What are instant payments?

Instant payments are credit transfers that make funds available in a payee’s account within ten seconds of a payment order being made.

SEPA Instant Credit Transfer

In the EU, all instant credit transfers in euro are based on the European Payments Council’s SEPA Instant Credit Transfer scheme (SCT Inst), which was launched in November 2017. The key features of SCT Inst include the service being consistently available (24 hours a day, 365 days a year); and it taking no more than ten seconds for the recipient’s payment service provider (PSP) to inform the payer’s PSP whether the money has been received and, in the case of a successful transaction, to make the funds available to the recipient. While uptake has been growing, the provision of instant payments to payment account holders is not available to the same degree across all SEPA jurisdictions. Measures to further harmonise the provision of instant payments across SEPA jurisdictions would increase customer choice and foster innovation, greater safety and strategic autonomy for European payments.

The ECB welcomes the Instant Payments Regulation (IPR) of 13 March 2024 which is aimed at speeding up the provision and uptake of instant payments. As stated in the ECB’s legal opinion, the initiative ties in well with one of the goals of the Eurosystem’s retail payments strategy, namely the full deployment of instant payments at European level.

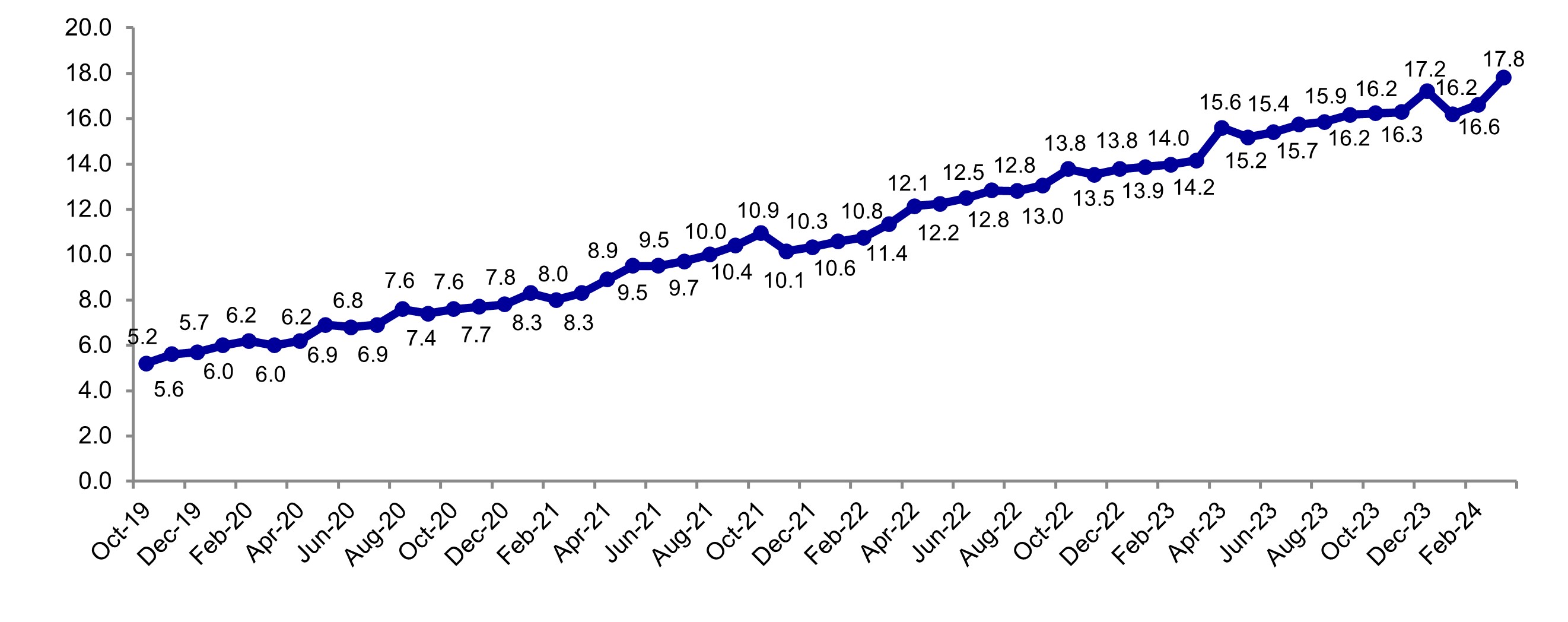

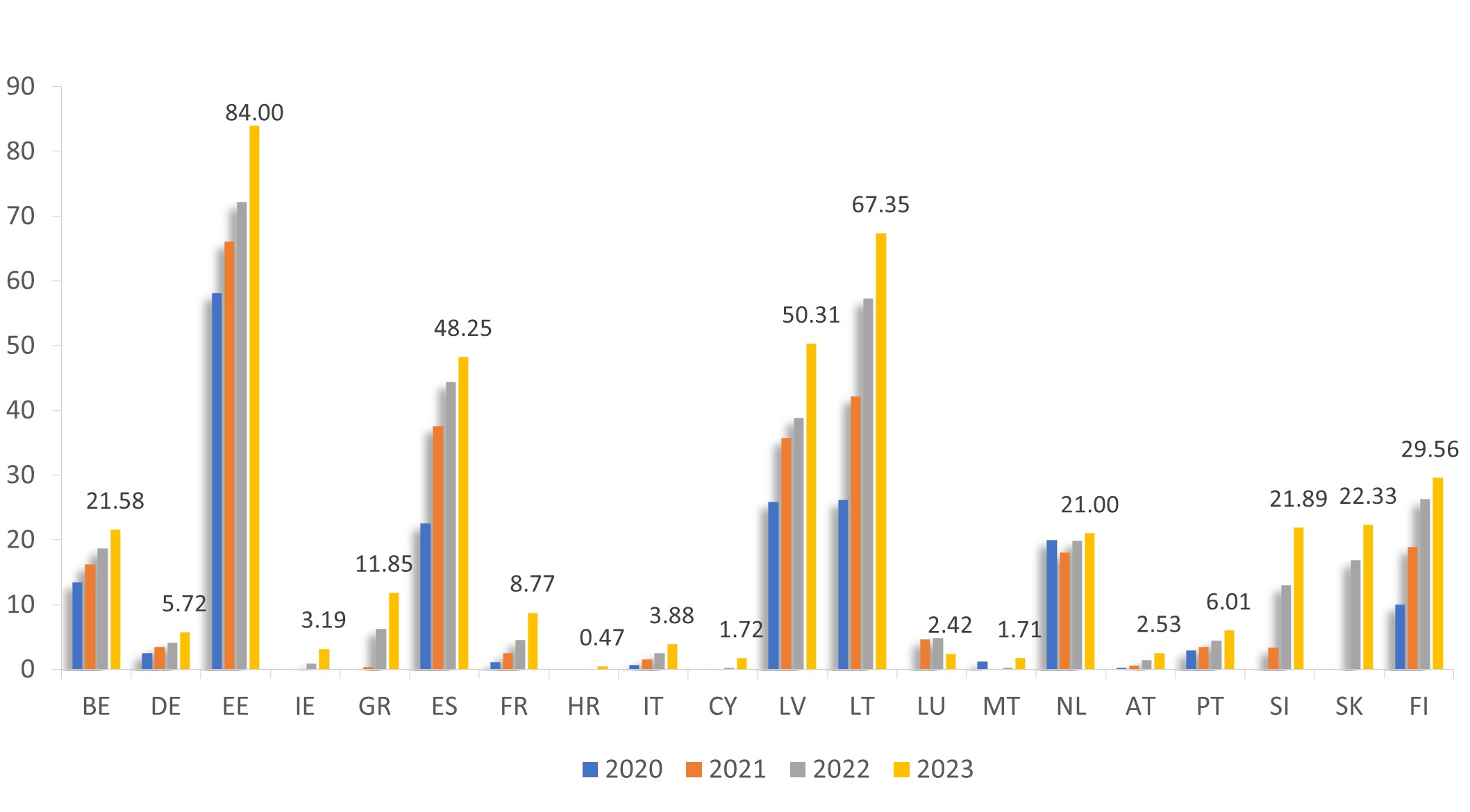

Requirements and milestones of the Instant Payments Regulation for PSPsThe Eurosystem monitors the use of SCT Inst via its euro area SCT Inst indicator. The indicator is calculated as the percentage of SCT Inst transactions out of all SEPA credit transfers. The data are compiled on a monthly basis and aggregated from clearing and settlement mechanisms at the end of each quarter.

Chart 1 shows the development of the indicator for the entire euro area over time, while Chart 2 shows annual figures for individual euro area countries.

Chart 1

The percentage of SCT Inst in all SEPA Credit Transfer transactions

(Percentage)

Chart 2

The percentage of SCT Inst in all SEPA Credit Transfer transactions per euro area country, in the period 2020-2023

(Percentage)

The figure for Germany might not be fully comparable with other countries’ figures as payments between PSPs in the savings and cooperative banking sectors are not included in the published figures. Banks serving the retail segment in Luxembourg started offering SCT Inst in 2020, in some cases as a standard product.

Instant payments at a pan-European level

Multiple instant payment solutions may help achieve the objectives of competition, innovation and integration, but only if they each have a pan-European reach. To this end, solutions should either be developed at the pan-European level or, if developed at the national level, be mutually interoperable with other solutions. To avoid any fragmentation and increase competition, instant payment solutions should consist of the following layers:

• end-user solution layer: cooperatively or competitively developed in the market (e.g. for person-to-person mobile payments);

• scheme layer: underlying payment schemes;

• clearing layer: arrangements for the clearing of transactions between PSPs;

• settlement layer: arrangements for settlement of transactions between PSPs.

End-user solution and scheme layers

The ECB continues to encourage market participants to develop and implement instant payment end-user solutions at a pan-European level and to support their uptake. The aim is that individuals and businesses across Europe have equal access to instant payment services and additional new functionalities, such as requests to pay.

To this end, the Eurosystem has created a set of recommendations for PSPs that also highlights the potential benefits of further market developments. As public administrations are also important stakeholders with regard to credit transfers, the ECB has developed a brochure to illustrate how instant payments could also benefit this sector.

Clearing and settlement layers

The Eurosystem is working closely with the industry to ensure that the clearing and settlement layers can support SCT Inst. It has defined a set of expectations for infrastructures offering clearing services for pan-European instant payments in euro and has replaced TARGET2 with an enhanced system, T2, to support the settlement of instant payments cleared by these infrastructures.

At the settlement layer, in November 2018 the ECB launched the TARGET Instant Payment Settlement (TIPS) service, which enables instant payments to be settled immediately, safely and at any time. As of 2022, PSPs that are part of the SCT Inst scheme and are reachable in T2 must also be reachable via TIPS. This contributes to the pan-European reachability (or interoperability) of PSPs that offer instant payments at the technical, market infrastructure level. Further information on the topic is available here.

See also

Find out more about related content

Euro Retail Payments Board

The Euro Retail Payments Board (ERPB) is a high-level strategic body tasked with fostering the integration, innovation and competitiveness of euro retail payments in the EU.

Eurosystem's retail payment strategy

Our retail payments strategy supports the creation of a pan-European payment solution and improve instant payments, among other things.