- 22 JUNE 2023 · RESEARCH BULLETIN NO. 108

Navigating liquidity crises in non-banks: An assessment of central bank policies

Using runs on mutual funds in March 2020 as a laboratory, this article examines central bank interventions that can help alleviate a liquidity crisis in the non-bank financial sector, given that non-banks do not have access to the lender of last resort. We find that the new large-scale asset purchase programme announced on 18 March 2020 was particularly effective in improving mutual fund performance and stopping runs on funds.

Overview

Non-bank financial intermediaries are playing an increasingly prominent role in the financial system. Their assets almost doubled during the second decade of the century, rising from €25 trillion in December 2009 to €47 trillion in December 2019 (when they represented 56% of total financial sector assets). As the importance of non-banks grew, so too did concerns that disruptions in the non-bank sector could lead to significant disruptions in the broader financial markets. These concerns materialised in March 2020 when investors in bond mutual funds started redeeming their shares on a large scale (see, for example, Falato, Goldstein and Hortaçsu, 2021). This quickly spilled over to financial markets, as funds sold off assets in an attempt to obtain liquidity to satisfy large redemption requests from investors (Ma, Xiao and Zeng, 2022; and Vissing-Jørgensen, 2021).

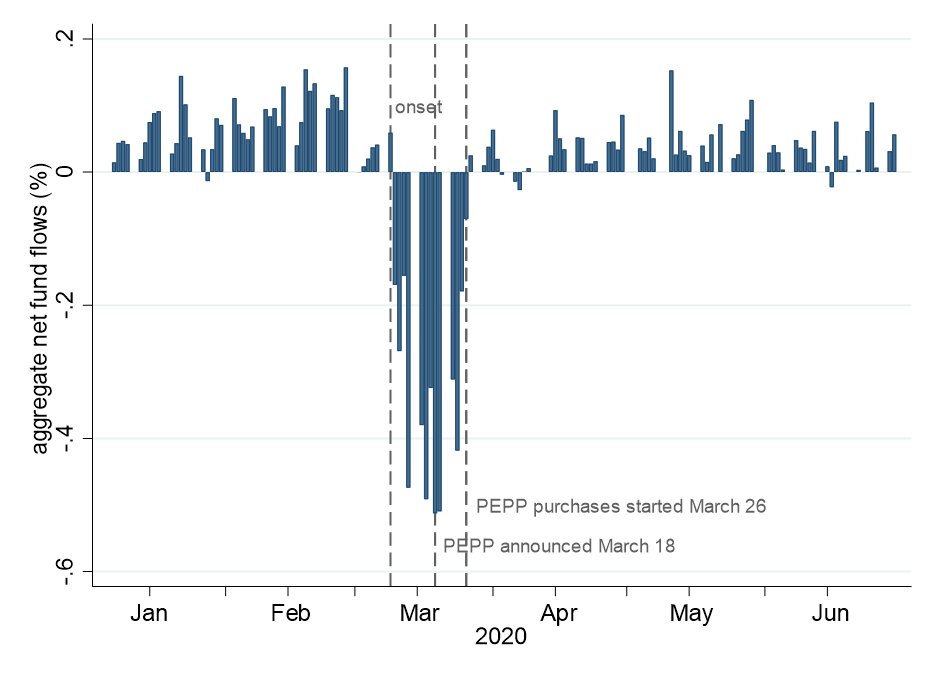

Chart 1 illustrates a run by investors on bond mutual funds investing in euro area securities in March 2020. It shows the balance between inflows of cash into the funds and outflows, with negative bars indicating net outflows from the mutual fund sector. Outflows reached their peak in the week of 16 March 2020. The developments in outflows are similar to the pattern documented by Falato, Goldstein and Hortaçsu (2021) using data on US corporate bond funds, although in our dataset outflows are somewhat smaller as we focus on investment-grade bond funds (investing in both government and corporate bonds).

Chart 1

Mutual fund net flows and key events

Notes: This chart depicts the evolution of daily average net fund flows (inflows minus outflows) before and after the initial coronavirus (COVID-19) shock in March 2020. The vertical dotted lines depict key events: the onset of the run (from 9 March) refers to the period of substantial mutual fund outflows; the ECB’s announcement of its pandemic emergency purchase programme (PEPP) on 18 March 2020 (since this took place after markets closed, the dotted line denotes 19 March 2020); and the start of PEPP purchases on 26 March 2020.

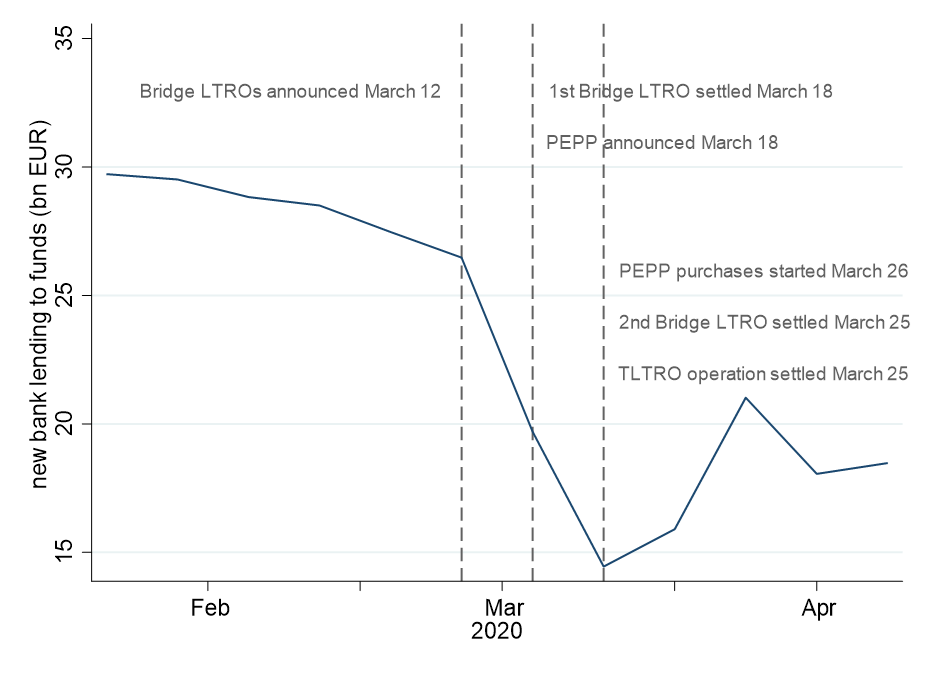

Faced with large investor redemptions, funds could sell off assets or, alternatively, generate cash by pledging assets as collateral in secured (repo) markets. However, using proprietary transaction-level data on repo trading we document that bank cash lending to funds dropped by 50% between early February and late March, falling from €30 billion to €15 billion per day (Chart 2). This further aggravated the liquidity tensions faced by the fund sector.

Chart 2

Bank lending to funds in the secured (repo) market, new transactions

Notes: This chart depicts the evolution of bank lending to funds in the euro area secured (repo) markets in terms of volumes of new transactions. The vertical dotted lines refer to key policy events: the announcement of bridge longer-term refinancing operations (LTROs) on 12 March 2020; the settlement of the first bridge LTRO on 18 March 2020; the announcement of the PEPP (after markets closed on 18 March 2020); and the package of measures settled/implemented on 25-26 March 2020 (the start of PEPP purchases); the settlement of the second bridge LTRO; and the settlement of a targeted LTRO (TLTRO-III, a “funding-for-lending” scheme that the ECB put in place in 2014, for which banks already submitted the required documentation in February 2020).

In Breckenfelder and Hoerova (2023), we aim to understand which central bank interventions can help alleviate a liquidity crisis in the non-bank financial sector, given that non-banks do not have access to the lender of last resort. Using the runs on mutual funds in March 2020 as a laboratory, we assess the effects of two interventions by the European Central Bank (ECB).

First, we analyse large-scale asset purchases, which can mitigate fire-sales in markets by stabilising market prices of assets held by funds. Improved fund performance can in turn alleviate investor runs (Goldstein, Jiang and Ng, 2017). Our analysis sheds light on these mechanisms by studying fund performance and fund outflows, using detailed fund-level data.

Second, we ask whether central bank liquidity provision to banks can trickle down to funds. Banks have access to the lender of last resort and, in the absence of frictions, can pass on central bank liquidity to non-bank financial intermediaries. We focus on bank-fund transactions in the repo markets to examine whether banks intermediate central bank liquidity to non-banks in a crisis. Repo markets provide a unique setting for our analysis: they provide short-term funding to those in need of immediate liquidity and banks act as key providers of liquidity in this market.

Large-scale asset purchases: impact on funds

On 18 March 2020 the ECB announced a new large-scale asset purchase programme, the pandemic emergency purchase programme (PEPP). The PEPP was launched to “counter serious risks to the monetary policy transmission mechanism and the outlook for the euro area posed by the COVID-19 outbreak”.[2]

To assess the effects of asset purchases, we focus on bond mutual funds that satisfy two criteria. First, they invest in investment-grade securities, meaning that they hold high-quality securities. Second, they hold euro area securities in their portfolio, meaning that they have exposure to the euro area. Using detailed fund-level data, we compare funds that were holding larger shares of assets eligible for PEPP purchases in their portfolio before the pandemic crisis with funds holding smaller shares. Importantly, we show that these two groups of funds are similar in terms of observable characteristics and had the same performance and flow dynamics before the PEPP announcement on 18 March 2020.

We find that after the announcement of the PEPP, a significant performance gap emerged between the funds holding more eligible bonds and funds holding fewer eligible bonds, with the former group performing relatively better. In the week of the PEPP announcement, the performance gap was 3.6 percentage points. In the week of 26 March the gap was still 2.7 percentage points, declining to 2.1 percentage points in the following week. Thereafter, there was no longer any significant difference between the two groups of funds.[3] We then examine whether the PEPP also led to a reduction in daily outflows from funds. We indeed find that after the announcement of the PEPP funds with larger eligible bond holdings had significantly lower outflows – a 61% decrease – compared with funds with smaller eligible bond holdings. Interestingly, by the end of March 2020 the run had stopped, and the flows had largely stabilised across both fund groups.

Liquidity provision to banks: impact on repo lending to funds

Banks and funds interact in repo markets, as documented in Chart 2. To assess whether central bank liquidity provision to banks trickles down to non-banks, we study bank lending to funds in the repo market. In particular, we ask whether banks lent more to funds following the additional provision of central bank liquidity by the ECB in March 2020.

On 12 March 2020 the ECB announced additional “bridge” LTROs, designed explicitly to “provide immediate liquidity support to banks and to safeguard money market conditions”.[4] These operations – satisfying bank demand for central bank liquidity without pre-set limits, against a large set of eligible collateral – were conducted on a weekly basis.

We find that banks that were themselves affected by the March 2020 liquidity tensions – and which therefore particularly welcomed central bank liquidity provision – lent relatively more to funds compared with other banks. The growth rate of repo lending to funds increased by a factor of 1.5 for such banks. The increase was even larger (up to a factor of 5) for banks that borrowed from the ECB in the first bridge LTRO operation settled on 18 March 2020. This finding suggests that banks do pass on some of the central bank liquidity they obtain from the lender of last resort to other players through financial markets.

Conclusions

We document that the provision of central bank liquidity to banks supported bank repo lending to funds. At the same time, repos are not a panacea for funds as their ability to borrow is limited by the restrictions on their leverage. By contrast, central bank asset purchases, akin to the market-maker of last resort interventions, do not create additional leverage for funds.[5] We show that funds with larger shares of assets eligible for purchases in their portfolio before the pandemic crisis hit saw their performance improve and their outflows decrease significantly relative to otherwise similar funds, following the announcement of the new large-scale asset purchase programme by the ECB.

Overall, our results suggest that even though funds did not have direct access to the lender of last resort, central bank interventions were nevertheless able to reach them during a severe liquidity crisis. We find central bank asset purchases to be particularly effective. Therefore, to the extent that non-banks hold high-quality marketable assets on their balance sheets, they could benefit from central bank asset purchases in the event of an aggregate liquidity squeeze. Importantly, central bank interventions to preserve market functioning should be a last resort and not a substitute for the private sector self-insuring against liquidity risk, e.g., by means of appropriate holdings of liquid assets.

References

Breckenfelder, J. and Hoerova, M. (2023), “Do non-banks need access to the lender of last resort? Evidence from fund runs”, Working Paper Series, No. 2805, ECB, April.

Buiter, W., and Sibert, A. (2007), “The central bank as the market maker of last resort: From lender of last resort to market maker of last resort”, VoxEU.org, 13 August.

Buiter, W., Cecchetti, S., Dominguez, K. and Sánchez Serrano, A. (2023), “Stabilising financial markets: lending and market making as a last resort”, VoxEU.org, 6 February.

Falato, A., Goldstein, I. and Hortaçsu, A. (2021), “Financial fragility in the COVID-19 crisis: The case of investment funds in corporate bond markets”, Journal of Monetary Economics, Vol. 123, pp. 35-52.

Goldstein, I., Jiang, H. and Ng, D. T. (2017), “Investor flows and fragility in corporate bond funds”, Journal of Financial Economics, Vol. 126, No 3, pp. 592-613.

Ma, Y., Xiao, K. and Zeng, Y. (2022), “Mutual fund liquidity transformation and reverse flight to liquidity”, Review of Financial Studies, Vol. 35 (10), pp. 4674-4711.

Vissing-Jørgensen, A. (2021), “The Treasury Market in Spring 2020 and the Response of the Federal Reserve”, Journal of Monetary Economics, Vol. 124, pp. 19-47.

This article was written by Johannes Breckenfelder (Senior Economist, Directorate General Research, European Central Bank) and Marie Hoerova (Senior Adviser, Directorate General Research, European Central Bank). The authors gratefully acknowledge the comments of Gareth Budden, Alexandra Buist, Ana Maria Borlescu and Alexander Popov. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

Decision of the European Central Bank of 24 March 2020 on a temporary pandemic emergency purchase programme.

In additional analysis, reported in detail in our paper, we argue that the elimination of the performance gap differential by early April 2020 was related to the interventions of the US Federal Reserve System, in particular its intervention on 9 April 2020.

Decision of the European Central Bank of 12 March 2020 on measures to support bank liquidity conditions and money market activity.

The term “market-maker of last resort” was mentioned already in the context of the great financial crisis by Buiter and Sibert (2007). See also Buiter, Cecchetti, Dominguez and Sánchez Serrano (2023) who examine potential designs for enhanced lender of last resort and market-maker of last resort facilities to maximise their effectiveness while minimising the damage that they might cause.