Published as part of the ECB Economic Bulletin, Issue 2/2023.

In recent years, geopolitical considerations have started to play an increasing role in global trade relations. While criticism of globalisation pre-dated the coronavirus (COVID-19) pandemic, geopolitical tensions have strengthened, particularly in the face of the pandemic and Russia’s invasion of Ukraine. The global trade disruptions experienced since 2020 have raised concerns over the resilience of supply chains and reinforced discussions about economic security. As a result, some countries have started taking supply chain measures aimed either at “reshoring” (bringing production home) or “friend-shoring” (sourcing inputs from suppliers in allied countries) in order to secure access to critical production inputs (for example China’s “dual circulation” strategy, the US Chips Act, and the European Union’s (EU’s) “open strategic autonomy”).[1]

A scenario in which global values chains (GVCs) are reshaped in response to concerns about economic security could result in a reversal of global trade integration. In this box we use a stylised, model-based analysis to quantify the potential economic effects of a hypothetical scenario of global trade fragmentation. In line with recent developments in the academic literature and using rising geopolitical tensions between the United States and China as an illustrative example, we consider the decoupling of the global economy into an Eastern bloc and a Western bloc.[2] In this scenario, countries are mechanically allocated to each bloc according to their voting patterns in the United Nations (UN) General Assembly.[3] In this fragmentation scenario we assume that trade (as a share of GDP) in intermediate inputs between the two blocs reverts back to the level of the mid-1990s (i.e. before sweeping trade liberalisation policies were implemented).[4] We target trade in intermediates only, rather than final products, as most of the measures recently adopted by countries have focused on reshoring/friend-shoring GVCs. Finally, we assume that this fragmentation scenario is achieved by means of higher non-tariff barriers to trade between blocs (for example in the form of regulations or standards) rather than tariffs – reflecting the scope of most recent trade policies.

The economic effects of trade fragmentation are quantified using a state-of-the-art multi-country, multi-sector model developed by Baqaee and Farhi.[5] This model allows the non-linear effects of higher trade barriers to be derived for a sample of 41 countries (or country groups) and 30 sectors.[6] Our focus is on the effects on welfare, trade in intermediate products and prices, both from a global perspective and for the two blocs.[7] A key advantage of this model is that, by featuring sectoral interlinkages, it accounts for amplification effects of trade shocks through production networks as well as substitution effects via international trade. The model considers the endogenous reactions of producers and consumers to a trade shock in an interconnected global economy. The transmission operates primarily through the price channel: higher barriers to trade increase import prices. As a result, producers within each bloc substitute away from more expensive “foreign” inputs, thereby generating a demand shock for upstream suppliers, resulting in lower trade flows between the blocs. This also leads to adjustments in production structures within the blocs and changes in the demand for factors of production (capital and labour). As the prices of capital and labour adjust, disposable incomes of households and consumption patterns also change. These substitution and re-allocation channels generate general equilibrium effects on prices, demand and supply, which in turn affect trade, production and welfare in both blocs.

General equilibrium effects can be obtained using two different model setups – rigid and flexible – which can be viewed as akin to the short-run and long-run impacts respectively. The propagation channels of the trade shock discussed above are captured in the model via three main parameters: (i) elasticity of substitution across production inputs,[8] (ii) ease of reallocation of production factors across sectors,[9] and (iii) degree of wage rigidity. We calibrate two polar setups. The flexible setup allows for flexible wages and high substitutability of inputs and factors of production, as in the recent literature.[10] This setup elicits a relatively muted response of the global economy as it allows consumers and producers to substitute seamlessly across products, factors of production to be shifted to sectors that face higher demand, and wages to be adjusted. In contrast, the rigid setup features sticky wages and a low substitutability of inputs and factors of production.[11] As a result, this setup generates a stronger reaction from the substitution and re-allocation channels, as the ability of a country/bloc to immediately adjust is more limited as a result of low factor mobility and less room to substitute away from more expensive inputs. The resulting drop in domestic production and household income is therefore greater, and so the disruption to the supply of intermediate inputs for downstream sectors and to demand for upstream producers is stronger. This reflects the amplification mechanism of global production networks. In addition, in the presence of sticky wages the economy adjusts to temporary fluctuations in demand (domestic and/or foreign) by shedding employment (not reducing wages), which weighs on consumption. Given that rigidities tend to be more binding in the short term, the rigid setup could be seen as a close approximation of short-run effects, whereas the flexible setup is closer to the long-run equilibrium.[12] In this respect, the results can also be viewed in terms of the transition from the short-run effects (rigid setup) to the long-run effects (flexible setup). Beyond this interpretation, these two setups also take into account the high level of uncertainty surrounding substitution elasticities in the literature.

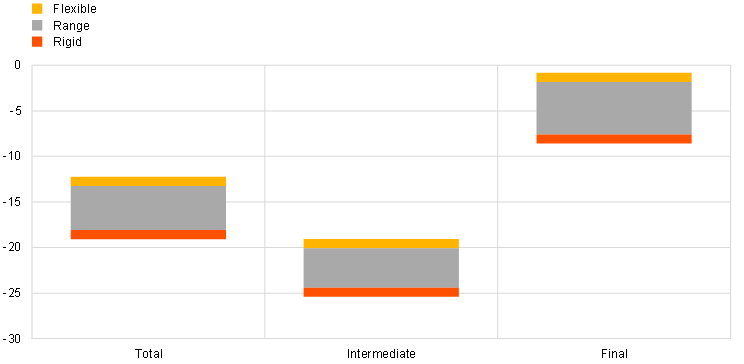

In a trade fragmentation scenario, losses in trade flows between the blocs would not be fully compensated for by trade diversion within blocs, causing net trade losses. Trade fragmentation along these hypothetical geopolitical lines could result in real imports declining between 12% (flexible setup) and 19% (rigid setup), mainly driven by a fall in trade in intermediates (which would drop between 19% and 25%), as shown in Chart A (panel a). Trade in final goods would also decline between 1% and 9%, despite not being the direct target of the trade barriers. This reflects reduced welfare of, and demand from, households and substitution away from foreign-produced, GVC-intensive final goods, whose price has increased, and towards final goods produced domestically or within the bloc. The decline in intermediate trade reflects a recomposition of production input sourcing by companies. Chart A (panel b) presents diversion effects for intermediates inputs. The decline in imports of intermediate inputs between blocs is only partially compensated for by a rise in imports within blocs and domestic sourcing rises more substantially, thereby weighing on trade.

Chart A

Real imports and sourcing of intermediate inputs

a) Global imports by type of trade

(percentage deviation from steady state)

b) Sourcing of intermediate inputs (world)

(percentage points, market share)

Sources: Baqaee and Farhi, Asian Development Bank, FPS database and ECB calculations.

Notes: Non-linear impact simulated through 25 iterations of the log-linearised model. In panel a) the grey areas indicate the range between the flexible setup (yellow line) and the rigid setup (red line) and provide an illustration of the scope of the effects associated with the trade shock. Panel b) refers to the flexible setup. In panel b) the red bar indicates losses in market share while the green bars indicate gains in market share.

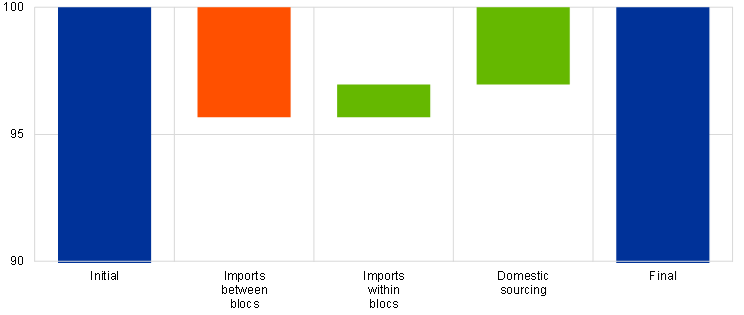

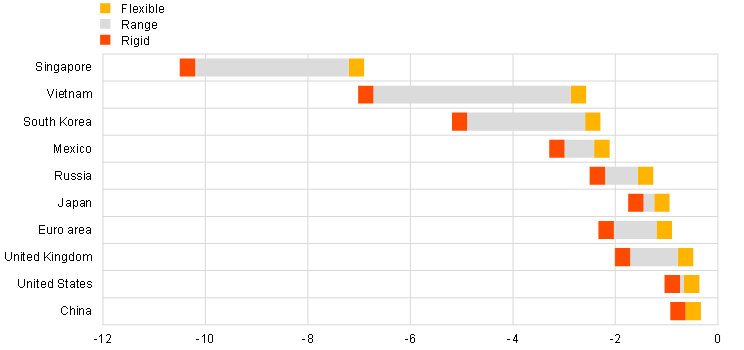

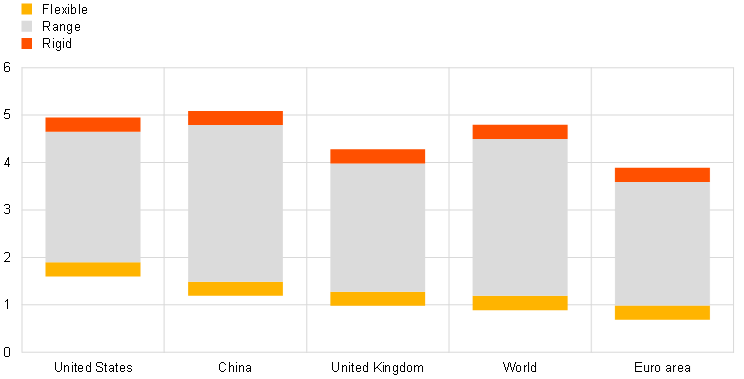

Welfare losses can be sizeable, albeit rather heterogenous across economies. From a global perspective, welfare losses, captured by the change in gross national expenditure (GNE), are estimated to range between 0.9% (flexible setup) and 5.3% (rigid setup) (Chart B, panel a). In line with the interpretation discussed above, this suggests that losses could be sizeable in the near term should a sharp correction in trade flows take place (rigid setup). Once the rigidities dissipate, losses are gradually absorbed as substitute inputs of production are found either via increased domestic production or increased intra-bloc trade. This in turn increases employment and reduces the price of foreign inputs, limiting the losses from trade fragmentation in the long run (flexible setup). Chart B (panel b) presents welfare losses for selected countries. Welfare losses vary widely across economies and range between 0.2% and 6.9% in the flexible setup and between 0.4% and 10.5% in the rigid setup. While all countries lose from fragmentation, countries that rely heavily on GVCs and trade extensively with the other bloc experience the largest losses. This contrasts with large economies, such as the United States and China, which see smaller losses even in the rigid setup. Losses in the euro area are also relatively mild as, like the United States and China, its large internal market more easily allows substitution by domestic intermediate inputs after the shock. Nonetheless, its losses are somewhat greater than those of the United States or China owing to the greater trade openness of the euro area. The estimated effects in the flexible setup are broadly in line with the recent literature, which finds muted effects of trade fragmentation in the long run.[13] In the short run, however, trade fragmentation may also involve significant transition costs (rigid setup) as it takes time to reconfigure supply chains.

Chart B

Change in gross national expenditure

a) Global

(deviation from steady state, percentages)

b) Individual countries

(deviation from steady state, percentages)

Sources: Baqaee and Farhi, Asian Development Bank, FPS database and ECB calculations.

Note: The non-linear impact is simulated through 25 iterations of the log-linearised model. In both panels, the grey areas indicate the range between the flexible setup (yellow line) and the rigid setup (red line) and provide an illustration of the scope of the effects associated with the trade shock.

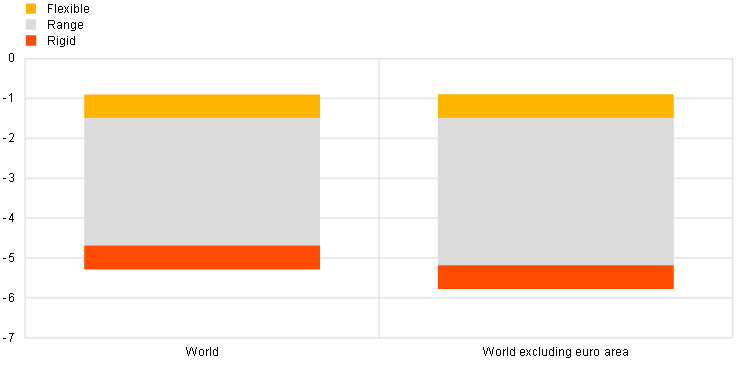

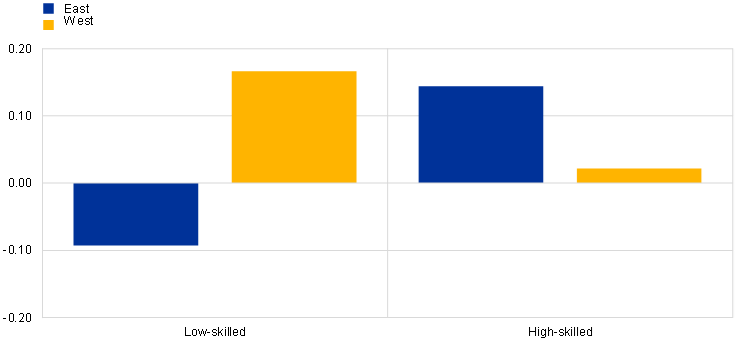

A fragmentation of value chains along geopolitical lines would generate price effects, as producers would have to substitute away from cheaper foreign inputs. The impact on prices is a combination of the import price shock and the reallocation effects discussed above. This is reflected in the cross-country heterogeneity of the price response (Chart C, panel a). At a global level, the increase in the level of consumer prices ranges between 0.9% (flexible setup) and 4.8% (rigid setup), whereas for the United States the range is between 1.7% and 4.9%.[14] For the euro area the smaller price increases compared to other large countries is explained by smaller upward price pressures from relocation effects. Trade fragmentation also has a distributional impact reflected in the relative evolution of wages for low, medium and high-skilled workers. Chart C (panel b) shows the evolution of wages for medium-skilled workers. In the Western bloc, trade fragmentation redistributes income towards low-skilled workers, whose wages evolve more favourably than those of high-skilled workers.[15] This reflects the fact that, amid rising trade fragmentation, Western countries would import fewer goods with low-skilled labour inputs from the Eastern bloc, thereby increasing demand and wages for low-skilled labour in the Western bloc. Conversely, in the Eastern bloc, wages of low-skilled workers fall relative to high-skilled labour.

Chart C

Nominal impact of trade fragmentation

a) Consumer prices

(deviation from steady state level, percentages)

b) Wages

(deviation from steady state level relative to medium-skilled labour, percentage points)

Sources: Baqaee and Farhi, Asian Development Bank, FPS database and ECB calculations.

Notes: Non-linear impact simulated through 25 iterations of the log-linearised model. In panel a) the grey areas indicate the range between the flexible setup (yellow line) and the rigid setup (red line) and provide an illustration of the scope of the effects associated with the trade shock. Panel b) refers to the flexible setup.

The estimates presented in this box are subject to uncertainty, as the future path of trade fragmentation remains largely unpredictable and other amplification effects could materialise which are not considered here. The estimates are strongly influenced by the magnitude and extent of any decoupling scenario. A scenario in which the East-West decoupling is limited to strategic sectors (cars, machinery, electronics, metals) yields a substantially lower impact, with global GNE losses ranging between 0.5% and 2.5%. In contrast, a scenario combining East-West decoupling with an intra-bloc decoupling for strategic sectors would increase the impact by about one third.[16] The composition of blocs could also differ from our mechanical allocation based on UN voting, notably as some countries could stay non-aligned. In the short term, other factors beyond sticky wages and low substitutability could drive even larger losses, for example the presence of critical inputs that are difficult to substitute (e.g. lithium or rare minerals) which could lead to temporary production stoppages, or financial amplification mechanisms (for example in the form of rising risk premia). In the longer run, transmission channels not considered in this box, such as cross-border knowledge diffusion, could also weigh on growth.

In conclusion, from a purely economic perspective, trade fragmentation would be a lose-lose situation given the costs it entails at both the global and the country level. While the above estimates are subject to both upside and downside risks (depending on the magnitude and scope of any fragmentation scenario), from a purely economic perspective, trade fragmentation would entail sizeable costs in terms of substantially distorted trade, decreased welfare and higher prices. Beyond the results presented in this box, academic evidence suggests that reshoring may increase economic vulnerabilities, since risk-sharing and diversification would be reduced.[17]

Under the “dual circulation” policy adopted in 2020, China aims (i) to vertically integrate production and achieve self-reliance supported by its huge domestic market and (ii) to globalise China’s home-grown companies. The EU’s “open strategic autonomy” refers to the capacity of the EU to act autonomously in strategically important policy areas; notably in the economy by ensuring the resilience of the EU industrial system and its supply of critical inputs. The US Chips Act of 2022 creates large subsidies and incentives for the research, development and production of technological components in the United States.

Such a scenario is modelled in, for example, Góes, C. and Bekkers, E., “The impact of geopolitical conflicts on trade, growth, and innovation”, Staff Working Paper, No ERSD-2022-09, World Trade Organization, June 2022; Felbermayr, G., Gans, S., Mahlkow, H. and Sandkamp, A., “Decoupling Europe”, Kiel Policy Brief, No 153, Kiel Institute for the World Economy, July 2021; and Felbermayr, G., Mahlkow, H. and Sandkamp, A., “Cutting through the Value Chain: The Long-Run Effects of Decoupling the East from the West”, Kiel Working Papers, No 2210, Kiel Institute for the World Economy, March 2022. A similar scenario is also used in Chepeliev, M., Maliszewska, M., Osorio-Rodarte, I., Seara e Pereira, M.F. and van der Mensbrugghe, D., “Pandemic, Climate Mitigation, and Reshoring: Impacts of a Changing Global Economy on Trade, Incomes, and Poverty”, Policy Research Working Paper, No 9955, World Bank, March 2022; and Cerdeiro, D., Kothari, S. and Redl, C., “Asia and the World Face Growing Risks From Economic Fragmentation”, IMF Blog, October 2022.

Country groups mirror the country allocation in Góes and Bekkers, op. cit. Countries are allocated to geopolitical blocs in a data-driven and mechanical way based on UN voting provided by the Foreign Policy Similarity (FPS) database in Hage, F., “Chance-Corrected Measures of Foreign Policy Similarity (FPSIM Version 2)”, Harvard Dataverse, 2017. We use voting in the year 2015 to allocate the countries to the blocs. The allocation to blocs is robust to using other years of the FPS (2000, 2005 or 2010) and to using more recent UN votes, for example the April 2022 vote on the suspension of Russia from the UN Human Rights Council. Ultimately, the resulting allocation broadly mirrors the division into advanced and developing economies. This approach follows similar studies in the literature that relied on UN voting to distinguish geopolitical similarities, such as Góes and Bekkers, op. cit.; and Campos, R., Estefania-Flores, J., Furceri, D. and Timini, J., “Trade fragmentation”, mimeo, 2023.

More specifically, the trade shock is calibrated such that the model-implied trade in intermediates between blocs (as a share of global GDP) matches the level observed in the data from the mid-1990s. Historical figures are based on the long-run World Input-Output Tables (WIOT) of Timmer, M., Dietzenbacher, E., Los, B., Stehrer, R. and de Vries, G., “An Illustrated User Guide to the World Input-Output Database: The Case of Global Automotive Production”, Review of International Economics, Vol. 23(3), August 2015, pp. 575-605. The Baqaee and Farhi model is calibrated on the 2017 Asian Development Bank Input-Output Table. The calibrated magnitude of the shock is a 20% increase in non-tariff trade barriers (iceberg trade costs).

Baqaee, D.R. and Farhi, E., “Networks, Barriers, and Trade”, Econometrica, forthcoming, 2023. For an application of a similar model to the impact of the energy price shock, please see the box entitled “Who foots the bill? The uneven impact of the recent energy price shock” in this issue of the Economic Bulletin.

The sample includes all sectors of the economy, including manufacturing, services, construction, energy, mining and agriculture.

It should be noted that the model-based quantifications reflect general equilibrium responses of relative prices. Results are presented relative to the initial steady state. The model does not include an expectation channel for inflation. The model features a central bank which reacts to the inflationary effect of a trade cost shock by dampening demand to contain price pressures.

The Baqaee and Farhi model does not allow different substitution elasticities to be applied across countries. However, the higher substitutability of goods produced within an economically integrated region (e.g. the euro area) is reflected in the model via higher input-output covariances, which in turn allow producers to switch more easily to goods produced within an integrated economic area following a trade shock.

The same does not apply to countries since factors of production are not mobile across countries in the Baqaee and Farhi model. In the model, factors of production are capital and low, medium and high-skilled labour.

Elasticities of substitution are taken from Atalay, E., “How Important Are Sectoral Shocks?”, American Economic Journal: Macroeconomics, Vol. 9, October 2017, pp. 254-80, in which a range of estimates are provided. Elasticities in the rigid and flexible setups, respectively, are taken from the lower and upper 10% of this range. It should be noted that, in both setups, the model-based quantification reflects general equilibrium responses. Trade models such as the Baqaee and Farhi model do not provide the dynamics of the adjustment.

In the Baqaee and Farhi model, sticky wages are modelled as constant wages (no evolution). Under this setup, the economy adjusts through the quantity of labour (employment). This is the opposite of the baseline working of the model in which wages respond endogenously but the quantity of each production factor is fixed and exogenous.

More specifically, the long-run impact on trade can be viewed as occurring at least 6 to 8 years after the shock, as in Peter, A. and Ruane, C., “The Aggregate Importance of Intermediate Input Substitutability”, 2019 Meeting Papers, No 1293, Society for Economic Dynamics, 2019. For the duration of sticky wages (around one year), this estimate is based on Taylor, J., “Aggregate Dynamics and Staggered Contracts”, Journal of Political Economy, Vol. 88(1), February 1980, pp. 1-23, as well as the empirical and theoretical studies based on it.

For instance, the International Monetary Fund (IMF) estimates that an East-West decoupling would decrease World GDP by 1.5% (see “Sailing into Headwinds”, Regional Economic Outlook: Asia and the Pacific, IMF, October 2022). Felbermayr, Mahlkow and Sandkamp, op. cit., find that a decoupling between China and the West would result in welfare losses of between 1.0% and 3.6%. Góes and Bekkers, op. cit., estimate global welfare losses of 5% in an East-West decoupling scenario. Welfare losses of between 1.6% and 6.2% in a Chinese-led decoupling are estimated in Lim, B., Yoo, J., Hong, K. and Cheong, I., “Impacts of Reverse Global Value Chain (GVC) Factors on Global Trade and Energy Market”, Energies, Vol. 14(12), June 2021, p. 3417. Quantitatively, welfare losses in the flexible setup can be lower than in some recent studies. However, this reflects the fact that we model the fallouts from a return of intermediate goods trade between geopolitical blocs to levels observed in the 1990s, while most of the recent literature focuses on the more disruptive scenario of a full shutdown of trade between blocs.

Because wage growth is, by design, zero in the rigid scenario, the increase in the level of consumer prices is equivalent to a decrease in real wages. As regards the central bank reaction function, see footnote 7.

The positive impact on high-skilled labour wages (relative to medium-skilled labour wages) in the Western bloc is mainly driven by a few countries within the bloc which initially have a lower share of high-skilled labour and for which friend-shoring leads to an increase in demand.

This alternative scenario features (non-tariff) barriers to trade in intermediates between the two blocs across all sectors – as in the baseline scenario. On top of this, it adds similar (non-tariff) barriers to trade in intermediates between regional free-trade areas (USMCA, MERCOSUR, the EU, RCEP) in strategic sectors (cars, machinery, electronics, metals).

See, for instance, Bonadio, B., Huo, Z., Levchenko, A. and Pandalai-Nayar, N., “Global supply chains in the pandemic”, Journal of International Economics, Vol. 133, 2021; and “Shocks, risks and global value chains: insights from the OECD METRO model”, Organisation for Economic Cooperation and Development, June 2020.