Economic and monetary developments

Overview

At its monetary policy meeting on 12 March, the Governing Council decided on a comprehensive package of monetary policy measures. Together with the substantial monetary policy stimulus already in place, these measures will support liquidity and funding conditions for households, businesses and banks and will help to preserve the smooth provision of credit to the real economy. Since the last Governing Council meeting in late January, the spread of the coronavirus (COVID-19) has been a major shock to the growth prospects of the global and euro area economies and has heightened market volatility. Even if ultimately temporary in nature, it will have a significant impact on economic activity. In particular, it will slow down production as a result of disrupted supply chains and reduce domestic and foreign demand, especially through the adverse impact of the necessary containment measures. In addition, the heightened uncertainty negatively affects expenditure plans and their financing. The risks surrounding the euro area growth outlook are clearly on the downside. In addition to the previously identified risks related to geopolitical factors, rising protectionism and vulnerabilities in emerging markets, the spread of the coronavirus adds a new and substantial source of downside risk to the growth outlook. Against this background, the ECB’s Governing Council took a number of policy decisions to preserve the monetary stance and to underpin the transmission of monetary policy to the real economy.

Economic and monetary assessment at the time of the Governing Council meeting of 12 March 2020

The unfolding COVID-19 epidemic is worsening the outlook for the global economy as embedded in the March 2020 ECB staff macroeconomic projections. Developments since the cut-off date for the projections suggest that the downside risk to global activity related to the COVID-19 outbreak has partly materialised, implying that global activity this year will be weaker than envisaged in the projections. The outbreak hit the global economy as signs of a stabilisation in activity and trade had started to emerge and the signing of the so-called Phase 1 trade agreement between the United States and China, accompanied by cuts in tariffs, had reduced uncertainty. Looking further ahead, the projected global recovery is expected to gain only modest traction. It will hinge on the recovery in a number of still vulnerable emerging market economies, while the projected cyclical slowdown in advanced economies and the structural transition to a slower growth trajectory in China will weigh on the medium-term outlook. The risks to global activity have changed, but their balance remains tilted to the downside. At the moment, the most acute downside risk relates to the potentially broader and longer impact of the COVID-19 outbreak as it continues to evolve. Global inflationary pressures remain contained.

Global risk sentiment deteriorated sharply and market volatility surged as the coronavirus spread around the world towards the end of the review period (12 December 2019 to 11 March 2020). Euro area long-term risk-free rates declined markedly to levels significantly lower than at the start of the period. The forward curve of the euro overnight index average (EONIA) shifted sharply downwards; its inversion at shorter to medium-term maturities signalled market pricing of further monetary policy accommodation. In line with the sharp rise in global risk aversion, euro area equity prices decreased strongly, while sovereign and corporate bond spreads widened. In volatile foreign exchange markets, the euro appreciated substantially against the currencies of 38 of the euro area’s most important trading partners.

Euro area real GDP growth remained subdued at 0.1%, quarter on quarter, in the fourth quarter of 2019, following growth of 0.3% in the previous quarter, driven by ongoing weakness in the manufacturing sector and slowing investment growth. Incoming economic data and survey information point to euro area growth dynamics at low levels, not yet fully reflecting developments related to the coronavirus, which started to spread across continental Europe at the end of February, adversely affecting economic activity. Looking beyond the disruptions stemming from the spreading of the coronavirus, euro area growth is expected to regain traction over the medium term, supported by favourable financing conditions, the euro area fiscal stance and the expected resumption in global activity.

According to the March 2020 ECB staff macroeconomic projections for the euro area, annual real GDP is expected to increase by 0.8% in 2020, 1.3% in 2021 and 1.4% in 2022. Compared with the December 2019 Eurosystem staff macroeconomic projections, the outlook for real GDP growth has been revised down by 0.3 percentage points for 2020 and by 0.1 percentage points for 2021, mainly on account of the coronavirus outbreak, although the recent rapid spread of the virus in the euro area is only partly reflected. The risks surrounding the euro area growth outlook are therefore clearly on the downside. The spread of the coronavirus adds a new and substantial source of downside risk to the growth outlook, in addition to risks related to geopolitical factors, rising protectionism and vulnerabilities in emerging markets.

According to Eurostat’s flash estimate, euro area annual HICP inflation decreased to 1.2% in February 2020, from 1.4% in January. On the basis of the sharp decline in current and futures prices for oil, headline inflation is likely to decline considerably over the coming months. This assessment is only partly reflected in the March 2020 ECB staff macroeconomic projections for the euro area, which foresee annual HICP inflation at 1.1% in 2020, 1.4% in 2021 and 1.6% in 2022, and are broadly unrevised compared to the December 2019 Eurosystem staff projections. Over the medium term, inflation will be supported by the ECB’s monetary policy measures. The implications of the coronavirus for inflation are surrounded by high uncertainty, given that downward pressures linked to weaker demand may be offset by upward pressures related to supply disruptions. The recent sharp decline in oil prices poses significant downside risks to the short-term inflation outlook.

Monetary dynamics have moderated from comfortable levels since late summer 2019. Credit to the private sector has continued to display divergent developments across loan categories. While lending to households has remained resilient, lending to firms has moderated. Favourable bank funding and lending conditions have continued to support lending and thereby economic growth. Euro area firms’ total net external financing has stabilised, supported by favourable debt financing costs. However, the recent increase in risk-off sentiment is likely to cause non-bank financing conditions for non-financial corporations to deteriorate.

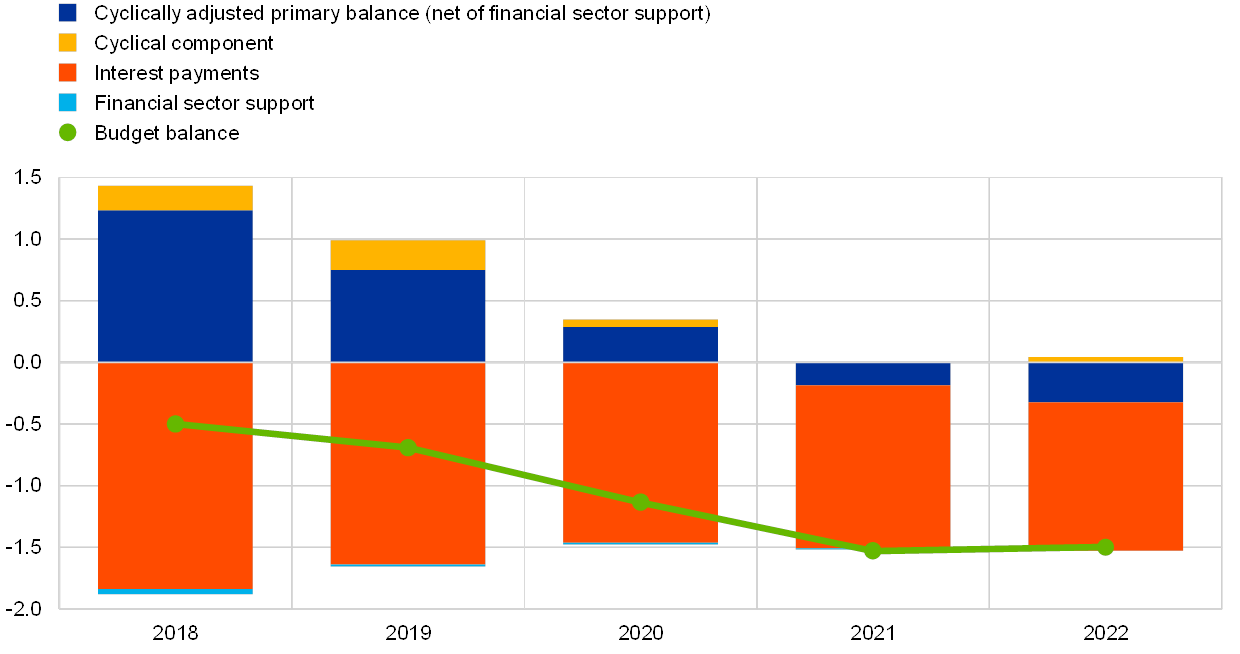

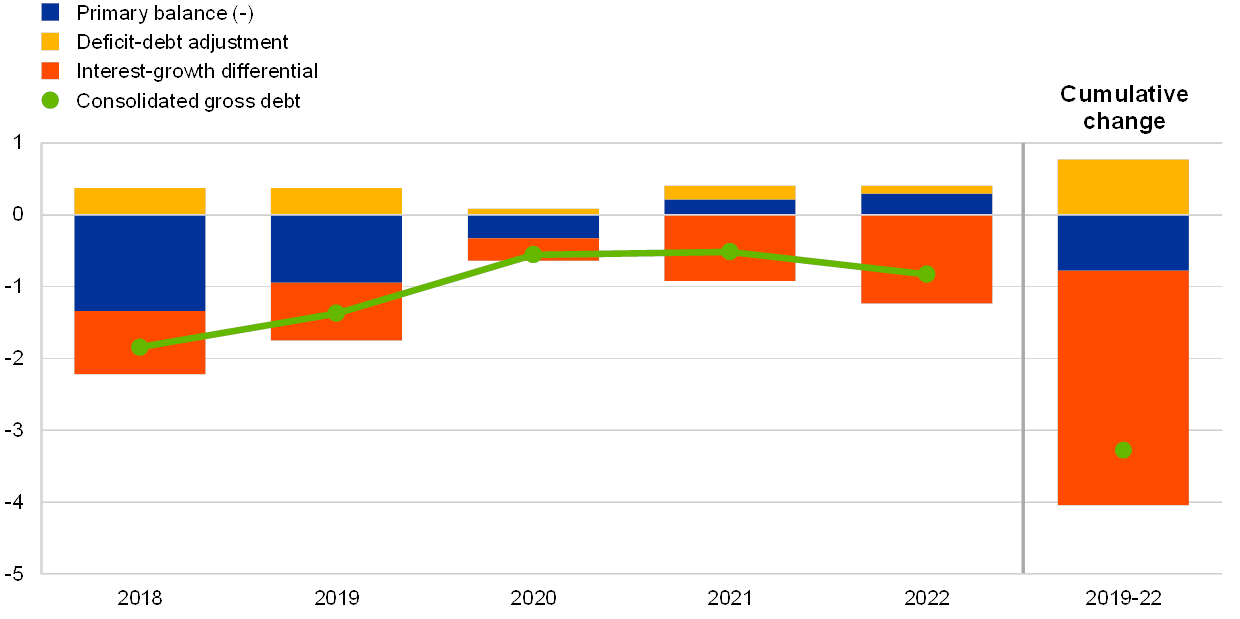

The euro area general government budget balance is projected to decline in 2020 and 2021 and to stabilise in 2022. The decline can be largely attributed to lower primary surpluses. These developments are also reflected in the projections in an expansionary fiscal stance in both 2020 and 2021, followed by a broadly neutral stance in 2022. Despite the relatively expansionary fiscal stance, in the projections the euro area government debt-to-GDP ratio is expected to remain on a gradual downward path, owing to a favourable interest rate-growth differential and a somewhat positive primary balance for the entire period. Developments related to the spread of the coronavirus (COVID-19) after the projections were finalised point to a clear worsening of the outlook for the fiscal stance. In addition to previously announced fiscal policies, the Eurogroup’s commitment to joint and coordinated policy action should be strongly supported in the light of the spread of the virus.

The monetary policy package

On 12 March 2020 the Governing Council decided on a comprehensive package of monetary policy measures. The monetary policy response encompassed three key elements: first, safeguarding liquidity conditions in the banking system through a series of favourably-priced longer-term refinancing operations (LTROs); second, protecting the continued flow of credit to the real economy through a fundamental recalibration of targeted longer-term refinancing operations (TLTROs); and, third, preventing financing conditions for the economy tightening in a pro-cyclical way via an increase in the asset purchase programme (APP).[1]

- In times of heightened uncertainty, it is essential that liquidity is provided on generous terms to the financial system to prevent liquidity squeezes and pressure on the price of liquidity, including in times when the coronavirus may pose operational risk challenges for participants in the financial system. The Governing Council therefore decided to conduct, temporarily, additional LTROs to provide immediate liquidity support to the euro area financial system. Although the Governing Council does not see material signs of strains in money markets or liquidity shortages in the banking system, these operations will provide an effective backstop in case of need. The operations will be carried out through a fixed rate tender procedure with full allotment. They will be priced very attractively, with an interest rate that is equal to the average rate on the deposit facility. These new LTROs will provide liquidity on favourable terms to bridge the period until the TLTRO III operation in June 2020.

- With revenues and expenditure plans of households and firms being hit by the spread of the coronavirus, it is crucial to support bank lending to those that are affected most by the economic ramifications, in particular small and medium-sized enterprises. Hence, the Governing Council decided to apply considerably more favourable terms during the period from June 2020 to June 2021 to all TLTRO III operations outstanding during that time. Throughout this period, the interest rate on these TLTRO III operations will be 25 basis points below the average rate applied in the Eurosystem’s main refinancing operations. For counterparties that maintain their levels of credit provision, the rate applied in these operations will be lower, and, over the period ending in June 2021, can be as low as 25 basis points below the average interest rate on the deposit facility. Moreover, the maximum total amount that counterparties will henceforth be entitled to borrow in TLTRO III operations has been raised to 50% of their stock of eligible loans as at 28 February 2019. This raises the total possible borrowing volume under this programme by more than €1 trillion to almost €3 trillion in total. Overall, the new conditions for the TLTRO will help to significantly ease the funding conditions that determine the supply of credit provided by banks to firms and households. In this context, the Governing Council has mandated the Eurosystem committees to investigate collateral easing measures to ensure that counterparties continue to be able to make full use of the ECB’s funding support.

- It is essential to ensure a sufficiently accommodative monetary policy stance, especially in an environment of high uncertainty and elevated financial volatility. It is against this background that the Governing Council also decided to add a temporary envelope of additional net asset purchases of €120 billion until the end of the year, ensuring a strong contribution from the private sector purchase programmes. Net asset purchases continue to be expected to run for as long as necessary to reinforce the accommodative impact of the ECB’s policy rates, and to end shortly before the Governing Council starts raising the key ECB interest rates. In combination with the existing APP, this temporary envelope will support financial conditions more broadly and thereby also ease the interest rates that matter for the real economy. Moreover, the higher pace of purchases will ensure that the Eurosystem shows a more robust presence in the market during these times of heightened volatility, including the full use of the flexibility embedded in the APP to respond to market conditions. This could imply temporary fluctuations in the distribution of purchase flows both across asset classes and across countries in response to “flight to safety” shocks and liquidity shocks. Such deviations from the steady-state cross-country allocation are within the remit of the programme, provided the capital key continues to anchor the total stock of the Eurosystem’s holdings in the long run.

- In addition, the Governing Council decided to keep the key ECB interest rates unchanged. They are expected to remain at their present or lower levels until the inflation outlook robustly converges to a level sufficiently close to, but below, 2% within the projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.

- Finally, the Governing Council also intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

In view of current developments, the Governing Council will continue to monitor closely the implications of the spread of the coronavirus for the economy, for medium-term inflation and for the transmission of monetary policy. The Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.

At the same time, an ambitious and coordinated fiscal stance is now needed in view of the weakened outlook and to safeguard against the further materialisation of downside risks. The Governing Council welcomes the measures already taken by several governments to ensure sufficient health sector resources and to provide support to affected companies and employees. In particular, measures such as providing credit guarantees are needed to complement and reinforce the monetary policy measures taken by the Governing Council.

Addendum on the decisions taken by the Governing Council on 18 March

The coronavirus pandemic represents a collective public health emergency that has few precedents in recent history. It is also an extreme economic shock that requires an ambitious, coordinated and urgent policy reaction on all fronts. On 18 March, the Governing Council announced a new pandemic emergency purchase programme (PEPP) to address the unprecedented situation the euro area is facing. The programme is temporary and will allow the ECB to safeguard the transmission of monetary policy and ultimately its capacity to deliver price stability in the euro area. In particular, developments in financial markets had led to a tightening in financing conditions, in particular at the longer end of the maturity spectrum. The risk-free curve had moved up and the sovereign yield curves – which are key to the pricing of all assets – had increased everywhere and become more dispersed. In the fulfilment of its mandate, the Governing Council took the following decisions:

- To launch a new temporary asset purchase programme of private and public sector securities to counter the serious risks to the monetary policy transmission mechanism and the outlook for the euro area posed by the outbreak and escalating diffusion of COVID-19.

This new pandemic emergency purchase programme (PEPP) will have an overall envelope of €750 billion. Purchases will be conducted until the end of 2020 and will include all the asset categories eligible under the existing asset purchase programme (APP).

For the purchases of public sector securities, the benchmark allocation across jurisdictions will continue to be the capital key of the national central banks. At the same time, purchases under the new PEPP will be conducted in a flexible manner. This allows for fluctuations in the distribution of purchase flows over time, across asset classes and among jurisdictions.

A waiver of the eligibility requirements for securities issued by the Greek government will be granted for purchases under PEPP.

The Governing Council will terminate net asset purchases under PEPP once it judges that the coronavirus crisis phase is over, but in any case not before the end of the year. - To expand the range of eligible assets under the corporate sector purchase programme (CSPP) to non-financial commercial paper, making all commercial papers of sufficient credit quality eligible for purchase under the CSPP.

- To ease the collateral standards by adjusting the main risk parameters of the collateral framework. In particular, we will expand the scope of Additional Credit Claims (ACC) to include claims related to the financing of the corporate sector. This will ensure that counterparties can continue to make full use of the Eurosystem’s refinancing operations.

The Governing Council of the ECB is committed to playing its role in supporting all citizens of the euro area through this extremely challenging time. To that end, the ECB will ensure that all sectors of the economy can benefit from supportive financing conditions that enable them to absorb this shock. This applies equally to families, firms, banks and governments.

The Governing Council will do everything necessary within its mandate. The Governing Council is fully prepared to increase the size of its asset purchase programmes and adjust their composition, by as much as necessary and for as long as needed. It will explore all options and all contingencies to support the economy through this shock.

To the extent that some self-imposed limits might hamper action that the ECB is required to take in order to fulfil its mandate, the Governing Council will consider revising them to the extent necessary to make its action proportionate to the risks that we face. The ECB will not tolerate any risks to the smooth transmission of its monetary policy in all jurisdictions of the euro area.

1 External environment

The unfolding coronavirus (COVID-19) epidemic has worsened the outlook for the global economy as embedded in the March 2020 ECB staff macroeconomic projections. Developments since the cut-off date for the projections suggest that the downside risk to global activity related to the COVID-19 outbreak has partly materialised, implying that global activity this year will be weaker than envisaged in the aforementioned staff macroeconomic projections. The outbreak hit the global economy as signs of a stabilisation in activity and trade had started to emerge and the signature of the so-called Phase 1 trade agreement between the United States and China, accompanied by cuts in tariffs, had reduced uncertainty. Looking beyond this year, global economic activity is expected to recover yet gain only modest traction. It will hinge on the recovery in a number of still vulnerable EMEs, while the projected cyclical slowdown in advanced economies and the structural transition to a slower growth trajectory in China will weigh on the medium-term outlook. The risks to global activity have changed, but their balance remains tilted to the downside. At the moment, the most acute downside risk relates to the potentially broader and longer impact of the COVID-19 outbreak as it continues to evolve. Global inflationary pressures remain contained.

Global economic activity and trade

The spreading of COVID-19 has clouded the global outlook. As the situation is still unfolding by the day, it is very difficult to estimate how long disruptions to production and trade will last and how consumers across the globe will respond to the related uncertainty. Moreover, the outbreak comes after a period of weak global activity. Global real GDP growth (excluding the euro area) declined to 2.9% last year, marking its slowest pace since the Great Recession. This slowdown was broader and more pronounced compared to the most recent episodes in 2012-13 and 2015-16. The key factor behind it was the recurrent escalation of trade tensions, which – through increased uncertainty – prompted firms to postpone investment and consumers to delay purchases of durable goods. This in turn resulted in a sharp decline in global manufacturing activity and trade. In addition, several EMEs were hit by idiosyncratic shocks, which further accentuated the deceleration in global activity last year. At the same time, a number of key advanced and emerging market economies deployed demand stimulating policies, thereby limiting both the pace and depth of the slowdown in growth in 2019.

The outbreak hit the global economy as signs of a stabilisation in activity and trade had started to emerge. The global composite output Purchasing Managers’ Index (PMI) (excluding the euro area) increased in January, supported by better readings for both the manufacturing and services sectors. Stronger output in the manufacturing sector signalled that a nascent recovery – following a protracted period of weakness – could be underway. These signals were mostly visible for EMEs, while developments in advanced economies have been more mixed. This trend was recently interrupted by the COVID-19 outbreak, which Chinese authorities sought to contain by extending the Lunar New Year holidays and imposing strict quarantine measures in Hubei province, the epicentre of the outbreak. As a result of these measures, manufacturing activity in China plunged in February and some negative spillovers were felt across the Asia-Pacific region, which is intrinsically linked to China through supply chains and is also one of the most popular destinations for Chinese tourists. Yet wider global spillovers in February were likely limited, as suggested by the relative stability of the global manufacturing PMI excluding China (see Chart 1). However, as production in China is only gradually returning to normal and many countries have imposed measures to contain the spreading of the virus, a more persistent and broader impact on global manufacturing activity in the near term can be expected.

Chart 1

Global manufacturing PMI

(diffusion indices)

Sources: Markit and Haver Analytics.

Notes: The latest observations are for February 2020.

Following a period of easing, global financial conditions have markedly tightened more recently. The previous easing period followed the announcement of the aforementioned Phase 1 trade agreement, which in turn spurred a rally in risky assets. This rally was interrupted abruptly around mid-February when global equity markets plunged as the outbreak continued to weigh on China and spread to other countries. Since the cut-off date for the March 2020 ECB staff macroeconomic projections, global financial conditions markedly tightened both in advanced economies and EMEs as the impact of the sharp correction in equity markets and the increase in corporate bond spreads was only partly outweighed by declining risk-free rates. In EMEs the tightening was less pronounced compared to recent episodes of financial stress, such as in the summer of 2018, as EMEs’ exchange rates remained broadly stable against the US dollar. The latter mainly reflected the actual and expected monetary policy easing measures taken by the Federal Reserve which weighed on the US dollar, offsetting the upward pressure emanating from the safe haven inflows into US Treasuries.

The March 2020 ECB staff macroeconomic projections envisage the global recovery to gain only modest traction over the projection horizon. In the projections, global activity excluding the euro area is projected to reach 3.1% this year, slightly higher than the 2.9% estimated for 2019. Over the medium term, global growth is expected to increase slightly to 3.5% and 3.4% in 2021 and 2022 respectively, below its long-term average of 3.8%. Compared to the December 2019 Eurosystem staff macroeconomic projections, global growth projections for 2020 are broadly unchanged, as upward revisions related to lower trade tariffs are offset by downward revisions in 2020Q1 owing to the virus outbreak in China. In the March projections, the medium-term outlook for the global economy hinged on the recovery in a number of EMEs. Yet the path to recovery in these countries is judged to be fragile amid external headwinds which, together with domestic political instability, could derail their recovery prospects. Developments since the cut-off date indeed suggest that an imminent downside risk related to the COVID-19 impact on the global economy has partly materialised. This in turn implies that global activity this year is very likely to be weaker than envisaged in the March 2020 ECB staff macroeconomic projections.

In the United States, economic activity was expected to remain steady in the near term. Real GDP grew by 2.1% on an annualised basis in the fourth quarter of 2019, keeping pace with the previous quarter. Consumption growth slowed by more than expected and business fixed investment declined for the third consecutive quarter. The halt in the production of the Boeing 737 Max is expected to weigh on manufacturing activity in the first quarter of 2020. Looking further ahead, growth was expected to decrease amidst a maturing business cycle and the fading impact of the 2018 tax reform. Annual headline consumer price inflation declined slightly to 2.3% in February from 2.5% in the previous month. Excluding food and energy, annual inflation ticked up to 2.4% from a 2.3% level recorded over the previous four months. Inflation is expected to increase gradually above the Fed’s 2% target by the end of the forecast horizon. On March 3, following an emergency meeting, the Federal Reserve cut its policy interest rate by 50 basis points to 1-1.25%, citing the risk the outbreak is posing to economic activity. Further measures, including liquidity provisions as well as additional fiscal spending, were enacted in order to tackle the impact of the outbreak on the economy.

In China, activity is expected to weaken considerably in the first quarter and recover thereafter. Over the medium term, real GDP is expected to remain on a gradual slowing trajectory. Annual GDP growth for 2019 decelerated to 6.1% from 6.6% in 2018, driven by less supportive investment and net trade. The impact of the COVID-19 outbreak will dominate in the near term, while lower tariffs in the context of the trade agreement with the United States are expected to support trade. Over the medium term, progress with the implementation of structural reforms is expected to facilitate an orderly slowdown and some rebalancing of the Chinese economy. Since the cut-off date for projections, incoming data in China suggest that the slowdown in the first quarter could be stronger than expected. In addition, a more gradual return of production to normality indicates that the recovery of activity could take somewhat longer than envisaged in the March 2020 ECB staff macroeconomic projections. A number of economic policy measures have been enacted in China since the outbreak started, including, among others, more accommodative monetary policy and additional fiscal spending.

In Japan, economic activity contracted significantly in the fourth quarter, reflecting a confluence of negative shocks, including a fall in domestic demand as a result of the consumption tax hike, production disruptions caused by powerful typhoons in October and weak external demand. The negative spillovers from the coronavirus outbreak in China, which hit the Japanese economy through a significant decline in inbound tourism spending during the Lunar New Year holidays, coupled with early signs of potential supply chain disruptions, are expected to weigh on activity in the first quarter. Furthermore, the Japanese authorities enacted a number of measures to contain the COVID-19 outbreak in the country, which jointly with more cautious behaviour by consumers, is expected to weigh on economic activity. In reaction to this, the Japanese government has responded with two emergency fiscal packages, including measures to support SMEs. The Bank of Japan stated that it is closely monitoring developments and stands ready to provide liquidity and ensure stability in financial markets. Fiscal stimulus measures announced by the Japanese authorities in late 2019 are expected to support growth in 2020-2021.

In the United Kingdom, activity was expected to recover in the first quarter. However, the economic impact of COVID-19 will likely result in a renewed slowdown in the second quarter. Real GDP growth was flat in the fourth quarter of 2019, reflecting a continued slowing in the underlying momentum seen earlier in the year and a broader deceleration seen since the 2016 referendum. Domestic demand had slowed markedly in the second half of 2019 against a backdrop of high Brexit-related uncertainty and a general election campaign in the last quarter of the year. While sentiment had improved markedly following the decisive results of the general election and the subsequent conclusion of an orderly withdrawal from the European Union at the end of January, a strong turnaround in activity in 2020 had not been anticipated, even before the outbreak, given the remaining uncertainties surrounding the future of UK-EU trade negotiations. In response to the COVID-19 outbreak, the Bank of England cut its policy rate by 50 basis points to 0.25% and introduced a targeted lending programme aimed at small and medium-sized enterprises, while the draft budget proposed by the government includes a number of fiscal measures to tackle the economic impact of the outbreak.

In central and eastern European countries, economic activity was expected to moderate from above-potential growth rates. This moderation reflected mainly slower investment growth against the backdrop of a more advanced phase of the EU funds cycle, while consumer spending was expected to be underpinned by solid labour markets.

Economic activity in large commodity exporting countries was expected to strengthen somewhat this year. In Russia, economic activity picked up in the course of 2019 and had been expected to accelerate further on the back of additional social spending decided upon by the new government. However, downside risks loom large as the global spread of the COVID-19 virus, the recent collapse of the OPEC+ agreement, and a sharp decline in oil prices render the outlook unusually uncertain. The medium-term outlook is primarily shaped by uncertainty regarding additional international sanctions as well as the policy priorities of the recently appointed government. GDP had been revised upwards in the near term, largely on the back of higher public spending. In Brazil, economic sentiment started to improve in the fourth quarter. However, growth remains subdued owing to tight fiscal constraints (including budget freezes) and an uncertain external environment, a situation that recently worsened with the increasing spread of the COVID-19 virus. The degree to which additional necessary fiscal reforms are implemented will significantly influence growth prospects in the medium term. At the same time, fiscal imbalances remain a principal source of risk should they fail to be addressed. Therefore adhering to fiscal rules such as the spending cap ceiling makes large fiscal stimulus less likely.

In Turkey, activity levels continue to recover strongly from the recent crisis-related recession. Real GDP growth in annual terms moved into positive territory in the third quarter and strengthened further in the fourth quarter of 2019. Expansionary fiscal policy and rapid credit expansion drove the robust growth in household consumption and the bottoming out of private sector investment. They are both expected to continue fostering growth this year. Notwithstanding this, growth rates remain relatively low in historical terms given the economy’s weakened potential.

Signs of a stabilisation in global trade had become visible in late 2019. Global imports turned out to be stronger owing largely to buoyant import growth in Turkey, China and other EMEs. In contrast, weaker-than-expected import data for advanced economies in 2019Q4 reflected a number of idiosyncratic shocks expected to dissipate over the near term. In Japan, these factors relate to a contraction in domestic demand following the consumption tax hike and the impact of a powerful typhoon. In the United Kingdom and the United States, they reflect the unwinding of previously accumulated inventories. The diverging development in trade between advanced economies and EMEs was also evident from merchandise trade data. Overall, global merchandise imports contracted by 0.7% in the fourth quarter of 2019 (see Chart 2). However, the COVID-19 outbreak is expected to delay the stabilisation of global trade, weighing on the global manufacturing sector in particular, as evidenced by the latest survey data. As the virus continues to spread globally, its impact on trade will be more significant than envisaged in the March 2020 ECB staff macroeconomic projections.

Chart 2

Surveys and global trade in goods (excluding the euro area)

(left-hand scale: three-month-on-three-month percentage changes; right-hand scale: diffusion indices)

Sources: Markit, CPB Netherlands Bureau for Economic Policy Analysis and ECB calculations.

Note: The latest observations are for February 2020 for the PMIs and December 2019 for global merchandise imports. The indices and data refer to the global aggregate excluding the euro area.

The recent signing of the so-called Phase 1 trade deal between the United States and China offers a respite from trade tensions. Under this deal, both countries reduced their bilateral trade tariffs, and China made a commitment to purchase an additional USD 200 billion in goods and services from the United States over the next two years. While this partial de-escalation of their trade conflict supports the recovery in global manufacturing activity and trade, uncertainty about the future course of global trade policies remains high.

The global trade outlook remains weak by historical standards, as the trade elasticity of income is expected to remain below its “new normal” of unity.[2] This reflects a confluence of factors, including, for example, the higher tariff rates enacted to date and elevated policy uncertainty. According to the March 2020 ECB staff macroeconomic projections, global import growth (excluding the euro area) is expected to pick up gradually from 0.3% last year to 1.4% in 2020, before rising to 2.6% and 2.7% in 2021 and 2022 respectively. Euro area foreign demand is projected to increase by 1.6% this year, before accelerating to 2.5% and 2.6% in 2021 and 2022 respectively. While euro area foreign demand has been revised upwards for 2020, compared to the December 2019 Eurosystem staff macroeconomic projections, this revision relates mainly to upside surprises in the second half of 2019 as well as higher bilateral imports between the United States and China resulting from the lower tariffs implemented under the Phase1 agreement. As the latter mostly supports bilateral trade between the two countries, it shall not be treated as a signal of higher foreign demand for goods and services produced in the euro area. Taking these factors into consideration, euro area foreign demand in the March projections is expected to be broadly in line with the December projections for this year and next. Developments since the cut-off date for projections suggest that the unfolding global COVID-19 epidemic is weighing on global trade and accordingly on euro area foreign demand. Taking them into account would imply that global imports and euro area foreign demand will be weaker than envisaged in the March 2020 ECB staff macroeconomic projections.

The risks to the global activity outlook have changed, but their balance remains tilted to the downside. The new and currently most acute downside risk relates to the potentially broader and longer impact of the still unfolding COVID-19 outbreak. Developments in the global economy since the cut-off date for the projections suggest that this downside risk has already partly materialised.[3] Downside risks stemming from trade tensions have abated somewhat following the Phase 1 deal, but uncertainty about the future path of global trade policies remains elevated. The risk of a no-deal Brexit has been pushed back to the end of the year and will depend on the outcome of the EU-UK negotiations over their future relationship. Moreover, a sharper slowdown in China could be increasingly difficult to counteract with policy stimulus and could prove a challenge to the ongoing rebalancing process. Repricing of risk by the financial markets might weigh negatively on global activity, especially on EMEs.

Global price developments

Oil prices have significantly decreased as worries about global demand intensified against the background of the unfolding epidemic. Discord among members of the OPEC+ alliance regarding production cuts further accentuated this decline. Initially, oil prices were hit hardest by news of the outbreak in China in late January. They recovered somewhat for a short period of time, but started to decline as the virus began to spread across the globe. In early March, the OPEC+ alliance between OPEC and some major non-OPEC countries broke down as Russia refused to implement cuts to oil production. Saudi Arabia responded to this by announcing an increase in production and by offering oil at a discount, in order to gain market shares. This resulted in one of the biggest one-day drops in oil prices recorded to date.

In the March 2020 ECB staff macroeconomic projections, oil prices were expected to remain relatively stable over the projection horizon. Declining spot prices had moved the short end of the oil futures curve down further compared to the longer end, resulting in a flattening of the curve over the projection horizon. Compared with the December 2019 Eurosystem staff macroeconomic projections, the oil price assumptions were 5.5%, 3.2% and 2.5% lower for 2020, 2021 and 2022 respectively. Since the cut-off date for the March projections, the price of oil has declined significantly, with Brent crude standing at USD 34.5 per barrel on 11 March.

Global inflation remains subdued, reflecting the growth dynamics. In countries belonging to the Organisation for Economic Co-operation and Development (OECD), annual consumer price inflation recorded an uptick to 2.1% in December 2019 from 1.8% in the previous month (see Chart 3). Annual energy price inflation bounced back in December after being in negative territory for four consecutive months, while food prices remained relatively steady. Meanwhile, annual core CPI inflation (excluding food and energy) was unchanged from the previous month at 2.1%.

Chart 3

OECD consumer price inflation

(year-on-year percentage changes; percentage point contributions)

Sources: OECD and ECB calculations.

Note: The latest observations are for January 2020.

2 Financial developments

Global risk sentiment deteriorated sharply and market volatility surged as the coronavirus (COVID-19) spread around the world towards the end of the review period (12 December 2019 to 11 March 2020). Euro area long-term risk-free rates declined markedly to levels significantly lower than at the start of the period, while spreads between sovereign bonds in the euro area increased tangibly towards the end of the review period. The forward curve of the euro overnight index average (EONIA) shifted sharply downwards; its inversion at shorter to medium-term maturities signals market pricing of further monetary policy accommodation. In line with the sharp rise in global risk aversion, euro area equity prices decreased strongly, while sovereign and corporate bond spreads widened. In volatile foreign exchange markets, the euro appreciated substantially against the currencies of 38 of the euro area’s most important trading partners.

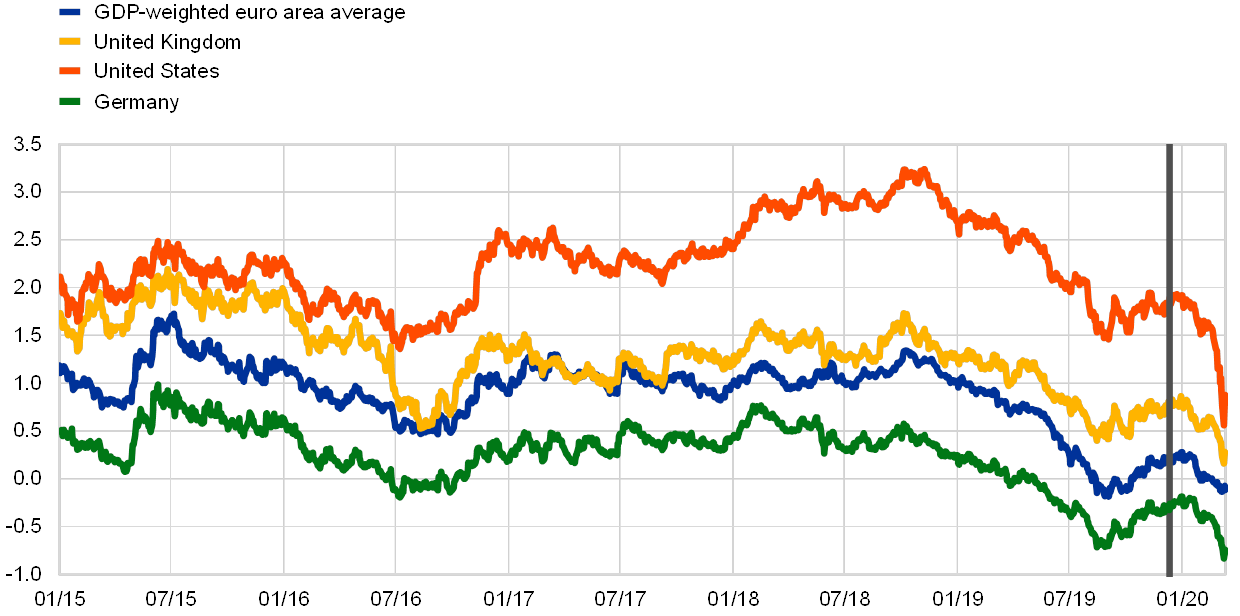

Long-term sovereign yields decreased significantly over the euro area as a whole and across the globe (see Chart 4) amid high volatility. Movements in average euro area sovereign yields can be divided into three distinct phases. Between 12 December 2019 and mid-January 2020, yields increased slightly amid improved global risk sentiment and some perceived bottoming-out of macroeconomic indicators. During the second phase, up until 21 February 2020, coronavirus-related news and disappointing macroeconomic releases led to a downturn in risk sentiment and sovereign yields started to decrease on average. In the most recent phase, sovereign yields suffered a further significant decline as the coronavirus started spreading around the world and concerns about its economic and social repercussions began to rattle global financial markets. Over the review period as a whole, the GDP-weighted euro area ten-year sovereign bond yield decreased by 33 basis points to return to negative territory at -0.12%. The ten-year sovereign bond yields in the United States and the United Kingdom also decreased, to 0.88% and 0.27% (down 102 and 54 basis points) respectively, mainly reflecting global concerns about the coronavirus and the expected monetary policy reaction coupled with flight-to-safety movements into risk-free assets.

Chart 4

Ten-year sovereign bond yields

(percentages per annum)

Sources: Thomson Reuters and ECB calculations.

Notes: Daily data. The vertical grey line denotes the start of the review period on 12 December 2019. The latest observations are for 11 March 2020.

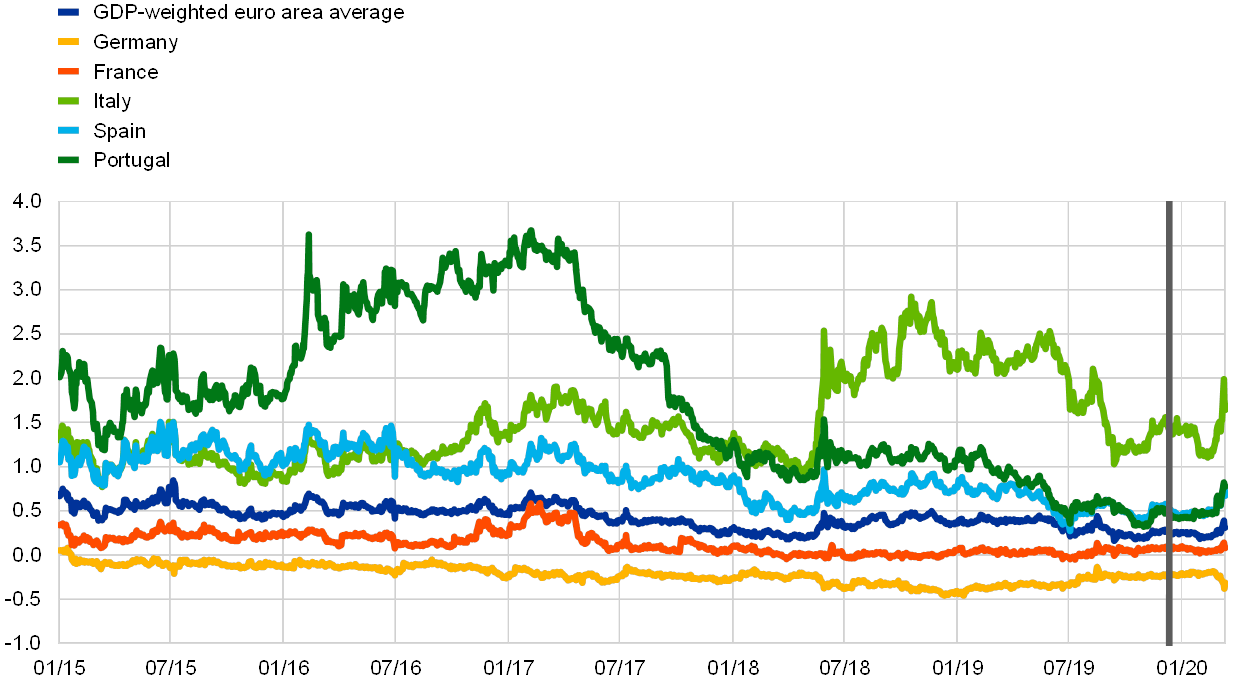

In line with the changing risk sentiment, the spreads of euro area sovereign bonds relative to overnight index swap (OIS) rates increased for a number of countries, with Germany forming a notable exception (see Chart 5). Specifically, the ten-year Greek, Italian, Portuguese and Spanish sovereign spreads increased by 45, 25, 15 and 32 basis points to reach 1.87, 1.64, 0.77 and 0.67 percentage points respectively. By contrast, the in Germany ten-year spread decreased by 10 basis points to -0.32 percentage points, while in France it remained broadly stable at 0.08 percentage points. The GDP-weighted euro area ten-year sovereign bond spread increased by 5 basis points to 0.31 percentage points.

Chart 5

Ten-year euro area sovereign bond spreads vis-à-vis the OIS rate

(percentage points)

Sources: Thomson Reuters and ECB calculations.

Notes: The spread is calculated by subtracting the ten-year OIS rate from the ten-year sovereign bond yield. The vertical grey line denotes the start of the review period on 12 December 2019. The latest observations are for 11 March 2020.

The EONIA and the new benchmark euro short-term rate (€STR) averaged -45 and -54 basis points respectively over the review period.[4] Excess liquidity decreased a slight €22 billion in the period under review to around €1,770 billion. This change mainly reflects voluntary repayments in the second series of targeted longer-term refinancing operations (TLTRO II) and, to a lesser extent, an increase in liquidity-absorbing autonomous factors, which offset the increased liquidity stemming from the restart of Eurosystem net asset purchases on 1 November 2019.

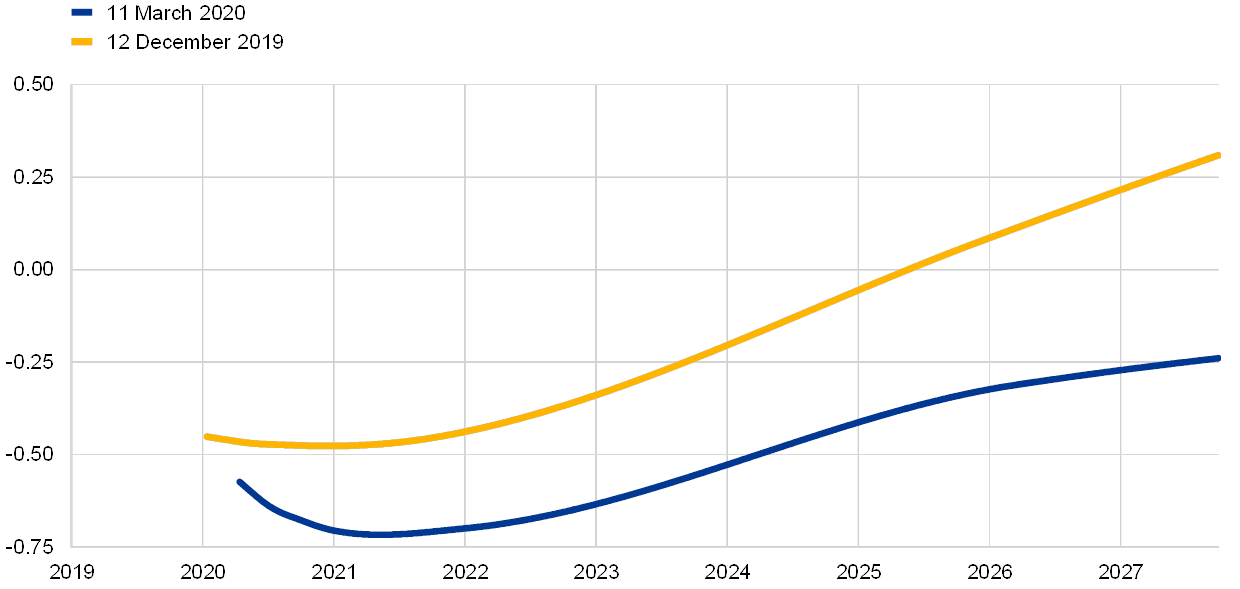

The EONIA forward curve shifted downwards and had inverted at shorter to medium-term maturities by the end of the review period (see Chart 6). While the curve was initially practically flat at shorter to medium-term maturities, at the end of the review period it reached -0.60% in mid-May 2020 and a low of -0.72% in April 2021. Despite these declines, the EONIA forward curve remains above the levels observed during the summer of 2019. Overall, market participants continue to expect a prolonged period of low and negative interest rates.

Chart 6

EONIA forward rates

(percentages per annum)

Sources: Thomson Reuters and ECB calculations.

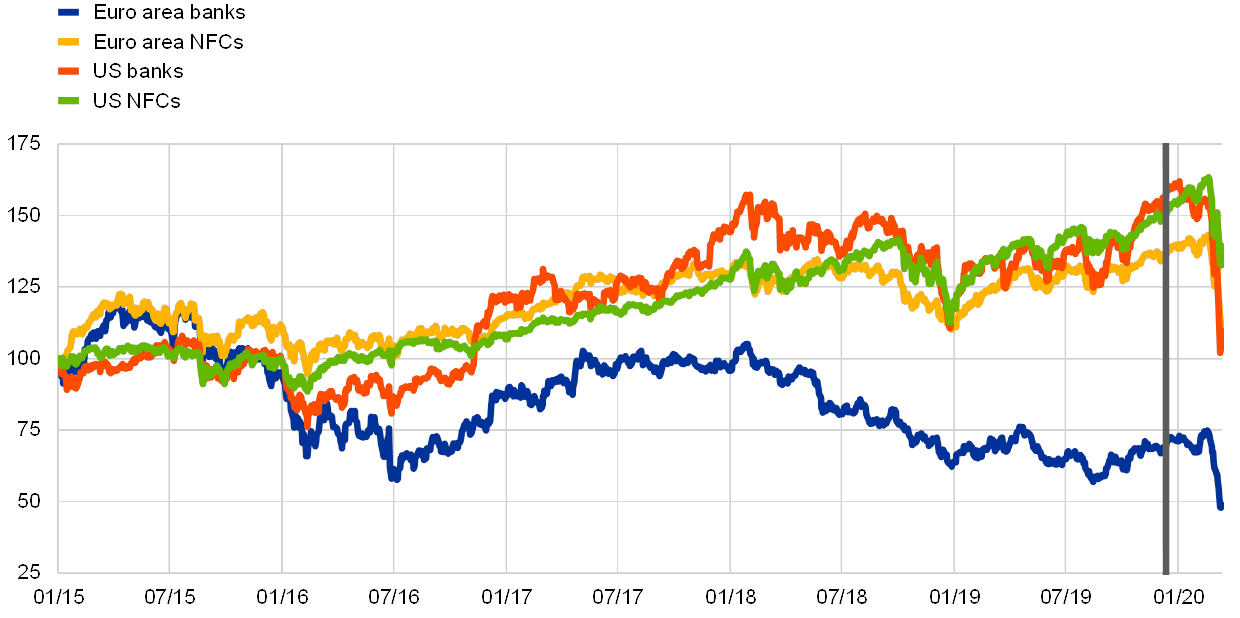

Euro area equity prices started declining strongly at the end of February against the background of increased risk premia (see Chart 7). Equity prices in the euro area and globally increased further during the first part of the review period and reached new record highs in some market segments. Equity markets suffered an initial yet short-lived decline at the end of January, when concerns about the coronavirus started to intensify but were confined mainly to China. Finally, stock prices dropped sharply across the board as the coronavirus spread outside China and risk aversion and uncertainty rose in parallel during late February. Specifically, equity prices of non-financial corporations (NFCs) in the euro area decreased by 19% between 21 February and 11 March 2020, while those of banks dropped by 30%. In the United States, NFC and bank equity prices fell back by 12% and 36% respectively. Implied stock market volatility surged in the euro area and globally.

Chart 7

Euro area and US equity price indices

(index: 1 January 2015 = 100)

Sources: Thomson Reuters and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 12 December 2019. The latest observations are for 11 March 2020.

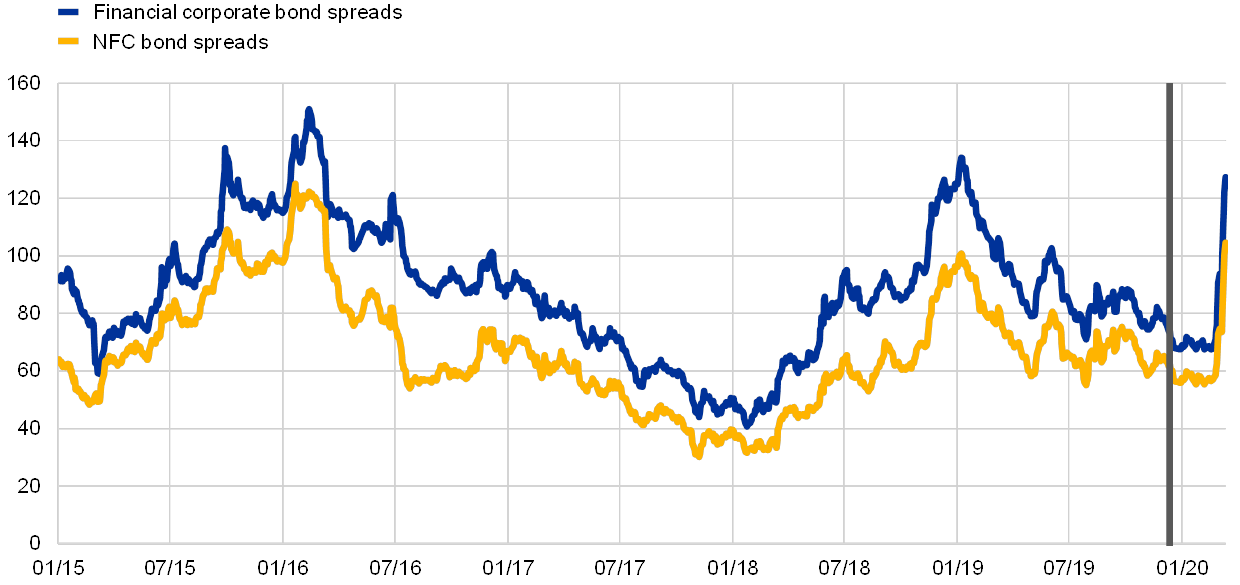

After remaining relatively stable for some time, financial and non-financial corporate bond spreads surged in the euro area in late February as the coronavirus spread outside China (see Chart 8). As of 21 February 2020, spreads on investment-grade NFC bonds and financial sector bonds relative to the risk-free rate increased by 42 and 53 basis points respectively to stand at 104 and 127 basis points. This widening mirrored the deterioration in risk sentiment as also seen in the equity market. At the same time, ratings and measures of expected default frequencies remained broadly unchanged.

Chart 8

Euro area corporate bond spreads

(basis points)

Sources: Markit iBoxx indices and ECB calculations.

Notes: Spreads are calculated as asset swap spreads to the risk-free rate. The indices comprise bonds of different maturities (but at least one year remaining) with an investment grade rating. The vertical grey line denotes the start of the review period on 12 December 2019. The latest observations are for 11 March 2020.

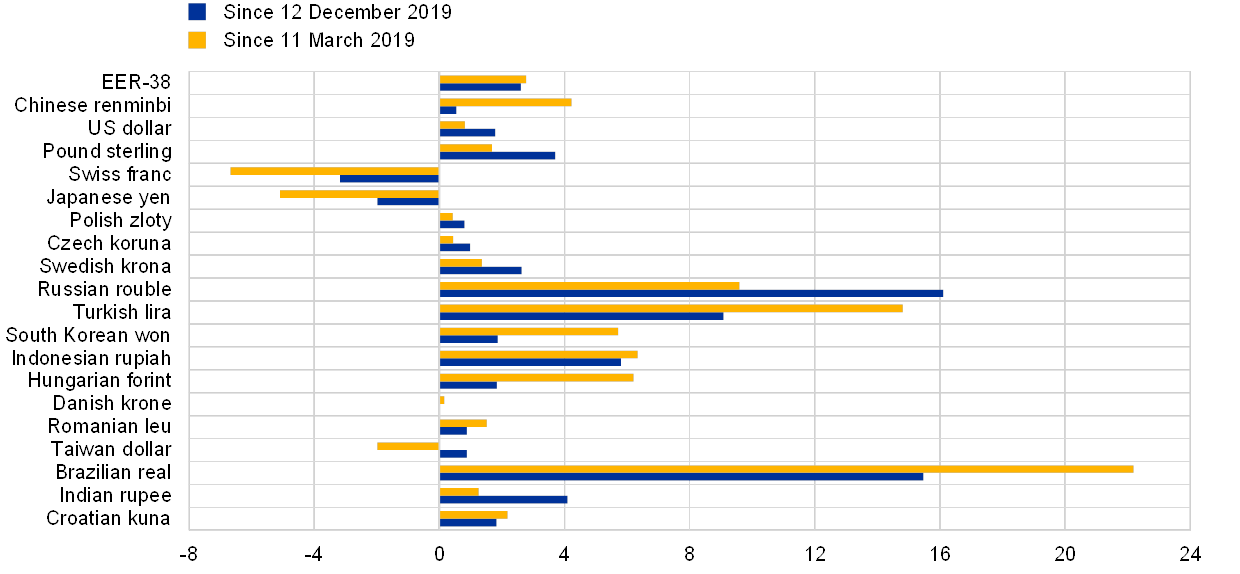

In foreign exchange markets, the euro appreciated substantially in trade-weighted terms (see Chart 9) amid increased volatility. The nominal effective exchange rate of the euro, as measured against the currencies of 38 of the euro area’s most important trading partners, appreciated by 2.6% over the review period. Regarding bilateral exchange rate developments, the euro appreciated strongly (by 1.8%) against the US dollar, albeit in an environment of heightened volatility. The US dollar had strengthened during the first half of February, partly on account of greater uncertainty around the global economic outlook but started to weaken in late February on expectations of monetary policy easing in the United States, a trend that continued after the Fed rate cut in early March and as coronavirus-related news continued to worsen. At the same time, the euro appreciated very strongly against the pound sterling (by 3.7%) and also strengthened vis-à-vis most other currencies, including those of non-euro area EU Member States and major emerging economies. The euro depreciated significantly against the Swiss franc (by 3.2%) and the Japanese yen (by 2.0%) in line with the decline in risk appetite.

Chart 9

Changes in the exchange rate of the euro vis-à-vis selected currencies

(percentage changes)

Source: ECB.

Notes: EER-38 is the nominal effective exchange rate of the euro against the currencies of 38 of the euro area’s most important trading partners. A positive (negative) change corresponds to an appreciation (depreciation) of the euro. All changes have been calculated using the foreign exchange rates prevailing on 11 March 2020.

3 Economic activity

Euro area real GDP growth remained subdued at 0.1%, quarter on quarter, in the fourth quarter of 2019, following growth of 0.3% in the previous quarter, driven by ongoing weakness in the manufacturing sector and slowing investment growth. Incoming economic data and survey information point to euro area growth dynamics at low levels. However, they do not yet fully reflect developments related to the coronavirus (COVID-19), which started to spread across continental Europe at the end of February, adversely affecting economic activity. Looking beyond the disruptions stemming from the spread of the coronavirus, euro area growth is expected to regain traction over the medium term, supported by favourable financing conditions, the euro area fiscal stance and the expected resumption in global activity. The March 2020 ECB staff macroeconomic projections for the euro area expect annual real GDP to increase by 0.8% in 2020, 1.3% in 2021 and 1.4% in 2022. Compared with the December 2019 Eurosystem staff macroeconomic projections, the outlook for real GDP growth has been revised down by 0.3 percentage points for 2020 and by 0.1 percentage points for 2021, mainly on account of the coronavirus outbreak, although the recent rapid spread of the virus to the euro area is only partly reflected. The risks surrounding the euro area growth outlook are therefore clearly on the downside. The spread of the coronavirus adds a new and substantial source of downside risk to the growth outlook, in addition to risks related to geopolitical factors, rising protectionism and vulnerabilities in emerging markets.

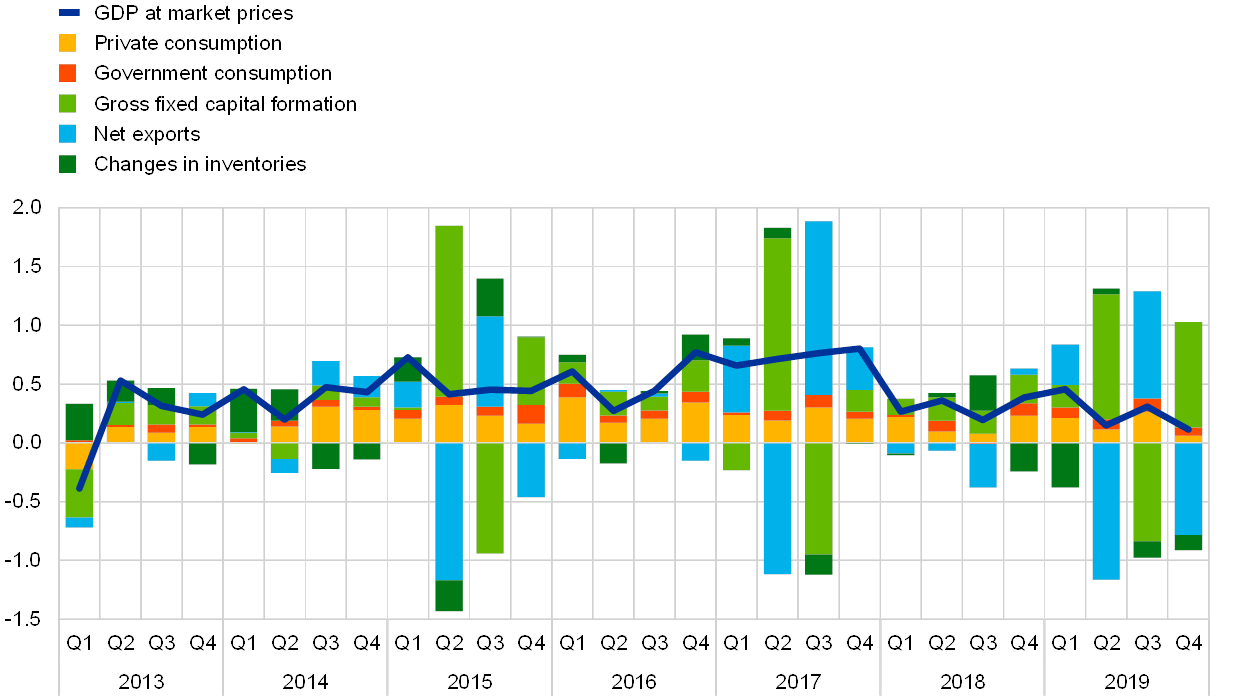

Growth in the euro area moderated in the fourth quarter of 2019, reflecting ongoing weakness in the manufacturing sector. Real GDP increased by 0.1%, quarter on quarter, in the fourth quarter of 2019, compared with 0.3% in the previous quarter (see Chart 10). Subdued growth in the fourth quarter was driven by a sharp contraction in the manufacturing sector, while the services and construction sectors continued to exhibit more resilient dynamics. Domestic demand made a positive contribution to growth of 1.0 percentage point, while net exports and changes in inventories contributed negatively by 0.8 and 0.1 percentage points, respectively. Overall, output growth in the fourth quarter led to a yearly rise in GDP of 1.2% in 2019, down from 1.9% in 2018.

Chart 10

Euro area real GDP and its components

(quarter-on-quarter percentage changes and quarter-on-quarter percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: The latest observations are for the fourth quarter of 2019.

Employment continued to increase in the fourth quarter of 2019, rising by 0.3% quarter on quarter (see Chart 11). Most euro area countries saw an increase in employment, but this was more concentrated in the construction and services sectors. The level of employment currently stands at almost 4.3% above the pre-crisis peak recorded in the first quarter of 2008. Taking into account the latest increase, there has been cumulative growth in employment in the euro area, with 12.0 million more people in employment than at the time of the trough in the second quarter of 2013. The positive development in employment growth in the fourth quarter of 2019 contrasts with the background of weaker real activity, with labour productivity per person employed decreasing by 0.2%. The higher than expected employment growth in the euro area could also be consistent with the resilience of the more labour intensive domestic demand, compared with the weaker growth in the less labour intensive external trade sector.

Despite stable readings from recent short-term labour market indicators so far in the first quarter of 2020, short term employment dynamics remain dependent on the impact of the coronavirus. The euro area unemployment rate stood at 7.4% in January 2020, unchanged from the fourth quarter of 2019, and remains at its lowest level since July 2008. Survey indicators point to further increases in employment in the first quarter of 2020, with the Purchasing Managers’ Index (PMI) employment composite indicator remaining broadly stable at 51.4 in February 2020, following levels of 51.4 in January 2020 and 51.3 in the fourth quarter of 2019.

Chart 11

Euro area employment, PMI assessment of employment and unemployment

(quarter-on-quarter percentage changes; diffusion index; percentages of the labour force)

Sources: Eurostat, Markit and ECB calculations.

Notes: The Purchasing Managers' Index (PMI) is expressed as a deviation from 50 divided by 10. The latest observations are for the fourth quarter of 2019 for employment, February 2020 for the PMI and January 2020 for the unemployment rate.

Private consumption continued to grow in the fourth quarter of 2019, albeit at a slower pace than in the previous quarter. Private consumption increased by 0.1%, quarter on quarter, in the fourth quarter of 2019, following somewhat stronger growth in the third quarter. The recent weakness in household expenditure partly reflected calendar effects in December. Employment growth strengthened in the fourth quarter of 2019 in an environment of robust wage increases. This implies steady growth in households’ real disposable income and supports consumer confidence and spending. In addition, while financing conditions remain very favourable, households’ net worth improved in the third quarter of 2019.

Available short-term indicators suggest some resilience in private consumption in early 2020, but this is subject to the spread of the coronavirus in Europe. Recent data on retail sales indicate moderate but steady growth in consumer spending, with some volatility being recorded around the turn of the year. The volume of retail sales increased by 0.6% in January 2020, following a drop of 1.1% in December 2019. In addition, consumer confidence increased for a second consecutive month in February 2020. The latest improvement reflects households’ more benign views regarding their past and future financial situation. Consumer confidence remains above its historical average and is consistent with ongoing steady growth in private consumption. However, recent measures to contain the spread of the coronavirus are expected to have a significant impact on consumption going forward.

The recovery in housing markets is expected to continue at a slower pace than in 2019 and to be negatively affected by the coronavirus outbreak. Housing investment increased by 0.4%, quarter on quarter, in the fourth quarter of 2019, reflecting a moderation in the growth momentum in euro area housing markets. Although housing investment growth decreased for the third consecutive year in 2019, recent short-term indicators and survey results point to positive but slowing momentum. Construction production in the buildings segment dropped by 1.0%, quarter on quarter, in the fourth quarter of 2019, marking its third consecutive quarterly decline. The European Commission’s construction confidence indicators for the past few months point to positive, albeit weakening, momentum in the fourth quarter of 2019 and early 2020. The PMI for housing activity averaged 50.6 in the fourth quarter of 2019 and 52.6 in January and February 2020.

Business investment growth in the euro area was particularly volatile in 2019, masking a slowdown in machinery and equipment investment and large swings in intangible investment. Non-construction investment grew by 8.0%, quarter on quarter, in the fourth quarter of 2019, on account of a 20% quarterly rise in investment in intellectual property products, mainly related to Ireland. Meanwhile, quarterly machinery and equipment investment growth slowed in 2019 and contracted in the fourth quarter, an outcome which was mirrored in the particularly weak industrial production of capital goods in that quarter. The loss of momentum partly reflects remaining elevated economic uncertainty and weaker demand conditions. In January and February 2020 the assessment of export order books and production expectations in the capital goods sector improved somewhat, according to information collected before the outbreak of the coronavirus in Europe. With regard to confidence indices for the capital goods sector, the PMI for January and the Economic Sentiment Indicator (ESI) for February increased from their levels in the fourth quarter of 2019, but remained below historical averages. Forward-looking indicators such as manufacturing uncertainty edged down in January, and the decline in the earnings expectations of listed companies came to a halt in February. Recovering profits, favourable financing conditions and ample corporate liquidity buffers should also support a gradual recovery in investment growth.

While extra-euro area goods exports recovered in the fourth quarter of 2019, driven by improvements vis-à-vis emerging market economies, this recovery is likely to be reversed in the first quarter of 2020 owing to the impact of the coronavirus outbreak. Nominal extra-euro area exports of goods increased by 1.3%, quarter on quarter, in the fourth quarter of 2019. In particular, exports to Turkey, Brazil, China and the rest of Asia recovered at the end of 2019. However, exports of goods to the United States and the United Kingdom weakened in the same period owing to lower exports of pharmaceuticals and the winding down of inventories previously built up in relation to Brexit, respectively. Intra-euro area trade remained anaemic, reflecting weakness in euro area industrial production and investment. Looking ahead, available leading indicators point to a decline in exports as a result of the coronavirus. The PMI on new euro area export orders for February 2020 dropped sharply, and shipping indicators (e.g. the Baltic Dry Index) reversed significantly in their latest releases. These indicators do not yet incorporate the effects of the coronavirus outbreak in Italy and other euro area countries. The impact of the coronavirus on euro area trade is expected to materialise through disruptions to extra- and intra-euro area supply chains, lower foreign demand, a deterioration in confidence and a sharp decline in services such as tourism and transport.

Incoming economic data and survey information point to some stabilisation in euro area growth, albeit at low levels, but do not fully reflect developments related to the coronavirus outbreak in continental Europe. The composite output PMI increased in February 2020, with improvements in both manufacturing and services components, putting the average for the first two months of 2020 above that for the fourth quarter of 2019 (51.4 compared with 50.7). The European Commission’s ESI increased in February, standing above its long-term average. So far in 2020 the average stands at 103.0, above the average of 100.6 in the fourth quarter of 2019. Although the ESI declined for the construction sector and softened slightly for the retail sector, this was broadly offset by improved sentiment in the manufacturing and services sectors and in households. Despite signs of stabilisation in survey data, supplier delivery times and business expectations in the surveys up to February already indicated constraints on euro area activity owing to the impact of the coronavirus in China. Developments related to the spread of the virus following the outbreak in Europe could lead to further supply chain disruptions and affect both consumption and investment, owing to very high levels of uncertainty and increased financial market volatility.

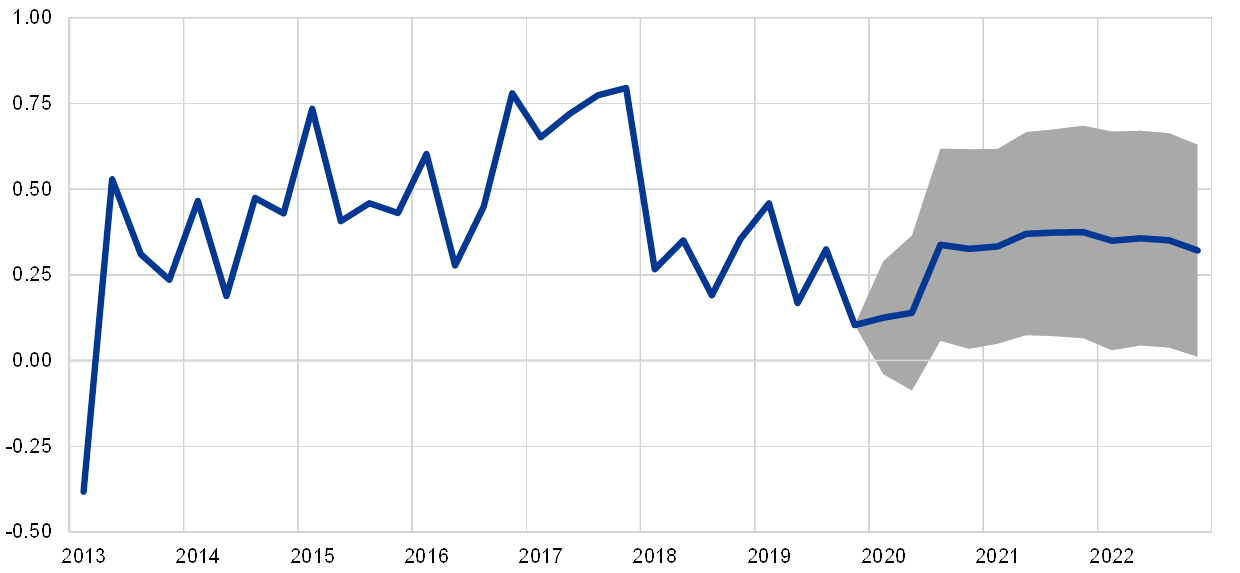

The March 2020 ECB staff macroeconomic projections for the euro area expect annual real GDP to increase by 0.8% in 2020, 1.3% in 2021 and 1.4% in 2022 (see Chart 12). Compared with the December 2019 Eurosystem staff macroeconomic projections, the outlook for real GDP growth has been revised down by 0.3 percentage points for 2020 and by 0.1 percentage points for 2021, mainly on account of the coronavirus outbreak, although the recent rapid spread of the virus to the euro area is only partly reflected. The risks surrounding the euro area growth outlook are therefore clearly on the downside. The spread of the coronavirus adds a new and substantial source of downside risk to the growth outlook, in addition to risks related to geopolitical factors, rising protectionism and vulnerabilities in emerging markets.

Chart 12

Euro area real GDP (including projections)

(quarter-on-quarter percentage changes)

Sources: Eurostat and the article entitled “March 2020 ECB staff macroeconomic projections for the euro area”, published on the ECB’s website on 12 March 2020.

Notes: The ranges shown around the central projections are based on the differences between actual outcomes and previous projections carried out over a number of years. The width of the range is twice the average absolute value of these differences. The method used to calculate the ranges, involving a correction for exceptional events, is documented in the “New procedure for constructing Eurosystem and ECB staff projection ranges”, ECB, December 2009.

4 Prices and costs

According to Eurostat’s flash estimate, euro area annual HICP inflation decreased to 1.2% in February 2020, from 1.4% in January. On the basis of the recent sharp decline in current and futures prices for oil, headline inflation is likely to decline considerably over the coming months. This assessment is only partly reflected in the March 2020 ECB staff macroeconomic projections for the euro area, which foresee annual HICP inflation at 1.1% in 2020, 1.4% in 2021 and 1.6% in 2022, and are broadly unrevised compared to the December 2019 Eurosystem staff projections. Over the medium term inflation will be supported by the ECB’s monetary policy measures. The implications of the coronavirus for inflation are surrounded by high uncertainty, given that downward pressures linked to weaker demand may be offset by upward pressures related to supply disruptions. The recent sharp decline in oil prices poses significant downside risks to the short-term inflation outlook.

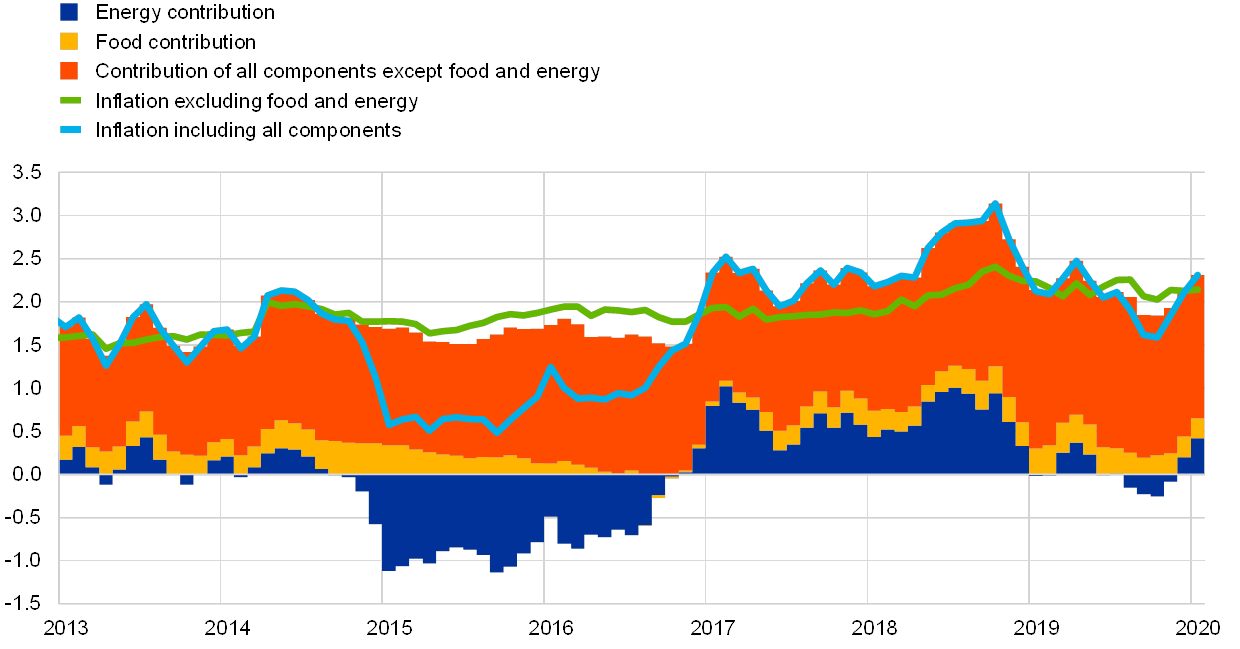

According to Eurostat’s flash estimate, HICP inflation decreased in February. The decrease from 1.4% in January to 1.2% in February reflected a decline in energy inflation, which more than offset increases in food, services and non-energy industrial goods inflation. While energy inflation remained the main driver of headline inflation dynamics, food inflation, at rates of more than 2%, has recently contributed substantially to the level of inflation.

Chart 13

Contributions of components of euro area headline HICP inflation

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: The latest observations are for February 2020 (flash estimates). Growth rates for 2015 are distorted upwards owing to a methodological change (see the box entitled “A new method for the package holiday price index in Germany and its impact on HICP inflation rates”, Economic Bulletin, Issue 2, ECB, 2019).

Measures of underlying inflation remained muted in general. HICP inflation excluding food and energy increased to 1.2% in February, following some upward movement to 1.3% in November and December, and downward movement to 1.1% in January. Other measures of underlying inflation have been more stable over recent months (data available up to January only; see Chart 14). HICP inflation excluding energy, food, travel-related items and clothing, as well as the Persistent and Common Component of Inflation (PCCI) indicator and the Supercore indicator,[5] continued the broad sideways movement that has been observed over the last year.

Chart 14

Measures of underlying inflation

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Notes: The latest observations are for February 2020 for HICP excluding energy and food (flash estimate) and for January 2020 for all other measures. The range of measures of underlying inflation consists of the following: HICP excluding energy; HICP excluding energy and unprocessed food; HICP excluding energy and food; HICP excluding energy, food, travel-related items and clothing; the 10% trimmed mean of the HICP; the 30% trimmed mean of the HICP; and the weighted median of the HICP. Growth rates for HICP excluding energy and food for 2015 are distorted upwards owing to a methodological change (see the box entitled “A new method for the package holiday price index in Germany and its impact on HICP inflation rates”, Economic Bulletin, Issue 2, ECB, 2019).

Pipeline price pressures for HICP non-energy industrial goods remained broadly stable at the later stages of the supply chain. Producer price inflation for domestic sales of non-food consumer goods, which is an indicator of price pressures at the later stages of the supply chain, stood at 0.7% year on year in January, unchanged since October and above its historical average. The corresponding annual rate of import price inflation increased from -0.1% in December to 0.5% in January. Indicators of price pressures at earlier stages of the supply chain remained weak, but increased slightly, with annual producer price inflation for intermediate goods rising to -1.0% in January from -1.1% in December, and import price inflation for intermediate goods increasing from -1.2% in December to -0.4% in January.

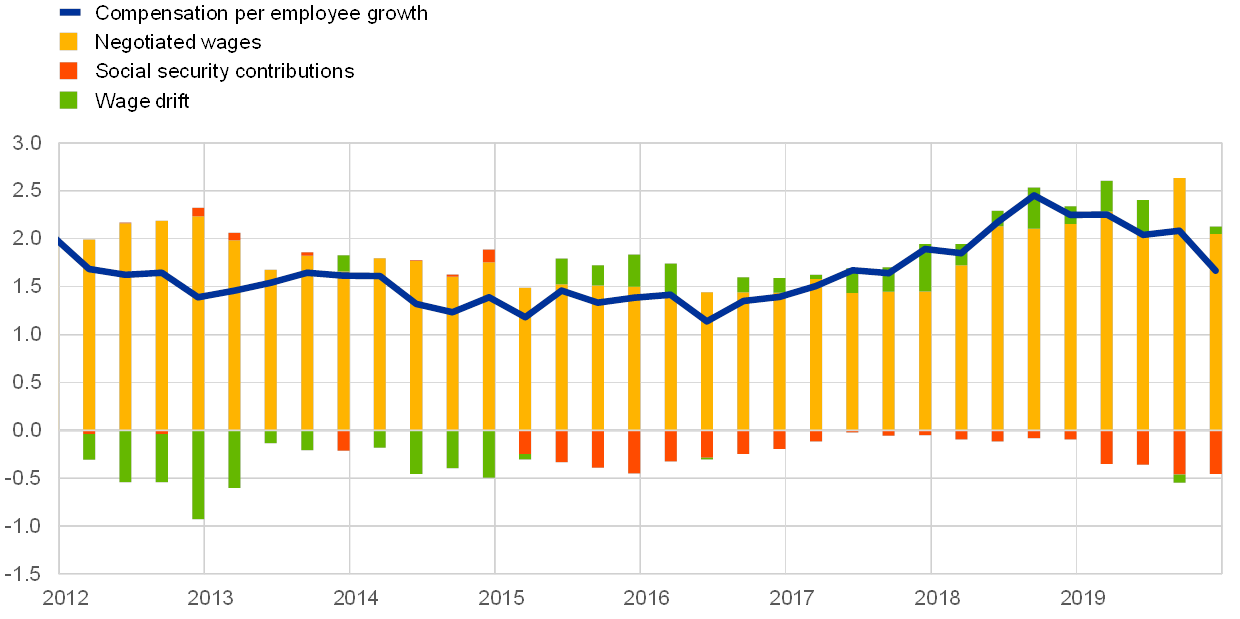

Wage growth decreased. Annual growth in compensation per employee stood at 1.7% in the fourth quarter of 2019, down from 2.1% in the third quarter (see Chart 15). The average for 2019 stood at 2.0%, decreasing slightly from 2.2% in 2018. The figures for 2019 have been affected by a significant drop in social security contributions in France.[6] Annual growth in wages and salaries per employee, which excludes social security contributions, was 2.1% in the fourth quarter, down from 2.5% in the third quarter, and averaged 2.4% in 2019, compared with 2.3% on average in 2018. Annual growth in negotiated wages in the euro area stood at 2.0% in the fourth quarter of 2019, down from 2.6% in the third quarter. This decrease was due mainly to one-off payments in the manufacturing sector in Germany in the third quarter. Looking across the different indicators and through temporary factors, wage growth decreased slightly in the course of 2019, although at rates around or slightly above historical averages.

Chart 15

Contributions of components of compensation per employee

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the fourth quarter of 2019.

Market-based indicators of longer-term inflation expectations declined to a new all-time low in early March, following a sharp correction in response to the global spread of the coronavirus. These recent declines in market-based indicators of inflation expectations followed an increase observed in the last quarter of 2019 and up to the January meeting of the Governing Council. Since mid-January, the 5y5y forward inflation-linked swap rate dropped by 42 basis points to stand at 0.91%. At the same time, the market-based (risk-neutral) deflation probability (based on average inflation over the next five years below zero) increased to 22%. The forward profile of market-based indicators of inflation expectations continues to point to a prolonged period of low inflation. According to the ECB Survey of Professional Forecasters for the first quarter of 2020 conducted during the second week of January 2020, as well as the latest releases from Consensus Economics and the Euro Zone Barometer, survey-based long-term inflation expectations in January were also at historically low levels.

Chart 16

Market-based indicators of inflation expectations

(annual percentage changes)

Sources: Thomson Reuters and ECB calculations.

Note: The latest observations are for 11 March 2020.

The March 2020 ECB staff macroeconomic projections foresee an increase in underlying inflation over the medium term. These projections expect headline HICP inflation to average 1.1% in 2020, 1.4% in 2021 and 1.6% in 2022, broadly unrevised from the December 2019 Eurosystem staff macroeconomic projections (see Chart 17). The weaker headline inflation rate in 2020 compared with 2019 reflects a notable drop in HICP energy prices given weak developments in oil prices (up to the cut-off date for the technical assumptions of 18 February), partly on account of the COVID-19 outbreak. HICP inflation excluding energy and food is expected to move sideways at 1.2% in the course of 2020 and strengthen gradually to 1.4% in 2021 and 1.5% in 2022. Beyond the impact on the oil price, the implications of the spread of COVID-19 for inflation are surrounded by considerable uncertainty. It is assumed in the projections that the downward pressures on prices related to weaker demand in 2020 will be largely offset by upward effects related to supply disruptions, although this assessment is subject to clear downside risks.

Chart 17

Euro area HICP inflation (including projections)

(annual percentage changes)

Sources: Eurostat and the article entitled “ECB staff macroeconomic projections for the euro area, March 2020”, published on the ECB’s website on 12 March 2020.

Notes: The latest observations are for the fourth quarter of 2019 (data) and the fourth quarter of 2022 (projection). The ranges shown around the central projections are based on the differences between actual outcomes and previous projections carried out over a number of years. The width of the ranges is twice the average absolute value of these differences. The method used for calculating the ranges, involving a correction for exceptional events, is documented in the “New procedure for constructing Eurosystem and ECB staff projection ranges”, ECB, December 2009. The cut-off date for data included in the projections was 18 February 2020.

5 Money and credit

Monetary dynamics have moderated from comfortable levels since late summer 2019. Credit to the private sector has continued displaying divergent developments across loan categories. While lending to households has remained resilient, lending to firms has moderated. Favourable bank funding and lending conditions continued to support lending and thereby economic growth. Euro area firms’ total net external financing has stabilised, supported by favourable debt financing costs. However, the recent increase in risk-off sentiment is likely to cause non-bank financing conditions for non-financial corporations (NFCs) to deteriorate.

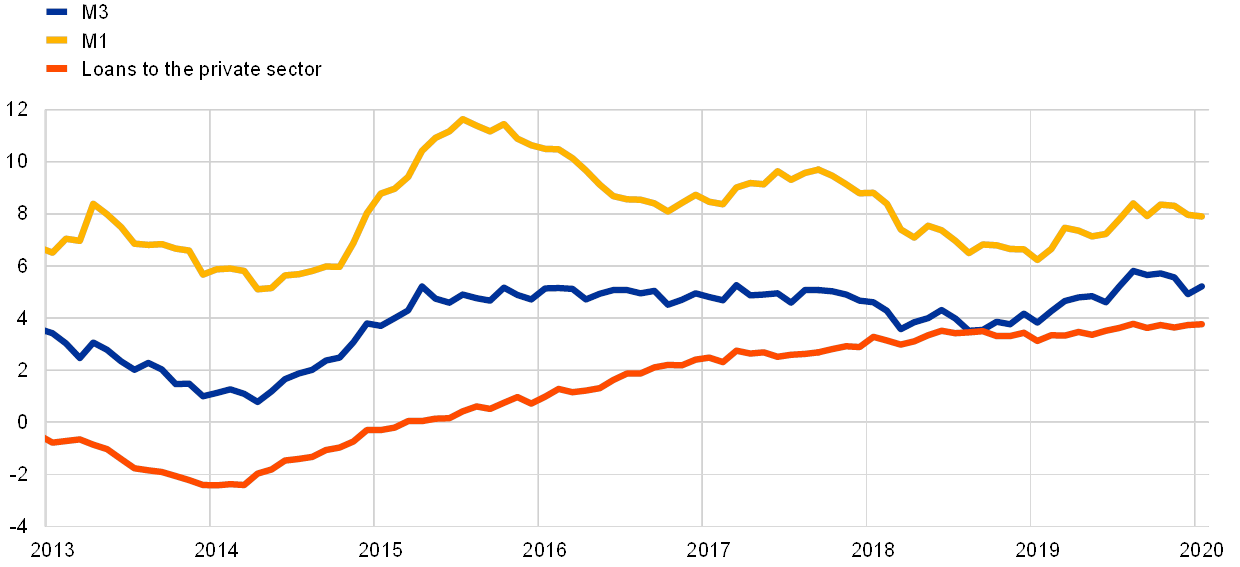

Monetary dynamics have moderated since late summer 2019. The annual growth rate of M3 increased to 5.2% in January, from 4.9% in December (see Chart 18), mainly on account of a positive base effect related to marketable instruments, which concealed the continued moderation of shorter-term monetary dynamics. Broad money growth was supported by the very low opportunity cost of holding monetary instruments. By contrast, the slowdown in economic growth has acted as a drag on M3 growth. As in previous quarters, M3 growth continued to be mainly driven by the narrow aggregate M1, which comprises overnight deposits and currency in circulation. The annual growth rate of M1 reached 7.9% in January, after 8.0% in December.

Chart 18

M3, M1 and loans to the private sector

(annual percentage changes; adjusted for seasonal and calendar effects)

Source: ECB.

Notes: Loans are adjusted for loan sales, securitisation and notional cash pooling. The latest observation is for January 2020.

Overnight deposits remained the main contributor to money growth. The annual growth rate of overnight deposits remained broadly stable in January, at 8.4%, after 8.5% in December, while its contribution to annual M3 growth has moderated somewhat since the autumn of 2019; from a sectoral perspective, overnight deposits placed by firms and by households contributed to this moderation. The annual growth rate of currency in circulation continued to hover around 5% in January and does not point to an accelerated substitution of deposits with cash in the prevailing low-interest rate environment. The small increase in annual M3 growth in January was mainly owing to marketable instruments (i.e. M3 minus M2), which contributed positively to monthly M3 dynamics. This has reversed the dampening effect of marketable instruments on M3 in December, owing to the strongly negative net debt securities issuance that month, which may have reflected end-of-year effects.

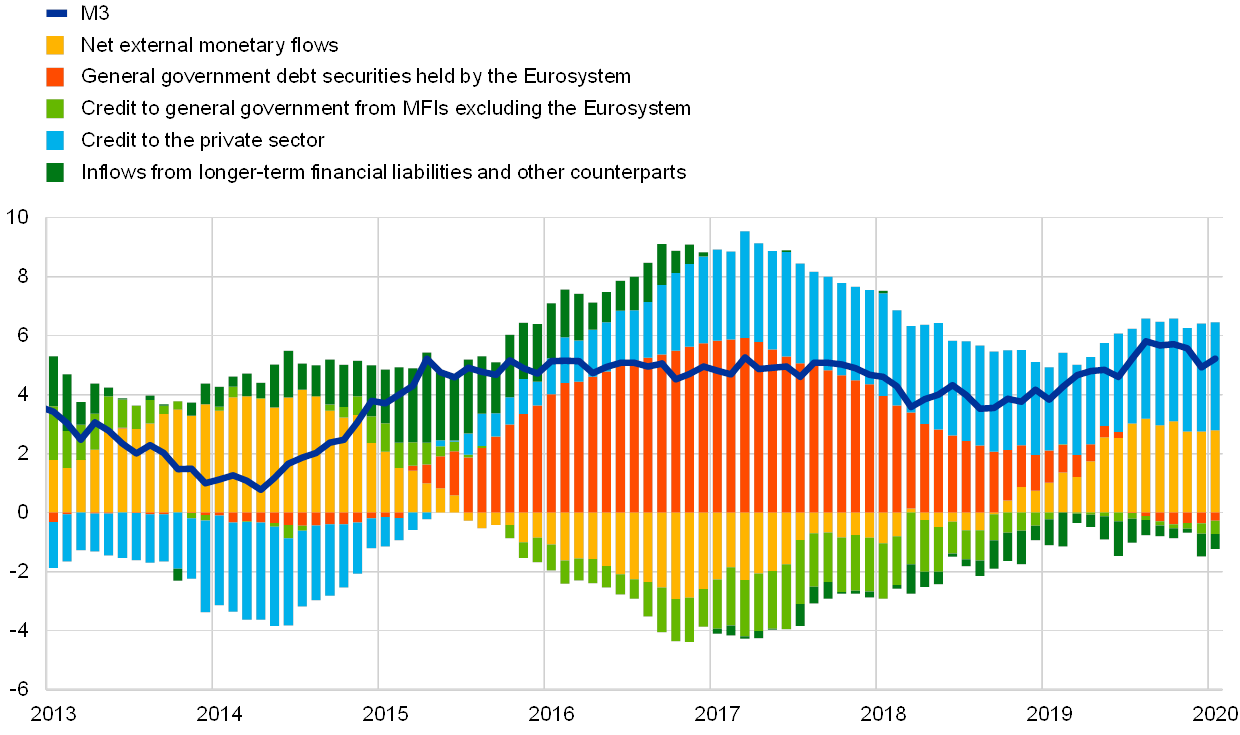

Credit to the private sector remained the main source of broad money creation. Credit to the private sector continued to make a stable, sizeable contribution to broad money growth in January (see the blue portion of the bars in Chart 19). The annual contribution of credit to the private sector up to January 2020 largely reflected robust annual loan growth. External monetary flows were the second main source of money creation, which have provided a broadly stable contribution to M3 since November 2019, reflecting investors’ preference for euro area assets (see the yellow portion of the bars in Chart 19). The resumption of the ECB’s net asset purchases under the asset purchase programme (APP) in November has had only a limited direct impact on M3 in its first three months; this is potentially on account of banks and non-residents being among the main sellers of bonds to the Eurosystem. The resumption of net asset purchases has also not compensated the drag on M3 growth coming from the maturing of non-APP related debt securities (see the red portion of the bars in Chart 19). The drag from longer-term financial liabilities remained small (see the dark green portion of the bars in Chart 19).

Chart 19

M3 and its counterparts

(annual percentage changes; contributions in percentage points; adjusted for seasonal and calendar effects)

Source: ECB.

Notes: Credit to the private sector includes monetary financial institution (MFI) loans to the private sector and MFI holdings of debt securities issued by the euro area private non-MFI sector. As such, it also covers purchases by the Eurosystem of non-MFI debt securities under the corporate sector purchase programme. The latest observation is for January 2020.

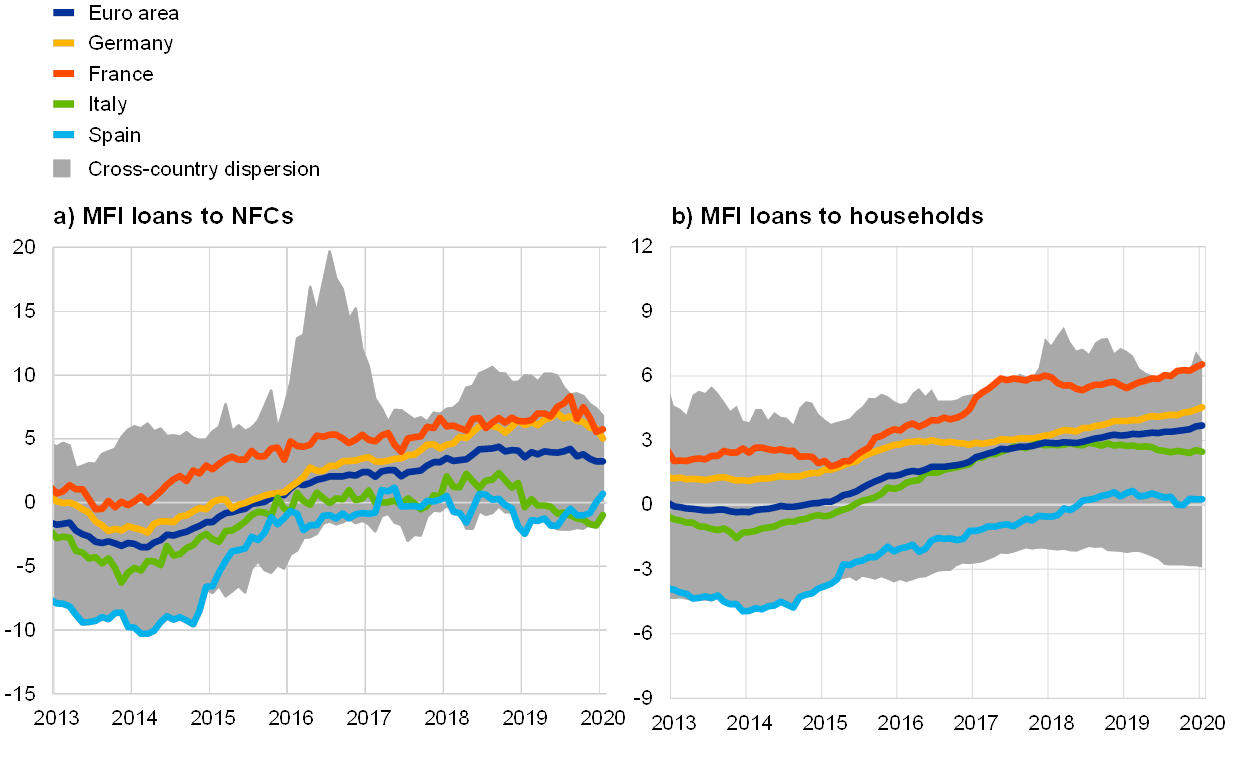

The annual growth rate of loans to the private sector remained overall broadly stable, amid divergent developments across sectors. The annual growth rate of MFI loans to the private sector (adjusted for loan sales, securitisation and notional cash pooling) stood at 3.8% in January, compared with 3.7% in December (see Chart 18). While the annual growth rate of loans to households remained on a slightly upward trajectory (3.7% in January, after 3.6% in December), the annual growth rate of loans to firms has stabilised at 3.2%, thus confirming its moderation since September 2018. The considerable heterogeneity in loan growth across countries reflects, inter alia, cross-country differences in economic growth, variations in the availability of other funding sources, the level of indebtedness of households and firms, and heterogeneity in house price developments across countries (see Chart 20).

The moderation in the growth of loans to firms is in line with its lagging cyclical pattern with respect to real economic activity. The moderation in bank lending to firms continues to be concentrated in the manufacturing and trade sectors, which are particularly affected by the persisting slowdown in global activity. By contrast, there has been, so far, little sign of spill-overs into the services sector (including firms providing real estate-related services), which accounts for the largest share of the growth in lending to NFCs. Judging from the results of the euro area bank lending survey (BLS), the slowdown in loan growth to firms appears mainly demand-driven, e.g. resulting from lower financing needs for fixed investment. The leading indicator properties of the BLS also point to some further moderation in loan growth to firms in the first half of 2020. Credit standards, so far, have remained broadly unchanged, amid a mild negative reappraisal of the credit risk of firms, especially for small and medium-sized enterprises, which tend to be particularly sensitive to the economic cycle.

Chart 20

MFI loans in selected euro area countries

(annual percentage changes)

Source: ECB.

Notes: Loans are adjusted for loan sales and securitisation; in the case of NFCs, loans are also adjusted for notional cash pooling. The cross-country dispersion is calculated on the basis of minimum and maximum values using a fixed sample of 12 euro area countries. The latest observation is for January 2020.

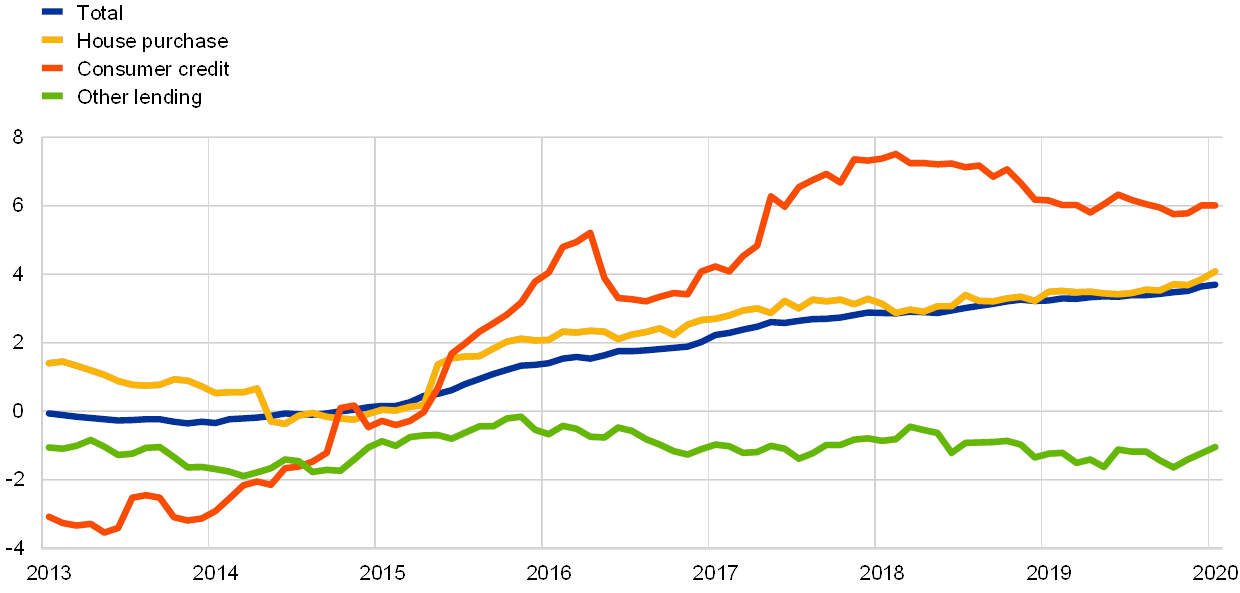

Lending to households for house purchase continued its gradual upward trend, while consumer credit growth stabilised. The annual growth rate of loans to households for house purchase increased to 4.1% in January, from 3.9% in December, continuing its steady upward path since 2015 (see Chart 21). The annual growth rate of consumer credit remained robust at the euro area level, standing at 6% in January, unchanged from December. It has moderated somewhat from levels above 7% in early 2018. In contrast to the robust growth of mortgage loans and consumer credit, the annual growth of other lending to households remained subdued at -1.0% in January, after -1.2% in December. The weakness in this loan type can be largely attributed to lending to small firms (sole proprietors and unincorporated partnerships), which are recorded in the household sector. These entities may have been particularly affected by the slowdown in economic activity and may also rely on non-bank sources of financing, including internal funds, to cover their financing needs.

Chart 21

MFI loans to households by purpose

(annual percentage changes; adjusted for seasonal and calendar effects)

Source: ECB.

Notes: The series for total loans to households is adjusted for loan sales and securitisation. The latest observation is for January 2020.

Household gross indebtedness has stabilised at the euro area level in recent quarters close to its end-2007 level.[7] The stabilisation at the euro area level comes amid divergent debt developments of households across countries. At the same time, households’ debt servicing costs reached a new historical low, which supports debt sustainability.