- RESEARCH BULLETIN NO. 68

- 27 March 2020

How costly are pension reform reversals?

In this article we examine the effects of reversing the pension reforms adopted since the early 2000s. We find that reversing past pension reforms would be very costly, and would put a disproportionate burden on current and future young generations. Even without reversals, further reforms are needed to address the adverse macroeconomic and fiscal impact of population ageing.

Population ageing and pension reforms

Europe’s population is ageing, and this trend is expected to continue over the coming decades. The demographic changes are captured by the change in the old-age dependency ratio, which measures the size of the elderly population – defined as people aged 65 years and older – in relation to the working-age population – aged 15-64. According to Eurostat, between now and 2070 the ratio for the euro area will rise strongly from 30% to 52%, with considerable differences across countries. Two-thirds of this increase will be concentrated in the next decade and a half, as the large “baby boom” generation born 1955-70 will be over 65, while life expectancy will keep rising and the fertility rate will remain low or fall even further.

Ageing societies are facing major macroeconomic challenges. Labour forces are shrinking and precautionary savings are likely increasing, while rising pension expenditures can pose a risk to the sustainability of pay-as-you-go pension schemes. To relieve the burden on public finances, most euro area countries have adopted sizeable pension reforms since the early 2000s. Among the most effective reforms are those that lift the retirement age, in particular if it is adjusted automatically to changes in life expectancy (Carone et al., 2016). More recently, however, a number of governments have been facing strong political pressure to undo past reforms. How costly are reversals of pension reforms for the economy and public finances? How do they affect intergenerational burden sharing? What measures are needed to compensate if public debt levels are rising due to reversals?

In a forthcoming ECB working paper (Baksa, Munkacsi and Nerlich, 2020), we explore these questions. To do so, we apply a new approach that allows us to quantify not only the macroeconomic and fiscal impact of population ageing and pension reforms, but also that of reform reversals. We show that in the long run reversing pension reforms can be very costly. This would not only result in higher pension expenditure and public debt, but could also worsen the adverse macroeconomic impact of ageing and make the public pension system more intergenerationally unfair.

Pension reform reversals: stylised country cases

As a starting point, we took the pension cost projections from the European Commission’s 2018 Ageing Report. These projections have many advantages: they are detailed, country-specific and account for the impact of all legislated reforms – including those not yet fully implemented. However, the Ageing Report is based on a simple accounting framework which ignores general equilibrium behavioural reactions, including feedback effects between the public sector and the macroeconomy. To address our questions, a more sophisticated approach is needed. Accordingly, we use a dynamic general equilibrium model with overlapping generations (developed by Baksa and Munkacsi, 2016).

We quantify the costs of reform reversals as deviations of important macroeconomic and fiscal variables from our baseline scenario, which is determined by population ageing and pension reform measures legislated in the past. Three stylised types of reform reversals are modelled: changes in the retirement age, in the contribution rate to the public pension scheme and in the pension benefit ratio (the average pension divided by the average wage). We focus on planned or already adopted reform reversals in Germany and Slovakia.

Germany decided to freeze the benefit ratio at its current level of 48% and cap the contribution rate at 20% until 2025. This is a deviation from the baseline scenario, in which we assume a gradual decline in the benefit ratio and a further rise in the contribution rate. Moreover, the German government is contemplating whether to extend these limits until 2040, in which case the many baby boomers would benefit from the measures.

Another example is Slovakia, where it was decided to break the automatic link between the gradual rise in the statutory retirement age and improvements in life expectancy by capping the retirement age at 64. Based on our model estimates, the retirement age of 64 will be reached by 2045.

Our four main findings, explained in more detail below, can be summarised as follows. First, the pension reforms adopted are unlikely to be sufficient. Second, reform reversals will significantly impact growth and government finances. Third, reversals might make pension schemes even more unfair to young generations and, fourth, taking compensatory measures later would disproportionately burden a single generation.

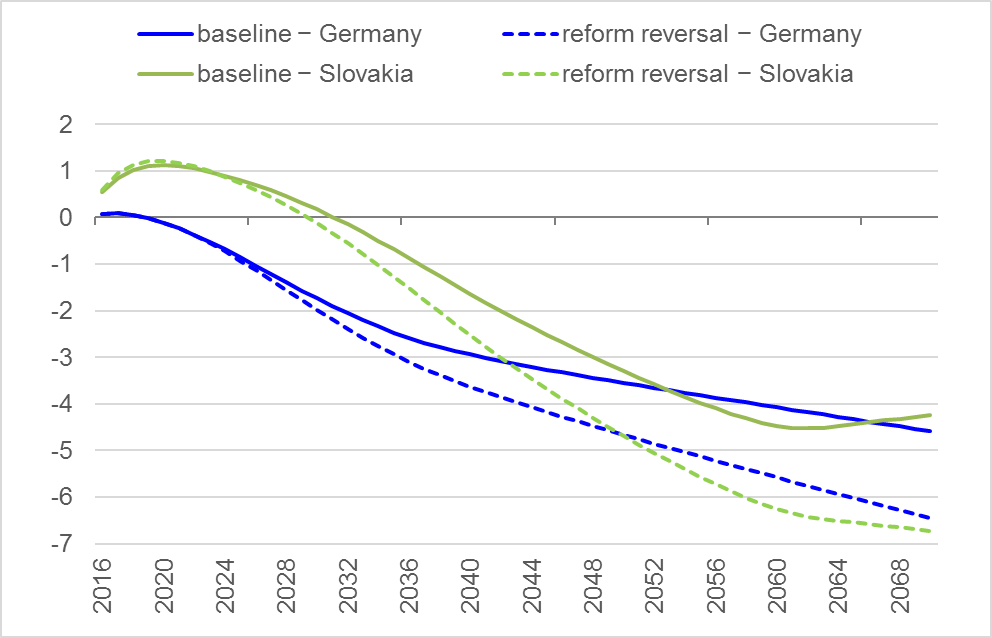

First, given the future demographic changes, the pension reform measures adopted in the past are unlikely to be sufficient to fully contain the adverse macroeconomic and fiscal impacts of ageing in the long run. Even if the reforms to public pensions were maintained, under the baseline scenario by 2070 the public debt-to-GDP ratio would increase in both Germany and Slovakia by around 100 percentage points (see Chart 1). Leaving aside any other factors influencing the debt trajectory, we find that additional pension reform measures are essential. By 2070, GDP per capita is predicted to decline by almost 14% in Germany and 9% in Slovakia.

Chart 1

Ageing-induced public debt trajectories with and without reform reversal (deviation from initial steady state, % of GDP)

Note: The chart shows the ageing-induced public debt trajectories, for Germany and Slovakia, which are the deviations from the debt ratio in the initial steady state (2016) until 2070, both under the baseline and under the reform reversal scenarios.

Second, reform reversals will carry sizeable costs in the form of a worse fiscal and macroeconomic outlook compared with the baseline scenario. For Germany and Slovakia, we find that the increase in the public debt-to-GDP ratio would be considerably higher if past reforms are reversed, namely by almost 60 percentage points in Germany and 50 percentage points in Slovakia (see Chart 1). Cushioning the rise in the retirement age in Slovakia would have a significant negative impact on GDP per capita (shrinking by almost 15%, instead of 9% in the baseline scenario). This is because people would retire earlier, which, in turn, would lower the size of the labour force. In Germany, the growth impact would be roughly unchanged from the baseline.

Third, reform reversals are likely to worsen the intergenerational fairness of pay-as-you-go pension systems. This can be captured by the relative share of consumption of future young generations, which is expected to decline more strongly than under the baseline scenario (see Chart 2). In fact, future young generations will be forced to increase their private savings.

Chart 2

Share of consumption by young generation over time (deviation from initial steady state, % of total consumption)

Note: The chart shows the deviation of the consumption share of the young generation in percent of total consumption from the initial steady state (2016) until 2070, under the baseline and the reform reversal scenarios, for Germany and Slovakia.

Fourth and finally, though countries could eventually adopt compensatory measures to partially offset the effects of the reversal on fiscal sustainability, this would be likely to place a disproportionally large adjustment burden on one single generation. For Germany, we assume that the compensatory measures would take the form of a rise in the retirement age. The results suggest that Germany would need to increase its effective retirement age by 5½ years in total to 71 years by 2070 to offset the rise in the public debt-to-GDP ratio, out of which 2 years would be on account of the reform reversal. For Slovakia, we consider as compensatory measures a lower benefit ratio or a higher contribution rate. We find that, if the retirement age were to be capped at 64 years, the public debt impact could be compensated for by a massive decline in the benefit ratio of more than 29 percentage points by 2070. This, in turn, might raise doubts about the adequacy of pensions for future retirees. Alternatively, the contribution rate could be increased which, instead, would shift the adjustment burden to the young generation. In addition, delaying offsetting measures would make the adjustment burden even heavier.

Concluding remarks

Our analysis suggests that reversals of pension reforms are potentially very costly. In fact, reform reversals would not only result in higher aggregate pension expenditure and public debt-to-GDP ratios, but would in most cases also worsen the adverse impact of ageing on economic activity. If the reversed reform elements were to be compensated for by other policy instruments, a disproportionally large part of the adjustment burden would fall on one generation.

The costs of reform reversals may be even higher when accounting for political-economy considerations, such as the gradual ageing of the median voter. Therefore, it might become increasingly difficult to adopt pension reforms, as demonstrated by recent protests in Europe. This, in turn, speaks even more strongly against reversing pension reforms that have already been legislated.

References

Baksa, D. and Munkacsi, Z. (2016), “A detailed description of OGRE, the OLG model”, Bank of Lithuania Working Paper Series, No 31, August 2016.

Baksa, D., Munkacsi, Z. and Nerlich, C. (2020), “A framework for assessing the costs of pension reform reversals”, ECB Working Paper Series, forthcoming.

Carone, G., Eckefeldt, P., Giamboni, L., Laine V. and Pamies- Sumner, S. (2016), “Pension reforms in the EU since the early 2000’s: achievements and challenges ahead”, European Commission Discussion Paper, December 2016.

European Commission (2018), “The 2018 Ageing Report: economic and budgetary projections for the EU Member States (2016-2070)”, European Economy, May 2018.

- This article was written by Daniel Baksa (Economist, International Monetary Fund), Zsuzsa Munkacsi (Economist, International Monetary Fund) and Carolin Nerlich (Senior Lead Economist, Directorate General Economics, Fiscal Policies Division, ECB). It is based on the forthcoming ECB Working Paper “A framework for assessing the costs of pension reform reversals”. The authors gratefully acknowledge the comments of Daehaeng Kim, Alberto Martin, Peter McAdam, Beatrice Pierluigi, Philipp Rother and Zoë Sprokel. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank, the Eurosystem or the International Monetary Fund, its Executive Board or IMF Management.