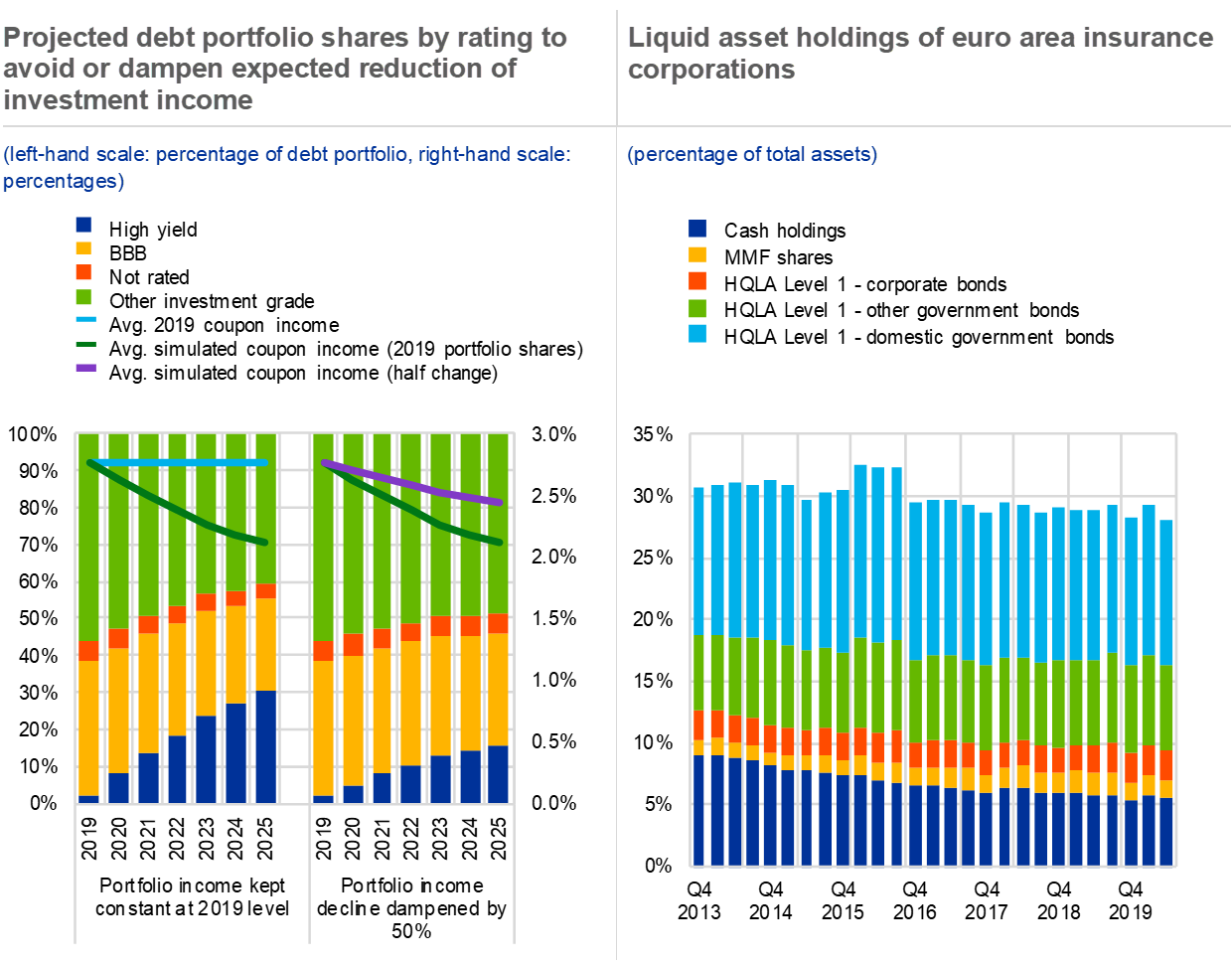

Non-bank financial intermediaries appear to have increased their risk-taking (see Chart 4, left panel). The non-bank financial sector continued to provide significant financing for firms after the initial coronavirus shock. However, following a return of inflows in recent months, euro area investment funds have increased their longer-duration and lower-rated non-financial corporate (NFC) debt exposures, increasing the likelihood of outflows and losses if corporate credit risk rises materially. After a temporary increase in cash positions following the March turmoil and despite significant inflows, cash holdings of corporate bond funds have reverted to previous levels (see Chart 4, right panel). Bond funds have increased the share of liquid bonds in their portfolios, but the fund sector as a whole has ventured further into less liquid assets. This leaves funds vulnerable to large outflows in the event of possible future turmoil. While insurers’ aggregate liquidity positions appear stable, cash needs, for example arising from margin calls, might rise if the risk of renewed market volatility were to materialise. Profitability pressures arising from lower underwriting volumes and higher claim provisions stemming from both the pandemic and a relatively large number of natural catastrophes in 2020 could induce insurers to further rebalance their portfolios towards higher-yielding, but riskier assets.

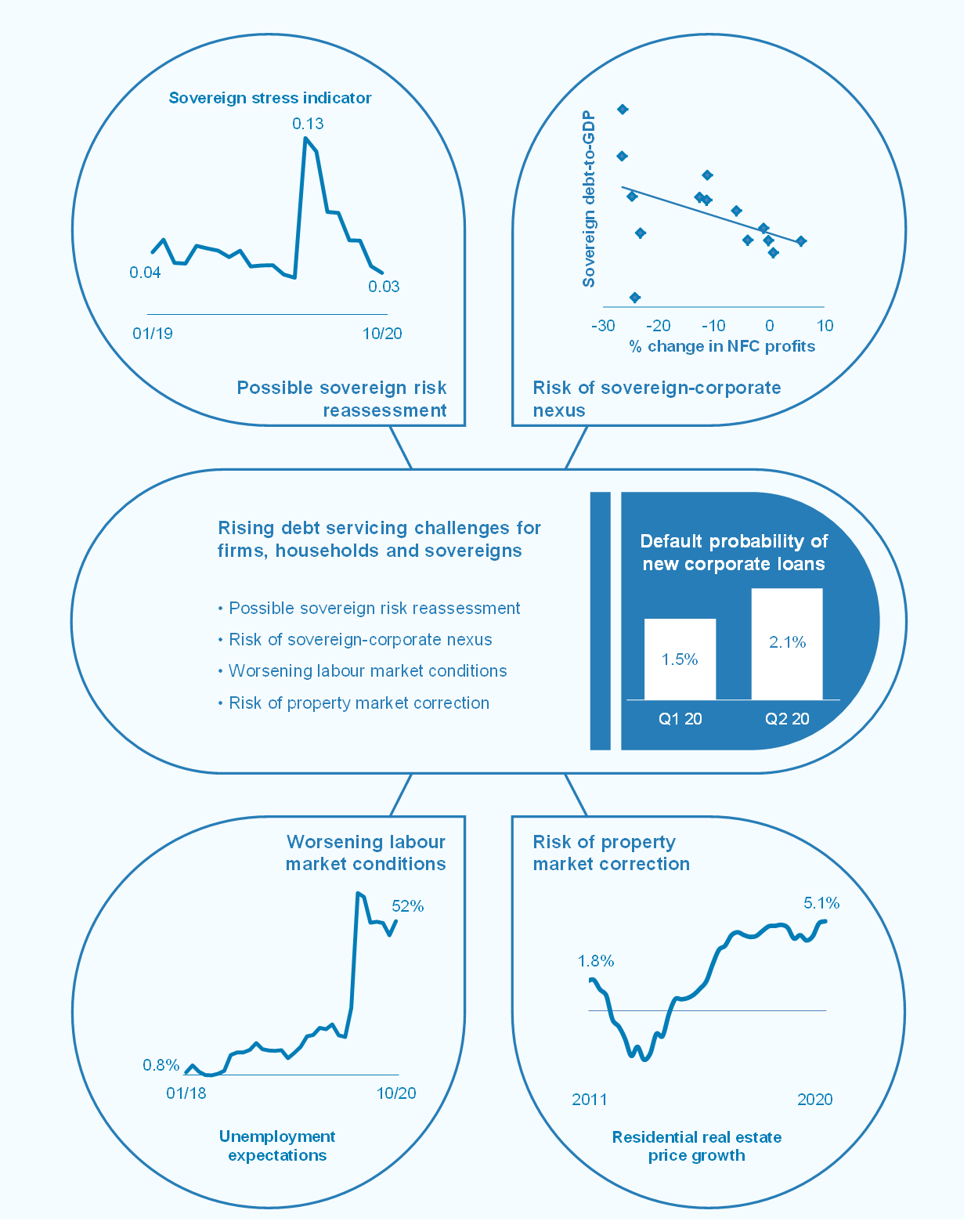

Rising fragilities among firms, households and sovereigns amid higher debt burdens and reliance on policy support

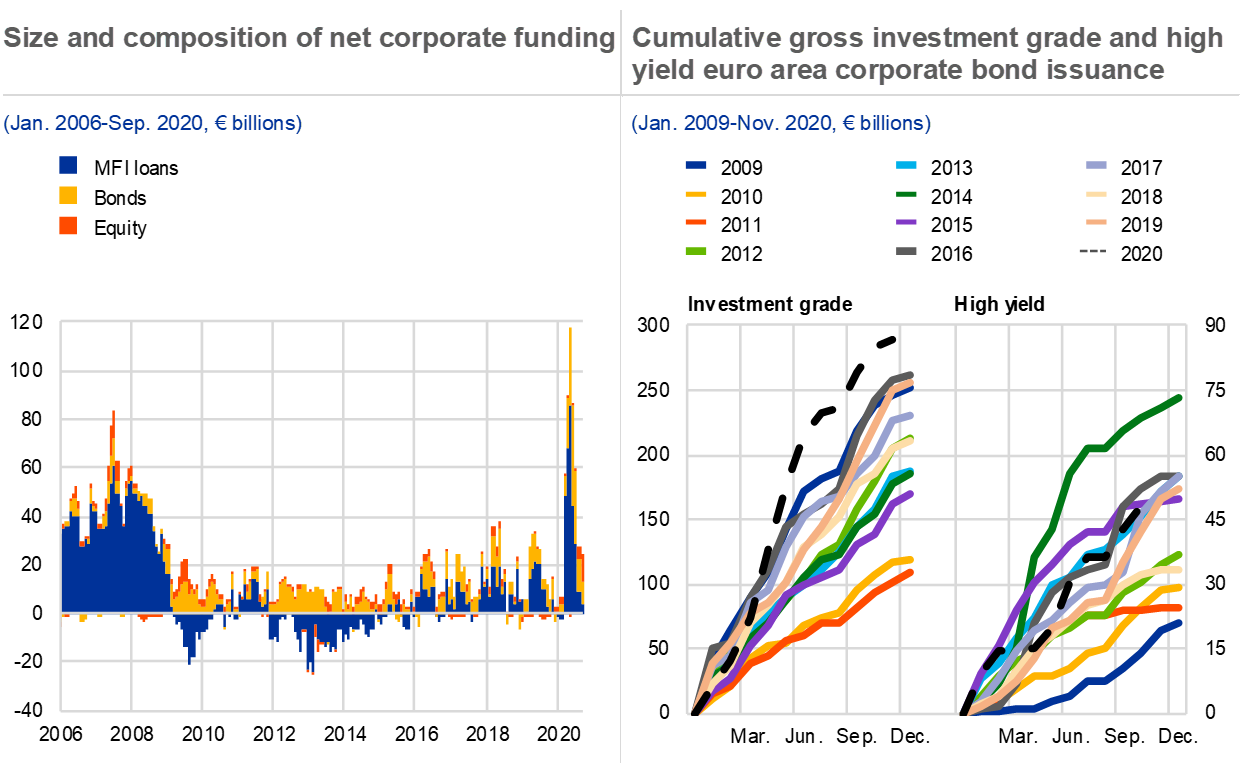

Balance sheet vulnerabilities in the public and non-financial private sectors have increased markedly in the wake of the pandemic. Debt-to-GDP ratios across sectors have risen to even more elevated levels in many euro area countries (see Chart 5, left panel). In particular, sovereign debt levels rose sharply as governments have financed extensive support to the economy in order to boost healthcare services, replace lost incomes and protect firms. This rise in debt ratios should reverse partially once GDP recovers, but the reversal is unlikely to be complete. Contingent liabilities could increase sovereign debt levels further if the economic situation deteriorates and loan guarantees are called. At the same time, firms have been drawing down on credit lines and have issued large amounts of bonds to meet liquidity needs, pushing corporate debt levels higher in many countries, in particular in the lowest investment-grade and high-yield segments (see Chapter 2). Household balance sheets have been affected modestly so far, thanks to government income support schemes, record high saving rates and continued robust developments in euro area residential property markets. Even so, households in a number of euro area countries continue to be burdened by high legacy debt.

Chart 5

Debt sustainability concerns are on the rise, but mitigated in the near term by favourable financing conditions and large-scale supranational support

Sources: ECB, European Commission and ECB calculations.

Notes: Left panel: the non-financial private sector comprises households and non-financial corporations, including debt relating to special-purpose entities. Non-financial private sector debt figures are on a consolidated basis. The horizontal line represents the threshold of 133% of GDP for non-financial private sector debt based on the European Commission’s macroeconomic imbalance procedure (MIP) scoreboard. The vertical line represents the threshold of 60% of GDP for sovereign debt as defined in the excessive deficit procedure under the Maastricht Treaty. Consolidated non-financial corporate debt figures also include cross-border inter-company loans, which tend to account for a significant part of debt in countries where a large number of foreign entities, often multinational groups, are located (e.g. Belgium, Cyprus, Ireland, Luxembourg and the Netherlands). Right panel: EIB: European Investment Bank; ESM: European Stability Mechanism; NGEU: Next Generation EU; SURE: European instrument for temporary Support to mitigate Unemployment Risks in an Emergency.

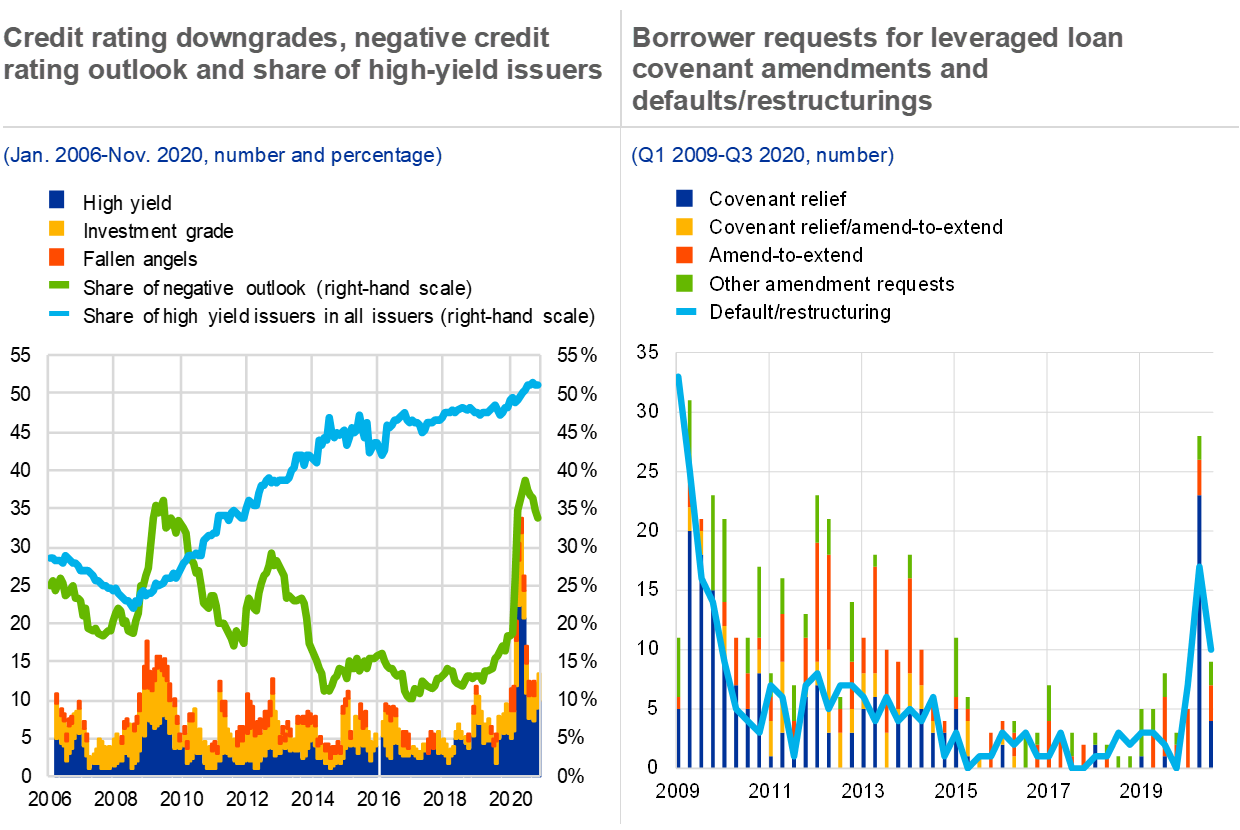

Favourable financing conditions and supranational support schemes alleviate near-term debt sustainability concerns. The availability and cost of funding have improved across sectors since the end of March on the back of large-scale monetary policy support, while the provisional agreement on the EU recovery fund in July has also helped stem the re-emergence of fragmentation in euro area sovereign bond markets. In the year to date, euro area governments have issued more than €1 trillion of debt on a net basis (see Chart 5, right panel) to finance a range of support schemes. But a large part of this new debt has been issued at the short end of the maturity spectrum, which increases near-term rollover risks. Similarly, euro area investment-grade firms issued record amounts in corporate bond markets in 2020, and high-yield companies’ debt issuance has rebounded markedly in recent months.

While supporting aggregate demand, higher indebtedness in the non-financial private and public sectors increases risks to financial stability in the medium term. In addition to mitigating the economic fallout from the pandemic and helping economic growth to recover more quickly, government support to the private sector can also be supportive of medium-term debt sustainability. However, higher sovereign and corporate debt levels may also reignite debt sustainability concerns in the future, especially in the event of a slower economic recovery than currently expected or if market participants were to reassess sovereign and/or corporate credit risk. Similarly, if interest rates were to normalise, risks could materialise in the medium term due to a rise in debt servicing costs, in particular in countries with elevated debt levels and a predominance of floating rate contracts.

Chart 6

Euro area non-financial firms and households are cushioned for the time being by various government support measures, but cliff-edge risks loom large

Sources: European Banking Authority, national authorities, Eurostat, ECB and ECB calculations.

Notes: Left panel: data on guaranteed loans capture information for the five largest euro area countries in terms of GDP, i.e. Germany, Italy, France, Spain and the Netherlands. Right panel: no data on jobs supported by government measures are available for Greece, Luxembourg, Malta or Finland, while the latest available data points from April were used for Cyprus and Italy.

An abrupt end to government policy support schemes would pose cliff-edge risks to the debt servicing capacity of euro area firms and households. The resilience of the non-financial private sector depends on the path of the economic recovery and the time span, breadth and effectiveness of government support measures. To overcome liquidity pressures, governments stepped in with loan guarantee schemes and direct transfers, while loan moratoria alleviated firms’ near-term debt servicing pressures. By the end of August 2020 guaranteed loans and loans under moratoria accounted for 7% and 15% respectively of the total stock of euro area corporate loans (see Chart 6, left panel). Already fragile corporate fundamentals could weaken further in the event of a premature withdrawal of government support and translate into sharply increasing default rates (see Box 1). This is particularly true for riskier firms, which have levered up in recent years amid low funding costs and now face downgrade risk. Similarly, policy action (including short-time work schemes, government transfers and public loan moratoria) to safeguard employment, income and debt servicing capacity mitigates the risks arising from the pandemic for euro area households. Households in countries with greater reliance on support measures seem more exposed to cliff-edge risks (see Chart 6, right panel). The materialisation of such risks could have a knock-on effect on economic activity and an adverse impact on banks’ balance sheets and capitalisation (see Special Feature A).

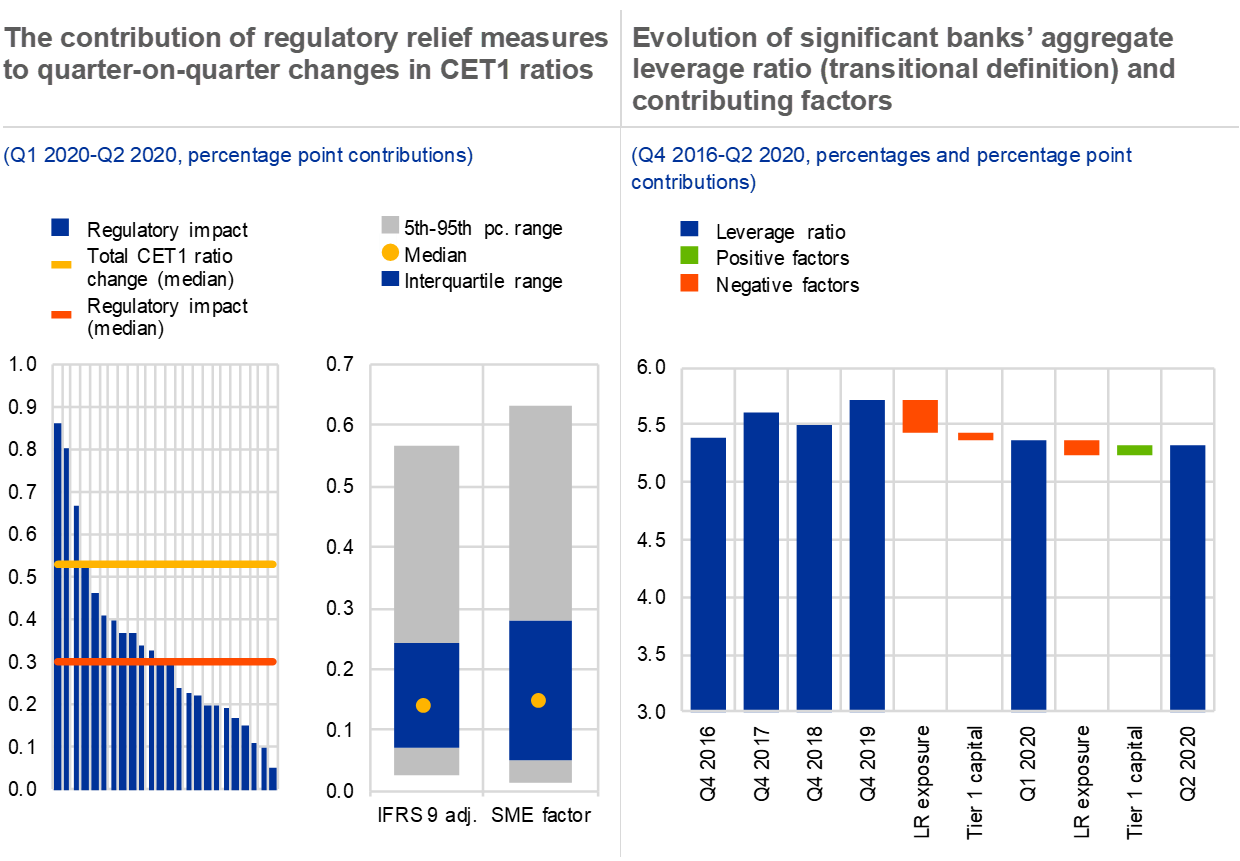

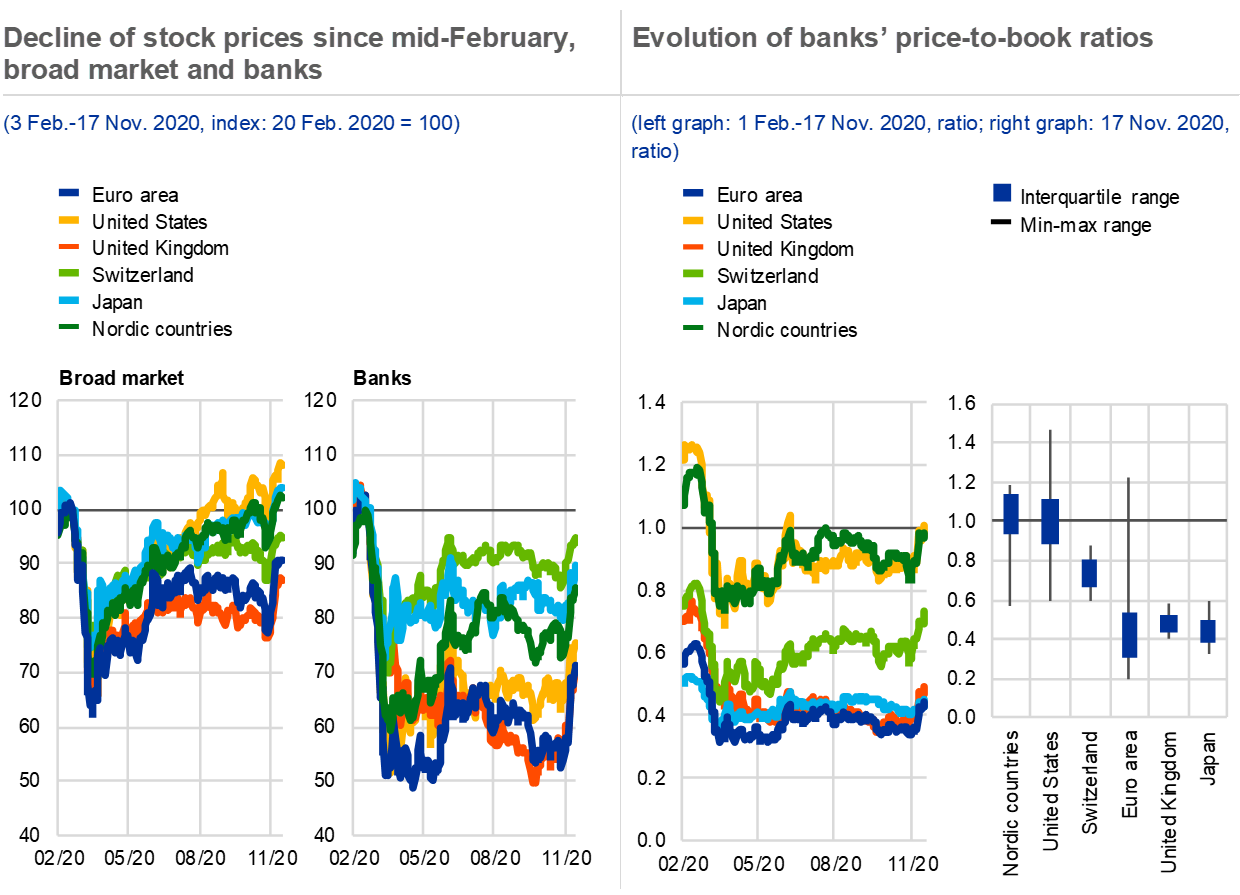

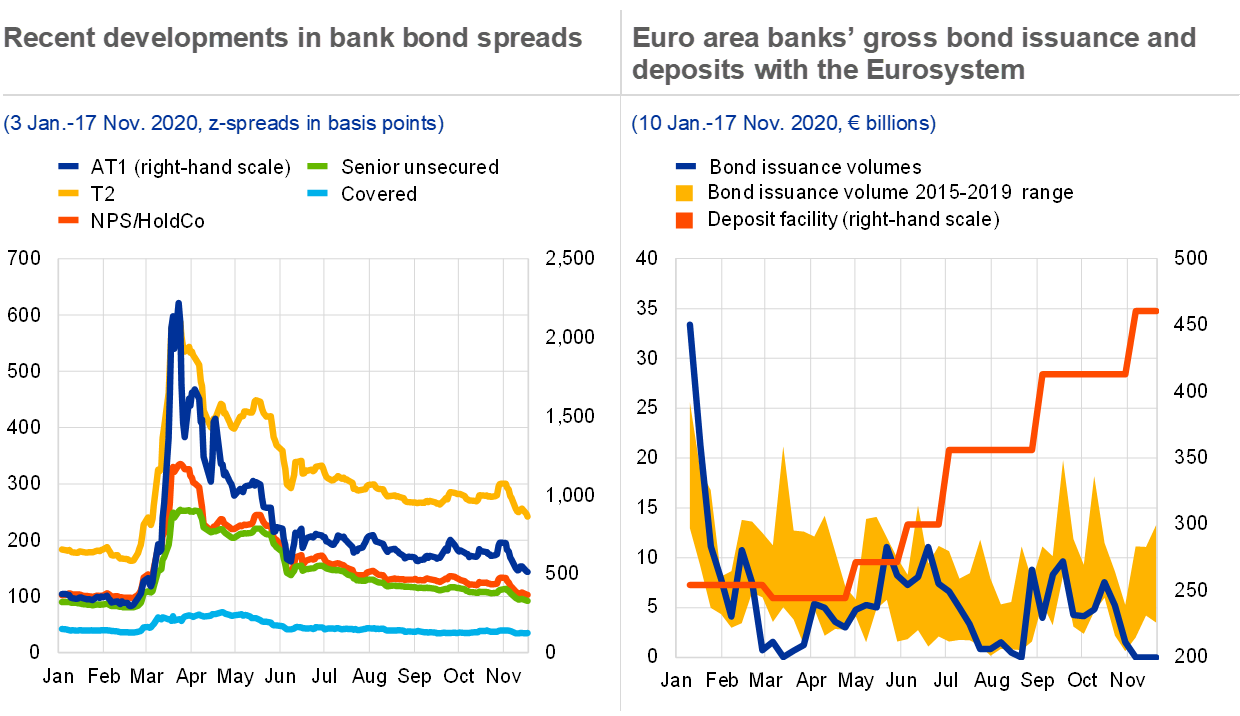

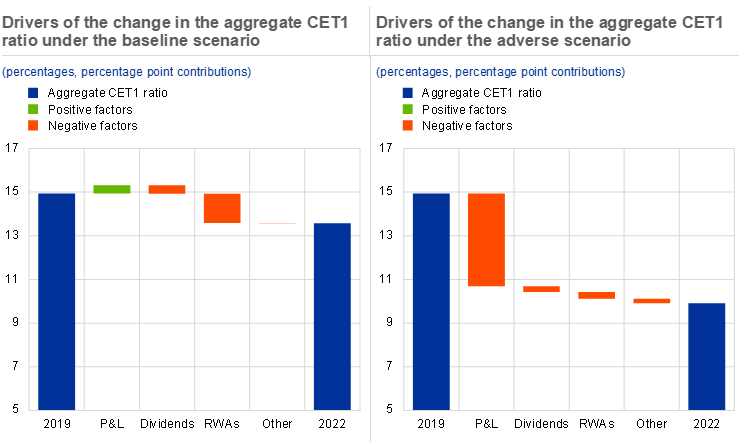

Euro area banks are well capitalised, but face credit losses and weak profitability prospects

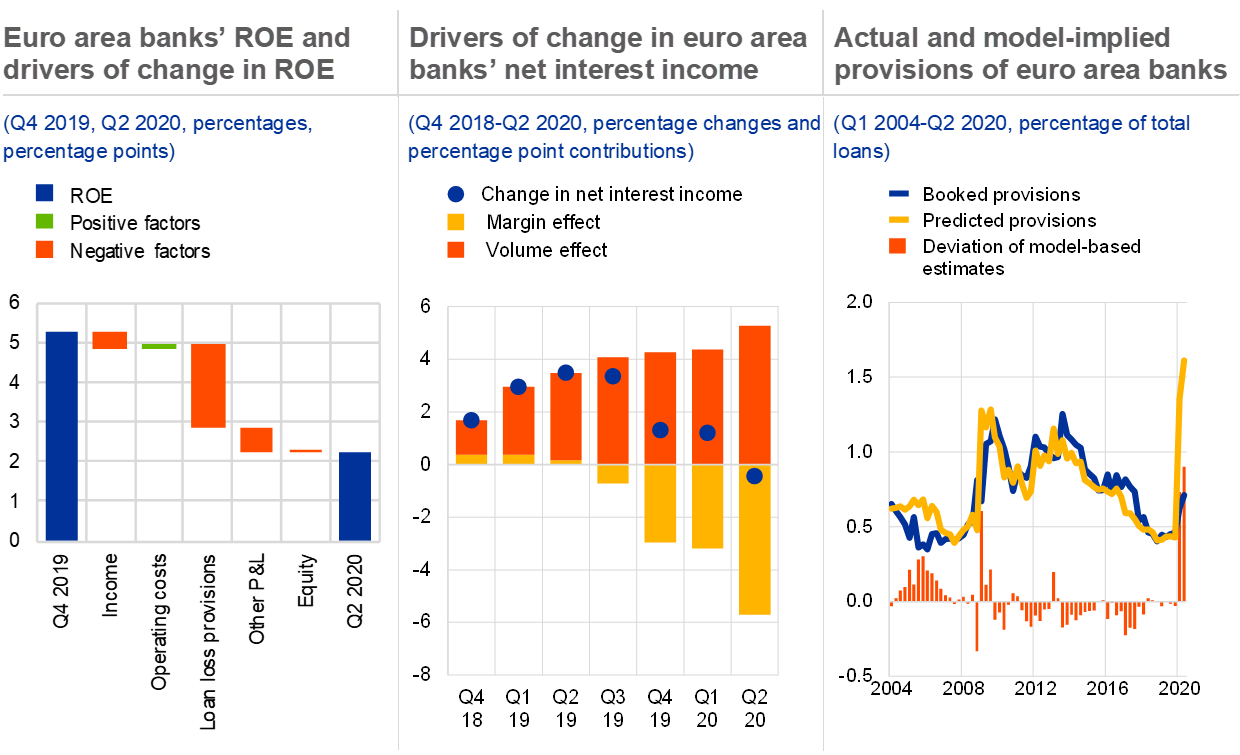

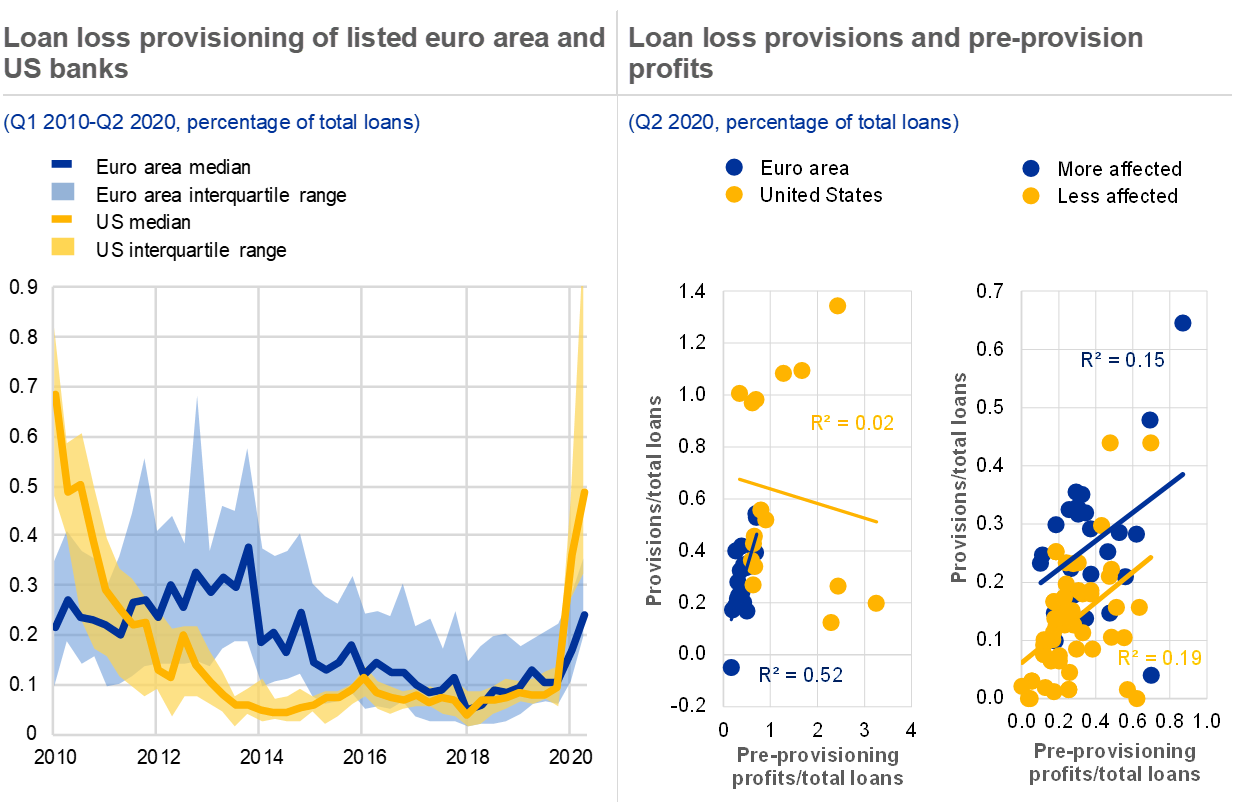

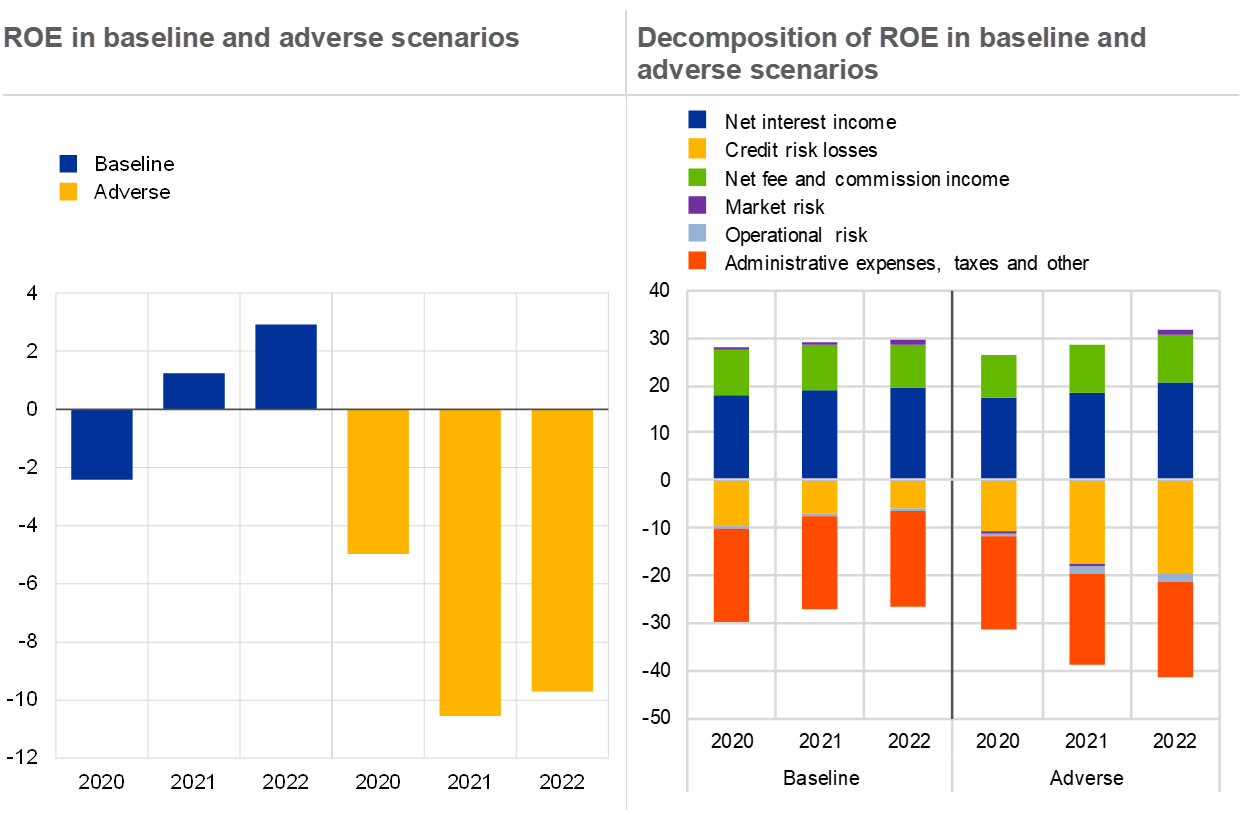

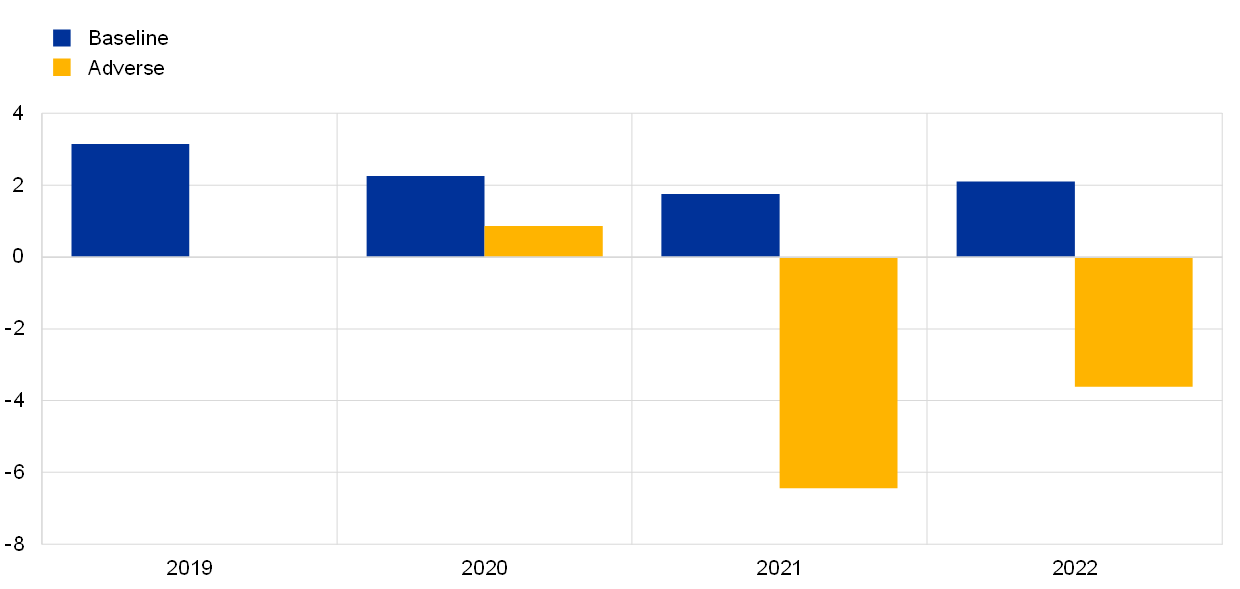

Despite the increased resilience of euro area banks since the global financial crisis, weak profitability prospects continue to weigh on bank valuations. The first half of 2020 saw a marked decline in euro area banks’ return on equity (ROE), from over 5% in the fourth quarter of 2019 to just above 2% in the second quarter of 2020. This change was driven predominantly by higher loan loss provisions and banks’ impaired income-generation capacity as a result of the economic fallout from the pandemic. Cost reductions have only partially offset this (see Chart 7, left panel). Looking ahead, bank profitability is expected to remain weak and to recover only very gradually to levels seen before the outbreak of the pandemic. Market analysts have revised down their ROE forecasts for euro area banks on account of higher expected credit losses. This weak profitability outlook is also reflected in historically low bank valuations (see Chapter 3).

Downside risks to bank profitability arise from a weaker outlook for lending volumes and signs of optimistic provisioning. In an environment characterised by low interest rates, an expected increase in credit losses, tightening credit standards and the phasing-out of state guarantees, euro area banks may find it increasingly difficult to generate income by compensating for lower margins with higher lending volumes (see Chart 7, middle panel). This may translate into lower profits or even losses going forward. At the same time, euro area banks have continued to set aside loan loss provisions to cover higher expected credit losses as they are increasingly confronted with missed payments and a growing number of corporate defaults. But provisioning remains below levels observed during previous crises and those in other jurisdictions, notably the United States. Provisioning levels are also lower than what would have been suggested by historical regularities (see Chart 7, right panel, and Chapter 3), although this may be partly explained by the impact of extraordinary policy measures in reducing credit risk (see Box 5). A weaker than expected economic recovery or premature end of loan guarantees coupled with growing vulnerabilities in the non-financial private sector may entail higher loan loss provisioning needs and weigh on bank profitability.

Chart 7

Bank profitability fell markedly due to continued margin compression and higher loan loss provisioning, which still seems lower than suggested by fundamentals

Sources: ECB supervisory data and ECB calculations.

Notes: Left panel: the return on equity figure for the second quarter of 2020 depends on the way net income is annualised. In the FSR, the four-quarter average of total equity is used in the denominator, while net income is annualised using four-quarter trailing sums. ECB Banking Supervision annualises quarterly/semi-annual data by multiplying it by four/two respectively, resulting in a different headline profitability figure. Right panel: the decomposition is based on a bank-level panel model for the provisions-to-total loans ratio. The explanatory variables and estimated signs (in brackets) are as follows: asset quality factors: non-performing assets ratio (+), annual change in non-performing assets ratio (+) and reserves/non-performing assets (+), pre-provision return on assets (+), loans/total assets (+), log of total assets (+); macro factors: output gap (-) and annual real GDP growth (-), year fixed effects, country fixed effects. The model does not include the impact of policy support measures. The model is estimated on a quarterly unbalanced panel covering around 60 euro area banks between the first quarter of 2000 and the second quarter of 2020.The in-sample fit of the model is fairly good with an adjusted R-squared of around 55%. The estimated year fixed effect for 2020 is highly negative at -1.22% and statistically significant at the 1% confidence level.

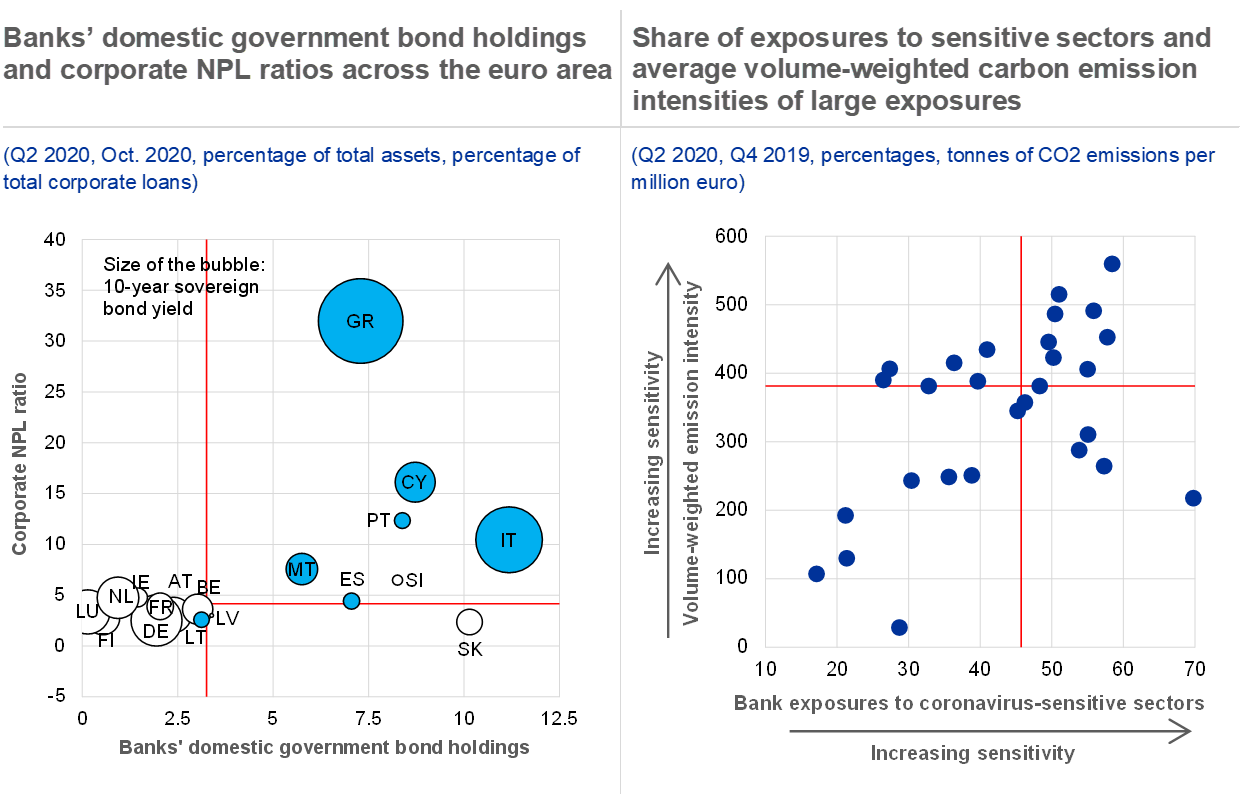

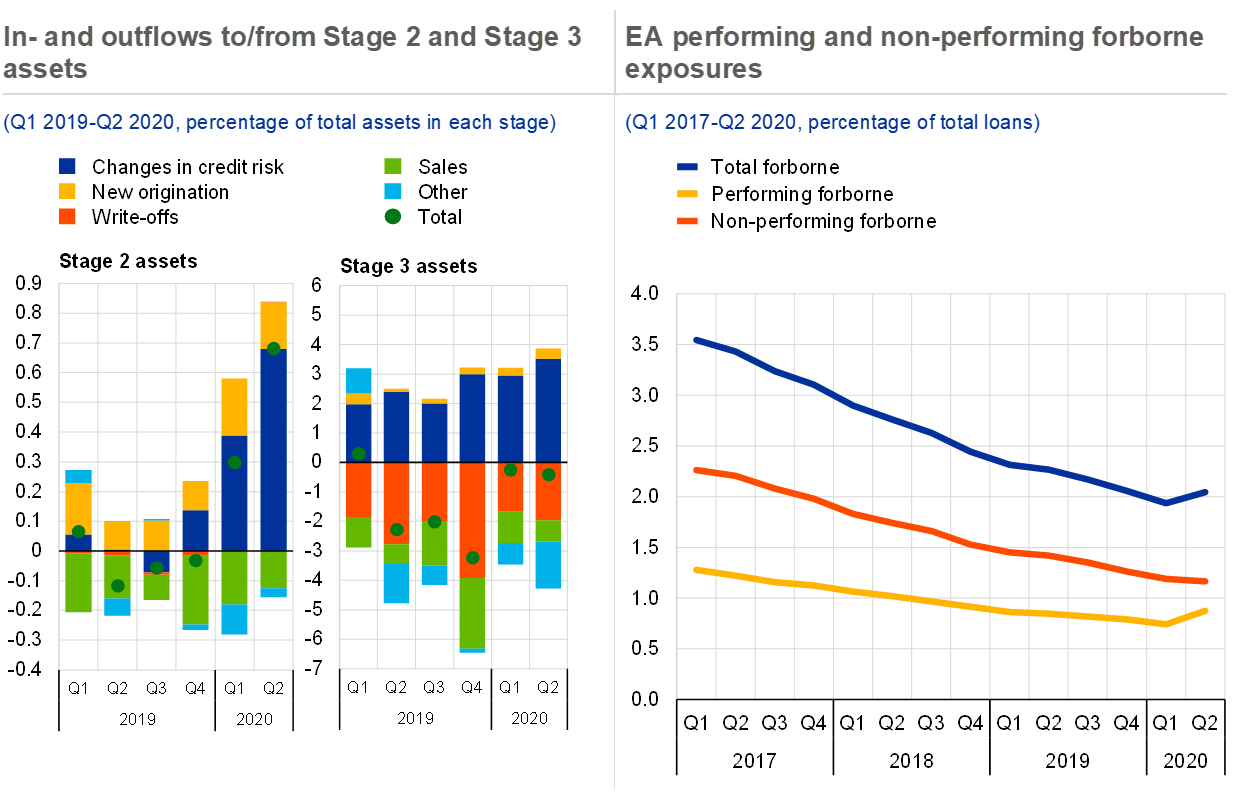

Vulnerabilities in the sovereign and corporate sectors could test euro area banks in the future. Euro area banks have significantly increased their lending to non-financial corporations during the pandemic. Guarantees and moratoria appear to have lengthened the time it takes for weak economic performance to translate into credit losses and non-performing loans (NPLs). However, higher volumes of lending to corporates could imply additional credit risk exposures, especially for banks in countries with a high legacy stock of corporate NPLs (see Chart 8, left panel). Guarantees and moratoria may harbour the risk of forbearance going forward. At the same time, banks in some countries have increased their domestic sovereign debt holdings, triggering concerns that the sovereign-bank nexus could re-emerge (see Box 4). Vulnerabilities intensifying in one sector could spill over to other sectors, leading to an adverse sovereign-corporate-bank feedback loop as well.

Chart 8

Resurfacing sovereign-bank nexus and worsening corporate credit quality coupled with climate-related transition risks may challenge euro area banks in the future

Sources: ECB (balance sheet item statistics and supervisory data), Bloomberg Finance L.P., Reuters, Refinitiv and ECB calculations.

Notes: Left panel: white bubbles indicate negative values. There are no ten-year sovereign debt securities for Latvia and Estonia; two-year sovereign bond yields are shown instead as a proxy for Latvia, whereas no suitable proxy could be identified for Estonia. The red horizontal and vertical lines indicate sample medians. Right panel: the x-axis shows the share of banks’ exposures to coronavirus-sensitive sectors in total exposures. Coronavirus-sensitive sectors are defined in line with the May 2020 FSR and include mining, manufacturing, retail and wholesale trade, transport, accommodation and food services, and arts and entertainment. The data refer to the second quarter of 2020. The y-axis shows the bank average volume-weighted emission intensity using direct and indirect energy-related carbon emissions of firms. Emission intensities are calculated as emissions over sales and are averaged over all firms to which banks have large exposures; these averages are then weighted by the share of each bank’s exposure to a firm compared with the banks’ total large exposures. The sample comprises 28 significant institutions for which at least ten large exposures can be matched with emission data. The data refer to the fourth quarter of 2019. The red horizontal and vertical lines indicate sample medians.

Euro area banks must also manage legacy structural problems and the increasing need to address climate risk. In particular, low cost-efficiency, limited revenue diversification and overcapacity afflict the euro area banking sector. Banks appear to have stepped up cost-cutting efforts as a result of the pandemic by further reducing the number of staff and branches, but low profitability may hinder meeting digital transformation needs. Consolidation via mergers and acquisitions (M&As) could be one potential avenue for reducing overcapacity in the sector. While M&A activity, both within and across borders, has been subdued in recent years in the euro area banking sector, the planned domestic mergers in some countries provide an encouraging sign. This process should be market-driven, but authorities may support it by completing the banking union and removing barriers to consolidation, as implied, for example, by differences in national insolvency and taxation regimes. In parallel, banks face increasing urgency to manage the implications of the transition to a greener economy. Medium-term risks may emerge for banks heavily exposed to sectors with high carbon emissions (see Chart 8, right panel).

Policymakers need to avoid near-term cliff-edge risks, while also considering medium-term vulnerabilities

The importance of policy measures in containing the economic and financial stability impact of the pandemic makes managing the exit from this support equally important. Economic and financial sector policy measures have so far limited the materialisation of credit risk and adverse feedback loops between the real economy and the financial system. A continued, powerful and targeted policy response is vital to protect the economy, until the pandemic passes. Even then, risks for households and firms facing a cliff edge from the withdrawal of policy support must be balanced against the risks related to prolonged support (e.g. possible misallocation of capital, postponed loss recognition, etc.). Looking ahead, medium-term vulnerabilities for euro area financial stability have remained elevated and relate to: (i) a mispricing of some asset classes and possible corrections in markets; (ii) growing fragilities in the non-financial private and public sectors; (iii) weaker bank profitability in the light of lower interest rates and expected higher credit losses; and (iv) renewed risk-taking by non-banks, in particular investment funds. The potential for these vulnerabilities to materialise simultaneously and possibly amplify each other further increases the risks to financial stability.

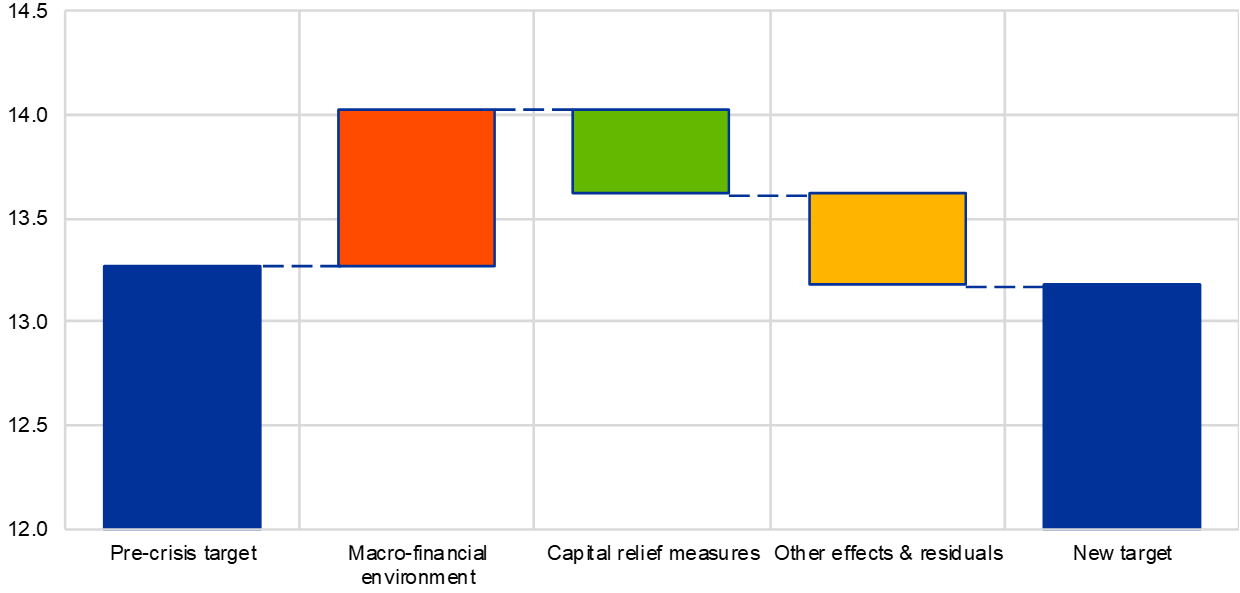

Bank capital buffers should remain available to absorb losses for an extended period, and any impediments to banks using buffers should be addressed. Ensuring that banks are willing to use capital buffers if losses arise in the coming months is crucial to averting the risk of bank deleveraging and a credit crunch. In particular, against the backdrop of limited bank capital-generation capacity, communication about future buffer replenishment can play an important role in ensuring that banks are willing to use buffers if needed.

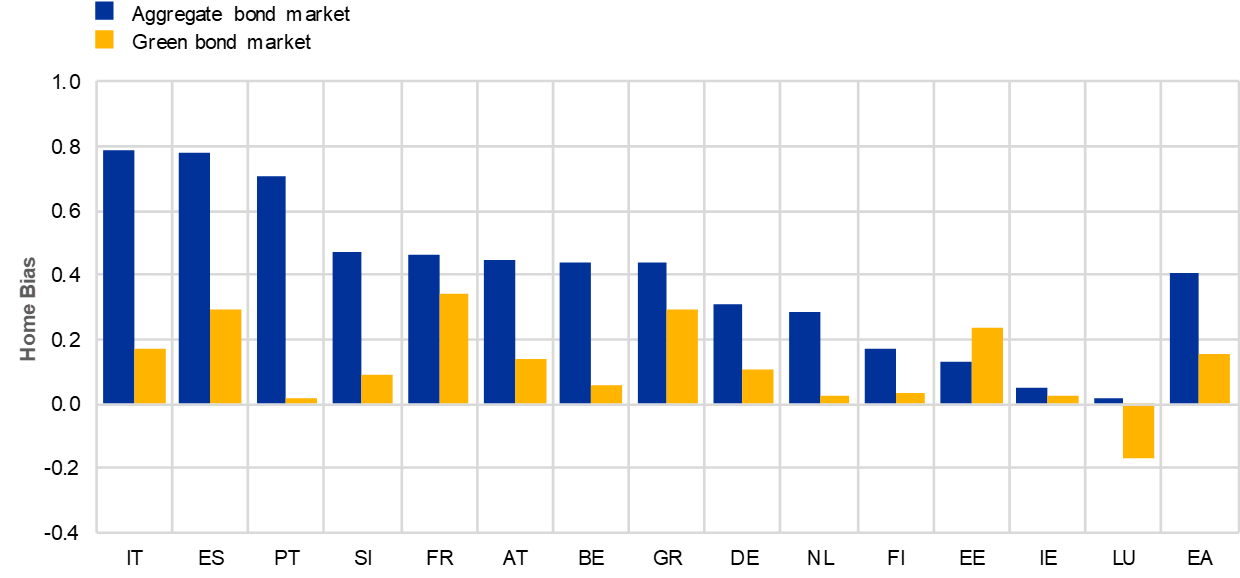

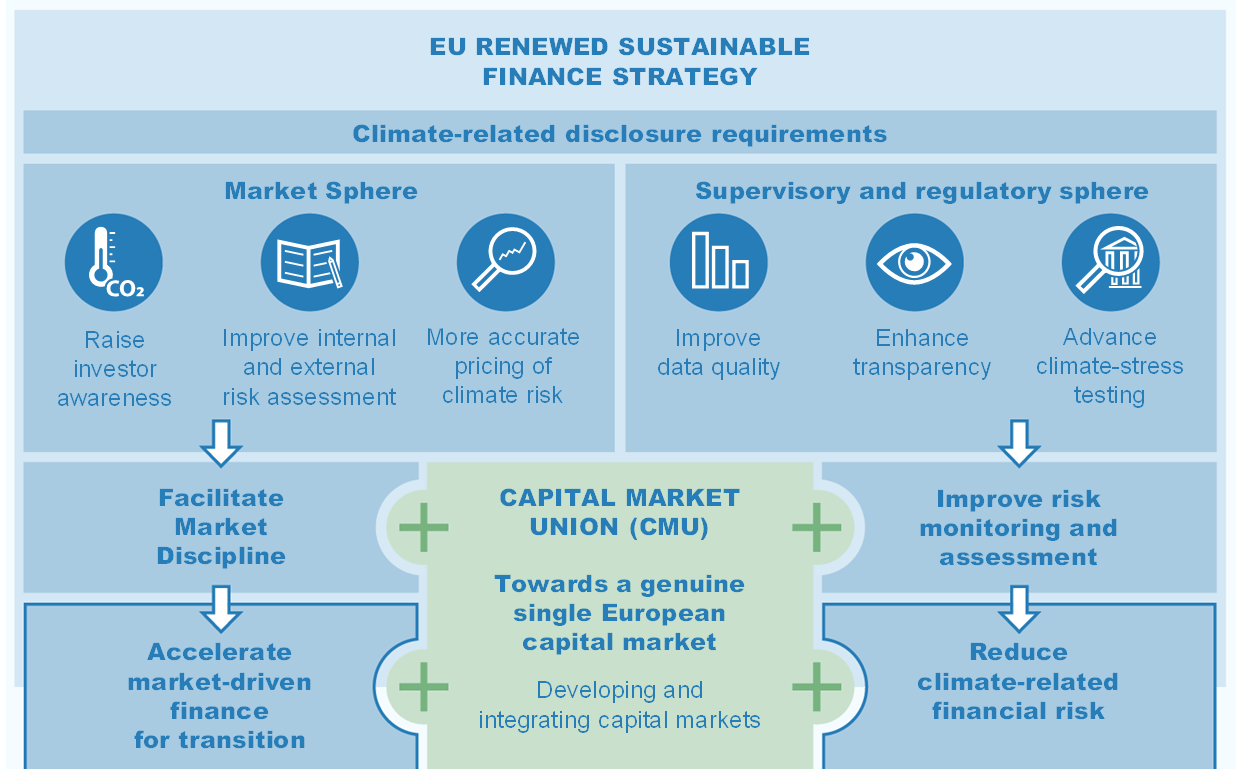

Near-term actions need to be accompanied by policy planning for medium-to-long-term risks. While policymakers focus mostly on addressing the immediate situation, attention also needs to be paid to a number of risks that could arise further ahead. First, in the face of an uneven recovery, integrated and resilient markets could be supported by completing the banking union and achieving progress in establishing the capital markets union (CMU), including enhancing the regulatory framework for non-banks in a way which reflects macroprudential perspectives (see Figure 1). Second, while facilitating the financing of the transition to a carbon-neutral economy offers opportunities for financial integration and growth, the financial stability risks posed by climate change must be managed. Finally, the experience of recent months shows the benefits of releasable bank capital and suggests rebalancing capital requirements to create macroprudential policy space in the medium term.

Figure 1

Policy roadmap

Source: ECB.

1 Macro-financial and credit environment

1.1 Policy support facilitates a rebound, but an uneven and protracted recovery looms

The resurgence of coronavirus cases in autumn dampened the economic recovery as governments reintroduced tighter albeit more targeted restrictions. As new cases declined in late spring, authorities began to ease the strict social distancing measures that had aimed to control the initial spread of the virus (see Chart 1.1, left and middle panels). At the same time, the major fiscal and monetary policy measures had started to take effect, which supported a sharp rebound in economic activity and business confidence over the summer (see Chart 1.1, right panel). Although the resurgence of infections since August has triggered a renewed tightening of restrictions, these have become more targeted (see Chart 1.1, middle panel), thereby limiting their overall economic impact somewhat. Nonetheless, there have already been signs of weaker business confidence and economic activity (see Chart 1.1, right panel).

Chart 1.1

Rebound in business confidence slows down as resurging infections trigger reintroduction of tighter albeit more targeted government restrictions

Sources: Eurostat, Google LLC "Google COVID-19 Community Mobility Reports" (accessed: 17/11/2020) and European Commission business and consumer confidence surveys. For data on government stringency, test positivity rates and COVID-19-related deaths see sources and notes of Chart 1, in the Overview.

Notes: Left panel: seven-day moving average of the share of positive new COVID-19 cases among all new cases (in %) and new deaths (in thousands) in the euro area. Middle panel: essential activities refer to closure of work places, schools and public transport as well as stay-at-home orders and restrictions on domestic travel. Non-essential activities refer to events, public gatherings and international travel. An index of one indicates the maximum possible stringency on an ordinal scale of that measure. The measures reflect and unweighted average across euro area countries. Right panel: drop in business confidence relative to December 2019 normalised by the standard deviation of the respective indicator.

The economic impact of the pandemic is highly skewed towards sectors that are directly affected by social distancing measures. While government restrictions were broad-based during the first wave of the pandemic, the current restrictions are more focused on activities judged as particularly conducive to spreading the virus, such as public gatherings and travel (see Chart 1.1, middle panel). Together with the more cautious behaviour of consumers, these targeted restrictions have weighed on consumption in general and in particular for those sectors that are most exposed to social distancing measures. The output contraction is therefore much more asymmetric across sectors than in previous crises (see Chart 1.2, left panel).

Governmental support to firms has preserved production capacity so far, but this could be challenged if the economic situation deteriorates further. Loan guarantees, loan moratoria, tax deferrals and direct transfers have alleviated immediate liquidity constraints for many companies, containing insolvencies during the first wave of the pandemic in spring. In labour markets, companies reduced labour input by cutting hours instead of laying off employees which was supported by short-time work schemes (see Chart 1.2, right panel). This adjustment mostly along the intensive margin (i.e. average hours worked) is mirrored by a more limited increase in unemployment compared with the global financial crisis (GFC) so far, even though total employment declined more than in the first half of 2009 due to substantial flows to inactivity. At the same time, these liquidity-providing support measures may become less effective if the economic situation deteriorates further and liquidity constraints morph into solvency issues.

Chart 1.2

Disproportionate output loss in sectors most affected by social distancing, but unemployment increase remains muted as firms cut hours

Sources: Eurostat and ECB calculations.

Notes: Left panel: distribution shows sectoral growth rates at the country level for ten sectors. Dashed lines reflect the means of the respective distribution. Right panel: the decomposition assumes that population remained constant and that changes in hours are only explained by the intensive margin, i.e. average hours worked, and net flows between employment, unemployment and inactivity. The residual reflects the multiplicative term in the stock-flow equations, i.e. the interaction between the extensive and intensive margins.

With cases resurging, the outlook for real GDP growth has weakened since the May FSR and remains highly uncertain. Since the previous FSR, market analysts have revised their projections for GDP growth in 2021 down from 6.2% in May to 4.7% in November (see Chart 1.3, left panel), which is roughly in line with the latest ECB staff macroeconomic projections in September (5%). Notably the upside risk of a sharp rebound in 2021 has receded substantially, pointing towards a more prolonged recession than expected in May. Although to a lesser extent when compared with May, these GDP forecasts remain highly dispersed, reflecting the uncertain macroeconomic outlook, which further weighs on consumer and business confidence. Forward-looking indicators, such as non-financial firms’ assessments of their order books or consumers’ plans for major purchases in the next year, therefore remain subdued.

A premature withdrawal of policy support and a protracted pandemic could prolong the recession and have permanent scarring effects. While policy support will need to be withdrawn eventually, an abrupt end to the ongoing measures could give rise to cliff effects and result in a more severe economic contraction than during the first wave of the pandemic. In addition, the spread as well as the eventual duration of the pandemic remain highly uncertain, with the tail risk of a prolonged period of social distancing measures. In particular firms that are most affected by social distancing may therefore face severe solvency issues or a more permanent disruption to their business models, the longer the pandemic lasts, even as the rest of the economy recovers. This risk is exacerbated by the already high leverage of many corporates, households and sovereigns following the first wave of the pandemic (see the remainder of Chapter 1).

Chart 1.3

Deterioration in the outlook, pointing to a more protracted recovery, as global risks are dominated by economic policy uncertainty due to the pandemic

Sources: Eurostat, Consensus Economics, policyuncertainty.com and ECB calculations.

Notes: Left panel: the dashed vertical lines represent the average real GDP growth forecast values. Right panel: Global Economic Policy Uncertainty until September 2020, World Trade Uncertainty covers data until Q3 2020 and Geopolitical Risk until August 2020.

Economic policy uncertainty amid the pandemic clouds the global economic outlook, even though geopolitical risks and trade uncertainty are receding. The timing and depth of the coronavirus crisis vary substantially across countries. While the Chinese economy rebounded strongly in the second quarter of 2020, other emerging market economies, as well as the United States and the United Kingdom, are experiencing protracted health and economic crises. Accordingly, the Global Economic Policy Uncertainty Index reached record highs in the first half of 2020, receding only partially since then (see Chart 1.3, right panel). This is also reflected in a subdued recovery of gross trade flows of the euro area with the rest of the world, despite the decrease in trade uncertainty. At the same time, emerging market economies face elevated financial and external sector vulnerabilities as governments have increased their debt levels amid the pandemic and have limited fiscal space to support the sluggish recovery.

Financial stability risks related to a possible no-deal Brexit at the end of the year are mostly contained and authorities have prepared for this scenario. The impact on the euro area economy of a sudden shift to WTO trading rules is currently assessed to be contained, though not negligible. Such a scenario could intensify macro-financial risks to the euro area economic outlook in the light of the ongoing global shock related to the pandemic. A possible no-deal scenario would probably also trigger substantial financial market volatility and an increase in risk premia. This could become a source of concern before the end of the year as financial markets start to price in the most likely outcome of negotiations between the United Kingdom and the EU. Cliff-edge risks in the area of centrally cleared derivatives have been addressed via the time-limited equivalence decision of the European Commission for UK central counterparties adopted on 21 September 2020. The ECB expects EU market participants to heed the Commission’s call for the industry “to develop a clear process to reduce their exposures and reliance on UK CCPs that are systemically important for the Union”, and prepare accordingly.[1] The ECB will contribute to ESMA’s comprehensive review of the systemic importance of UK CCPs and their clearing services,[2] and support any appropriate measures to preserve the EU’s financial stability. This includes examining whether the euro-denominated clearing services provided by UK CCPs are of such substantial importance for the EU financial system that UK CCPs should not be recognised to provide such clearing services. The private sector has means at its disposal to mitigate outstanding risks related to the end of the transition period in a number of other areas, such as the continuity of uncleared derivatives contracts.[3] It is important that the private sector uses the remaining time to prepare for all possible contingencies and that banks continue to progress towards their target operating models within the timelines previously agreed with their supervisors.[4] The ECB will continue to monitor risks very closely and stands ready to provide, if needed, additional liquidity in euro and foreign currencies.

1.2 Rising medium-term sovereign debt sustainability risks

The fiscal response to the pandemic entails sizeable budget deficits in 2020, which are expected to decline in 2021. Governments across the euro area have deployed a wide range of fiscal support measures in response to the pandemic. Although the swift support for households and corporates has pre-empted an even deeper contraction (see Special Feature A), it is leading to large fiscal deficits among euro area countries in 2020. A smaller cyclically adjusted deficit of -2.9% is currently projected for the euro area in 2021 as some temporary fiscal support measures are expected to be reversed, implying a slightly tighter fiscal stance in the coming year (see Chart 1.4, left panel). A fiscal tightening at a time when output gaps are still projected to be negative could exacerbate the current economic situation. That said, in 2020, euro area countries that recorded a larger output gap in general adopted a tighter fiscal stance. However, in 2021 this pattern is projected to reverse and the fiscal stance of countries will be more aligned with their expected output gaps, although fiscal developments will inevitably depend on the evolution of the pandemic and governments’ response to it.

Chart 1.4

Large fiscal deficits and falling output raise sovereign debt ratios

Source: European Commission (AMECO database).

Notes: Left panel: fiscal stance is defined as the change in the cyclically adjusted primary budget balance. Right panel: Data for 2020 on debt and GDP based on European Commission Autumn forecast. The decomposition assumes that only nominal debt or only nominal GDP changed between 2019 and 2020, affecting debt-to-GDP ratios through the numerator and denominator respectively. The interaction effect between changes in the numerator and denominator, which is positive due to the negative co-movement of debt and GDP, is attributed to GDP but of second-order importance quantitatively.

Government debt-to-GDP ratios have increased sharply in 2020, reflecting both an increase in outstanding debt and a drop in GDP. In order to fund the fiscal response to the pandemic, governments have issued close to one trillion euro of net debt in the first ten months of 2020. In addition to this increase in outstanding nominal debt, the drop in GDP has further raised sovereign debt-to-GDP ratios in 2020 compared with the previous year (see Chart 1.4, right panel). While this increase in debt ratios will partially reverse once GDP recovers, the elevated nominal debt levels will have a persistent effect on governments’ debt service needs going forward. Furthermore, higher debt levels imply that governments are more exposed to an abrupt tightening of financing conditions.

Chart 1.5

Cash buffers alleviate short-term debt service needs, while the EU recovery package supports in particular countries most affected by the crisis and with high bond yields

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: Left panel: cash holdings refer to government accounts at national central banks. Right panel: EU yield refers to the yield of the first COVID-19-related EU bond issued on 20 October with an original maturity of ten years. Sovereign bond yields refer to ten-year benchmark yields in October. NPV gain is computed assuming that only EU countries with an NPV gain would take up the loans and that the envelope is used in full and equally across take-up countries. It is further assumed that all countries with higher funding costs would make use of the Next Generation EU loans, irrespective of possible concerns related to the attached conditions or stigma. Future cash-flow gains are discounted using the ten-year overnight index swap (OIS) forward rate.

Elevated debt service needs are partly alleviated by higher cash buffers and favourable funding conditions in the short run. The additional borrowing by governments since the start of the pandemic has been concentrated at shorter maturities, in particular in securities maturing within the next year (see Chart 1.5, left panel). At the same time, the cash holdings of governments with the Eurosystem have increased markedly since the end of last year. Taking into account these cash buffers, the net debt service needs in the coming year are therefore lower than the increase in gross short-term debt suggests. However, the cash buffers may also be needed to provide additional fiscal support or to accommodate cash outflows if contingent liabilities materialise. The extent to which governments will be able to use their cash buffers to repay their elevated short-term debt in the next year or whether they will roll over the debt into longer maturities therefore crucially depends on the evolution of the pandemic. At the same time, the prevailing low-yield environment implies that sovereign debt servicing costs increase only moderately from 20% to 23% of GDP over the next two years, despite the substantial increase in outstanding debt, which further alleviates governments’ debt service needs in the short term.

The EU recovery package will especially support the most affected countries through a mix of net transfers and loans at favourable refinancing conditions. Once the EU recovery package is operational, the allocation key of its grant component entails net transfers which are partly targeted towards those countries most affected by the pandemic. Furthermore, the €360 billion of loans that will be made available by the EU constitute a favourable refinancing option that is cheaper than the current funding costs of the majority of euro area countries (see Chart 1.5, right panel). Over the lifetime of these loans, the cheaper refinancing conditions imply a net present value gain of up to 1% of gross national income, in particular for countries with high sovereign bond yields. Over the medium-to-long term, the loan component therefore provides additional support for countries with high funding costs whose debt service capacity has been strained by the pandemic. At the same time, the effectiveness of both the loans and the grants from the recovery package hinges on countries deploying these funds for productivity enhancing purposes.

Chart 1.6

Contingent liabilities and the sovereign-corporate nexus are weighing on debt sustainability as the pandemic continues

Sources: European Commission (AMECO database), KfW, French Banking Federation, French Ministry of the Economy, Finance and the Recovery, Italian Banking Association, Instituto de Crédito Oficial, Dutch Banking Association and ECB calculations.

Notes: Left panel: data are based on national sources and cover guarantees committed or announced until end October. “Remaining envelope” denotes announced envelopes of guarantees that have not been committed yet. Right panel: countries are split into highly and less highly indebted based on the median debt-to-GDP ratio of 13 sovereigns in 2019 for which data on the NFC gross operating surplus are available. Highly indebted (above median): ES, FR, BE, PT, IT, GR. Less highly indebted (below/equal to median): EE, NL, IE, FI, DE, SI, AT.

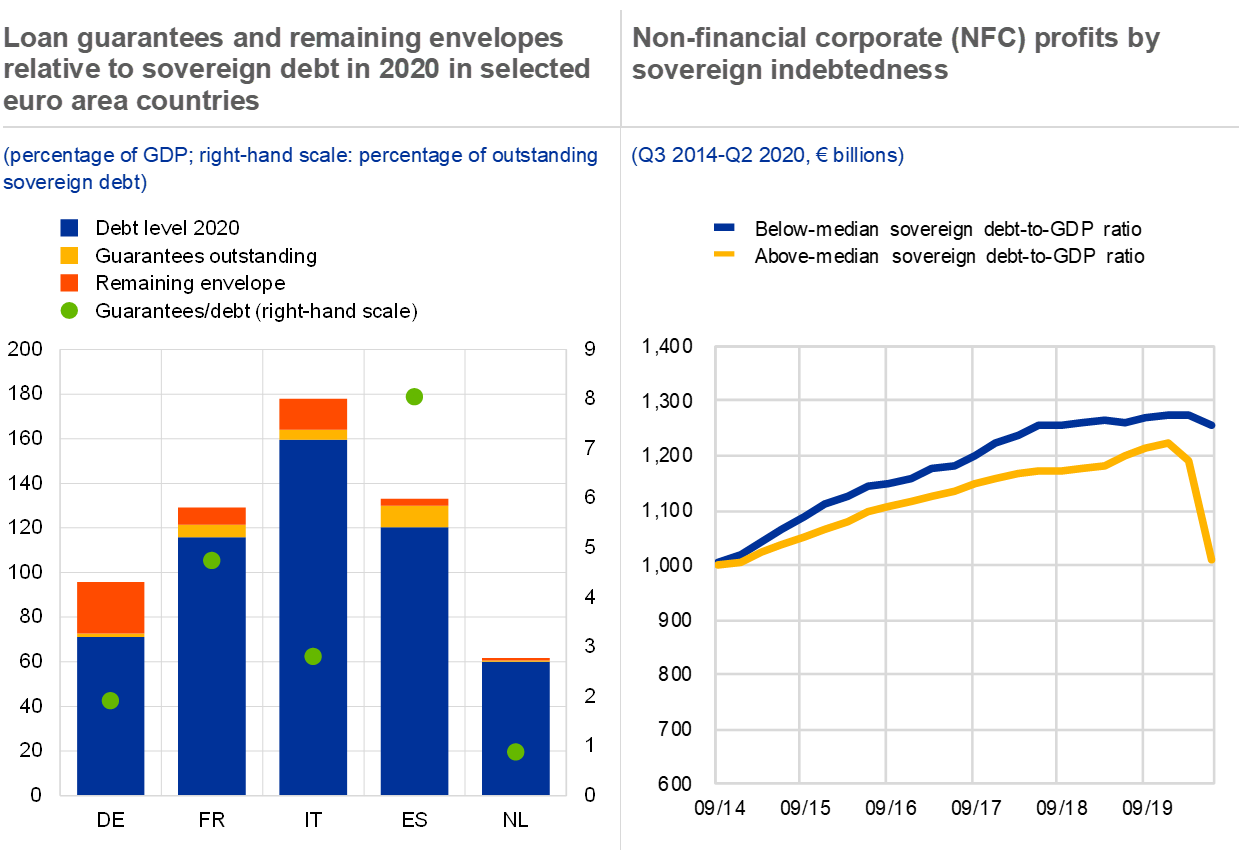

Contingent liabilities could increase sovereign debt levels further, if the economic situation deteriorates and loan guarantees are called. Besides the direct fiscal support measures such as tax cuts and transfers, governments have supported corporates and households by underwriting credit risks through loan guarantee schemes. These contingent liabilities do not immediately affect official government deficit and debt levels, but can be relevant for debt sustainability as they could result in additional cash outflows if the underlying loans do not perform (see Chart 1.6, left panel). In addition to the already committed guarantees, the remaining guarantee envelopes could be used should the economic situation deteriorate, which would further raise the exposure of sovereigns to contingent liabilities.

Highly indebted sovereigns are exposed to corporates that have been particularly affected by the pandemic, creating a sovereign-corporate nexus. The drop in corporate profits has been especially pronounced in countries that already had high debt levels going into the crisis. This is partly due to their different industrial structure which is more dependent on highly affected sectors such as tourism and hospitality, in particular in southern Europe (see Chart 1.6, right panel). This coincidence of stretched sovereign debt ratios and a vulnerable corporate sector gives rise to a sovereign-corporate nexus, especially considering that sovereigns are increasingly exposed to corporates through contingent liabilities.

As governments are backstopping the economy, sovereign vulnerabilities in the medium term have increased, but remain contained in the short run. Governments have stepped in to soften the economic fallout from the pandemic which has increased fiscal deficits and sovereign debt levels. In the short run, mitigating factors such as cash buffers, favourable financing conditions and the agreement on the EU recovery package have contained sovereign vulnerabilities. In addition, the euro area as a whole remains a net creditor globally which limits its reliance on non-euro area external financing. That in turn mitigates the risk that the debt service capacity of sovereigns, as well as firms and households, in the euro area is negatively affected by an abrupt reversal in external capital flows. However, the large exposure of governments to a weaker corporate sector through contingent liabilities and the bleak outlook for the macroeconomy increase the risks to sovereign debt sustainability over the medium term.

1.3 Euro area households cushioned by government support

Despite recent improvement, euro area consumer confidence remains weak, reflecting bleak unemployment expectations and elevated uncertainty (see Chart 1.7, left panel). Survey-based indicators point to higher expectations of unemployment across all main business sectors, albeit with a marked improvement from earlier lows. The retail and services sectors record among the biggest improvement in unemployment expectations, reflecting the effectiveness of short-time work schemes and the easing of lockdown measures. The change in consumer sentiment remains correlated with the economic impact of the pandemic, and coincides with the evolution of new coronavirus cases (see Chart 1.7, right panel).

Chart 1.7

The pandemic maintains a firm grip on euro area consumer sentiment

Sources: ECB, European Commission and JHU CSSE COVID-19 Data.

Notes: Left panel: “Unemployment expectations” are presented using an inverted scale, i.e. an increase (decrease) in the indicator corresponds to more (less) optimistic expectations. This is a survey-based measure reflecting consumer expectations for the number of people that will become unemployed over the next 12 months. Right panel: monthly percentage change of new coronavirus infections per 100,000 inhabitants versus net change in consumer confidence in the euro area. For details on the source, see the notes to Chart 1, left panel, in the Overview.

Government support schemes have shielded the spending capacity and balance sheets of euro area households. Short-time work schemes effectively preserved a large share of employment, thus limiting the decline in aggregate gross wages (see Section 1.1). At the same time, household gross disposable income was cushioned by a substantial increase in net social transfers and temporary tax relief, adding on average 5 percentage points to the annual growth rate in disposable income for the euro area. Despite the support measures, disposable income contracted by 2.7% in the second quarter, mainly due to the decline in compensation paid to employees and falling property income (see Chart 1.8, left panel).

Households’ net worth has been supported by a recovery in the value of financial assets, record savings and still buoyant residential real estate markets (see Chart 1.8, right panel). As a result, aggregate household balance sheets remained strong, with net worth and savings deposits accounting for 7.4 and 4.5 times disposable income respectively, giving some resilience to weather a prolonged period of low economic growth. However, there is large heterogeneity across countries and households. Low-income individuals and countries that already exhibited low economic growth before the pandemic are being hit disproportionally hard.[5] Moreover, the uncertainty surrounding equity markets, high unemployment expectations and a possible decline in housing wealth, coupled with the winding-down of support measures, may weigh on household financial resilience going forward.

Chart 1.8

Household income shielded by government support schemes as social transfers increased, while gains in net worth boosted household resilience

Sources: Eurostat, ECB and ECB calculations.

Notes: Right panel: other changes in non-financial assets mainly include gains and losses on real estate holdings (including land). Other changes in financial assets and liabilities mainly include gains and losses on holdings of shares and other equity, while the changes in net worth due to net saving comprise net saving, net capital transfers received and the discrepancy between financial and non-financial accounts.

Household borrowing has slowed, and households face tighter lending standards from banks (see Chart 1.9, left panel). Growth in aggregate bank lending to households has fallen by 0.2 percentage points since the start of 2020. Divergent trends across different credit types mirror the heterogeneous impact of the pandemic on the economy. Consumer credit growth dropped from 6% at the start of the year to zero in September, consistent with the fall in demand for durable consumer goods. In contrast, mortgage net lending volumes have been broadly resilient, partly supported by lower loan redemptions. Despite growth moderation since the start of the year, new loan originations for the purpose of house purchase remain at solid levels. Furthermore, banks tightened lending standards across all loan types considerably amid higher risk perceptions and are expected to make them even stricter (see Chart 1.9, middle panel).

Households’ debt sustainability has been supported by government schemes and record low debt servicing costs. So far, the pandemic has had a relatively modest effect on household debt ratios, as income has been largely preserved by government support schemes. Delinquency rates have increased, in particular among the self-employed, but remain close to their long-run average as some euro area countries removed the obligation to file for insolvency. Moreover, loan moratoria have helped households which faced income losses. In addition, debt servicing costs have hit record lows as a result of very low interest rates, with interest payments as a share of disposable income falling below 2.4%. Overall, this means that household debt has been largely cushioned from the economic impact of the pandemic.

Chart 1.9

Bank lending slowed down amid tighter lending standards, as highly indebted households look vulnerable to increasing debt service burdens

Sources: European Commission, Eurostat, euro area bank lending survey, ECB and ECB calculations.

Notes: Left panel: “Loans for other purposes” mainly reflect lending to sole proprietors. “Loans for house purchase” represent 77% of total lending, “Consumer credit” 12% and “Loans for other purposes” 11%. Right panel: “Unemployment expectations” are a survey-based measure reflecting consumer expectations for the number of people that will become unemployed over the next 12 months.

A sustained economic slowdown and a resulting increase in unemployment could weigh on household debt repayment capacity. Countries with buoyant housing markets have also experienced a gradual build-up of household debt in recent years. A protracted economic slowdown could weigh on household incomes or lead to a sharp correction in some property markets, with the effects varying across countries. Moreover, high-debt countries show high unemployment expectations, making them more vulnerable to possible cliff-edge effects from the ending of support (see Chart 1.9, right panel). As a result, whether risks materialise will depend in part on the ability of governments to keep supporting households that experience declining incomes.

1.4 Euro area corporates shielded by government support but facing rising solvency pressures

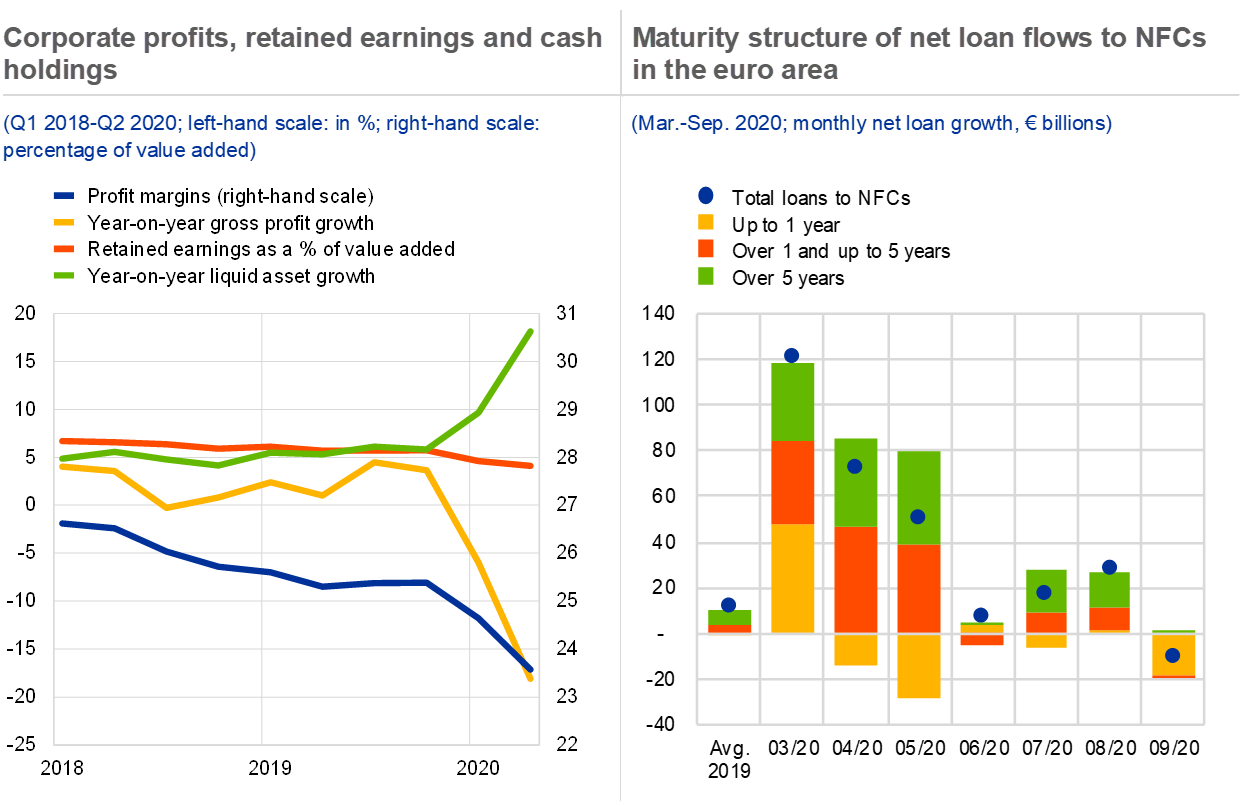

Corporate earnings and profits dropped sharply as economic activity collapsed in March. Corporates experienced a continued deterioration in profits, profit margins and retained earnings as economic activity contracted amid tight social distancing measures (see Chart 1.10, left panel). As a result, corporate vulnerabilities increased substantially in the euro area (see Box 1).

As net loan flows to corporates abated over the summer, firms continued to replace the short-term funding they took on in March with longer-dated loans. During the early phase of the pandemic, firms increased their borrowing from banks substantially to cover their ongoing expenses, relying largely on loans with maturities of up to one year (see Chart 1.10, right panel). Borrowing from banks remained at elevated levels in the second quarter, while corporate debt issuance reached record highs (see Chapter 2). As economic activity rebounded in late spring, both debt issuance and new bank lending slowed down in the third quarter, but remained at solid levels in seasonally adjusted terms. At the same time, firms continued to shift towards longer-maturity debt which reduced the immediate refinancing needs of businesses and allowed them to lock in the currently favourable credit conditions.

Chart 1.10

Corporate profits collapsed and net loan flows rose during the initial lockdowns, but net loan flows slowed as of April as firms shifted towards longer-maturity debt

Sources: Eurostat, ECB (quarterly sectoral accounts and balance sheet item statistics) and ECB calculations.

Notes: Left panel: profit margins are proxied by net operating surplus over value added. Retained earnings are proxied by net savings over value added. Year-on-year growth of gross profits is proxied by the respective growth rate of quarterly gross operating surplus. Liquid assets include currency and deposit holdings. Right panel: net loan growth refers to the net flow of loans to NFCs in a given month and maturity bracket (new issuance minus redemptions). Total loans are seasonally adjusted and therefore differ from the sum of the loans by maturity brackets which are not seasonally adjusted.

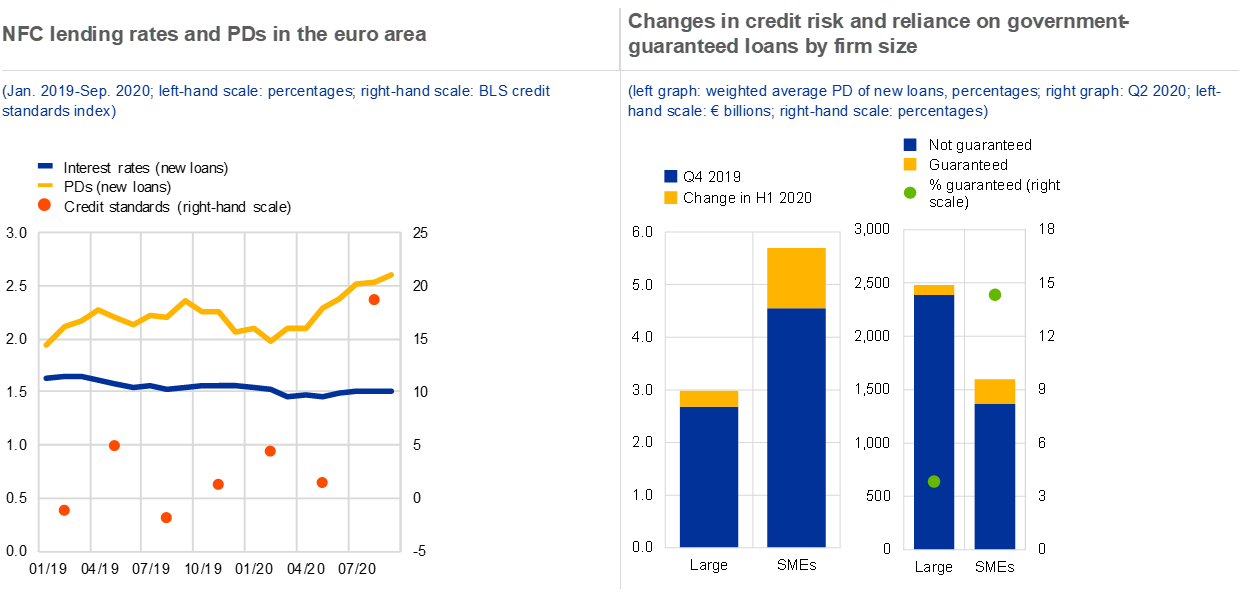

Despite an increase in underlying credit risk, credit conditions remain favourable but could tighten if government support ends. Unlike in previous periods of stress, bank lending to non-financial corporations (NFCs) increased substantially at the onset of the pandemic (see Chart 1.10, right panel). At the same time, lending rates remained stable (see Chart 1.11, left panel), which indicates that the increase in credit supply so far has outpaced the surge in credit demand. Governments that provided loan guarantees thereby underwriting credit risk played a crucial role in that context. The guarantees reduced the loss given default of new loans which relieved the upward pressure on rates stemming from higher probabilities of default (PDs) (see Chart 1.11, left panel). In turn, a premature withdrawal or suspension of loan guarantee schemes could cause banks to tighten credit standards further, resulting in a credit crunch for NFCs.

Chart 1.11

Guarantees support funding conditions despite higher credit risk especially for SMEs, but credit standards are tightening

Sources: Left panel: AnaCredit data and euro area bank lending survey (BLS); right panel: AnaCredit data, FINREP and national sources for loan guarantee take-up.

Notes: Left panel: PDs and interest rates on new loans granted to NFCs are based on AnaCredit data. Credit standards reflect backward-looking actual credit standards up to the third quarter of 2020. Right panel: PDs refer to the average PDs weighted by loan size of newly issued loans in that quarter within the respective size category. Guaranteed loans refer to the flow of guaranteed loans by firm size based on national sources for France, Germany, Italy and Spain. The stock of loans by firm size is based on FINREP (supervisory financial reporting) data for the second quarter of 2020 (more recent data not available).

Credit risk has increased for small and medium-sized enterprises (SMEs) in particular, and they are more exposed than larger firms to tightening credit conditions once loan guarantees expire. In the first half of 2020 the credit quality of new loans deteriorated more for SMEs than for large enterprises in the four largest euro area countries (see Chart 1.11, left graph in right panel). Reflecting this pattern, SMEs relied more on state-guaranteed loans than larger companies, with such facilities accounting for 14% of total outstanding loans to SMEs in June (see Chart 1.11, right graph in right panel). In addition, SMEs are generally less likely to have access to market-based funding sources, which leaves them more exposed to a sudden deterioration in bank lending conditions. They are therefore particularly vulnerable to a possible expiration of state guarantees and a subsequent tightening of credit conditions.

Although corporate debt ratios are likely to remain elevated, they may fall back somewhat once the economy recovers. There was a sharp increase in companies’ debt ratios in the first half of 2020, when businesses borrowed more in the face of a contracting economy. A rebound in economic activity would partially reverse these elevated debt ratios, as more than half of the increase in the corporate debt-to-GDP ratio was driven by lower GDP (see Chart 1.12, left panel). Nonetheless, the higher nominal debt levels will have a persistent if not permanent effect on corporate indebtedness unless companies actively deleverage once the economy recovers. If not addressed, these elevated debt ratios could raise corporate debt sustainability concerns in the longer term, even if the economy recovers and GDP returns to pre-pandemic levels.

Chart 1.12

Gross NFC indebtedness increased on the back of lower GDP, while insolvencies are expected to rise despite higher cash holdings

Sources: Left and middle panels: Eurostat, ECB quarterly sectoral accounts and ECB calculations; right panel: Euler Hermes and Allianz Research.

Notes: Left panel: decomposition shows contribution of changes in debt financing (numerator) and changes in GDP (denominator) to changes of NFC debt-to-GDP ratio since the fourth quarter of 2019 (non-consolidated basis). The interaction effect, which is positive due to the negative co-movement of debt and GDP, is attributed to GDP but of second-order importance quantitatively. Middle panel: “Liquid assets” comprise currency and deposits; “Gross debt” includes loans, debt securities and pension entitlements but excludes trade credit; “Net debt” is the difference between gross debt and liquid assets. Right panel: forecast for DE, FR, ES, IT and NL based on a revised version of the Euler Hermes and Allianz Research report dated 24 September, other countries based on previous report dated 16 July. EA* refers to GDP-weighted sample of countries shown in the chart.

Although corporate cash buffers on aggregate mitigate the elevated debt levels, the most affected firms may face severe refinancing constraints. The increase in corporate debt was accompanied by a similarly-sized increase in cash buffers in the corporate sector, implying that net debt remained stable on aggregate (see Chart 1.12, middle panel). However, this overall picture masks substantial heterogeneity reflecting the asymmetric impact of the pandemic across industries (see Section 1.1). While corporates less affected by the pandemic were able to build up cash buffers, those in the worst affected sectors were forced to increase their net debt position and face higher refinancing pressures going forward.

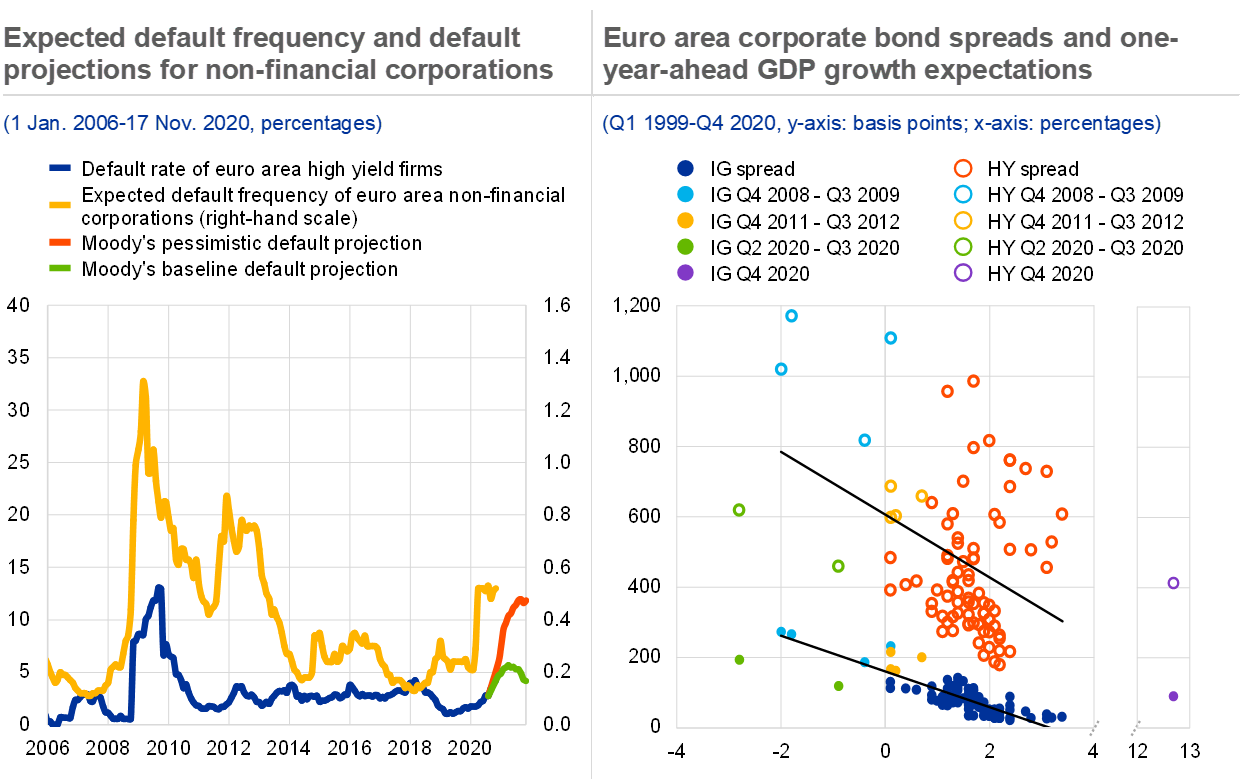

Corporate insolvencies are likely to increase as the pandemic continues and liquidity constraints morph into solvency issues. In the first half of 2020 corporate insolvencies across a range of euro area countries were lower than during the same period in the previous year. This pattern was supported by various policy measures that either explicitly deferred insolvency proceedings or indirectly pre-empted liquidity-driven insolvencies by alleviating cash constraints through loan guarantees and similar schemes. At the same time, many of these measures only postponed companies’ payment needs and increased their debt burden (see Chart 1.12, left panel). Companies that already had stretched balance sheets before the pandemic will therefore face more severe debt sustainability issues going forward. Insolvencies are projected to increase in 2020 and 2021 accordingly (see Chart 1.12, right panel). Similarly, an increasing share of corporate issuers has been downgraded or faces a negative rating outlook (see Chapter 2). The deterioration in corporate solvency would be exacerbated if government support measures were withdrawn prematurely, as viable companies could face a sudden tightening of credit conditions before earnings have sufficiently recovered.

Box 1

Assessing corporate vulnerabilities in the euro area

By bringing much of the euro area economy to a temporary halt, the coronavirus pandemic has threatened the existence of many euro area firms. While liquidity shortages were seen as the major threat to non-financial corporate (NFC) health at the beginning of the pandemic, more recently firms’ solvency has become the primary concern. Without the massive monetary and fiscal support measures, many more viable firms could have been forced into failure by the impact of the pandemic, adding to pressures on the economy and banks. Against this backdrop, this box assesses euro area NFC vulnerabilities and the underlying factors.

More1.5 Euro area property markets at risk of correction

Euro area residential real estate (RRE) prices continued rising throughout the first half of 2020. At the euro area level, nominal house prices increased by around 5% in annual terms in the first half of 2020 (see Chart 1.13, left panel). While prices continued to trend upwards in the euro area as a whole, growth rates varied greatly across countries and between capital cities and rural areas. The resilience to the pandemic observed in housing markets reflects a number of factors. First, supporting measures in the form of payment moratoria and job protection schemes have successfully mitigated its impact on household debt servicing capacity and total wealth. Second, the low interest rate environment continues to put a floor under demand. Finally, contracts signed after the lockdown period may in some cases entail conditions which were established before the lockdown.

Leading indicators point to an uncertain outlook for house price growth (see Chart 1.13, left panel). RRE price growth might face headwinds going forward as a result of a marked decline in GDP, consumer confidence and employment expectations. Moreover, results from the latest ECB bank lending survey indicate that mortgage loan demand moderated in the second quarter of 2020, while banks significantly tightened lending standards amid higher risk perceptions. Tighter lending standards and fading demand could accelerate the slowdown in the euro area housing cycle anticipated for 2021.

In some countries, high household indebtedness makes the housing market even more vulnerable. A number of euro area countries have both household debt-to-disposable income ratios at or above 100% and increasing signs of overvaluation (see Chart 1.13, right panel). A marked rise in unemployment could have a negative impact on debt servicing capacity, which might contribute to a price correction in the RRE market. Whether these risks to RRE prices materialise will depend to a large extent on how far unemployment rises and how far future household income drops when support schemes are scaled back.

Chart 1.13

Despite resilience over the first half of 2020, house prices are expected to moderate against the background of high indebtedness in some euro area countries

Sources: ECB and ECB calculations.

Notes: Left panel: the shaded area denotes the interquartile range of various leading indicators. Leading indicators include: BLS actual and expected lending standards for house purchase loans (inverted), BLS actual and expected demand for house purchase loans, BLS housing market prospects, consumer confidence, services confidence, Purchasing Managers’ Index (PMI) composite index, PMI residential construction index, economic sentiment, real GDP growth, unemployment expectations (inverted), annual change in pure new loans, residential investment growth, construction survey price expectations and the cost of borrowing for house purchase (inverted). Right panel: the size of the bubbles reflects the growth in overvaluation since the first quarter of 2019. Countries with a green bubble recorded a decline in overvaluation. The blue bubble reflects the euro area average. Overvaluation is the average of the price-to-income ratio and the output of an econometric model. The estimates are subject to considerable uncertainty and should be interpreted with caution, and alternative valuation measures can suggest lower/higher estimates of overvaluation.

In contrast with residential markets, the pandemic led to an abrupt and sustained drop in CRE market activity. When lockdown measures were introduced in March and April, activity in the CRE market dropped to around half of the levels seen in previous years (see Chart 1.14, left panel). Moreover, there has been a pronounced increase in the role of international buyers in euro area CRE markets in recent years as a result of the search for yield.[6] The observed decline in transactions has been driven by both euro area and non-euro area investors. However, activity by international buyers has fallen disproportionately (see Chart 1.14, right panel), reflecting the tendency for these buyer types to engage in flight to safety and reallocate funds during times of elevated global economic uncertainty.

Chart 1.14

A sharp and sustained drop in commercial real estate (CRE) market activity, with a shift in buyer composition

Sources: ECB, Real Capital Analytics, Bloomberg Finance L.P. and ECB calculations.

Note: Activity is compared with the same months in previous years, as CRE transaction activity is highly seasonal.

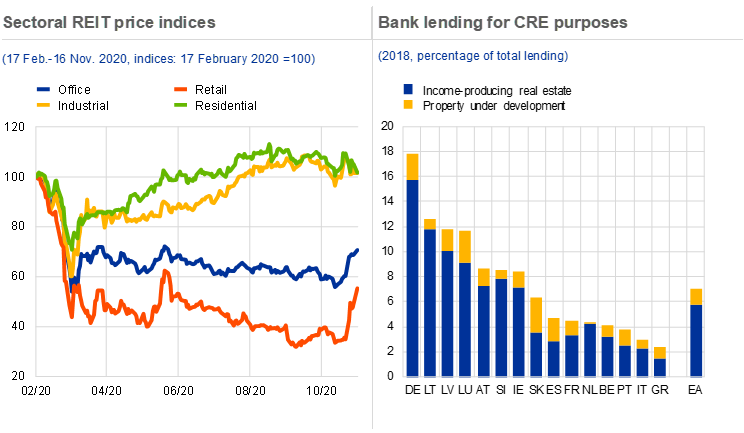

Market valuations suggest that the CRE market may face an extended period of decline. Limited liquidity means that backward-looking measures of price developments may not fully reflect current market dynamics. Market-based valuation indicators such as real estate investment trust (REIT) indices signal a significant decline in market value for the retail and office sectors (see Chart 1.15, left panel). Moreover, there is significant dispersion within the euro area. German price indices indicate a full price recovery, while those in Spain, Italy and France show almost no rebound from pandemic lows. This reflects the uneven economic impact of the pandemic across euro area economies.

A sharper CRE market correction could have implications for bank balance sheets, although exposure varies. Shocks to the CRE sector could feed through to the financial system via increased credit risk, decreased collateral values and losses on direct holdings. Bank lending for CRE purposes accounts for 7% of exposure to the non-financial private sector, although levels vary substantially across countries (see Chart 1.15, right panel). Against this background, a large decline in the value of CRE could contribute to bank vulnerability in some euro area countries in the context of a wider coronavirus shock.

Risks to financial stability stemming from real estate markets have increased further. The CRE sector has been affected by the pandemic faster than the RRE sector and may have entered a period of risk materialisation. Going forward, the demand for housing might slow amid tighter lending standards and deteriorating employment prospects, leading to a further decline in the real estate cycle. Against this background, the financial sector may be exposed to the risk of real estate market corrections, in particular where such exposures are significant, debt levels are elevated and properties are overvalued.

Chart 1.15

CRE assets are still vulnerable to a price correction, which could feed through to bank balance sheets

Sources: Bloomberg Finance L.P., ECB and 2019 SSM credit underwriting data collection for significant institutions.

2 Financial markets

2.1 Recovery and stabilisation in financial markets following policy support

Financial conditions have continued to ease on the back of monetary and fiscal policy measures to almost unprecedentedly accommodative levels. Better than expected macroeconomic data, strong policy support and, most recently, positive news on coronavirus vaccine trials have led to a considerable improvement in global risk sentiment. This has eased global financial conditions to almost unprecedentedly accommodative levels, reflected in narrower credit spreads and recovering equity markets (see Chart 2.1, left panel). Financial conditions remain somewhat tighter in the euro area given the appreciation of the euro and an incomplete equity market recovery. The accommodative financial conditions are largely predicated on the significant monetary and fiscal policy measures. If such measures expire prematurely, or if recently renewed lockdowns are intensified, there is a risk that financial conditions could tighten again.

Improved financial conditions turned investor sentiment in favour of the euro. The improving global risk sentiment and expectations of more accommodative US monetary policy, complete with narrowing real interest rate differentials, contributed to reversing the safe-haven flows into US dollar-denominated assets, leading to an appreciation of the euro. Indicators from options markets and positioning data in futures markets indicate that market sentiment has turned in favour of the euro, but moderated more recently (see Chart 2.1, right panel).

Chart 2.1

Financial conditions ease and investor sentiment turns in favour of the euro

Sources: Refinitiv, Bloomberg Finance L.P., Commodity Futures Trading Commission (CFTC) and ECB calculations.

Notes: Left panel: financial conditions are computed as weighted averages of five daily financial indicators: ten-year government bond yields, short-term interest rates, nominal effective exchange rates (the weighted average of the foreign exchange value of each country's currency against the currencies of its major trading partners), price/earnings ratios and corporate bond spreads, aggregated using GDP purchasing power parity shares of eleven large advanced economies (Australia, Canada, France, Germany, Italy, Japan, New Zealand, Norway, Sweden, the United Kingdom and the United States). FCI: financial conditions index. Right panel: net speculative positioning refers to the EUR/USD net non-commercial position. Risk reversal is the difference between the cost of a three-month EUR/USD call option and put option.

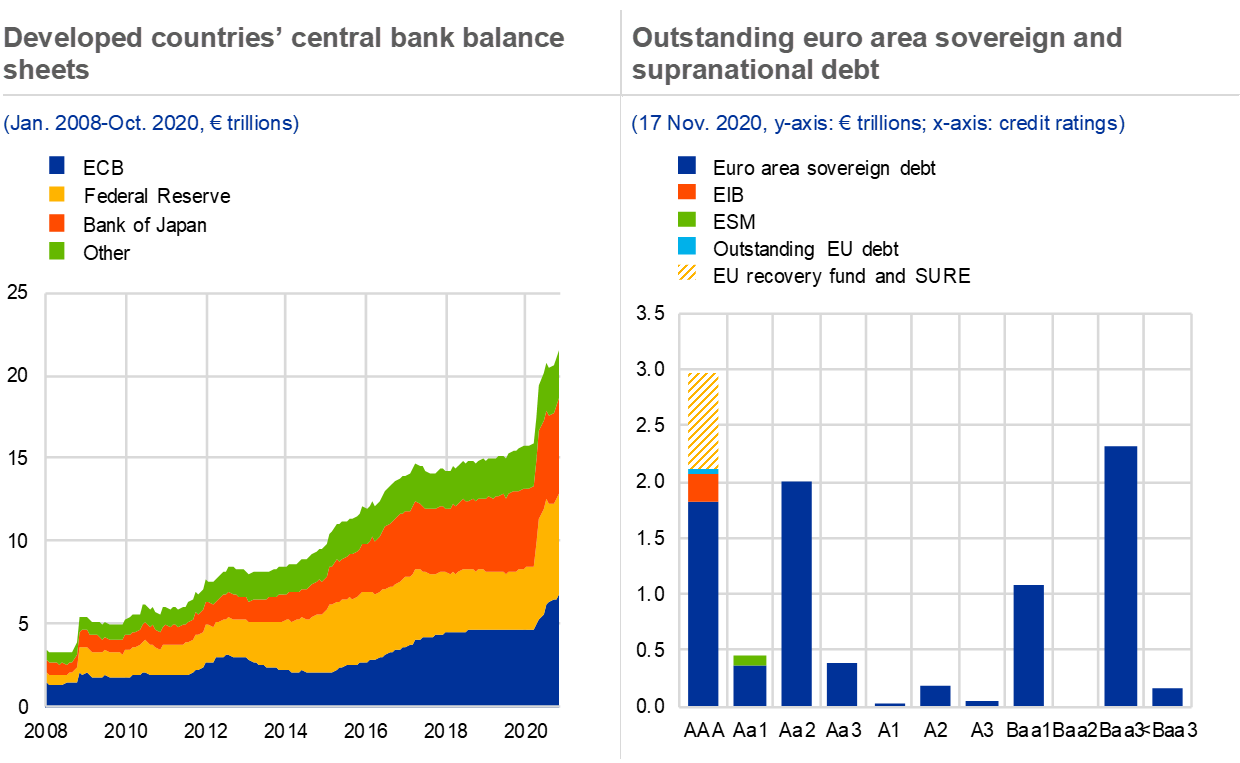

The accommodative monetary policy environment has provided support to financial markets. Central banks around the world have expanded their balance sheets by increasing liquidity operations and launching (targeted) asset purchases in response to the pandemic. Advanced economy central bank balance sheets have ballooned by more than €5 trillion in 2020 to above €20 trillion. This has outpaced any previous expansion and provided extensive support to financial markets (see Chart 2.2, left panel). The ECB has purchased €629 billion of euro area debt securities under the pandemic emergency purchase programme (PEPP) in net cumulative terms as of October and gross take-up was €1,483 billion in the third series of targeted longer-term refinancing operations (TLTRO III) in June and September. Among other things, the liquidity injection has increased demand for overnight cash facilities, contributing to higher euro short-term rate (€STR) transaction volumes than before the pandemic, which has served to confirm its robustness in stressed market conditions. However, the €STR is still not established as a main reference in financial contracts, such as in the overnight index swap (OIS) market where its use remains limited (see Box 2). On 15 March the ECB also announced enhanced provision of US dollar liquidity via the standing US dollar liquidity swap line arrangements, alleviating US dollar funding pressures.

The agreement on the EU recovery fund on 21 July has also supported risk sentiment and sovereign spreads. Despite the implied increase in overall debt issuance in the coming years, the recovery fund has been associated with narrowing sovereign spreads as it will replace some of the national issuance. The fund will add significant amounts of highly rated assets to the euro area sovereign and supranational debt market and may contribute to the further development of the European capital markets union (see Chart 2.2, right panel).[7]

Chart 2.2

Strong policy support has helped to stabilise financial markets, with EU debt issuance expected to provide a large amount of highly rated euro area bonds

Sources: Bloomberg Finance L.P., respective central bank and ECB calculations.

Notes: Left panel: the “Other” category refers to the balance sheets of the Bank of England, Swiss National Bank, Bank of Canada, Reserve Bank of Australia, Reserve Bank of New Zealand, Sveriges Riksbank and Norges Bank. Right panel: euro-denominated sovereign debt and supranational debt in the euro area. Credit ratings are Moody’s long-term local currency credit rating categories. Outstanding EU debt refers to the end of September 2020. EIB: European Investment Bank; ESM: European Stability Mechanism; SURE: European instrument for temporary Support to mitigate Unemployment Risks in an Emergency.