- THE ECB BLOG

One year of the PEPP: many achievements but no room for complacency

Blog post by Christine Lagarde, President of the ECB

22 March 2021

One year ago, we launched our pandemic emergency purchase programme (PEPP). Since then, the PEPP has provided crucial support to euro area citizens in difficult times. It stabilised financial markets by preventing the market turbulence in the spring of last year from morphing into a full-blown financial meltdown with devastating consequences for the people of Europe. And it has ensured that financing conditions have remained favourable, helping households and families to sustain consumption, firms to remain in business and governments to undertake the necessary fiscal actions.

We launched the PEPP on 18 March 2020, with an initial envelope of €750 billion, as a targeted, temporary and proportionate measure in response to a public health emergency that was unprecedented in recent history.[1] The rapid spread of the coronavirus (COVID-19) and the far-reaching containment measures constituted an extreme economic shock, effectively switching off large parts of the economy. Public life came to a standstill.

Conditions in financial markets deteriorated sharply as liquidity dried up and investors sought the safety of the least risky assets, causing acute fragmentation in the single currency area. Equity prices dropped by nearly 40% in a matter of weeks, sovereign bond yields surged in most countries and corporate bond spreads widened to levels last seen during the global financial crisis.

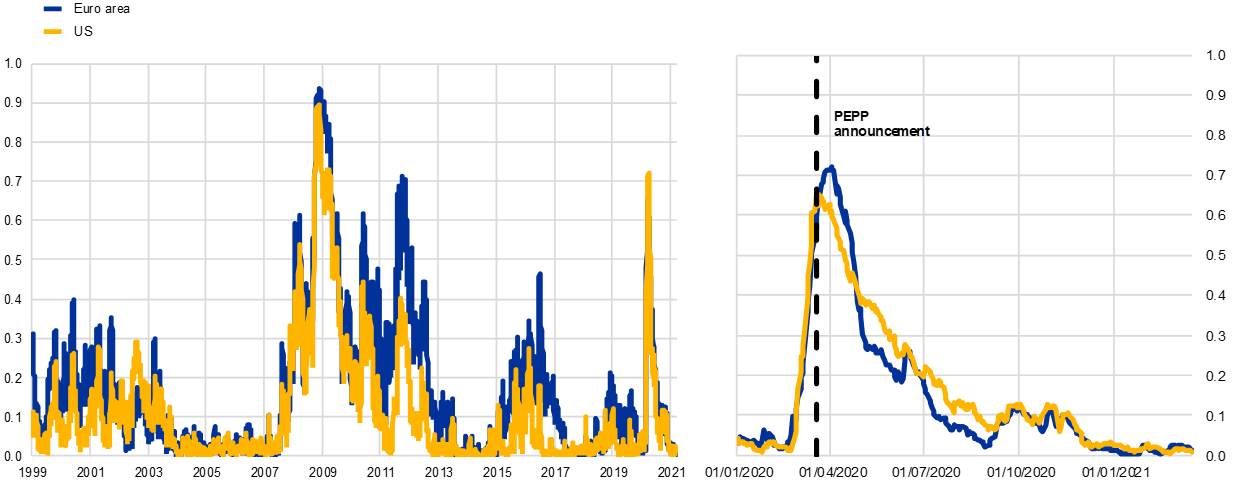

In short, a perilous macro-financial feedback loop threatened to impair the smooth transmission of our monetary policy, putting at risk the achievement of the ECB’s price stability mandate. Indicators of stress across different market segments reflect the severity of the situation in global financial markets at the onset of the crisis (Chart 1).

Chart 1

Composite indicator of systemic stress for the euro area and the United States

(0 = no stress, 1 = high stress)

Source: Working Paper Series, No 1426, ECB.

Notes: The composite indicator of systemic stress aggregates stress symptoms across money, bond, equity and foreign exchange markets and is computed from time-varying correlations among individual asset returns. The latest observation is for 18 March 2021.

The launch of the PEPP acted as a powerful circuit breaker. Market conditions stabilised before we bought even a single bond. Our commitment to do everything necessary within our mandate to support the euro area economy throughout the pandemic was understood and internalised by markets from day one.

Flexibility in the way asset purchases can be conducted under the PEPP underlined our commitment. To this day, this flexibility remains the PEPP’s most precious asset. It has allowed our purchases to fluctuate over time, across asset classes and among jurisdictions to stave off risks to the transmission of our policy where and when they were most pressing.

In the first months of the programme, when the risk-bearing capacity of private investors was severely constrained, we frontloaded purchases to help restore orderly liquidity conditions, absorbing assets at a pace well in excess of €100 billion every month, on top of the monthly purchases under the asset purchase programme, which we decided to also step up with an additional envelope of €120 billion. We also shifted a large share of our purchases to the commercial paper market to help euro area corporates manage their rising short-term cash needs. And we distributed our purchases across the euro area in a way that succeeded in reducing fragmentation and ensuring that all sectors and countries benefited from our monetary policy response.

By the summer, buttressed by the establishment of three European safety nets for households, firms and governments and the launch of the EU Recovery and Resilience Facility, euro area bond markets had largely been restored to normal, as also evidenced by the strong revival of the primary market for corporate bond issuance.

Additional wide-ranging measures targeted at ensuring that banks remained reliable carriers of our monetary policy protected corporate funding conditions well beyond capital markets. Our recalibrated targeted longer-term refinancing operations (TLTRO III), together with easier collateral standards, provide strong incentives for banks to maintain their lending to the real economy throughout the crisis, benefiting in particular small and medium-sized companies. After the operation settling later this week, we will have extended more than €2 trillion in loans to banks under TLTRO III at historically favourable rates, an unprecedented level of support.

Renewed stability in financial markets was a precondition which allowed the Governing Council to switch the focus in the calibration of PEPP from crisis relief mode to its second modality, that of contributing to an appropriate monetary policy stance. Price pressures in the euro area had softened considerably on account of paralysed activity and weak demand. Headline inflation was rapidly approaching negative territory, also due to temporary factors, and was expected to remain exceptionally weak for a considerable period of time.

Further decisive action was therefore needed to ensure that the PEPP could provide sufficient support to the euro area economy to help offset the pandemic-related downward shift in the projected path of inflation. In June 2020 we expanded the PEPP envelope by €600 billion, to a total of €1,350 billion, and announced that we expected purchases to run for at least another year.

By the end of last year, however, given the sharp resurgence in new COVID-19 infections, it had become clear that the economic fallout from the pandemic would be even more prolonged. The December Eurosystem staff macroeconomic projections pointed to a more protracted weakness in inflation than previously envisaged.

But the environment that the Governing Council faced towards the end of last year differed in two fundamental aspects from the challenges we faced in the early stages of the crisis.

One was the concrete prospect of the rollout of multiple vaccines bringing a solution to the health crisis, which provided some much-needed light at the end of the tunnel.

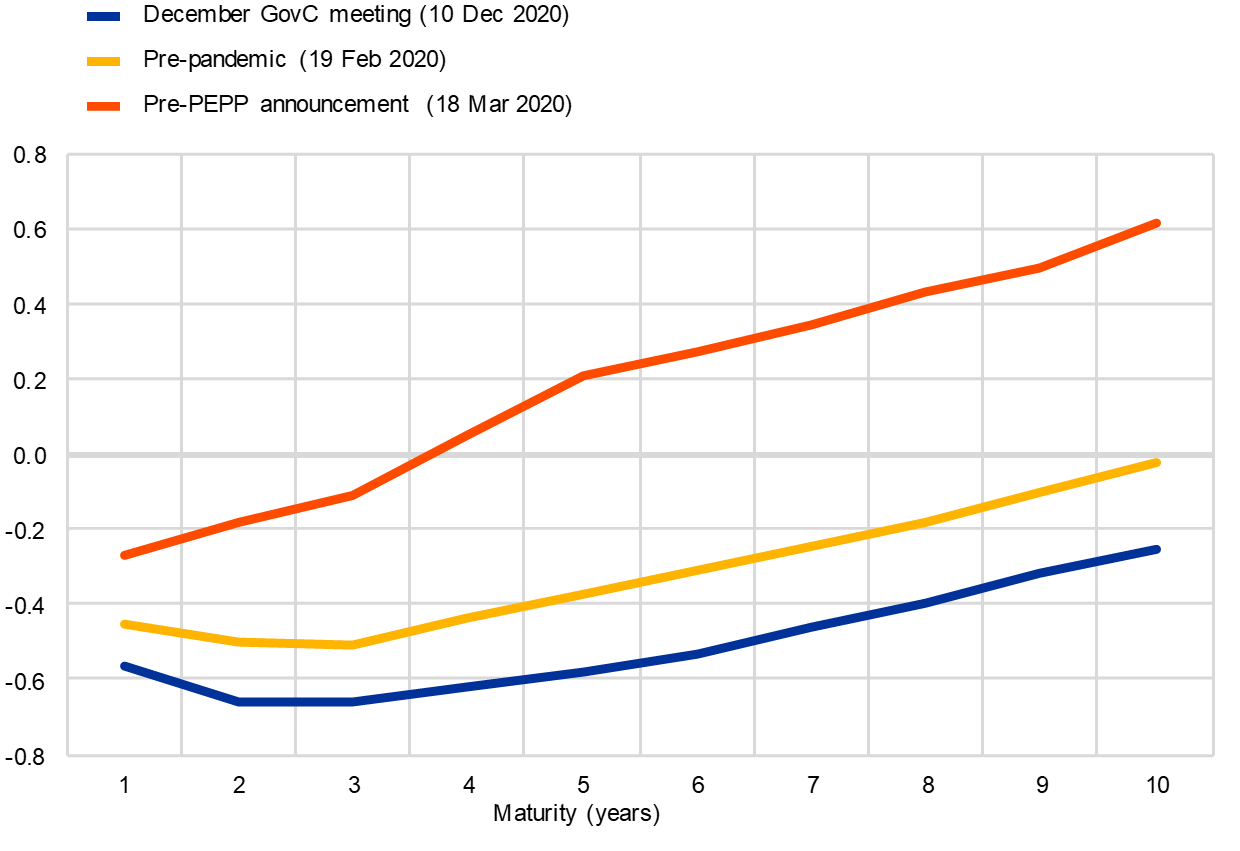

The other was the lasting success of our measures, and the PEPP in particular, in delivering a degree of monetary accommodation that was historic on various levels. The euro area GDP-weighted sovereign yield curve was firmly in negative territory and well below pre-crisis levels (Chart 2). The dispersion across euro area long-term sovereign yields had reached a new low for the period since the global financial crisis. And bank lending rates were at, or close to, historical lows.

Chart 2

Euro area GDP-weighted sovereign yield curve

(percentages per annum)

Source: Refinitiv and ECB calculations.

Against this backdrop, the Governing Council committed to preserving favourable financing conditions for as long as needed in order to bridge the gap until vaccination allowed the recovery to build its own momentum.[2]

The pledge to use the PEPP to preserve favourable financing conditions relies on its inbuilt flexibility. It means that we can purchase less if financing conditions can be maintained on favourable terms even with a lower volume of bond purchases. And it means that we need to purchase more when we see a tightening of financing conditions that is inconsistent with countering the downward impact of the pandemic on the projected path of inflation.

To underpin our commitment, in December 2020 the Governing Council decided to expand the PEPP envelope by an additional €500 billion, to a new total of €1,850 billion – more than 15% of pre-pandemic euro area GDP. Our promise to conduct net asset purchases until at least March 2022 strengthened public confidence in our commitment to remain a reliable and steady source of support even as vaccines are rolled out.

Two broad aspects are crucial to understanding how our commitment works in practice. The first is how we define financing conditions. And the second is how we assess favourability.

We think of financing conditions in a holistic and multifaceted way.

A holistic approach means taking a perspective that covers the entire transmission chain – from “upstream” to “downstream” stages. “Upstream” refers to the interest rates that are at the start of the transmission process: risk-free interest rates and sovereign yields. We say they are located upstream because, on the one hand, they respond fairly well to adjustments in the pace of PEPP purchases and, on the other, they influence, with a lag, the downstream financing conditions for companies and households seeking funding in the capital markets or via bank loans.

A multifaceted approach allows us to study each indicator in its own right rather than basing our assessment on composite measures of financing conditions. This ensures that we take a perspective that is sufficiently granular to allow us to detect movements in specific market segments in a timely manner.

This matters because not all shocks to financing conditions may occur in the upper stages of transmission. Changes in the conditions for government loan guarantee schemes, for example, may affect bank lending conditions without impinging on upstream indicators. Our multifaceted approach assigns an adequate weight to such indicators, also reflecting the importance of bank lending for growth and employment in the euro area.

How, then, do we assess the favourability of financing conditions?

Such an assessment cannot be conducted in isolation. It requires a joint test that appraises the prevailing financing conditions against the euro area’s economic and inflation outlook. That test is conducted incrementally: we assess the drivers, the pace and extent of the change in financing conditions since our last favourability assessment, and the impact of that change on progress towards countering the downward impact of the pandemic on the projected path of inflation.

The quarterly updates of the Eurosystem/ECB staff macroeconomic projections provide an appropriate platform for incorporating all the information that is relevant for us to conduct such a joint assessment. At the same time, we retain the option to adjust the pace of purchases at any point in time in response to potential changes in market conditions, as we have done in the past. In other words, we will continue to purchase flexibly over time, across asset classes and among jurisdictions.

At our Governing Council meeting on 11 March, we assessed recent changes in financing conditions against the latest ECB staff macroeconomic projections.

Downstream indicators, such as bank lending rates, had remained stable and close to historical lows. Upstream indicators, by contrast, had increased measurably since our December meeting. The 10-year euro area overnight index swap rate and the 10-year GDP-weighted sovereign yield had both increased by around 30 basis points, in large part reflecting prospects of a stronger global economic recovery.

A joint assessment of the evolution of financing conditions and the inflation outlook, however, concluded that there was a risk that the repricing in long-term bond yields could be inconsistent with offsetting the negative pandemic shock to the projected inflation path.

While inflation rose at the start of the year and is expected to increase further over the course of 2021, these developments largely reflect transitory factors. Underlying inflation is predicted to increase only moderately in the coming years as slack will continue weighing on price formation in the euro area.

Moreover, uncertainty around the inflation outlook remains considerable, and the latest staff projections suggested a medium-term inflation outlook that was broadly unchanged from the December 2020 projections, foreseeing inflation at 1.4% in 2023, still below the projected path seen before the pandemic.

In this environment, a sizeable and persistent increase in market-based interest rates, if left unchecked, could translate into a premature tightening of financing conditions for all sectors of the economy at a time when preserving favourable financing conditions still remains necessary to underpin economic activity and safeguard medium-term price stability.

Based on this joint assessment, the Governing Council expects purchases under the PEPP over the next quarter to be conducted at a significantly higher pace than during the first months of this year. We will purchase flexibly according to market conditions and with a view to preventing a premature tightening of financing conditions that is inconsistent with countering the downward impact of the pandemic on the projected path of inflation.

The overall crisis response has powerfully illustrated how monetary, supervisory and fiscal policies can be mutually reinforcing, within their respective mandates. Looking back over the past year, the Governing Council has been resolute in its commitment to supporting the citizens of the euro area through this extraordinary crisis. The PEPP has been, and remains, at the core of our policy response to the crisis. And just as the pandemic and the macro-financial landscape have evolved over time, so has the PEPP. Its flexibility has allowed us to respond swiftly to the rapidly changing financial and macroeconomic landscape. Overall, it is fair to say that, without the PEPP, the euro area would presumably have experienced a severe economic and financial crisis with devastating consequences for society as a whole.

And while much progress has been made and we can see light at the end of the tunnel, we cannot be complacent. The near-term economic outlook is subject to uncertainty, relating in particular to the dynamics of the pandemic and the speed of vaccination campaigns. We therefore stand ready to adjust all of our instruments, as appropriate, to ensure that inflation moves towards our aim in a sustained manner, in line with our commitment to symmetry.

- Lagarde, C. (2020), “Our response to the coronavirus emergency”, The ECB Blog, 19 March.

- Lagarde, C. (2020), “Monetary policy in a pandemic emergency”, keynote speech at the ECB Forum on Central Banking, Frankfurt am Main, 11 November.