The role of sectoral developments for wage growth in the euro area since the start of the pandemic

Published as part of the ECB Economic Bulletin, Issue 5/2021.

The economic consequences of and policy responses to the pandemic pose challenges for interpreting wage developments. Aggregate wage growth is mostly assessed in terms of compensation per employee or compensation per hour worked.[1] The coronavirus (COVID-19) pandemic has led to a substantial divergence between compensation per employee and compensation per hour. The high number of workers on job retention schemes played a decisive role in these developments, especially via the implications for hours worked per person. Such schemes tend to have a downward effect on compensation per employee, as employees usually retain their employment status but, in most countries, face pay cuts when enrolling in these schemes. Moreover, the benefits of such schemes are not included in statistical measures of compensation where they are directly paid to employees.[2] At the same time, such schemes have an upward effect on compensation per hour, as hours worked tend to be reduced far more strongly than pay.

Year-on-year growth in compensation per employee (CPE) dipped sharply at the start of the pandemic but was back at pre-crisis rates in the first quarter of 2021. This strong V-shaped pattern obviously mirrors the pattern of economic activity, but it is unusual in the sense that it has been driven mainly by adjustments in compensation and less by changes in employment (Chart A). By comparison, while the number of employees declined at a rate comparable to that during the great financial crisis, the total compensation of employees was clearly adjusting much more than back then. This can be explained by the more decisive role that job retention schemes played this time round. The schemes helped to preserve the employment status of employees but also came with some reduction in compensation as, in most countries, not all of the lost hours were reimbursed through the schemes and payments from these were mostly recorded as transfers rather than compensation.[3] As the economy recovered, hours worked normalised and the recourse to job retention schemes receded – leading to an adjustment in compensation. In the first quarter of 2021 zero annual growth of compensation and a still negative year-on-year growth rate in the number of employees brought CPE growth to 1.9% – close to its long-term average (since 1999) of 2.0%.

Chart A

Decomposition of growth in compensation per employee in the euro area

(annual percentage changes)

Sources: Eurostat and ECB staff calculations.

Notes: The latest observations are for the first quarter of 2021. For both panels, the series for employees is inverted, meaning that positive numbers reflect a reduction of the number of employees in year-on-year terms while negative numbers reflect an increase.

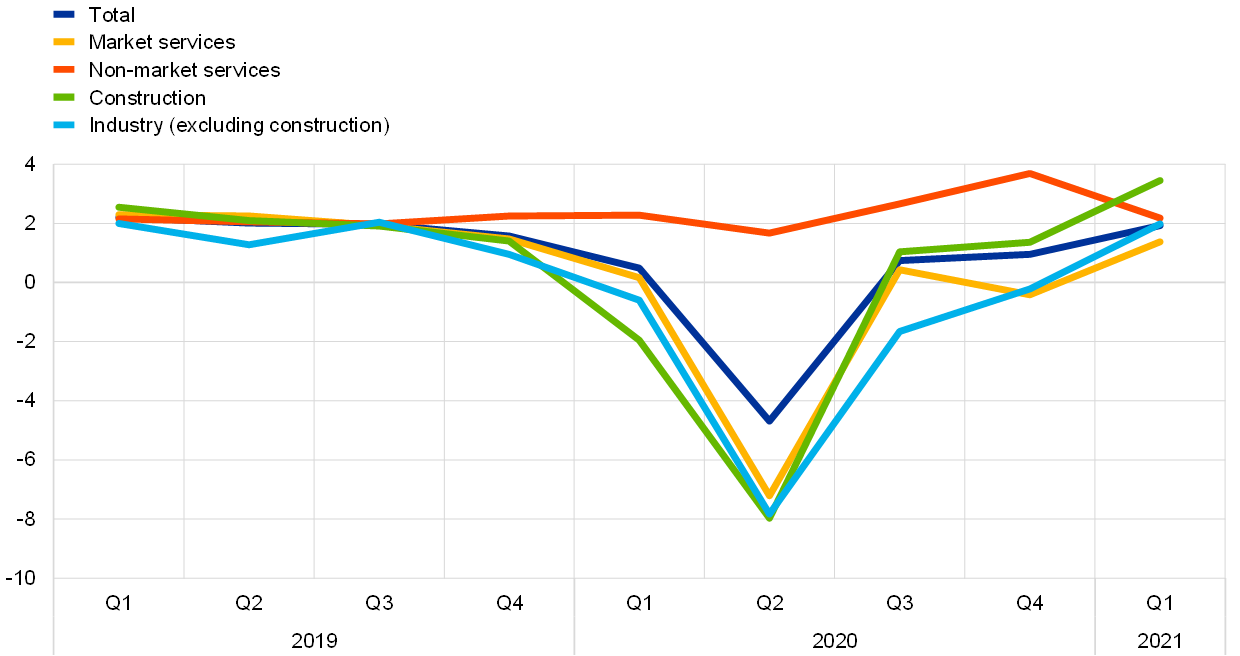

The movements in aggregate CPE growth conceal some notable sectoral differences (Chart B). With the onset of the crisis, wage growth slumped in the second quarter of 2020 to a similar extent in market services, industry (excluding construction) and construction. The third quarter saw a general recovery in wage growth which continued into early 2021 for industry and construction, while wage growth in market services experienced a second, albeit smaller, hit in the fourth quarter of 2020 as the pandemic necessitated a renewed period of lockdown that mainly affected service sector jobs. Within the services sector, non-market services stood out throughout the pandemic in the sense that wage growth remained close to its pre-crisis level until summer 2020 and even increased substantially in the second half of 2020 (reaching 3.7% in the fourth quarter) before falling back to 2.2% in the first quarter of 2021. Special bonuses in particular for employees in the health sector linked to their high workload, which were granted in many euro area countries, played an important role in the strong wage growth in non-market services in the second half of 2020. Overall, the dispersion of CPE growth has remained higher than during pre-pandemic times – underlining the importance of taking sectoral developments into account when analysing aggregate wage growth.

Chart B

Growth in compensation per employee in the euro area by main sector

(annual percentage changes)

Sources: Eurostat and ECB staff calculations.

Notes: The latest observations are for the first quarter of 2021. “Non-market services” includes public administration, defence, education, health and social work activities.

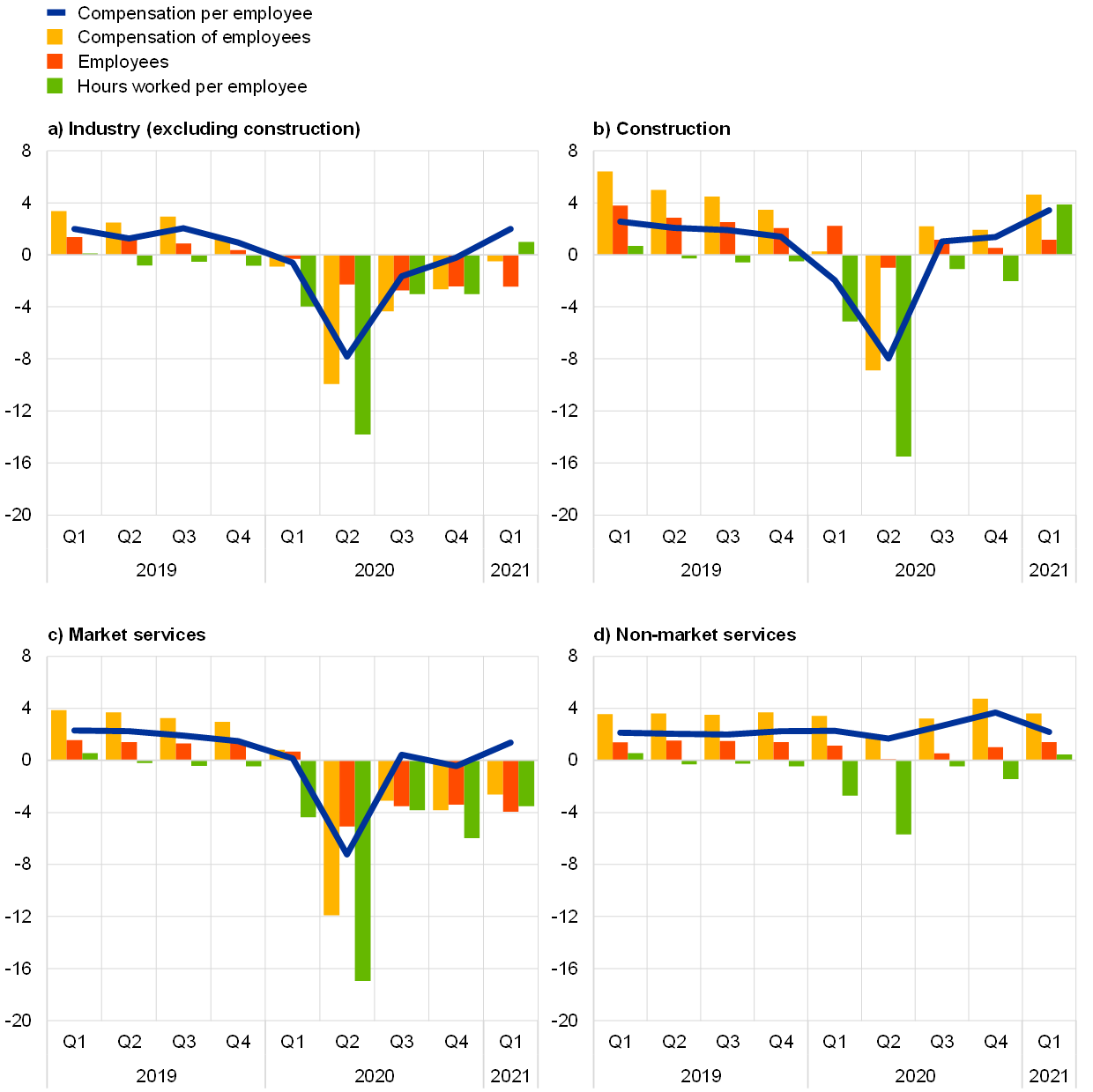

The differences in sectoral developments in CPE growth reflect the differences in the extent to which sectors were affected by the pandemic and the measures taken to contain it, in particular the recourse to job retention schemes. Contrary to previous crises, the pandemic hit the market services sector hardest, as a large part of its activity was especially affected by restrictions to physical mobility and lockdown measures. Harmonised data concerning the reliance on job retention schemes in the different sectors are not available for the whole euro area, but the relative adjustments in employment and hours worked per employee can provide some crude indication (see Chart C). In the second quarter of 2020 all sectors saw a large relative adjustment in hours worked per employee compared with employment. In construction, employment contracted only slightly, and the situation normalised again quite quickly from the third quarter of 2020 onwards. The industrial sector experienced a more substantial reduction in employment, which persisted until the first quarter of 2021, while hours worked per person normalised more quickly. The implied reduced recourse to job retention schemes was then visible in the continued recovery of compensation of employees. The market services sector was hit hardest with the largest losses in employment which, like those in industry, persisted until the first quarter of 2021. However, in contrast to the other sectors, hours worked per employee dipped again relative to employment in the fourth quarter of the year, implying a further decrease in compensation of employees in line with a renewed recourse to job retention schemes. There were no employment losses in non-market services during the crisis, and the reduction in hours worked per employee in the second quarter of 2020 was accompanied by only small losses in compensation of employees. This sector was characterised by considerable resilience in compensation of employees and wage growth relative to the other sectors.

Chart C

Sectoral developments in compensation per employee growth in the euro area

(annual percentage changes)

Sources: Eurostat and ECB staff calculations.

Notes: The latest observations are for the first quarter of 2021. “Non-market services” includes public administration, defence, education, health and social work activities.

The asymmetric impact of the pandemic is even more visible when distinguishing within the market services sector between high and low-contact services. As the restrictions introduced to contain the spread of the pandemic were aimed at reducing especially interpersonal contacts, high-contact services (including wholesale and retail trade, transport, accommodation and food service activities) suffered more than low-contact services (such as information and communication, finance and insurance, and real estate, among others). While CPE growth was hit substantially in both sub-sectors during 2020, the effects were far more pronounced for high-contact services owing to a much higher reduction in hours worked per employee given the stronger role of job retention schemes. CPE growth in low-contact services has been positive again since the third quarter of 2020, standing at 2.0% in the first quarter of 2021, up from 0.8% and 1.0% in the third and fourth quarters of 2020 respectively. However, CPE growth continued to be negative for high-contact services, as a result of pandemic restrictions affecting especially this sub-sector (Chart D).

Chart D

Wage developments in high and low-contact market services in the euro area

(annual percentage changes)

Sources: Eurostat and authors’ calculations.

Notes: “High-contact market services” comprises wholesale and retail trade, transport, accommodation and food services. “Low-contact market services” corresponds to market services excluding high-contact market services. The latest observations are for the first quarter of 2021.

The effects of the pandemic on growth in compensation per employee are expected to continue shaping wage developments in 2021 and across all sectors. The massive decrease in CPE growth in the second quarter of 2020 can be expected to lead to strong base effects in CPE growth in the second quarter of 2021. Such upward base effects can be expected to be strongest in the sectors hit most severely during the pandemic – namely high-contact services – but will also play an important role in other sectors. As labour markets are projected to gradually recover over the coming years and the impact of job retention schemes wanes, developments in compensation per employee should normalise in the main sectors of the economy. Going forward, a key question is whether sectoral wage negotiations will aim to make up for temporary losses in compensation during the pandemic at least partly and in some sectors, which could add to wage growth over the next years.

- See the box entitled “Assessing wage dynamics during the COVID-19 pandemic: can data on negotiated wages help?”, Economic Bulletin, Issue 8, ECB, 2020.

- See also the box entitled “Short-time work schemes and their effects on wages and disposable income”, Economic Bulletin, Issue 4, ECB, 2020.

- See the box entitled “Developments in compensation per hour and per employee since the start of the COVID‑19 pandemic” in the article entitled “The impact of the COVID-19 pandemic on the euro area labour market”, Economic Bulletin, Issue 8, ECB, 2020.