Published as part of the ECB Economic Bulletin, Issue 3/2022.

This box reviews the dynamics of household savings as derived from deposit flows across the wealth distribution from the onset of the coronavirus (COVID-19) pandemic in March 2020 to the surge in inflation that started mid-2021. Deposit flows are used as a proxy for household savings since they are a primary means of savings for households.[1] Deposit flows account for around half of the changes in households’ liquid assets and, in particular, help poorer households to smooth consumption in the face of economic shocks.[2] Mandatory and voluntary restrictions on mobility together with policy support measures produced a unique combination of declines in contact-intensive consumption on the one side and income resilience on the other. This led in turn to a large increase in deposit flows in the early phases of the COVID-19 pandemic. There has since been a slowdown in the accumulation of deposits owing to the recent surge in inflation, a recovery in demand and considerable supply bottlenecks.[3] These developments in deposit dynamics were unevenly distributed across household groups.[4] This box explores the drivers of euro area household deposit flows across the wealth distribution, where the distributional dimension has greater relevance given the potential macroeconomic implications of economic inequality.[5] The analysis focuses on the period from the onset of the COVID-19 pandemic in the first quarter of 2020 to the surge in inflation starting in the second quarter of 2021. The data used for this purpose are from the novel Distributional Wealth Accounts (DWA) for the euro area between the first quarter of 2009 and the third quarter of 2021.[6]

Inequality in household deposits has risen since the global financial crisis, although there have been signs of stabilisation in recent years. The upward trend in deposit inequality – as measured by the Gini coefficient and the top 10% share of the wealth distribution – steepened between 2011 and 2015, broadly in line with total wealth inequality. Over this period, households in the top decile of the wealth distribution increased their deposits by around €600 billion, while deposits by households in the bottom half decreased by approximately €50 billion. Inequality nevertheless moderated in the course of the subsequent economic recovery (Chart A). After the onset of the pandemic the different inequality measures picked up slightly, while they declined somewhat in the second and third quarters of 2021.[7] However, substantial disparities persist. In the third quarter of 2021 the top 10% of the wealth distribution held around 45% of total deposits, while the bottom 50% held only 17% of total deposits.

Chart A

Inequality in household deposits in the euro area

(left-hand scale: index; right-hand scale: percentages)

Sources: Experimental DWA and ECB calculations.

Note: “Top 10%” refers to the share of deposits held by households in the top 10% of the net wealth distribution.

The recent increase in deposit flows has been historically large for all households, in particular during the early phases of the COVID-19 pandemic. The mandatory and voluntary restrictions introduced in response to the pandemic caused an abrupt decline in contact-intensive consumption. This, in combination with the income resilience thanks to support from policy relief measures, led to a significant rise in deposit flows (as a share of income) that was almost double the size observed in the period prior to COVID-19 (Chart B). However, the increase in deposit flows was unevenly distributed across the wealth distribution, as households in the top 10% of the distribution accounted for around half of the total increase, accumulating a stock of deposits almost four times larger than that accumulated by households in the bottom half.[8] This is likely due to the fact that wealthier households suffered lower income losses than poorer households. In addition, the uneven distribution of changes in deposit dynamics could also be attributable to the distinctive feature of the COVID-19 pandemic, as wealthier households tend to spend a higher share of their consumption basket on services that were massively curtailed during the pandemic.[9] In the second and third quarters of 2021, amid a rebound in contact-intensive consumption and building inflationary pressures, the accumulation of deposits moderated, albeit continuing at a higher pace compared with the pre-pandemic period.

Chart B

Deposit flows across the wealth distribution

(changes, as percentages of total disposable income)

Sources: Experimental DWA, Eurostat and ECB calculations.

Notes: “Pre-COVID-19 period” denotes the period between the fourth quarter of 2014 and the fourth quarter of 2019. “Early phases of COVID-19 pandemic” denotes the period between the first quarter of 2020 and the first quarter of 2021. “Surge in inflation period” denotes the period between the second quarter and the third quarter of 2021. Changes in deposits are normalised by total disposable income in the corresponding period. All data are seasonally adjusted.

An empirical model disentangles the underlying drivers of household deposit flows across the wealth distribution.[10] Structural drivers of macroeconomic fluctuations may have different effects on household deposit flows. In the context of strengthening economic activity with higher levels of “demand-pull” inflation, both real consumption and income should rise. By contrast, in the presence of weakening economic activity with higher levels of “cost-push” inflation, declines in real consumption and income should occur at the same time. To assess the impact of the underlying drivers of deposit flows, an empirical model is estimated using quarter-on-quarter growth in real private consumption, the private consumption deflator and deposit flows across the wealth distribution. The model identifies demand-pull and cost-push shocks by assuming that real private consumption rises in response to the former and falls in response to the latter, while both shocks raise the private consumption deflator. Moreover, changes in the Google mobility index capture the impact of the pandemic restrictions on contact-intensive consumption.[11] As the goal is to assess the impact of these structural factors on deposit flows, the response of this variable to all shocks is left unrestricted.[12]

Restrictions on contact-intensive consumption have a positive impact on deposit flows, while the impact of rising inflation depends on the underlying drivers. The results suggest asymmetrical effects among different drivers of inflation. Inflationary cost-push shocks weigh on deposit flows and exacerbate savings inequality by reducing real wages, thereby affecting poorer households to a relatively larger extent (Chart C). Moreover, these shocks have statistically significant effects. By contrast, inflationary demand-pull shocks tend to have opposite and statistically insignificant effects. As for the impact of the pandemic restrictions, the effects of a change in mobility on consumption, prices and inequality mimic those of an inflationary cost-push shock. However, deposit flows increase in response to the pandemic shock owing to the negative impact of mandatory and voluntary restrictions on contact-intensive consumption.

Chart C

Response of deposit flows across the wealth distribution

(quarter-on-quarter growth rates, percentage points)

Sources: Experimental DWA, Eurostat and ECB calculations.

Notes: A structural vector autoregression (SVAR) model is used to assess the structural drivers of household deposit flows across the wealth distribution. The model is identified by means of zero and sign restrictions, whereby a positive demand-pull shock leads to an increase in both real private consumption and the private consumption deflator, while a positive cost-push shock leads to an increase in the private consumption deflator and a decline in real private consumption. The responses of deposit flows (total and different measures across the net wealth distribution) and the Gini coefficient are left unrestricted. Real private consumption and the private consumption deflator are assumed not to respond on impact to other unidentified shocks by imposing zero restrictions. The model is estimated based on quarterly data expressed in quarter-on-quarter percentage changes from the first quarter of 2009 to the third quarter of 2021. All data (except the Gini coefficient) are seasonally adjusted. The yellow lines refer to the 68% credibility band.

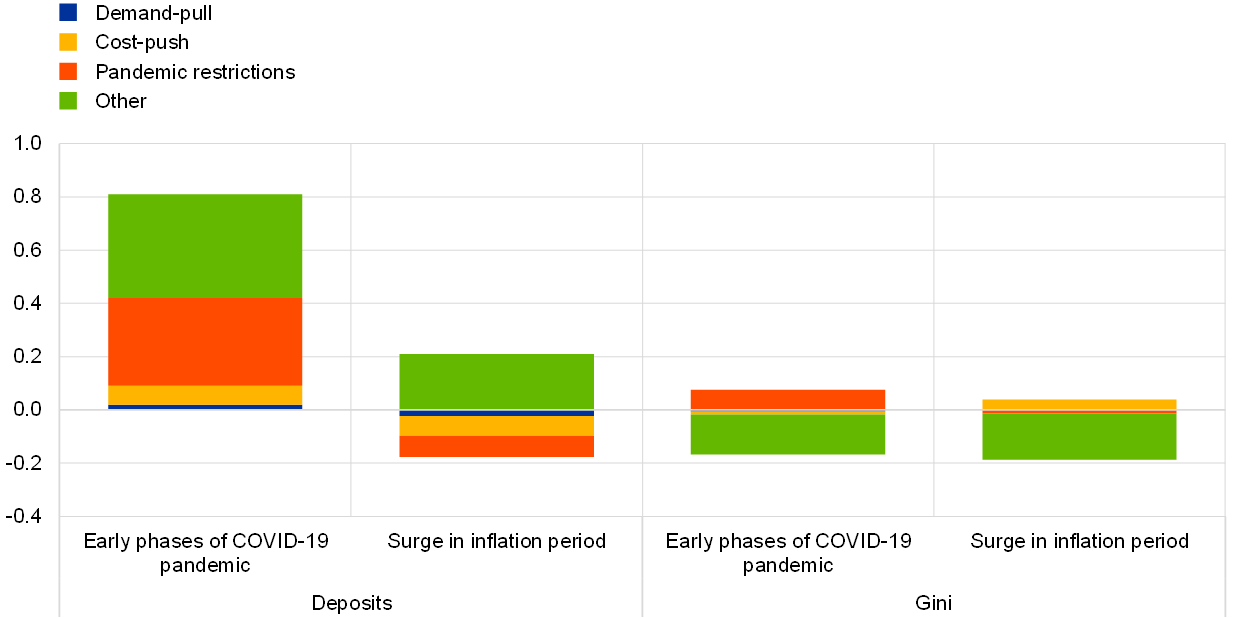

Inflationary cost-push shocks weighed on deposit flows and increased savings inequality in the second and third quarters of 2021, partly offset by looser pandemic restrictions. The increase in deposit flows between the first quarter of 2020 and the first quarter of 2021 was due to restrictions on contact-intensive consumption and, to a lower extent, disinflationary cost-push shocks (Chart D). However, this picture reversed in the second and third quarters of 2021, with looser pandemic restrictions and cost-push inflation weighing on deposit dynamics. Over the same period, the former led to a decline in savings inequality, stimulating contact-intensive consumption, especially for wealthier households, while the latter had the opposite effect, weighing relatively more on the real labour income of poorer households. This suggests that households, especially at the lower end of the wealth distribution, might have adjusted deposit flows to cushion the impact of inflationary cost-push shocks on consumption spending.[13]

Chart D

Drivers of total deposit flows and the Gini coefficient

(contributions to deviations from quarter-on-quarter trend growth rates in the fourth quarter of 2019, percentage points)

Sources: Experimental DWA, Eurostat and ECB calculations.

Notes: A structural vector autoregression (SVAR) model is used to assess the structural drivers of household deposit flows across the wealth distribution. The model is identified by means of zero and sign restrictions, whereby a positive demand-pull shock leads to an increase in both real private consumption and the private consumption deflator, while a positive cost-push shock leads to an increase in the private consumption deflator and a decline in real private consumption. The responses of deposit flows (total and different measures across the net wealth distribution) and the Gini coefficient are left unrestricted. Real private consumption and the private consumption deflator are assumed not to respond on impact to other unidentified shocks by imposing zero restrictions. The model is estimated based on quarterly data (expressed in quarter-on-quarter percentage changes) from the first quarter of 2009 to the third quarter of 2021. All data (except the Gini coefficient) are seasonally adjusted. “Early phases of COVID-19 pandemic” denotes the period between the first quarter of 2020 and the first quarter of 2021. “Surge in inflation period” denotes the period between the second quarter and the third quarter of 2021.

It is likely that recent developments in household deposit flows and savings inequality have been shaped by pandemic restrictions and cost-push inflation, as well as uncertainty caused by the war in Ukraine. In the fourth quarter of 2021 and the first quarter of 2022, tighter restrictions on contact-intensive consumption and inflationary cost-push shocks should have had opposite effects on deposit dynamics, and they should have both exacerbated savings inequality. Uncertainty caused by the war in Ukraine may have increased precautionary savings by households, but may also have induced portfolio rebalancing effects, ultimately having unclear effects on deposit flows and their distribution.

Total household savings go beyond changes in deposit holdings. This is because households typically save in a variety of ways, depositing money into a bank account or buying financial assets (i.e. stocks, mutual fund shares and bonds), real estate or other assets, such as non-financial business assets if households are active as sole proprietors.

In this context, liquid assets refer to the sum of deposits, bonds and listed equities. Across the wealth distribution, deposit flows represent about 80% of total flows in liquid assets for the bottom 50% of the distribution, while they represent about 70% for the next 40% and only 36% for the top 10%.

For an overview of the developments of total household savings and the drivers during the pandemic, see the box entitled “COVID-19 and the increase in household savings: precautionary or forced?”, Economic Bulletin, ECB, Issue 6, 2020, and the box entitled “COVID-19 and the increase in household savings: an update”, Economic Bulletin, ECB, Issue 5, 2021.

See, for instance, the article entitled “Energy prices and private consumption: what are the channels?” in this issue of the Economic Bulletin.

See, for instance, the article entitled “Economic inequality and citizens’ trust in the European Central Bank” in this issue of the Economic Bulletin.

The DWA are an experimental dataset that uses historical relationships between macroeconomic quarterly sectoral accounts aggregates and survey distributions to extrapolate from the net wealth distribution measured in the various waves of the Household Finance and Consumer Survey (HFCS). The DWA are under development and the first results used in this box are therefore provisional.

These developments are also related to the way in which the experimental DWA data are constructed, as the last survey that takes into account shifts in the wealth distribution dates back to 2017. Therefore, the data for the latest quarters after the last available HFCS wave need to be interpreted with caution, since they are extrapolated under the assumption of a stable distribution at the level of each instrument, while allowing for changes to the wealth distribution owing to different developments across instruments. Results on the distributional changes during the COVID-19 pandemic will become available with the next HFCS in 2023.

This is confirmed by Bounie et al. (2020) using data on bank deposits for France, “Consumption Dynamics in the COVID Crisis: Real Time Insights from French Transaction & Bank Data”, CEPR Discussion paper series, No DP15474, November 2020.

See the box entitled “COVID-19 and income inequality”, Economic Bulletin, ECB, Issue 2, 2021.

The analysis is based on a zero and sign-restricted structural vector autoregression (SVAR) model, which is estimated with Bayesian techniques over the sample between the first quarter of 2009 and the third quarter of 2021. For a similar model framework, see the article entitled “Energy prices and private consumption: what are the channels?”..

The Google mobility index for the euro area enters the model as an exogenous variable and is calculated as a composite indicator constructed as the average of the euro area indices for recreation, workplaces and transit stations, computed as population-weighted of the country-specific indices.

Moreover, real private consumption and the private consumption deflator are assumed not to respond on impact to other unidentified shocks by imposing zero restrictions. For further details on the methodology, see the article entitled “Energy prices and private consumption: what are the channels?” in this issue of the Economic Bulletin.

This is in line with the fact that poorer households spend a relatively large share of their income on energy. For more information, see the article entitled “Energy prices and private consumption: what are the channels?” in this issue of the Economic Bulletin.