Euro area balance of payments (June 2005)

In June 2005, the seasonally adjusted current account of the euro area was in deficit as the income and current transfer deficits exceeded the surpluses in goods and services. In the financial account, combined direct and portfolio investment recorded net inflows of EUR 96 billion. This predominantly reflected substantial net purchases of euro area securities by non-residents.

Current account

The seasonally adjusted current account of the euro area showed a deficit of EUR 2.5 billion in June 2005 (corresponding to a EUR 2.1 billion deficit in non-seasonally adjusted terms). This reflected the fact that the surpluses in goods (EUR 6.2 billion) and services (EUR 0.5 billion) were more than offset by deficits in income (EUR 4.7 billion) and current transfers (EUR 4.5 billion).

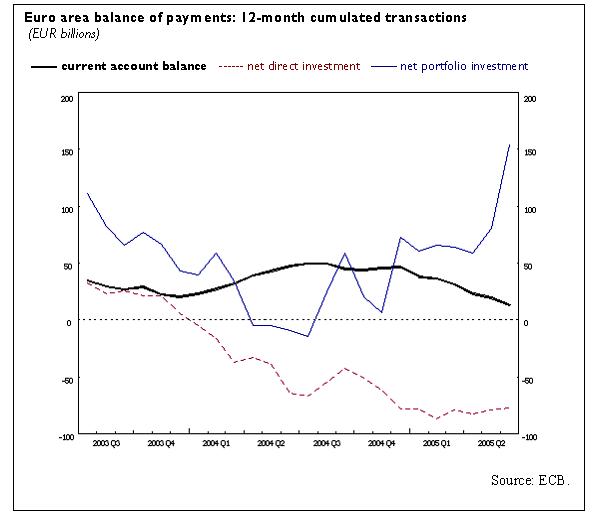

The 12-month cumulated surplus of the euro area current account up to June 2005 amounted to EUR 15.5 billion, i.e. around 0.2% of GDP, as compared with EUR 47.3 billion a year earlier. This decrease mainly resulted from a decline of EUR 45.6 billion in the surplus in goods, which was partly compensated for by a lower deficit in income (by EUR 13.3 billion).

Financial account

In the financial account, combined direct and portfolio investment recorded net inflows of EUR 96 billion in June 2005. This reflected substantial net inflows in portfolio investment (EUR 105 billion) and net outflows in direct investment (EUR 9 billion).

The developments in portfolio investment resulted from large net inflows in both equity securities and debt instruments. Net inflows in equity securities (EUR 62 billion) were predominantly accounted for by net purchases of euro area equity securities by non-residents (EUR 58 billion). Net inflows in debt instruments (EUR 44 billion) mainly reflected net purchases of euro area bonds and notes by non-residents (EUR 77 billion).

As regards direct investment, net outflows of EUR 21 billion in equity capital and reinvested earnings mainly reflected investment abroad by euro area residents. These net outflows were partly offset by net inflows in other capital – mostly inter-company loans (EUR 12 billion).

Other investment showed net outflows of EUR 84 billion, mainly as a result of large net outflows in short-term investment by monetary financial institutions (MFIs) excluding the Eurosystem (EUR 95 billion).

Reserve assets decreased by EUR 0.9 billion (excluding valuation effects). The stock of the Eurosystem’s reserve assets stood at EUR 302 billion at the end of June 2005.

In the 12-month period up to June 2005, combined direct and portfolio investment recorded cumulated net inflows of EUR 76 billion, as compared with net outflows of EUR 73 billion a year earlier. This mainly resulted from a shift from net outflows (EUR 9 billion) to net inflows (EUR 154 billion) in portfolio investment that was due to increased net purchases of euro area securities by non-residents. Over this period, net outflows in direct investment increased by EUR 14 billion, largely on account of higher investment abroad by residents.

Data revisions

In addition to the monthly balance of payments data for June 2005, this press release incorporates some revisions to the data for May 2005. These revisions have not significantly altered the main results.

Additional information on the euro area balance of payments and international investment position

A complete set of updated euro area balance of payments and international investment position statistics is available on the ECB’s website in the “Statistics” section under the heading “Data services”/“Latest monetary, financial markets and balance of payments statistics”. The results up to June 2005 will also be published in the September 2005 issue of the ECB’s Monthly Bulletin. A detailed methodological note is available on the ECB’s website. The next press release on the euro area monthly balance of payments will be published on 21 September 2005.

Annexes

Table 1: Current account of the euro area – seasonally adjusted data.

Table 2: Monthly balance of payments of the euro area – non-seasonally adjusted data.

Evropská centrální banka

Generální ředitelství pro komunikaci

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Německo

- +49 69 1344 7455

- media@ecb.europa.eu

Reprodukce je povolena pouze s uvedením zdroje.

Kontakty pro média