Financial stability considerations arising from the digitalisation of financial services

Published as part of the Financial Stability Review, November 2023.

The digitalisation of financial services brings a variety of benefits but could also amplify and accelerate the materialisation of financial stability risks. The surge in retail investors participating directly in equity markets during the pandemic was associated with increased access to capital markets via trading apps (Chart A, panel a). This trend has certainly brought some benefits, for example by broadening risk sharing and lowering transaction costs. Nonetheless, authorities’ attention was drawn to episodes of extreme volatility in the prices of “meme” stocks[1] in the first half of 2021, which had been induced by individual investors coordinating trades through social media.[2] Furthermore, the banking sector stress in the United States in March 2023 reignited concerns around the impact of digitalisation on financial stability, as the interaction of increased online banking (Chart A, panel b) and social media may accelerate the pace of bank runs.

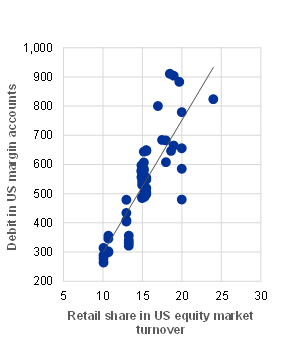

The increased popularity of retail trading via apps, while bringing some benefits, could result in more procyclicality in financial markets. Digitalisation has made it easier for retail investors to trade in financial instruments not only by speeding up the opening of an investment account or the submission of trading orders, but also by providing widespread access to investment ideas published on social media. Making financial markets accessible to a broader range of investors is beneficial, as it enables risk sharing across the economy, provides more equal opportunities to gain financial returns and can help to deepen financial markets. At the same time, it can raise concerns about investor protection and market functioning. The new market participants are typically younger and less financially literate, and have a greater risk appetite, which has major implications for their trading behaviour.[3] These investors might trade more frequently based on emotions or other non-fundamental factors. Such activity can be accentuated by trading platforms’ “social trading” functionality, which allows users to copy other investors’ trades automatically. Increased herding could, in turn, undermine the orderly functioning of financial markets by making asset price bubbles or disorderly corrections more likely. Moreover, the design of trading apps and their marketing campaigns have led to a “gamification of trading”, which might have attracted risk-seeking individuals during the pandemic.[4] Furthermore, excessive use of leverage via margin debt (Chart A, panel c) or embedded in derivatives contracts such as 0 days to expiry (0DTE) options could potentially amplify market movements in tail events.[5]

Chart A

Digitalisation is progressing in both traditional banking and investment services

a) Share of retail investors in the US equity trading volume and revenue of a leading mobile trading app provider | b) Share of euro area and US population using online banking | c) Share of retail investors in US equity market turnover and debit in US margin accounts |

|---|---|---|

(Q1 2019-Q2 2023; percentages, USD millions) | (2010, 2022; percentages) | (Jan. 2010-June 2023; percentages, USD billions) |

|  |  |

Sources: Bloomberg Finance L.P., Eurostat, FINRA, World Bank and ECB calculations.

Notes: Panel a: revenue of an app provider refers to the revenue of Robinhood. Retail share refers to the share of retail investors in US equity market turnover. Panel b: “EA avg.” is the average of all countries shown weighted by population in 2010 and 2022. US data are only available for 2022. Structural breaks in the series mean that the change between 2010 and 2022 may be underestimated for Germany, Latvia and Luxembourg and overestimated for Estonia and Ireland. Panel c: the debit balance in a margin account is the amount of money a customer owes their broker for funds they have borrowed to purchase securities.

Social media allows information to spread faster but can also trigger or amplify shocks. Social media has the potential to help retail investors make more informed and more timely decisions[6], and to enable those bank depositors that are not protected by deposit insurance schemes to better understand financial risks. At the same time, it may foster herd behaviour while feeding rumours and disinformation, which could raise financial stability concerns. During the GameStop episode in 2021, retail investors coordinated on social media to buy the company’s heavily shorted stocks, resulting in some institutional investors facing a short squeeze which had a significant impact on market volatility (Chart B, panel a).[7] The US bank tensions in March 2023 raised concerns that negative sentiment on social media platforms could adversely affect banks’ stock prices or fuel deposit outflows, as was likely the case with Silicon Valley Bank.[8] For euro area banks, the correlation between sentiment on X, previously known as Twitter, and stock returns reached an all-time high of 64% in March 2023 (Chart B, panel b), though the nature of this relationship requires further investigation. At the same time, negative social media coverage was not associated with systematic deposit shifts between individual euro area banks during the March tensions. These events should not, however, be seen as a decisive test, given the lack of fundamental concerns about euro area banks at the time.

Chart B

Financial stability impact of social media tends to increase rapidly during periods of stress

a) GameStop share price and Twitter coverage | b) Twitter coverage and correlation with stock returns and deposit flows of euro area banks |

|---|---|

(1 June 2020-31 Dec. 2021; USD, thousands) | (Jan. 2022-June 2023; correlation coefficient, negative tweets) |

|  |

Sources: Bloomberg Finance L.P., ECB (BSI) and ECB calculations.

Notes: Panel a: the “Twitter Publication Count – Index” was established by scaling the publication count time series, capturing the number of tweets on a specific topic or security by a predefined list of selected influential accounts, by its maximum observation over the period shown. Panel b: based on a sample of 23 euro area listed significant institutions in the EURO STOXX Banks index. Deposit flows are monthly percentage changes of household and non-financial corporate deposits at the bank. Twitter sentiment data are normalised between 1 and -1 and indicate the average sentiment of tweets posted on individual banks. Stock returns are monthly price returns. Correlation is expressed as the monthly correlation coefficient for the cross-sectional data of bank-level Twitter sentiment and deposit movements or stock returns. “Negative tweets” captures the number of original negative tweets by a predefined list of selected influential accounts. Tweets are classified as “negative” from a long position investor perspective by Bloomberg’s supervised learning algorithm.

The digitalisation of financial services may have broader policy-relevant implications for financial markets and banks. More retail investors are participating in financial markets thanks to digitalisation. Sometimes this might lead to excessive risk taking and undermine market integrity. In particular, additional monitoring of how leverage is used in financial products and extra scrutiny in market abuse supervision are both warranted. The case of Silicon Valley Bank represents the most prominent bank run of the digital era. Few depositors queued up outside a branch – instead they used bank apps and phone calls to access their money within minutes.[9] Accordingly, regulators and supervisors should consider the issue of how digitalisation could accelerate the pace of deposit withdrawals in a structural way during periods of stress.[10] This could encourage the collection of deposit data at a higher frequency. Finally, how social media activities relate to financial stability concerns and how the analysis of such activities can be used to monitor risks requires further investigation.

Stocks that became popular among retail investors via social media.

See the box entitled “Retail Investors, Social Media, and Equity Trading”, Financial Stability Report, Board of Governors of the Federal Reserve System, November 2021, pp. 18-21.

See “Final Report – On the European Commission mandate on certain aspects relating to retail investor protection”, ESMA, 29 April 2022.

See, for example, Chiah, M. and Zhong, A., “Trading from home: The impact of COVID-19 on trading volume around the world”, Finance Research Letters, Vol. 37, November 2020, or Chiah, M., Tian, X. and Zhong, A., “Lockdown and retail trading in the equity market”, Journal of Behavioral and Experimental Finance, Vol. 33, March 2022.

See the box entitled “The Fast-Growing Interest in Retails’ Trading in the Zero-Day Options Market: Is It a Hidden Risk?’’, Global Financial Stability Report, International Monetary Fund, 11 April 2023, pp. 50-51.

See Farrell, M., Green, T.C., Jame, R. and Markov, S., “The democratization of investment research and the informativeness of retail investor trading”, Journal of Financial Economics, Vol. 145, Issue 2, Part B, August 2022.

See, for example, Anand, A. and Pathak, J., “The role of Reddit in the GameStop short squeeze”, Economics Letters, Vol. 211, Issue C, February 2022, or Vasileiou, E., “Does the short squeeze lead to market abnormality and antileverage effect? Evidence from the GameStop case”, Journal of Economic Studies, Vol. 49, No 8, October 2022.

Communication via social media likely accelerated the failure of Silicon Valley Bank which faced fundamental issues due to the materialisation of unrealised losses. A highly concentrated depositor base with a large share of uninsured deposits may have made it particularly vulnerable to coordinated deposit outflows. See “Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank”, Board of Governors of the Federal Reserve System, 28 April 2023. See also Cookson, J.A., Fox, C., Gil-Bazo, J., Imbet, J.F. and Schiller, C., “Social Media as a Bank Run Catalyst”, Université Paris-Dauphine Research Paper, No 4422754, 13 July 2023.

In contrast to physical branches, online banking services are available 24/7 except during periods of scheduled maintenance.

See McCaul, E., “Mind the gap: we need better oversight of crypto activities”, blog post, ECB, April 2023, and Bindseil, U. and Senner, R., “Destabilisation of Bank Deposits Across Destinations – Assessment and Policy Implications”, SSRN, 15 September 2023.