ECB macroprudential stress test complements the EBA/SSM stress tests results in 2021

Published as part of the Financial Stability Review, November 2021.

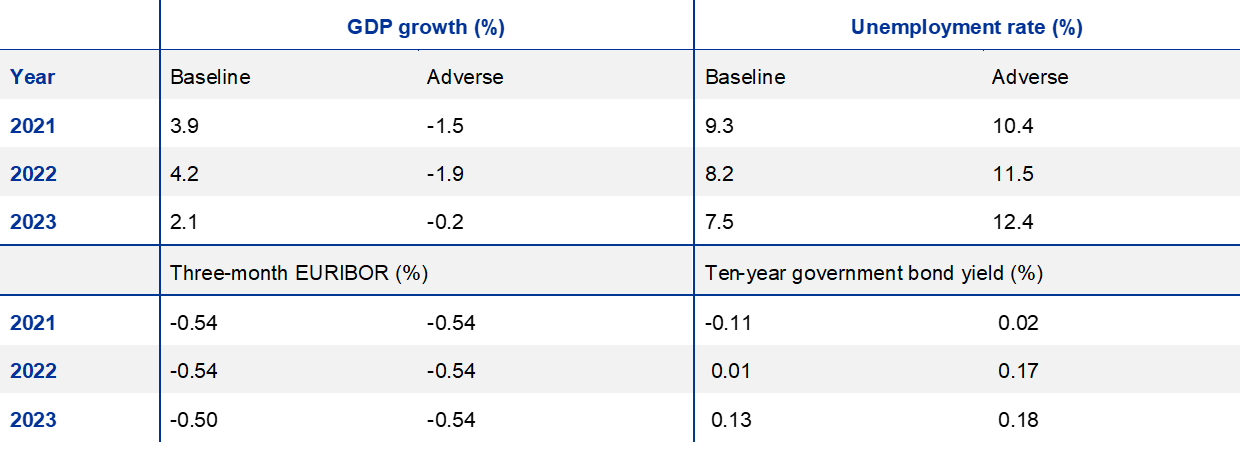

The ECB’s biennial macroprudential stress test evaluates the resilience of the euro area banking system, this year also assessing the impact of pandemic-related policy measures[1]. The macroprudential stress test exercise complements the supervisory stress test recently published by the European Banking Authority/Single Supervisory Mechanism (EBA/SSM). While relying on the same adverse and baseline scenarios (see Table A),[2] it also employs a dynamic balance sheet perspective and introduces amplification mechanisms.[3],[4] This year it also examined a number of remaining pandemic-related policy measures, including the profit distribution restrictions phased out at the end of September 2021, public guarantee programmes and public moratoria.

Table A

Baseline and adverse scenarios in the EBA/SSM and macroprudential stress test exercises

Source: Macro-financial scenario for the 2021 EU wide banking sector stress test, ESRB 2021.

Note: The table is taken from the macro-financial scenario for the 2021 EU-wide banking sector stress test published by the ESRB on 29 January 2021, excluding the feedback loop between the macro environment and banking sector.

EUR swap rate 3M.

In the baseline scenario, the system-wide CET1 ratio returns from around 15.5% at the end of 2020 to its pre-pandemic level of 14-14.8% in 2023 within a 90% uncertainty band.[5] The baseline scenario features a strong rebound in economic activity during 2021 and 2022. The slight decline in bank capitalisation compares with a final CET1 ratio of 15.8% in the EBA/SSM exercise (see Chart A, panel a). This reflects an expansion of bank assets in the macroprudential exercise coupled with a strong rebound in profit distribution by financial institutions.

Despite relatively strong bank capitalisation under the baseline scenario, the results emphasise some financial stability concerns. In the face of increasing credit default risk due to corporate solvency challenges in sectors highly impacted by the pandemic and the phasing-out of different policies measures, bank profitability remains muted,[6] representing a risk to the long-term sustainability of solvency levels. Bank profitability stays negative throughout the adverse scenario due to increasing credit losses over time along with lasting adverse economic conditions amplified by real-financial feedback loop impacts in the medium term (see Chart A, panel b).

Chart A

Macroprudential stress test yields a slight decline in CET1 ratios in the baseline scenario as banks expand balance sheets, but a large decline in solvency and profitability in the adverse scenario

Sources: ECB calculations.

Note: Panel a) illustrates the aggregate CET1 ratio forecast from the macroprudential stress test (blue and orange bars) compared with the EBA/SSM supervisory stress test figures (green and red dots) under a constant balance sheet assumption. Panel b) illustrates bank profitability in terms of return on assets. The whiskers around the bars indicate the parameter uncertainty of the macroprudential stress test projections.

Chart B

Lending outlook sharply differs for the two scenarios supported by policy support measures, with both demand and supply factors at play

Sources ECB calculations.

Notes: Panel a) illustrates annual loan growth projection for the non-financial private sector in two model settings. The bars represent the annual loan growth with existing policy measures, while the dots represent the resulting loan growth in the absence of policies. The whiskers around the bars indicate model and parameter uncertainty in the macroprudential stress test projections. Panel b) shows the breakdown of annualised loan growth by its demand and supply components.

- Macroprudential stress test of the euro area banking system amid the coronavirus (COVID-19) pandemic, ECB, October 2021.

- The two scenarios employed in the macroprudential stress test are aligned with the scenarios from the recently published EU-wide stress test (see ESRB, Macro-financial scenario for the 2021 EU-wide banking sector stress test, 2021). The baseline scenario is equivalent to the Eurosystem and ECB staff macroeconomic projections from December 2020, and was revised upwards in September 2021. The adverse scenario follows a different scenario selection procedure to that described in Box 6 of the November 2020 edition of the FSR.

- The dynamic modelling approach builds on a macro-micro model tracking the evolution of all 19 euro area economies and that of 89 significant banks covering approximately 70% of the euro area banking sector. Banks’ behavioural responses are modelled with empirical relationships representing their reactions in terms of lending volumes, loan pricing, liability structure and profit distribution. A more detailed description of the methodology and structure of the Banking Euro Area Stress Test (BEAST) model and of the implementation of stress test scenarios can be found in Budnik et al., “Banking euro area stress test model”, Working Paper Series, No 2469, ECB, November 2020.

- In terms of assumptions, the main differences between the constant and the dynamic balance sheet stress test exercises can be summarised by the presence of additional amplification mechanisms, the release of additional constraints such as zero recovery rates and constant dividend payout ratios. The differences and their implication are discussed in detail in Macroprudential stress test of the euro area banking system amid the coronavirus (COVID-19) pandemic, ECB, October 2021.

- The macroprudential stress test projections starting at the beginning of 2021 take into account parameter uncertainty in the estimated core model equations. Bank solvency results are reported as transitional CET1 ratio.

- Historical average ROA for the selected bank sample is 0.99% (2015-20).