The role of the inventory cycle in the current recovery

Published as part of the ECB Economic Bulletin, Issue 2/2022.

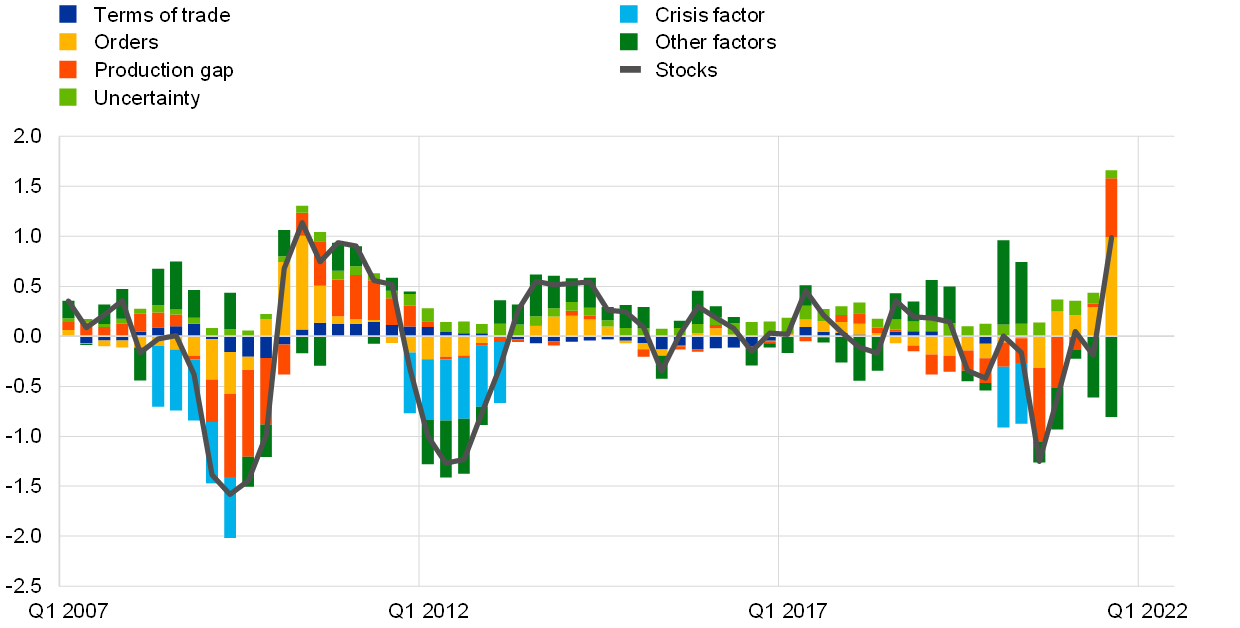

The inventory cycle is generally procyclical, with changes in inventories being a notoriously volatile expenditure component of GDP. This box reviews the impact of inventories and their drivers on euro area activity in the current economic recovery. The inventory cycle correlates strongly and positively with activity. Over the past two decades it has made contributions ranging from +1.0 percentage point to ‑1.5 percentage points to year-on-year euro area GDP growth rates, with particularly large fluctuations seen in crisis periods (Chart A). The economic interpretation of inventory dynamics is challenging for two main reasons. First, inventory contributions to GDP growth reflect changes in the speed of stockbuilding, i.e. whether there is an acceleration or deceleration.[1] Therefore, inventories can make a positive contribution to growth if the pace of destocking (i.e. reduction of inventories) merely slows down; it does not require actual stockbuilding to take place. Second, stockbuilding not only captures developments in several categories of inventories, which can offset each other in aggregate terms, but it also includes discrepancies (a “residual” component) and the net acquisition of valuables. The dynamics in these two elements are often unrelated to the business cycle.[2]

Chart A

Changes in stocks

(percentage point contributions to year-on-year GDP growth – left-hand scale; diffusion index, four-quarter differences – right-hand scale)

Sources: Eurostat and Markit.

Notes: Markit data comprise quarterly averages of monthly data. Aggregate stocks are based on national accounts data. The stock of finished goods refers to responses to the question in the Purchasing Managers’ Index (PMI) survey on “the level of finished products which has come off the production line and is awaiting shipment/sales (in units, not money) this month compared with the situation one month ago”. The recession periods are as defined by the Centre for Economic Policy Research. The latest observations are for the fourth quarter of 2021 for stocks and February 2022 for the PMI survey.

Inventories comprise finished products, goods for resale, work in progress and inputs. Inventories therefore relate to several different stages of the production process. For instance, the ratio of input inventories to finished goods inventories is procyclical, as the build-up of inputs takes place early in economic upswings and precedes the accumulation of finished goods. In the absence of conjunctural data, survey indicators can give insights into the short-term inventory situation. The annual change in stocks of finished goods in manufacturing, based on the survey for the Purchasing Managers’ Index (PMI) – which measures the change in the growth of stocks – is well aligned with the annual contribution from changes in inventories to GDP growth based on the national accounts, and points to a continued positive contribution from stockbuilding in the first quarter of 2022 (Chart A).

Fluctuations in the contribution of stockbuilding to GDP growth reflect adjustments to changes in supply and demand conditions. Changes in the inventories of firms primarily serve as a buffer to enable a smooth production process, and to reduce the costs of adjusting production and the cost of deliveries as sales vary.[3] A regression equation estimated using a data sample for the period 2000-19 shows that the production gap – defined as the difference between dynamics in manufacturing production and in retail sales – explains the inventory cycle relatively well in times of crisis (Chart B). In other words, the contribution of stockbuilding to GDP growth declines when production falls more than retail sales (because stocks are used to make up the shortfall), and vice versa. Demand factors, as captured by the dynamics in orders, also induce firms to adjust their inventories. Deteriorating terms of trade and rising uncertainty, which could potentially trigger stockbuilding, have played a minor role. The contribution of stockbuilding has been particularly negative during times of crisis. In “normal” times “other factors”, i.e. the residual component, explain a non-negligible part of the contributions of stocks to GDP, reflecting the fact that inventory statistics contain a residual component which is not related to the business cycle, as described above.

Chart B

Inventories and their drivers

(percentage point contributions to year-on-year GDP growth)

Sources: Eurostat and ECB calculations.

Notes: The estimation is based on Boata, A., “Painful destocking in sight for European corporates”, EulerHermes, 2019. The estimation period in the chart covers the period from the first quarter of 2000 to the fourth quarter of 2019. Orders (based on the PMI manufacturing survey information), terms of trade (the export/import deflator), and the production gap (industrial production minus retail trade) are expressed in year-on-year terms, lagged by one quarter. Uncertainty is captured by the level of the European Policy Uncertainty index. The crisis factor is a dummy variable for the recession periods (as defined by the Centre for Economic Policy Research). The item “Other factors” reflects the residual component. The latest observation is for the third quarter of 2021.

The current acceleration in stockbuilding could also reflect a “bullwhip effect” related to supply bottlenecks. In an environment characterised by high demand and uncertainty about the supply of inputs, as a precaution manufacturing firms tend to hoard inventories of inputs and at times they inflate orders compared with their actual needs. This so-called bullwhip effect might have led to an amplification of the procyclicality of changes in inventories in the present environment.[4],[5] A breakdown of the PMI data for the manufacturing sector shows that the speed of stockbuilding of purchases (i.e. inputs) reached an all-time high at the end of 2021 for capital goods, intermediate goods and motor vehicles (Chart C, panel a), then started to ease at the beginning of 2022. Overall, the PMI data on stocks of finished goods suggest that inventories have been broadly unchanged over the past few months for capital and intermediate goods, after having progressively increased since mid-2021. By contrast, stockbuilding continued to increase for motor vehicles until late 2021 (Chart C, panel b), owing to the accumulation of (almost) finished cars lacking microchips. The stock of finished motor vehicles only started to decline very recently, following an improvement in the global supply of microchips.

Chart C

Stocks by type and sector

(diffusion indices, 50 = no change)

Source: Markit.

Notes: The stock of purchases refers to responses to the PMI survey question on “the level of inventory of materials purchased (in units, not money) this month compared with the situation one month ago”; regarding the stock of finished goods, see the notes to Chart A. The latest observations are for February 2022 for the total and for January 2022 for the components.

Looking ahead, the very low levels of inventories and the persistence of supply-side constraints may point to additional inventory building. The PMI manufacturing survey indicates an overall continued acceleration in stockbuilding in the first quarter of 2022, while in the European Commission survey inventory levels in both the manufacturing and retail sectors are still assessed as historically low, despite some recent improvements in the manufacturing sector (Chart D). Evidence from corporate contacts[6] reflects heterogenous views on stocks across sectors, product complexity and the place in the production chain, but overall confirms that inventories of inputs and finished goods are low, while stocks of semi-finished goods and goods in transit tend to be high.[7] The aggregate change in the pace of stockbuilding – which determines the contribution of stocks to GDP growth – depends in particular on the resolution of supply-side constraints and possible over-ordering. Corporate contacts expect bottlenecks to linger at least until the second half of this year, which could prolong the bullwhip effect. While the additional expected stockbuilding could reflect precautionary motives, corporate contacts and other sources[8] have not so far provided strong evidence of a general change in firms’ inventory management strategies from just-in-time[9] to just-in-case production, which could permanently affect the inventory cycle.

Chart D

Assessment of stocks of finished goods

(demeaned, percentage balances)

Sources: European Commission (DG-ECFIN) and ECB calculations.

Notes: The data refer to responses to the European Commission survey question “Do you consider your current stock of finished products to be too large (above normal) / adequate / too small (below normal)?”. The latest observation is for February 2022.

- This is because production that is not sold in the accounting period in which it is made increases inventories in that period; hence it is the change in inventories that enters the “accounting identity” that links GDP and its expenditure components. See the box entitled “Stockbuilding – theoretical considerations and recent developments”, Monthly Bulletin, ECB, May 2012.

- Discrepancies occur because inventories often play a prominent role in the balancing process of national accounts and thus contain a large “residual” component, owing to the lack of actual or reliable source data on inventories at a quarterly frequency. Valuables comprise, for instance, precious metals and art objects and constitute a small share of inventories.

- See Khan, A., “The Role of Inventories in the Business Cycle ” Business Review, Federal Reserve Bank of Philadelphia, Q3 2003.

- See Lee, H. L, Padmanabhan, V. and Whang, S., “Information Distortion in a Supply Chain: The Bullwhip Effect”, Management Science, 1997, Vol. 43, Issue 4.

- See Shin, H. S., “Bottlenecks, labour markets and inflation in the wake of the pandemic”, speech at the G20 International Seminar “Recover together, recover stronger”, December 2021.

- For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.

- See the box entitled “Main findings from the ECB’s recent contacts with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2022. Higher than usual finished goods inventories could reflect shipping constraints, a lack of components or high prices, raising the value of inventories and thus the cost of working capital, while unusually low inventories result from high demand.

- See for instance Alicke, K., Barriball, E. and Trautwein, V., “How COVID-19 is reshaping supply chains” McKinsey & Company, November 2021.

- The “just-in-time” supply chain model focuses on lean inventories to reduce production costs, which dampens the inventory cycle, see Piger, M., “Is the Business Cycle Still an Inventory Cycle?”, Economic Synopses, No 2, Federal Reserve Bank of St Louis, 2005. Inventories are reduced to a minimum level and short-term supply contracts, which can quickly be adjusted to changes in demand, are used.