Rotation towards normality – the impact of COVID-19 vaccine-related news on global financial markets

Published as part of the ECB Economic Bulletin, Issue 1/2021.

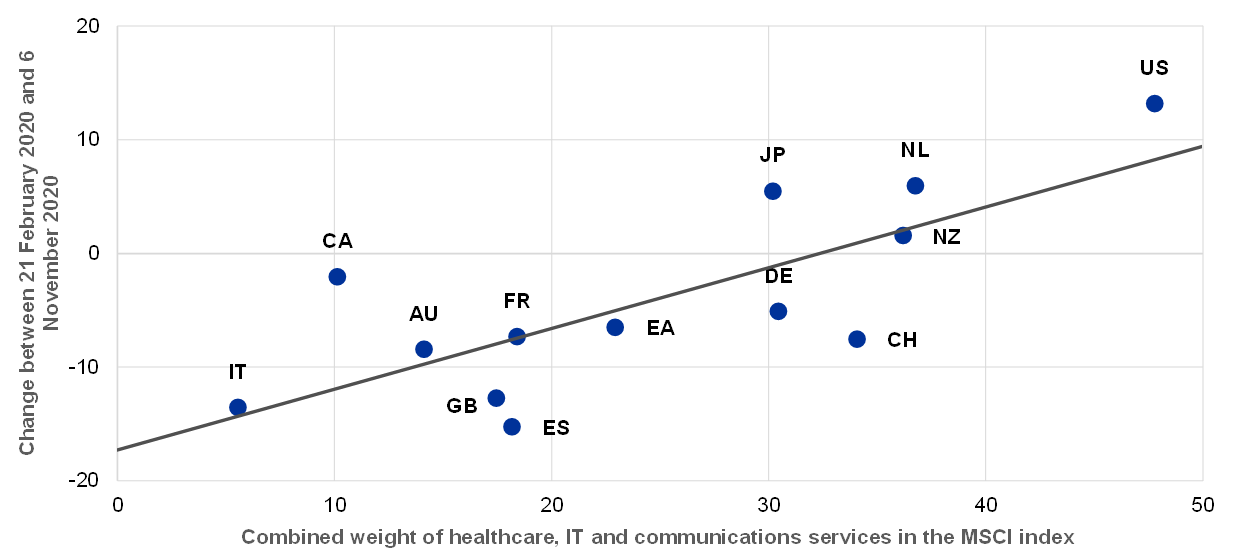

The outbreak of the coronavirus (COVID-19) pandemic led to a synchronised sell-off of global risky assets, followed by an uneven recovery across sectors and countries. The stock market recovery was characterised by investors rebalancing away from countries and sectors hit by the pandemic, including airlines, tourism and energy, towards those perceived to benefit from the crisis, most notably IT and communications services, as well as pharmaceutical firms. Across countries, the pre-pandemic sector composition of the stock market explains the bulk of the differences in equity market performances in 2020 (Chart A, upper panel).

The announcements in mid-November on the successful development of several vaccines seem to have partly reversed this “COVID trade” investment strategy. News of the effectiveness and imminent arrival of multiple vaccines led to a rotation out of equity market sectors with high momentum until then. Countries with equity markets that were lagging the recovery, in part because they have a smaller share in the sectors that gained from the pandemic, benefited more from the news on the development of an effective vaccine (Chart A, lower panel).

Chart A

Countries and sectors hit harder by the pandemic benefited more from vaccine-related announcements

Advanced economies’ equity market performance pre-vaccine news

(percentages)

Post vaccine news

(percentages)

Sources: Bloomberg and ECB staff calculations.

Notes: The date 21 February corresponds to the COVID-19 shock. The date 6 November corresponds to the day before the announcement of a first successful vaccine by Pfizer/BioNTech. Sector shares are as of December 2019. The latest observation is for 7 December 2020.

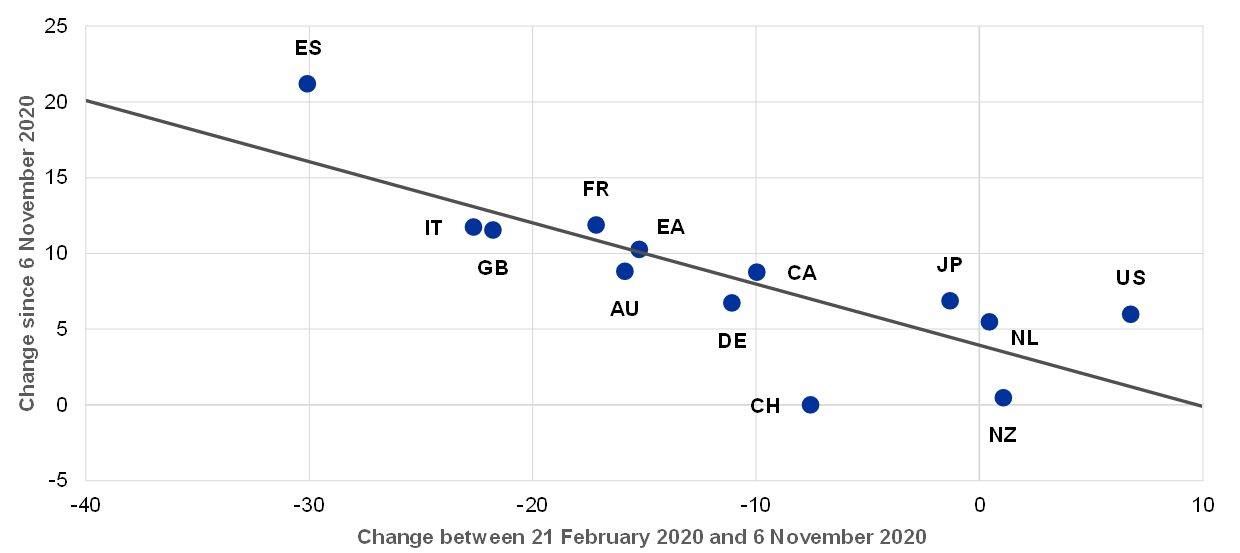

The vaccine announcements in November 2020 were not the first vaccine-related news to materially affect the probability of near-term vaccine delivery. According to Good Judgement, which surveys “superforecasters”, the likelihood that a vaccine would be delivered by the end of the first quarter of 2021 increased markedly during summer 2020 (Chart B). Hopes for an early delivery of a vaccine experienced a setback in September, which created some volatility in the probability indicator.

Chart B

Previous vaccine-related news also affected the probability of near-term vaccine delivery

Probability of vaccine delivery by the first and third quarters of 2021

(percentages)

Source: Good Judgement.

Notes: (1) Vaccine approval in Russia, (2) Pfizer/BioNTech late-stage tests, (3) US Food and Drug Administration fast-track announcement, (4) AstraZeneca trial put on hold, (5) Pfizer/BioNTech announce vaccine. The latest observation is for 7 December 2020.

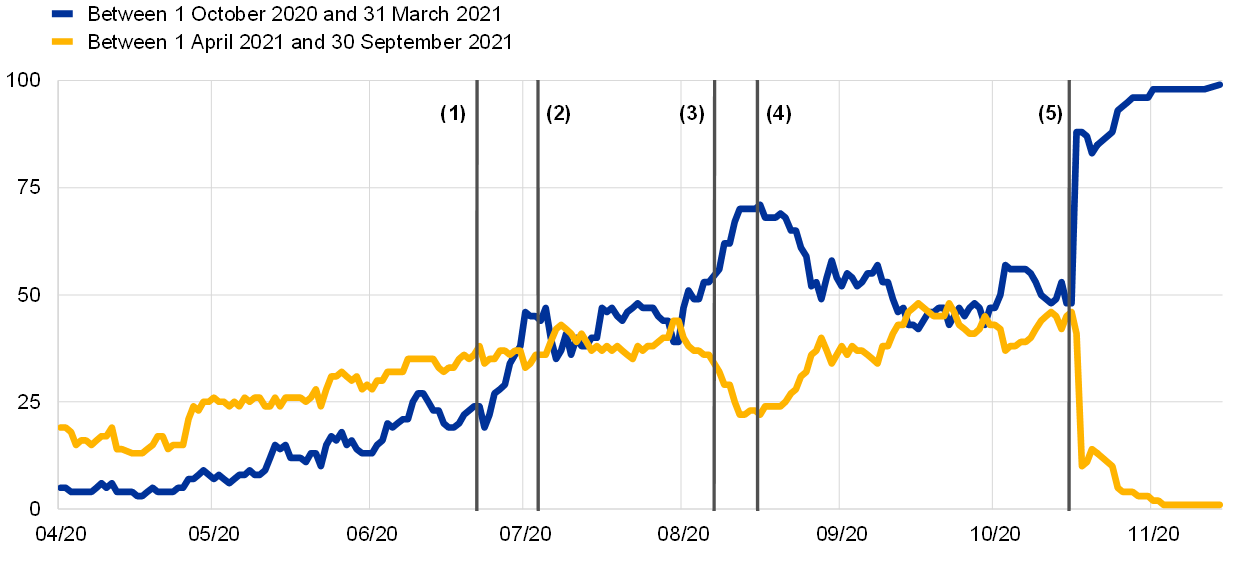

This box assesses how confidence in the probability of vaccine delivery has affected a broad range of financial assets. Local projections are used to estimate the impact of vaccine-related news between April and mid-November 2020 on different market segments, sectors and countries. The shock variable is defined as the first difference in the probability of vaccine delivery by the first quarter of 2021 on major vaccine event days. The events are identified on a narrative basis.[1] Control variables include past macro news, monetary policy and market stress.

The econometric results suggest that the stock market sectors hit hardest by the pandemic benefited the most from positive vaccine news. This holds when looking at US and euro area airline and energy sectors, as well as in assessing the impact on so-called low momentum indices, such as the Dow Jones Low Momentum Index which includes the 200 US companies ranked as having the lowest returns over the past year (Chart C). In quantitative terms, the results suggest that a 10 percentage point increase in the probability of early vaccine delivery boosted euro area airline shares by 5%.

Chart C

Low momentum sectors outperformed

Cumulative responses over three working days to a 1 percentage point increase in the probability of vaccine shipment by the first quarter of 2021 in the United States and euro area

(percentages/basis points)

Sources: Bloomberg, Good Judgement and ECB staff calculations.

Note: Change in 10-year yields in basis points. The euro area (EA) bond yield corresponds to the 10-year Bund. An increase in the Financial Condition Index (in index points) represents an easing, while a decline represents a tightening. All other variables are expressed as percentages. The latest observation is for 7 December 2020.

By contrast, equity market sectors that have benefited from the pandemic have tended to underperform in response to increases in the probability of near-term vaccine delivery. The impact of vaccine news on sectors that led the recovery out of the market trough has been largely insignificant. This holds when looking at individual sectors, IT and pharmaceutical, or when looking at high momentum stock market indices. The fact that these sectors’ equity prices have not declined also suggests that optimistic vaccine-related news has had a positive effect on aggregate.

The euro area seems to have benefited disproportionately from positive vaccine news. Across most sectors, including the energy, airline, pharmaceutical and technology sectors, euro area equity prices are estimated to have increased more in response to positive vaccine events compared with their US peers. This may reflect the fact that economies in which risky asset markets were hit harder by the pandemic are expected to benefit more from a vaccine.

Despite an increase in risk-free yields, financial conditions have tended to ease. Longer-term risk-free yields increased in response to positive vaccine news, suggesting that it provided a boost to global risk sentiment. However, financial conditions have eased overall, as the increase in yields has not offset the easing impulses from equity markets and other risky assets. Consistent with the stronger impact on euro area equity market sectors compared with US peers, euro area financial conditions are estimated to have eased more.

Overall, positive news regarding the arrival, effectiveness and number of vaccines has boosted risky assets and eased financial conditions, suggesting that investors have become more willing to look through the near-term challenges of the pandemic. At the same time, the results also suggest that any setback in the development or shipment of the vaccine may have economically significant implications for global financial markets.

- All events that capture progress/setbacks in vaccine development or major changes in relevant institutional frameworks are selected.