Published as part of the ECB Economic Bulletin, Issue 4/2023.

Earnings calls can provide useful and timely information on corporate sentiment. An earnings call is a conference call between the board of a publicly listed company, investors, analysts and the press to discuss the company’s financial results. Such calls typically take place once a quarter.[1] NL Analytics has automated the retrieval of information from transcripts of English-language earnings calls.[2] Focusing on euro area firms across the main non-financial sectors, this box is based on textual searches for matches with a number of synonymous words. The aim is to extract quarterly sentiment and risk indices, which are particularly timely as the database is being updated for the current quarter once every two weeks.

Textual analysis helps to derive measures of corporate perceptions. The sentiment index reflects the number of sentences in an earnings call containing a specific word that matches a given topic over the total number of sentences, and it is expressed in net terms, i.e. good news versus bad news. The risk index shows the number of times a topic is mentioned in a sentence in conjunction with keywords, such as “risk” and “uncertainty”.[3] The large volume of transcripts, together with the textual searches, generates a high-frequency, firm-level dataset of sentiment and risk indices, which we average and convert into structured quarterly data for the period from the first quarter of 2002 to the first quarter of 2023. The respective indices are validated in that they have comoved with the business cycle over the past two decades and correlated with standard indicators for the respective variables. It is also possible to retrieve quotes from earnings calls that capture the prevailing narrative associated with a particular and significant movement in the indices.

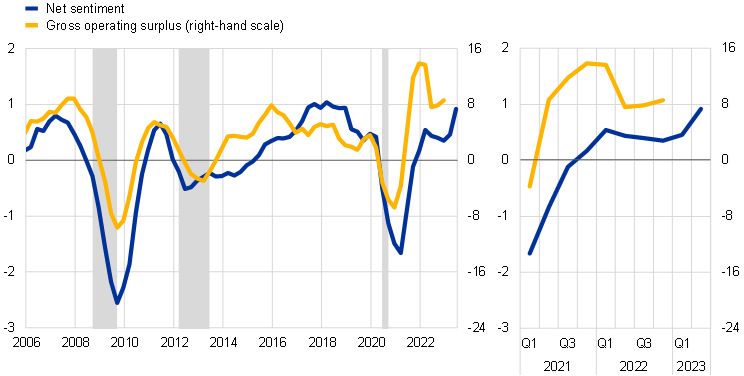

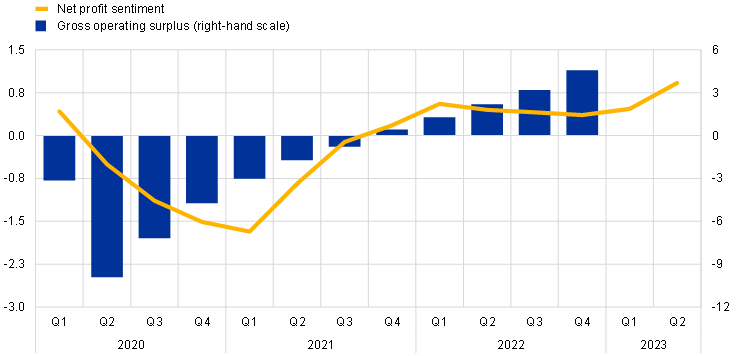

Euro area corporate profit sentiment continued to rise above historical averages in the second quarter of 2023. Over the past two decades there has been a strong correlation between the profit sentiment index derived from earnings calls and sectoral accounts data on the gross operating surplus in the euro area non-financial corporate (NFC) sector (Chart A, left-hand panel). For the profit sentiment index, the correlation coefficient rises up to four quarters ahead of the gross operating surplus and peaks at around 0.6. The index exhibits a clear business cycle pattern, with troughs during the global financial crisis, the sovereign debt crisis and the COVID-19 pandemic, which is to be expected given the cyclicality of profits. After a strong recovery in 2021, net sentiment stabilised to some extent in 2022 before rising further in the second quarter of 2023. The growth rate of the gross operating surplus in the NFC sector decreased somewhat, but remained robust, in the second half of 2022, owing to tighter financing conditions and weakening demand (Chart A, right-hand panel). This is in line with evidence from market and survey earnings data, suggesting that profit growth eased in the course of 2022, but remained above its historical averages. The euro area NFC gross operating surplus has exceeded the level observed in the fourth quarter of 2019 and is now growing at a rate above its pre-pandemic trend, indicating that there is no need for any catching up from this perspective (Chart B). The strength in profit growth since early 2021 could have been driven by lingering post-pandemic pent-up demand, easing supply bottlenecks and imperfect substitutability of production inputs.

Chart A

Euro area profit sentiment and NFC gross operating surplus

(Z-score; year-on-year percentage changes)

Sources: NL Analytics, ECB and ECB staff calculations.

Notes: Net sentiment reflects the frequency of the recurrence of synonyms for profits (earnings, revenue, etc.) in firms’ earnings calls. The Z-score is computed by subtracting the historical average from each data point and dividing this demeaned series by the standard deviation. Recession periods are marked in grey. The latest observations are for the second quarter of 2023 (for calls conducted up to 12 June) for net sentiment and for the fourth quarter of 2022 for the gross operating surplus.

Chart B

Euro area profit sentiment and detrended NFC gross operating surplus

(Z-score; detrended cumulative growth rates)

Sources: NL Analytics, ECB and ECB staff calculations.

Notes: The cumulated detrended growth rates of the gross operating surplus were computed by cumulating the difference between the actual series and its pre-pandemic trend (2002-19) and then dividing them by the cumulated pre-pandemic trend. The latest observations are for the second quarter of 2023 (for calls conducted up to 12 June) for net sentiment and for the fourth quarter of 2022 for the gross operating surplus.

Corporate investment sentiment rose slightly further in the second quarter of 2023. Over the past two decades net investment sentiment and the growth rate of business investment (excluding the volatile component of investment in intellectual property products in Ireland and the Netherlands) have correlated well (Chart C, left-hand panel). The correlation peaks when the sentiment index leads investment growth by two quarters, with a correlation coefficient of 0.5. In 2021 and at the start of 2022, investment sentiment continued to rise to above its historical average, alongside overall robust quarterly growth rates in business investment, as the economy reopened (Chart C, right-hand panel). Thereafter in 2022 it worsened somewhat, reflecting weakening demand, high energy costs and elevated uncertainty. In the second quarter of 2023 it edged up further above its long-term average, in line with improving supply conditions and easing energy costs.

Chart C

Euro area investment sentiment

(Z-score, right-hand scale of left-hand panel: year-on-year percentage changes; right-hand scale of right-hand panel: quarterly percentage changes)

Sources: NL Analytics, Eurostat and ECB staff calculations.

Notes: Net investment sentiment reflects the frequency of the recurrence of synonyms for investment (investment, capital investment, investment plans, etc.) in firms’ earnings calls. The Z-score computed by subtracting the historical average from each data point and dividing this demeaned series by the standard deviation. Recession periods are marked in grey. Business investment growth excludes investment in intellectual property products in Ireland and the Netherlands. The latest observations are for the second quarter of 2023 for net sentiment (for calls conducted up to 12 June) and for the first quarter of 2023 for business investment.

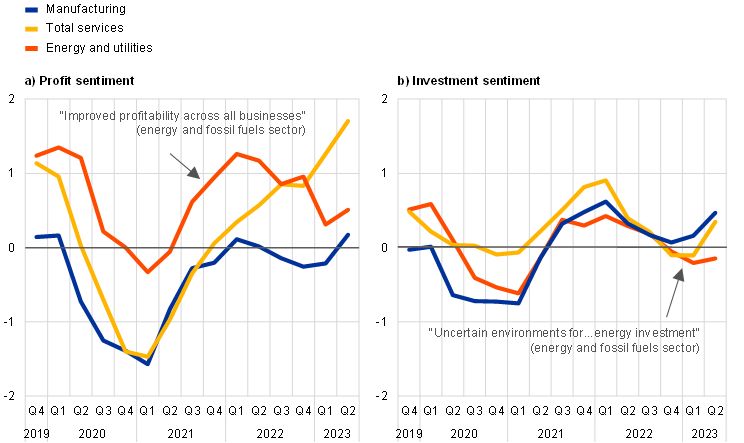

Looking at individual sectors, in 2023 profit sentiment has so far been strongest in the services sector, while investment sentiment has been strongest in the manufacturing sector. During the pandemic, profit sentiment deteriorated more in the services sector than in manufacturing sector. However, in the post-pandemic recovery phase and again in the first half of 2023, it improved more strongly in the services sector than it did in the manufacturing sector (Chart D, panel a). This is also in line with other sentiment indicators, such as the Purchasing Managers’ Index. Investment sentiment, however, has deteriorated sharply since early 2022 across sectors, although so far in 2023 it seems to have held up slightly better in the manufacturing sector than in the services sector. In the energy and utilities sector, profit sentiment has been more positive than in the other sectors over the past three years, but has ebbed recently, reflecting developments in energy prices. Investment sentiment has been relatively weak in the sector, possibly owing to uncertainty surrounding energy investment, and also in the context of the green transition, as expressed by one firm in the sector (Chart D, panel b).

Chart D

Euro area profit and investment sentiment in selected sectors

(Z-score)

Sources: NL Analytics and ECB staff calculations.

Notes: The series do not average the total series, as some firms are not covered by the sectoral classifications. The latest observations are for the second quarter of 2023 (for calls conducted up to 12 June).

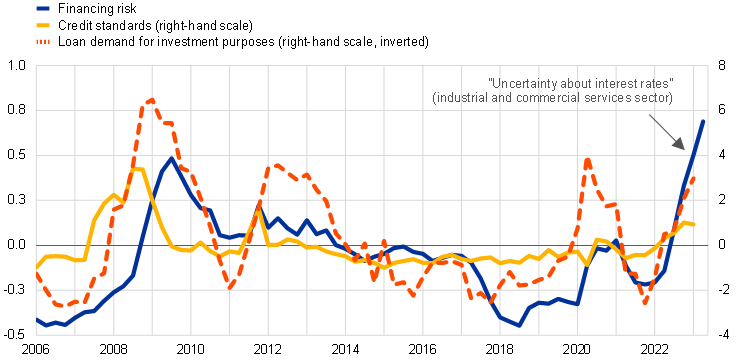

Firms currently view financing conditions as a significant risk. For the purposes of this box, we also created an indicator of financing risk by searching for keywords, such as “interest rate”, “financing conditions” and “borrowing costs”, together with “uncertainty” and “risk”. Financing conditions were perceived to be an elevated risk during the global financial crisis, in line with tighter credit standards and less lending for investment purposes, as highlighted in the euro area bank lending survey (Chart E). The firms in the sample appear to have also viewed financing conditions as a heightened risk during the sovereign debt crisis. In the recovery phase from 2015 to 2019, risk perceptions surrounding financing conditions fell overall to levels seen prior to the global financial crisis. So far in 2023, following a small spike during the pandemic, firms have seen financing conditions as a high and rising risk – in the context of rapidly increasing interest rates and recent financial market tensions – with values in recent quarters reaching levels not seen since the global financial crisis. Although the indicators are not directly comparable, as the financial risk indicator is broader, there is some co-movement with credit standards. According to the bank lending survey, the perceived higher financing risk is also coinciding with shrinking demand for loans for investment purposes.

Chart E

Euro area financing risk, credit standards and loan demand for fixed investment purposes

(Z-score, percentage balances)

Sources: NL Analytics, euro area bank lending survey and ECB staff calculations.

Notes: The textual search for the financial risk indicator covers keywords such as “interest rates”, “financing conditions” and “borrowing costs”. The latest observations are for the first quarter for credit standards and loan demand, and for the second quarter of 2023 for financing risk (for calls conducted up to 12 June).

In some cases, however, an earnings call takes place once every six months or year. The exact timing of the call during the quarter varies, depending on the quarter.

The database of NL Analytics contains earnings call transcripts of around 14,000 publicly listed firms across 82 countries, with the majority being headquartered in the United States, the United Kingdom and other English-speaking countries. On average, 600 euro area firms report every quarter. The number of observations per quarter in the early years of the sample, which dates back to 2002, was around one-quarter of what it is now.

For an additional example of a risk index computed using textual analysis of earnings call transcripts, see Hassan, T.A., Schreger, J., Schwedeler, M. and Tahoun, A., “Sources and Transmission of Country Risk”, NBER Working Paper, No 29526, November 2021.