Eurosystem balance sheet

The annual consolidated balance sheet of the Eurosystem comprises the assets and liabilities of euro area national central banks (NCBs) and the ECB held at year-end vis-à-vis third parties.

Claims and liabilities between Eurosystem central banks (intra-Eurosystem claims and liabilities) are netted and are therefore not visible.

The content and format of the Eurosystem’s annual consolidated balance sheet are set out in Annexes IV and VII to Guideline (EU) 2016/2249 of the European Central Bank of 3 November 2016 on the legal framework for accounting and financial reporting in the European System of Central Banks (ECB/2016/34).

Financial developments in 2021

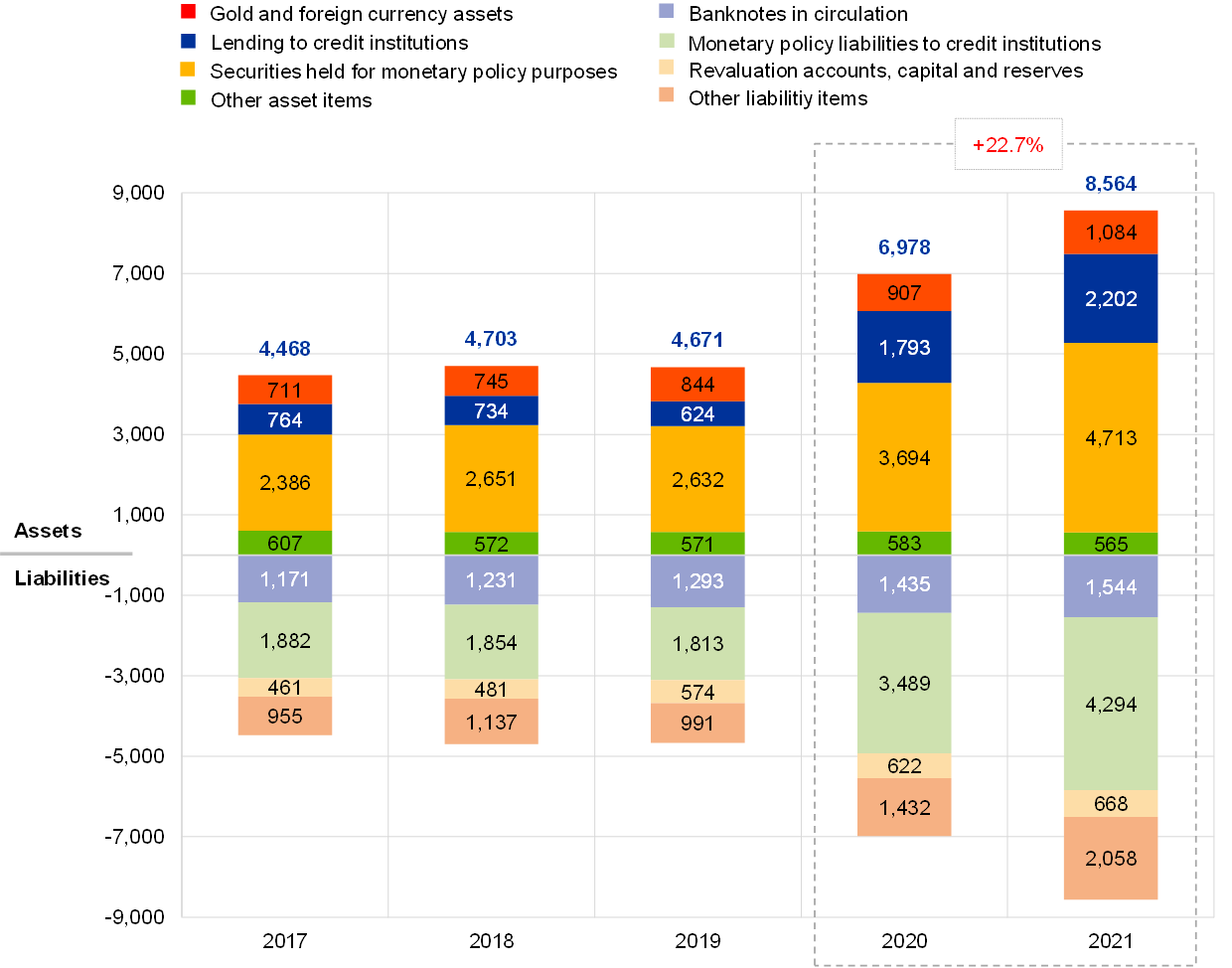

In 2021 the Eurosystem’s balance sheet total increased by €1,586.7 billion to €8,564.4 billion (+22.7%), mainly because of purchases of securities under the asset purchase programme (APP)[1] and the pandemic emergency purchase programme (PEPP)[2] coupled with an increase in Eurosystem refinancing operations, in particular due to net allotments under the third series of targeted longer-term refinancing operations (TLTRO III).

Chart 1 presents the main components of the Eurosystem’s balance sheet from 2017 to 2021. The balance sheet expanded in 2017 and 2018, mostly owing to the net acquisition of securities under the APP. Net purchases under this programme ceased in December 2018 and resumed in November 2019, as a result of which the size of the Eurosystem’s balance sheet decreased slightly in 2019. The increase in the size of the balance sheet in 2020 and 2021 can mainly be attributed to the monetary policy measures taken to soften the impact of the coronavirus (COVID-19) pandemic.

Chart 1

Eurosystem balance sheet by component, 2017-21

(EUR billions)

Source: Eurosystem.

Euro-denominated securities held for monetary policy purposes (asset item 7.1) constituted 55% of the Eurosystem’s total assets as at the end of 2021. Under this balance sheet item, the Eurosystem holds securities acquired under the APP, the PEPP and the terminated purchase programmes, i.e. the Securities Markets Programme (SMP) and the first two covered bond purchase programmes (CBPP1 and CBPP2).

In 2021 securities held by the Eurosystem for monetary policy purposes increased by €1,018.9 billion to €4,713.4 billion (Chart 2), with PEPP purchases amounting to 81.2% (or €827 billion) of this increase. Securities holdings under the APP increased by €214.5 billion to €3,123.4 billion. Securities held under the SMP and the first two covered bond purchase programmes (CBPP1 and CBPP2) declined by €22.1 billion and €0.4 billion respectively owing to redemptions.

Chart 2

Securities held for monetary policy purposes, 2017-21

(EUR billions)

Source: Eurosystem.

Impairment tests of securities held for monetary policy purposes are conducted on an annual basis and approved by the Governing Council. As a result of the impairment tests conducted at the end of 2021, the Eurosystem has not recorded any impairment losses on the securities held in its monetary policy portfolios.

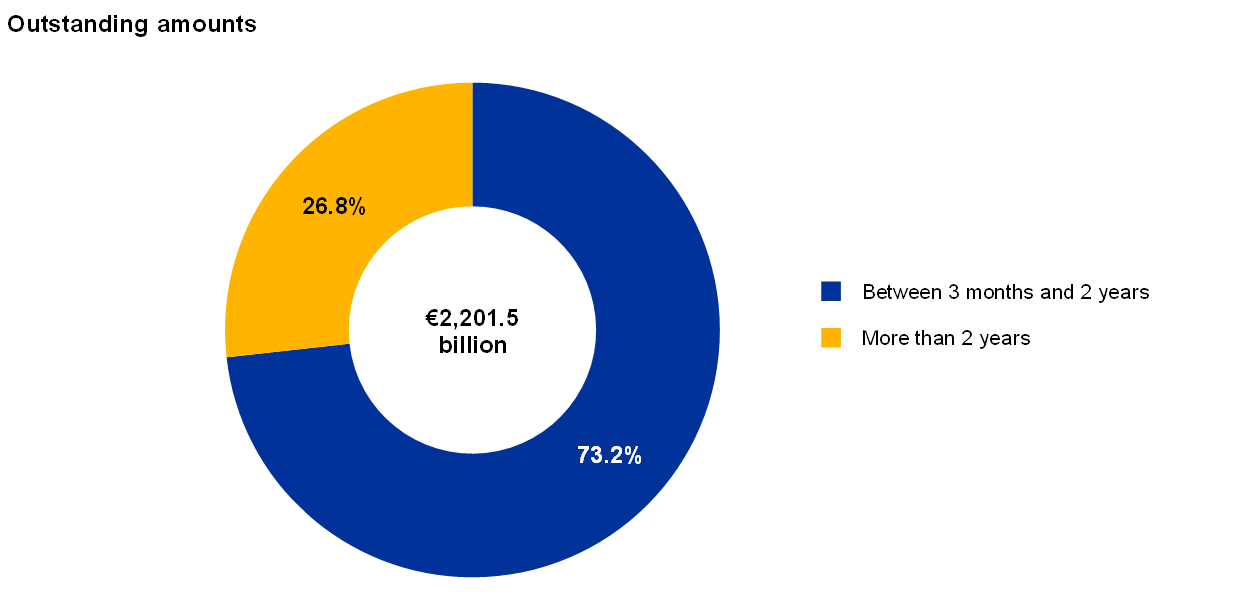

Lending to credit institutions (asset item 5)[3] increased by €408.7 billion to €2,201.9 billion. The increase is mainly attributable to net allotments under TLTRO III (€448.7 billion)[4], which were partially offset by repayments under the pandemic emergency longer-term refinancing operations (PELTROs) (€23.2 billion) and TLTRO II (€15.7 billion). Chart 3 shows the breakdown of maturity for outstanding longer-term refinancing operations (asset item 5.2) as at 31 December 2021.

Chart 3

Residual maturity of outstanding longer-term refinancing operations

Source: Eurosystem.

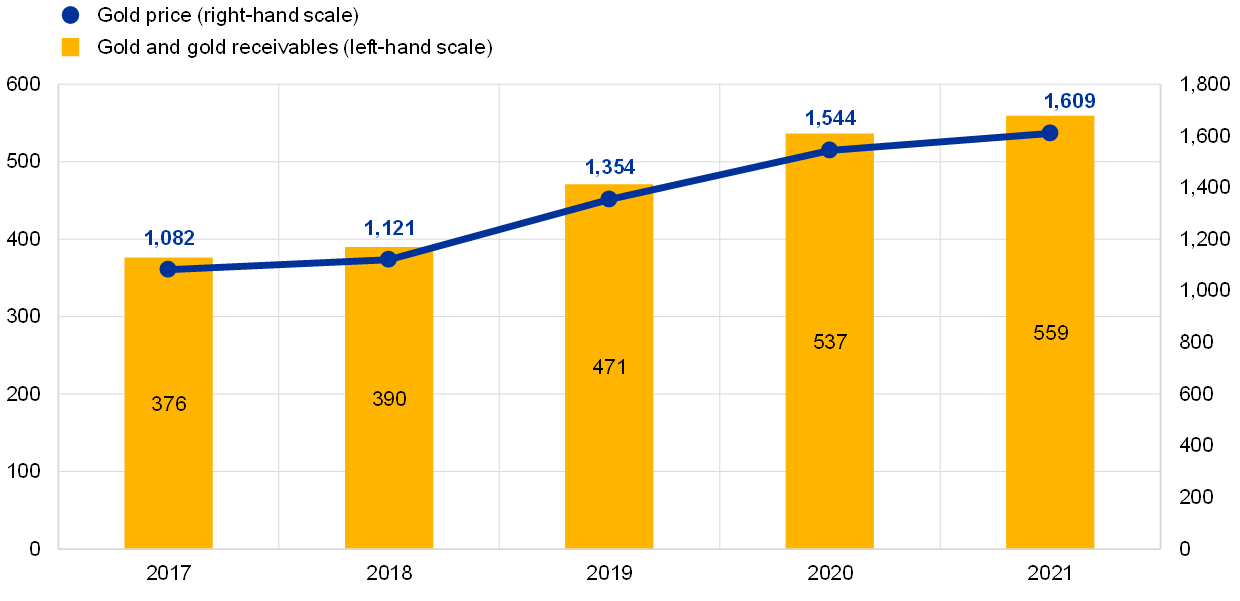

In 2021 the value of the Eurosystem’s gold and gold receivables (asset item 1) increased by €22.8 billion to €559.4 billion (Chart 4), primarily reflecting the rise in the market price of gold in euro terms. This increase also led to an equivalent rise in the Eurosystem’s gold revaluation accounts.

Chart 4

Gold holdings and gold prices, 2017-21

(left-hand scale: EUR billions; right-hand scale: euro per fine ounce of gold)

Source: Eurosystem.

The net position of the Eurosystem in foreign currency (asset items 2 and 3 minus liability items 7, 8 and 9) rose by €25 billion in euro terms to €329.1 billion. The increase is mainly due to the effects of the revaluation of assets and liabilities denominated in foreign currency, which accounted for €17.7 billion of the increase. The remaining increase of €7.3 billion is due to a rise in customer and portfolio transactions. The Eurosystem’s foreign currency holdings comprise mainly US dollars, special drawing rights (SDRs) and Japanese yen.

The increase in receivables from the International Monetary Fund (IMF) (asset item 2.1), and in the counterpart of special drawing rights allocated by the IMF (liability item 9), is mainly due to the allocation of SDRs to the Eurosystem central banks by the IMF in August 2021. The allocation was designed to provide liquidity to the global economic system by supplementing the foreign reserves of the IMF member countries.[5] The Eurosystem central banks received the general SDR allocation in proportion to their existing quotas in the Fund.[6]

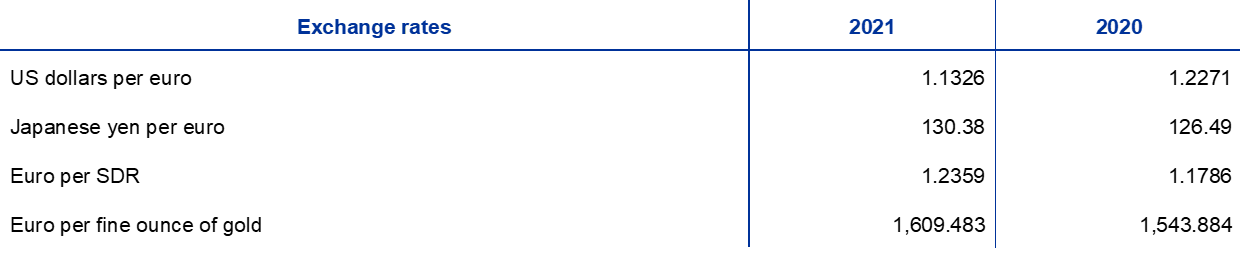

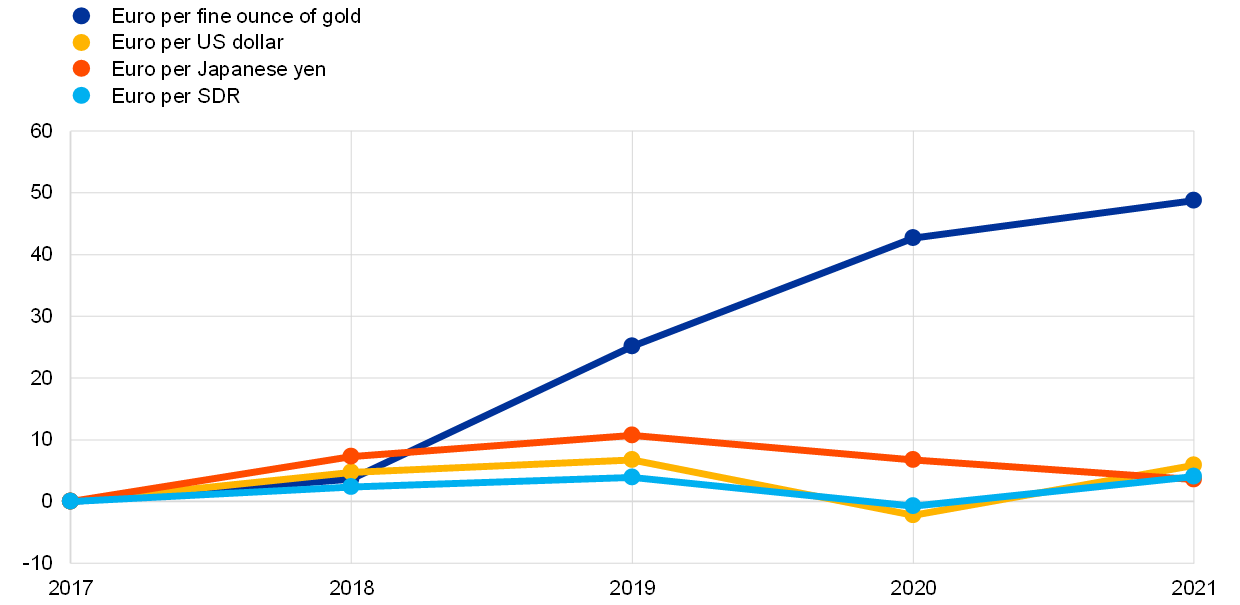

In line with the Eurosystem’s harmonised accounting rules, gold, foreign exchange and financial instruments (other than securities classified as held-to-maturity, non-marketable securities and securities held for monetary policy purposes) are revalued at market rates and prices. The gold price and the principal exchange rates used for the revaluation of year-end balances and those of the previous year-end were as follows:

Chart 5 below shows the gold price and main foreign currency rate movements against the euro during the period from 2017 to 2021.

Chart 5

Main foreign exchange rates and gold price, 2017-21

(percentage changes vis-à-vis 2017, year-end data)

Source: Eurosystem.

In 2021 banknotes in circulation[7] (liability item 1) increased by €109.9 billion to €1,544.4 billion. The amount of euro banknotes in circulation has grown strongly since the euro was introduced in 2002 and intensified during the pandemic.

Base money, which in addition to banknotes in circulation includes current accounts (liability item 2.1) and the deposit facility (liability item 2.2), rose by €912.3 billion to €5,836.1 billion in 2021. This is mainly due to the greater size of Eurosystem refinancing operations and the continuation of monetary policy securities purchases. The increase under current accounts was further influenced by the two-tier system[8] introduced in October 2019.

Liabilities to other euro area residents denominated in euro (liability item 5) increased by €145.9 billion to €757.1 billion as a result of an increase in deposits of government and other euro area residents, including financial institutions not subject to minimum reserve requirements.

Liabilities to non-euro area residents denominated in euro (liability item 6) rose by €278.8 billion to €710 billion, mainly due to an increase in Eurosystem reserve management service (ERMS)[9] deposits and securities lending operations against cash collateral with non-euro area counterparties over year-end.

Revaluation accounts (liability item 11) increased by €42.4 billion to €554.9 billion in 2021, primarily reflecting a rise in the revaluation accounts for gold and foreign currencies (Chart 6).

Chart 6

Breakdown of revaluation accounts, 2020-21

Source: Eurosystem.

Capital and reserves (liability item 12) increased by €3.4 billion to €113 billion in 2021. Some Eurosystem central banks maintain provisions (part of liability item 10) for risks that have not materialised.[10] These provisions stood at €115.9 billion at the end of 2021, compared with €110 billion at the end of 2020.

The APP consists of the third covered bond purchase programme (CBPP3), the asset-backed securities purchase programme (ABSPP), the public sector purchase programme (PSPP) and the corporate sector purchase programme (CSPP). Further details can be found on the ECB’s website under Asset purchase programmes.

The PEPP is a temporary asset purchase programme of private and public sector securities initiated in March 2020 to counter the serious risks to the monetary policy transmission mechanism and the outlook for the euro area posed by the pandemic. Further details can be found on the ECB’s website under Pandemic emergency purchase programme.

More information about lending can be found on the ECB’s website under Open market operations.

Allotments net of the early repayments.

More information can be found on the IMF website under 2021 General SDR Allocation.

As disclosed in the press release entitled Consolidated financial statement of the Eurosystem as at 27 August 2021.

Information on the development of banknotes in circulation since 2002, broken down by denomination, can be found on the ECB’s website under Banknotes and coins circulation.

More information on the two-tier system can be found on the ECB’s website under Two-tier system for remunerating excess reserve holdings.

More information on the ERMS can be found on the ECB’s website under Eurosystem reserve management services.

The creation of these provisions is subject to the legal frameworks of the individual central banks. Provisions related to Eurosystem monetary policy operations are not included.