Published as part of the ECB Economic Bulletin, Issue 3/2022.

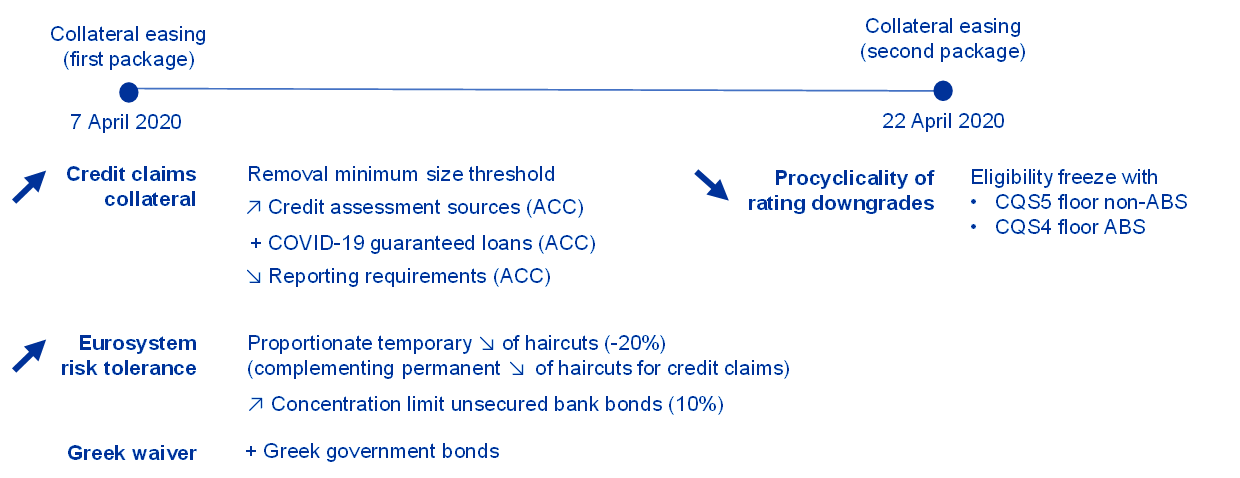

Collateral easing measures have played a key role in the ECB’s monetary policy response to the coronavirus (COVID-19) pandemic, facilitating access to Eurosystem credit operations. The temporary collateral measures (summarised in Figure A) were introduced in April 2020 to ensure that the banking sector could expand its access to central bank liquidity on favourable terms via the Eurosystem’s liquidity-providing credit operations (mainly targeted longer-term refinancing operations or TLTRO III), allowing it to continue to cover the funding needs of the euro area economy.[2] More specifically, these measures were introduced to serve the following three interconnected primary objectives.

- Pre-empting shortages of eligible collateral: all measures were introduced pre-emptively to avoid shortages of eligible collateral in case of increased demand for liquidity. This facilitated banks’ access to ample central bank liquidity on favourable terms, contributing to the large take-up of TLTRO III, thereby transmitting the stimulus smoothly to the broader economy.

- Adding flexibility to the collateral framework: some of the measures provided national central banks (NCBs) with additional flexibility to address the collateral needs of domestic banks, e.g. by allowing loans with government/public-sector guarantees under COVID-19 schemes that were not fully compliant with the requirements for the general collateral framework to be mobilised under national additional credit claims (ACC) frameworks.

- Countering adverse procyclical feedback effects: falling asset prices and potential rating downgrades could have increased pressure on collateral availability, potentially creating uncertainty about individual banks’ access to central bank liquidity. To prevent procyclical feedback loops and ultimately safeguard and restore favourable lending conditions for the real economy, a number of measures were thus introduced. These included maintaining the eligibility of certain marketable assets which met the minimum credit quality requirements on 7 April 2020 but whose credit ratings subsequently deteriorated below the minimum rating threshold (the “eligibility freeze”) and temporarily reducing valuation haircuts.

Figure A

Collateral easing measures in response to the COVID-19 pandemic

Source: Box 1entitled “TLTRO III and collateral easing measures” of the article entitled “TLTRO III and bank lending conditions”, Economic Bulletin, Issue 6, ECB, September 2021.

Notes: “ACC” refers to additional credit claims, “ABS” refers to asset-backed securities and “CQS” refers to credit quality step, as defined in the Eurosystem credit assessment framework. In addition to the measures outlined in Figure A, it should be noted that some NCBs created new ACC frameworks or expanded their existing ACC frameworks with features already acceptable before the pandemic.

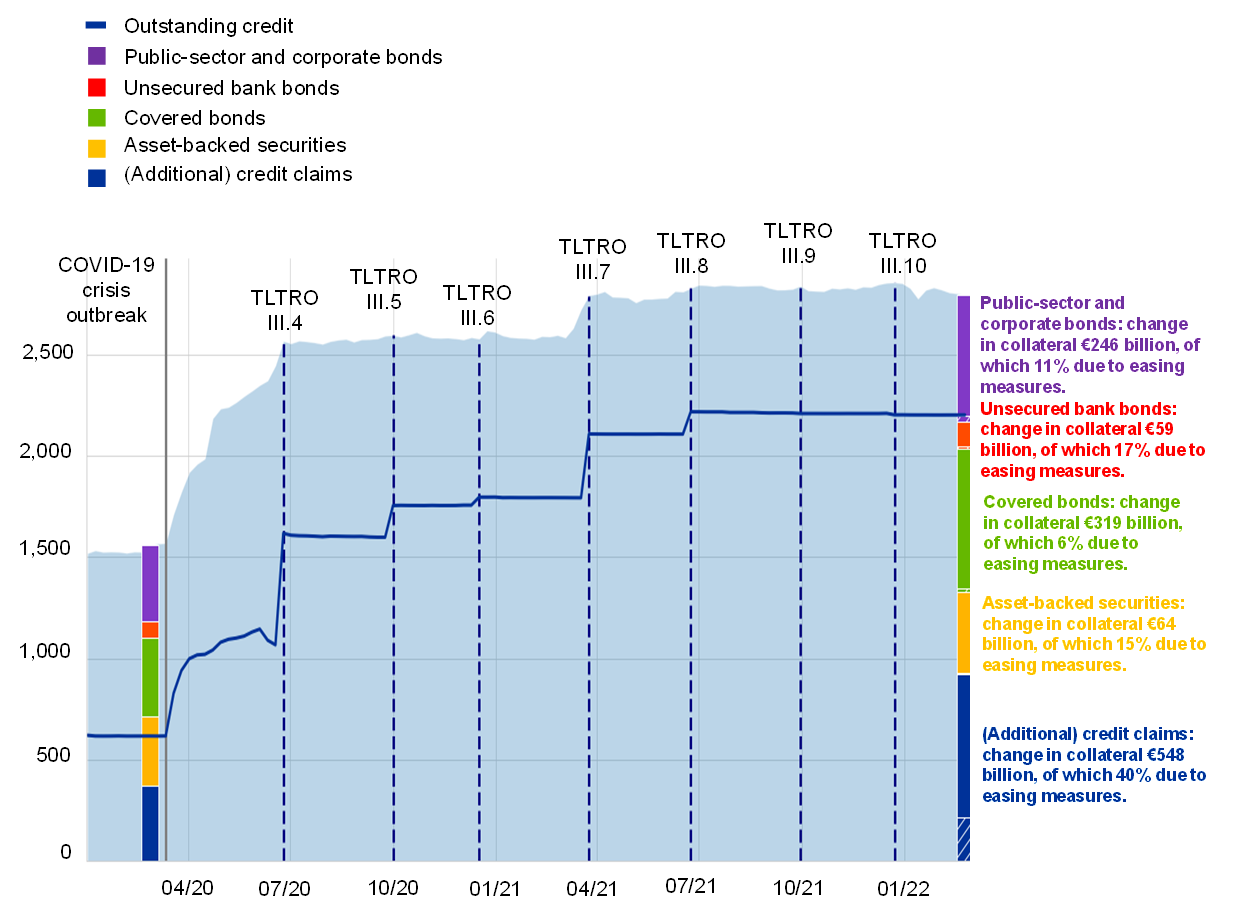

The ECB’s collateral easing measures made a significant contribution to increasing the volume of eligible collateral. Overall, ECB staff estimates indicate that total collateral value attributable to the easing measures stood at around €285 billion (roughly 10%) of the total €2,794 billion of collateral mobilised at the end of February 2022. This means they contributed around 23% of the €1,236 billion total increase in collateral positions (Chart A). The contribution from collateral easing measures was predominantly driven by the temporary haircut reduction and the extensions to the ACC frameworks of NCBs, which jointly accounted for more than 90% of the total effect.

Chart A

Mobilisation of collateral and recourse to Eurosystem credit operations

(EUR billions)

Sources: ECB and ECB calculations.

Notes: The bar chart shows the mobilisation of Eurosystem-eligible collateral by asset category and the values are after valuation and haircuts. The first observation shows the composition of collateral before the outbreak of the pandemic, on 27 February 2020. The cross-shaded areas in the bars on the right-hand side show the total collateral value due to collateral easing measures for the respective asset category on 24 February 2022.

Phasing-out in three steps

On 24 March 2022, the Governing Council announced its decision to gradually phase out the pandemic collateral easing measures.[3] The decision reflected the expected decline over time of banks’ demand for liquidity, as TLTRO III operations will gradually mature. The ECB also assessed the efficiency of the different measures from a financial risk perspective, expressed in terms of temporary collateral expansion relative to changes in the Eurosystem’s risk protection. In particular, the temporary haircut reduction shows a higher ratio of financial risk per unit of exposure than the other collateral easing measures. The assessment further considered the extent to which the specific initial policy motivation was still relevant, e.g. allowing banks to mobilise collateral more quickly thanks to reduced reporting requirements.

The gradual phasing-out is scheduled to take place in three steps and gives banks time to adapt to the adjustments to the collateral framework.

In the first step, starting on 8 July 2022, the ECB will halve the temporary reduction in collateral valuation haircuts across all assets from the current 20% adjustment to 10%. This allows a gradual restoration of pre-pandemic risk tolerance levels and reduces the Eurosystem’s financial risks associated with the haircut reduction. The haircut reduction accounts for approximately 40% of the total collateral value generated by the collateral easing measures. The partial reversal provides an appropriate lead time for banks to adjust their collateral mobilisation. The ECB will also phase out a set of measures with more limited impact and scope: i) the ECB will no longer maintain the eligibility freeze for downgraded marketable assets; ii) the ECB will restore the limit on unsecured debt instruments issued by any single other banking group in a credit institution’s collateral pool from 10% to 2.5%; iii) the ECB will phase out the temporary easing of several technical requirements for the eligibility of ACCs, mainly relating to fully restoring the frequency of ACC loan-level reporting requirements for pools, as well as the acceptance requirements for banks’ own credit assessments by internal rating-based systems.

In the second step, in June 2023, the ECB expects to implement a new valuation haircut schedule based on its pre-pandemic risk tolerance level for credit operations, phasing out the temporary reduction in collateral valuation haircuts completely. Details of the new haircut schedule will be announced in due course and be based on the results of the forthcoming regular review of the ECB’s risk control framework.[4]

In the third step, in March 2024, the ECB will, in principle, phase out the remaining pandemic collateral easing measures. The Governing Council will take the final decision following a comprehensive review of the ACC frameworks, taking into account banks’ collateral needs for continuing to participate in Eurosystem credit operations, including TLTRO III transactions running until December 2024. The measures in place until March 2024 include acceptance of various ACCs introduced during the pandemic, in particular loans guaranteed by the government and certain public-sector entities. These have significantly contributed to collateral availability since the start of the pandemic. Specifically, guaranteed loans mobilised account for around 40% of total collateral value generated by the collateral easing measures. NCBs may nevertheless decide to terminate some or all of their ACC frameworks earlier than this, for example if limited use is being made of them.

Minimum credit quality waiver for Greek government bonds to be continued

The Governing Council has decided to continue to allow NCBs to accept Greek government bonds (GGBs) that do not satisfy the Eurosystem’s minimum credit quality requirements but fulfil all other applicable collateral eligibility criteria. This applies for at least as long as reinvestments in GGBs under the pandemic emergency purchase programme (PEPP) continue. The Governing Council introduced this waiver for using GGBs as collateral on 7 April 2020, on a temporary basis and subject to a specific haircut schedule, following the inclusion of GGBs in the PEPP, which was agreed on 18 March 2020. The extension of the measure is based on multiple additional considerations, including the need to continue to prevent fragmentation in access to Eurosystem monetary policy operations, which would impair the proper functioning of the transmission of policy to the Greek economy while it is still recovering from the pandemic. Other considerations include the fact that Greece remains subject to regular post-programme reviews of its economic and financial situation and benefits from disbursements under the Recovery and Resilience Facility, subject to the successful implementation of its reform agenda.

The Eurosystem’s monetary policy framework grants the Governing Council discretion to deviate from the assessments of credit rating agencies (CRAs) if warranted, avoiding mechanistic reliance on their ratings. The discretion to avoid mechanistic use of CRA ratings is stated under Article 159 of the ECB’s General Documentation for monetary policy implementation.[5] It is in line with Principle III.1 of the Financial Stability Board’s principles for reducing reliance on CRA ratings.[6] Previous examples of the application of this discretion include waivers of minimum credit quality requirements for several countries during the euro area sovereign debt crisis. Another example of this is the eligibility freeze adopted on 22 April 2020 and phased out from 8 July 2022, as described above.

This box is based on extensive work related to the review of pandemic collateral easing measures. In addition to the authors mentioned above and staff of national central banks (NCBs), the following colleagues also commented and contributed: M.-A. Anghel, L. Bara de La Fuente, N. Bihrer, M. Blau, G. Camba-Méndez, S. Ciummo, T. Dzaja, B. Hartung, N. Luo, M. Micuch and P. Kusmierczyk.

See the press releases of 7 April 2020 and 22 April 2020 for the initial adoption of the package and the press release of 10 December 2020 for the extension of collateral easing measures until June 2022. The measures were described in the ECB blog post by Luis de Guindos and Isabel Schnabel, “Improving funding conditions for the real economy during the COVID-19 crisis: the ECB’s collateral easing measures”. Their relevance to supporting TLTRO III operations was highlighted in Box 1 entitled “TLTRO III and collateral easing measures” of the article entitled “TLTRO III and bank lending conditions”, Economic Bulletin, Issue 6, ECB, September 2021.

See the press release of 24 March 2022.

The risk control framework and the methodology for determining the valuation haircuts is described in the paper entitled “The financial risk management of the Eurosystem’s monetary policy operations”, ECB, July 2015.

See Guideline (EU) 2015/510 of the European Central Bank on the implementation of the Eurosystem monetary policy framework (General Documentation Guideline) (ECB/2014/60) (recast) (OJ L 091 2.4.2015, p. 3).

See Financial Stability Board, “Principles for Reducing Reliance on CRA Ratings”, October 2010.