Creditor coordination in resolving non-performing corporate loans

Published as part of the Financial Stability Review, November 2021.

Numerous European and national initiatives have been launched since 2014 to reduce non-performing loan (NPL) stocks on euro area bank balance sheets. NPL ratios have fallen as a result, but very gradually, mainly thanks to sales to non-bank investors. Despite stronger market activity, prices paid by NPL investors have only improved marginally and continue to stand well below values assigned to NPLs by banks. One type of NPL that has proven particularly difficult to resolve is loans to non-financial firms that have borrowed from multiple banks – multi-creditor loans. Analysis of these and other loans finds lower provision coverage by the lending banks, reflecting more optimistic valuations by individual banks and limited recognition of the expected costs of multi-creditor coordination. This special feature proposes a strategy to overcome creditor coordination failures and costs, through the use of data platforms providing ex ante transparency to NPL investors. These, together with NPL securitisation, could substantially reduce the gap between the value of the loans carried on banks’ balance sheets and the prices offered by investors for NPL portfolios.

1 Introduction

Stocks of NPLs on euro area bank balance sheets reached a peak of over €1 trillion by 2014 and NPL ratios have taken about seven years to return to pre-global financial crisis levels. The aggregate NPL ratio of euro area banks increased from 2.4% in 2007 to about 8% by 2014. It then declined again to 2.4% by mid-2021. Various factors have been cited in explaining the persistence of these stocks, including failures in the markets for NPLs and inefficiencies in insolvency frameworks. Numerous policy actions, perhaps most notably the EU Council’s 2017 NPL Action Plan, were set in train to address these challenges. Further policies should build on the considerable progress made and on the lessons learnt about the effectiveness of policy initiatives.

Chart C.1

NPL markets have grown rapidly since 2014, while transaction prices reflected the collateralisation of loan portfolios

Sources: KPMG, Deloitte, EY, Banca Ifis, Acuris Debtwire, bank announcements and ECB calculations.

Notes: Data include sales of mixed portfolios which, in addition to NPLs, may include performing loans and repossessed collateral. Panel b: left chart based on 56 transactions with a gross book value of €157 billion. For the methodology of the IRR estimates, see Box 7 entitled “Recent developments in pricing of non-performing loan portfolio sales”, Financial Stability Review, ECB, May 2018. Right chart based on 34 NPL securitisation transactions. GACS: Garanzia Cartolarizzazione Sofferenze scheme; IRR: internal rate of return; NPL: non-performing loan.

The decline so far has been achieved mainly via market disposals, often aided by government guarantee schemes. Since end-2014, NPLs worth €584 billion have been sold by banks, mainly to non-bank investors. This represents 96% of the total net NPL reduction in this period. The market for NPL sales and securitisations in euro area grew more than eight-fold from 2014 to its peak in 2018 (see Chart C.1, panel a).[2] In Italy and Greece, government guarantees were offered on senior tranches of NPL securitisations, and these schemes account for the largest part of NPL reductions in those countries.[3] For the guaranteed senior notes in NPL securitisations, usually retained by the selling bank, the sovereign risk weight can be used to determine the capital requirement, which substantially reduces the cost and amount of funding needed by NPL investors. While no system-wide asset management companies (AMCs) have been created since 2014, government-owned AMCs have also played a supportive role in dealing with distressed banks in Italy and Cyprus.[4]

In parallel, NPL prices have improved, and supporting market infrastructure has developed. The underlying asset pools in the NPL market have expanded to include secured loans. The wider use of NPL securitisations has fostered the development of market standards, such as the use of the GACS data template for information sharing in Italy.[5] At the same time, market transparency for prospective NPL buyers remains limited, sustaining the “market for lemons” problem in the NPL market and limiting investor participation.[6] Loan servicing infrastructure has expanded to accommodate the growing NPL markets. Further harmonisation will be facilitated by the proposed EU Directive on credit servicers and credit purchasers, on which political agreement was reached in June, and by the actions envisaged by the EU’s 2020 NPL Action Plan.[7] Based on a sample of transactions, it appears that NPL prices – which move inversely with the internal rate of return demanded by investors – improved after 2017, despite a slight setback observed during the coronavirus (COVID-19) pandemic. Higher prices were achieved for NPL portfolios with a higher proportion of secured assets (see Chart C.1, panel b). Nonetheless, the remuneration required by NPL investors remains high and indicates that banks selling NPLs usually incur sizeable losses. While single-seller transactions remain the standard practice, transactions involving multiple selling banks which pool their NPLs have appeared, and smaller banks have entered the NPL market as well.[8]

This special feature is structured as follows. It first discusses the creditor coordination problem for corporate NPLs as a source of market failure and financial stability risks, as banks may incur substantial losses on NPL sales. The subsequent section explores remedies to the market failure, and the last section concludes.

2 The creditor coordination problem as a source of market failure

Sources of market failure may remain despite significant improvements in NPL markets. Market failures that have an adverse impact on NPL prices can be attributed to information asymmetry, oligopsonistic market structure and/or imperfect excludability.[9] While the first two sources have to some extent been addressed, limited progress has been made with respect to the third issue, which, in this context, means that the existence of multiple creditors leads to uncertainty about rights to the assets and cash flows of the debtor for any specific creditor. This can have a negative impact on asset values because an investor may discount the value of a loan asset to reflect the reality that the underlying debtor may have multiple creditors, and resolution in cooperation with other creditors may be difficult and costly.[10]

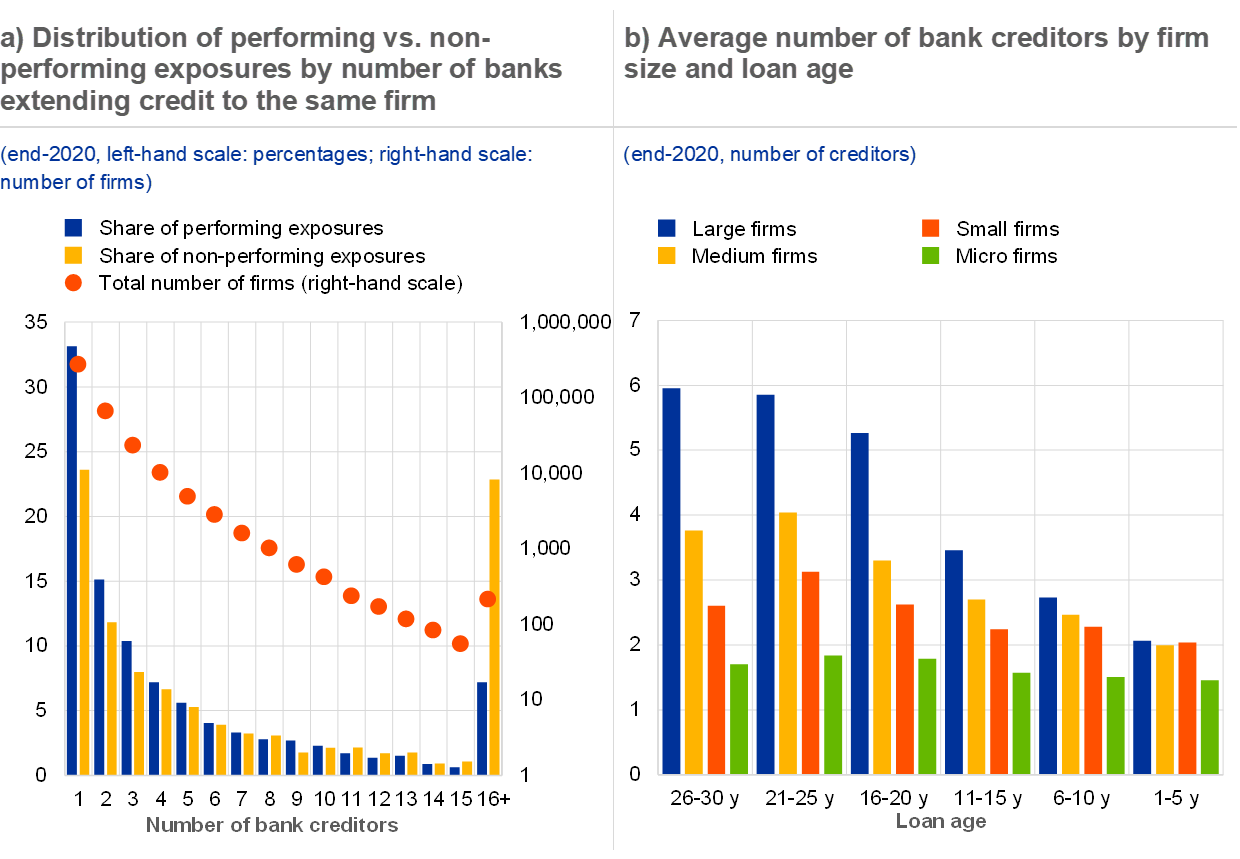

Chart C.2

Multi-creditor lending relationships are common and tend to be resolved less efficiently than single-creditor loans

Sources: ECB AnaCredit and ECB calculations.

Notes: Sample of all credit instruments outstanding as at end-2020. Data only cover loan relationships with euro area banks and may underestimate the total number of bank creditors.

Loan relationships with multiple banks are common in corporate lending in the euro area. Loan-level data show that most corporate credit exposures in the euro area are extended to firms which have more than one bank creditor. Granular data show that the number of creditor relationships that large firms have (2.7 on average) is larger than for other firms, but small and medium-sized enterprises (SMEs) also borrow from multiple banks (with 2.1 and 2.5 lenders respectively, on average). Multi-bank credit relationships are disproportionately represented among non-performing loans (see Chart C.2, panel a). At the same time, seasoned loan vintages tend to have, on average, more creditors compared with younger loan vintages (see Chart C.2, panel b). All in all, these findings imply that multi-creditor relationships take longer to resolve and that coordination challenges can be faced when resolving both large and small NPLs.[11]

Chart C.3

Multi-bank credit relationships are associated with lower provision coverage

Sources: ECB AnaCredit and ECB calculations.

Notes: Sample of non-performing credit instruments reported in AnaCredit. Data only cover loan relationships with euro area banks.

Further analysis reveals that provision coverage of NPLs tends to be lower for borrowers with multiple creditors. It could be expected that banks would recognise the higher cost of creditor coordination and lower recoveries in their provision estimates. However, Chart C.3 shows a clear negative correlation between provision coverage and the number of bank creditors.[12] This may be driven by several factors, including that the costs of creditor coordination are not fully internalised by banks or that creditors do not fully identify and capture evolving credit risk information in timely assessments.

3 Market-led solutions to creditor coordination problems

Combining theory, evidence and practice may offer some insight into possible policy solutions for more effective NPL resolution. Poor coordination among creditors may result in market failure when transparency is limited; previously presented data highlight the potential extent of this problem. Consolidation of the entire debt of a distressed firm by one investor, as done by some system-wide AMCs, would address this challenge.[13] A pre-trade NPL data hub could deliver substantial benefits in NPL resolution. Experience with securitisation schemes, such as GACS and the Hercules Asset Protection Scheme (HAPS) in Greece, highlights the potential for private sector-led schemes to resolve NPLs without the need for public sector sponsorship and the State aid implications of a system-wide AMC. A layered approach could be followed, depending on the degree of ambition of the scheme.

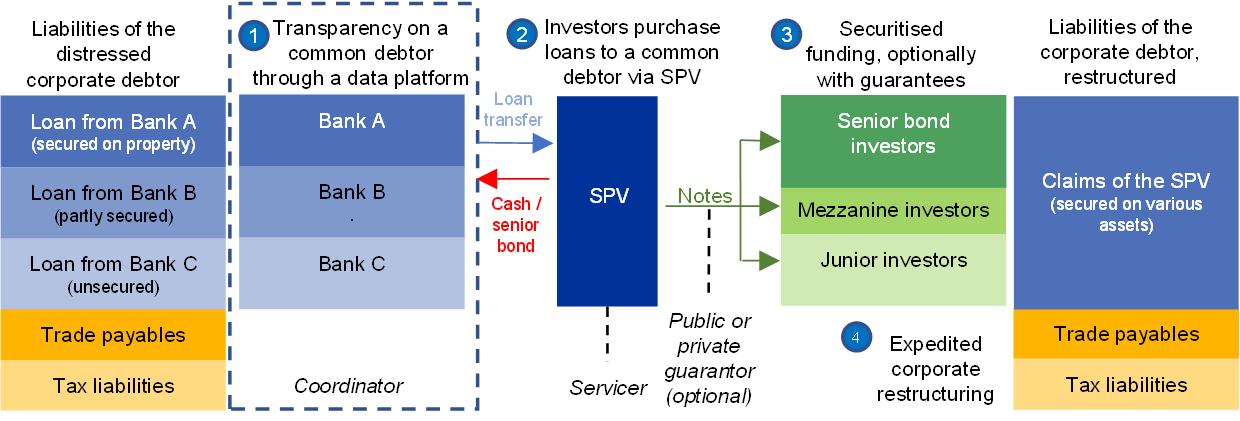

Transparency on common debtor relationships among banks could be delivered by data and coordination platforms.[14] Figure C.1 provides an overview of such an approach. In a first step, a dedicated coordinating platform would collate data on common debtors from participating banks,[15] using common data definitions already employed for existing data collections. Participation would increase prospects for favourable NPL resolution and higher NPL sales prices.[16]

Figure C.1

Schematic outline of a securitisation-based approach to working out multi-creditor corporate NPLs

Source: ECB staff illustration.

Note: SPV: special-purpose vehicle.

Once multi-creditor relationships are identified, investors may purchase a distressed firm’s claims from multiple banks to obtain a qualified majority of the debt. As illustrated in the second step in Figure C.1, investors could buy claims of the entire banking sector on the same debtor. This would reduce the costs of creditor coordination, to the benefit of the debtor, who, instead of dealing with several small and competing creditors, could face a single, specialised investor with a more in-depth and tailored involvement, greater financial firepower and turnaround expertise. It would also help reduce recourse to judicial procedures, accelerate and increase recoveries, improve pricing of NPLs and reduce losses to the banking sector.[17] Real economy benefits may also accrue from the transaction as a result of rapid resolution and investor participation, underpinning growth and employment and staving off instances of corporate zombification.

To leverage the potential of the scheme, it could be combined with securitisation (see Figure C.1, step 3). A securitisation scheme would facilitate the funding of the NPL transfers and provide a strong incentive for banks to participate, as the benefits of securitised funding may be substantial. Selected tranches could additionally carry a private or public guarantee, priced in line with State aid rules. However, this should be used with caution to avoid increasing moral hazard and recreating the sovereign-bank nexus. Capital relief provided by state guarantees serves as a strong incentive for banks. Guarantees would further increase the price offered by investors by reducing capital requirements on the retained senior tranche and the cost of debt funding. The state could require adequate servicing performance and set up dedicated monitoring committees to mitigate the fiscal risks.[18] National authorities may also wish to further facilitate the scheme by encouraging public sector creditors to participate in such market transactions alongside private investors. At the same time, the SPVs should remain governed by the private sector, with no political interference in the operations of the independent servicers.

More efficient creditor coordination would improve the pricing of multi-creditor corporate loan portfolios, leading to better outcomes for banks and non-financial firms. The EBA insolvency benchmarking exercise[19] showed that, on average, euro area banks recover about 40% of the gross book value of a non-performing SME loan portfolio over an average period of 4.1 years. On a net present value basis, this is worth about 36% of the gross book value. These data can be used to illustrate the impact of more efficient resolution on prices of NPL portfolios. An NPL investor, assumed to expect a 10% rate of return on its high-risk investment and discount the costs charged by an external servicer, would pay 13.2 percentage points less for the portfolio than the bank book value. If improved creditor coordination were to shorten the workout to 2.5 years, this gap would narrow by nearly 6 percentage points (see Chart C.4).[20] If the selling banks co-finance the transaction by retaining senior tranches of the securitisation, even without any public sector involvement, the gap could shrink by a further 5 percentage points, to about 2.3 percentage points, one-sixth of its original size.

Independent servicers are an essential element of the described approach and would need to be appropriately incentivised to rehabilitate viable companies. Loan servicing would be assigned to an independent specialist firm, in line with the common practice for NPL sales and securitisations (see Figure C.1, step 3). Their efforts should focus on offering sustainable long-term loan modifications, taking advantage of reduced coordination needs with other creditors and avoiding judicial procedures. Even in cases where an amicable resolution cannot be achieved, the servicers could engage in a single judicial process for all debts of an individual debtor. Public support measures could facilitate the corporate restructuring efforts.[21]

Chart C.4

Improved creditor coordination may generate a sizeable increase in prices of multi-creditor NPL portfolios

Sources: ECB, Refinitiv, EBA and ECB calculations.

Notes: Recovery rates and judicial costs collected from the 2020 EBA insolvency benchmarking report. Investor discount rate assumed to stand at 10% and bank discount rate assumed to be equal to the 12-month average of lending rates on the outstanding stock of loans to non-financial corporations. Servicers are assumed to charge 12% of recoveries achieved. Improved creditor coordination is assumed to reduce the recovery period from 4.1 years to 2.5 years. Benefits of the securitisation estimated under the assumption that the senior tranche funds 80% of the purchase price and carries a stand-alone BBB rating, paying a yield consistent with observed BBB-rated unsecured senior bank bonds, with a capital requirement determined by a 100% risk weight. The guarantee is assumed to reduce the risk weight to zero and the cost of funding to that implied by the sovereign five-year yield, plus the guarantee fee determined using a basket of European corporate credit default swaps, plus an additional liquidity premium of 25 basis points.

Such schemes may be best suited for medium-sized and large companies, and could be open to non-bank creditors. As creditor coordination issues are particularly relevant for corporate NPLs, a threshold for exposure size and a specific sectoral focus may help maximise benefits.[22] Non-bank financial creditors as well as commercial creditors may wish to accelerate recoveries, and the platform would provide them with a channel through which they can sell their claims. The public sector, which may hold claims arising from COVID-19-related guarantee schemes or from unpaid taxes or social security contributions, could also join the scheme.

4 Conclusions

This special feature proposes an approach to addressing creditor coordination problems which can inhibit the market-based resolution of NPLs. These problems are relevant in the euro area as many firms borrow from multiple banks. By providing pre-trade transparency about multi-creditor lending relationships, which would ease the time and reduce the cost of resolution, the investor discount on large and medium-sized corporate loan portfolios may be substantially reduced. Building on the experience of the Greek and Italian schemes, markets may be deepened further with guarantee schemes in place for NPL securitisation, even though such solutions involving state participation (via state guarantees or publicly owned AMCs) should be considered with caution. Beyond the benefits of improved NPL workout for the financial sector, debtors too may ultimately be better off under such a scheme. The recovery of the real economy may also be supported and the destruction of value, often associated with drawn-out and ineffective resolution, minimised.

- The authors are grateful to Nathaniel Butler Blondel, Antonella Pellicani and Wouter Wakker for excellent research assistance.

- Most of the transactions took place in Spain, mainly via sales, and in Italy, predominantly through NPL securitisations, which were accelerated by the introduction in 2016 of the Garanzia Cartolarizzazione Sofferenze (GACS) scheme, an Italian government guarantee for senior notes of NPL securitisations.

- The Hercules Asset Protection Scheme (HAPS) is the Greek equivalent of the Italian GACS scheme.

- AMCO in Italy and KEDIPES in Cyprus.

- The European Banking Authority (EBA) initiative to develop data templates for use by banks and investors aimed to improve data quality. The templates are being streamlined as part of the 2020 NPL Action Plan. Separately, two securitisation data repositories were approved by ESMA in June 2021 (see “ESMA registers European DataWarehouse GmbH and SecRep B.V. as Securitisation Repositories”, press release, European Securities and Markets Authority, 25 June 2021). While reporting could be an important step towards improving post-transaction market transparency, it should be proportional and avoid creating barriers to entry into the NPL market.

- See Special Feature B entitled “Addressing market failures in the resolution of non-performing loans in the euro area”, Financial Stability Review, ECB, November 2016.

- See “Action plan: Tackling non-performing loans in the aftermath of the COVID-19 pandemic”, European Commission, December 2020.

- 16 out of the 34 GACS transactions from 2016 to 2020 included multiple banks, with a total gross book value of €42.4 billion. Transaction types involved owner/subsidiary transactions (i.e. a parent bank sells NPLs jointly with one or more bank or non-bank subsidiaries), cooperative group transactions and private group transactions (i.e. a collection of cooperative and private banks which are not formally associated with carrying out joint transactions).

- See Special Feature A entitled “Overcoming non-performing loan market failures with transaction platforms”, Financial Stability Review, ECB, November 2017.

- Addressing difficulties in creditor coordination for corporate NPLs is a key motivation for out-of-court debt workout mechanisms (see, for example, “Statement of Principles for a Global Approach to Multi-Creditor Workouts II”, INSOL International, April 2017) and an often-cited advantage of system-wide AMC solutions (see, for example, Section 3 of the 2020 NPL Action Plan).

- The positive relationship between loan age and the number of creditors can also be observed for loans with an original maturity below one, three and five years. This would argue against an explanation that this observation is only due to a statistical effect which could arise if long-term loans, which are larger in size and often used by firms to finance capital expenditure, are more often split among multiple creditors.

- This is confirmed by regression analysis, controlling for collateral coverage, days past due and firm size.

- System-wide AMCs in Ireland and Slovenia followed a debtor-level approach to tackle imperfect excludability and acquired most of the exposure of the banking system towards suitable debtors. This simplified the task of gaining control over the business of the debtor and resolving the respective NPLs.

- An alternative approach is inter-bank cooperation, which provides less additional transparency for outside parties than data platform solutions and can be hindered by misaligned incentives of participating banks. Project Solar in Greece, which involves joint servicing for common SME borrowers by Greek significant institutions, and PNCB, the private Portuguese NPL coordination platform, are examples of inter-bank cooperation to solve creditor coordination problems, albeit on a relatively small scale.

- For example, data would be collated by an external adviser hired by a bank association, bank consortium or public entity

- To encourage the participation of a minimum number of systemic banks per jurisdiction, which would be essential for the success of the scheme, it might be advisable to avoid an upfront sale commitment of participating institutions for the assets on which data are provided to the platform. At the same time, to mitigate the risk of individual bank data being misused, safeguards would be necessary to avoid that the identity of the seller banks is disclosed at an early stage of the transaction.

- The data platform may be extended to form a transaction platform, which could be used by credit institutions that are unable to originate NPL transactions on their own (e.g. less significant institutions, due to the limited size of the portfolio), or transactions could be executed via the platform. See “Overcoming non-performing loan market failures with transaction platforms” (op. cit.) for a discussion on NPL transaction platforms.

- Ultimately, the decision to intervene, and the choice and magnitude of the intervention, would lie with the respective Member State or a European institution in the case of a European guarantee. Generally, a Member State’s intervention on market terms, where risk is remunerated accordingly, does not constitute State aid. However, it is the European Commission, as the body responsible for EU State aid control, that must assess in each case that any measure implemented is in line with EU rules.

- “EBA publishes Report on benchmarking of national insolvency frameworks across the EU”, press release, European Banking Authority,18 November 2020.

- While data on the duration of the individual stages of the recovery process are not available, the World Bank Doing Business 2020 data show that more than half of the time needed for enforcement of a contract in large euro area countries is spent in the trial phase. This suggests that a 40% reduction in recovery time could be achieved if a court procedure is avoided.

- For example, support measures could include a partial debt write-off by the public sector in the event of private debt restructuring (see Blanchard, O., Philippon, T. and Pisani-Ferry, J., “A new policy toolkit is needed as countries exit COVID-19 lockdowns”, Policy Contribution, Issue No 12, Bruegel, June 2020) or governments conditioning equity injections on investments by private banks and investors, which signal confidence in a firm’s viability (see Díez, F.J., Duval, R., Fan, J., Garrido, J., Kalemli-Özcan, S., Maggi, C., Martinez-Peria, S. and Pierri, N., “Insolvency Prospects Among Small and Medium Enterprises in Advanced Economies: Assessment and Policy Options”, IMF Staff Discussion Note, SDN/2021/002, International Monetary Fund, April 2021).

- Excluding small business loans secured on primary residences from the asset perimeter would be particularly advisable, given the political and social sensitivities involved in such foreclosures. See, for example, “AMC Blueprint”, European Commission, March 2018.