Published as part of the ECB Economic Bulletin, Issue 1/2025.

This box summarises the findings of recent contacts between ECB staff and representatives of 82 leading non-financial companies operating in the euro area. The exchanges took place between 6 and 14 January 2025.[1]

Contacts pointed to subdued business momentum at the turn of the year, with flat or declining manufacturing output but more resilient growth in services activity (Chart A and Chart B). Weakness in manufacturing was increasingly viewed as structural, reflecting high energy and labour costs, an inhibitive regulatory environment and increased import competition. Growth in services activity was driven both by consumer spending and by demand for business services focused on efficiency and the transformation of business models.

Chart A

Summary of views on activity, employment, prices and costs

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of what contacts said about quarter-on-quarter developments in activity (sales, production and orders), input costs (material, energy, transport, etc.) and selling prices, and about year-on-year wage developments. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. For the current round, previous quarter and next quarter refer to the fourth quarter of 2024 and the first quarter of 2025 respectively, while for the previous round these refer to the third and fourth quarters of 2024. Discussions with contacts in January and in March/April regarding wage developments normally focus on the outlook for the current year compared with the previous year, while discussions in June/July and September/October focus on the outlook for the next year compared with the current year. The historical average is an average of scores compiled using summaries of past contacts extending back to 2008.

Growth in consumer spending still saw services being prioritised over goods, with a continued focus on prices. In the food retail sector, shoppers were still “trading down”. This benefited discounters, while supermarkets reacted by expanding their private label range at the expense of premium brands. In the non-food retail sector, contacts reported increasing competition from Chinese online retailers. In this context, clothing retailers reported significant disruption in mid-price segments, in contrast with good demand growth for higher luxury brands. The consumer market for household appliances was showing some signs of recovery. Contacts in travel and tourism pointed to ongoing strong growth. This included an extended 2024 summer season, a positive winter season so far and very strong growth in early bookings for the 2025 summer season, albeit partly reflecting an increasing tendency to book early. Demand for leisure travel was still growing robustly in spite of strongly rising prices, but with consumers reportedly saving on extras such as restaurant dining. Contacts in the telecom services industry also reported steady growth in consumer demand.

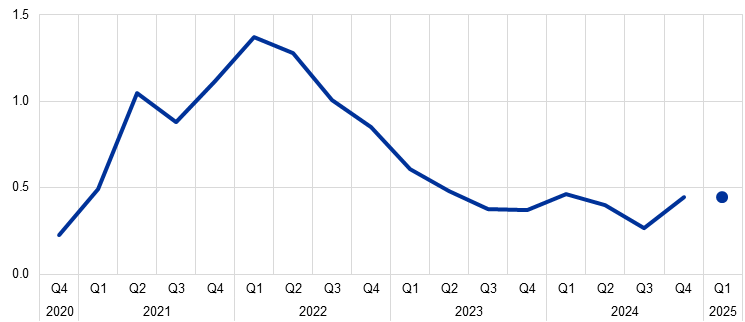

Chart B

Views on developments in and the outlook for activity

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of what contacts said about quarter-on-quarter developments in activity (sales, production and orders). Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. The dot refers to expectations for the next quarter.

Subdued manufacturing activity continued to weigh on investment, but a focus on efficiency stimulated demand for some business services. Most contacts in the manufacturing sector said that activity had disappointed relative to expectations in 2024, which had been for a mild recovery. Instead, demand had remained fairly flat at low levels and the downturn was increasingly viewed as structural. Many cited the surge in energy and labour costs in recent years, which had not been borne to the same extent by competitors in other parts of the world. They also cited a more onerous regulatory regime, coupled now with uncertainty regarding future tariffs. This, together with still relatively high interest rates, created a bad climate for investment in new machinery and equipment, with many firms seeking to reduce capacity in the euro area. There was, however, growth in demand for goods and services that would help firms cut costs, reduce carbon emissions and transform their business or make it more resilient. Consequently, capital goods firms that delivered more efficient or green technologies saw good or recovering demand. Moreover, business service providers reported rapidly growing demand for AI and cyber security, which also stimulated demand for related consultancy services.

By contrast with manufacturing, there were slightly more positive reports from the construction and real estate sector. Construction activity was still held back by a lack of housebuilding, reflecting high costs and long approval processes, as well as a lack of public spending and decision making, especially in Germany and France. However, non-residential construction (particularly data centres, green and telecoms infrastructures) continued to grow, the real estate market showed signs of recovery and residential construction was expected to recover over the course of 2025.

Overall, however, contacts did not expect any substantial change in business momentum in the short term. Economic and political uncertainty was very high following the collapse of governments in Germany and France and the lack of clarity as to the policies that would be pursued by the incoming government in the United States. Therefore, confidence was unlikely to improve significantly in the short term. But many remained hopeful for a stronger recovery later in 2025, when there should be greater clarity regarding economic policies in the euro area and globally.

The employment outlook remained weak, given many firms’ focus on raising efficiency and productivity. Many manufacturing firms were laying off staff, while others had adopted a cautious approach to hiring. Employment placement agencies reported another quarter of declining business in most countries and sectors as well as a low rate of conversion of temporary contracts into permanent ones. Several said that staff turnover was low, as employees were more reluctant to change jobs and potential destination companies did not offer the necessary salary inducements. Despite “structural tightness” in labour markets in some areas, there were fewer reports of labour shortages than there had been for a long time, making recruitment easier in sectors that were growing.

Contacts reported moderate price growth, with a slight pick-up, on average, particularly in the services sector (Chart A and Chart C). Manufacturing prices were reportedly quite stable overall. Prices were said to be increasing modestly in the capital goods sector (as companies sought to pass on rising costs), stable in the consumer goods sector and declining for intermediate goods (reflecting both weak demand and declining prices for many raw materials). In the construction sector, the prices of most building materials were declining, although increasing carbon emission prices and a shift towards less carbon-intensive – but more expensive – cement was putting upward pressure on average cement prices. Services prices were growing more robustly. This largely reflected the higher labour content of many business and consumer services, as well as the continued willingness of customers to accept higher prices, including, most notably, those for tourism-related services. Retailers mostly reported stable or moderate price increases in a context of rising costs but also a competitive environment with price-sensitive customers. Contacts also reported a pick-up in energy and transport services prices. The former mainly reflected higher prices for gas given lower storage levels. The latter partly reflected increased regulatory costs, and partly rising shipping rates due to continued limited supply and strong demand in recent months.[2]

Chart C

Views on developments in and the outlook for prices

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of what contacts said about quarter-on-quarter developments in selling prices. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. The dot refers to expectations for the next quarter.

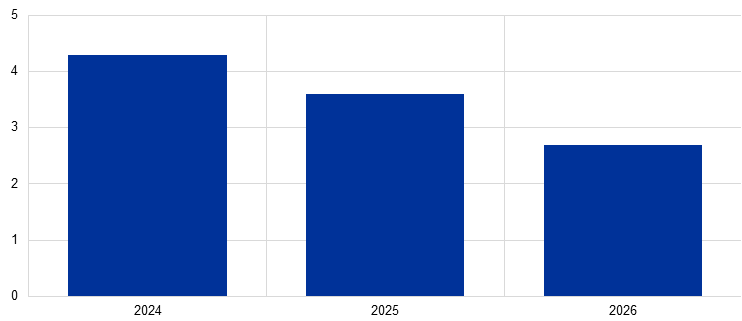

Contacts continued to expect a gradual moderation of wage growth (Chart D). On the basis of a simple average of the quantitative indications provided, they assessed wage growth as slowing, from 4.3% in 2024 to 3.6% in 2025, basically unchanged from the previous survey round. Furthermore, those contacts (albeit a limited number) who gave quantitative indications for 2026 anticipated a further slowdown in wage growth (to 2.7%) on average.

Chart D

Quantitative assessment of wage growth

(percentages)

Source: ECB.

Notes: Averages of contacts’ perceptions of wage growth in their sector in 2024 and their expectations for 2025 and 2026. The averages for 2024, 2025 and 2026 are based on indications provided by 73, 75, and 21 respondents respectively.

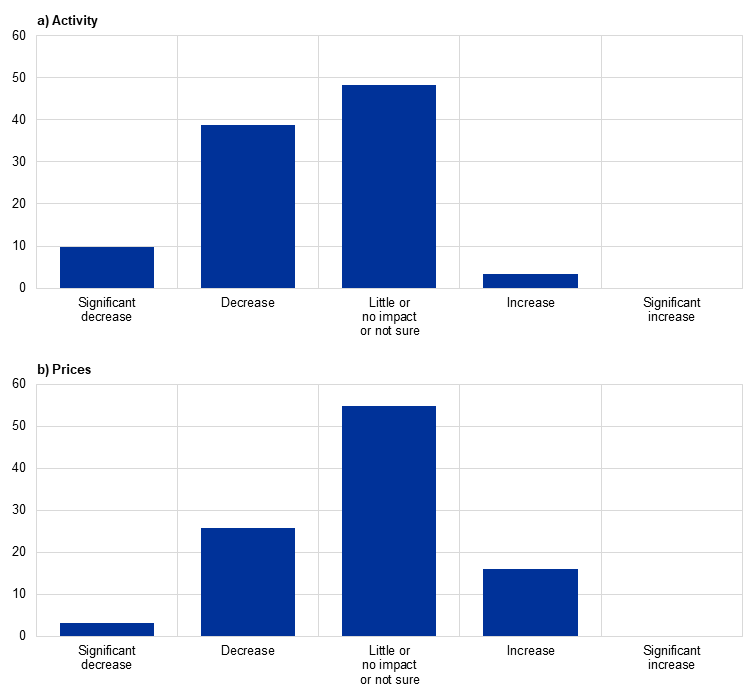

This round we asked contacts what they expected the impact to be for activity and prices in their sector in the euro area if the incoming US administration were to hike tariffs to the full extent suggested. Around half of manufacturing firms said that their activity in the euro area would be negatively affected (Chart E, panel a). Many said, however, that the impact would be mitigated by production models that were already largely “local for local”. Some said it was only the more sophisticated products that they exported from the euro area to the United States. For such products, there was often little or no US competition and the cost of tariffs would be passed through to prices in the United States. The overriding concern of many, as far as their activity in the euro area was concerned, was the potential for trade diversion, especially if the United States were to hike tariffs disproportionately on goods from China. In the absence of protective EU measures, this led more contacts to expect a negative effect on prices in their sector in the euro area than a positive one (Chart E, panel b). In the event of protective measures and retaliation leading to a more generalised tariff war, it was much more likely that costs and prices would rise.

Chart E

Expected impact of a rise in US tariffs on manufacturing firms in the euro area

(percentage of respondents from manufacturing firms)

Source: ECB.

For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.

Shipping supply remained constrained by the rerouting of much shipping away from the Red Sea; meanwhile, some shipping activity was brought forward ahead of an earlier-than-usual Chinese New Year, fears of docker strikes on the US east coast and potential tariffs on imports to the United States.