Fiscal policies in 2022 – implications of the 2022 draft budgetary plans

Published as part of the ECB Economic Bulletin, Issue 8/2021.

On 24 November 2021 the European Commission released its opinions on the euro area governments’ draft budgetary plans for 2022.[1] These opinions focus on the consistency of the plans with the Council recommendations of 18 June 2021, which advise Member States to adopt more differentiated fiscal policies in 2022. The Council recommended Member States with low or medium levels of debt to pursue or maintain a supportive fiscal stance in 2022 and Member States with high debt to use the Recovery and Resilience Facility (RRF) to finance additional investment in support of the recovery, while pursuing a prudent fiscal policy. It advised all Member States to preserve nationally financed investment. The Commission’s assessment of the draft budgetary plans takes into account the continued application of the general escape clause of the Stability and Growth Pact in 2022. The clause is expected to be deactivated as of 2023.[2]

On the basis of an adjusted indicator that aims to capture the fiscal policy orientation in the current economic context, the euro area fiscal stance is projected to remain supportive in 2021 and 2022. For its assessment, the Commission uses a revised measure of the fiscal stance that was developed in light of the current crisis and the national and EU fiscal measures taken to address it. [3] First, the fiscal stance measure takes into account expenditures funded by the RRF and other EU funds, which provide a fiscal impulse to the economy but are not reflected in Member States’ recorded budget balance. Second, it nets out temporary emergency measures taken in response to the crisis. According to the Commission’s 2021 autumn forecast, which incorporates the 2022 draft budgetary plans, the fiscal expansion based on this definition of the fiscal stance will amount to around 1.75% of GDP in 2021, while a further expansion of nearly 1% of GDP is expected for 2022.[4]

According to the Commission’s assessment, the individual draft budgetary plans are broadly in line with the fiscal policy recommendations adopted by the Council on 18 June 2021. When measured on the basis of the adjusted indicator capturing the orientation of fiscal policies in the current crisis, the majority of low and medium-debt euro area countries pursue a supportive fiscal stance. Of the Member States in this grouping (Germany, Estonia, Ireland, Cyprus, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Austria, Slovenia, Slovakia and Finland), only Malta and Slovakia are not projected to do so in 2022. The Commission assesses that all Member States in this grouping − with the exception of the Netherlands, which has not yet submitted its recovery and resilience plan − intend to use the RRF to support their recovery. All preserve or broadly preserve nationally financed investment.

The Commission further indicates the importance for high-debt Member States “to preserve prudent fiscal policies”. To this end, the Commission assesses that Belgium, Greece, Spain, France and Italy, in line with the Council recommendations of June 2021, use the RRF to finance additional investment in support of the recovery and preserve nationally financed investment.[5] The Commission also stresses that these countries should “preserve prudent fiscal policy in order to ensure sustainable public finances in the medium term” when taking supporting budgetary measures.

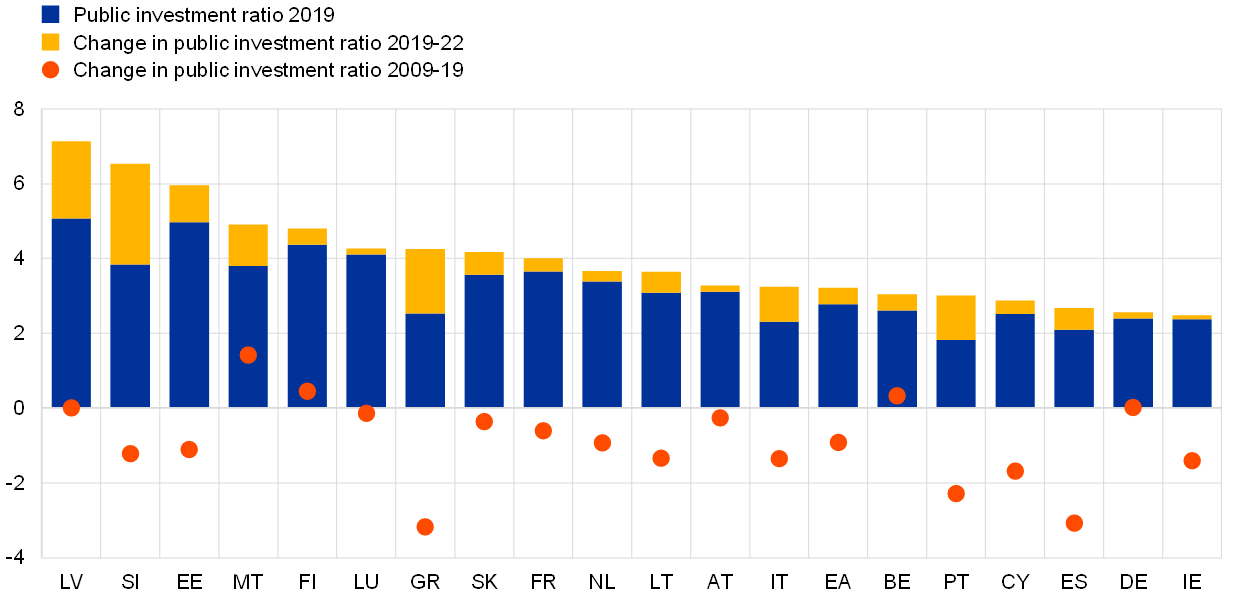

The Commission’s assessment reflects the euro area-wide rise in government investment seen throughout the pandemic, which contrasts with the pattern observed in the aftermath of the global financial crisis, with a significant part of the increase being attributed to EU funding, including through the RRF. The Commission projects euro area government investment to increase from 2.8% of GDP in 2019 to 3.2% of GDP in 2022, thus partially reversing the pre-pandemic and post-global financial crisis trend of reduced public investment (Chart A). Both the Commission’s 2021 autumn forecast and the draft budgetary plans point to the aggregate spending profile of RRF grants being frontloaded, with around two-thirds of the RRF grants allocated to euro area countries being spent by the end of 2023. In terms of GDP, RRF-funded expenditure is projected at around 0.5% of GDP in both 2022 and 2023. Overall, the high quality of government budgets and sustained public investment should support the twin transition towards green and digital economies.

Chart A

Public investment, 2009-22

(percentages of GDP)

Sources: European Commission (AMECO database) and ECB calculations.

At the same time, there is scope to reduce the contribution of current spending to the fiscal support, which would curtail the increase in government debt. The Commission indicates that, among the countries with low or medium levels of government debt, Latvia and Lithuania are not projected to sufficiently ensure the control of the growth of nationally financed current expenditure. Among the countries with high government debt-to-GDP ratios, Italy is not considered to sufficiently ensure the limitation in the growth of nationally financed current expenditure. The Commission and the Eurogroup[6] thus invite Italy to take the necessary measures to curtail such expenditures.

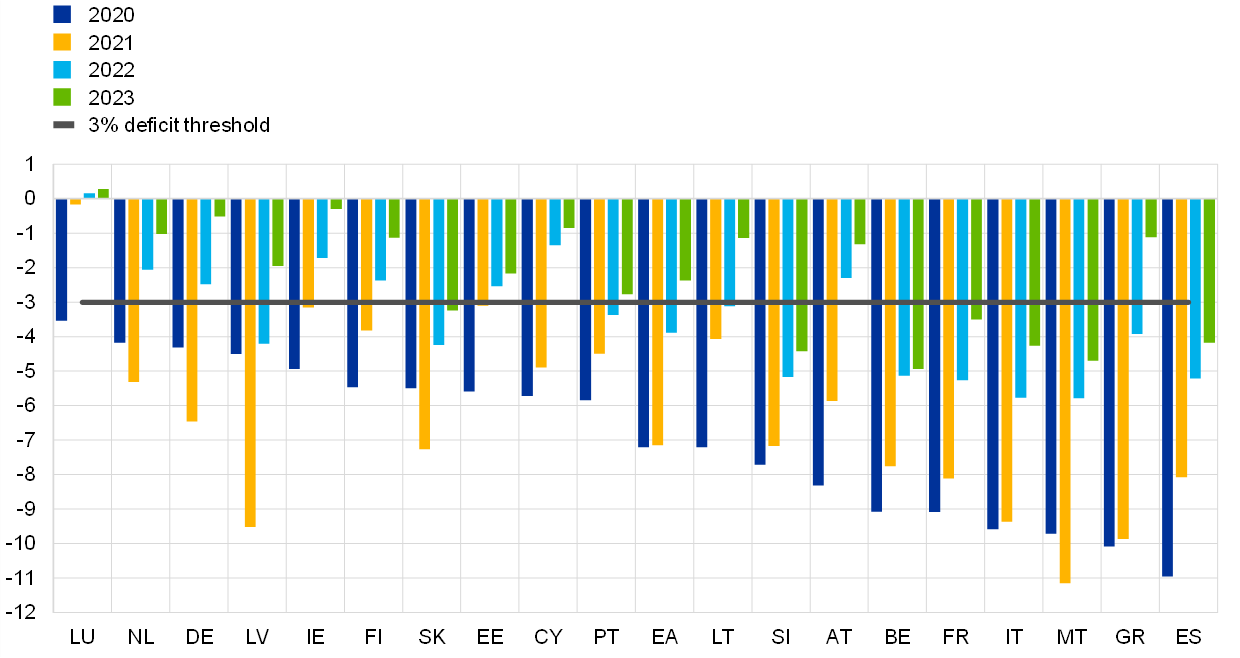

The correction of fiscal imbalances continues to evolve heterogeneously across the euro area countries.[7] According to the Commission’s 2021 autumn forecast, deficits are projected to decrease in all euro area countries in both 2022 and 2023 (Chart B). Seven euro area countries are projected to record deficits above the 3% of GDP threshold in 2023. The largest deficits in the years 2022-23 are projected for some countries that entered the pandemic period with high government debt-to-GDP ratios. Debt-to-GDP ratios in most euro area countries are foreseen to drop in 2022, while in some they will remain on an increasing path until the end of the forecast horizon in a no-policy change scenario (Chart C). Generally, they are forecast to remain above the pre-crisis levels at the end of the projection horizon in 2023 − including in some Member States which entered the crisis with comparatively high debt-to-GDP ratios.

Targeted and growth-friendly fiscal measures need to remain in place. Fiscal policies still need to balance achieving a safe and sustained exit from this crisis with remaining attentive to fiscal sustainability. Given the large uncertainty, fiscal support that is responsive to macroeconomic developments can facilitate this balancing act. Should the pandemic situation deteriorate, additional fiscal support would curtail the detrimental impact on output growth. At the same time, if economies learn to adapt more effectively to the pandemic and grow faster than currently foreseen, countries with high government debt could improve fiscal sustainability by utilising better than projected developments in nominal GDP for enhancing budgetary positions. If, in line with the June 2021 Council recommendations, the fiscal support in 2022 were to focus on productive spending – including investment financed through the RRF, the impact on economic growth would be particularly beneficial. Given the expected deactivation of the Stability and Growth Pact’s general escape clause as of 2023 and the possible implications of the ongoing review of the EU’s economic governance framework[8], a timely agreement on the orientation of fiscal policies appears warranted.

Chart B

General government budget balances, 2020-23

(percentages of GDP)

Sources: European Commission (AMECO database) and ECB calculations.

Chart C

General government gross debt, 2019-23

(percentages of GDP)

Sources: European Commission (AMECO database) and ECB calculations.

- European Commission (2021), “Communication from the Commission to the European Parliament, the Council, and the European Central Bank on the 2022 Draft Budgetary Plans: Overall Assessment”.

- The clause was introduced as part of the “six-pack” reform of the Stability and Growth Pact in 2011. The clause can be activated in the case of an unusual event − outside the control of the Member State concerned − which has a major impact on the financial position of the general government, or in periods of severe economic downturn for the euro area or the EU as a whole. When the clause is activated, Member States may temporarily depart from the fiscal adjustment requirements under both the preventive and corrective arms of the Pact, provided this does not endanger fiscal sustainability in the medium term.

- The Commission computes the fiscal stance by looking at the annual increase in net expenditure relative to ten-year potential growth. Following the Council’s recommendations on the 2021 Stability Programmes, the net expenditure aggregate used to compute the overall fiscal stance was adjusted to include expenditure financed by RRF grants and other EU funds and to exclude the temporary emergency measures related to the coronavirus (COVID-19) crisis. In addition to the contribution from EU-financed expenditure, the Commission’s assessment also looks at the contributions to the overall fiscal stance from different nationally financed expenditure aggregates namely (i) investment, (ii) other capital expenditure, and (iii) current primary expenditure (net of discretionary revenue measures).

- European Commission (2021), op. cit.

- The European Commission did not adopt an opinion on the draft budgetary plan submitted by Portugal, as the Portuguese Parliament had in the meantime rejected the draft budget on which the plan was based.

- The Eurogroup Statement on the Draft Budgetary Plans of 2022, issued on 6 December 2021, “invites those high-debt Member States, where the growth of the nationally financed current expenditure is not planned to be sufficiently limited according to the Commission’s assessment, to take the necessary measures within the national budgetary process.”

- For details on budgetary developments for the euro area aggregate based on the December 2021 Eurosystem staff macroeconomic projections for the euro area, see Section 6 of this issue of the Economic Bulletin.

- Eurosystem reply to the Communication from the European Commission “The EU economy after COVID-19: implications for economic governance” of 19 October 2021.