Published as part of the ECB Economic Bulletin, Issue 3/2023.

The increase in consumer goods price inflation in the euro area over the last two years was preceded by a sharp rise in producer prices. Leading indicator properties of industrial producer prices for consumer prices form a well-established and central element of the ECB’s analysis of pipeline pressures.[1] A previous analysis introduced a framework to obtain a time profile for the impact of producer prices on consumer prices.[2] This box takes that analysis further by using the time profile of these impacts to derive indicators for producer price pressures (IPPIs), which summarise total price pressures from producer prices on food and non-energy industrial goods (NEIG) consumer prices over time. These IPPIs complement a broad range of various measures that are useful in anticipating and assessing the extent of underlying price pressures in the economy.[3]

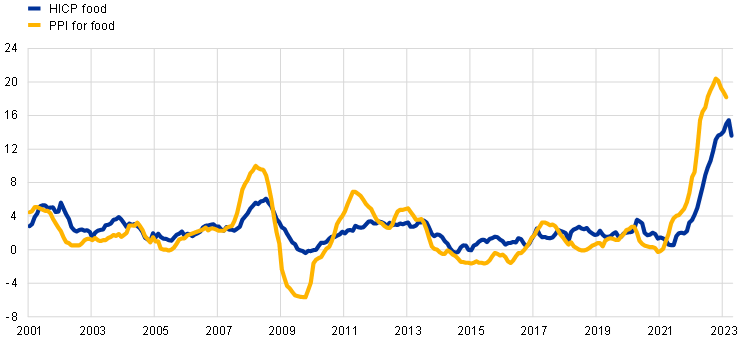

Producer price indices (PPIs) capture the prices of goods at the time when these goods leave factory gates. PPIs reflect the costs of production and the markups on these costs, while consumer prices also include taxes and levies, as well as the costs and markups of the distribution and retail sectors. There are different indicators of PPIs, which capture prices at different stages of the production chain. For example, PPIs for energy and intermediate goods capture pricing at earlier stages of production. For NEIG prices, the immediately relevant PPI is that of domestic sales for non-food consumer goods industries, whereas for consumer food prices it is the PPI of domestic sales for food industries.[4] These PPIs capture pricing developments in both the earlier and later stages of the production chain. Due to the conceptual differences, different weights of subcomponents in producer and consumer price indices, and the fact that consumer prices also reflect the prices of imported goods in addition to domestically produced goods, there is no full alignment between developments in the PPIs and their respective HICP counterparts (Chart A). The role of these differences becomes apparent, for example, in the somewhat greater amplitude of producer price developments over inflation cycles.

Chart A

Developments in euro area producer price indices (PPIs) and the respective HICP

a) Prices for food products

(annual percentage changes)

b) Prices for non-energy industrial goods

(annual percentage changes)

Sources: Eurostat, ECB calculations.

Note: The latest observations are for April 2023 (flash) for HICP and February 2023 for producer prices.

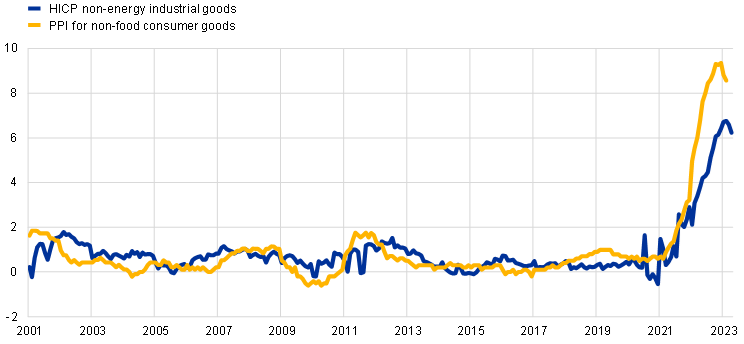

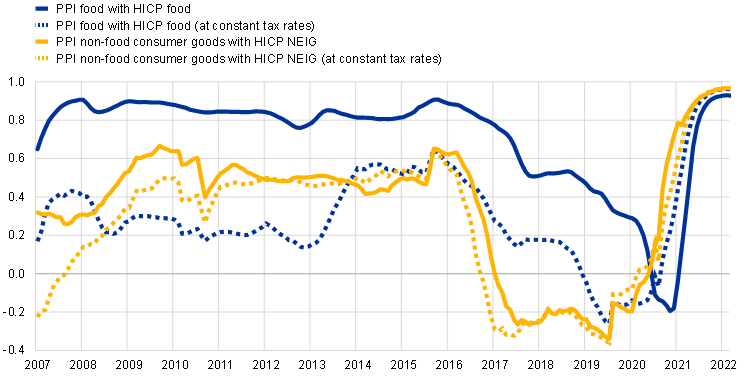

Simple correlation analysis suggests that the strength of the link between producer and consumer price indices varies over time (Chart B). There was a sharp rise in the contemporaneous correlation coefficients between PPI and HICP for both food and non-food consumer goods in 2022. This suggests that the exceptional underlying surge in energy and bottleneck-related costs since the beginning of 2021 revived the link between producer and consumer prices after an apparent decoupling during the years of low inflation.[5] The recent increase also indicates that the extent of the underlying pressures has reduced the ability of firms to buffer these substantially higher costs by adjusting profits and has led to a more pronounced adjustment of consumer prices than in the low-inflation environment, thus contributing to the inflation surge over the last two years.

Chart B

Contemporaneous correlation over time

(correlation coefficient; five-year moving average)

Sources: Eurostat, ECB calculations.

Notes: The latest observations are for February 2023. Correlation coefficient is calculated for the annual rates of change.

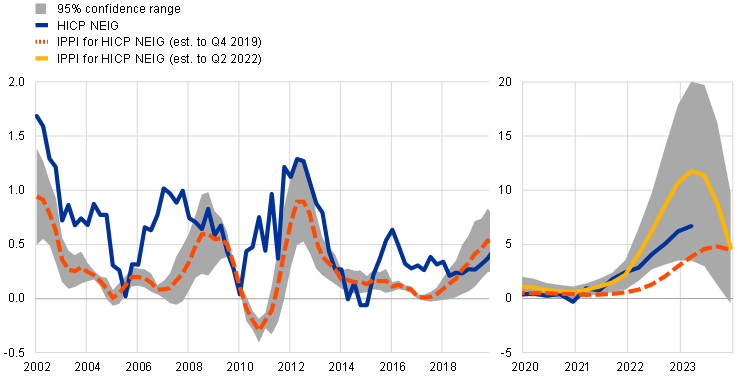

IPPIs are constructed using dynamic impulse responses of consumer prices to producer prices (elasticities) obtained with the local projections (LP) estimation method.[6] The equations relate the food and NEIG consumer prices to their own lags and contemporaneous and lagged changes in the respective PPIs. In addition, the equation for NEIG consumer prices includes import prices of non-food consumer goods and, to capture demand conditions, the unemployment rate. The estimation results suggest that NEIG prices respond to producer prices gradually, but the speed of these responses is likely to have significantly increased over the last two years.[7] The results including data for the more recent period are also accompanied by a much wider confidence band, in part reflecting the inclusion, in one specification, of both a previously lower inflation regime and the currently high inflation regime, which the model interprets as an increase in uncertainty. Such a widening of confidence bands and an increase in the correlation coefficient may indicate changes in the pricing strategies of firms amid the significant cost shocks observed as of 2021.

The LP results for consumer food prices show a faster response to changes in the producer prices than in the case of NEIGs. Moreover, the size and speed of the impact seem to have remained unchanged when extending the estimation sample with data from the last two years.[8] Examining whether the response of consumer food prices is different following increases or decreases in producer prices shows that the response after increases is faster. After a 1% increase in food producer prices, an equivalent 1% impact on consumer food prices already materialises within the first year, whereas after a 1% decline in producer prices the impact is more gradual and reaches only 0.8% within two years.[9] Such an asymmetry in responses was not evident in the case of non-food consumer goods prices.

The constructed IPPIs suggest that underlying cost pressures rose significantly in the course of 2022 and remained high for both non-food consumer goods and food products in early 2023. The elasticities for producer price impacts on consumer prices can be transformed to construct indicators which capture the cumulative impact of changes in producer prices on the annual inflation rate of non-food consumer goods and food products over time.[10] The IPPIs shown in Chart C encompass the pressures on consumer prices based on changes in producer prices over the previous eight quarters. According to these indicators, developments in producer prices over the course of 2021 and 2022 imply that the peak of the upward pressures on consumer prices for NEIG and food products may have been reached in the first and second quarters of 2023 respectively (Chart C). If the index for producer prices stops increasing or even starts declining in relation to the previous quarter, the underlying pressures can be expected to ease thereafter. Historically there are sizeable differences between the IPPIs and consumer prices, which in part reflects a different amplitude of volatility in producer prices relative to consumer prices.

Chart C

Indicators of producer price pressures on consumer goods prices (IPPIs)

a) IPPI for HICP non-energy industrial goods

(annual percentage changes)

b) IPPI for HICP food

(annual percentage changes)

Sources: Eurostat, ECB calculations.

Notes: The latest observations are for Q1 2023 for HICP and Q4 2023 for IPPI (derived using PPI data for Q1 2023, which refer to the average for January and February). The IPPI is derived using elasticities over an eight-quarter period obtained with the LP estimation method. The LP estimation method yields elasticities for a change in consumer prices with respect to the change in producer prices. To obtain the IPPI these elasticities are transformed to an impact on the annual inflation rates of an index. Afterwards, for a given change in PPI the impact on consumer prices is calculated for the next seven quarters (taking the quarter-on-quarter change in PPI and multiplying this by the time profile of the impacts). Thereafter, the paths for changes in the PPI from the eight preceding consecutive quarters are added together to obtain the joint impact on consumer prices in a given quarter. For panel a) the IPPI indicator based on the estimation sample until the end of 2019 (red line) is also derived for the period afterwards, in order to show the differences due to changes in elasticities when the indicator is obtained based on an extended sample (yellow line). The 95% confidence range refers to the IPPI based on LP estimates until Q4 2019 in the left-hand panel, and to the IPPI estimated until Q2 2022 in the right-hand panel. The IPPI in panel b) is obtained by using the higher responses of consumer food prices to changes in producer prices after PPI increases as opposed to PPI declines (the path for the impacts on consumer prices over eight quarters from a one-quarter change in PPI is obtained by multiplying higher elasticities when the change in PPI is positive and lower elasticities when the change is negative).

Overall, IPPIs can help to assess the strength and direction of the underlying pressures on NEIG and food prices. However, a number of caveats should be considered when analysing these indicators. Although designed for generating additional information in periods like the current one, the exceptionally large swings in producer and consumer price developments lead to estimations surrounded by uncertainty. The significant rise in the response of consumer prices to PPIs when including the last two years, especially for NEIGs, suggests that firms’ pricing strategies may have changed towards faster pass-through and less buffering through profits when responding to the extraordinary size and length of recent cost shocks (as indicated by the gap between the red and yellow lines in Chart C, panel a). Continuous monitoring of the relationship between PPIs and consumer prices is warranted. IPPIs are, by construction, backward-looking indicators, because they are based on developments in PPIs only up until their latest observation. If PPIs were to decline over the next few quarters, the IPPIs would also adjust downwards accordingly. More generally, the IPPIs should not be assessed in isolation, but always alongside all other information as regards underlying price pressures in the economy.

See the boxes entitled “Industrial producer prices for sales in domestic and non-domestic markets”, Monthly Bulletin, ECB, April 2013; and “What can recent developments in producer prices tell us about pipeline pressures?”, Economic Bulletin, Issue 3, ECB, 2017.

See the box entitled “Recent developments in pipeline pressures for non-energy industrial goods inflation in the euro area”, Economic Bulletin, Issue 5, ECB, 2021.

See P.R. Lane, “Underlying inflation”, lecture at Trinity College Dublin, 6 March 2023.

The euro area producer price index is an aggregation of individual country data, which refer only to the domestic market (i.e. not to the internal euro area market as a whole).

Conceptually, the link between PPIs and changes in consumer prices would be more appropriate if changes in indirect taxes could be excluded from the measured HICP series. However, the approach for deriving producer price pressures in this box is based on the HICP including the impacts from changes in indirect taxes. Nevertheless, when using the HICP series published by Eurostat at constant tax rates, the results are broadly similar to the ones reported in this box.

The LP method generates estimates for each forecast horizon H by regressing the dependent variable at T+H on the available information set at time T using quarterly frequency data. This approach mirrors the one used by Colavecchio, R. and Rubene, I. in “Non-linear exchange rate pass-through to euro area inflation: a local projection approach”, Working Paper Series, No 2362, ECB, Frankfurt am Main, January 2020. Estimations with data up until 2019 suggest that a 1% increase in producer prices would subsequently lift NEIG consumer prices by around 0.8% over the next two years. Estimations using data up until the second quarter of 2022 point to a much faster impact of PPIs on NEIG prices – specifically, a full pass-through within the first two quarters, implying a substantially stronger link between producer and consumer prices more recently.

The higher frequency of price changes over the more recent period has also been reported by large non-financial companies operating in the euro area. See the box entitled “Main findings from the ECB’s recent contacts with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2023.

The faster response of consumer food prices is obtained in an estimation using the sample up until 2019, whereas when extending the estimation sample to Q2 2022, the speed of NEIG response to the respective PPI is approaching that of food.

The LP estimation can also be used to examine whether positive changes in the respective PPI have the same pass-through to consumer prices as negative changes. Such an analysis is done by introducing dummy variables – see the approach in Colavecchio and Rubene, op. cit.

LP regressions provide an estimate for the cumulative impact of a 1% change in the PPI on consumer prices. The estimated responses seem to stabilise after eight quarters – therefore, this horizon is used for the derivation of the IPPI. To obtain an estimate of the impact on the annual inflation rates, results of the LP for the impact on consumer price levels are transformed to the impact on the annual rate of change. The impacts are then rescaled for the size of the quarter-on-quarter change each period and assigned for the eight quarters ahead accordingly. Thereafter, the total impact on consumer prices for a given quarter is obtained by adding the impacts from PPI (with an appropriate lag impact) in the preceding eight quarters.