The impact of war: extreme demand for euro cash in the wake of Russia’s invasion of Ukraine

Published as part of the The international role of the euro, June 2023.

Proximity to war boosts foreign and domestic demand for euro cash

Geopolitical conflicts can have a significant impact on the demand for euro cash outside the euro area, as illustrated by Russia’s invasion of Ukraine in February 2022. Chart A, panel a, compares the deviation of demand for euro banknotes from historical averages, both from non-euro area countries (blue line) and from countries within the euro area (dotted grey lines) between January 2021 and May 2022 – immediately after demand returned to near-average levels. In the months before the invasion, foreign demand for euro cash remained below its historical average. However, it rose far above its historical average just after the invasion (in March 2022), to an extent greater than in most euro area countries in that period. This suggests that precautionary motives were a determinant of demand for euro cash from non-euro area countries, mainly driven by high-value denominations (€100 and €200) which are mostly used for store-of-value purposes.[1]

Precautionary demand for euro cash is most likely related to the impact of the war, with distinct regional effects. Additional data on euro area countries offer indirect evidence that geographical proximity to the conflict could be an important determinant of precautionary demand in non-euro area countries – i.e. that demand was driven by the standard law of gravity. Chart A, panel b, shows how in the wake of the invasion monthly banknote issuance deviated exceptionally from historical averages in euro area countries geographically located near Ukraine, while issuance levels in countries geographically further from the conflict remained within the historical regularities. Some euro area countries bordering Ukraine or Russia (such as Estonia, Lithuania, Slovakia and Finland) saw extremely elevated demand levels, ranging from six to ten standard deviations from their respective historical average. Other countries, which are relatively close to but do not share a border with Ukraine also saw unusual excess demand for cash, with deviations of up to five standard deviations from the mean (e.g. Austria, Germany, Latvia and Slovenia).

Chart A

Russia’s war and precautionary cash demand: evidence from outside and within the euro area

Sources: ECB.

Notes: On the x-axis of both panels, the time series data on banknote issuance were seasonally adjusted for each country and standardised. Net shipments abroad from each euro area country were removed to avoid double-counting. Panel a shows each country’s maximum standard deviation in February or March 2022, as some countries reacted more rapidly than others after Russia’s invasion on 24 February 2022. On the y-axis of panel b, the physical distance in kilometres from each country’s capital to Kyiv is measured using straight lines.

The absence of other clearly identified events to explain these cross-country differences suggests that extreme precautionary demand in countries close to the conflict area could be attributed to geopolitical risks. In line with demand from the euro area, foreign demand may have been unusually higher in countries near the war zone, as data provided by wholesaler banks suggest. In particular, euro banknote gross outflows to central, eastern and south-eastern European (CESEE) countries from the European Union more than trebled in 2022 compared with 2021.

Foreign demand in CESEE countries – further evidence from the OeNB Euro Survey

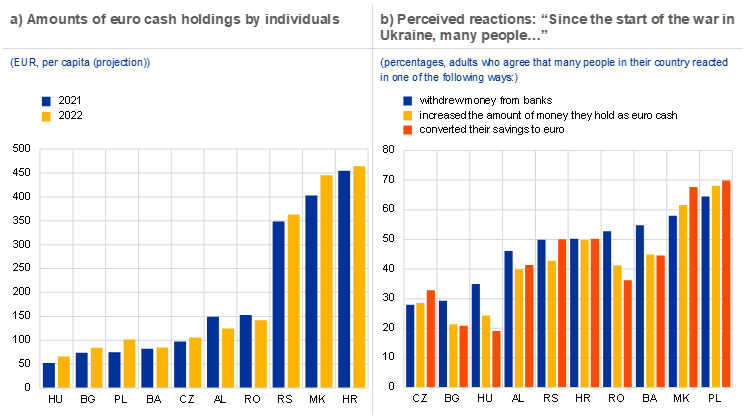

Data from a regular survey conducted by the Oesterreichische Nationalbank (OeNB) shed further light on foreign demand for euro cash.[2] The OeNB Euro Survey data – collected in the autumn of 2022 – investigate how widespread the use of and demand for euro cash is in CESEE countries that do not have the euro as legal tender. Chart B, panel a, shows that per capita euro cash holdings increased slightly in most countries in 2022 compared with 2021. The increase seems moderate compared with the surge in foreign demand in March 2022 shown in Chart A, panel a. This is probably in part because the survey was conducted in October 2022, i.e. after euro banknote shipments normalised to pre-war levels and saw a further strong decline after the ECB increased policy interest rates. In addition, the survey also asked individuals about their perceived reaction to the war (Chart B, panel b).[3] Between 30% and 60% of CESEE citizens report observing withdrawals of cash from banks, increases in euro cash holdings and conversions of savings into euro. The substantial differences across countries notwithstanding, the survey results provide further evidence of strong demand for euro cash from CESEE countries in response to the war.

Chart B

OeNB Euro Survey results on central, eastern, and south-eastern European countries' euro cash holdings and reactions to Russia’s war in Ukraine

Source: OeNB Euro Survey.

Notes: In panel a, per capita values are extrapolated for the entire population aged 14 years and over. In panel b, bars indicate the share of respondents that “strongly agree”, “agree” or “somewhat agree” that adults in their countries reacted by either withdrawing money from banks, increasing their euro cash holdings or converting savings to euro.

The determinants of individuals’ perceptions of changes in euro cash holdings in response to the war, and how these perceptions vary across countries, can be identified using statistical analysis.[4] The results suggest that, in line with broader demand for euro cash,[5] network effects play an important role: individuals living in regions where euro cash usage is common were more likely to report increases in cash withdrawals, euro cash holdings and euro savings after the start of the war. Moreover, those who were affected by the economic fallouts of the transition to a market economy, or those expecting that their local currency would depreciate relative to the euro, also tended to report perceived increases in euro cash holdings. Finally, lower trust in the domestic central bank and government affects people's perceptions of increases in euro cash holdings, while lower trust in European institutions seems to be uncorrelated with the perceptions in question.

Significantly large increases in precautionary cash demand were observed globally in past financial, technological or natural disaster-related crises. See “The paradox of banknotes: understanding the demand for cash beyond transactional use”, Economic Bulletin, Issue 2, ECB, Frankfurt am Main, 2021.

The OeNB Euro Survey has collected information about individual euro cash holdings, saving and borrowing decisions using a nationally representative sample and looked into respondents’ economic opinions, expectations and experiences since autumn 2007.

The indirect question regarding observed behaviour has the advantage of not being very personal, in contrast to asking about personal cash holdings in a face-to-face interview where the incentive not to respond or to underreport is high. Results for perceived behaviour are positively and significantly correlated with reported personal behaviour.

The estimates reported are marginal effects from probit regressions.

See Stix, H. (2013), “Why do people save in cash? Distrust, memories of banking crises, weak institutions and dollarization”, Journal of Banking & Finance, Vol. 37, No 11, pp. 4087-4106.