- STATISTICAL RELEASE

- 3 July 2020

Households and non-financial corporations in the euro area: first quarter of 2020

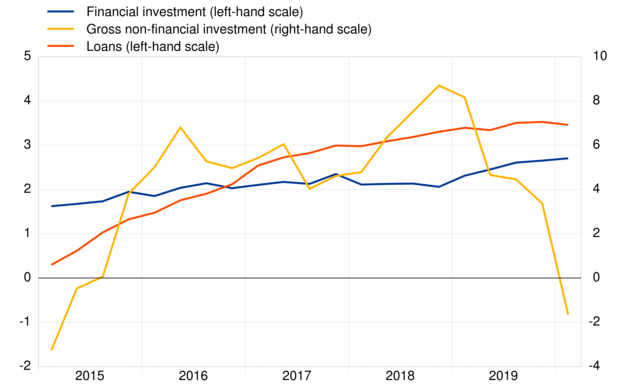

- The annual growth rate of loans to households was unchanged at 3.5% in the first quarter of 2020 compared with the previous quarter. The financial investment of households increased at a higher rate of 2.8% (after 2.6%) and their gross non-financial investment decreased (-1.7% after an increase of 3.4%), while their net worth increased at a lower rate of 2.3% (after 5.4%).

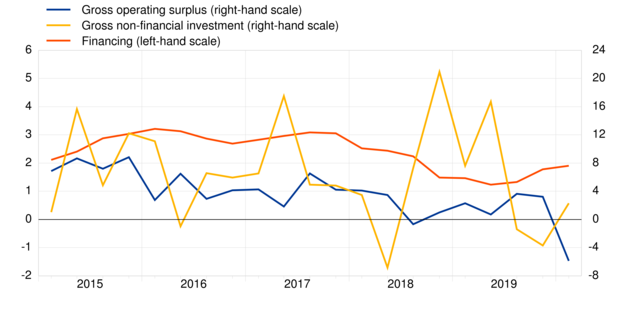

- The annual growth rate of the gross operating surplus of non-financial corporations (NFCs) stood at -5.9% in the first quarter of 2020, following an increase in the previous quarter (3.2%). Gross entrepreneurial income decreased, at a rate of -6.8%, after growing by 3.6%. The annual growth rate of NFCs' gross non-financial investment increased to 2.3% (after -3.7%), while their financing increased at a broadly unchanged rate of 1.9%.

Chart 1. Household financing and financial and non-financial investment

(annual growth rates)

Chart 2. NFC gross-operating surplus, non-financial investment and financing

(annual growth rates)

Households

The annual growth rate of household gross disposable income increased to 2.0% in the first quarter of 2020 (after 1.8% in the previous quarter). Gross operating surplus and mixed income of the self-employed decreased slightly (at a rate of -0.2% after increasing previously by 2.6%). Compensation of employees grew at a lower rate of 1.0% (after 3.0%). The annual rate of growth of household consumption expenditure decreased (-2.5%) compared to the previous quarter (1.9%).

The household gross saving rate in the first quarter of 2020 was 14.1%, compared with 13.1% in the previous quarter.

The annual growth rate of household gross non-financial investment (which refers mainly to housing) decreased to -1.7% in the first quarter of 2020, from 3.4% in the previous quarter. Loans to households, the main component of household financing, increased at an unchanged rate of 3.5%.

The annual growth rate of household financial investment increased to 2.8% in the first quarter of 2020, from 2.6% in the previous quarter. Among its components, currency and deposits grew at an unchanged rate of 5.1%. Investment in life insurance and pension schemes grew at a lower rate of 2.1% (after 2.6%), and shares and other equity grew at a higher rate of 1.7% (after 0.3%). Net sales of debt securities accelerated, reaching an annual rate of -12.3% (after -8.5%).

The annual growth rate of household net worth decreased to 2.3% in the first quarter of 2020, from 5.4% in the previous quarter. The growth in net worth was due to increases in the value of housing wealth (at a rate of 3.7%), which exceeded the increase in liabilities and the net valuation losses on financial assets. The household debt-to-income ratio continued to increase, to 93.7% in the first quarter of 2020 from 93.3% in the first quarter of 2019, as loans to households grew faster than disposable income.

Non-financial corporations

Net value added by NFCs decreased at an annual growth rate of -3.6% in the first quarter of 2020, after increasing in the previous quarter (2.9%). Gross operating surplus decreased in the first quarter of 2020 (at an annual growth rate of -5.9%), after a rise in the previous quarter (3.2%), and net property income (defined in this context as property income receivable minus interest and rent payable) decreased. As a result, gross entrepreneurial income, broadly equivalent to cash flow, decreased (-6.8% after an increase of 3.6%).[1]

The annual growth rate of NFC gross non-financial investment increased to 2.3% (from -3.7%).[2] Financing of NFCs increased at a broadly unchanged rate of 1.9%, while the annual growth rate of loan financing increased to 3.2% (after 1.9%). The annual growth rate of issuance of debt securities by NFCs decreased to 5.1% in the first quarter of 2020, from 6.4% in the previous quarter, and trade credit financing was broadly unchanged. Equity financing grew at a lower rate of 1.1% (after 1.5%).

NFC's debt-to-GDP ratio (consolidated measure) increased to 79.3% in the first quarter of 2020, from 77.6% in the same quarter of the previous year; the non-consolidated, wider debt measure increased to 140.4% from 138.9%.

NFC financial investment grew at an annual rate of 2.1%, compared with 2.3% in the previous quarter. Among its components, loans granted as well as investment in shares and other equity both grew at a lower rate (1.3% after 1.6%, and 1.9% after 2.4%, respectively). Conversely, holdings of currency and deposits grew at a higher rate of 9.2% (after 5.7%).

For queries, please use the Statistical information request form.

Notes

- The annual growth rate of non-financial transactions and of outstanding assets and liabilities (stocks) is calculated as the percentage change between the value for a given quarter and that value recorded four quarters earlier. The annual growth rates used for financial transactions refer to the total value of transactions during the year in relation to the outstanding stock a year before.

- Hyperlinks in the main body of the statistical release are dynamic. The data they lead to may therefore change with subsequent data releases as a result of revisions. Figures shown in annex tables are a snapshot of the data as at the time of the current release.

- The production of quarterly financial accounts (QFA) may have been affected by the COVID-19 crisis. More information on the potential impact on QFA can be found here.

- [1]Gross entrepreneurial income is the sum of gross operating surplus and property income receivable minus interest and rent payable.

- [2]Gross non-financial investment is the sum of gross fixed capital formation, changes of inventories, and the net acquisition of valuables and non-produced assets (e.g. licences).

Bank Ċentrali Ewropew

Direttorat Ġenerali Komunikazzjoni

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, il-Ġermanja

- +49 69 1344 7455

- media@ecb.europa.eu

Ir-riproduzzjoni hija permessa sakemm jissemma s-sors.

Kuntatti għall-midja