- THE ECB BLOG

How will higher carbon prices affect growth and inflation?

25 May 2023

Carbon pricing is a central instrument in the EU’s fight against climate change, but it will also affect our economies. In this post on The ECB Blog, we use macroeconomic models to look at what higher prices for carbon emissions will do to growth and inflation.

Urgent action is needed to reduce greenhouse gas emissions and prevent the most disastrous effects of climate change. This is why the EU aims to reduce such emissions by 55% by 2030 (compared to 1990 levels), and to achieve net zero emissions by 2050. The EU’s Fit-for-55 package will use measures like carbon prices, regulation and green investment, all of which will affect the economy. But how, and with what economic consequences?

Carbon pricing and the economy

In this post we focus on carbon pricing. It is the most effective instrument to reduce emissions because it is targeted at the carbon footprint of the economy. It forces everyone to take the damage caused by emissions into account – for example when running a business, driving a car, or heating a home. Carbon pricing usually takes the form of a tax imposed on emissions or an emission trading scheme in which companies can buy and sell the right to generate emissions (which The ECB Blog will look at in a dedicated post soon). All forms of carbon pricing provide incentives to reduce emissions. They do that by putting a price tag on the emissions from consumption and production. For example, you might travel less often by plane as you see prices rising due to the fact that airlines have to buy carbon emissions allowances.

How does carbon pricing affect the economy and, eventually, growth and inflation? Carbon prices influence both supply and demand primarily via higher energy prices – either directly via their impact on consumer prices or indirectly via their impact on production costs. On the supply side, the increase in production costs drives up inflation and results in lower production. If the government sets out the future path of carbon price increases in a credible way, firms can anticipate and factor in those higher costs when they set their prices or decide on production volumes. The more firms do so today, the stronger the inflation impact will be upfront. On the demand side, higher carbon prices hit household incomes and firm profits. This in turn reduces consumption and investment, eventually creating downward pressure on inflation. The more households and firms take into account future carbon price increases for their spending today, the more they will frontload this reduction in consumption and investment. So we have two forces moving inflation in opposite directions.

There are a number of factors affecting how strong these effects are, and in which direction they pull. Fiscal policy, for example, can redistribute the receipts from carbon taxes to low-income households. This would reduce the loss of real incomes and help sustain household consumption. If countries around the world tax carbon emissions differently this will affect international competitiveness, the terms of trade (the amount of goods a country can purchase for a certain amount of exported goods), and the demand for export goods.

Quantifying the overall effect of carbon pricing on the economy is fraught with a high level of uncertainty, including model uncertainty. To deal with this uncertainty, we used six macroeconomic models to assess the impact of raising carbon prices in the euro area.[2] For the calculation we assumed a carbon price increase from €85 in 2021 to €140 per tonne of CO2 emission by 2030.[3] For the rest of the world, we factored in a proportionate increase in carbon prices, albeit from lower levels.

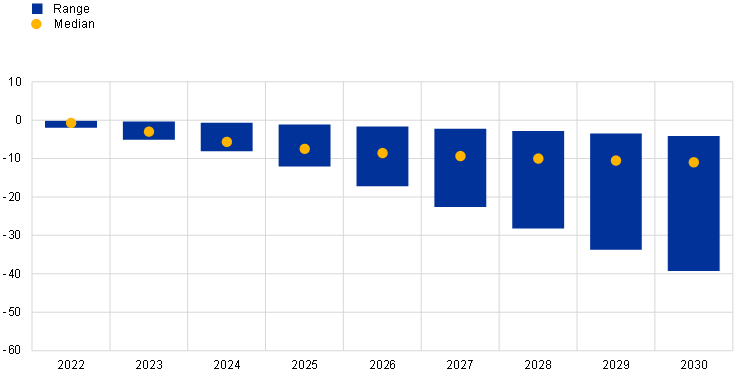

What would be the quantitative impact of this increase in carbon prices on the euro area economy? The models suggest that it would moderately lower consumption and investment, with GDP falling 0.5-1.2% below baseline by 2030 (see Chart 1, LHS, where the baseline refers to a scenario with no changes in carbon prices). Across all models, the median estimate for GDP translates into average annual growth dropping by roughly 0.1 percentage points. Likewise, the models suggest that the maximum impact on annual inflation would be modest at less than 0.2 percentage points per year in the period up to 2025, and falling gradually thereafter (see Chart 1, RHS).

Chart 1

Carbon pricing impact on real GDP (LHS) and inflation (RHS)

percentage and percentage-point deviation from baseline paths

Sources: NAWM-E, E-DSGE I + II, G-Cubed, NiGEM and Oxford.

Note: The charts display the impact (range and median across models) of the assumed carbon price increase on euro area real GDP and inflation between 2022 and 2030.

Accordingly, the carbon price increase, as assumed for this simulation, would only have a rather limited economic impact on the euro area economy. That means monetary policy would face only a modest trade-off in terms of stabilising inflation relative to output. The size and, ultimately, the direction of the resulting response of policy interest rates depend on the model. Models emphasising the adverse supply-side effects of the scenario, with a larger impact on inflation, tend to prescribe a limited increase of policy interest rates. And models in which adverse demand effects dominate tend to show a small decline of policy rates.

Raising carbon prices is expected to support the transition to a low-carbon economy. But the carbon price increase in our scenario would reduce carbon emissions in the euro area by only around 11% by 2030. This is the median estimate of our six models (see Chart 2). And that figure is far below the EU’s intermediate goal of reducing emissions by 46% by 2030 (compared to 2021 levels). This shortfall highlights the need for a more ambitious carbon pricing policy, additional regulatory action, green investments, and technological adaptation and innovation.

Chart 2

Carbon pricing impact on carbon emissions

percentage deviation from baseline path

Sources: NAWM-E, E-DSGE I + II, G-Cubed, NiGEM and Oxford. Note: The chart displays the impact (range and median across models) of the assumed carbon price increase on euro area carbon emissions between 2022 and 2030.

We have to put the estimated reductions in carbon emissions in the euro area into an international perspective. The euro area currently contributes a mere 5% of global carbon emissions. Achieving a substantial effect on global emissions would require a more ambitious increase in carbon prices in the rest of the world. If these carbon prices were aligned with those for the euro area by 2030, the estimated reduction in global carbon emissions would be about three times greater than in our benchmark scenario. In this event, the euro area terms of trade would improve by more, while euro area foreign demand would weaken more strongly, doubling the estimated negative impact on euro area GDP.

How fast carbon emissions can be reduced depends on how quickly the economy adjusts to higher prices for carbon emissions. If capital and labour get reallocated more swiftly, if the economy adapts more rapidly to new technologies and if there is sufficient financial support, the process can go faster. It would also help if green energy could replace fossil fuel generated energy more easily than assumed in the models. This would reduce emissions more strongly and also mitigate the impact on GDP and inflation. More green investments or major technological advances would also help in this regard.

To conclude, model-based estimates of carbon-price increases consistent with the International Energy Agency’s net-zero scenario in 2050 suggest a moderate impact on euro area GDP and inflation over the current decade, with modest inflation-output trade-offs for monetary policy as it seeks to preserve price stability. But the estimated carbon emission reductions by 2030 are limited, equal to around one-fourth of the EU’s intermediate goal. Achieving greater cuts in emissions with higher carbon prices would have a bigger impact on inflation and GDP, with more sizeable trade-offs for monetary policy. Accordingly, reaching the EU’s climate goals will require a mix of ambitious carbon emission pricing, additional regulatory action and technological innovation, as set out in the Fit-for-55 package.

Acknowledgements: Prepared in liaison with Alina Bobasu, Kai Christoffel, Alistair Dieppe, Michael Dobrew, Marien Ferdinandusse, Alessandro Ferrari, Thaïs Massei, Romanos Priftis, Angela Torres Noblejas and Aurelian Vlad.

Three of these models were developed at the ECB in line with its climate change action plan: the New Area-Wide Model with a disaggregate energy sector (NAWM-E), as well as two smaller-scale environmental DSGE models with financial frictions and costly abatement, respectively (E-DSGE I + II). The three other models are commercial models that are widely used for climate change analysis: NiGEM, G-Cubed and the Oxford Economics model.

The starting value of €85/tCO2 in 2021 corresponds to estimates of effective carbon rates by the Organisation for Economic Co-operation and Development. The terminal value of €140/tCO2 by 2030 is aligned with the carbon price assumption in the International Energy Agency’s net-zero scenario for 2050, as set out in its 2022 World Energy Outlook.