Euro area monthly balance of payments (August 2016)

- In August 2016 the current account of the euro area recorded a surplus of €29.7 billion.[1]

- In the financial account, combined direct and portfolio investment recorded net acquisitions of assets of €95 billion and net incurrences of liabilities of €15 billion.

Current account

The current account of the euro area recorded a surplus of €29.7 billion in August 2016 (see Table 1). This reflected surpluses for goods (€30.9 billion), services (€4.8 billion) and primary income (€6.6 billion), which were partly offset by a deficit in secondary income (€12.6 billion).

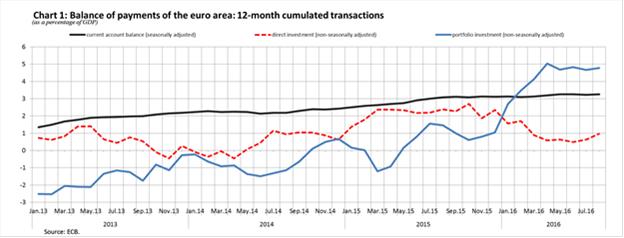

The 12-month cumulated current account for the period ending in August 2016 recorded a surplus of €350.0 billion (3.3% of euro area GDP), compared with one of €317.0 billion (3.1% of euro area GDP) for the 12 months to August 2015 (see Table 1 and Chart 1). This development was mostly due to an increase in the surplus for goods (from €327.7 billion to €372.7 billion), as well as a decrease in the deficit for secondary income (from €134.4 billion to €123.6 billion). These were partly offset by decreases in the surpluses for services (from €65.4 billion to €56.5 billion) and primary income (from €58.3 billion to €44.4 billion).

Financial account

In August 2016 combined direct and portfolio investment recorded net acquisitions of assets of €95 billion and net incurrences of liabilities of €15 billion (see Table 2).

Euro area residents recorded net acquisitions of €56 billion of direct investment assets as a result of net acquisitions of equity (€36 billion) and debt instruments (€20 billion). Direct investment liabilities increased by €10 billion as a result of net acquisitions of debt instruments (€15 billion) by non-euro area residents, which were partly offset by net disposals of equity (€5 billion).

As regards portfolio investment assets, euro area residents made net acquisitions of foreign securities amounting to €39 billion. This resulted from net purchases of short and long-term debt securities (€5 billion and €28 billion respectively) and equity (€6 billion). Portfolio investment liabilities recorded net incurrences of €5 billion as a result of the net acquisition of euro area debt securities (€6 billion) by non-euro area residents, which was partly offset by net disposals of equity (€1 billion).

The euro area net financial derivatives account (assets minus liabilities) recorded negative net flows of €3 billion.

Other investment recorded increases of €20 billion in assets and €73 billion in liabilities. The net acquisition of assets by euro area residents was mainly attributable to the MFI sector (excluding the Eurosystem) (€11 billion). The net incurrence of liabilities was mainly explained by the MFI sector (excluding the Eurosystem) (€31 billion), the Eurosystem (€21 billion) and other sectors (€22 billion).

In the 12 months to August 2016 combined direct and portfolio investment recorded increases of €913 billion in assets and €303 billion in liabilities, compared with increases of €1,066 billion and €667 billion respectively in the 12 months to August 2015. This primarily reflected a shift in portfolio investment liabilities from net acquisitions of euro area securities by non-euro area residents (€290 billion) to net sales/amortisations (€41 billion).

Direct investment recorded a decrease in the net acquisition of assets (from €624 billion to €448 billion) and in the net incurrence of liabilities (from €377 billion to €344 billion). This development is mainly explained by a shift in the euro area investment in foreign debt instruments, from net acquisitions (€200 billion) to net disposals (€2 billion).

According to the monetary presentation of the balance of payments, the net external assets of euro area MFIs decreased by €165 billion in the 12 months to August 2016, compared with a decrease of €45 billion in the 12 months to August 2015. This reflected an increase in the surplus in the current and capital account balance (from €296 billion to €351 billion), which was offset by net transactions in other items. In particular, the cumulated transactions in portfolio investment liabilities issued by non-MFI euro area residents showed a shift from net purchases of debt securities (€129 billion) to net sales/amortisations (€140 billion) and a decrease in the investment in non-MFI euro area equity securities (from €173 billion to €118 billion) by non-euro area residents.

In August 2016 the Eurosystem’s stock of reserve assets decreased by €6.3 billion to €718.3 billion (see Table 3). This was mostly explained by negative price revaluations, particularly of monetary gold (€7.2 billion).

Data revisions

This press release incorporates revisions for July 2016. These revisions have not significantly altered the figures previously published.

Additional information

Time series data: ECB’s Statistical Data Warehouse (SDW)

Methodological information: ECB’s website

Monetary presentation of the balance of payments Next press releases:- Quarterly balance of payments and international investment position: 13 January 2017 (reference data up to the third quarter of 2016);

- Monthly balance of payments: 18 November 2016 (reference data up to September 2016);

Annexes

Table 1: Current account of the euro area

Table 2: Balance of payments of the euro area

Table 3: Reserve Assets of the euro area

For media enquiries, please contact Rocío González, tel.: +49 69 1344 6451.

[1]References to the current account are always to data that are seasonally and working day-adjusted, unless otherwise indicated, whereas references to the capital and financial accounts are to data that are neither seasonally nor working day-adjusted.

Banca Centrală Europeană

Direcția generală comunicare

- Sonnemannstrasse 20

- 60314 Frankfurt pe Main, Germania

- +49 69 1344 7455

- media@ecb.europa.eu

Reproducerea informațiilor este permisă numai cu indicarea sursei.

Contacte media