Euro area balance of payments in February 2013 and international investment position at the end of 2012

In February 2013 the seasonally adjusted current account of the euro area recorded a surplus of €16.3 billion. In the financial account, combined direct and portfolio investment recorded net outflows of close to €11 billion (non-seasonally adjusted).

At the end of 2012 the international investment position of the euro area recorded net liabilities of €1.1 trillion vis-à-vis the rest of the world (approximately 12% of euro area GDP). This was broadly unchanged in comparison with the revised data for the end of the third quarter of 2012.

Balance of payments in February 2013

The seasonally adjusted current account of the euro area recorded a surplus of €16.3 billion in February 2013 (see Table 1). This reflected surpluses for goods (€12.2 billion), services (€8.0 billion) and income (€5.9 billion), which were partly offset by a deficit for current transfers (€9.8 billion).

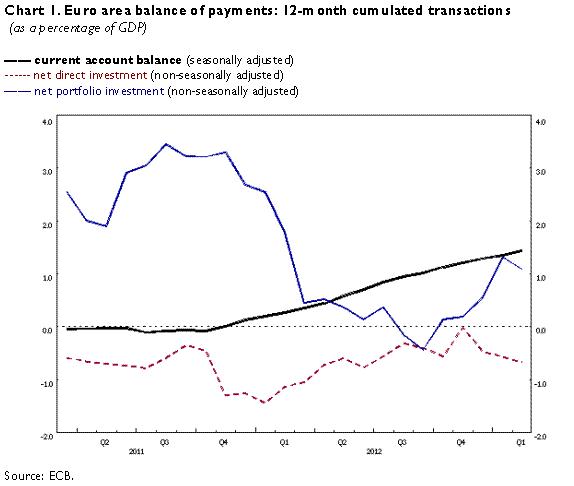

The seasonally adjusted 12-month cumulated current account recorded a surplus of €136.7 billion in February 2013 (around 1.4% of euro area GDP; see Table 1 and Chart 1), compared with a surplus of €25.9 billion a year earlier. This development resulted mainly from an increase in the surplus for goods (from €16.9 billion to €115.0 billion) and, to a lesser extent, from an increase in the surplus for services (from €76.5 billion to €92.2 billion); whereas the surplus for income and the deficit for current transfers remained broadly unchanged.

In the financial account (see Table 2), combined direct and portfolio investment recorded net outflows of close to €11 billion in February 2013, as a result of net outflows for both direct investment (€2 billion) and portfolio investment (€9 billion).

The net outflows for direct investment essentially resulted from net outflows in equity capital and reinvested earnings (€4 billion), which were partly offset by inflows in other capital (€2 billion).

The net outflows for portfolio investment were accounted for by net outflows for both debt instruments (€1 billion) and equity (€8 billion). In both cases, these net outflows resulted from the fact that net purchases of foreign securities by euro area residents were higher than the net purchases of euro area securities by non-residents. The net outflows for debt instruments resulted from two compensatory effects, namely from net outflows in bonds and notes (€13 billion) and net inflows in money market instruments (€12 billion).

The financial derivatives account recorded net inflows of €6 billion.

Other investment recorded net outflows (€16 billion), reflecting predominantly net outflows for both the Eurosystem (€12 billion) and other sectors (€17 billion), which were partly offset by net inflows for MFIs excluding the Eurosystem (€14 billion).

The Eurosystem’s stock of reserve assets was €672 billion at the end of February 2013, down from €675 billion at the end of January 2013, mainly on account of transactions (€3 billion). Valuation effects for gold (devaluation) and foreign currency assets (appreciation) offset one another.

In the 12-month period to February 2013 combined direct and portfolio investment recorded cumulated net inflows of €39 billion, compared with net inflows of €60 billion in the preceding 12-month period. This decrease was the result of two opposing effects: lower net inflows for portfolio investment (down from €167 billion to €103 billion) and lower net outflows for direct investment (down from €107 billion to €64 billion).

International investment position at the end of 2012

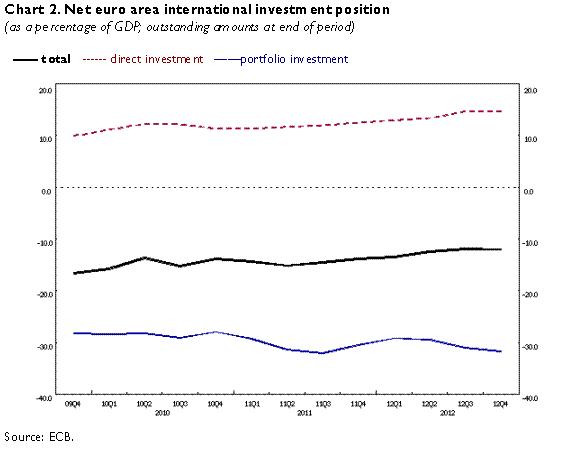

At the end of 2012 the international investment position of the euro area recorded net liabilities of €1.1 trillion vis-à-vis the rest of the world (approximately 12% of euro area GDP; see Chart 2). This represented an increase of €13 billion in comparison with the revised data for the end of the third quarter of 2012 (see Table 3).

This slight increase in the net liability position was mainly the result of a higher net liability position in portfolio investment (up from €2,935 billion to €3,006 billion) and a lower net asset position in reserve assets (down from €734 billion to €711 billion), which were partly offset by a lower net liability position for other investment (down from €296 billion to €222 billion). The changes in the positions for direct investment and portfolio investment broadly reflected transactions and “other changes” (predominantly revaluations on account of changes in exchange rates and asset prices), whereas transactions were of greater relevance in explaining changes in positions for other investment.

At the end of 2012 the gross external debt of the euro area amounted to €11.7 trillion (approximately 124% of euro area GDP), which represented a decrease of €194 billion in comparison with the revised data for the end of the third quarter of 2012.

Data revisions

This press release incorporates revisions to the monthly balance of payments for the period from January 2008 to January 2013, and to the quarterly international investment position from the end of the first quarter of 2008 to the end of the third quarter of 2012.

The revisions to the balance of payments in January 2013 were of relevance for the financial account, particularly other investment, on account of better source data.

The current account surpluses in 2011 and 2012 were revised slightly upwards (from €12.5 billion to €14.9 billion and from €112.8 billion to €116.0 billion respectively). This, together with the revisions in the financial account, reduced net errors and omissions, which were particularly visible in the third quarter of 2012. In addition, underestimated positions for direct investment in the reporting economy in the first three quarters of years 2008 to 2012 were corrected. This contributed to a revision of the net liability position of the euro area, which ranged between €9 billion (in the third quarter of 2008) and €263 billion (in the first quarter of 2012).

Additional information on the euro area balance of payments and international investment position

In this press release, the seasonally adjusted current account refers to working day and seasonally adjusted data. Data for the financial account are not working day or seasonally adjusted.

In line with the agreed allocation of responsibilities, the European Central Bank compiles and disseminates monthly and quarterly balance of payments statistics for the euro area, whereas the European Commission (Eurostat; see news releases for “Euro-indicators”) focuses on quarterly and annual aggregates for the European Union. These data comply with international standards, particularly those set out in the IMF’s Balance of Payments Manual (fifth edition). The aggregates for the euro area and the European Union are compiled consistently on the basis of transactions and positions vis-à-vis residents of countries outside the euro area and the European Union respectively.

A complete set of updated euro area balance of payments statistics (including a quarterly geographical breakdown for the main counterparts) and international investment position statistics is available in the “Statistics” section of the ECB’s website under the headings “Data services”/“Latest monetary, financial markets and balance of payments statistics”. These data, as well as historical euro area balance of payments time series, can be downloaded from the ECB’s Statistical Data Warehouse (SDW). Data up to February 2013 will also be published in the May 2013 issues of the ECB’s Monthly Bulletin and Statistics Pocket Book. Detailed methodological notes are available on the ECB’s website. The next press release on the euro area monthly balance of payments will be published on 22 May 2013. The next press release including the quarterly international investment position will be published on 18 July 2013.

The ECB will start publishing, at the end of 2014, the euro area balance of payments and international investment positions statistics in accordance with its Guideline ECB/2011/23, which adheres to the sixth edition of the IMF Balance of Payments and International Investment Position Manual (BPM6). More detailed information is available on a dedicated webpage

Annexes

Table 1: Current account of the euro area

Table 2: Monthly balance of payments of the euro area

Table 3: Quarterly international investment position of the euro area

Europeiska centralbanken

Generaldirektorat Kommunikation och språktjänster

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Tyskland

- +49 69 1344 7455

- media@ecb.europa.eu

Texten får återges om källan anges.

Kontakt för media