Foreword

The recent economic recovery in the euro area has also brought a recovery in corporate activity that has reduced many of our worst fears about economic scarring and rising credit risk. Instead, risks of high rates of corporate defaults and bank losses are now significantly lower than six months ago. Across the euro area, reliance on policy support schemes has been shifting and a number of schemes have expired without creating disruption.

But risks stemming from the pandemic have not disappeared entirely, not least because vaccination progress has remained slow in many areas of the world, while global supply chain pressures and rising energy prices pose new challenges to the strength of the recovery and the outlook for inflation. Pandemic-related losses are likely to continue materialising for some time, amid a legacy of higher debt.

Meanwhile, a number of vulnerabilities have intensified. The markets for equity and risky assets have maintained their striking buoyancy, making them more susceptible to corrections. There have been examples of established market players exploring more novel and more exotic investments. In parallel, euro area housing markets have expanded rapidly, with little indication that lending standards are tightening in response.

Against this backdrop, the November 2021 Financial Stability Review (FSR) assesses financial stability vulnerabilities and their implications for financial market functioning, debt sustainability, bank profitability and the non-bank financial sector.

This issue of the FSR also includes three special features focused on addressing some long-standing challenges which affect the strength of euro area banks. They examine the usability of capital within the regulatory buffer framework, consider how mergers and acquisitions (M&As) could help the sector to return to more sustainable levels of profitability and explore approaches for managing non-performing loans, which can be a long-term drag on bank balance sheets.

This issue of the FSR has been prepared with the involvement of the ESCB Financial Stability Committee, which assists the decision-making bodies of the ECB in the fulfilment of their tasks. The FSR exists to promote awareness of systemic risks among policymakers, the financial industry and the public at large, with the ultimate goal of promoting financial stability.

Luis de Guindos

Vice-President of the European Central Bank

Overview

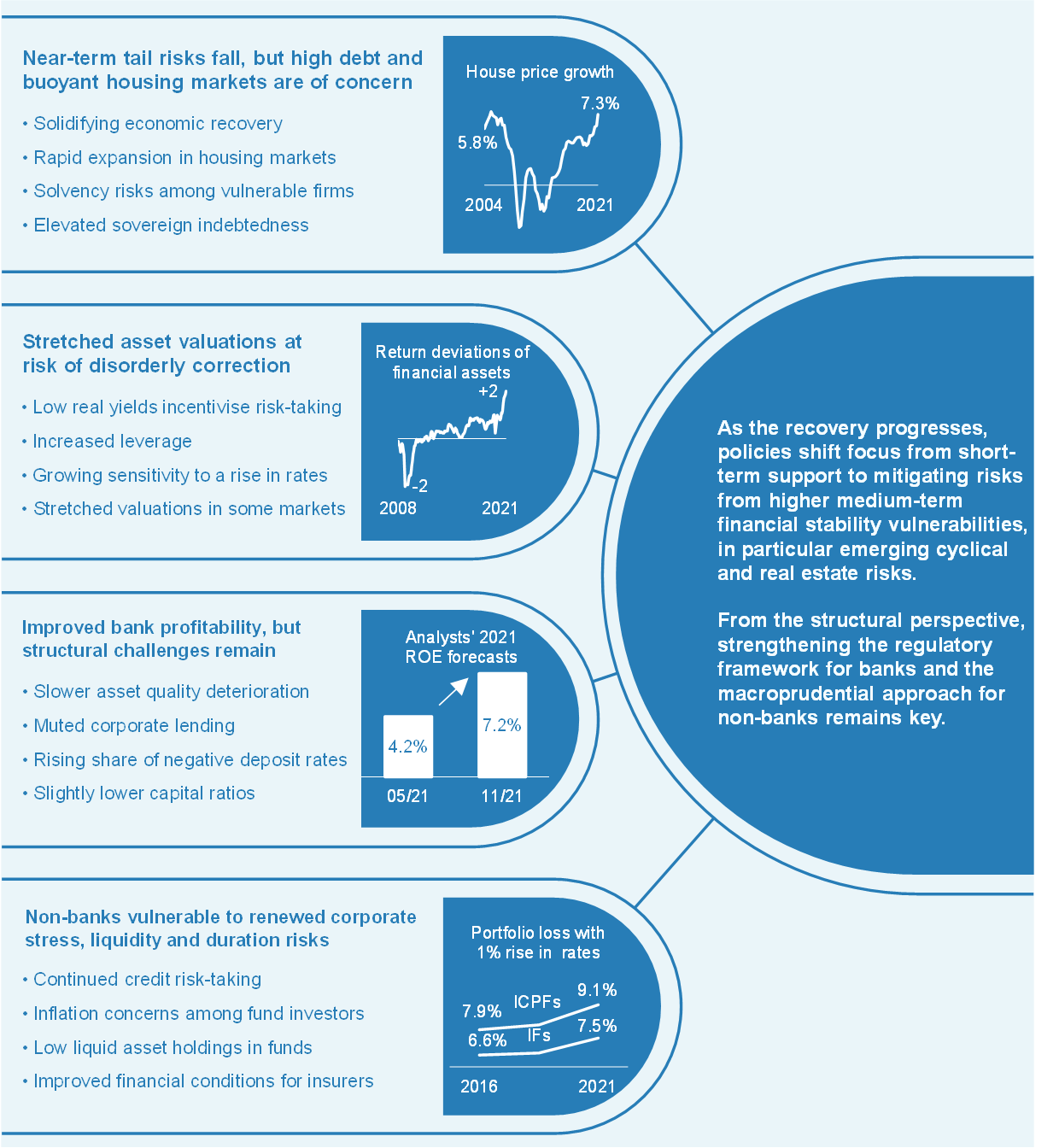

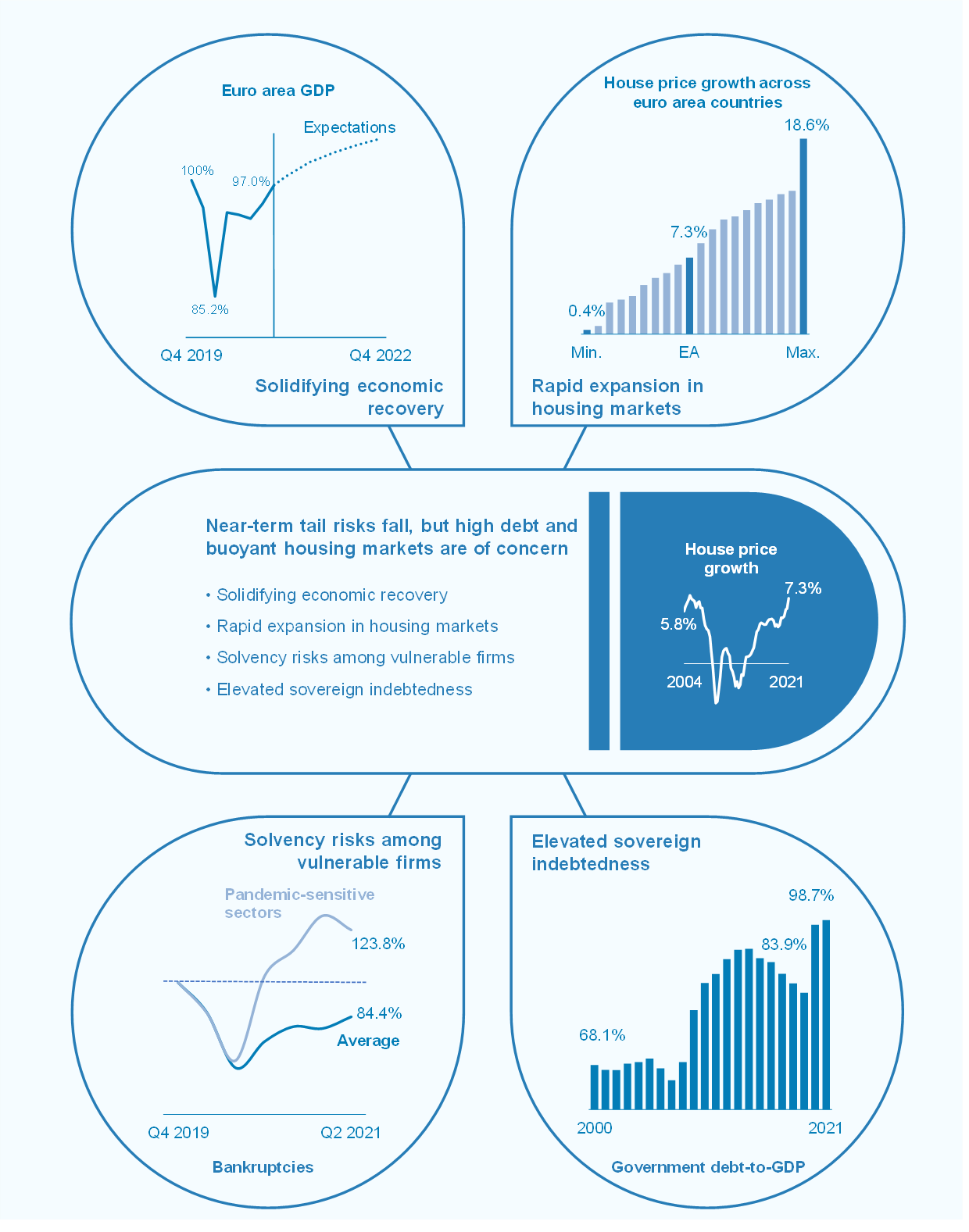

Near-term pandemic risks lessen, as vulnerabilities ahead build up

Improved economic conditions have reduced near-term tail risks to financial stability. Indicators of near-term financial stress have fallen to pre-pandemic lows since the previous FSR (see Chart 1, panel a), in line with the recovery seen in euro area economic activity in the first half of 2021. While the recovery has broadened across euro area countries and sectors as lockdown measures have eased, some near-term risks remain, as corporate fragility remains high in certain sectors which were more heavily impacted by pandemic restrictions and had higher pre-existing indebtedness. There is also a risk that recent strains in global supply chains and the spike in energy prices could have longer-lasting effects on inflation than expected and weigh on the economic recovery.[1] Low vaccination rates in some parts of the world and growing vulnerabilities in major emerging market economies, notably the strains experienced by major property developers in China, also add to risks.

Chart 1

Near-term risks have lessened in the financial sector and the real economy as pandemic-related uncertainty fades, but vulnerabilities further out are on the rise

Sources: ECB and ECB calculations.

Notes: Panel a: “Probability of default of two or more LCBGs” refers to the probability of simultaneous defaults in the sample of 15 large and complex banking groups (LCBGs) over a one-year horizon. On the composite indicator of systemic stress in financial markets, see Holló, D., Kremer, M. and Lo Duca, M., “CISS – a composite indicator of systemic stress in the financial system”, Working Paper Series, No 1426, ECB, March 2012. On the composite indicator of systemic stress in euro area sovereign bond markets, see Garcia-de-Andoain, C. and Kremer, M., “Beyond spreads: measuring sovereign market stress in the euro area”, Working Paper Series, No 2185, ECB, October 2018. Panel b: the systemic risk indicator has been adjusted to assume Q4 2019 GDP in the computation of the bank credit-to-GDP contribution. For more details on the systemic risk indicator, see Lang, J.H., Izzo, C., Fahr, S. and Ruzicka, J., “Anticipating the bust: a new cyclical systemic risk indicator to assess the likelihood and severity of financial crises”, Occasional Paper Series, No 219, ECB, February 2019. Panel c: growth-at-risk is the 5th percentile prediction of the quantile regressions model estimated for a panel of euro area countries. Explanatory variables include a lag of GDP growth and indicators of cyclical systemic risk, financial stress and economic sentiment. RRE: residential real estate.

Vulnerabilities further out have been building up. Indicators of medium-term systemic risk have continued increasing in recent months (see Chart 1, panel b), while rising medium-term growth-at-risk estimates also point to a changing time profile of risks (see Chart 1, panel c). Concerns particularly relate to pockets of exuberance in credit, asset and housing markets as well as higher debt levels in the corporate and public sectors as a legacy of the pandemic.

Generally improved outlook for sovereigns and firms

Sovereign debt positions in the euro area, although historically high, have benefited from the ongoing recovery and continued favourable financing conditions. Sovereign debt levels have risen sharply since 2019 to nearly 100% of GDP on aggregate for the euro area. While government action was instrumental in avoiding deeper pandemic-related scars on the euro area economy, it still adds to medium-term sovereign debt challenges, particularly for the more highly indebted countries. For the time being, current favourable financing conditions, driven in part by European initiatives such as the Next Generation EU instrument, have allowed governments to lock in long-term financing at historically low interest rates across the rating spectrum (see Chart 2, panel a). The related increase in the residual maturity of outstanding government debt helps reduce rollover risks going forward.

Chart 2

Stress in euro area sovereign bond markets is mitigated by favourable financing conditions, while the sovereign-bank-corporate nexus has loosened

Sources: Bloomberg Finance L.P., S&P, Moody’s, Fitch, IHS Markit, ECB and ECB calculations.

Notes: Panel a: the rating score represents the average rating by the three major rating agencies: Moody’s, Standard & Poor’s and Fitch. The bond yields indicate the long-term interest rate for convergence purposes (secondary market yields of government bonds with maturities of ten, or close to ten, years). Panel b: sovereign CDS spreads on five-year senior bonds are in relation to the average for five countries (France, Germany, Italy, the Netherlands and Spain). For corporate spreads, the iBoxx EUR Non-Financials option-adjusted spread is used. Bank CDS spreads are based on an average across five-year senior bonds of 12 listed euro area banks. CDS: credit default swap.

The ongoing economic recovery has also helped debt-to-GDP ratios to stabilise. The transition from blanket fiscal support to more targeted measures, coupled with the gradual exit from support schemes, has reduced strains on public finances. The positive role that fiscal (and monetary) policies have had in limiting lasting damage to corporates and banks has in turn limited negative feedback to governments via the sovereign-bank-corporate nexus (see Chart 2, panel b). That said, if financing costs were to rise and economic growth were to fall short of expectations, this could put sovereign debt dynamics on an unfavourable trajectory, in particular in higher-debt countries (see Box 1), and contribute to some reassessment of sovereign risk by market participants going forward.

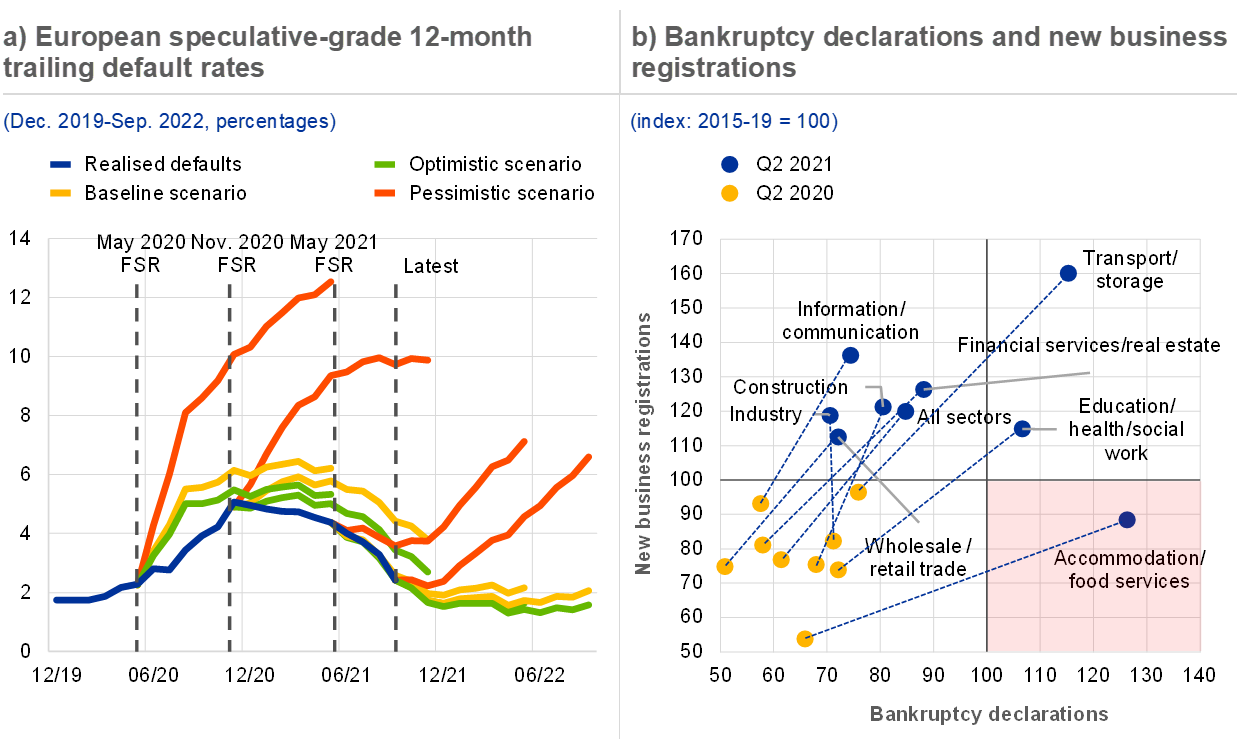

Chart 3

Corporate solvency concerns have lessened, but some sectors continue to feel the impact of the pandemic more than others

Sources: Moody’s Analytics, Eurostat and ECB calculations.

Notes: Panel a: European speculative-grade default rates forecast by Moody’s Analytics as at May 2020, November 2020, May 2021 and September 2021. In the baseline scenario, declining default rates among speculative-grade credits are assumed to be supported by increasing vaccination rates and continued low policy rates. The optimistic scenario builds on the favourable baseline, expecting markets to remain very supportive of speculative-grade issuers in 2021. By contrast, the pessimistic scenario acknowledges a particularly weak ratings mix among European speculative-grade issuers. For more details on the different scenarios, see Moody’s website. Panel b: “Bankruptcy declarations” refers to the number of legal units that had started bankruptcy proceedings at any time during the second quarter of 2020 and the second quarter of 2021 respectively. “New business registrations” captures the number of legal units entered in the company register.

Near-term euro area corporate insolvency concerns have fallen, although some firms remain vulnerable, notably in pandemic-sensitive sectors. Corporate profitability has shown a broad-based recovery in 2021 as economic activity has expanded. Corporate debt servicing capacity has also improved on account of low financing costs, improved revenues and continued public support measures. On average, corporate defaults have come in lower than the most optimistic expectations earlier in the pandemic (see Chart 3, panel a), while insolvencies have remained around 15% below pre-pandemic levels. However, insolvencies in those sectors most affected by the pandemic did rise strongly and without being offset by a rise in new business registrations, suggesting a more pessimistic outlook for those sectors (see Chart 3, panel b). Going forward, corporate insolvencies could still rise further, due to a backlog of unresolved bankruptcy cases and a gradual phasing-out of policy support measures, although by less than feared in the initial phases of the pandemic. That said, more vulnerable and highly leveraged firms may be challenged by the scaling-back of support measures and, in the medium term, debt sustainability concerns may re-emerge given the sizeable debt accumulation during the pandemic.

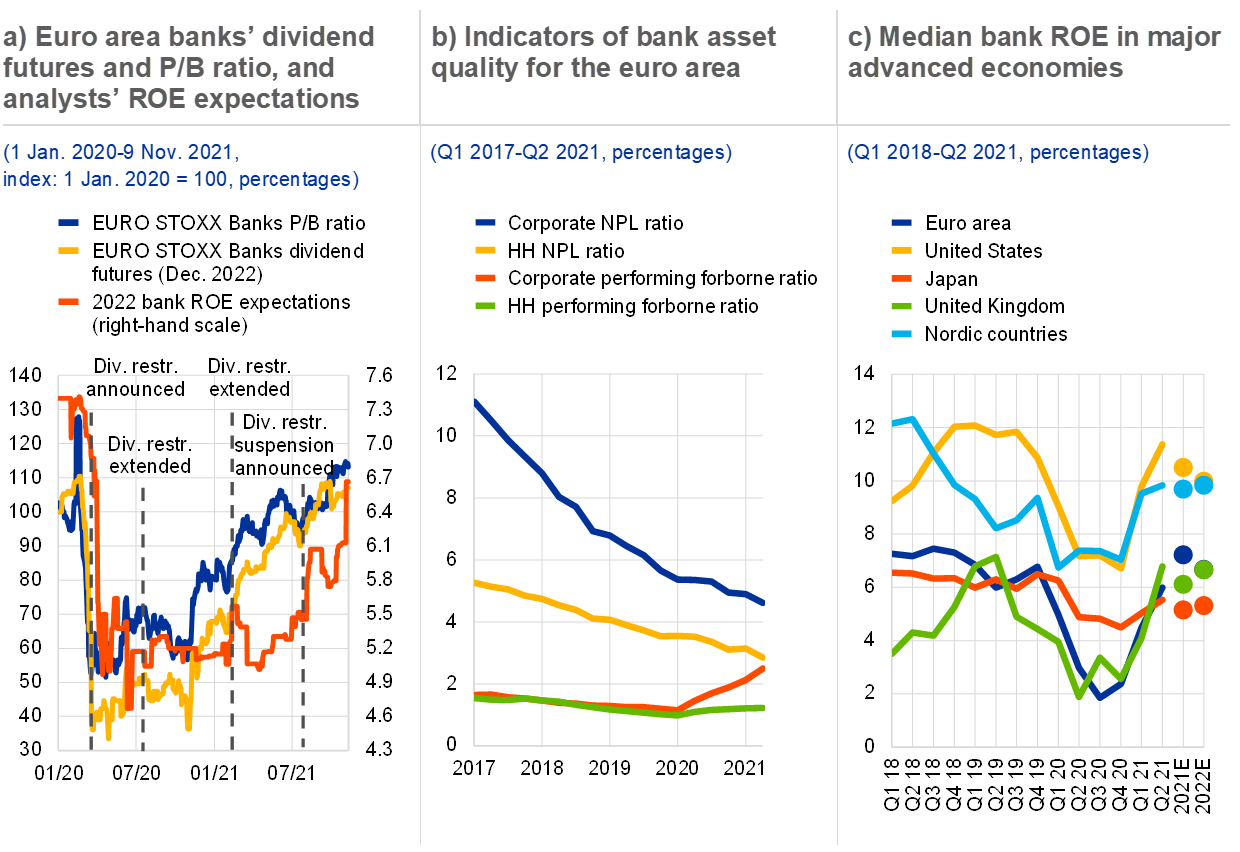

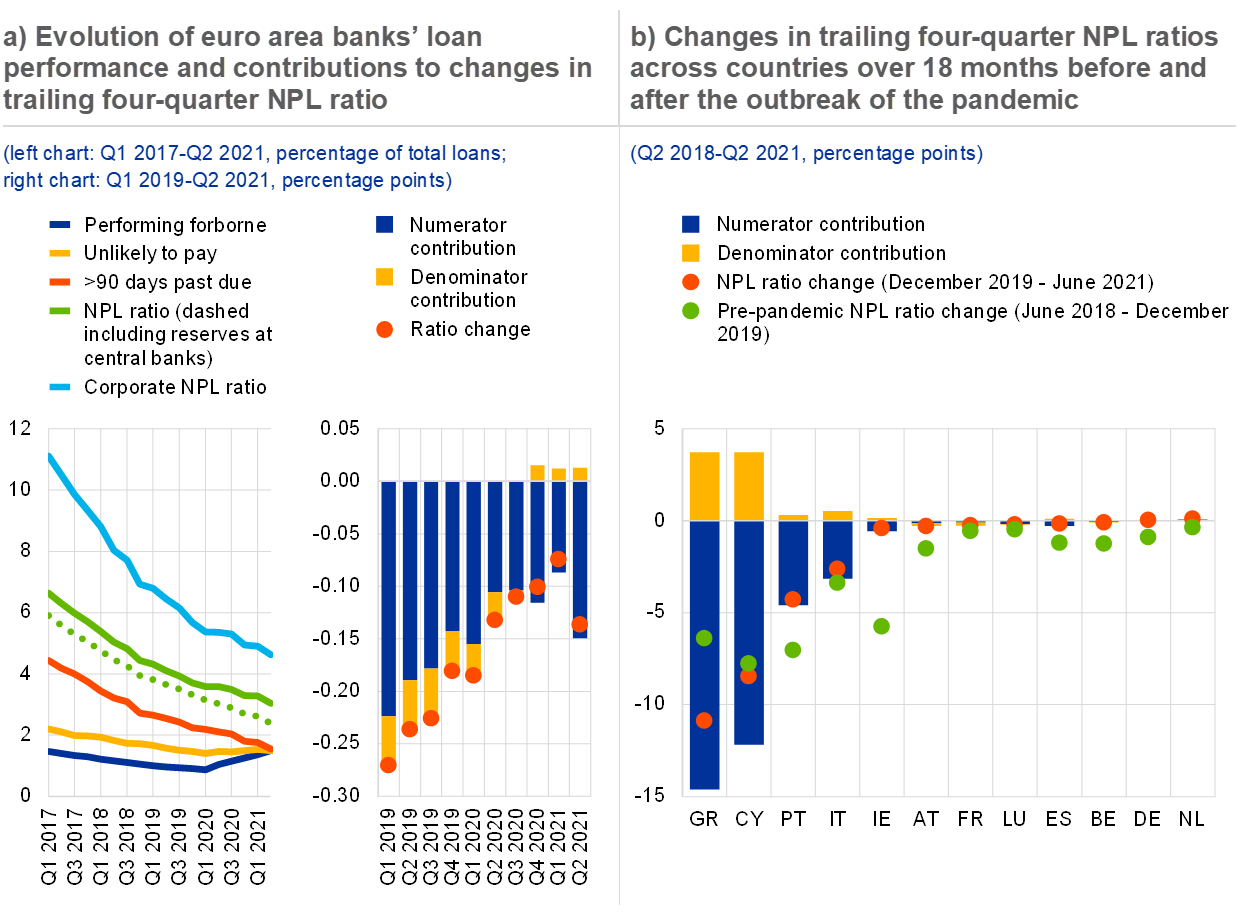

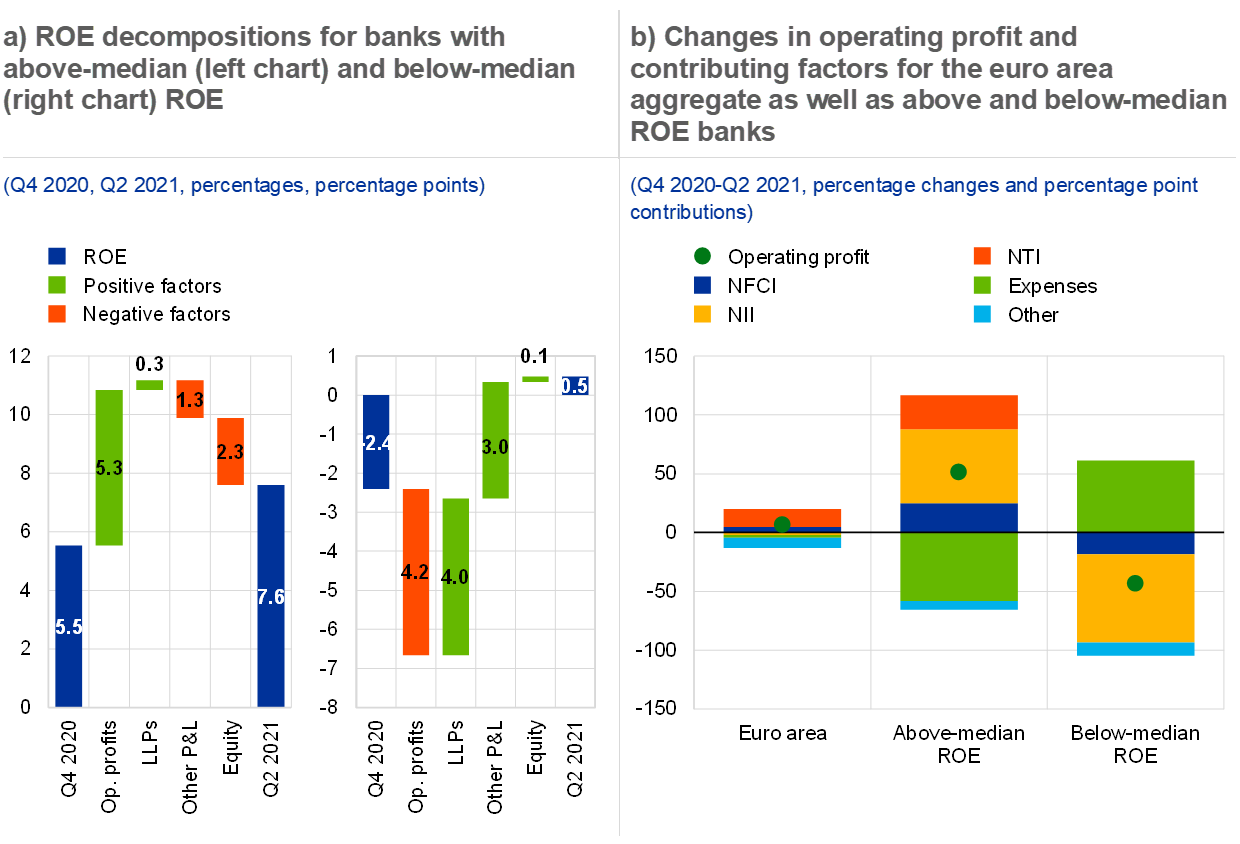

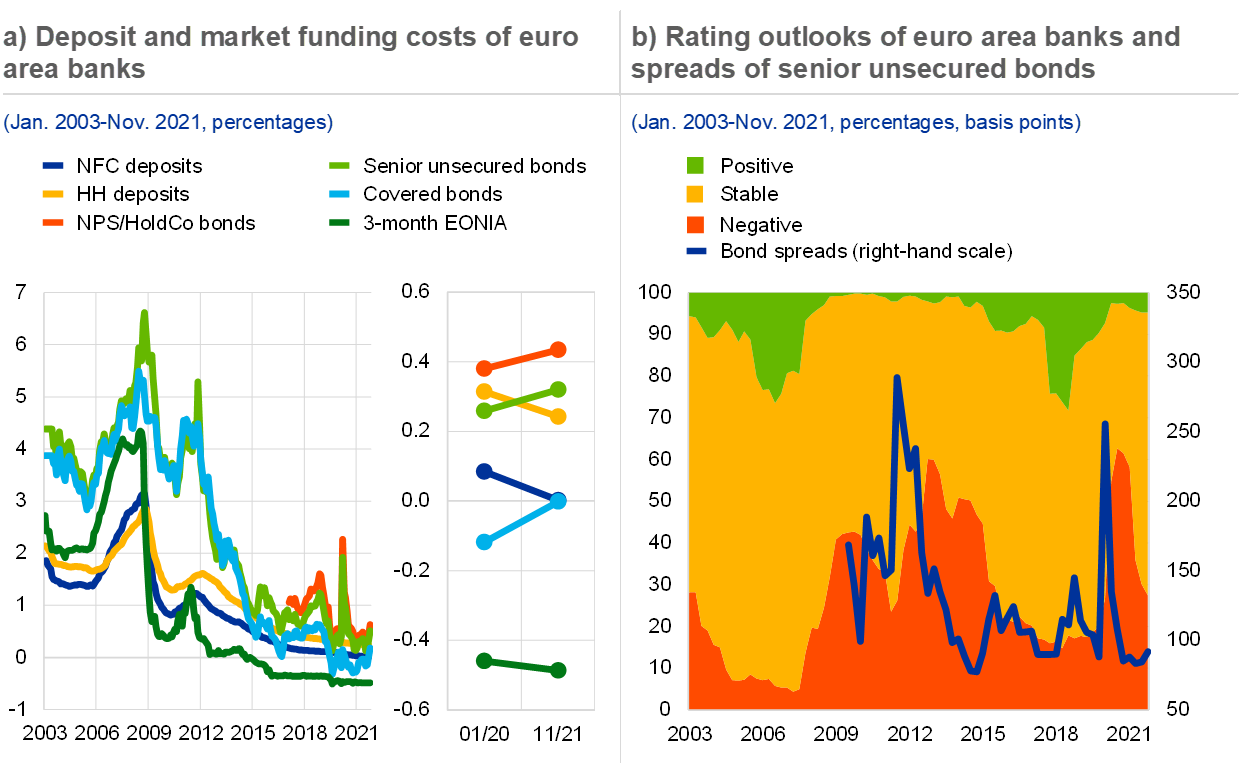

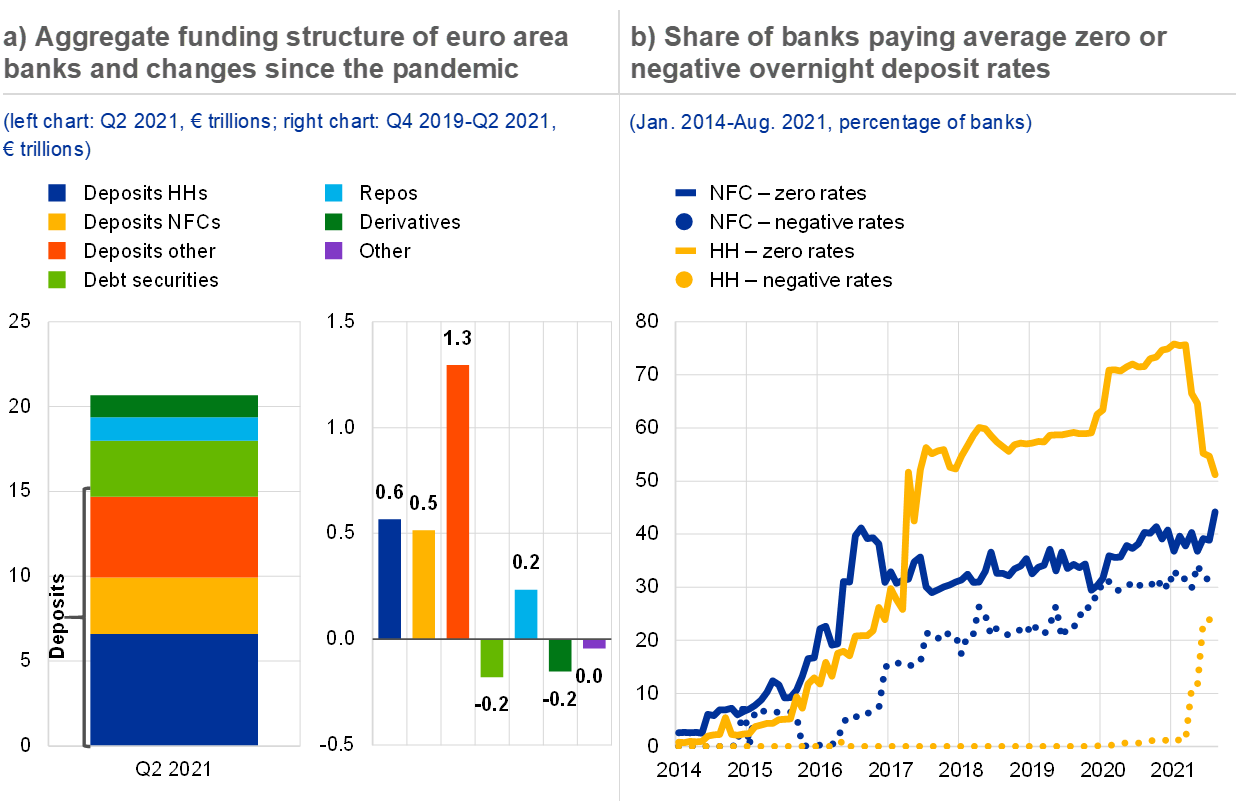

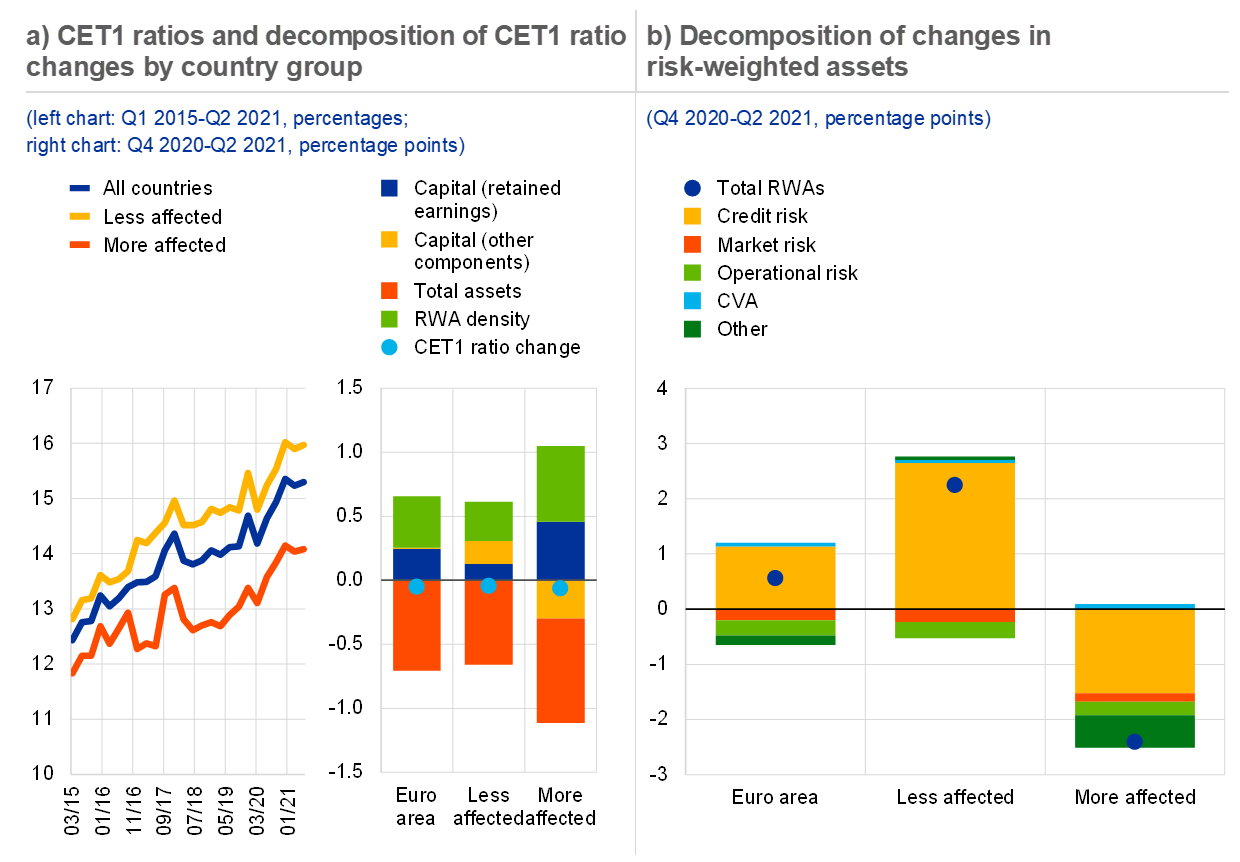

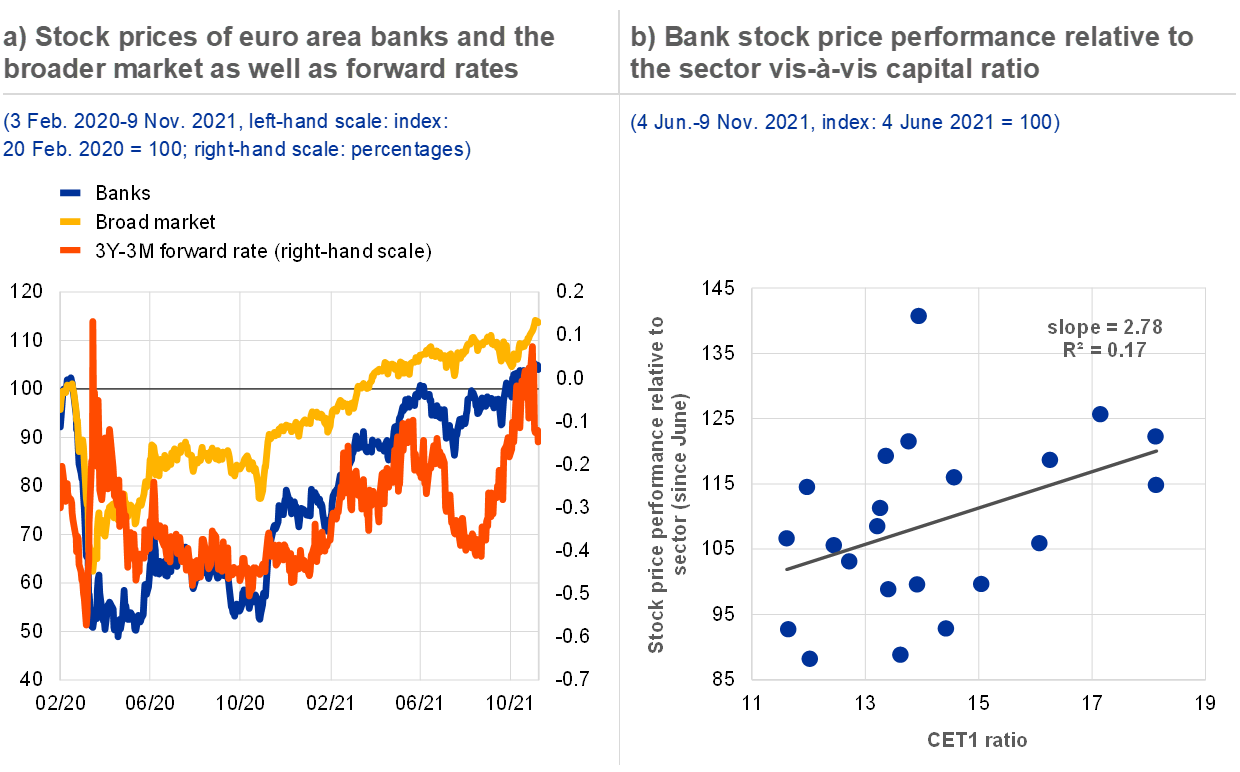

Euro area banks’ structural problems resurface as pandemic-induced vulnerabilities dissipate

Market sentiment towards euro area banks has remained favourable, as the near-term profitability outlook has improved. Continuing the trend that started in July 2020, banks’ equity price valuations have returned to pre-pandemic levels (see Chart 4, panel a). This was driven, among other things, by better than expected bank results on aggregate in the first half of the year, the lifting of the ECB Banking Supervision recommendation on limiting dividends as of October 2021[2] and a steeper yield curve. At the same time, the overall credit risk outlook for banks has improved in tandem with more benign conditions in the non-financial corporate sector (see Chart 4, panel b). Bank valuations were additionally bolstered by the confirmation of the resilience of the sector to adverse shocks in both the July 2021 stress test and the October 2021 macroprudential stress-test exercise (see Box 6). Taken together, these factors seem to indicate that investors consider the banking sector to have largely overcome the initial pandemic-induced challenges.

Looking ahead, bank profitability remains hampered by euro area banks’ structural challenges. Bank profitability has improved overall since the start of 2021 on the back of lower loan loss provisions and stronger revenue streams from investment banking (see Box 5), but the profitability outlook continues to depend on the path of overall economic recovery and the pandemic. While the non-performing loan (NPL) ratio has dropped to levels last seen before the global financial crisis on account of further progress made in NPL sales, asset quality concerns may resurface as government support measures are gradually withdrawn, reinforcing the need for effective NPL solutions (see Special Feature C). Euro area bank profitability remains lower than in other jurisdictions (see Chart 4, panel c). Thus, even as pandemic-related challenges abate, pre-pandemic structural challenges, such as low cost-efficiency, limited revenue diversification, overcapacity and compressed margins in a low interest rate environment, remain. Consolidation via mergers and acquisitions could be one potential avenue for helping the sector to return to more sustainable levels of profitability (see Special Feature B). Looking ahead, euro area banks also face increasing urgency to meet digital transformation needs and to manage the implications of the transition to a greener economy.

Chart 4

Sentiment remains positive towards euro area banks as dividend payments resume and asset quality concerns fade, but structurally low profitability is still a concern

Sources: Bloomberg Finance L.P., ECB supervisory data and ECB calculations.

Notes: Panel a: 2022 bank ROE expectations indicate the median of a sample of 31 listed euro area banks. Panel b: based on a balanced sample of 92 significant institutions. Panel c: based on a sample of 31 listed euro area banks, 15 listed US banks, 4 listed UK banks, 11 listed Japanese banks and 7 listed Nordic banks. “Nordic countries” refers to Denmark, Finland and Sweden. The forecasts for 2021 and 2022 are as of 9 November 2021. E: estimated; HH: household; P/B: price-to-book; ROE: return on equity.

Continued exuberance leaves parts of real estate and financial markets increasingly susceptible to corrections

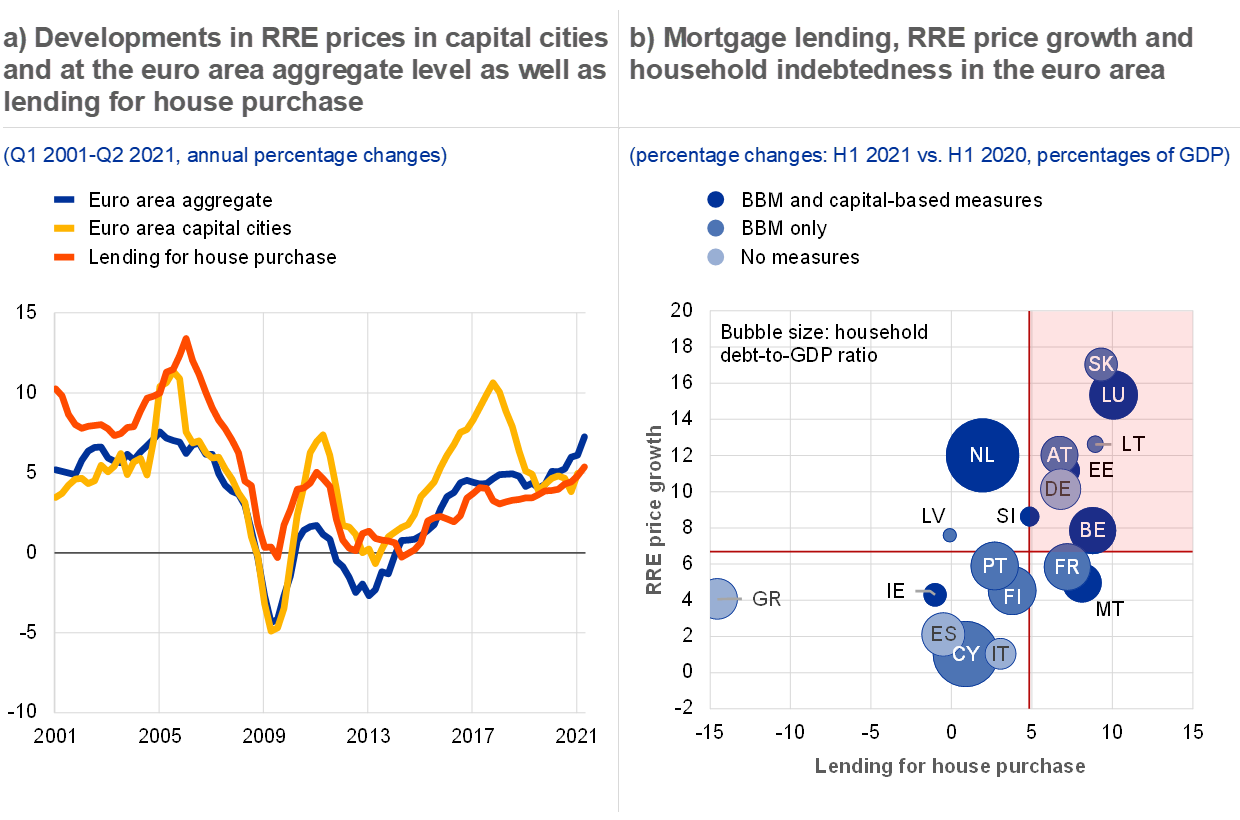

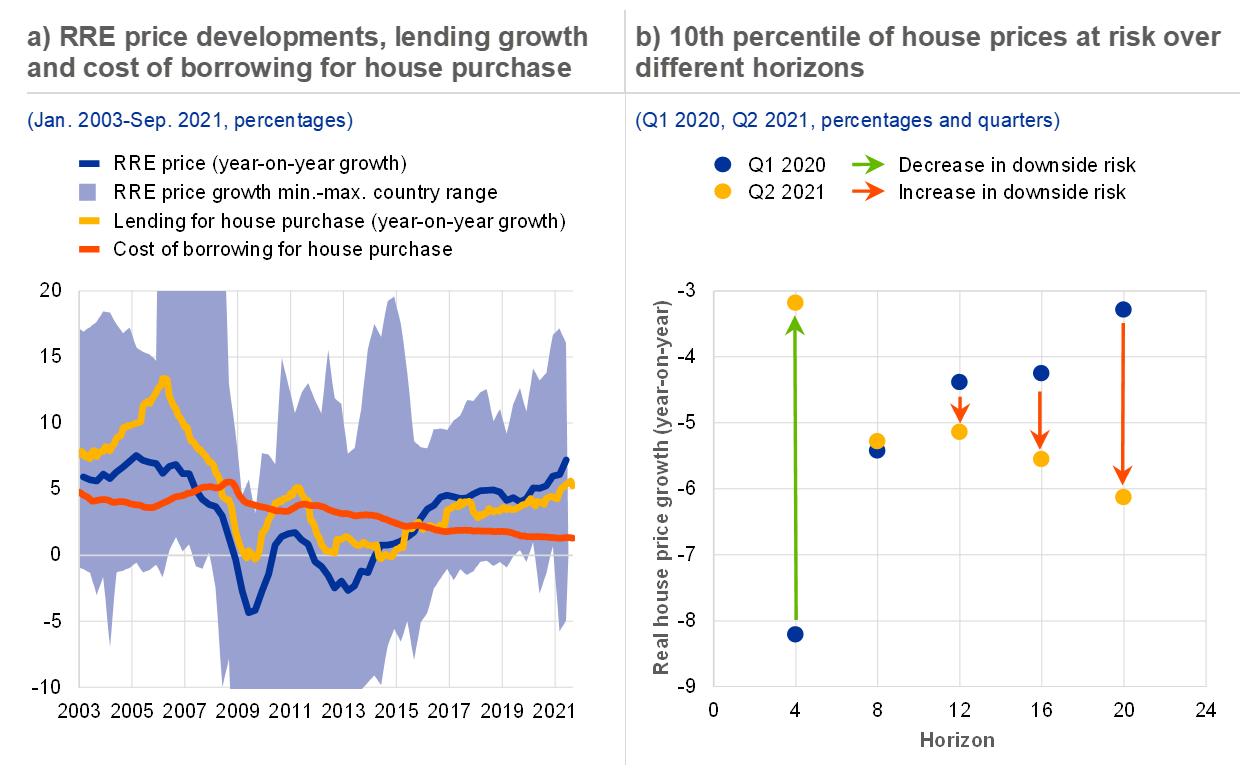

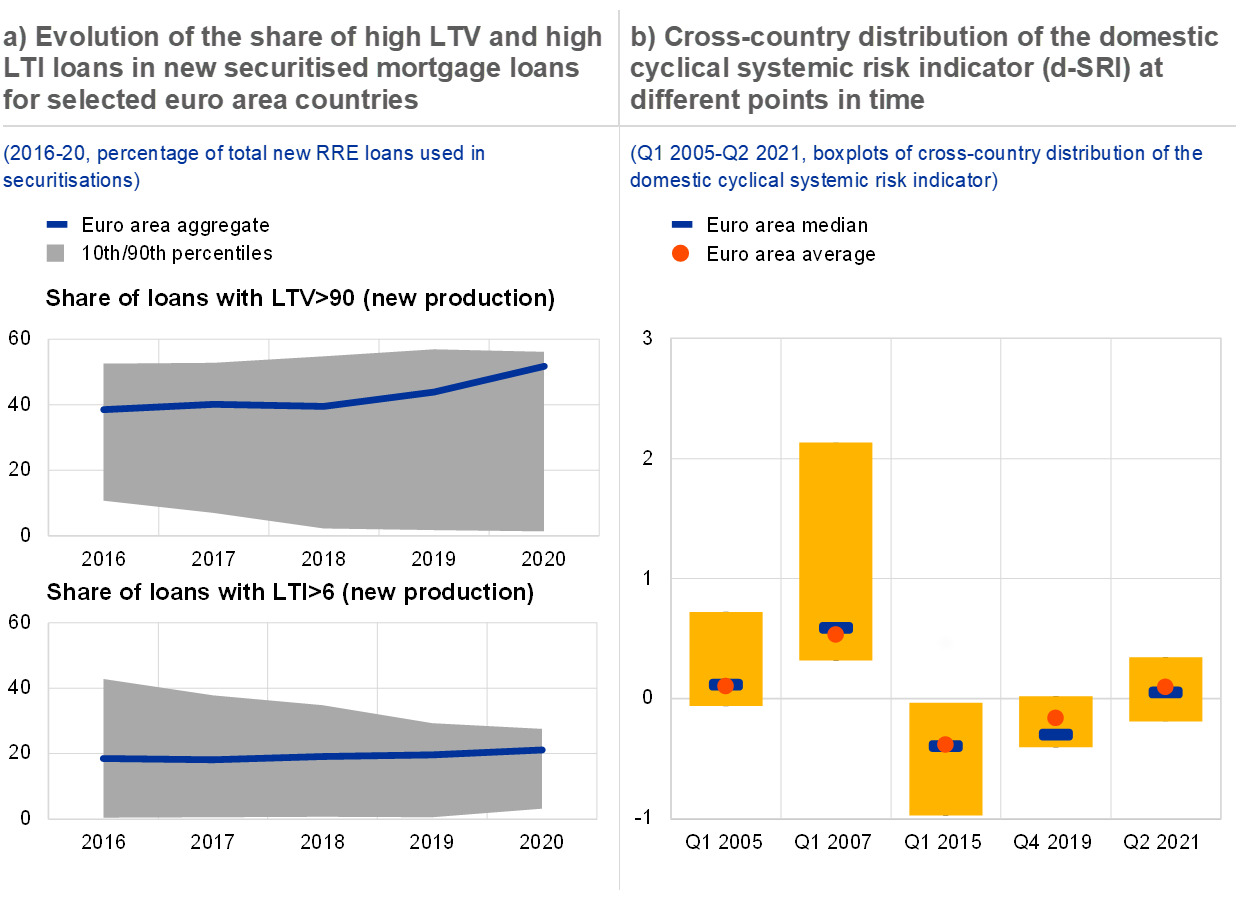

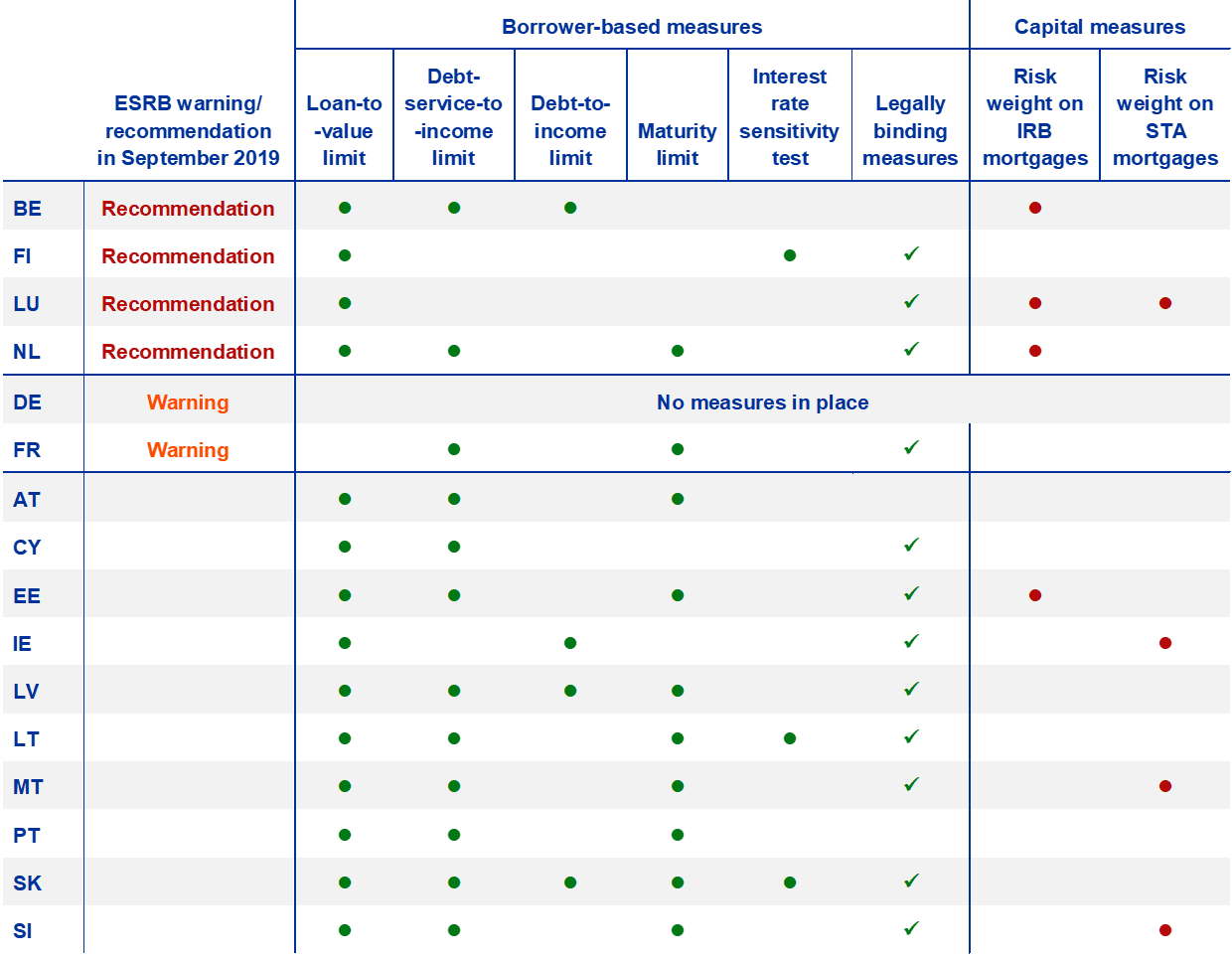

Euro area house prices rose at their fastest pace since 2005 in the second quarter of 2021, amid signs of easing mortgage lending standards. While the economic recovery has also supported near-term fundamentals for the housing market, continued strong house price growth of around 7% at the euro area aggregate level remains a cause for concern amid signs of more broad-based price increases across both urban and non-urban areas (see Chart 5, panel a). Some of this rise could reflect an increase in demand for housing (including larger properties) during the pandemic. But growing signs of overvaluation for the euro area as a whole render residential real estate (RRE) markets more prone to a correction, in particular in countries with more elevated valuation levels (see Section 1.5). In some countries, the strength of RRE markets is coupled with buoyant mortgage lending, and there is evidence of a progressive deterioration in lending standards, as reflected by the increasing share of loans with high loan-to-value and loan-to-income ratios (see Chapter 5). High and rising levels of household indebtedness also contribute to heightened medium-term vulnerabilities in some countries (see Chart 5, panel b). Taken together, these developments have strengthened the case for considering further activation of macroprudential policy measures, where appropriate.

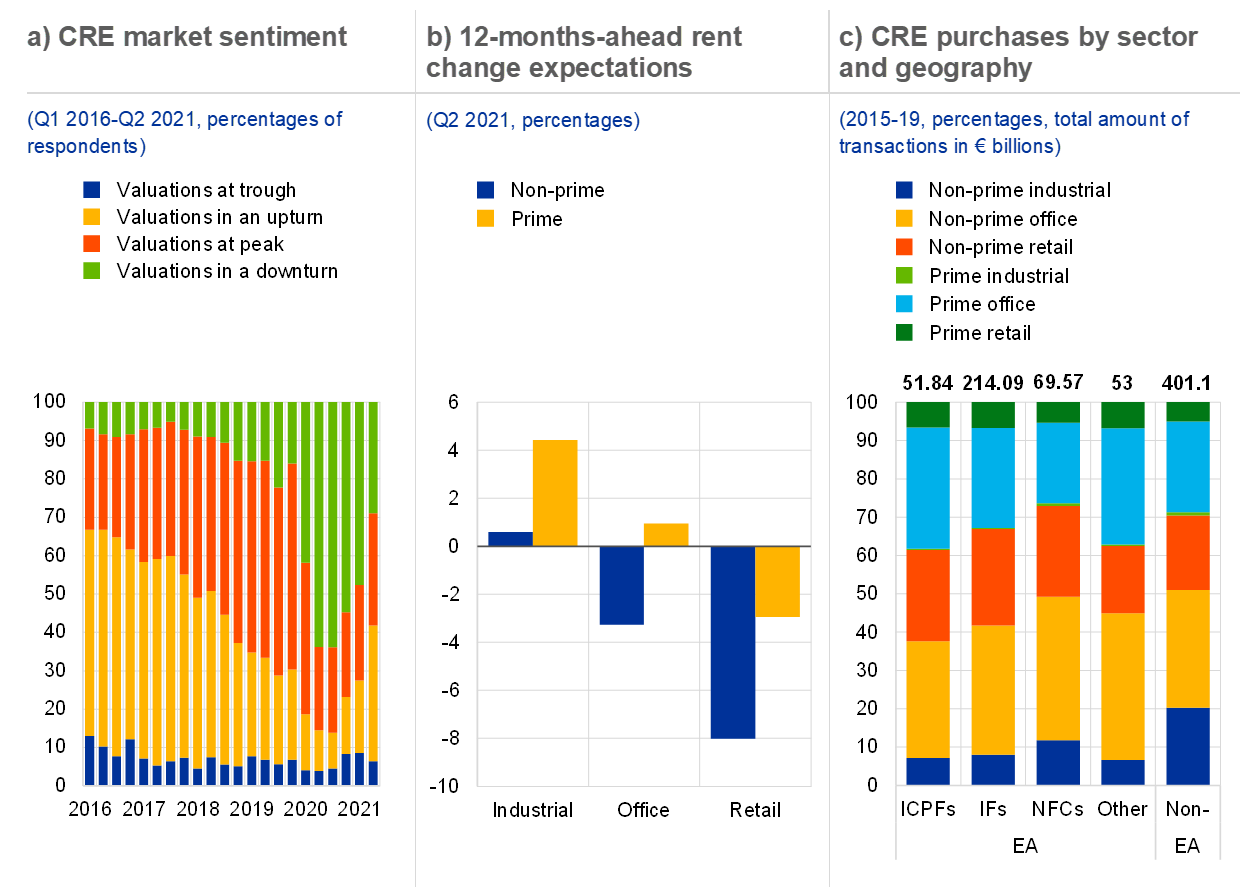

Commercial real estate (CRE) markets have benefited from the improving economic outlook, but parts of the market remain vulnerable to further price corrections. Investor sentiment has improved over recent quarters, but a substantial share of CRE investors still see the market in a downturn. The outlook seems particularly poor for lower quality CRE assets, with market intelligence flagging remote working, health concerns and the rush for greener property as channelling demand towards the prime segment. This intersects with elevated vulnerabilities among those sectors most affected by the pandemic, namely retail and office assets. Transaction data suggest substantial holdings of these most vulnerable assets across the euro area financial system, in particular for non-banks.

Chart 5

Vulnerabilities are on the rise in non-financial asset markets amid buoyant credit dynamics in some countries

Sources: ECB and ECB calculations.

Notes: Panel a: the composition of the sample underlying the time series on RRE price developments in capital cities changes over time and includes Austria, Belgium, Estonia (from 2003), Finland (from 2010), France, Germany, Ireland (from 2005), Italy, the Netherlands, Slovenia (from 2010) and Spain. The euro area series is a weighted average based on 2014 GDP weights. Panel b: the bubble size indicates the household debt-to-GDP ratio as at March 2021. Light blue bubbles refer to countries which have applied borrower-based macroprudential measures such as collateral or income-based limits. Dark blue bubbles refer to countries that have applied both capital-based (e.g. risk weights on RRE exposures) and borrower-based macroprudential measures. Grey bubbles indicate countries with no capital or borrower-based measures in place. The red horizontal and vertical lines indicate the euro area aggregate. BBM: borrower-based measures; RRE: residential real estate. In the Netherlands, the announced CRR measure (Article 458) foreseen for Q3 2020 (LTV-dependent risk weights floor for domestic IRB mortgage loan portfolios) was postponed in March 2020 in light of the COVID-19 pandemic. The measure should come into effect on 1 January 2022.

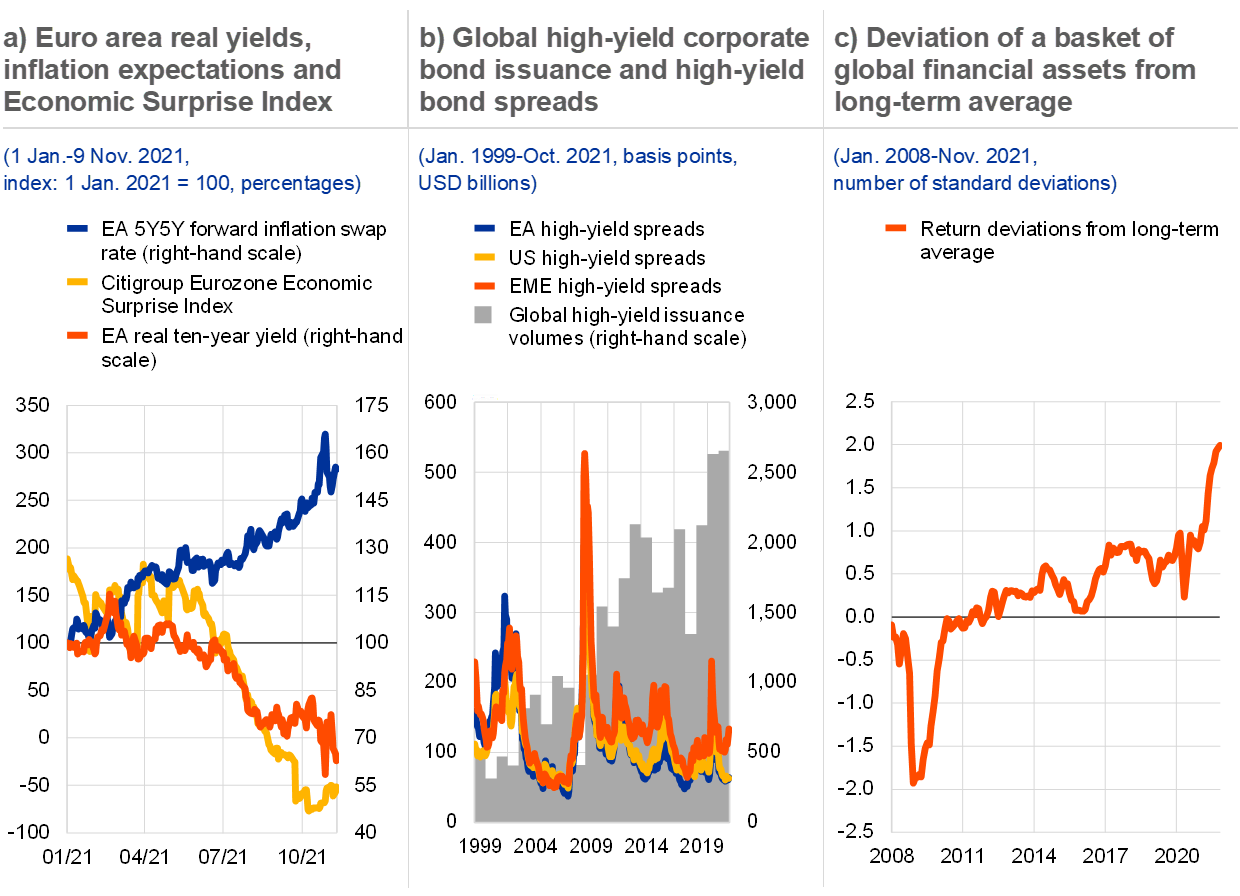

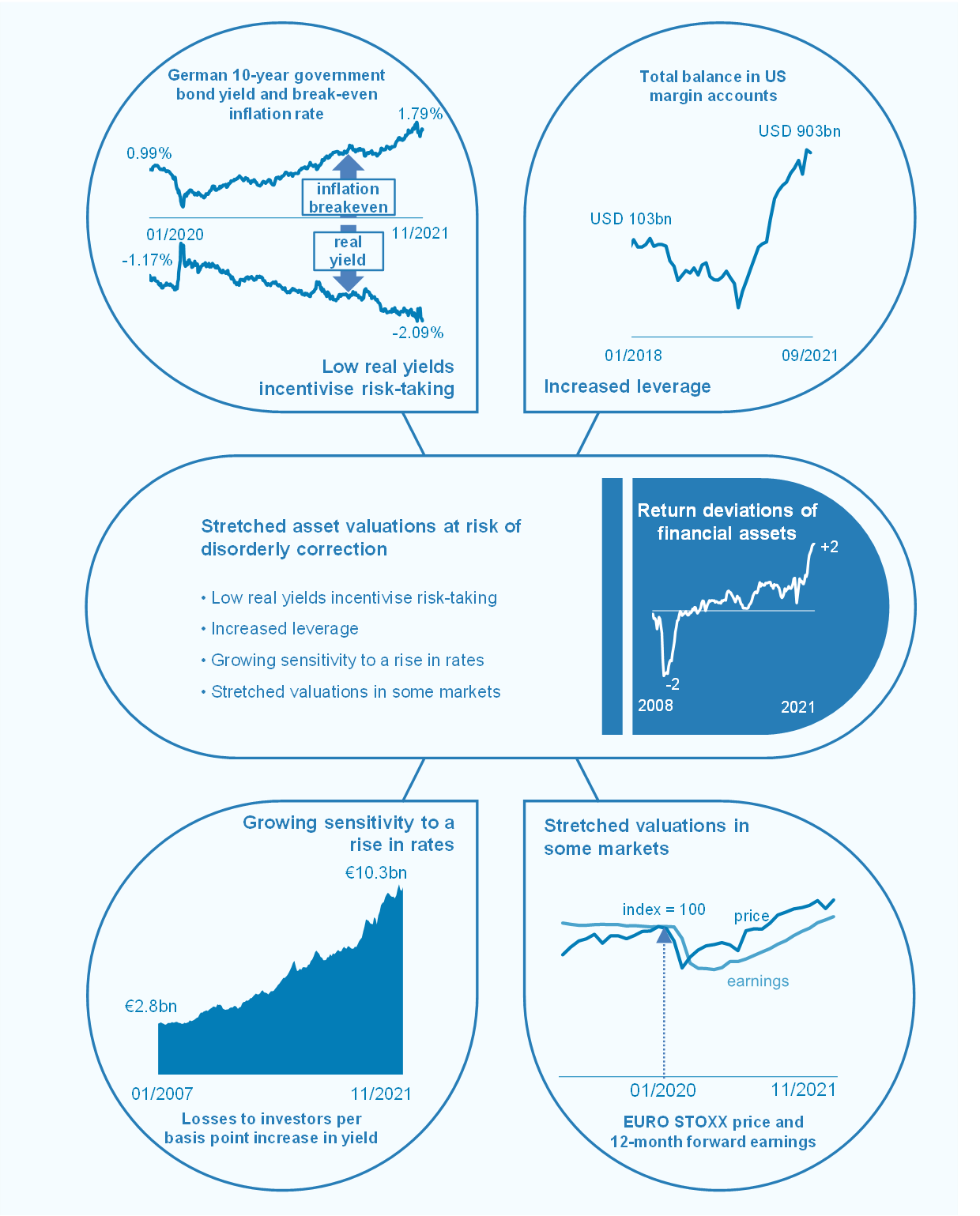

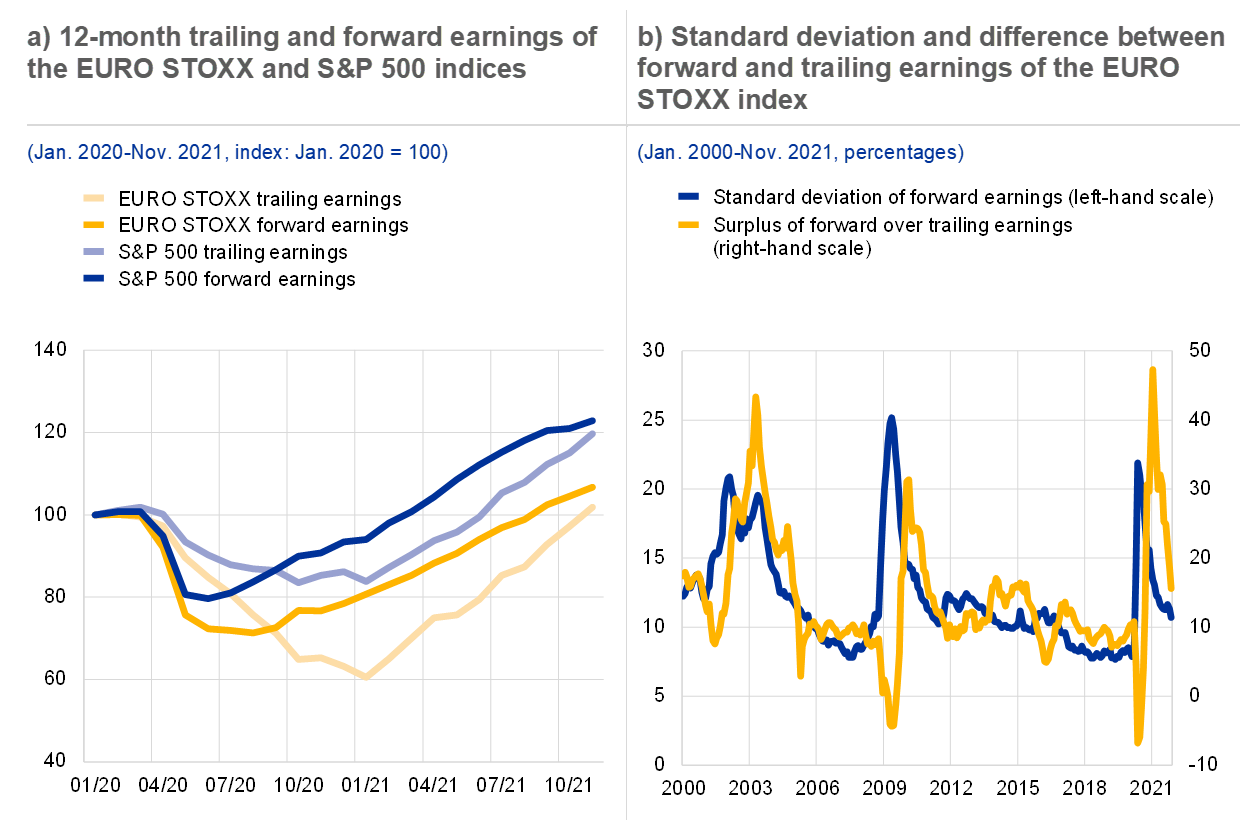

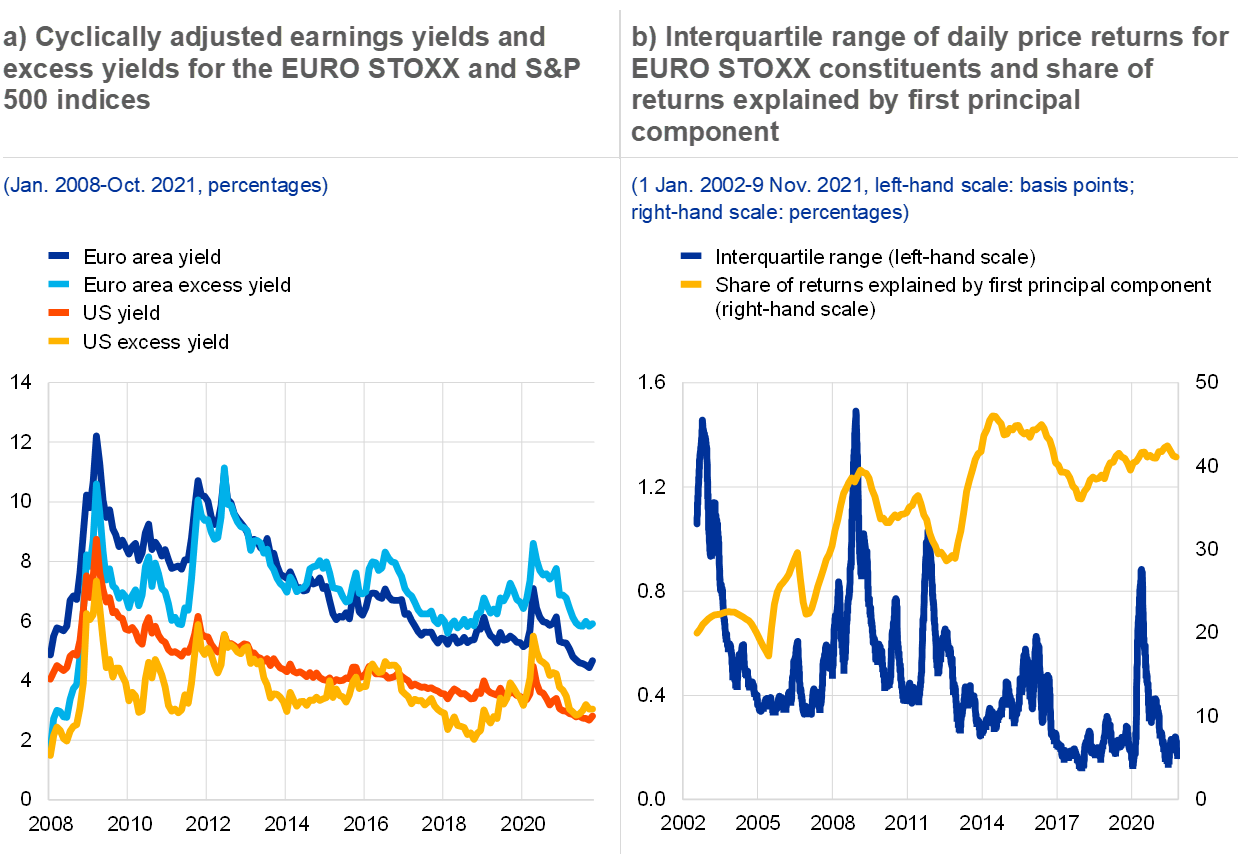

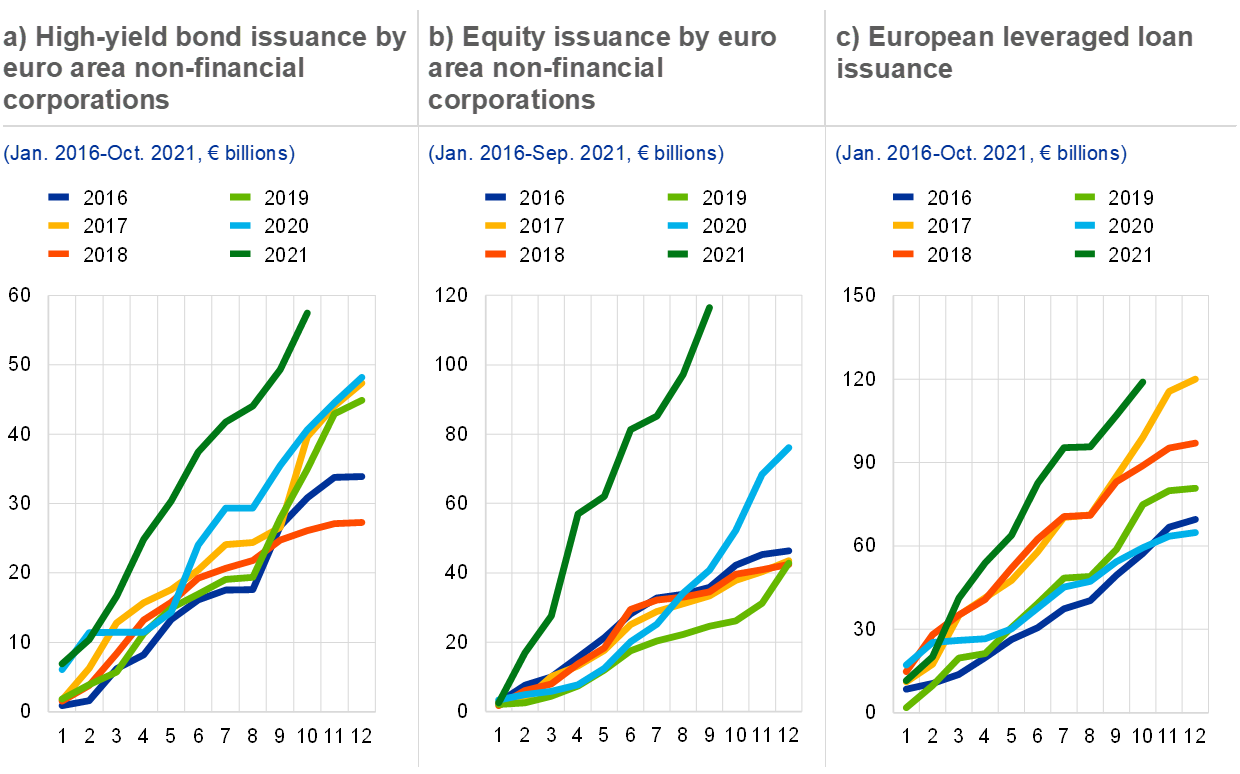

Signs of exuberance are increasingly visible in some financial market segments as real yields fall and the search for yield continues. Real yields fell to all-time lows amid indications of a moderating pace of the economic recovery and increased inflationary pressures (see Chart 6, panel a), incentivising risk-taking in financial markets. Euro area and global equity markets have continued to advance since the publication of the previous FSR, also bolstered by a better than expected corporate earnings season and continued accommodative financial conditions. The stock prices of pandemic-sensitive firms have continued to underperform the market, indicating a continued concentration of risk in some sectors. Issuance activity in high-yield corporate credit markets has reached new highs in 2021 (see Chart 6, panel b). Despite large issuance volumes, spreads remain at record lows, pointing to strong investor appetite for risky assets.

Chart 6

Exuberance in markets continued amid lower real yields, and high valuations render some financial markets vulnerable to repricing if global liquidity conditions change

Sources: Refinitiv, Dealogic, Bloomberg Finance L.P., ECB and ECB calculations.

Notes: Panel a: “EA 5Y5Y forward inflation swap rate” refers to the euro area five-year forward inflation-linked swap rate five years ahead. Panel b: government option-adjusted spreads are employed. Panel c: the basket of global financial assets used to compute the valuation metric includes: real yields on euro area, Japanese, UK and US ten-year government bonds; euro area and US investment-grade and high-yield bonds; euro area, Japanese, UK and US equity; US real estate investment trusts and mortgage-backed securities; and emerging market sovereigns and equity. EA: euro area.

Buoyant financial asset price developments raise overvaluation concerns in some markets, increasing the likelihood of market corrections. The combination of historically low real yields and elevated valuations (see Chart 6, panel c) leave sub-investment-grade bond and some equity markets vulnerable to adverse interest rate and growth shocks (see Chapter 2). The presence of a cohort of vulnerable firms could increase the sensitivity of corporate securities prices to risk-off shocks (see Box 3). A correction in markets could be triggered by a weaker than expected economic recovery, spillovers from adverse developments in emerging market economies, a re-intensification of stress in the non-financial corporate sector or abrupt adjustments in market expectations regarding the prospective path of monetary policy normalisation. In addition, more persistent inflationary pressures than currently anticipated could push nominal yields higher, which may put valuations under pressure. Beyond core markets, some more exotic market segments, such as crypto-asset markets, also remain subject to speculative bouts of volatility, with the growing popularity of stablecoins increasing interlinkages between crypto-asset and conventional financial markets (see Box 4).

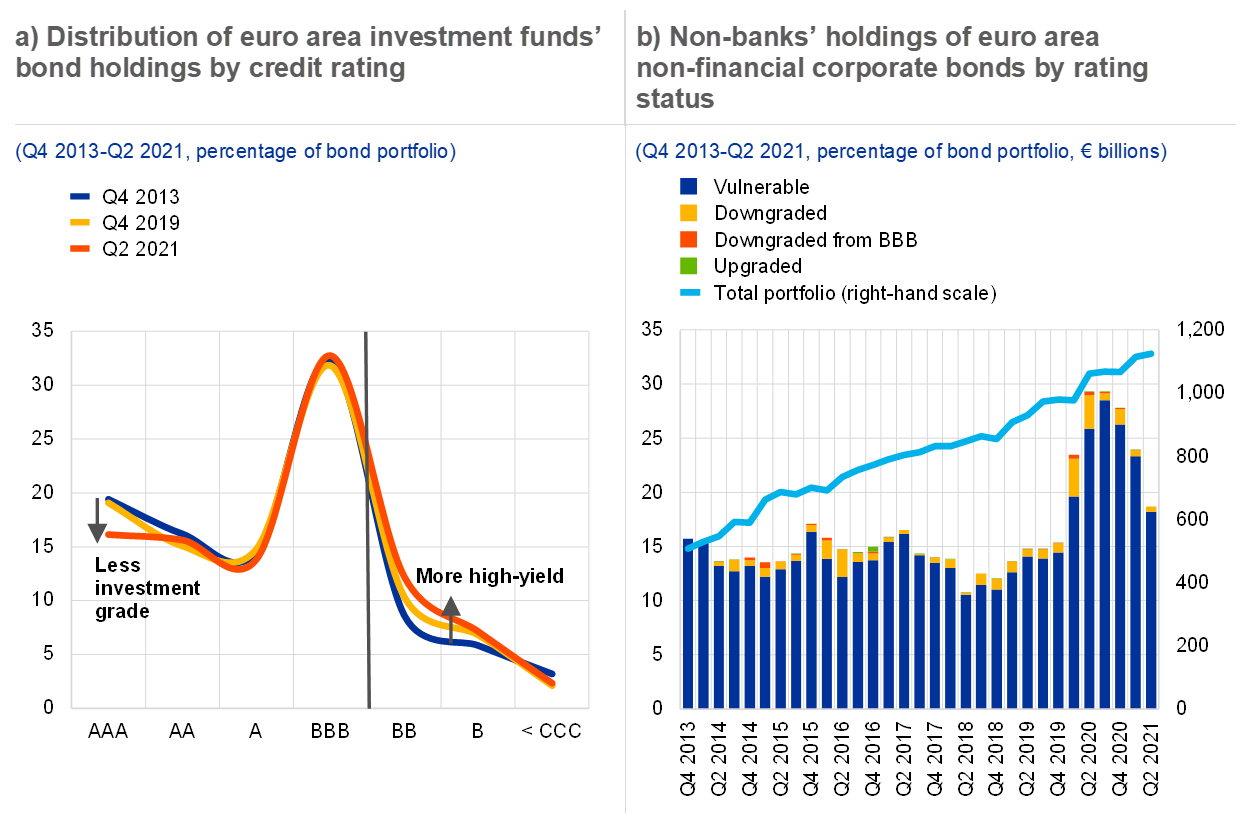

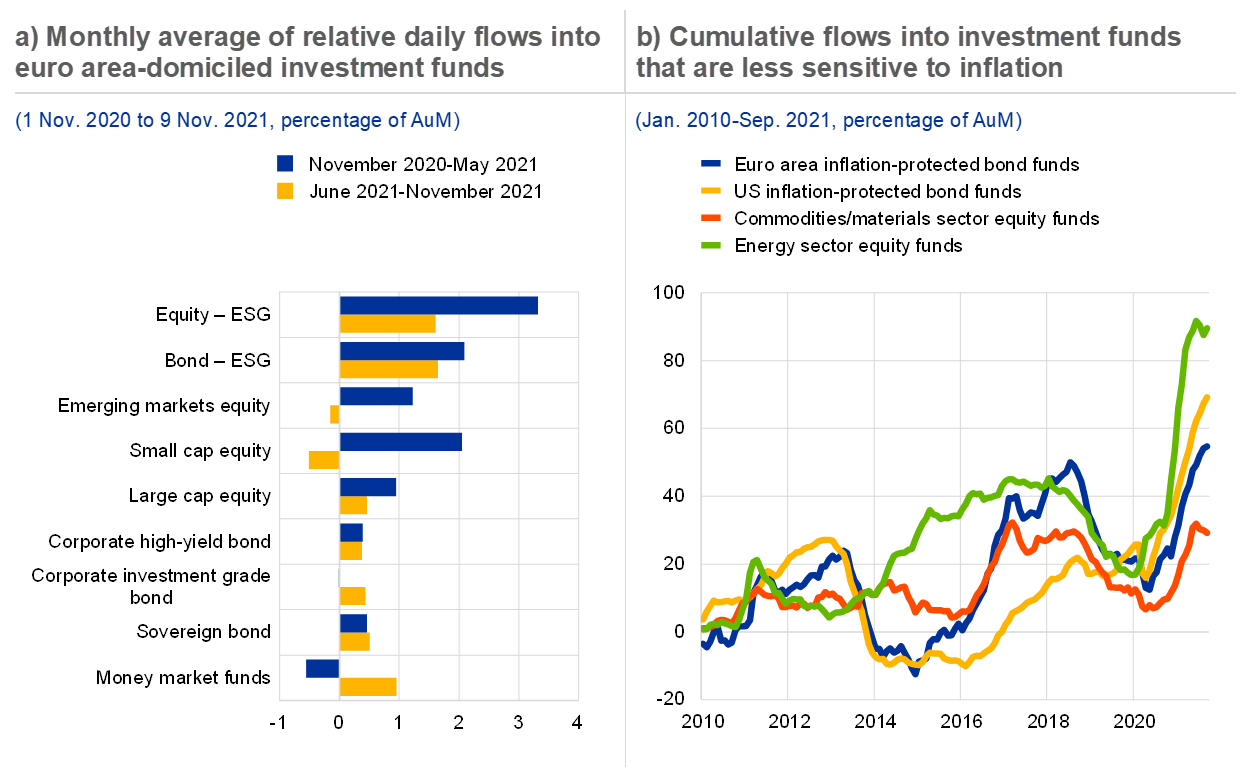

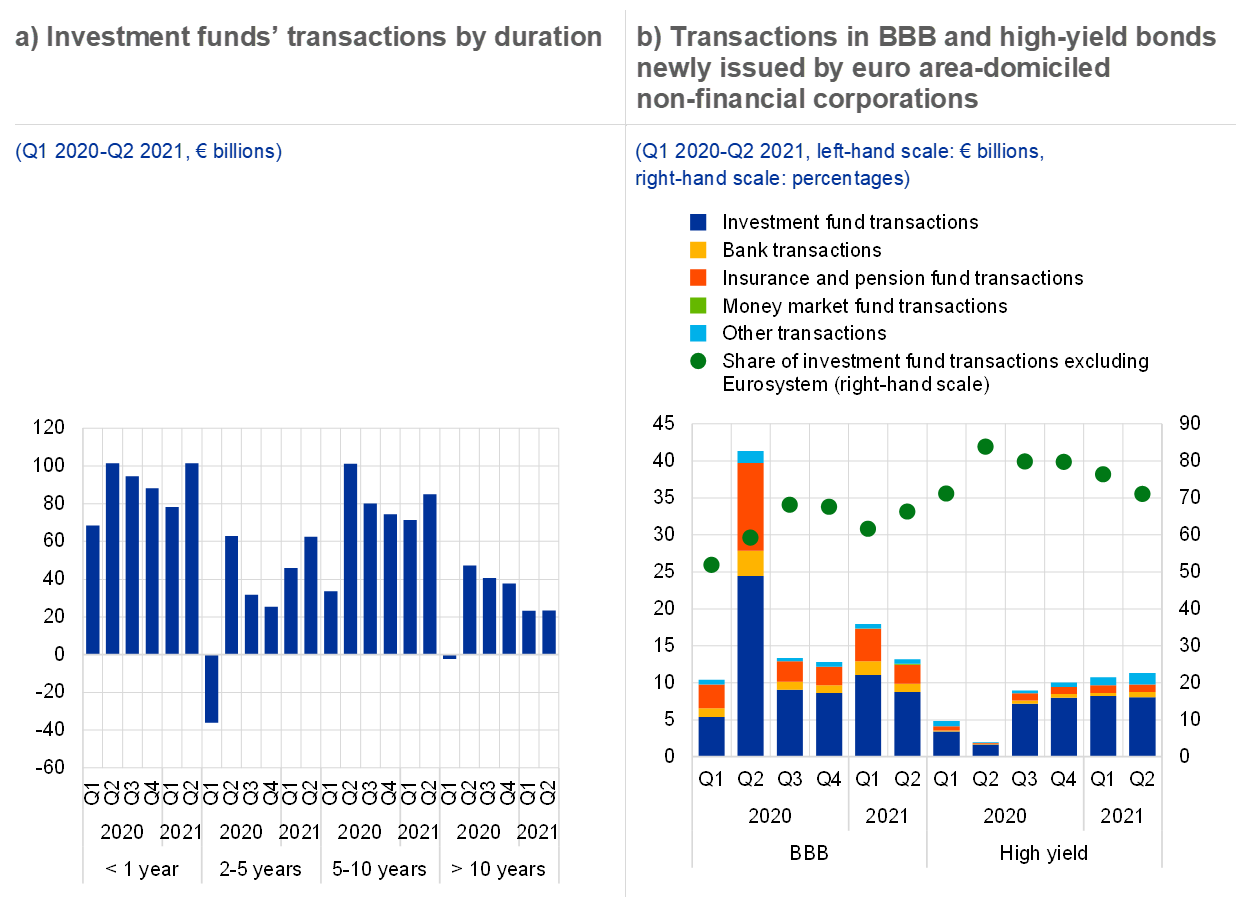

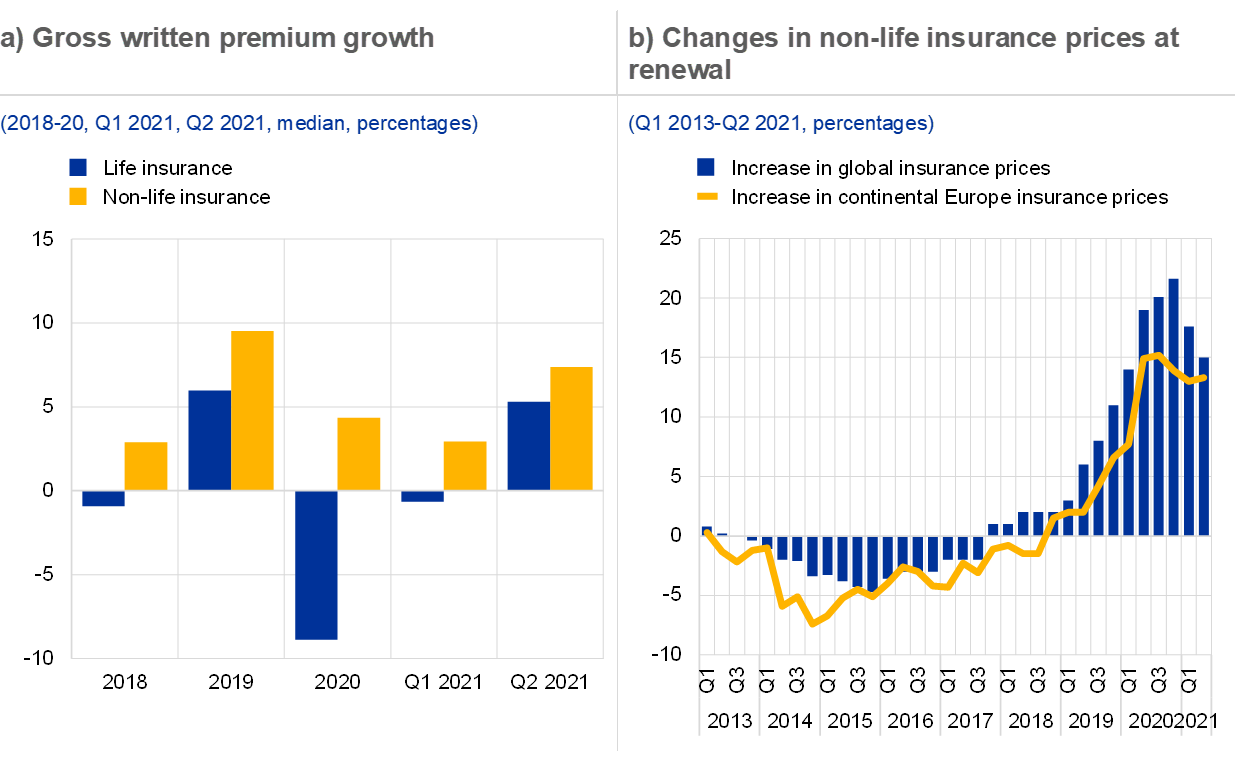

In parallel, the non-bank financial sector continues to face elevated credit risk. Non-banks continue to be an important source of financing for non-financial corporations (NFCs) as the economy recovers. However, in their search for yield, investment funds (IFs) have increased credit risk in their portfolios by purchasing around 70% of euro area-domiciled NFCs’ newly issued BBB and high-yield bonds, leading to increased holdings of lower quality bonds in their portfolios (see Chart 7, panel a). Similarly, insurance corporations and pension funds (ICPFs) have further expanded their lower-rated corporate debt holdings (see Chart 7, panel b). While reduced corporate sector vulnerabilities alleviate related credit risks in the short run, non-banks remain exposed to the risk of substantial credit losses should conditions in the corporate sector deteriorate. For insurers, risks are partly mitigated by a more favourable operating environment, underpinned by the sector’s robust capitalisation.

Chart 7

Non-banks continue to absorb the bulk of the record-high issuance of lower-rated instruments amid growing credit, liquidity and duration risks

Sources: ECB (securities holdings statistics and Centralised Securities Database) and ECB calculations.

Notes: Panel a: the red horizontal and vertical lines indicate long-term sample averages between Q4 2013 and Q2 2021. The bubble size indicates the duration risk approximated by the weighted average residual maturity of the investment fund sector’s bond holdings and scaled exponentially for visualisation purposes. The credit rating refers to debt securities’ worst rating in the given period. Highly liquid assets are holdings with HQLA level 1. Panel b: holdings include globally issued long and short-term debt securities excluding non-rated assets. Credit rating refers to debt securities’ worst rating in the given period. HQLA: high-quality liquid assets.

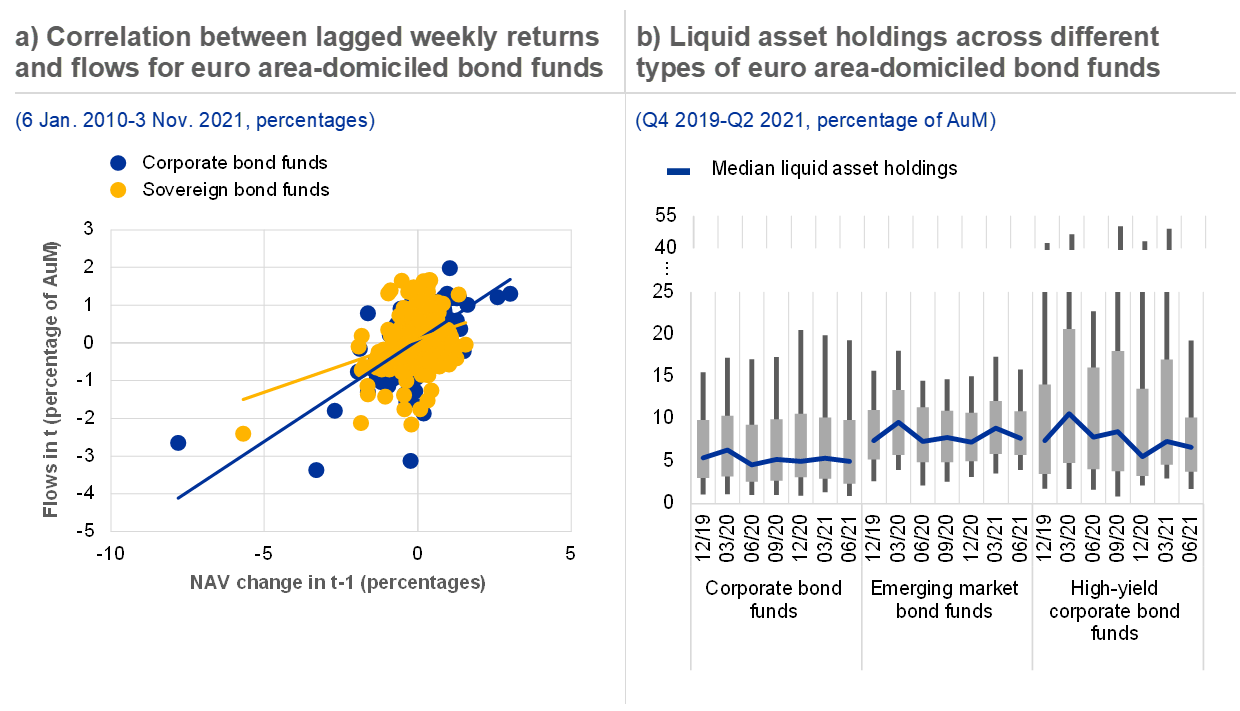

For investment funds, growing credit risks are exacerbated by high liquidity risk as well as increasing duration risk exposure. Low liquidity holdings leave the sector vulnerable in the event of large-scale outflows (see Chart 7, panel a). At the same time, the average duration of exposures has increased during the pandemic. Were bond yields to rise, valuation losses could trigger outflows from investment funds which – when coupled with the low liquidity buffers – could force bond funds to liquidate assets to meet investor redemptions. Such procyclical selling behaviour could also amplify other financial market shocks. Overall, elevated levels of credit, liquidity and duration risks underscore the importance of strengthening the resilience of the non-bank financial sector, including from a macroprudential perspective.

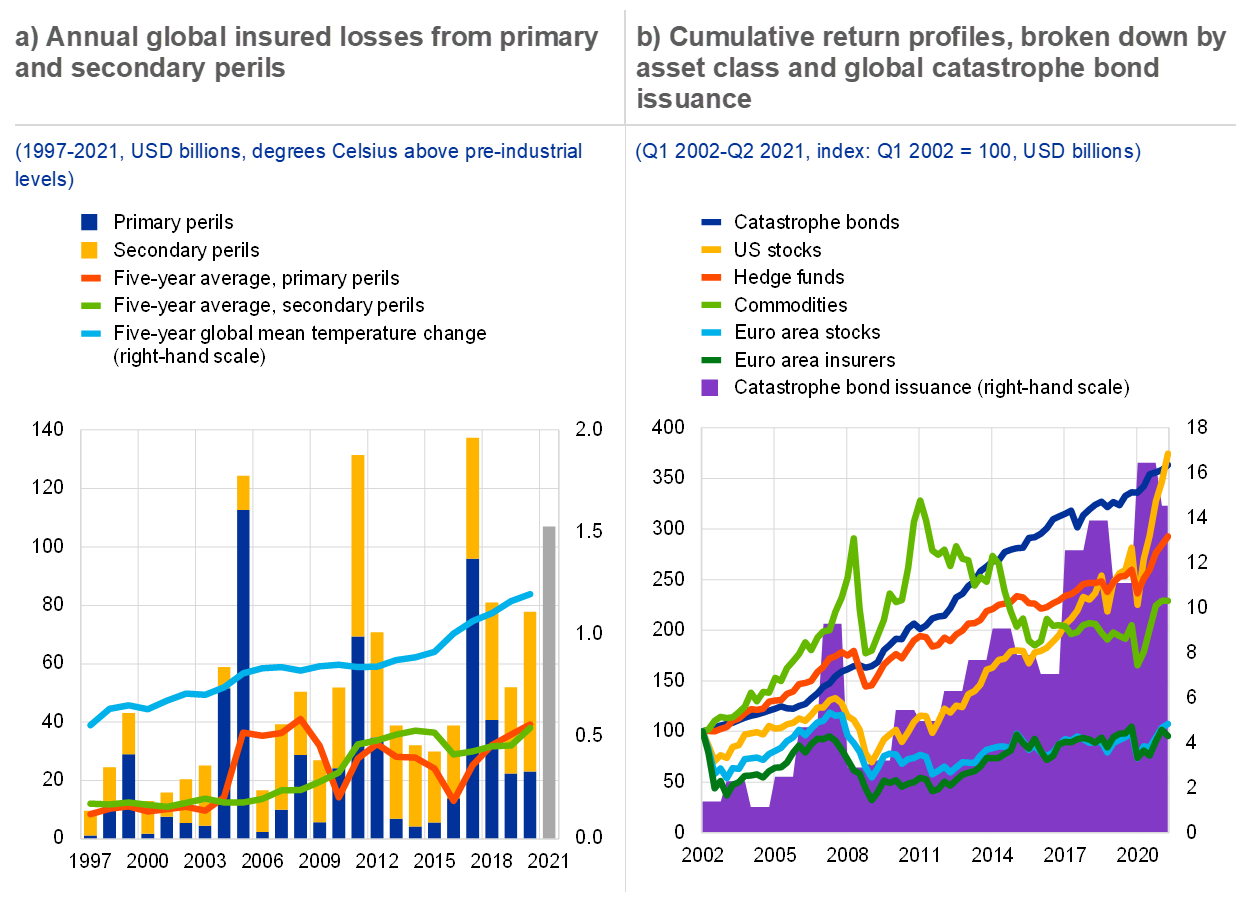

Climate change-related vulnerabilities call for policies to support an orderly transition

A rapid deepening of green financial markets continues, but greenwashing risks warrant monitoring. Investor interest in green finance has continued to grow rapidly over the course of 2021, alongside green investment more generally (see Chart 8, panel a), indicating increasing awareness of the need to transition to a low-carbon economy. While financial markets can play an important role in financing this transition, greenwashing concerns persist. These need to be tackled through better information, especially in relation to forward-looking commitments and plans, and enhanced standards, both to ensure that green finance effectively supports the transition and to foster efficient market mechanisms. Ongoing official sector initiatives in Europe and in global standard-setting bodies to shore up disclosures, standards and taxonomies should help in addressing some of these issues.

Chart 8

Financial markets, non-banks and banks all face the challenge of achieving an orderly transition to a low-carbon economy

Sources: Bloomberg Finance L.P., ECB and ECB calculations based on NGFS scenarios (2020).

Notes: Panel a: “Investment in sustainability” includes investments in operational environmental and social compliance and other internal environmental and social initiatives (e.g. the amount invested in pollution prevention, recycling, employee training and environmental remediation). Panel b: the average percentage change in median loan portfolio PDs is presented relative to 2020 values for the top 10% of banks in terms of expected loss dispersion, and is compared with the same values for the median results across all banks in the sample. “Tail portfolios” are those banks within the 90th percentile of highest relative increase in expected losses between 2020 and 2050; “Average portfolios” refers to the total sample. For the specification of the scenarios, see Alogoskoufis, S., Dunz, N., Emambakhsh, T., Hennig, T., Kaijser, M., Kouratzoglou, C., Muñoz, M., Parisi, L. and Salleo, C., “ECB economy-wide climate stress test”, Occasional Paper Series, No 281, ECB, September 2021, and “NGFS Climate Scenarios for central banks and supervisors”, Network for Greening the Financial System, June 2020. AuM: assets under management; ESG: environmental, social and corporate governance; PD: probability of default.

Timely, concerted action would ensure an orderly transition to a greener economy and the resilience of the financial system to climate-related risks. The results of the ECB’s recent top-down climate stress test highlight the benefits of a timely and orderly transition to mitigate climate-related vulnerabilities, in particular for the tail of banks most exposed to climate risks (see Chart 8, panel b). The floods and wildfires in Europe earlier this year illustrate financial impacts of climate-related hazards. This includes not only impacts on bank lending, but also on insurers directly exposed to losses from natural catastrophes. From a systemic perspective, insufficient and potentially diminishing insurability of climate-related risks and associated risk pooling could also significantly amplify future economic losses.

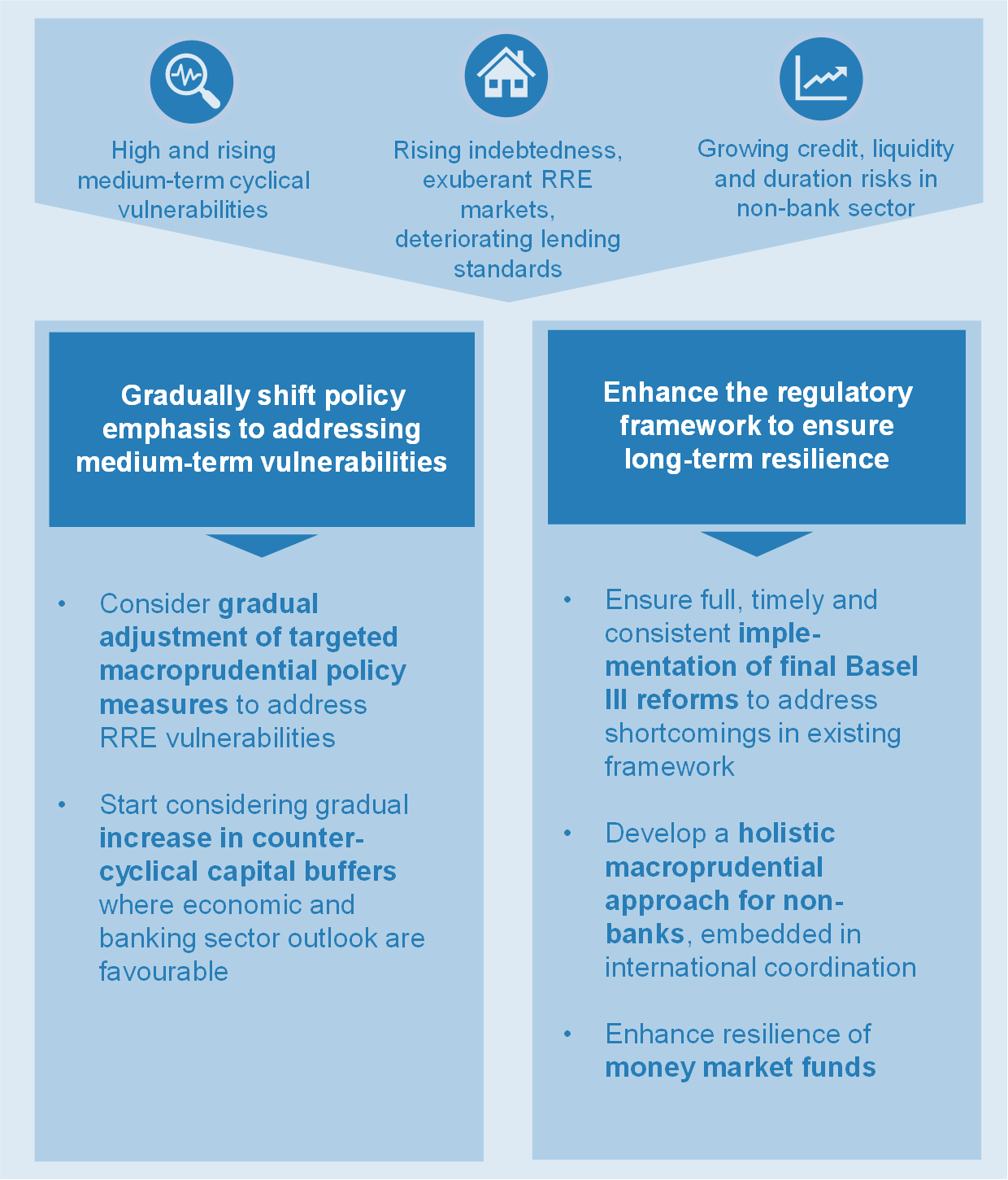

As near-term risks fall, policy moves to address financial stability vulnerabilities further out

Recent months have seen attention shift from near-term financial stability risks associated with the pandemic to increasing medium-term vulnerabilities. Improved economic conditions have contributed to a decline in near-term vulnerabilities for sovereigns, corporates and banks, even if heterogeneity at the country and sector levels remains. Vulnerabilities from mispricing in some financial and tangible asset markets have increased, however, amid continued risk-taking by non-bank financial institutions. Moreover, the pandemic has left a legacy of significantly higher levels of indebtedness across sectors. These vulnerabilities could unravel in a disorderly manner through shocks such as: (i) an abrupt change in market expectations regarding the pace of monetary policy normalisation; (ii) a premature withdrawal of government support to non-financial sectors; or (iii) a re-intensification of the spread of the coronavirus. The potential for these vulnerabilities to materialise simultaneously and to possibly amplify each other further increases the medium-term risks to financial stability.

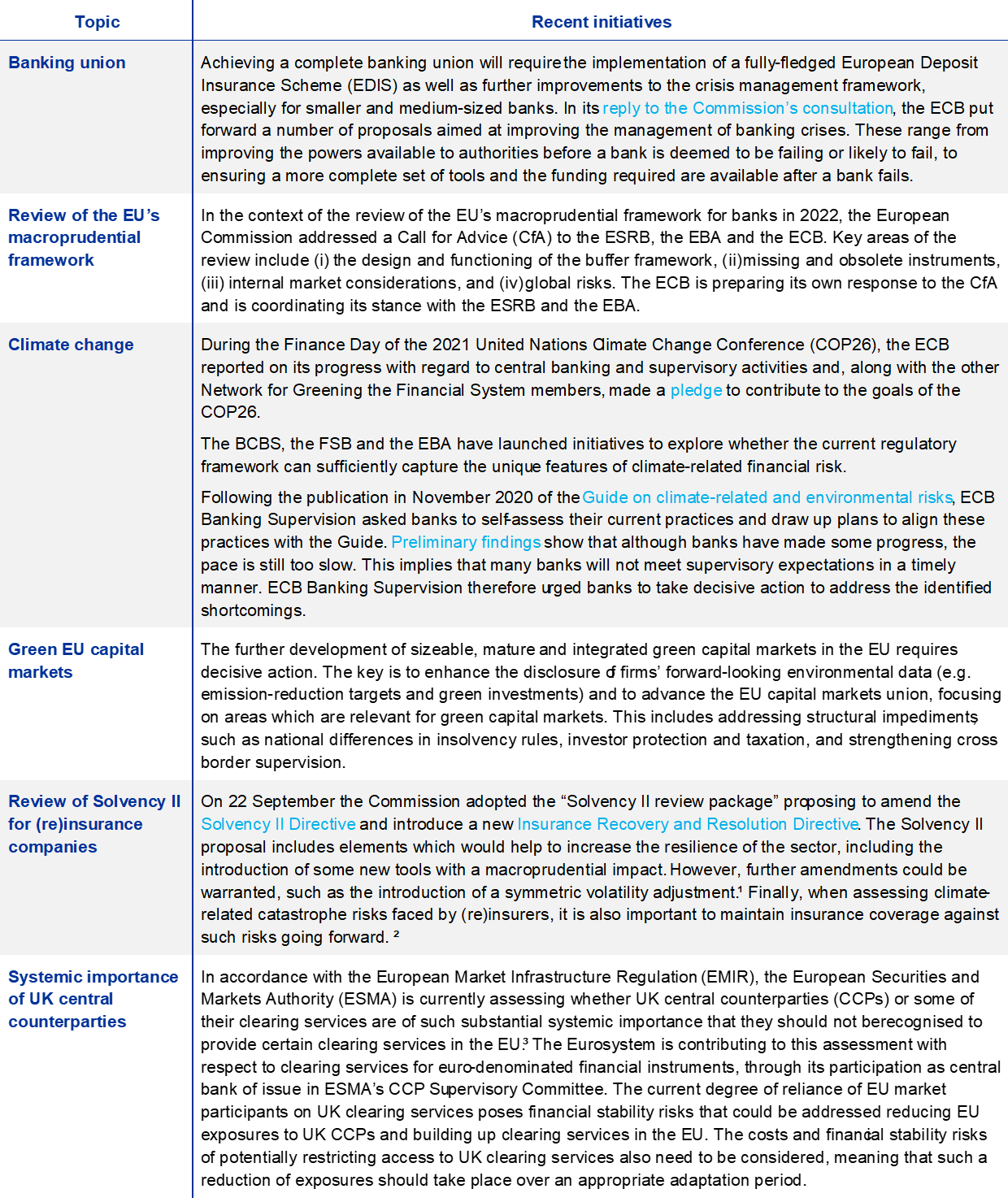

Policies are also shifting from providing short-term support towards addressing financial stability vulnerabilities ahead. Fiscal, supervisory and monetary policies have remained supportive, thereby avoiding strong adverse real-financial feedback loops. However, policies have started to shift from containing the immediate economic fallout from the pandemic and ensuring the near-term recovery to managing medium-term risks to financial stability. While the new ECB monetary policy strategy foresees a flexible approach to considering financial stability going forward (see Box 8), macroprudential policies remain the first line of defence against the build-up of systemic risk. A tightening of macroprudential policies may need to be considered in a number of countries as the economic recovery progresses and medium-term vulnerabilities rise, notably in property markets (see Section 5.1). At the same time, there is a need for structural policies to play a greater role in managing the transition to more resilient economic and financial structures that support sustainable economic growth.

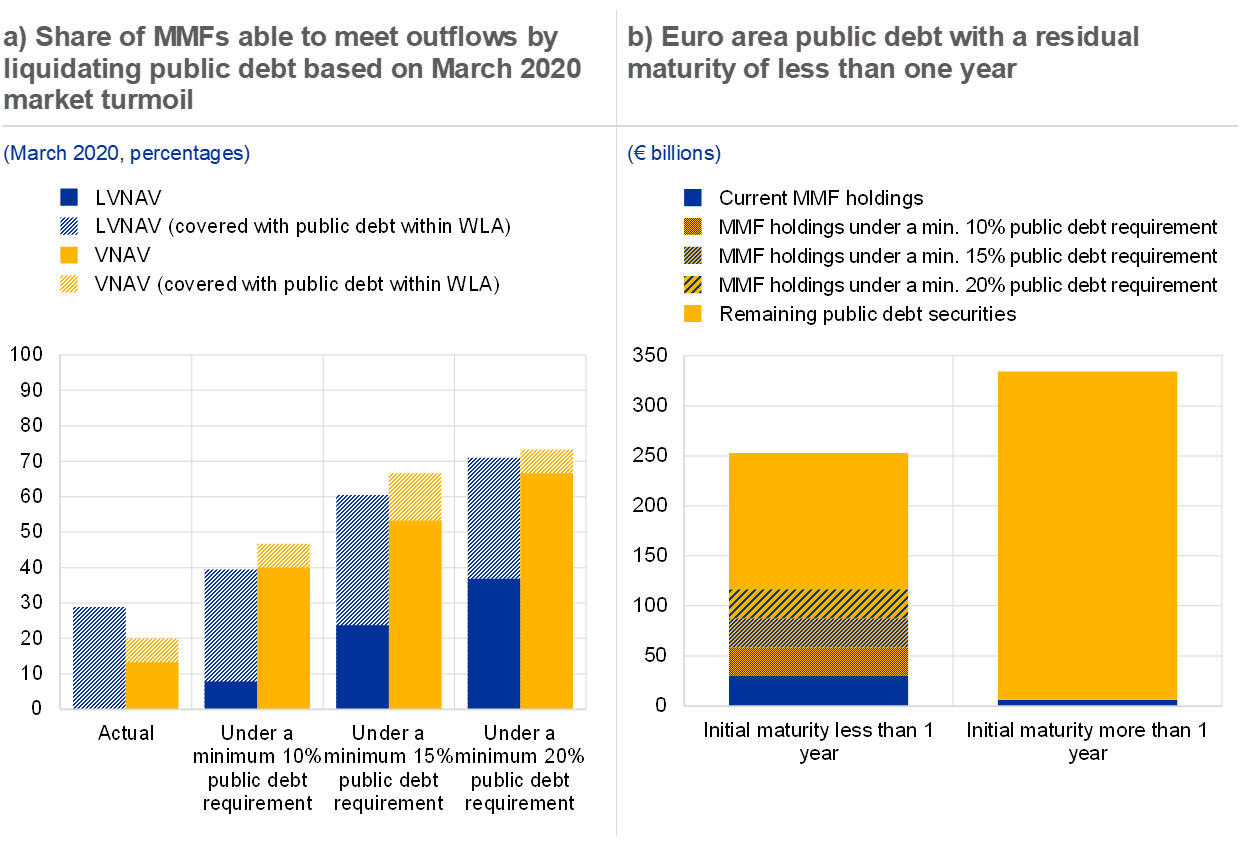

Strengthening the regulatory framework, in both the bank and non-bank financial sector, is crucial for the stability of the financial system. From a broader regulatory perspective, strengthening the banking union and the timely, full and consistent implementation of the final leg of Basel III reforms are essential to address shortcomings in the existing framework. That said, the effectiveness of the framework could be improved, as some banks may be reluctant to use available capital buffers in periods of economic distress (see Special Feature A), while some features of the current structural buffer regime could unintentionally create disincentives for cross-border mergers (see Special Feature B). Finally, from a system-wide perspective, further progress towards developing a macroprudential approach for non-banks is needed given their increasing role in funding the real economy and their close interlinkages with the wider financial system (see Section 5.2). In particular, the Financial Stability Board (FSB) has recently issued policy proposals to tackle vulnerabilities in money market funds, with a key aim being to ensure that they hold sufficient safe and liquid assets. It is now important for the FSB to move towards developing concrete policy proposals in relation to open-ended investment funds and margining practices.

1 Macro-financial and credit environment

1.1 The economy reopens, but inflationary pressures pose downside risks to the recovery

Economic growth surprised to the upside in the first two quarters of 2021, although growth momentum has slowed more recently. Overall, real GDP in the third quarter of 2021 was about 0.5% below its level in the fourth quarter of 2019, as the euro area continued to recover. However, the momentum of the growth has moderated to some extent recently, with the rise in energy prices and supply chain bottlenecks posing downside risks to economic growth going forward. At the same time rising coronavirus (COVID-19) incidence rates had a more limited impact so far on hospitalisations and deaths than in previous waves (see Chart 1.1, panel a). Moreover, mobility data indicate that time spent at home as well as time spent on retail and recreational activities remain near pre-pandemic levels (see Chart 1.1, panel b). Despite the slowdown in the recovery, it is still likely that real GDP will surpass its pre-pandemic levels in the fourth quarter of 2021, two quarters earlier than had been expected at the start of the year.

Chart 1.1

COVID-19 cases on the rise as society and economies have largely reopened

Sources: Our World in Data, Hale et al., Eurostat, Google LLC “Google COVID-19 Community Mobility Reports” and ECB calculations.

Notes: Panel a: hospitalisations exclude Germany and Greece. Panel b: the stringency index used is the Oxford COVID-19 Government Response Tracker from the Blavatnik School of Government, University of Oxford. It is based on 20 indicators, ranging from information on containment and closure policies (e.g. school closures and restrictions on movement) to economic policies (e.g. income support provided to citizens) and health system policies (e.g. COVID-19 testing regimes or emergency investments in healthcare). It reports the strictness of lockdown-style policies that primarily restrict people’s behaviour, on a scale of 0 to 100. See Hale, T. et al., “A global panel database of pandemic policies (Oxford COVID-19 Government Response Tracker)”, Nature Human Behaviour, 2021. Changes relate to the number of visitors to places of retail, and recreation time spent in places of residence relative to a baseline day representing a normal value for that day of the week. The baseline day is the median value for the five‑week period running from 3 January to 6 February 2020. The index is smoothed to the rolling seven-day average.

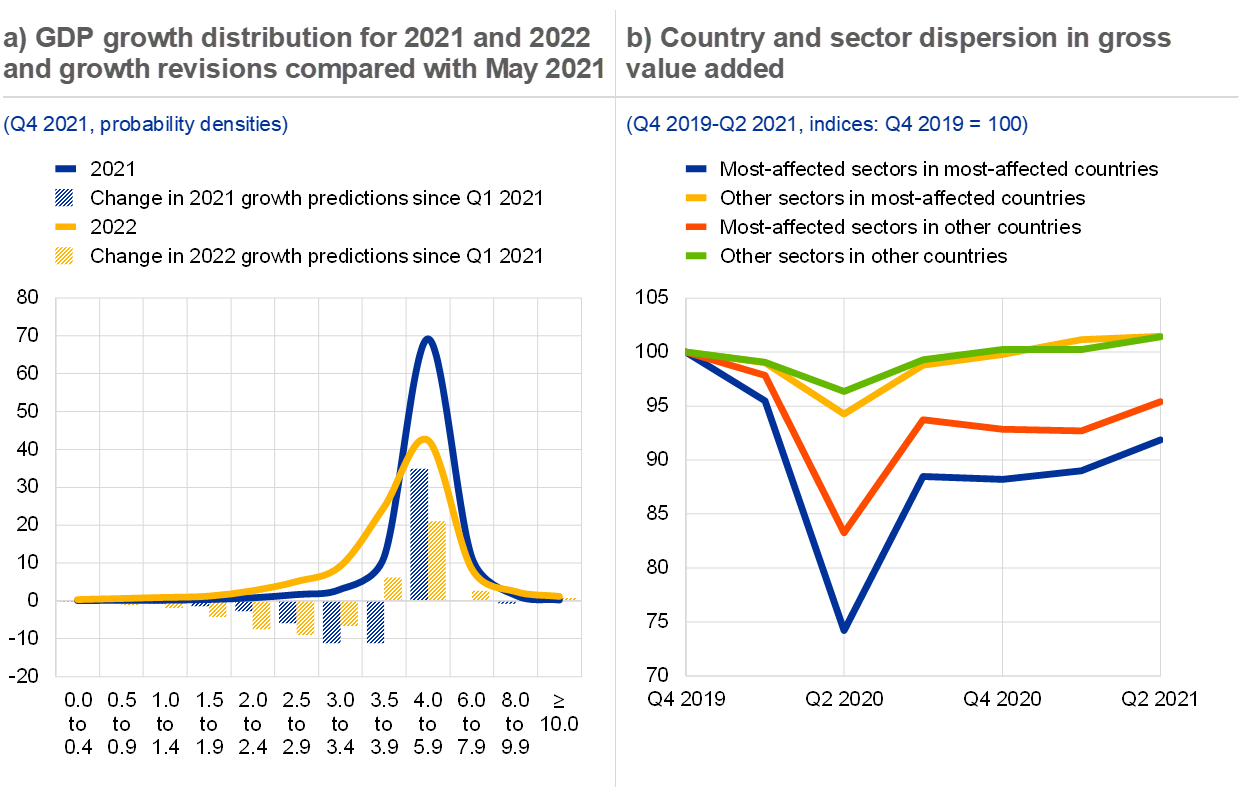

While vaccination progress has helped to balance the risks to the economic recovery in the euro area, some downside risks remain. Higher vaccination levels compared with the spring have reduced the level of downside risks for both this year and next (see Overview and Chart 1.2, panel a). However, current economic expectations are still surrounded by uncertainty stemming from the possible need for new containment measures during the winter months. The virus is continuing to spread, possibly affecting vaccine-induced immunity or creating new mutations, which might translate into new constraints on economic activity. In addition, although economic activity has rebounded, the number of people in employment and total hours worked remain below pre-pandemic levels (see Section 1.3). Moreover, labour shortages, reflecting increasing job reallocation and labour mismatches, could affect the labour market for sectors that are facing a more permanent drop in demand. As such, the pandemic continues to be one of the main risks to economic growth going forward.

Divergence in gross value added between sectors and countries narrowed, in part reflecting lockdown measures becoming more targeted. The reopening of the euro area economy since the spring and increasingly targeted containment measures have reduced divergence in gross value added between sectors and countries (see Chart 1.2, panel b). In addition, although they have softened since the summer, confidence indictors are signalling a recovery in economic activity in both services and manufacturing going forward. However, despite the economic recovery, the unequal impact of the pandemic on these countries continues to be reflected in economic projections. Although the euro area economy as a whole is expected to surpass pre-pandemic growth levels this year, private sector expectations show that for some of the countries hardest hit by the pandemic this is not likely to happen before the second half of next year. Moreover, activity in the most-affected sectors remains significantly below pre-pandemic levels (see Chart 1.2, panel b). These sectors would also be subject to the greatest downside risk in the event of a new lockdown. As such, if the uncertain environment prevails, this could result in lower investment and subdued employment prospects, leading to scarring in those sectors that remain vulnerable to an intensification of the pandemic.

Chart 1.2

Tail risks have fallen, but not all sectors have fully recovered from the pandemic

Sources: ECB, ECB Survey of Professional Forecasters and Eurostat.

Notes: Panel a: x-axis labels reflect the year-on-year GDP growth for the euro area economy. Panel b: most-affected sectors include mining, construction, retail and wholesale trade, transport, accommodation and food services, professional and administrative services, arts and entertainment, and other services. Sensitivity to the pandemic is determined by the relative loss in gross value added in the second quarter of 2020. Most-affected countries include Greece, Spain, France, Italy and Portugal, while other countries include the remaining euro area countries.

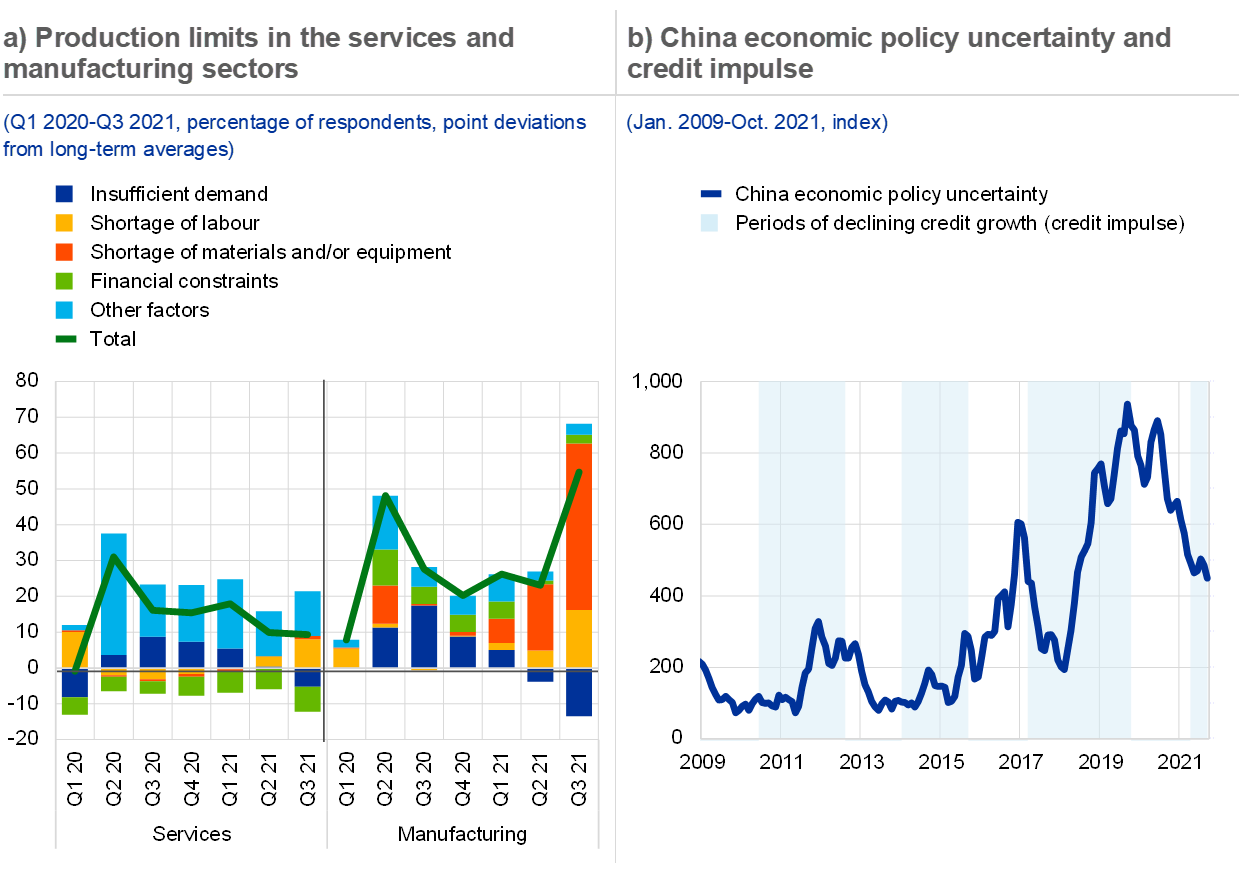

Supply chain disruptions and surging oil, gas and electricity prices have resulted in rising global inflationary pressures, which could be amplified by unequal vaccination levels. In many advanced economies, inflation reported in 2021 so far has been higher than was projected last year. Although this widespread spike in headline inflation rates around the world largely reflects a sharp increase in energy prices, increases in input costs related to supply disruptions have also contributed to upward pressure on inflation. Moreover, enterprises in both the manufacturing and the services sectors report that production is being hampered by a shortage of material (manufacturing) and labour (services, see Chart 1.3, panel a). Going forward, supply chain disruptions could intensify if further virus outbreaks warrant new lockdowns, notably in emerging markets, where vaccination campaigns are less advanced than they are in developed markets. At the same time, if persistent bottlenecks feed through into higher than anticipated wage rises or the economy returns more quickly to full capacity, price pressures could become stronger. A more persistent high inflation scenario could translate into an untimely tightening of financial conditions, weighing on the economic recovery.

Chart 1.3

Supply chain bottlenecks are increasingly constraining output, while China uncertainty represents a downside risk for the global economic outlook

Sources: European Commission, policyuncertainty.com, Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: reflects the answer to the European Commission’s business and consumer survey question “What main factors are currently limiting your production?”; the category “total” excludes the answer “none”. The long-term average covers 2003-19. Panel b: shaded area reflects a month-on-month decline in Bloomberg’s China credit impulse index. The China economic policy uncertainty index is displayed as the three-month moving average.

High uncertainty in relation to China, combined with evidence of weakening economic activity, has added to downside global economic risks. While China recovered swiftly from the contraction induced by the pandemic in the first quarter of 2020, private sector forecasters have revised down their 2021 economic projections for the Chinese economy as credit impulse has declined and economic policy uncertainty remains elevated (see Chart 1.3, panel b). The deceleration in economic activity has been compounded by the authorities’ efforts to limit leverage among Chinese property developers. Tighter regulations are also aimed at reducing reliance on residential real estate sector growth, which is a key growth driver in China’s economy. Following these developments, Evergrande – one of China’s largest and most indebted property developers – prompted wider market concern in the autumn over the health of the Chinese property sector. So far, the impact on global growth projections and financial markets has been limited, as foreign exposure seems relatively small. However, these developments add to the downside risks for global economic growth prospects[3], given China’s increasing role in global economic and trade developments.

1.2 Sovereign risks are contained in the near term, but elevated debt poses a medium-term vulnerability

Although the pandemic continues to weigh on public finances, the need for further stimulus is gradually declining as the recovery solidifies. With the euro area economy recovering faster than anticipated, governments are expected to run smaller deficits in 2021 and 2022 than projected at the beginning of 2021 (see Chart 1.4, panel a). Moreover, support measures have become more targeted on those sectors of the economy that are still affected by restrictions, thereby reducing their fiscal impact compared with the early days of the pandemic. According to the September 2021 ECB staff macroeconomic projections, the contribution of discretionary stimulus related to the pandemic is expected to decline from 4.6% of GDP in 2021 to 1.5% and 1.2% in 2022 and 2023 respectively. Meanwhile, additional fiscal stimulus measures for 2022 have been adopted by most governments in the context of their draft budgetary plans. These include an expansion of some pandemic-related spending, additional measures to alleviate the adverse impact of the increase in energy prices and other fiscal loosening measures in several countries.

Scaling back pandemic-related stimulus implies a tightening of the fiscal stance in 2022. Current projections for the euro area indicate that, as the economy recovers and government support measures unwind, the fiscal stance will tighten in 2022 (see Chart 1.4, panel a). Although the projected economic outlook allows for such tightening, pandemic-related downside risks surrounding economic projections could make it necessary to introduce new stimulus measures (see Section 1.1).

Despite governments running sizeable budget deficits, the increase in debt-to-GDP levels this year is projected to remain limited. While deficits will be at similar levels to 2020, the increase in debt ratios is expected to be far less pronounced this year, mainly reflecting robust economic growth (see Chart 1.4, panel b). Moreover, the gradual scaling back of fiscal support measures will serve to improve public finances and will contribute to a further decline in debt levels going forward. In 2020, approximately 35% of the increase in the euro area debt-to-GDP ratio was driven by the fall in GDP, but as the economy recovers this denominator effect will subside. Despite these favourable developments, however, government debt is expected to remain significantly above pre-pandemic levels, increasing the vulnerability of the economy to a deterioration in financial conditions and negatively affecting its resilience to future economic shocks (see Box 1).

Chart 1.4

Pandemic-related expenses have caused budget deficits to remain large in 2021, but general government indebtedness has stabilised this year

Sources: ECB, September 2021 ECB staff macroeconomic projections and ECB staff calculations.

Notes: Panel a: the dotted line depicts the 3% of GDP budget deficit threshold set in the Maastricht Treaty to delineate excessive government deficits. The data refer to the aggregate general government sector of euro area countries, adjusted for the impact of NGEU grants on the revenue side. The cyclical component refers to the impact of the economic cycle as well as temporary measures taken by governments, such as one-off revenues or one-off capital transfers. NGEU: Next Generation EU.

Governments have continued to benefit from low debt servicing costs and reduced rollover risk by increasingly issuing long maturity debt. Moreover, sovereign stress has fallen to its lowest level since 2001, as monetary support measures have continued to support financing costs (see Chart 1.5, panel a, and Chapter 2). As a result, governments have increasingly made use of easy financial conditions to issue longer-term debt (see Chart 1.5, panel b). The issuance of such debt fits with the ongoing trend of lengthening the maturity of the government debt portfolio, as the average maturity increased from 6.7 years in December 2010 to 7.9 years in September 2021 for the euro area on aggregate. In terms of debt servicing needs over a period of two years, this increased residual maturity translates into a 15% reduction in principal repayments compared with running the same amount of debt against the maturity profile in 2010.[4] However, debt servicing needs remain elevated, with some euro area countries facing refinancing and interest expenditure in excess of 40% of GDP over the next two years.[5] As such, a future deterioration in financial conditions could weigh on public finances in higher indebted euro area countries, hampering the recovery.

Chart 1.5

Euro area sovereign risk dispersion declined to near all-time lows, while governments made use of easy financial conditions to issue long-term debt

Sources: ECB and ECB government finance statistics.

Notes: Panel a: the sovereign CISS is computed for the euro area as a whole. It includes 15 raw, mainly market-based, financial stress measures that are split equally into five categories, namely the financial intermediaries sector, money markets, equity markets, bond markets and foreign exchange markets. For further details, see Holló, D., Kremer, M. and Lo Duca, M., “CISS - A composite indicator of systemic stress in the financial system”, Working Paper Series, No 1426, ECB, March 2012. Panel b: cumulative net issuance refers to the cumulative issuance of government debt securities between January 2020 and January 2021, net of redemptions.

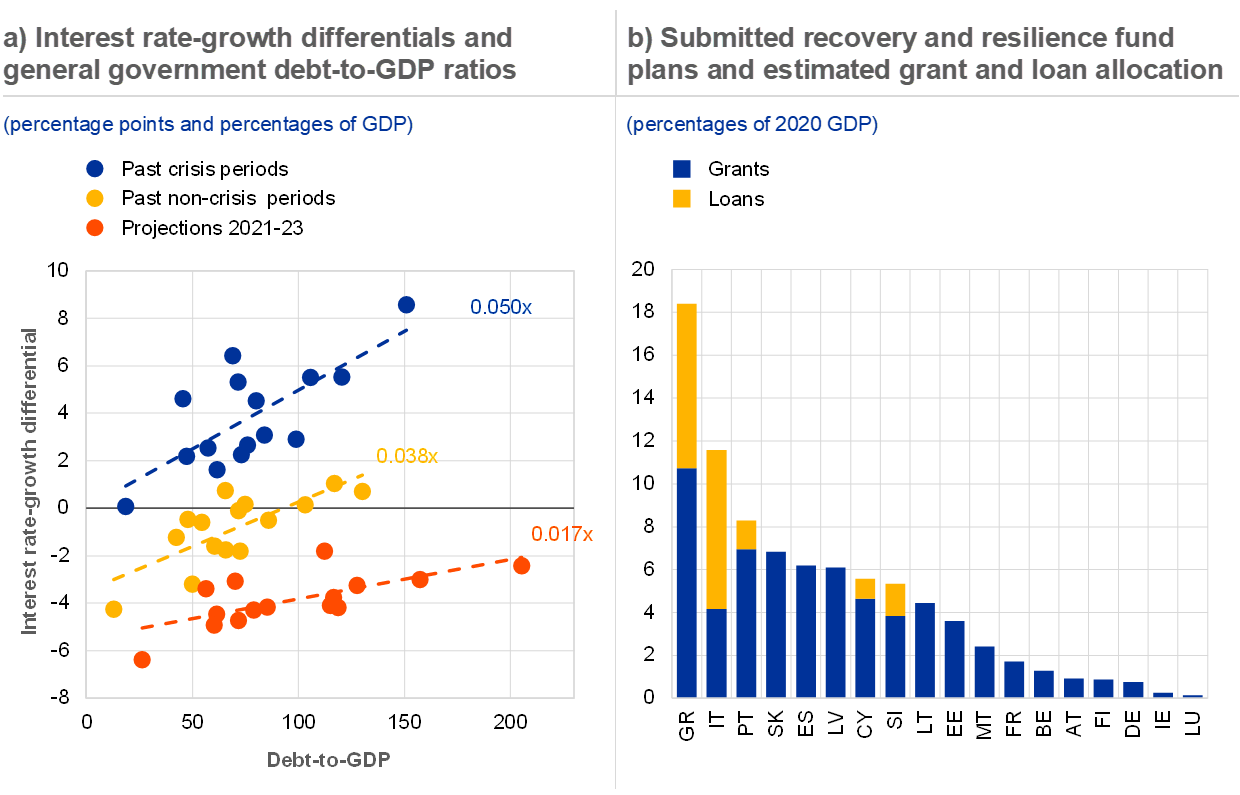

Projected negative interest rate-growth differentials should facilitate a decline in debt levels over time, though their trajectory is surrounded by uncertainty. The economic recovery and the low interest rate environment will result in a negative interest rate-growth differential in the coming years (see Chart 1.6, panel a). As a result, debt levels are expected to decline gradually from their present level.[6] Moreover, current expectations only show marginally higher interest rate-growth differentials for higher debt countries than for lower debt countries. Historically, the relationship between a country’s debt level and its interest rate-growth differential grows stronger in times of elevated stress levels. This illustrates how the higher debt levels resulting from the pandemic could be more detrimental for government finances going forward if left unchecked (see Box 1).

The EU recovery package could improve long-term economic prospects and, therefore, sovereign debt sustainability. Moreover, positive spillovers of investments under the NGEU between euro area countries could further boost economic growth[7] and could help to sustain the recovery without national budgets being directly negatively affected[8]. Currently, most euro area governments have submitted their recovery and resilience plans for the €750 billion NGEU funding envelope: the plans are composed of grants and loans (see Chart 1.6, panel b). Countries have until August 2023 to apply for loans: not all euro area countries have requested a full allocation so far, possibly reflecting the fact that most countries currently enjoy very favourable financing conditions. In the plans submitted to date, the largest share of the funds is allocated to public administration, construction, transport and energy. This may be because governments are looking to finance projects that will promote growth, in line with the digitalisation, green transition and social objectives of the NGEU package, rather than just focusing on the sectors hardest hit by the pandemic. But as only a few countries have set out a timeline for planned spending, uncertainty surrounding actual absorption rates, and hence the effectiveness of the NGEU package, remains high.

Chart 1.6

Favourable financing conditions and the economic recovery are expected to contribute to sovereign debt sustainability

Sources: European Commission, Eurostat and ECB staff calculations.

Notes: Panel a: the interest rate-growth differential (i-g) is computed as the difference between the average nominal interest rate that governments pay on their debt (ratio of government interest payments in year t to the debt stock in t-1) and the nominal GDP growth rate. “Crisis periods” reflects the (i-g) and the debt-to-GDP ratio in 2008-09, 2011-14 and 2020; non-crisis periods are the remaining years between 2002 and 2021. Projections over the period 2021-23 are based on the September 2021 ECB macroeconomic projections. Outliers LT, LV and EE are excluded.

While favourable financing conditions mitigate short-term risks, higher debt leaves euro area sovereigns more vulnerable in the medium term. Although financing conditions have limited the impact of increased sovereign debt levels on budgets and debt servicing costs, the increased debt burden resulting from the pandemic could potentially represent a longer-lasting drag on the economy. Moreover, the sizeable increase in contingent liabilities since the start of the pandemic might weigh on government debt levels should economic growth slow. At the current juncture, the increase in sovereign indebtedness is not expected to reverse for at least another decade, and a return to less favourable financial conditions could imply less benign debt dynamics (see Box 1).

Box 1

Sensitivity of sovereign debt in the euro area to an interest rate-growth differential shock

Euro area sovereigns have issued significant amounts of new debt in response to the pandemic. As a result of this and the sizeable GDP drop, the euro area debt-to-GDP ratio increased to about 100% of GDP in 2020, above the peak of 95% reached in the aftermath of the euro area sovereign debt crisis. While the related fiscal support was crucial to limit economic scarring and aid the recovery, it has also triggered concerns about medium to longer-term debt sustainability. Sustainability risks hinge on a multitude of factors, including fiscal and economic prospects, financial market conditions, the structure of debt and institutional features.[9] A key factor among these is the interest rate-growth differential (𝑖−𝑔), also known as the “snowball effect”. If 𝑖>𝑔 a primary surplus is needed to stop the debt ratio from rising and an ever-larger surplus being needed to reduce it. Conversely, a persistently negative differential (𝑖<𝑔) would imply that debt ratios could be reduced even in the presence of primary budget deficits, as long as such deficits have a lower impact on the debt ratio than (𝑖−𝑔). This implies that projected budget balances play a key role as well: large and persistent primary deficits could prevent debt ratios from stabilising. The differential is surrounded by uncertainty related to the medium-term growth outlook and the long-term path of sovereign interest rates. Against this backdrop, this box assesses the impact of a rising (𝑖−𝑔) differential on sovereign debt ratios in the euro area.

More1.3 Households remain resilient, but pockets of vulnerabilities may emerge

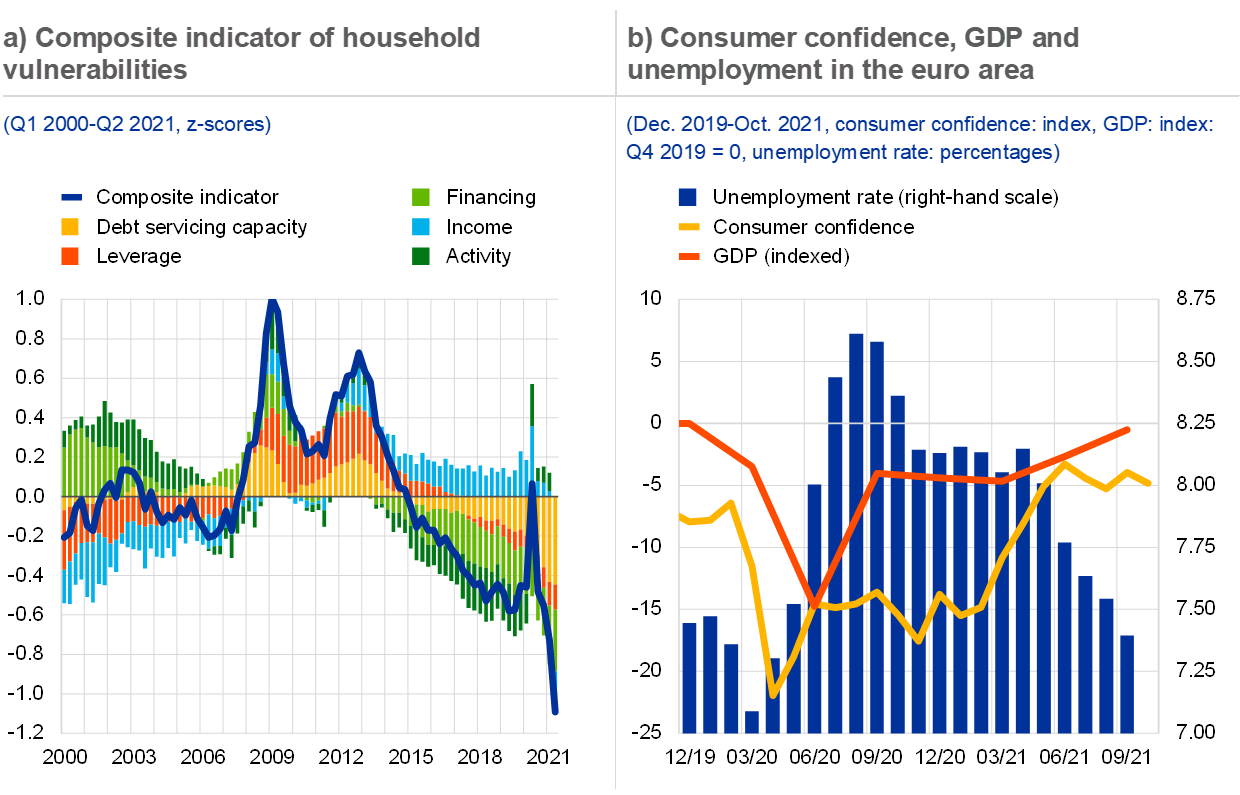

Euro area households’ aggregate balance sheets have remained robust, although some uncertainty persists. The financial situation of euro area households has improved further on aggregate, with indicators of financial health signalling vulnerabilities below long-term averages (see Chart 1.7, panel a). The largest uplift comes from households’ debt servicing capacity being bolstered by lower interest payments and a high savings rate as household income was shielded by government support throughout the pandemic and containment measures limited spending opportunities. In addition, financing conditions and credit provision have remained favourable. Consumers gained confidence as vaccination campaigns accelerated and economies reopened over the summer, which has supported GDP growth (see Chart 1.7, panel b). Households further benefited from a decline in unemployment throughout the second and third quarters of 2021, with the unemployment rate of 7.4% in September back to pre-pandemic levels. With several sectors reporting labour shortages, the general outlook for employment remains positive. That said, global supply chain bottlenecks could weigh on the economic recovery, and jobs created in the hospitality and leisure sectors could be vulnerable to a renewed deterioration in the pandemic situation.

Chart 1.7

Households are benefiting from easy financial conditions, while sentiment is robust and unemployment has fallen

Sources: Eurostat, ECB and ECB calculations.

Notes: Panel a: the composite measure is based on a broad set of indicators along five dimensions: debt servicing capacity (measured by gross interest payments-to-income ratio, savings ratio and expectation of the financial situation); leverage (gross debt to income and gross debt-to-total assets ratios); financing (bank lending rate, short-term debt-to-long-term debt ratio, quick ratio (defined as current financial assets/current liabilities) and credit impulse (defined as the change in new credit issued as a percentage of GDP)); income (income growth and income-to-GDP ratio); and activity (labour participation rate and unemployment expectations). The indicators are standardised by transforming them into z-scores, i.e. they are converted into a common scale with a mean of zero and a standard deviation of one. Composite sub-indicators are computed for each of the five dimensions by taking the simple arithmetic average of the respective underlying z-scores of the individual indicators. Finally, the overall composite indicator is obtained by equally weighting the composite z-scores of the five sub-categories. Positive values indicate higher vulnerability, negative values lower vulnerability. Panel b: the latest observation is the third quarter 2021 for GDP growth and September 2021 for the unemployment rate.

Record savings have enhanced households’ resilience but are unevenly distributed, which may limit any additional boost to consumption. Households continued to accumulate excess savings as containment measures limited spending. Substantial parts of these are held in deposits and cash, but an increasing share is invested in less liquid financial assets like equity and investment fund shares (see Chart 1.8, panel a). Households may hold these savings for precautionary reasons, to pay down debt or in anticipation of possible price or tax rises as survey data suggest that they do not intend to increase their spending on durables beyond pre-pandemic levels, thus limiting hopes that pent-up demand would translate into higher consumption.[10] In addition, higher-income households, which tend to have a lower marginal propensity to consume, account for the highest savings. While the importance of government support schemes is receding overall, they still play a significant role in stabilising income, consumption and debt servicing capacity, especially for lower-income households that will be left vulnerable to cliff effects if support schemes are withdrawn prematurely (see Chart 1.8, panel b). Together with robust house price and stock market valuation gains, households’ net worth surged to 772% of disposable income in the second quarter of 2021 (see Section 1.5).

Chart 1.8

Excess savings are increasingly invested in illiquid assets, while lower-income households still depend on government support

Sources: Eurostat, ECB Consumer Expectations Survey (CES) and ECB calculations.

Notes: Panel a: figures shown are four-quarter trailing sums of transactions expressed as percentages of income. Panel b: expectations of government support are taken from the August 2021 CES wave, the savings rate is inferred from the July 2021 CES wave. Data cover surveys from Belgium, Germany, Spain, France, Italy and the Netherlands. The savings rate is calculated as the difference between monthly income and reported expenses on consumption divided by the monthly income, where income is inferred from income buckets. Accordingly, the data should be interpreted with caution, and mainly as an illustration of differences across different income classes.

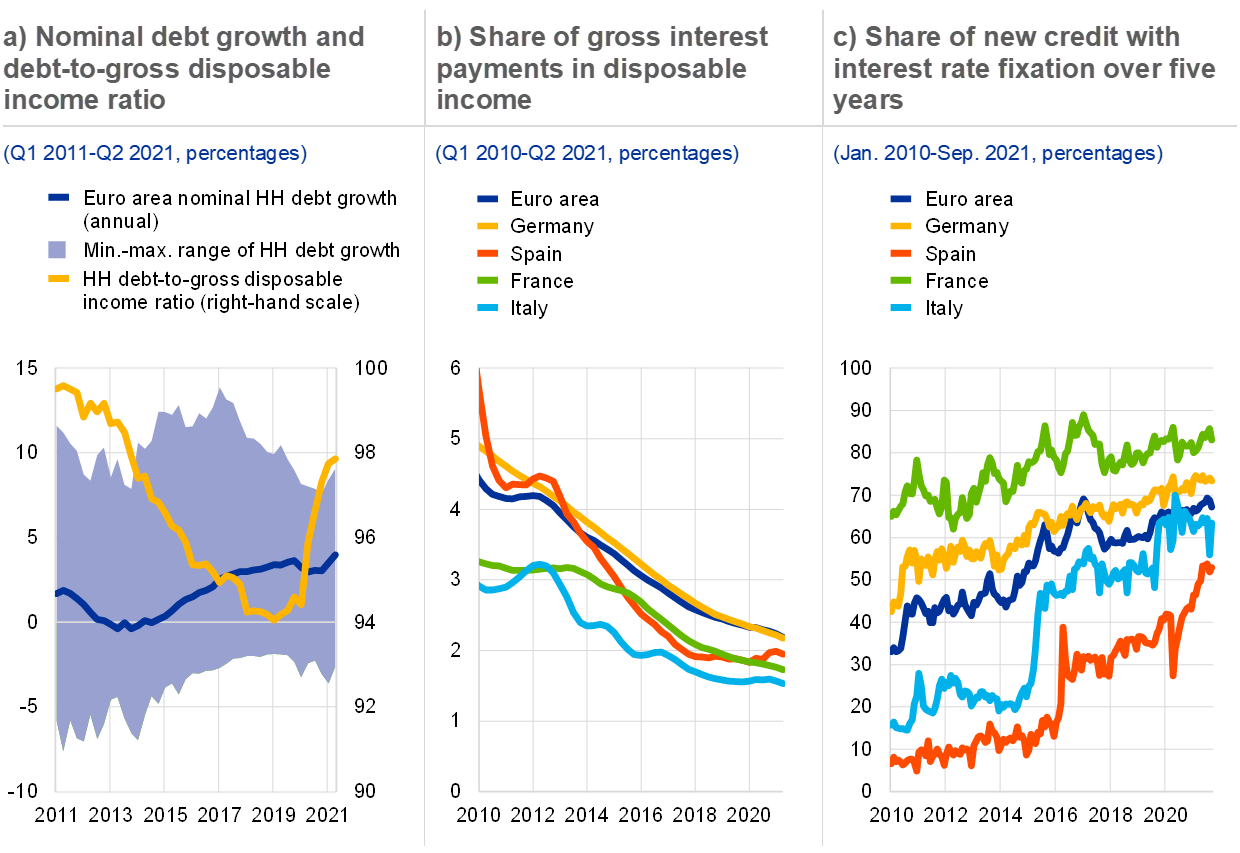

Household debt continues to grow amid record low debt servicing costs. While the situation differs across countries, aggregate household debt grew at the highest rate in a decade – almost 4% in annual terms in the second quarter of 2021 (see Chart 1.9, panel a), mainly on the back of robust mortgage lending (see Section 1.5). Household income, on the other hand, has grown at a slower rate, increasing the debt-to-disposable income ratio to 97.9%. Record low interest rates support households’ debt servicing capacity as only around 2.2% of disposable income needs to be spent on interest payments (see Chart 1.9, panel b). In addition, the increasing share of fixed-rate loans in new credit flows makes the household sector less vulnerable to interest rate shocks going forward (see Chart 1.9, panel c). Nevertheless, should debt continue to grow faster than income, vulnerabilities could build up in the household sector.

Chart 1.9

While household indebtedness is rising, low interest rates and longer periods of interest fixation support households’ debt servicing capacity

Sources: Eurostat, ECB and ECB calculations.

Notes: Panel a: annual euro area nominal HH debt growth is calculated as the four-quarter moving sum of household loan flows divided by the previous quarter’s loan stock. Panel b: interest payments are measured before allocation of financial intermediation services indirectly measured (FISIM). Panel c: share of new credit flows with initial interest rate fixation over five years of new lending to households for house purchase, consumption and other purposes, including renegotiations. HH: household.

Overall, financial stability risks stemming from the household sector remain contained, but some medium-term vulnerabilities are rising. With excess savings, robust net wealth and record low debt servicing costs, households retain their capacity to weather economic headwinds. However, lower-income households are disproportionally reliant on government support and have likely benefited less from higher financial wealth, leaving them in a potentially vulnerable position when policy support is scaled back. In addition, should higher inflation persist and households’ spending on essential goods increase, both their ability to support the broader economic recovery and their debt servicing capacity could be hurt. Concerns over household debt sustainability could rise, especially in those countries where the take-up of policy support is substantial, residential properties are overvalued and debt levels are elevated.

1.4 Corporate outlook improves, reducing near-term risks

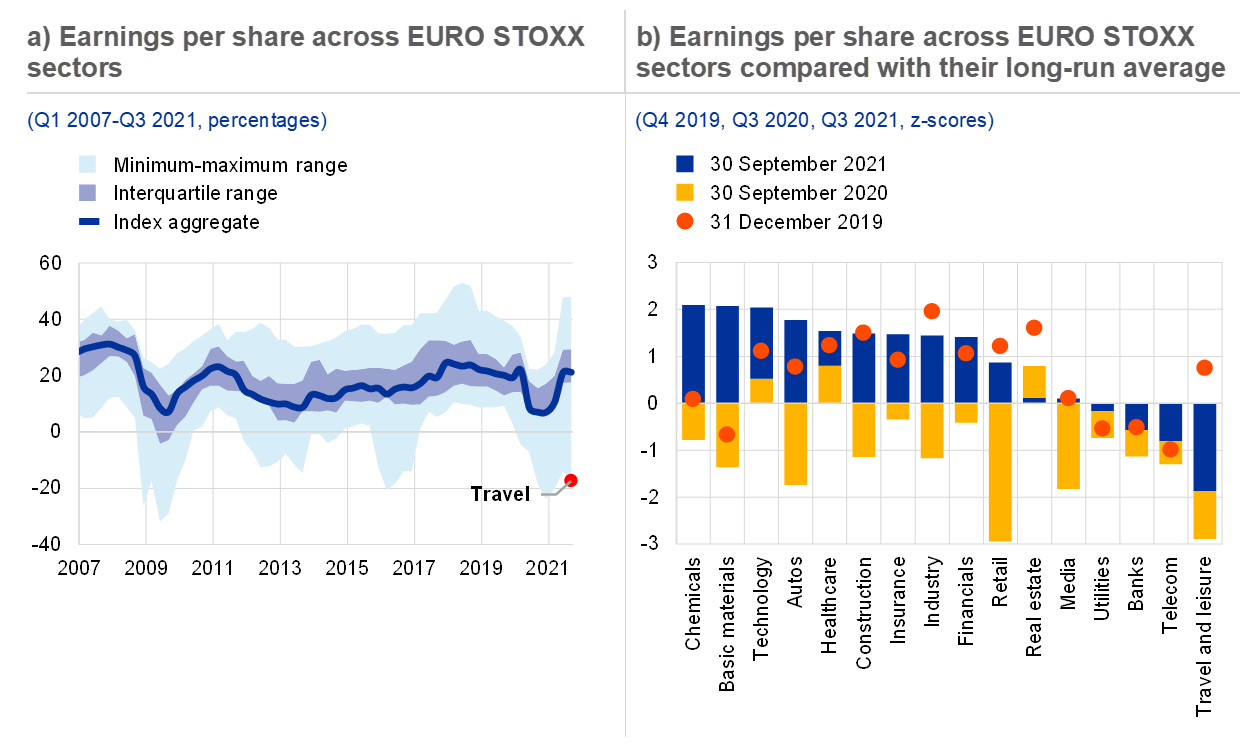

Near-term corporate sector vulnerabilities declined as economic activity picked up. Corporate earnings showed a large, broad-based improvement in the second quarter of 2021, returning to pre-pandemic levels for listed firms, thereby alleviating solvency concerns (see Chart 1.10, panel a). Despite this marked improvement, corporates face challenges stemming from the swift pick-up in economic activity as energy prices soar, supply chain bottlenecks limit production among manufacturers and labour shortages start to weigh on the services sector, potentially slowing its recovery going forward (see Section 1.1). Moreover, profitability has lagged behind in those sectors where activity continues to be supressed by pandemic restrictions and which have experienced only a marginal improvement on their pandemic lows, such as the travel industry (see Chart 1.10, panel b). In addition, corporates will probably need a prolonged period of growth to make up for lost earnings, as backward-looking cumulative earnings are still 6.5% below pre-pandemic levels.

Chart 1.10

Earnings rebounded from pandemic lows for most sectors, but not all

Sources: Bloomberg Finance L.P., ECB and ECB calculations.

Notes: Panel a: sample consists of the EURO STOXX sectors chemicals, basic materials, technology, autos, healthcare, construction, insurance, industry, financials, retail, real estate, media, utilities, banks, telecom, and travel and leisure. Panel b: Bloomberg best earnings estimates. z-score calculated over the reference period Q1 2007-Q3 2021.

Insolvencies remain strikingly subdued, although they have materialised in some of the sectors most affected by the pandemic. On aggregate, the level of insolvencies in the euro area remained 15% below pre-pandemic levels in the second quarter of 2021. However, more granular data show that insolvencies have risen in those sectors hardest hit by the pandemic (e.g. in the accommodation and education sectors). At the same time, the swift economic recovery makes it unlikely that insolvency numbers will rise to match earlier private sector projections (see Chart 1.11, panel a). Policy support measures as well as the suspension of the obligation to file for insolvency have likely prevented the large-scale materialisation of additional bankruptcies. However, assessing corporate viability remains challenging in the light of the post-pandemic prospects for different business models. This is also signalled by the balance of positive and negative rating outlooks for companies with a credit rating, as many firms are still at risk of a credit rating downgrade (see Chart 1.11, panel b). As such, insolvencies and bond defaults could still pick up if less favourable economic outturns were to materialise.

Chart 1.11

Insolvencies remain subdued in most countries, although the outlook remains challenging for many corporations

Sources: Euler Hermes (Allianz Research), ECB calculations and Moody’s Analytics.

Notes: Panel a: insolvency statistics and projections are taken from “Insolvencies: we’ll be back”, Euler Hermes (Allianz Research), 6 October 2021 for September 2021 expectations and “Vaccine Economics”, Euler Hermes (Allianz Research), 18 December 2020 for December 2020 expectations. Panel b: the number of negative outlook and negative watchlist ratings is inverted.

Corporate credit growth increased moderately, reflecting large liquidity buffers and improving economic activity. Demand for bank loans increased in the third quarter of 2021 on account of slightly higher fixed investment, debt refinancing needs and financing needs for inventories and working capital (see Chart 1.12, panel a). However, non-financial firms built up significant liquidity buffers, with gross debt remaining elevated, while net debt declined to below pre-pandemic levels, contributing negatively to the demand for new loans. This largely reflects the position of large listed corporates, whereas SMEs were more heavily affected by the pandemic and are less likely to have access to market-based funding, resulting in lower cash buffers. Finally, large firms also partially replaced borrowing from banks with market-based debt to benefit from favourable market conditions. Going forward, banks expect a small net increase in demand for loans to firms (see Chart 1.12, panel a).

Although demand for liquidity declined, guaranteed loans still account for a non-negligible share of new loan origination in some countries. Guaranteed loans still make up between 5% and 10% of new loan origination in Italy and Spain. Public guarantee schemes play a less material role in other euro area countries. Moreover, the results of the ECB’s bank lending survey indicate that demand for guaranteed lending has started to decline among large and small and medium sized enterprises, reflecting lower demand amid broadly unchanged lending standards (see Chart 1.12, panel b). Unless it is decided to prolong them further, national guarantee programmes are generally expected to wind down at the end of 2021. As they still attract sizeable demand in some countries, there is a risk that their termination could lead to an unwarranted tightening of lending conditions and lower credit volumes, which could weigh on the economic recovery in those countries where the share of guaranteed lending remains significant.

Chart 1.12

Corporate loan demand increased moderately as debt accumulated in some sectors

Sources: Eurostat, ECB, ECB bank lending survey and S&P Capital IQ.

Notes: Panel a: “actual” values are changes that have occurred, while “expected” values are changes anticipated by banks. Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks that responded “increased considerably” and “increased somewhat” and the sum of the percentages of banks that responded “decreased somewhat” and “decreased considerably”. Panel b: the net percentage refers to the difference between the sum of the percentages for “tightened considerably” and “tightened somewhat” and the sum of the percentages for “eased somewhat” and “eased considerably”. Data for H2 2021 reflect six-month forward expectations as indicated by banks in the Q2 2021 round of the bank lending survey. SME: small and medium sized enterprises, LE: large enterprises. Panel c: a fixed sample of 1,057 euro area non-financial corporations with total assets larger than €50 million as at Q3 2019; data available for Q2 2021 are used. Whiskers reflect the 10th and 90th percentile of the distribution across corporations.

Longer-term corporate sector vulnerabilities remain elevated, despite the improvement in economic prospects compared with the spring. On aggregate, corporate debt levels declined to 115% of GDP in the second quarter of 2021 from 119% of GDP in the first quarter of 2021 as the economy recovered.[11] However, pockets of highly indebted companies have so far not succeeded in bringing their debt levels down (see Chart 1.12, panel c). These firms are more likely to encounter permanent scarring and remain vulnerable to a further scaling back of support measures. Moreover, highly indebted firms are also likely to run at lower levels of investment and employment,[12] which could represent a longer-term drag on the euro area economy. Adding further to these vulnerabilities, highly-indebted firms applied for guaranteed loans and moratoria in greater numbers than did companies with a lower level of indebtedness (see Chapter 3). While this mitigated the short-term impact of the pandemic, the sizeable uptake in guaranteed lending in some countries could weigh on sovereign debt sustainability if the economic recovery is weaker than anticipated or if financial conditions deteriorate.

1.5 Vulnerabilities are growing in euro area property markets

Euro area residential real estate (RRE) prices showed robust growth throughout the first half of 2021. Nominal house prices grew at 7.3% at the euro area aggregate level in the second quarter of 2021 – the fastest rate observed since 2005 (see Chart 1.13, panel a). Policy measures have helped to maintain household incomes during the pandemic, while favourable financing conditions have allowed households to obtain financing for house purchase at record low interest rates (see Chart 1.13, panel a). Together with a possible preference for more living space as people worked from home, this fuelled demand for housing during the pandemic. Despite the recovery in residential construction, labour shortages, global supply chain bottlenecks and input price increases are weighing on the construction sector’s ability to expand housing supply, which is putting upward pressure on house prices.[13] Rents have not followed the strong increases in house prices in most countries, which may partly reflect regulations in many rental markets.

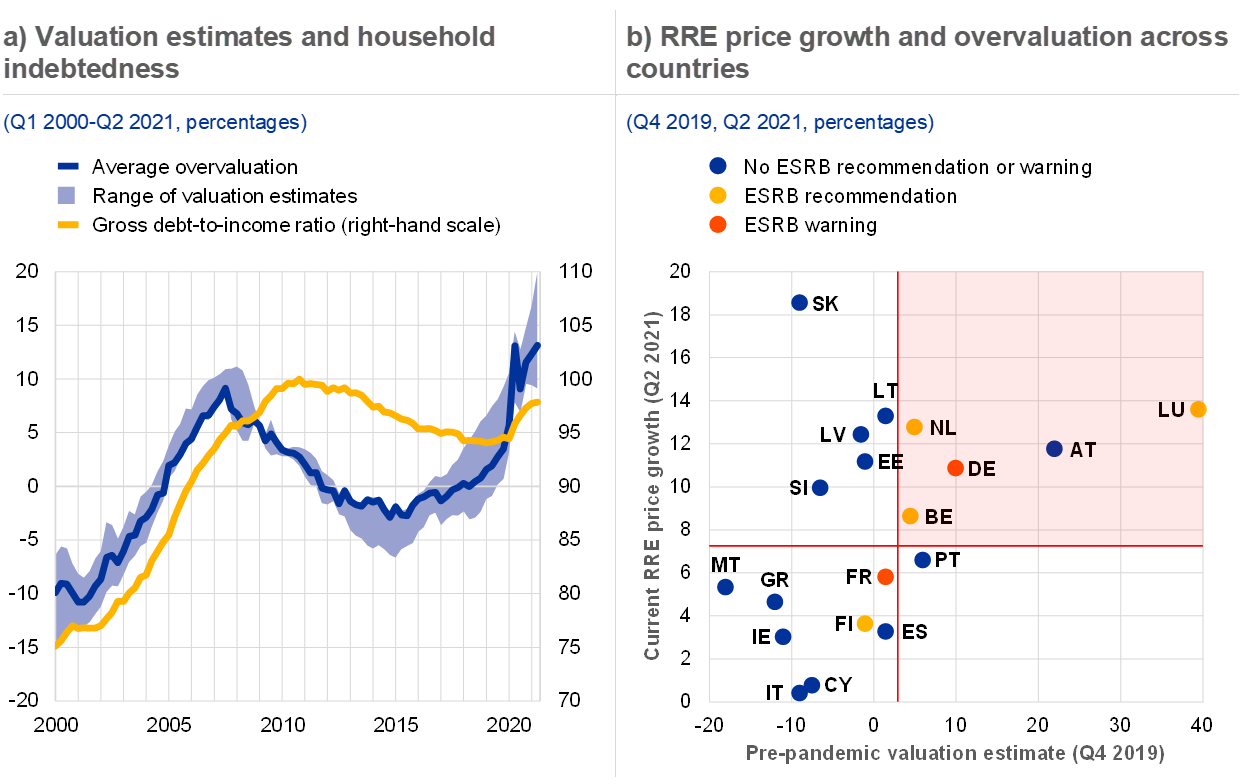

Medium-term vulnerabilities in euro area residential property markets have continued to build up. While short-term risks have declined markedly since the height of the pandemic as financial conditions have eased, risks of price corrections over the medium term have increased substantially (see Chart 1.13, panel b) amid rising estimates of house price overvaluations. As price and lending dynamics are outpacing household income growth, household indebtedness and RRE overvaluation are increasing (see Chart 1.14, panel a), adding to the build-up of medium-term vulnerabilities and concerns over a debt-fuelled housing bubble. In particular, households with variable rate mortgages or shorter fixed-rate periods on their mortgages are exposed to an unexpected rise in interest rates, which could adversely affect their ability to service their debt (see Section 1.3).

Chart 1.13

Euro area residential property prices continue rising, increasing medium-term risks

Sources: ECB and ECB calculations.

Notes: Panel a: the latest observation for RRE price growth is for the second quarter of 2021. The y-axis is truncated to make the main series more readable. Panel b: results from a house price-at-risk model based on a panel quantile regression on a sample of 19 euro area countries over the period from the first quarter of 1999 to the first quarter of 2021. Explanatory variables: lag of real house price growth, overvaluation (average of deviation of house price-to-income ratio from long-term average and econometric model), systemic risk indicator, consumer confidence indicator, financial market conditions indicator capturing stock price growth and volatility, government bond spread, slope of yield curve, euro area non-financial corporate bond spread, and an interaction of overvaluation and a financial conditions index.

House price and lending dynamics have been much stronger in many of the countries with pre-existing vulnerabilities. House prices have generally risen more in countries which had stretched valuations prior to the pandemic (see Chart 1.14, panel b), resulting in further increases in estimated overvaluation. Coupled with higher mortgage lending growth in some countries where households face higher debt levels (see Chart 5, panel b, in the Overview), the risks of a price correction and the build-up of vulnerabilities appear unevenly spread across euro area countries. Particularly notable are developments in countries that had already received a warning or recommendation from the European Systemic Risk Board (ESRB). This has strengthened the case for considering activating further macroprudential policy measures (see Chapter 5). Lending standards like loan-to-income and loan-to-value ratios had eased prior to the pandemic and there is some indication that they have eased further, adding to concerns about household and bank resilience going forward (see Chart 5.1 in Chapter 5).[14]

Chart 1.14

Estimates of house price overvaluation have been rising alongside prices, particularly for some countries

Sources: ECB and ECB calculations.

Notes: Both panels: the average valuation estimate is the simple average of the price-to-income ratio and an estimated Bayesian vector autoregression (BVAR) model. For details of the methodology, see Box 3 in Financial Stability Review, ECB, June 2011, and Box 3 in Financial Stability Review, ECB, November 2015. Overall, estimates from the valuation models are subject to considerable uncertainty and should be interpreted with caution. Alternative valuation measures can point to lower/higher estimates of overvaluation. Panel a: the range of valuation estimates is based on four different valuation methods: the price-to-rent ratio, the price-to-income ratio, an asset pricing approach and an estimated BVAR model. Panel b: red and yellow dots indicate countries that received an ESRB warning or recommendation respectively in September 2019. The red horizontal and vertical lines indicate the euro area aggregate. Given that Q2 2021 RRE price growth is not yet available, Q1 2021 data are shown for Ireland and Finland and Q4 2020 data for Cyprus.

Commercial real estate (CRE) markets started to recover following marked declines during the pandemic, but the outlook for the non-prime segment remains poor. While overall market sentiment has improved in tandem with the wider economy, an elevated share of investors still sees the market in a downturn (see Chart 1.15, panel a). Recent market intelligence suggests that this downturn is particularly pronounced for the lower-quality end of CRE markets. Pandemic-related experience with remote working, health concerns and stronger demand for more environmentally friendly buildings may move demand towards modern, high-quality office spaces over the medium term. The shift towards e-commerce may also have an outsized impact on lower-quality retail space. This division is clearly visible in survey data which show that investors expect rents for non-prime office and retail properties to decrease strongly over the next 12 months (see Chart 1.15, panel b). Should these trends prove to be lasting structural changes, non-prime segments could face risks of pronounced market corrections.

A sustained decline in CRE markets could feed through the wider financial system and negatively affect the real economy. The financial system is exposed to a deterioration in CRE prices via increased credit risk, decreased collateral values and losses on direct holdings. Transaction data show that over the five year period preceding the pandemic, euro area insurance corporations and pension funds, investment funds and non-financial corporations (NFCs) predominantly purchased non-prime retail and office properties (see Chart 1.15, panel c), suggesting that exposures to the most vulnerable CRE asset types could be substantial. In addition, banks in some countries have high exposures to CRE via loan purposes and collateral. A significant drop in CRE prices and the associated reduction of collateral values could hamper NFCs’ access to finance and thus result in lower scope for investment and economic activity. Other market participants, such as investment funds faced with redemption pressure, could behave procyclically and amplify the price decline, thereby exacerbating negative feedback loops.

Chart 1.15

Conditions in CRE markets have improved somewhat, in tandem with the wider real economy, but the outlook for lower-quality buildings remains poor

Sources: RICS, Real Capital Analysis and ECB calculations.

Notes: Panel a: chart shows percentage shares of survey respondents perceiving the current phase of the property cycle to be at a trough, in an upturn, at a peak or in a downturn respectively. Panel c: numbers reported at the top of the chart are aggregated transaction values in billions of euro. ICPFs: insurance corporations and pension funds, IFs: investment funds, NFCs: non-financial corporations, EA: euro area.

Risks to financial stability stemming from real estate markets remain elevated and have increased for the medium-term horizon. A sharper than expected decline, particularly in lower-quality CRE valuations, might set off negative economic feedback loops. In residential property markets, while credit dynamics and household balance sheet vulnerabilities look less concerning than in the run up to the global financial crisis, buoyant expansion of RRE prices and a sense of deteriorating lending standards may warrant monitoring going forward (see Box 2). Against this background, the financial sector may be exposed to the risk of real estate market corrections, especially in those countries where debt levels are elevated, exposures are high and properties are overvalued.

Box 2

Assessing the strength of the recent residential real estate expansion

Credit-fuelled residential real estate booms can pose major risks to financial stability. Residential real estate (RRE) booms and busts have frequently been associated with deep recessions and financial crises, especially when the RRE boom is fuelled by debt.[15] The real estate bubble in the United States ahead of the global financial crisis (GFC) is possibly the most prominent recent example. In a boom, a feedback loop of rising prices and rising credit growth can result in a later correction of overvalued RRE prices affecting the economy and financial system through several channels. A collapse in RRE prices can weigh on household expenditure via wealth effects and/or confidence. High household indebtedness can further contribute to a reduction in consumption and can lead to defaults on loans if debts prove unsustainable. Investment and corporate loans can be impaired if the RRE price boom has been accompanied by a twin construction boom. Finally, the bursting of a real estate bubble can severely affect the credit supply and amplify the downturn as the value of available collateral shrinks and losses impair banks’ intermediation capacity.[16]

More2 Financial markets

2.1 Real yields fall due to risks of higher inflation and slower global recovery

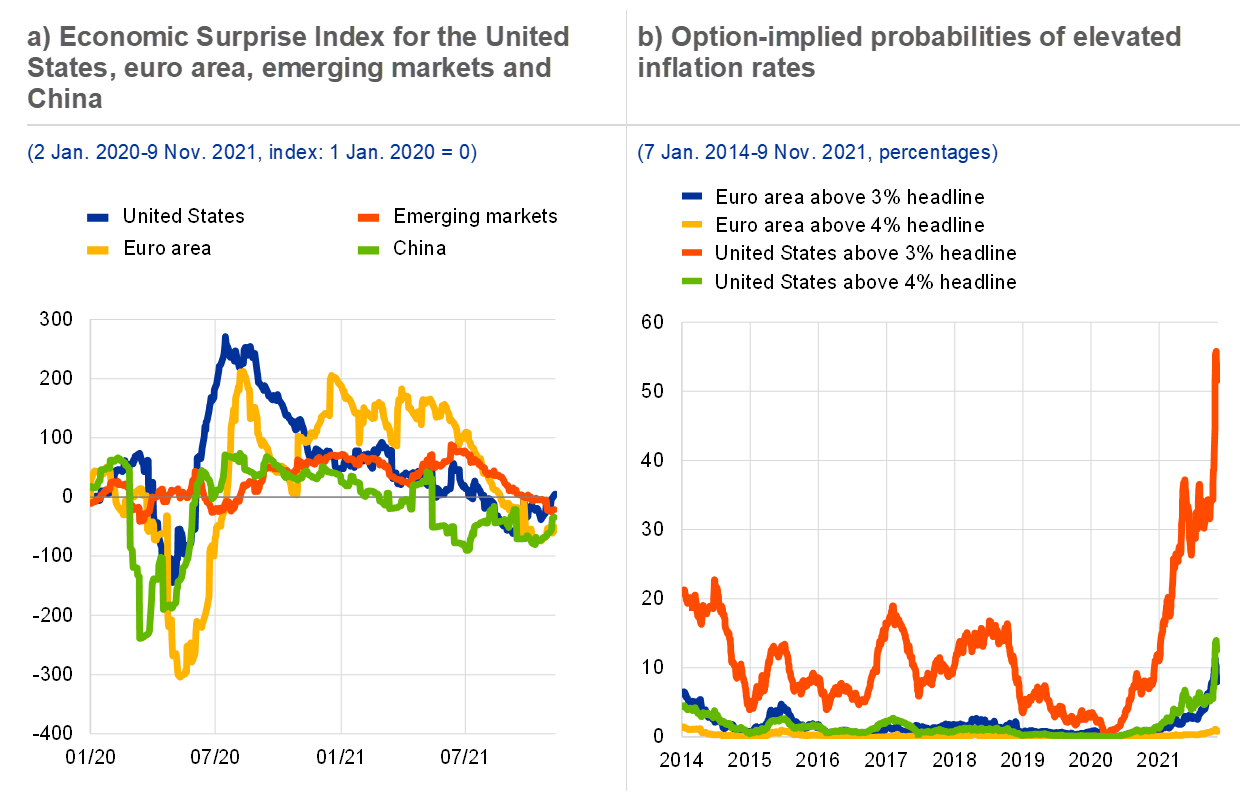

Financial market pricing has adjusted in recent months for a continued but slower global recovery amid increasing supply-side constraints and surging energy prices. During the first half of 2021, markets were dominated by positive risk sentiment following the November 2020 news on the development of COVID-19 vaccines. As the recovery unfolded and economic data surprised on the upside (see Chart 2.1, panel a), markets started to focus on emerging global inflationary pressures and the implications of increasing yields. Over the course of the summer, however, disappointing economic data and concerns about the Delta variant of the coronavirus started to adversely affect market sentiment. The global economic recovery has continued, but momentum has slowed and risks are skewed to the downside.[17] Despite the slowdown in global growth dynamics, inflationary pressures have persisted, driven in part by supply-side constraints and surging energy prices (see Chart 2.3, panel a). Although inflationary pressures in the euro area are expected to decline in the course of next year, recent inflation surprises, notably in the US, have led a growing number of market participants to see risks that higher inflation rates last for a more extended period. The market-implied probability for “high inflation scenarios” remains relatively subdued for the euro area, but has risen sharply for the United States (see Chart 2.1, panel b). At the same time, market prices now imply a very low probability for scenarios of very low inflation (below 1%) or deflation.

Chart 2.1

Economic data start to disappoint as we enter a new phase of the recovery

Sources: Citigroup, ECB Statistical Data Warehouse and Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: negative values of the Citigroup Economic Surprise Index point to disappointing economic data as performance was lower than expected. Panel b: probabilities implied by five-year zero-coupon inflation options, averaged over five business days. Risk-neutral probabilities may differ significantly from true probabilities. “Headline” refers to headline inflation.