Published as part of the ECB Economic Bulletin, Issue 1/2024.

The euro area composite output Purchasing Managers' Index (PMI) tends to be strongly correlated with real GDP growth (Chart A). The composite output PMI is a diffusion index, which measures the sum of the percentage of month-on-month “higher” output responses and half the percentage of “no output change” responses. The PMI survey output question asks about the actual unit volume of output this month compared to the previous month. It indicates the degree to which output changes are diffused throughout the panel of respondents and has a no-change benchmark of 50. A simple PMI-based rule of thumb, hereafter referred to as the PMI-based tracker rule, calculates euro area quarterly real GDP growth as 10% of the quarterly average level of the composite output PMI from which a value of 50 is subtracted. This rule-of-thumb exhibited a good nowcasting performance during the pre-coronavirus (COVID-19) period.[1] However, since the composite output PMI is a diffusion index, it provides information on the extensive margin of change (the number of firms that reported a change in output) but not on the intensive margin of change (the amount by which output changed). It implies that in periods of extreme volatility in output, such as during the COVID-19 pandemic, the level of the composite output PMI might become less informative. Another limitation of the composite output PMI is the incomplete sector coverage; the index is a weighted average of the services business activity PMI and the manufacturing output PMI, while other important sectors such as retail, construction and government are missing. Moreover, the euro area composite output is based solely on the four largest euro area countries and Ireland.

Chart A

Euro area composite output PMI and real GDP growth

(left axis: quarterly percentage changes, right axis: diffusion index)

Sources: Eurostat, S&P Global and ECB calculations.

Notes: The two y-axis scales reflect the PMI-based tracker rule, which is calculated as 10% of the quarterly average of the composite output PMI minus 50.

Information derived from composite and sectoral PMIs plays an important role for the mechanical short-term GDP forecasting tools used by ECB and Eurosystem staff. The ECB short-term mechanical forecasting models include basic linear regressions, which directly link quarterly averages of monthly PMI data with real GDP.[2] These regressions are known as bridge equations because GDP predictors bridge the gap between earlier available higher frequency data, such as industrial production, and quarterly GDP. The GDP predictors are, in turn, forecast with satellite models using sectoral PMIs, among other monthly indicators. Overall, compared with other indicators, PMIs tend to have a relatively high weight in the forecasting models due to their timeliness.

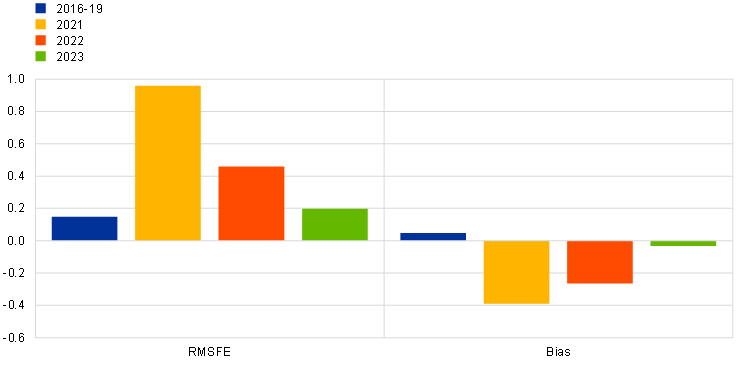

After losing some predictive capacity during pandemic-related lockdowns and reopenings, the forecast accuracy of the PMI-based short-term forecasting models of the ECB has recovered (Chart B). After deteriorating in 2020 and 2021, the forecast accuracy of the PMI-based short-term tool of the ECB improved in 2022 and 2023 when the prediction errors – measured by the root mean squared forecast error – became much lower and gradually returned to previous more regular levels as measured by the 2016-19 average.[3] The PMI-based models underpredicted GDP growth, as indicated by a negative bias, in 2021 and 2022 by 0.4 and 0.3 percentage points respectively, while the average bias was practically zero in 2023. This suggests that growth drivers in 2021 and 2022 were not fully captured by the PMIs. More specifically, looking at sectoral developments, PMIs did not fully capture reopening effects and supply disruptions, which led to some underprediction of services activity and an overestimation of industrial activity.

Chart B

Forecast accuracy of the ECB’s PMI-based short-term forecasting tool

(in percentage points)

Sources: ECB calculations.

Notes: The chart shows the root mean squared forecast error (RMSFE) and the bias, which is defined as the average difference between the forecast and the outcome. The forecasts use real-time data and are made two weeks before the official flash estimate of GDP is released by Eurostat and are evaluated against it.

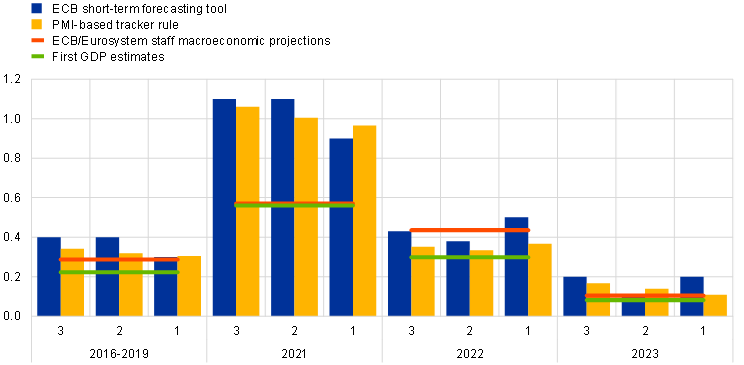

In 2022 and 2023 the forecast accuracy of PMI-based nowcasts was comparable to the accuracy of the first GDP estimates with the latest GDP vintage as target (Chart C).[4] The forecast errors of the ECB’s PMI-based short-term forecasting models and PMI-based tracker rule were also of a similar size to those for the nowcasts from the ECB/Eurosystem staff macroeconomic projections, which make use of all available real-time information, including the PMI-derived forecasts, as well as expert judgement. Typically, as more monthly information becomes available in real time within a given quarter, the nowcast errors for GDP growth in that same quarter become smaller. For 2022 and 2023 this was not the case for the GDP nowcasts from the ECB’s PMI-based short-term forecasting tool. The unusual slight deterioration in the performance as more information became available probably reflected policy responses to successive shocks and the growth impact of sectors not covered by the composite output PMI, such as government expenditure. However, no strong conclusions can be drawn given the small number of observations per calendar year. In short, the PMI composite output index is still a reliable indicator for nowcasting euro area real GDP growth.

Chart C

Root mean squared forecast errors in nowcasting euro area real GDP growth based on the latest GDP vintage

(in percentage points)

Sources: ECB, S&P Global and ECB staff calculations.

Notes: The numbers “3”, “2” and “1” represent the number of months before the release of the first GDP estimate. The real-time nowcast from the ECB/Eurosystem staff macroeconomic projections is available around two months before the first GDP estimate. The forecast errors are calculated using the latest available GDP vintage (19 January 2024) as a target. 2023 is based on the first three quarters of 2023 only because the first GDP vintage for the fourth quarter of 2023 was released after the cut-off date of this Bulletin.

See de Bondt, G.J., “Nowcasting: Trust the Purchasing Managers’ Index or wait for the flash GDP estimate?” in Papanikos, G.T. (ed.), Economic essays, Athens Institute for Education and Research, pp. 83–97, 2012; and de Bondt, G.J., “A PMI-based real GDP tracker for the euro area”, Journal of Business Cycle Research, Volume 15, pp.147–170, 2019.

See the article entitled “Short-term forecasting of euro area economic activity at the ECB”, Economic Bulletin, Issue 2, ECB, 26 March 2020.

The results for 2020 are not reported in this Box. During the COVID-19 outbreak in 2020, the standard tools used for nowcasting euro area real GDP growth in real time warranted adjustments, as reported in the article entitled “Assessing short-term economic developments in times of COVID-19”, Economic Bulletin, Issue 8, ECB, 5 January 2021.

In recent quarters the errors, including those derived from the first GDP release might, however, turn out to be falsely low because GDP will be revised over time.