Insurers’ balance sheets amid rising interest rates: transmission and risk-taking

Published as part of the Financial Stability Review, November 2022.

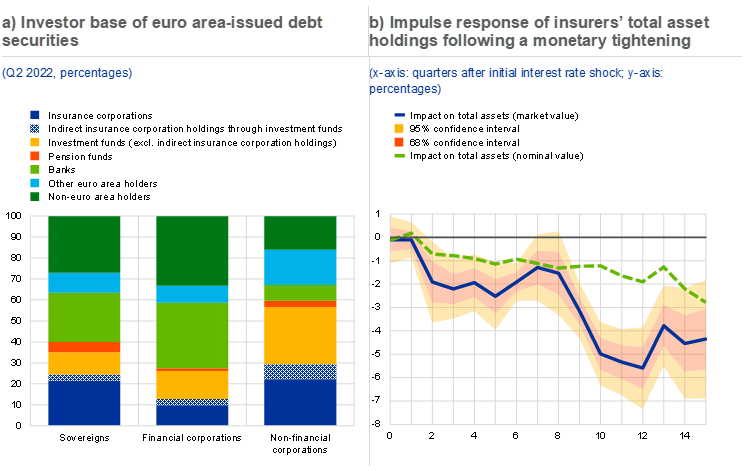

The euro area insurance sector and its relevance for real economy financing have grown significantly over the last two decades. As of the second quarter of 2022, the sector’s total assets amounted to around €8.5 trillion, equivalent to more than a quarter of the euro area banking sector’s assets. Insurers’ investments of policyholder premiums make the sector one of the largest investors in euro area debt markets (Chart A, panel a). As such, insurers provide an important source of funding for euro area sovereigns and corporates.[1] This means that, in an environment of changing interest rates, shifts in the sector’s investment behaviour can significantly affect market financing conditions; they may also have implications for financial stability as insurers rebalance risks in their investment portfolios.

Chart A

Insurers are key bond market investors and significantly reduce their balance sheets in response to higher interest rates

Sources: ECB (Insurance Corporations Statistics, Securities Holdings Statistics) and authors’ calculations.

Notes: Panel a: nominal holdings excluding the Eurosystem. Panel b: estimates are based on local projections using a panel of quarterly data for all euro area countries between Q1 2010 and Q4 2019. Monetary policy shocks are identified as in Jarociński and Karadi*, using the high-frequency data provided by Altavilla et al.**. The independent variables included in the model are two lags of the dependent variable, country-specific GDP and inflation, the three-year Bund yield, a three-year euro area BBB-rated corporate bond spread, the VSTOXX volatility index and country fixed effects. Standard errors are clustered at the country level. The monetary policy shock implies a 50 basis point increase in the three-year euro area risk-free rate on impact, which rises gradually to 150 basis points one year after the shock and triggers a persistent fall in GDP and inflation.

*) Jarociński, M. and Karadi, P., “Deconstructing monetary policy surprises – the role of information shocks”, American Economic Journal: Macroeconomics, Vol. 12, No 2, April 2020, pp. 1-43.

**) Altavilla, C., Brugnolini, L., Gürkaynak, R., Motto, R. and Ragusa, G., “Measuring euro area monetary policy”, Journal of Monetary Economics, Vol. 108, December 2019, pp. 162-179.

This box examines the effects of higher interest rates on the size and composition of euro area insurers’ balance sheets, as well as the implications of these effects for financial stability. Monetary policy can affect insurers in several ways. When a monetary tightening dampens real economic activity and households’ disposable income, this can translate into reduced demand for insurance services, a decline in premiums collected and ultimately lower demand for assets from insurers. At the same time, higher yield levels boost investment income and support insurers’ ability to provide guaranteed returns to their policyholders. This can reduce incentives for insurers to search for yield. Finally, as most insurers’ balance sheets feature a negative duration gap, higher yields may improve the capital position of insurers, potentially allowing them to countercyclically invest additional funds.[2] A local projections framework is used to empirically test the impact of monetary policy shocks on the size and composition of balance sheets in the euro area insurance sector. Based on quarterly data between the first quarter of 2010 and the fourth quarter of 2019, the results suggest that changes in monetary policy have a significant impact on both sector size and risk-taking.

The size of insurers’ balance sheets is highly responsive to interest rate changes, with total assets decreasing materially after a monetary tightening. After a monetary policy shock leading to a 50 basis point increase in yields on impact and gradually rising to 150 basis points after one year, total assets in market (nominal) value decrease by 4.2% (2.3%) over the course of one year (Chart A, panel b). The cumulative decline of the sector’s assets in nominal terms amounts to almost €200 billion one year after the shock and implies an active reduction in investments, while the additional decline in terms of market value can be attributed to revaluation losses. The financial intermediation capacity of the insurance sector thus decreases after a monetary tightening.

Rising yields induce shifts in euro area insurers’ asset holdings, which lead to a reduction in credit, liquidity and duration risk-taking. Applying the same monetary policy tightening described above against the asset composition of the euro area insurance sector at the end of 2021, it is clear that insurers rebalance their portfolios towards a higher share of debt securities while reducing comparatively riskier investments in direct lending, equities and investment fund shares (Chart B, panel a). Cash buffers, which fell considerably in the low interest rate environment, are projected to more than double to around 12% within three years, improving the liquidity of the sector. Credit risk-taking within the bond portfolio is also reduced as the share of bonds rated above BBB is projected to increase by around 6 percentage points, while the overall share of lower-rated bonds declines (Chart B, panel b). At the same time, the share of lower-rated euro area sovereign debt increases countercyclically.[3] Insurers also reduce their duration risk-taking in response to higher yields by investing less in bonds with maturities of over ten years (Chart B, panel c).

Chart B

Insurers reduce their credit, liquidity and duration risk exposures in response to higher interest rates

Sources: ECB (Insurance Corporations Statistics, Securities Holdings Statistics, Centralised Securities Database) and authors’ calculations.

Notes: All results are based on local projections as described in the notes to panel b in Chart A. Panels a and b show balance sheet projections over 15 quarters against the asset composition in Q4 2021. Panel b: lower-rated debt includes securities rated at BBB and below. Panel c: the variable shown is the holdings of AAA-rated sovereign debt with residual maturity in excess of ten years, relative to all AAA-rated sovereign debt holdings.

Medium-term financial stability risks in the insurance sector could decline amid rising interest rates. The results presented in this box show that insurers may reduce the riskiness of their assets in response to rising yields. This would strengthen the sector’s resilience to adverse macroeconomic shocks, such as an increase in corporate defaults. Lower demand from insurers for riskier assets may, however, also contribute to deteriorating financing conditions for firms and the wider economy. Projected increases in insurers’ cash holdings could allow the sector to withstand larger liquidity shocks – helping it to absorb policy lapses that may become more frequent as yields rise – and large margin calls. Finally, insurers’ increased demand for lower-rated sovereign debt could partially alleviate concerns about fragmentation in euro area sovereign bond markets.

For further information on the growing importance of insurers and other non-banks, see also Box 2 entitled “Measuring market-based and non-bank financing of non-financial corporations in the euro area”, Financial Integration and Structure in the Euro Area, ECB, April 2022.

For an earlier discussion of these channels, see, for example, Chapter 4.3 in the Financial Stability Review, ECB, May 2021.

This is consistent with Fache Rousová, L. and Giuzio, M., “Insurers’ investment strategies: pro- or countercyclical?”, Working Paper Series, No 2299, ECB, July 2019, who also show that insurers operate countercyclically on sovereign debt markets in response to changes in risk-free rates, but procyclically in response to increases in risk premia.