Understanding banks’ response to collateral value shocks – insights from AnaCredit and the COVID-19 shock in commercial real estate (CRE) markets

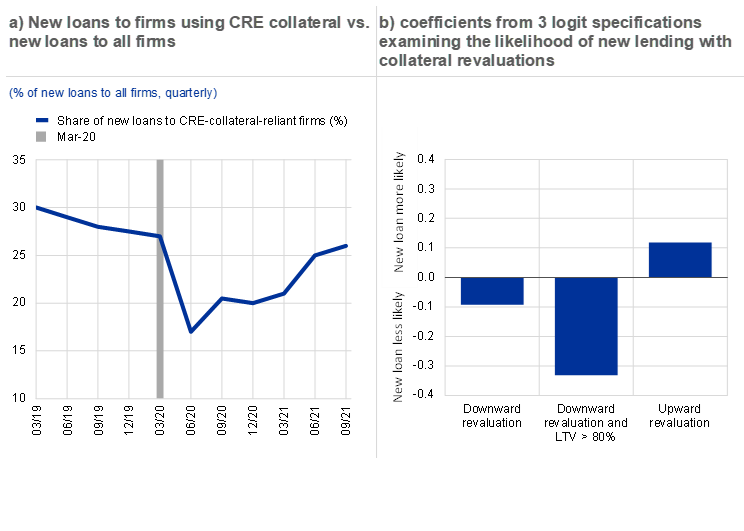

During the COVID-19 pandemic banks appeared to avoid lending to firms that were reliant on CRE collateral, even though their formal collateral revaluations showed little response to the CRE market shock. Chart A (left panel) uses AnaCredit data to show quarterly new loans to firms reliant on CRE collateral as a share of new loans to all firms.[1] This ratio drops sharply at the outbreak of the COVID-19 pandemic, suggesting that banks – despite their limited collateral revaluations – disproportionately decreased lending to CRE-reliant companies. We can confirm the statistical significance of this result using difference-in-difference regressions. The granularity of AnaCredit data allows us to run a number of tests to ensure that the result is not solely driven by banks’ unwillingness to lend to firms involved in CRE activities.[2] For example, it even holds when we include borrower fixed effects, meaning that when the same firm borrowed from multiple banks, they received less credit from the bank where the firm used CRE collateral before the pandemic.

Chart A

Banks appeared to avoid lending against CRE collateral during the COVID-19 pandemic, particularly when downward revaluations were made

Source: Anacredit, ECB calculations.

Notes: Left panel: pre-pandemic CRE-collateral reliance means that 100% of collateral pledged in a company/bank relationship was classified as CRE; right panel: the chart shows coefficients from logit regressions of revaluations run dummy on dummy for new loans made in a given month in 2020 and 2021. Controls included the revaluation dummy, the bank’s pre-COVID-19 CET1 and NPL ratios (Dec 2019), the number of loans outstanding between the bank and borrower in February 2020, the average number of new loans between the bank and borrower during the years 2018-2020; dummy = 1 if new collateral is posted that month. Borrower fixed effects included.

Where downward revaluations did occur, this was associated with a lower likelihood of lending, particularly to highly leveraged borrowers. Chart A (right panel) shows coefficients of interest from three separate logit regressions run on AnaCredit data where dummies reflecting the downward or upward revaluation of CRE collateral in a given month are regressed on a dummy which equals 1 if a new loan is made in that month. The first bar shows that a downward revaluation reduces the likelihood of a new loan being made and the second bar shows that this relationship is up to four times stronger when the borrower is highly leveraged. As expected, an upward revaluation increases the likelihood of the loans being extended. Again, this result is robust to a number of endogeneity tests and the coefficients shown are also from regressions including borrower fixed effects.

Pre-COVID-19 reliance is used to categorise firms so that results are not affected by government guarantees during the pandemic.

We know that this dynamic was playing out at the same time – see article 3 on commercial real estate, Chart 3 (left-hand side).