An opportunity to review and improve the EU’s bank crisis management framework

Published as part of the Macroprudential Bulletin 23, December 2023

This article argues that the EU’s crisis management framework for banks should be further improved in two key areas. First, a broader set of crisis management tools should be put in place to deal with failures of small and medium-sized banks. Second, preparedness for systemic crises should be improved. Stricter regulatory requirements and tighter supervision make bank failures significantly less likely by strengthening capital and liquidity buffers, as well as banks’ risk management. Still, bank failures will and should be allowed to happen. This calls for a combination of resolution planning – including the build-up of banks’ own loss-absorbing capacity – and a strong resolution toolkit and industry-funded safety nets, to minimise the fallout for financial stability and the broader economy.

1 Bank crisis management: back in the spotlight

The need to be able to manage banking crises effectively was thrown back into the spotlight in 2023 by the failures of Credit Suisse and several regional banks in the United States. The macro-financial environment is much less predictable than it was before the onset of the COVID-19 pandemic and the Russian invasion of Ukraine. The above-mentioned bank failures, though outside the EU, have been a powerful reminder of the need to ensure the readiness of the EU to effectively manage a banking crisis here, should one arise.

This heightened interest in bank crisis management fortuitously coincides with an opportunity to improve the EU’s bank crisis management framework. Following years of preparatory work and consultation, the European Commission put forward a proposal for a reform of the EU crisis management and deposit insurance (CMDI) framework in April 2023. Established step by step since 2012, this framework implements the lessons learned from the great financial crisis (GFC) in 2008-09 and the euro area sovereign debt crisis in 2010-12. It reflects international best practices as well as the fact that, especially within a tightly integrated monetary union, bank failures have severe cross-border consequences and therefore require joint rules, joint crisis-management institutions and joint safety nets. EU co-legislators are now working on the Commission’s proposal to further enhance the framework.

This article sheds light on what successful bank crisis management looks like, how the EU CMDI framework contributes to such successful crisis management and what could be done to further improve it. This article first surveys the progress made on improving banks’ resilience and preparedness for their possible failure. It then focuses on how to improve the crisis management framework for dealing with failures of smaller banks and systemic crises.

2 What is successful bank crisis management?

The core objective of bank crisis management since the GFC has been to preserve financial stability without exposing taxpayers to losses. Banks fulfil a vital role in the economy. They provide access to efficient payment services and savings options, as well as lending to households and firms, thereby enabling them to make investments or offset temporary income fluctuations. Despite sound regulatory requirements and effective supervision, which increase bank resilience, bank failures will not and should not be excluded. Where access to banking services is disrupted, the impact on households and firms can be severe: their deposits may be frozen or subject to losses, and their access to credit curtailed. Households and firms may then cut back on spending. A banking crisis can thus quickly trigger an economic downturn as seen during the GFC. To avoid such a domino effect, bank crisis management aims at minimising the impact of a bank failure on the bank’s customers, the financial system and the broader economy. Concretely, this requires: ensuring the continuity of systemically important banking services; protecting depositors; and minimising the destruction of value triggered by the bank’s failure. At the same time, these objectives should not be achieved at taxpayers’ expense. Where losses arise, they should first and foremost be borne by the bank’s shareholders as well as unsecured and uninsured creditors, according to their rank in the creditor hierarchy.[1] Finally, non-viable banks must also be able exit the market in an orderly way. This enhances market discipline and sets incentives for prudent risk management by banks.[2]

3 Reducing the likelihood of a bank failure

The most effective way to preserve financial stability and shield taxpayers from losses is to avoid a bank failure in the first place, hence authorities and legislators have prioritised ensuring banks’ resilience. Banks fail primarily because of either solvency or liquidity crises. A solvency failure occurs when a bank is realising or expected to realise losses on its assets that will deplete its equity, and is therefore at risk of not being able to repay its creditors. A liquidity failure occurs when withdrawals by creditors, including depositors, are depleting a bank’s reserves of cash and other liquid assets to such an extent that it may not be able to fulfil further requests for withdrawals right away.[3] These root causes can be difficult to distinguish in practice, as concerns about solvency can trigger liquidity outflows, while liquidity outflows may force the bank to sell assets at a loss. Avoiding a failure therefore requires, first and foremost, good governance and sound risk management by banks. Minimising the likelihood and magnitude of losses as well as establishing prudent buffers of capital and liquidity allows banks to absorb shocks when they do arise.[4] The objective of the Basel Standards is to ensure such governance and risk management are in place. The Standards have been agreed and strengthened over time by the Basel Committee on Banking Supervision, and have been implemented in prudential requirements in jurisdictions around the world (see also Box 1).[5] Banking supervisors – including the European Central Bank, which supervises significant institutions (SIs) in the banking union – are tasked with making sure that banks follow these rules, strengthening their resilience.

A bank is expected to react if its financial situation deteriorates, also drawing on the recovery plans it has prepared for such situations, and banking supervisors also have intrusive tools with which to push banks to take action. The closer a bank comes to failing, the stronger the measures the supervisor can take. EU banking supervisors can require banks to address problems identified, including any risk of breaches of capital or liquidity requirements. They can require changes to the bank’s business strategy and even remove bank managers found unfit to perform their duties and replace them with a temporary administrator.

4 Managing the failure of a bank

Despite effective regulation and supervision, bank failures cannot and should not be ruled out entirely and a crisis management framework is hence needed to minimise the wider impact of such failures. Weak banks should exit the market. How challenging this exit and bank crisis management is depends partly on the size and complexity of the failing bank. This section first discusses the challenges arising from the failure of a large bank and what is needed to preserve financial stability in such a scenario. It then moves on to small and medium-sized banks and the lessons that can be drawn from the framework for big banks. The section concludes with proposals to prepare the EU crisis management framework better for systemic crises.

4.1 Large bank failures: high risks – strong toolkit

During the GFC, fear of the chaos that can be triggered by large uncontrolled bank failures led many governments to opt for state support to the banking sector. The bankruptcy of Lehman Brothers in 2008 demonstrated the destructive systemic effects a bank failure can have. A loss of confidence spread through global financial markets, prompting financial market participants to hoard liquidity. This greatly constrained the availability of market financing and put intense market pressure on banks around the world, including in the EU. Aiming to stop the crisis from spreading further, governments stepped in with taxpayers’ money to shore up banks’ liquidity and solvency positions.[6] In the meantime, the liquidation of Lehman Brothers Holdings, Inc., which is still ongoing as of September 2023, proved to be very costly. Asset sales and the unwinding of Lehman’s derivatives book dislocated markets, and counterparties had to bear significant losses.[7]

Orderly bank failure management for large banks, without the need to use taxpayers’ money, has therefore been a major focus of regulatory efforts following the GFC. Beyond the prudential requirements and crisis management tools for supervisors outlined above, this regulatory work has focused on two areas. First, ensuring that banks’ balance sheets can reliably absorb losses– even after their failure – without endangering financial stability. And second, equipping authorities with the necessary tools to maintain a failed bank’s critical functions and contain the fallout. For this purpose, resolution authorities have been set up around the world to be able to act when a large bank fails.

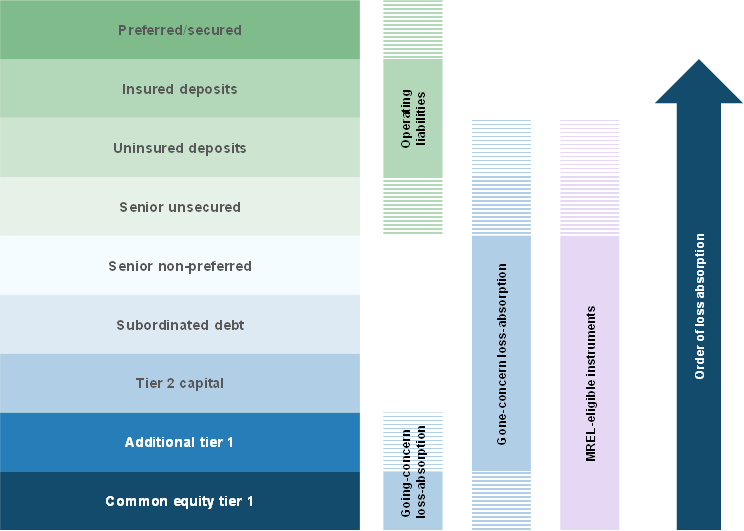

Loss-absorbing capacity for failed banks shields sensitive operating liabilities, including deposits, from losses. A bank’s creditors typically risk losing their investment in a bank failure. However, the ability of a bank’s creditors to absorb such losses varies greatly. On the one hand, a diversified investment fund may aim for high medium to long-term returns, but be able absorb losses on individual investments. On the other hand, individual investors may have most of their liquid assets in their bank accounts. For them, losing these funds would be highly disruptive and could cause contagion risks by prompting deposit runs at other banks, with further knock-on effects for the economy at large.[8] When determining the creditor hierarchy for banks, the legislator takes these differences and financial stability considerations into account. Legislators assign a relatively high ranking to depositors and other operating liabilities such as derivatives. The claims of less vulnerable creditors rank lower: they are first in line to absorb losses in a bank failure, in exchange for higher returns as long as the bank does not fail. Large banks are subject to the Financial Stability Board’s (FSB’s) global standard for total loss-absorbing capacity (TLAC) and, within the EU, similar minimum requirements for own funds and eligible liabilities (MREL)[9]. These require large banks to build up liabilities that can reliably absorb losses when the bank fails, thereby better shielding sensitive operating liabilities. EU resolution authorities, including the Single Resolution Board (SRB) for the large banks in the banking union, set the MREL according to banks’ size and riskiness and the envisaged resolution strategies. They also monitor banks’ compliance with these requirements.

Figure 1

The creditor hierarchy for banks in the EU (simplified)

Note: The figure depicts the creditor hierarchy for banks in the EU, showing their liabilities in the order in which they absorb losses in an insolvency process. Own funds/capital instruments, such as common equity tier 1 (CET1), absorb losses first and to some extent already before a bank’s failure (going concern). Once the bank has failed (gone concern), the remaining own funds and liabilities absorb losses starting with the lowest-ranking ones. The illustration is simplified and in some Member States, some uninsured deposits rank at the same level as senior unsecured instruments. For small and medium-sized banks, CET1 and deposits often make up most of the liability side of the balance sheet, with other types of own funds and debt being of lower importance.

The bail-in tool allows resolution authorities to use a bank’s loss-absorbing capacity to restore the bank’s viability. Bank failures can be triggered by banks making losses on their investments, for example when firms default on bank loans during a recession. Initially, the bank’s losses lower its capital buffers. However in more severe cases, losses may threaten the bank’s ability to repay its creditors or fulfil its capital requirements, leading to the bank’s failure and its resolution . In such a scenario, the bail-in tool can be applied once shareholders’ equity has been written down. The EU’s bail-in tool can: i) absorb additional losses by also writing down some liabilities; and ii) restore the banks’ capital by converting further liabilities into equity. The aim of using this tool – together with a significant restructuring of the bank, including changes to its management if needed – is to restore the bank’s viability, preserving its critical functions and financial stability. However, this will only succeed if there are sufficient liabilities that can reliably absorb losses and if restructuring successfully restores market confidence.

In addition, so-called transfer tools make it possible to sell the key functions of one bank to another bank or a bridge bank. This can preserve the important functions of the bank, such as its ability to provide loans to households and firms, but also its deposit-taking business. It is ideal if such a transfer can be implemented without any delay, for example over a weekend or even overnight, using the sale-of-business tool. If more time is required, for example because no acquirer is immediately available, a temporary bridge bank may need to be set up. The bridge bank continues to provide services to the failed bank’s customers and uninterrupted access to deposits, but only serves as an interim solution until the final sale to another bank is carried out. The sale-of-business tool was used successfully in the EU to resolve Banco Popular Español in 2017, as well as the Croatian and Slovenian subsidiaries of Sberbank in 2022. Recent examples of the use of a bridge bank include the failures of Silicon Valley Bank and Signature Bank in the United States in 2023.[10]

In exceptional cases, where losses are more severe than anticipated, resolution funds can step in. While banks’ own loss-absorbing capacity should be sufficient in the vast majority of cases, it is important to be prepared for scenarios that are more severe than anticipated. In such a severe scenario, for example, losses might be exceptionally high and might have to be imposed on sensitive operating liabilities like unprotected deposits, which could trigger deposit runs at other banks. In the EU, resolution funds have been set up for such scenarios and other cases where external support is needed to implement a resolution. These include the Single Resolution Fund (SRF) in the banking union. Resolution funds are filled through contributions from the banking sector, thereby avoiding risks to taxpayers. The SRF for example reached a size of €77.6 billion by the end of 2023.[11] However, this fund can only exceptionally be used to support resolution in lieu of a bail-in, as the EU requires a prior contribution from shareholders and creditors of at least 8% of the bank’s total liabilities including own funds (TLOF). Therefore, if it is used, the resolution fund is always complementary to banks’ loss-absorbing capacity.

4.2 Enhancing the crisis management framework for small and medium-sized banks

Most bank failures in the EU in the past decade led to the liquidation of the bank rather than its resolution. The resolution framework is the primary route for addressing larger bank failures in the EU. Resolution authorities in the banking union have, in their resolution plans, earmarked most SIs as well as some of the less significant institutions (LSIs) for resolution.[12] The resolution framework therefore covers most of the banking sector in the banking union in terms of banks’ size. However, currently many smaller banks would not be resolved if they were to fail, but would instead be liquidated through a national insolvency process. In resolution, key functions of the failed bank are preserved. By contrast, liquidation typically results in a bank’s piecemeal dismantling. Those depositors covered by a national deposit guarantee scheme (DGS; typically limited to €100,000 per household depositor or smaller firm) are reimbursed within a few days. The assets of the bank are sold or mature over time. Once the proceeds come in, creditors, including the DGS, are at least partially repaid, with those ranking highest in the creditor hierarchy recovering their funds first. It is not uncommon for these insolvency procedures to take more than a decade. Also they can also result in significant losses for uncovered depositors, which may be problematic for financial stability. As seen during the failures of Silicon Valley Bank and Signature Bank in the United States in March 2023, the prospect or experience of bearing losses can, in scenarios of systemic fragility, lead to runs of uncovered depositors on other banks perceived as similar to the failed bank.

Table 1

List of bank failures in the banking union since 2016

Bank | Member State | Year | SI/LSI | Resolution/liquidation |

|---|---|---|---|---|

Maple Bank | DE | 2016 | LSI | Liquidation |

Banca Popolare delle Province Calabre | IT | 2016 | LSI | Liquidation |

Trasta Komercbanka | LV | 2016 | LSI | Liquidation |

Banca Popolare di Vicenza | IT | 2017 | SI | Liquidation |

Veneto Banca | IT | 2017 | SI | Liquidation |

Banco Popular Español | ES | 2017 | SI | Resolution |

Nemea Bank | MT | 2017 | LSI | Liquidation |

Dero Bank | DE | 2018 | LSI | Liquidation |

Versobank | EE | 2018 | LSI | Liquidation |

Banca Sviluppo Economico | IT | 2018 | LSI | Liquidation |

ABLV Bank | LV/LU | 2018 | SI | Liquidation |

PNB Banka | LV | 2019 | SI | Liquidation |

Commerzialbank Mattersburg | AT | 2020 | LSI | Liquidation |

Anglo Austrian AAB Bank | AT | 2020 | LSI | Liquidation |

AutoBank | AT | 2021 | LSI | Liquidation |

Greensill Bank | DE | 2021 | LSI | Liquidation |

Aigis Banca | IT | 2021 | LSI | Liquidation |

Sberbank Europe | AT | 2022 | SI | Liquidation |

Sberbank banka | SI/HR | 2022 | SI | Resolution |

Amsterdam Trade Bank | NL | 2022 | LSI | Liquidation |

Baltic International Bank | LV | 2023 | LSI | Liquidation |

North Channel Bank | DE | 2023 | LSI | Liquidation |

Olympus Cooperative Bank | GR | 2023 | LSI | Liquidation |

Notes: Cases of application of preventive DGS measures, precautionary recapitalisation, preventive private or market-conform public measures are not listed here. Liquidation can entail the application of alternative DGS measures or a DGS payout.

Broadening the scope of application of resolution tools enhances crisis management options for some banks currently earmarked for liquidation. As outlined above, the resolution framework is designed to improve outcomes when a bank fails. Notably, it offers tools which help to manage a bank failure swiftly and with minimal loss of value for creditors[13], thereby better preserving financial stability. The resolution framework also requires banks to prepare for possible resolution by building up additional internal loss-absorbing capacity, thereby shielding depositors and other sensitive operating liabilities from bearing losses. Extending the resolution toolkit to a broader set of banks would therefore be very desirable. Achieving a broader scope of resolution in this way is therefore a cornerstone of the Commission’s CMDI proposal.

Funding is the key challenge for broadening the scope of resolution. The value-preserving features of resolution can contribute to lowering the need for loss absorption as compared with a liquidation scenario. However, also in resolution losses will have to be allocated. Those smaller banks to which resolution could be expanded are often heavily reliant on deposits as a funding source. Depending on local market conditions, they may have difficulty issuing financial instruments that can reliably absorb losses when the bank fails and instead rely more strongly on own funds which may be largely depleted at the point of failure. Compared with larger banks, there is a greater likelihood for these banks that losses in resolution cannot be fully absorbed by dedicated loss-absorbing instruments and that uncovered depositors will have to contribute. For scenarios where loss absorption by uncovered depositors would trigger widespread contagion, the Commission proposal foresees the possibility that the DGS would be able to contribute in resolution in order to safeguard financial stability and to count this contribution towards the threshold for accessing the resolution fund. The DGS, like the resolution funds, is filled with contributions from the banking sector. Once shareholders, creditors and the DGS have contributed 8% of TLOF, the resolution fund could then provide support. This option is subject to strict safeguards[14]. It would make full use of banks’ internal loss-absorbing capacity, and uncovered deposits would still be expected to bear losses – provided this would not raise financial stability concerns. The possibility of using the DGS to unlock access to the resolution fund is crucial for closing possible funding gaps in resolution for small and medium-sized banks. Without it, governments may be faced with a choice between widespread contagion and having to use taxpayers’ money to mitigate it. The crisis management framework should be designed in such a way as to avoid such a dilemma.

Amendments to the creditor hierarchy and the least-cost test would help unlock DGS funding in resolution. The contribution of the DGS in resolution is constrained by the least cost test and the creditor hierarchy. The least cost test limits the contribution of the DGS to the amount of losses the DGS would have had to bear had the institution been wound up under national insolvency proceedings. As EU DGSs enjoy a very high ranking in the creditor hierarchy, they would be prioritised when distributing the liquidation proceeds. The eventual losses for the DGS in an insolvency proceeding are therefore typically rather small – especially for banks earmarked for resolution, which are required to have some internal loss-absorbing capacity in place. In most cases, therefore, the DGS cannot in fact contribute meaningfully in resolution. To allow for such a contribution, amendments are needed to the creditor hierarchy and the least cost test. The Commission proposed introducing a single-tier depositor preference as applied in the United States. This would give all deposits – and hence also the DGS – the same ranking in the creditor hierarchy, above senior unsecured creditors. Therefore it would limit the preferential treatment of the DGS, improving its capacity to contribute under the least cost test. It would also facilitate the bail-in of senior unsecured instruments by avoiding having deposits rank at the same level in the creditor hierarchy, which is currently the case in some Member States. Some question the merits of a single-tier depositor preference, as they are concerned that depositor payouts would become more expensive for the DGS. However, it should be noted that this effect is mitigated to some extent by the fact that payouts are less likely to happen under the revised framework. Alternatives to a single-tier depositor preference can be considered, but in order to safeguard the effectiveness of the reform the alternative solutions should: i) enable the DGS to contribute to the same degree in resolution[15] as it could in the presence of a single-tier depositor preference and ii) achieve a harmonisation of the ranking of deposits that facilitates crisis management by ranking materially all deposits above senior unsecured claims.[16]

Despite the expanded scope of resolution, there will still be banks going into liquidation – and the crisis management options should also be enhanced for these banks. Changing the crisis management strategy for a bank from liquidation to resolution would not be proportionate for all banks. The expansion of the scope of resolution is therefore intended to remain moderate. For many small banks, there will be no public interest in resolution. They will therefore remain earmarked for liquidation. Improving crisis management options for them should therefore be a priority as well. Some Member States and non-EU jurisdictions have developed options for their DGSs to avoid payouts. Such options consist in intervening either to prevent the failure (preventive measures)[17] or to implement a transfer of the failed bank’s assets and liabilities to an acquiring bank (alternative measures). These options are very helpful additions to the toolkit of a DGS. They can bring small banks some of the benefits of resolution, including value preservation, depositor confidence and financial stability. Additionally, they can contribute to reducing pressure on the DGS by avoiding a payout that might dent its financial means considerably. Preventive and alternative measures would therefore usefully complement the expansion of resolution. They should become available across the EU and be subject to the same least cost test conditions as the DGSs’ contribution in resolution.[18]

4.3 Preparedness for systemic crises and completing the banking union

There is room for improvement in the preparedness of the banking union’s crisis management framework for extraordinary scenarios. The areas for improvement concern access to the resolution fund and operationalising a public backstop to the resolution fund, as well as putting in place a framework for liquidity in resolution and a resilient and effective deposit insurance system.[19]

Funding gaps remain a risk in systemic crisis scenarios and a financial stability exemption is needed. The possibility for the DGS’s contribution to facilitate access to the resolution fund will substantially improve crisis management options for adverse scenarios. Yet, even with this option, a funding gap could still emerge. This makes it very difficult for the resolution authority to manage a crisis smoothly. A systemic crisis can exacerbate funding gaps, both by leading to extraordinarily high losses that are sudden and widespread, and by potentially limiting the feasibility of bailing in certain liabilities. With higher losses and less loss-absorbing capacity, banks may have more difficulty fulfilling the 8% TLOF threshold in order to access the resolution fund. For such exceptional scenarios, the International Monetary Fund (IMF) and the ECB recommended introducing a financial stability exemption in the EU, making it possible to lower this threshold subject to strict safeguards.[20]

The backstop to the SRF needs to be put in place. Despite a political agreement to enable the European Stability Mechanism (ESM) to provide a backstop to the SRF, the required amendment to the ESM Treaty has not yet been fully ratified. This is blocking the operationalisation of the backstop. It limits the SRB’s ability to intervene in a scenario in which significant funds from the SRF are needed to effectively implement a resolution strategy, especially during a systemic crisis.

There continues to be an important gap in the banking union: a strong backstop for liquidity support in resolution. EU resolution authorities are well equipped to deal with a large failing bank, especially where the bank’s primary problem arises from doubts about its solvency, i.e. the risk that its assets are worth less than its liabilities. However, to restore market confidence following the resolution of a bank, any liquidity concerns have to be addressed with an unequivocal statement of support based on a public liquidity backstop, as stated in the FSB Guiding Principles.[21] A bank in resolution is quite likely to exhaust its eligible collateral. In the banking union the SRF can provide liquidity, but its size may be insufficient to address the liquidity problems experienced by medium-sized to large banks or during a systemic event. Unlike most other key jurisdictions, the banking union does not yet have a public sector backstop to provide liquidity with sufficient size and speed.[22] The FSB has long recommended the setting-up of a public sector backstop to provide temporary funding in resolution. The importance of such a backstop was also underlined by the Credit Suisse case, where the Swiss central bank made CHF 200 billion available following the bank’s failure, of which CHF 100 billion was backed by a government guarantee. The liquidity assistance helped stabilise the bank following its failure and was repaid within less than three months.[23]

A European Deposit Insurance Scheme (EDIS) is needed to enhance the resilience of the crisis management framework and to ensure equal protection and value of deposits across the banking union. While the Commission’s CMDI proposal will strengthen DGSs’ ability to act, setting up an EDIS is only envisioned for the medium term. The DGS landscape in the banking union will therefore remain fragmented along national lines. This diminishes the capacity of the crisis management framework to absorb severe shocks and maintains the link between banks and national public finances. It also impedes the creation of a level playing field and weakens financial stability, which means that key objectives of the banking union are not achieved. A common EDIS would ensure that the level of confidence in the safety of bank deposits is equally high in all participating Member States, reducing the risk of bank runs, enhancing financial stability and helping to complete the banking union.

5 Conclusion

EU regulators, supervisors and resolution authorities have made significant progress on making banks more resilient and ensuring their resolvability. Stricter regulatory requirements and tighter supervision make bank failures significantly less likely by strengthening capital and liquidity buffers as well as banks’ risk management. The combination of resolution planning – including the build-up of banks’ internal loss-absorbing capacity – with a strong resolution toolkit and industry-funded safety nets minimises the fallout for financial stability and the broader economy when a bank nonetheless fails.

The EU crisis management framework needs to be better prepared for failures of smaller banks and for systemic crises. The Commission’s CMDI proposal, once adopted by co-legislators, will improve the handling of bank failures by making the resolution toolbox available to a broader set of banks. In particular, it should also address funding gaps that may arise for smaller banks. Greater ambition among co-legislators to improve crisis management for banks going into liquidation would be welcome. In addition, the crisis management framework would be better prepared for a systemic crisis with a financial stability exemption for accessing the resolution fund, the ESM backstop to the SRF, a European framework for liquidity in resolution and EDIS.

The creditor hierarchy determines the order in which creditors recover their funds in an insolvency process. A detailed overview is provided by the SRB: “Creditor Ranking in the jurisdictions of the banking union”.

Financial Stability Board (2014), “Key Attributes of Effective Resolution Regimes for Financial Institutions”.

Breaches or likely breaches of supervisory requirements can lead to a bank being declared failing or likely to fail before they are formally insolvent or illiquid.

See also keynote speech by Andrea Enria, “Well-run banks don’t fail – why governance is an enduring theme in banking crisis”.

See “Basel Committee on Banking Supervision – The Basel Framework”.

See also Wiggens, Metrick (2019), “The Lehman Brothers Bankruptcy H: The Global Contagion”.

As of April 2023, senior unsecured creditors have only been able to recover 46.6% of their claims. (See also Benahmed (2023), “Enhancing the credibility of the EU bail-in design: the example of the treatment of discretionary exclusions”).Some deposits are therefore also protected by deposit guarantee schemes.

TLAC applies only to global systemically important banks, while the MREL applies to a broader set of EU banks. See SRB (2023), “Minimum Requirement for Own Funds and Eligible Liabilities”.

For the sake of completeness, it should be noted that EU resolution authorities can also use an asset separation tool in combination with the aforementioned resolution tools.

See the SRB press release (2023), “Single Resolution Fund grows by €11.3 billion to reach € 77.6 billion”.

The category “significant institutions” comprises the 109 most significant banks and banking groups in the banking union. All significant institutions are supervised by the ECB and the resolution authority in charge of them is the SRB. The SRB envisages resolution in 85% of the 103 resolution plans developed for the banking union banks under its scope – see SRB (2023), “Resolvability of banking union banks: 2022”. The category “less significant banks” covers the remaining banks, which are supervised at national level.

See for example the “Valuation 3 report for Banco Popular Español”, which shows that liquidation would have resulted in a doubling or tripling of losses for shareholders and creditors compared to resolution. Creditor losses alone would have been higher in liquidation by a factor of 7 to 12.

For a broader discussion of the value preserving features of transfer tools, see Eule, Kastelein and Sala (2022), “Protecting depositors and saving money”.For example, the option is only available to banks that have previously been earmarked for resolution and only when transfer tools are used.

Or by means of preventive and alternative measures, which are addressed in more detail below.

For further details on the advantages of a depositor preference, see Section 9 of the ECB Opinion on the CMDI proposal (Opinion of the European Central Bank of 5 July 2023 on amendments to the Union crisis management and deposit insurance framework; OJ C 307,31.8.2023, p. 19).

While applied primarily to smaller banks, in principle this option may also be available for banks earmarked for resolution.

For a broader discussion of alternative measures in comparison to DGS payouts, see Eule, Kastelein and Sala (2022), “Protecting depositors and saving money”.

See Costa et al (2022), “Counting the cost of payout: constraints for deposit insurers in funding bank failure management” and Grund, Nomm and Walch (2020), “Liquidity in resolution: comparing frameworks for liquidity provision across jurisdictions”.

See IMF (2018), “Euro Area Policies: Financial Sector Assessment Program-Technical Note-Bank Resolution and Crisis Management” and paragraph 8.5 of the ECB Opinion on the CMDI proposal.

See FSB (2018), “Funding Strategy Elements of an Implementable Resolution Plan”.

See Grund, Nomm and Walch (2022), “Liquidity in resolution: comparing frameworks for liquidity provision across jurisdictions” and Amamou et al (2020), “Liquidity in resolution: estimating possible liquidity gaps for specific banks in resolution and in a systemic crisis”.

See FSB (2018), “Funding Strategy Elements of an Implementable Resolution Plan”, FSB (2023) “2023 Bank Failures: Preliminary lessons learnt for resolution”, “Swiss National Bank provides substantial liquidity assistance to support UBS takeover of Credit Suisse” and “Credit Suisse has paid back government-backed liquidity, Swiss finance minister says”.