Published as part of the ECB Economic Bulletin, Issue 5/2023.

This box summarises the findings of recent contacts between ECB staff and representatives of 73 leading non-financial companies operating in the euro area. The exchanges took place between 26 June and 5 July 2023.[1]

Contacts continued to describe a situation consistent with broadly stagnating activity overall, but with substantial variation both across and within sectors. In this respect, not much had changed since the start of the year. Contacts still largely saw business activity rising or falling in relation to how the ripple effects of past shocks (the COVID-19 pandemic and Russia’s invasion of Ukraine) and ongoing structural changes (digitalisation and decarbonisation) affected supply and demand in their industry.

In the industrial sector, weakness was mainly concentrated in the construction and intermediate goods sectors, while developments in the consumer and capital goods sectors were more mixed. Orders and production in much of the intermediate goods sector (chemicals, steel, paper/packaging and electronic components) were reportedly falling due to both subdued final demand and continued de-stocking by customers as well as, in some cases, increased import competition. Demand for new residential and commercial construction was falling most sharply, followed by demand for industrial machinery and equipment. By contrast, infrastructure investment – and generally any investment related to decarbonisation – was proving resilient. Many capital goods manufacturers still had long order books to work through, which was sustaining production despite weak demand. Automotive production continued to recover as supply constraints eased, although there were reports of bottlenecks in logistics hindering the delivery of new vehicles to sales outlets, and demand for internal combustion vehicles was more robust than that for electric vehicles. In the consumer goods sector, the main source of weakness was still falling demand for household appliances and consumer electronics, reflecting the shift in spending from goods to services and the overall squeeze on household incomes (with higher nominal spending on food and energy crowding out spending on consumer durables).

Services sector output was boosted by strong demand for travel and leisure, some resilience in retail trade and growth in digital services, while activity in many other services was stable or contracting. Contacts in the travel and hospitality industries reported very strong growth in activity. Air passenger travel and hotel bookings had recovered or even exceeded their pre-pandemic levels in the second quarter, and bookings for the summer were at full or very high capacity, notwithstanding high prices. Some retailers were surprised by the resilience of consumer spending. While there were still many reports of consumers “downtrading”, especially in relation to food and day-to-day products, clothes retailers mostly reported increasing sales and at least broadly stable volumes. Growth in sales of more expensive clothing brands and luxury items, such as cosmetics and jewellery, were particularly strong as higher income consumers continued to spend. These parts of the retail sector also benefited from the recovery in tourism. Growth in digital services benefited from a combination of structural and cyclical drivers, including the growth of data centres and cloud computing (related to artificial intelligence) and the recovery of roaming services (through tourism). By contrast, demand for transport (shipping and haulage) and logistics (warehousing) services continued to fall. Contacts in employment, security, advertising and business travel services reported broadly stable developments, although business travel still remained at a very low level.

Current trends in activity were likely to persist in the third quarter, with the balance of risks a few quarters ahead tilted mildly to the downside. In the manufacturing sector, some contacts anticipated a recovery in orders later in the year as the inventory cycle turned, but others anticipated reduced production if orders did not recover. There was concern about the weaker-than-expected recovery of the Chinese economy and what this would mean both for exports and for import competition. Capacity constraints would limit the potential for further growth in tourism services during the summer, and doubts were expressed about the sustainability of current levels of consumer spending. Against this background, many contacts thought that there was a very high risk of recession, albeit a mild one, in late 2023 or in 2024. At the same time, a clearer indication of inflation being under control, and hence the path of interest rates, would help reduce uncertainty and boost business confidence.

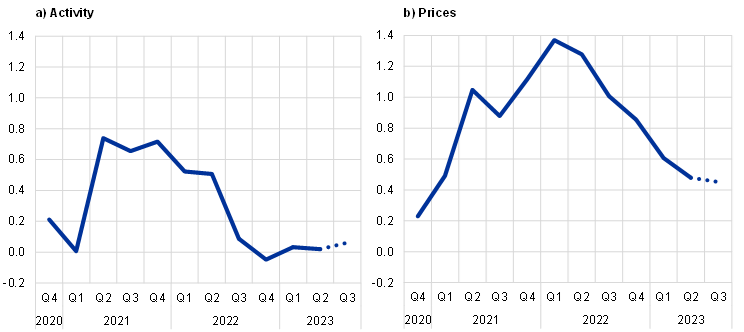

Chart A

Summary of views on activity and prices: developments and outlook

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of what contacts said about quarter-on-quarter developments in activity (sales, production and orders) and prices. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. The dotted line refers to expectations for the next quarter.

Developments in – and the near-term outlook for – employment largely mirrored those for activity and hence were fairly diverse but stable overall. Contacts reported increasing, decreasing and stable employment levels in broadly equal shares with little change compared to the previous quarter. Companies that wanted to reduce headcount could generally achieve this through natural churn, although a small number pointed to expected layoffs later in the year. Reports from employment agencies were fairly varied and included an apparent shift away from permanent placements and towards temporary ones, which was interpreted as a reflection of the high level of business uncertainty. Many contacts continued to find recruitment challenging given shortages of various skills, but there were also a few signs of increasing slack in some parts of the labour market. When asked whether they observed reductions in working hours, these reductions were largely interpreted as part of a longer-term structural shift in preferences around work-life balance and flexible working conditions, especially among younger people.

Overall, selling price increases decelerated further in the second quarter. This aggregate picture nonetheless masked substantial variation. The moderation in price growth in recent quarters largely reflected the effect of past commodity price increases and their subsequent falls feeding through the value chain, while input prices were now increasingly influenced by the rising wages faced by suppliers. Overall, this was giving rise to fairly stable non-labour input costs (with input prices tending to fall at earlier stages of the value chain but still rise further down the chain). Along with the recent easing of non-labour input cost pressures, lower demand made it more difficult for manufacturers and retailers of consumer goods to increase their prices. Several said they had still increased prices and would continue to do so, but that they had to be more cautious and selective during this process, while others anticipated broadly stable prices going forward. Price growth in the services sector generally outpaced that in manufacturing, given the higher share of wage costs. Furthermore, exceptional price growth in the tourism and hospitality sectors, driven by strongly recovering post-pandemic demand, was showing no signs of abating. Overall, contacts therefore anticipated a slightly lower rate of price growth in the third quarter compared with the second quarter. There were also signs of further moderation coming later in the year or in 2024, with an increasing number of contacts expecting prices in their sectors to either stabilise or decline.

Wage expectations point to a slight moderation in wage growth next year. Taking a simple average of the mid-points of the quantitative indications provided, contacts expected wage growth to decelerate from around 5.5% this year to 4.7% in 2024. Around half of contacts expected wage growth in 2024 to be similar to 2023, while four in ten said they thought that wage increases would be lower next year.

For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.