Foreword

Since February 2020, the coronavirus (COVID-19) pandemic has disrupted social and economic life across the euro area and the globe, to an extent unseen in most of our lifetimes and unexpected six months ago. It has caused one of the largest and sharpest economic contractions in recent history. As news unfolded of the spread of the virus, global financial markets responded with sell-offs, volatility and a sharp increase in borrowing costs, which rivalled ‒ and at times exceeded ‒ those seen during the 2008 global financial crisis.

Economic and financial policymakers – fiscal, monetary, micro- and macroprudential – have responded with action on an unparalleled scale to dampen the impact on near-term economic activity where they can, minimise longer-term damage and help our economy to recover quickly as the threat from the virus recedes. A central part of this policy response has been to ensure that the financial system – its intermediaries, markets and infrastructures – withstands the shock and provides the credit and financial services that will help households and businesses through these times, supporting the economic recovery.

Against this backdrop, the May 2020 Financial Stability Review assesses how the financial system has operated so far during the pandemic. It considers the financial stability implications of the potential economic after-effects of the pandemic, taking account of the financial vulnerabilities identified before the pandemic, including those related to financial market functioning, debt sustainability, bank profitability and the non-bank financial sector. It also sets out policy considerations for both the near term and the medium term. It does so to promote awareness of systemic risks among policymakers, the financial industry and the public at large, with the ultimate goal of promoting financial stability. By providing a financial system-wide assessment of risks and vulnerabilities, the Review also provides key input to the ECB’s macroprudential policy stance.

The Review has been prepared with the involvement of the ESCB Financial Stability Committee, which assists the decision-making bodies of the ECB in the fulfilment of their tasks.

Luis de Guindos

Vice-President of the European Central Bank

Overview

The coronavirus pandemic prompted extreme financial market sell-offs and stress

The spread of the coronavirus (COVID-19) triggered abrupt shifts in asset prices and led to an increase in financial system stress (see Chart 1, left panel). The reaction of financial markets reflected both the rapid spread of the virus across borders as well as the economic and financial implications of far-reaching social distancing and lockdown measures (see Chart 1, right panel). Financial stress was compounded by a shock to oil prices as global demand collapsed, the inability of major oil producers to agree upon a production cut, as well as turbulence on US futures markets linked to storage capacity. After several years of low volatility with only short-lived spikes, financial market volatility quickly surged to levels last seen at the time of the global financial crisis. At the same time, financial conditions tightened sharply as economic uncertainty increased and market participants priced in the possibility of a sharp slowdown in global growth.

Chart 1

Euro area systemic stress indicators rose sharply as a result of the spread of the coronavirus and the enforcement of public containment measures

Sources: ECB, Hale et al. (2020), Johns Hopkins University and ECB calculations.

Notes: Left panel: “Probability of default of two or more LCBGs” refers to the probability of simultaneous defaults in the sample of 15 large and complex banking groups (LCBGs) over a one-year horizon. Right panel: the chart shows the maximum value of the government response stringency index. The index is based on 17 indicators, ranging from information on containment and closure policies (e.g. school closures, restrictions on movement) to economic (e.g. income support to citizens) and health system policies (e.g. coronavirus testing regime or emergency investments in health care). For further details, see Hale, T., Petherick, A., Phillips, T. and Webster, S., “Variation in government responses to COVID-19”, BSG Working Paper Series, April 2020.

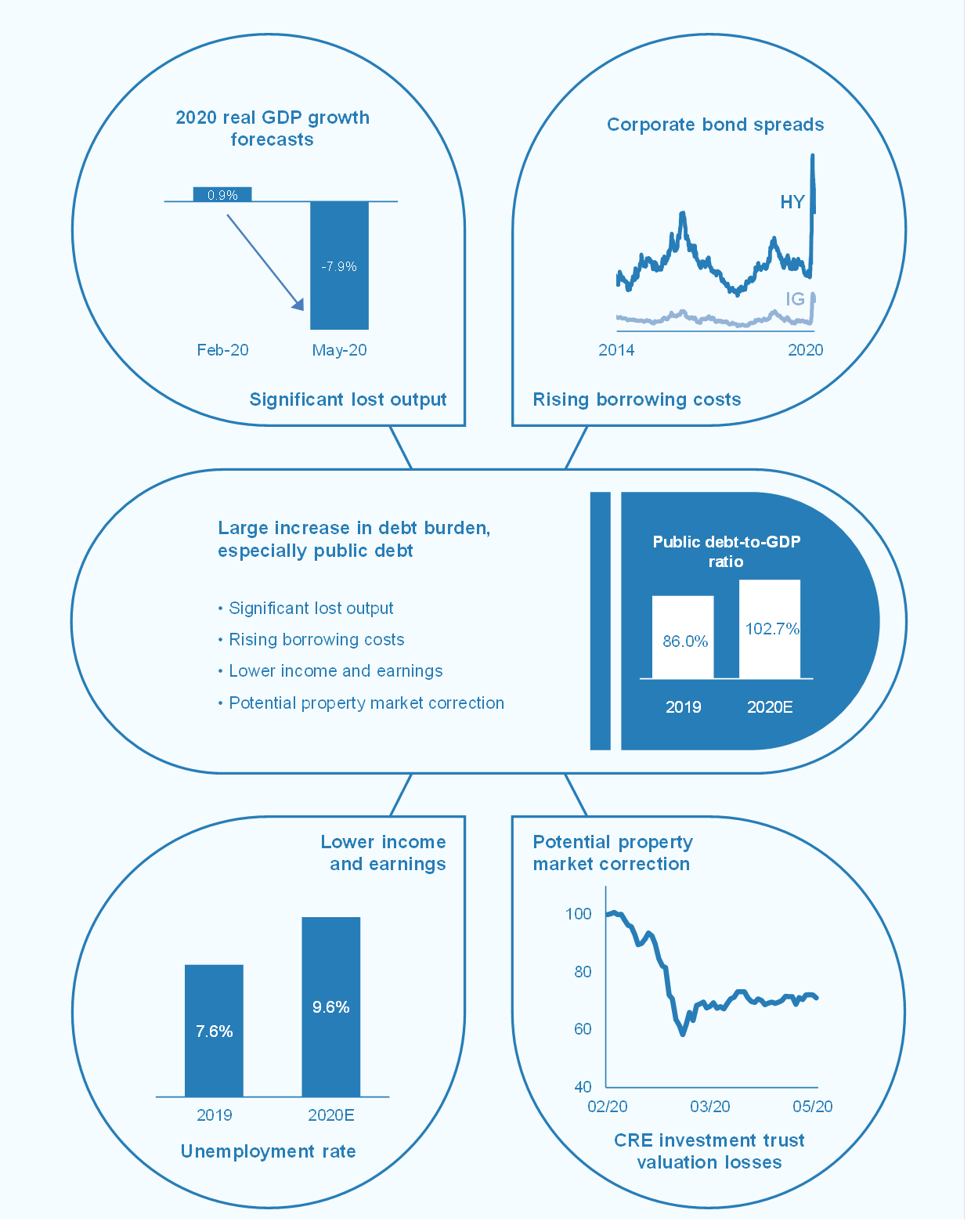

The coronavirus pandemic has affected virtually all aspects of economic activity, at times interacting with pre-existing financial vulnerabilities (see Figure 1). As set out in previous issues of this Review, those vulnerabilities included: overvalued asset prices; low bank profitability; high sovereign indebtedness; and increased liquidity and credit risks in the non-bank sector. While the presence of these vulnerabilities amplified some of the response to the coronavirus shock, the financial system nonetheless proved broadly resilient, partly reflecting the regulatory reforms of the past decade. Nevertheless, looking ahead, further stress cannot be excluded. Some asset prices could be susceptible to corrections, if GDP and earnings growth outturns are worse than markets appear to expect. Further ahead, some already indebted sovereigns and corporates could make it more challenging to sustain the additional large increase in debt, while structurally weak bank profitability could slow the recovery of bank lending capacity.

Figure 1

The coronavirus pandemic affected the real economy and the financial system, with sector-specific vulnerabilities being reinforced by strong interlinkages

Source: ECB.

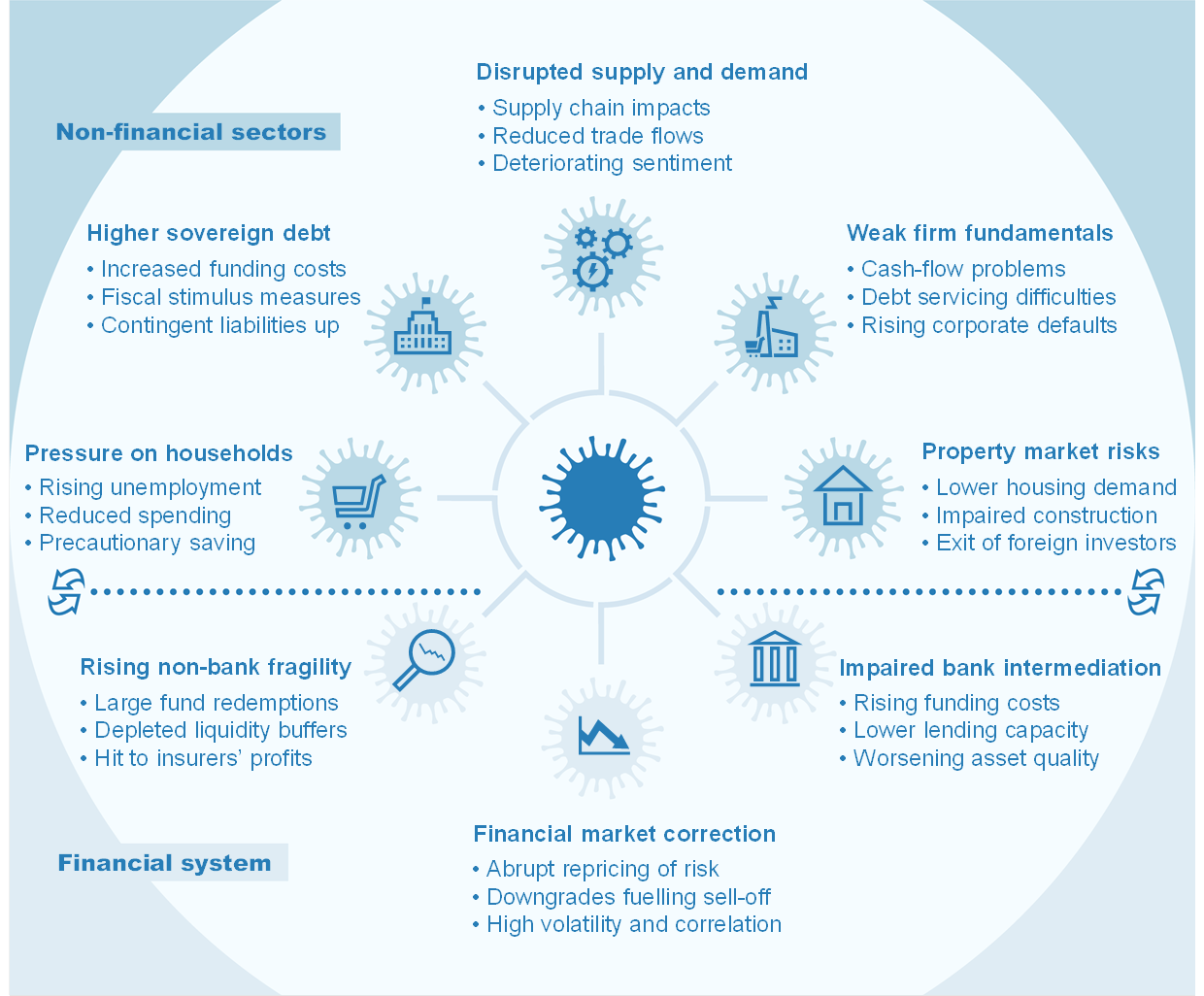

Even if temporary, there will be a significant contraction in euro area economic activity this year. Large parts of the global and euro area economies came to a near standstill in early 2020. Economic indicators suggest an abrupt contraction in economic growth in the first half of 2020 with full-year figures likely to be weaker than in the year following the 2008 global financial crisis, according to private sector estimates (see Chart 2, left panel). Since the extent to which containment measures continue to be required and measures are eased remains unknown, uncertainty surrounding the overall economic impact is likely to persist for some time. The timing and strength of the recovery are uncertain too, with a risk of both “false starts” in exiting from containment measures and persistent economic effects. This new and substantial source of downside risk adds to previously identified geopolitical risks such as rising protectionism and vulnerabilities in emerging markets, notably commodity exporters exposed to lower oil prices.

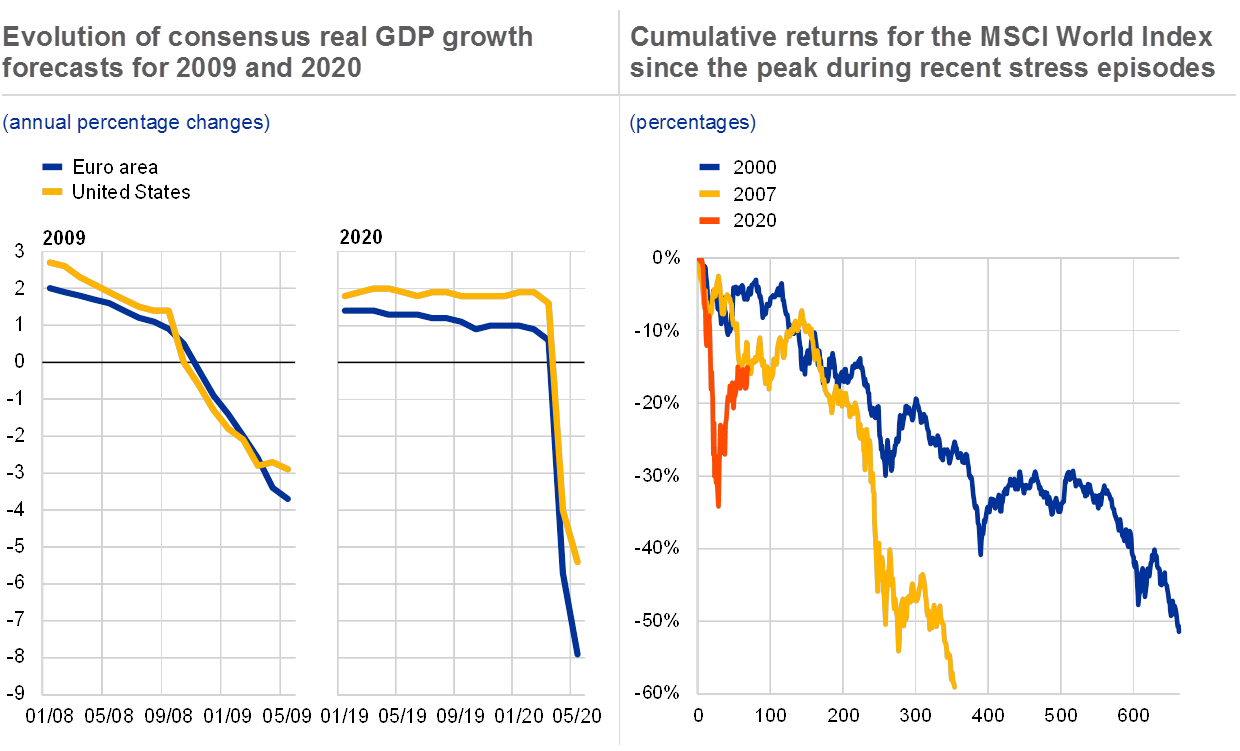

The initial tightening of market conditions was sudden, broad-based and, at times, disorderly. The scale of the early correction in global equity markets (see Chart 2, right panel) may, in part, have reflected high market valuations and compressed risk premia in some regions and asset classes prior to the outbreak of the pandemic. Sectors more affected by the pandemic, such as travel services, automobiles, and energy – which faced additional pressure from the sharp fall in oil prices – saw significant declines. Similarly, lower-rated sovereigns saw sharp rises in the cost of credit protection, while expectations of a rise in corporate defaults also led to a sharp sell-off in high-yield corporate debt markets (see Chart 3, left panel). Since the end of March, there has been a notable recovery in equity prices and key bond spreads, although conditions remain significantly tighter than before the pandemic.

Chart 2

The deterioration of global economic growth prospects triggered a spike in volatility and an abrupt correction in global stock markets

Sources: Consensus Economics, Bloomberg Finance L.P. and ECB calculations.

Note: Right panel: the horizontal axis denotes the number of working days from peak to trough of the index during recent stress episodes.

Market liquidity came under pressure, with investment funds experiencing outflows and amplifying market dynamics. Liquidity fell sharply not only for riskier assets, but briefly also in high-quality markets, such as the US Treasury and money markets, as both financial and non-financial sectors demanded cash. As the market sell-off intensified, investment funds experienced outflows resembling those seen during the global financial crisis. The extent of outflows from funds investing in less liquid asset classes, such as high-yield bonds, likely amplified market dynamics as funds were forced to sell assets to raise cash at short notice. Having benefited from flight to liquidity in the early phase of the turmoil, even money market funds and funds investing in sovereign bonds saw large outflows in mid-March as demand for cash rose (see Chart 3, right panel). Flows into and out of euro area funds stabilised, as central bank stimulus began to support markets.

Liquidity stress among investment funds may reappear, given their low level of liquid assets prior to the turmoil and the currently low levels of market liquidity. During the recent stress, overall market liquidity improved following central bank policy interventions. But further declines in the market value of assets or a sharp increase in market volatility could prompt renewed outflows from funds, which remain exposed due to the search for yield and liquidity risk-taking over recent years. As a result, large outflows may prompt funds to sell assets or suspend redemptions.

Chart 3

In addition to stress in riskier bond market segments, liquidity pressures triggered large-scale investment fund outflows from safer assets as well

Sources: Bloomberg Finance L.P., Dealogic, EPFR Global and ECB calculations.

Note: Right panel: flows are measured relative to daily initial assets under management and chained together in a similar way to how cumulative fund returns are calculated.

Markets eventually calmed and liquidity pressures eased, following forceful responses by monetary authorities across the globe. These measures range from standard monetary policy action to non-standard measures, including asset purchases, lending facilities, liquidity support and currency swap lines. In March and April, the ECB’s Governing Council announced a set of monetary policy measures to ensure an appropriate monetary stance and underpin the transmission of monetary policy to the real economy. These included targeted longer-term refinancing operations at very favourable terms to support bank lending, the launch of a temporary pandemic emergency purchase programme (PEPP) with an envelope of €750 billion, a new series of non-targeted pandemic emergency longer-term refinancing operations (PELTROs) to support liquidity conditions in the euro area financial system and an easing of the collateral framework.

The main euro area central clearing counterparties (CCPs) were able to avoid operational disruption during the turmoil. Despite high volatility in financial markets prompting large variation margin calls in both cleared and non-cleared derivatives markets (see Special Feature B), calls were in general met by market participants. Initial margins increased for some euro area CCPs, although anti-procyclicality measures in the European Market Infrastructure Regulation, such as margin buffers or floors, were able to slow down the increase. The robustness of central clearing, a key area of financial sector reform after 2008, also helped avoid wider dysfunction in derivatives markets. However, the reformed financial system (including central clearing) has not yet been tested for a widespread deterioration in creditworthiness.

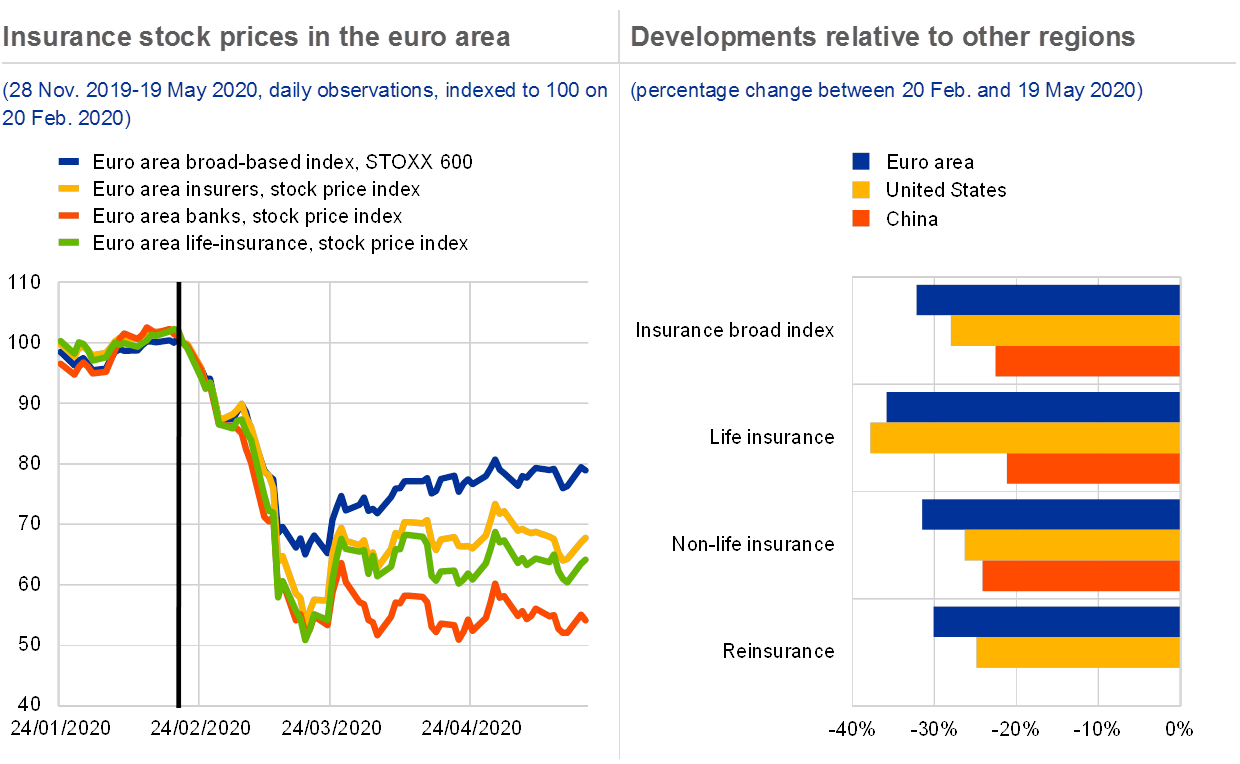

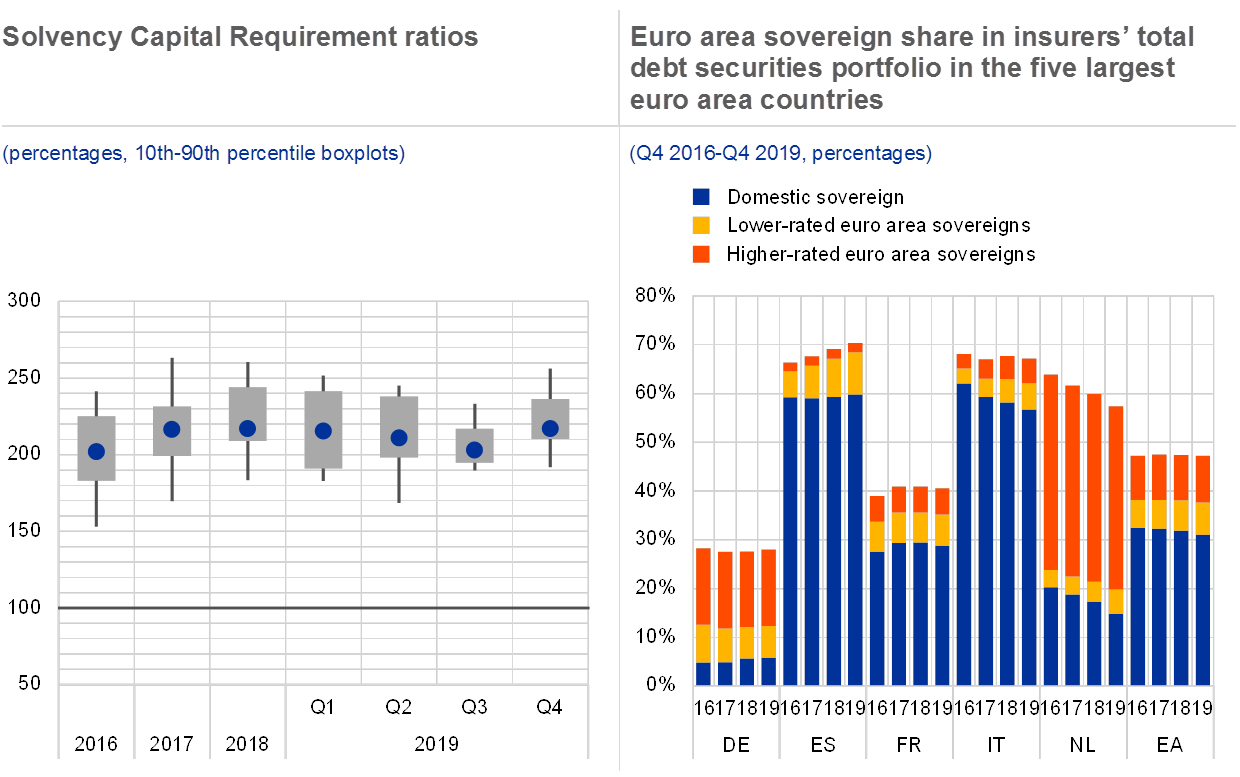

Euro area insurers and pension funds face pressures from both the fall in asset prices and the prevailing low interest rate environment. Increases in risk premia and equity price declines during the turmoil are expected to have a significant adverse impact on solvency ratios. These effects could be exacerbated if risk-free rates remain lower for longer. Some insurers could also face weakened cash inflows as a result of stalled new business during lockdowns, and possible disruptions to premium payments and investment income. Cash outflows may also rise as a result of higher claims in some business lines, policyholders’ withdrawals from unit-linked products and larger derivative margin calls in a higher volatility environment. That said, in general, the impact on claims is expected to be less significant, as epidemics are usually excluded from (non-life) insurance cover.

Corporates and households face lower income and rising debt burdens

Corporate fundamentals are set to weaken in line with deteriorating economic conditions. Non-financial firms, many already highly indebted and facing profitability challenges prior to the pandemic, now face cash-flow strains and higher financing costs. This weakens corporate debt sustainability over the medium term. For some firms, the sudden collapse in cash flows could translate quickly into liquidity risks and lead to sharply increasing default rates, especially in the high-yield segment. The increased drawing on credit lines indicates that temporary shutdowns are putting pressure on euro area firms’ liquidity (see Chart 4, left panel). To overcome liquidity pressures affecting viable companies, governments stepped in with loan guarantee schemes and direct transfers.

In particular, riskier firms, which have levered up in recent years amid low funding costs, are likely to face downgrade risk (see Chart 4, right panel). This could imply higher funding costs and possible rollover risks going forward, primarily for the very large lower-rated investment-grade segment. Downgrades of BBB-rated issuers, in particular, could have non-linear effects on bond prices, as the markets for high-yield and (lower) investment-grade bonds are highly segregated (see Section 2.2). Given the higher use of leverage, developments in leveraged loan and private equity markets also warrant close monitoring (see Box 1).

Chart 4

Corporate liquidity pressures are increasingly evident, while higher downgrade risk may challenge non-financial firms

Sources: ECB (April 2020 bank lending survey), Fitch Ratings, Moody’s, Standard & Poor’s and ECB calculations.

The pandemic and subsequent containment measures are affecting euro area households, primarily through higher unemployment and weaker income. At the same time, private consumption has declined as consumer confidence has fallen and households have deferred non-essential purchases. Higher unemployment and income risks are compounded by the already high level of household indebtedness in several euro area economies. Households in countries with high pre-pandemic unemployment rates, a limited capacity to resort to existing savings and impaired debt servicing capabilities (as indicated by relatively high household non-performing loan (NPL) ratios) might be particularly affected by the repercussions of the recent shock (see Chart 5, left panel). But policy action, including loan moratoria and income support measures in a number of countries, could mitigate the related risks.

The risk of corrections in euro area residential and commercial real estate markets has increased in the wake of the pandemic. Risks in residential real estate markets continued to build in 2019, amid more visible signs of house price overvaluation for the euro area as a whole. Survey evidence also indicates an easing of lending standards for households since 2017 (see Special Feature A). As housing demand is set to slow along with the drop in economic activity and employment, the risk of house price corrections has increased (see Chart 5, right panel). Models assessing downward risks to house prices indicate that on average there is a 5% probability that house prices will decline by 15% or more over the next four quarters. A correction of stretched valuations in commercial real estate markets is also increasingly probable, given pressures on corporates and weaker investor sentiment. The prominent role of foreign investors and open-ended real estate investment funds might make commercial real estate markets more exposed to a disorderly adjustment.

Chart 5

Households challenged in countries with high pre-pandemic unemployment and low liquidity buffers amid growing risks of real estate market corrections

Sources: ECB, Johns Hopkins University and ECB calculations.

Notes: Left panel: liquid assets are calculated as the sum of households’ currency and deposits, short-term debt securities and money market fund holdings over total financial assets. The red vertical and horizontal lines represent the euro area averages. The colours of the bubbles reflect the number of confirmed coronavirus cases in the country as a share of total population. Red: upper tercile; orange: middle tercile; and yellow: lower tercile. Right panel: results from house price-at-risk model based on a panel quantile regression on a sample of 19 euro area countries over the period from the first quarter of 1999 to the first quarter of 2020. Explanatory variables: lag of house price growth, overvaluation (average of deviation of house price-to-income ratio from long-term average and econometric model), systemic risk indicator, consumer confidence indicator, financial market conditions indicator capturing stock price growth and volatility, government bond spread, slope of yield curve, euro area non-financial corporate bond spread, and an interaction of overvaluation and a financial conditions index. Euro area aggregate computed using nominal GDP as weights. The vertical dashed lines indicate the fifth quantile of the respective probability densities.

Fiscal measures provide essential support, but add to public debt burdens

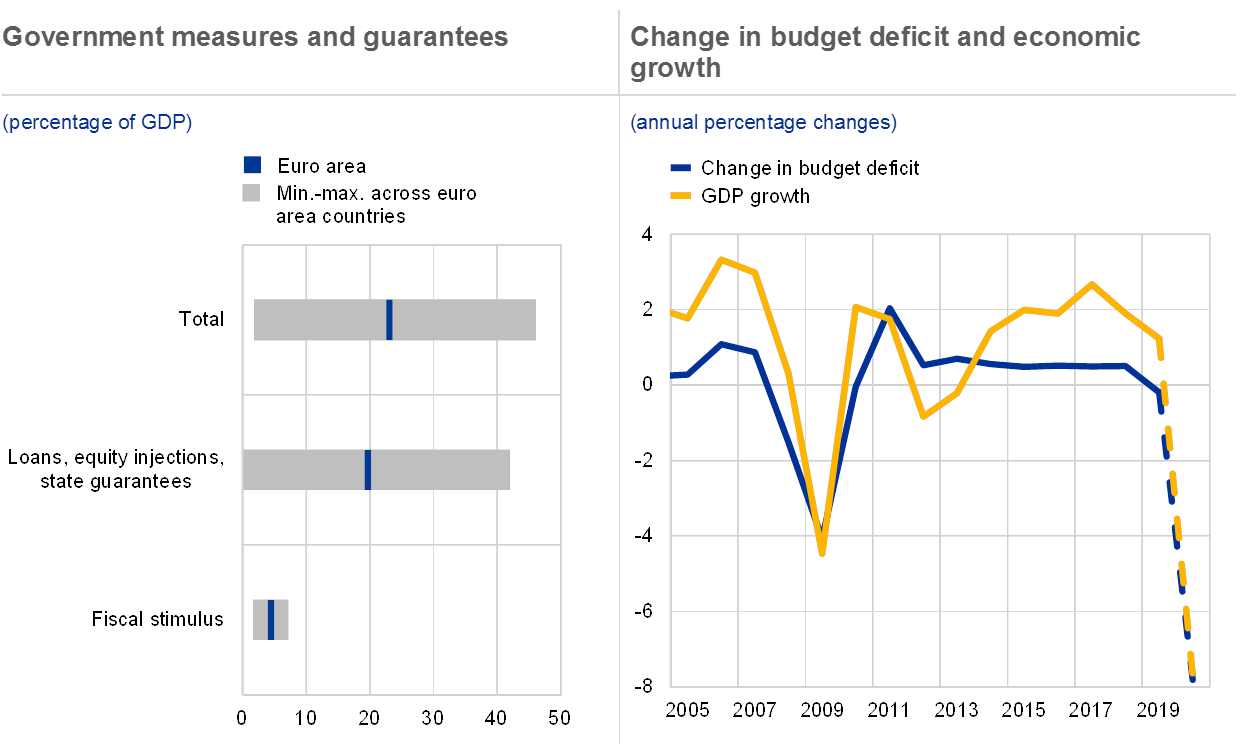

Euro area governments took action to mitigate the impact of the pandemic. All euro area countries have announced fiscal measures to cushion the economic impact of the pandemic. These measures aim to support health services, to replace lost incomes, and to protect the corporate sector. The measures include tax breaks, public investments and fiscal backstops, such as public guarantees or credit lines (see Chart 6, left panel). The size of these combined support schemes varies widely across the euro area, but is substantial in many countries (see Section 1.2 and Box 4), with additional support being provided at the EU level.

The pandemic represents a medium-term challenge to the sustainability of public finances. Euro area governments continue to benefit from benign financing conditions against the backdrop of the ECB’s ongoing asset purchase programmes, but the pandemic is set to weaken fiscal positions as automatic stabilisers and discretionary support measures translate into higher deficits. The fiscal measures help mitigate the economic fallout, and to the extent that they help economic growth to recover more quickly, they can be supportive of medium-term debt sustainability. But the associated increase in public debt levels (see Chart 6, right panel) could also trigger a reassessment of sovereign risk by market participants and reignite pressures on more vulnerable sovereigns going forward. A more severe and prolonged economic contraction than envisaged, if coupled with higher sovereign funding costs for some euro area countries and the materialisation of contingent liabilities, would risk putting the public debt-to-GDP ratio on an unsustainable path in already highly indebted countries.

Chart 6

Fiscal relief measures reduce the near-term impact of the pandemic, but may reinforce medium-term public debt sustainability concerns

Sources: ECB staff assessment based on information from the national Ministries of Finance and central banks, European Commission (AMECO database), ECB and ECB calculations.

Notes: Left panel: discretionary measures and other liquidity support for the euro area are based on information collected from the 2020 stability programmes. Given the heterogeneity in the reporting of the data, the aggregate figure for discretionary measures could be distorted by the impact of automatic stabilisers. Figures are expressed as a percentage of 2019 GDP.

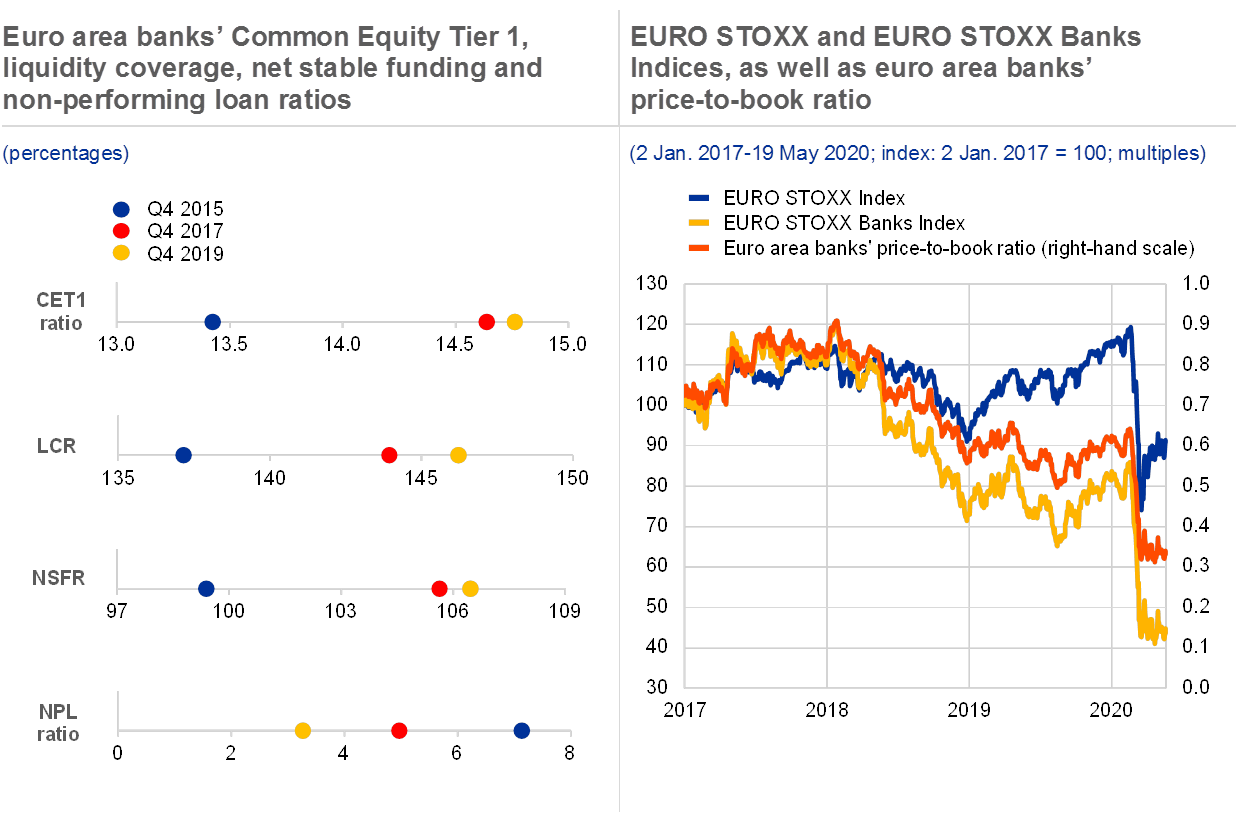

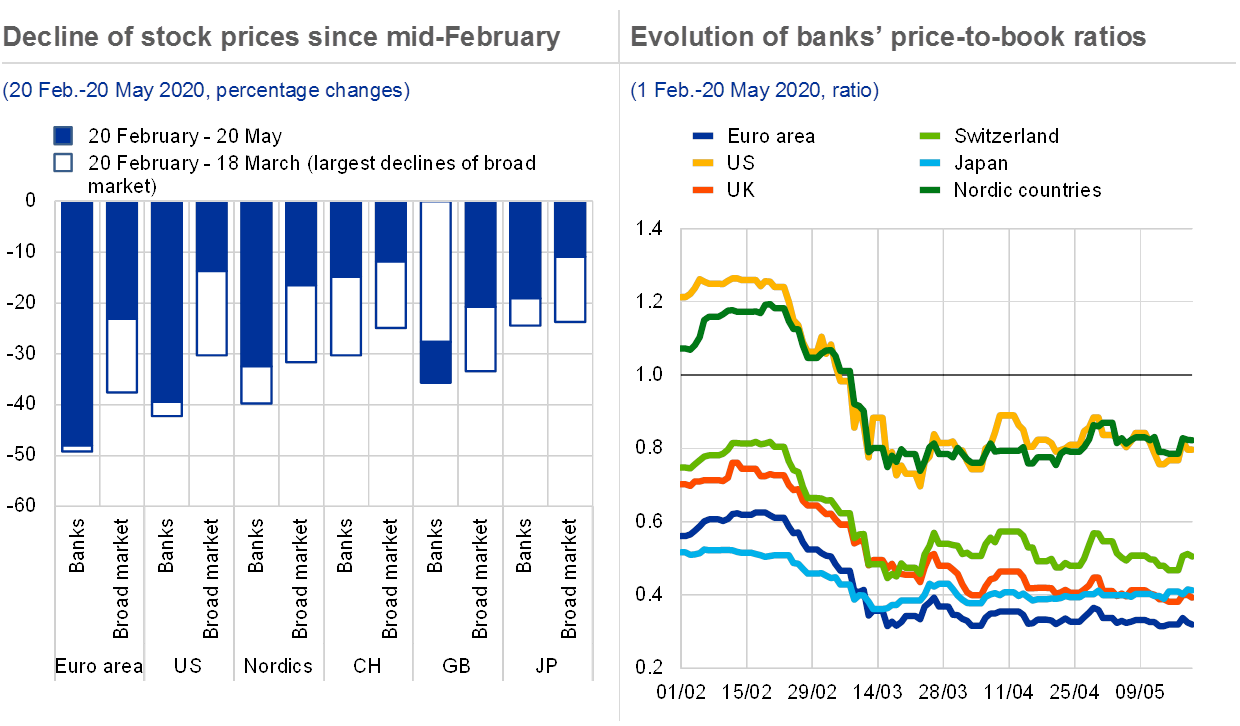

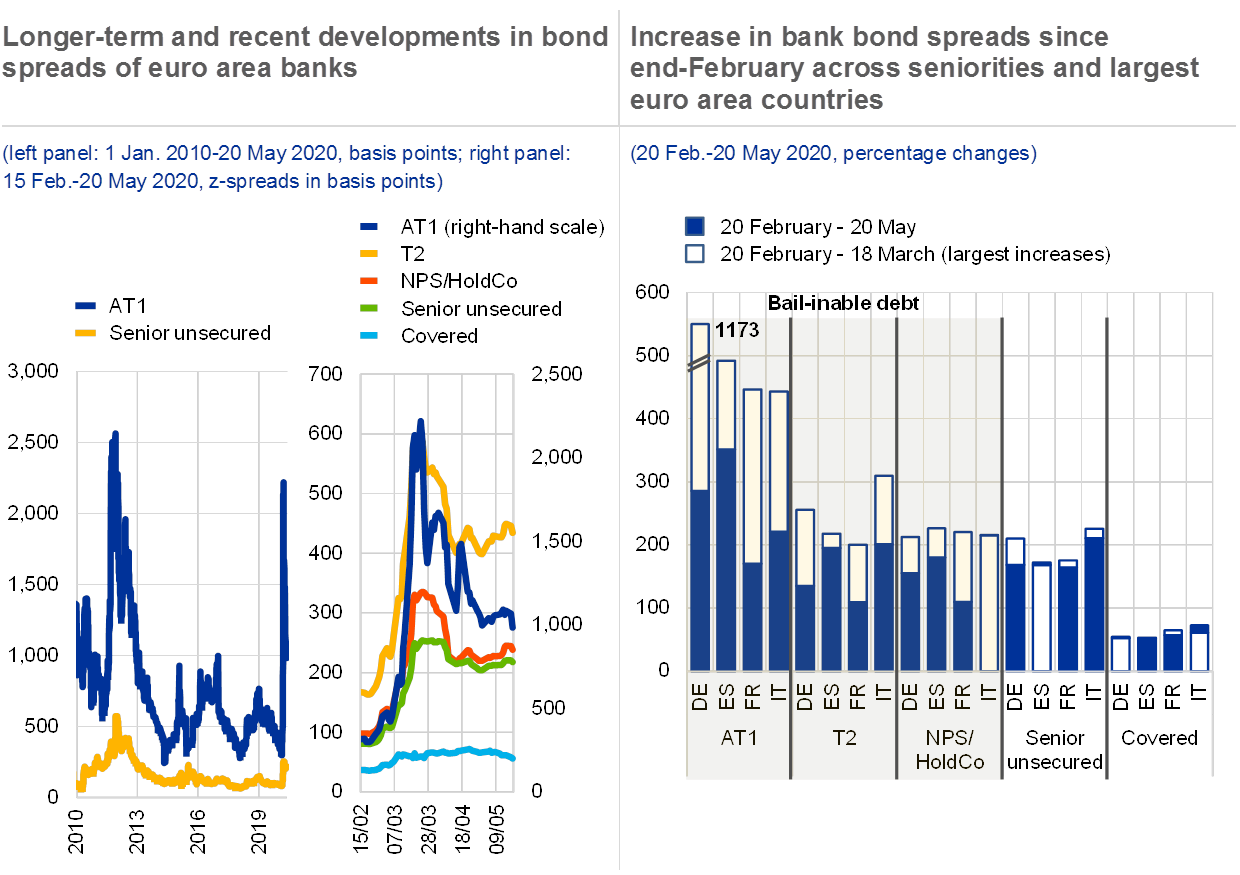

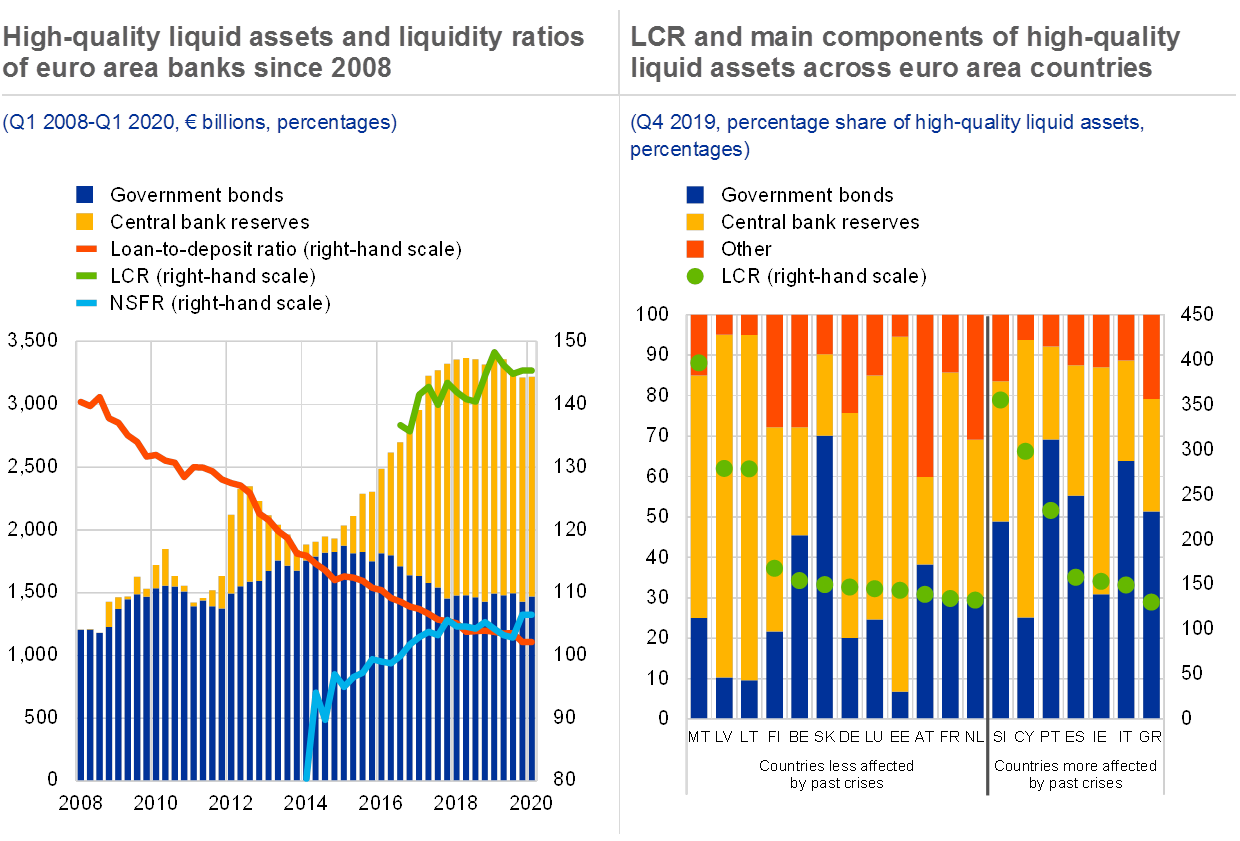

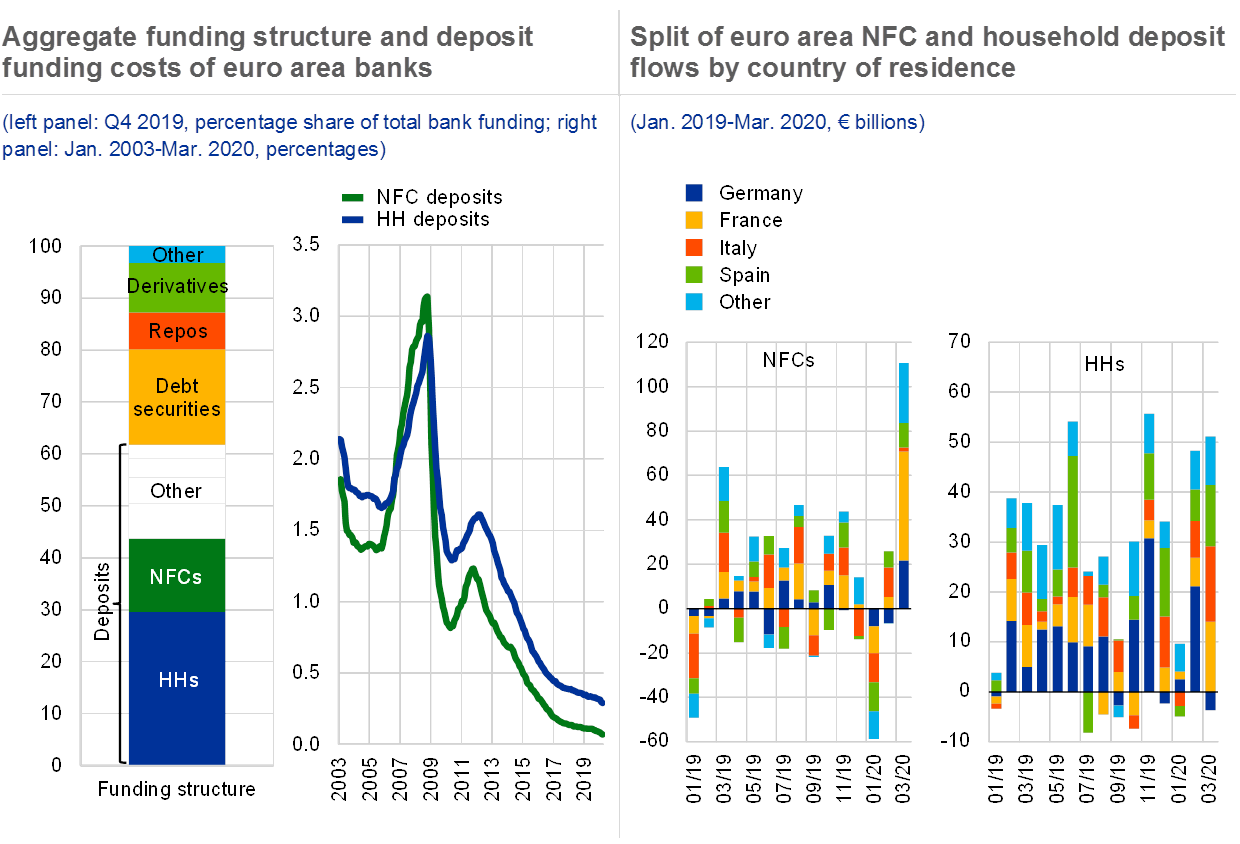

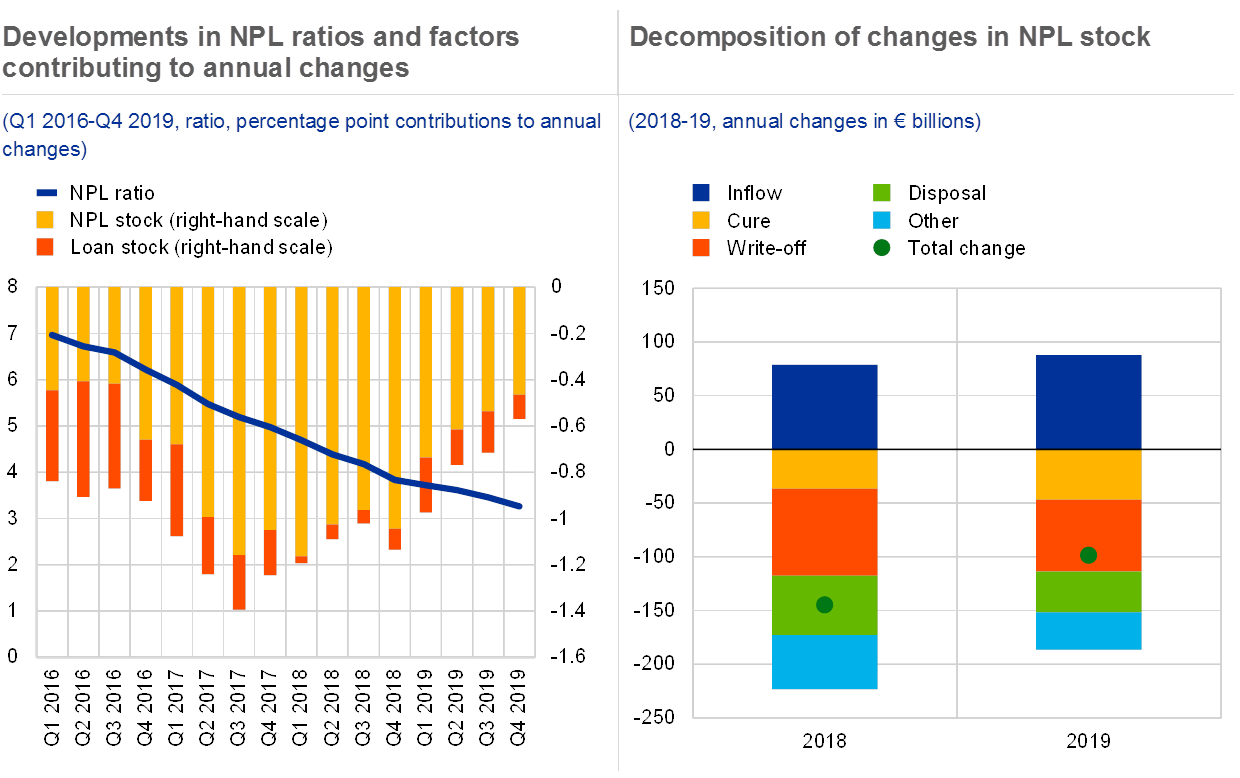

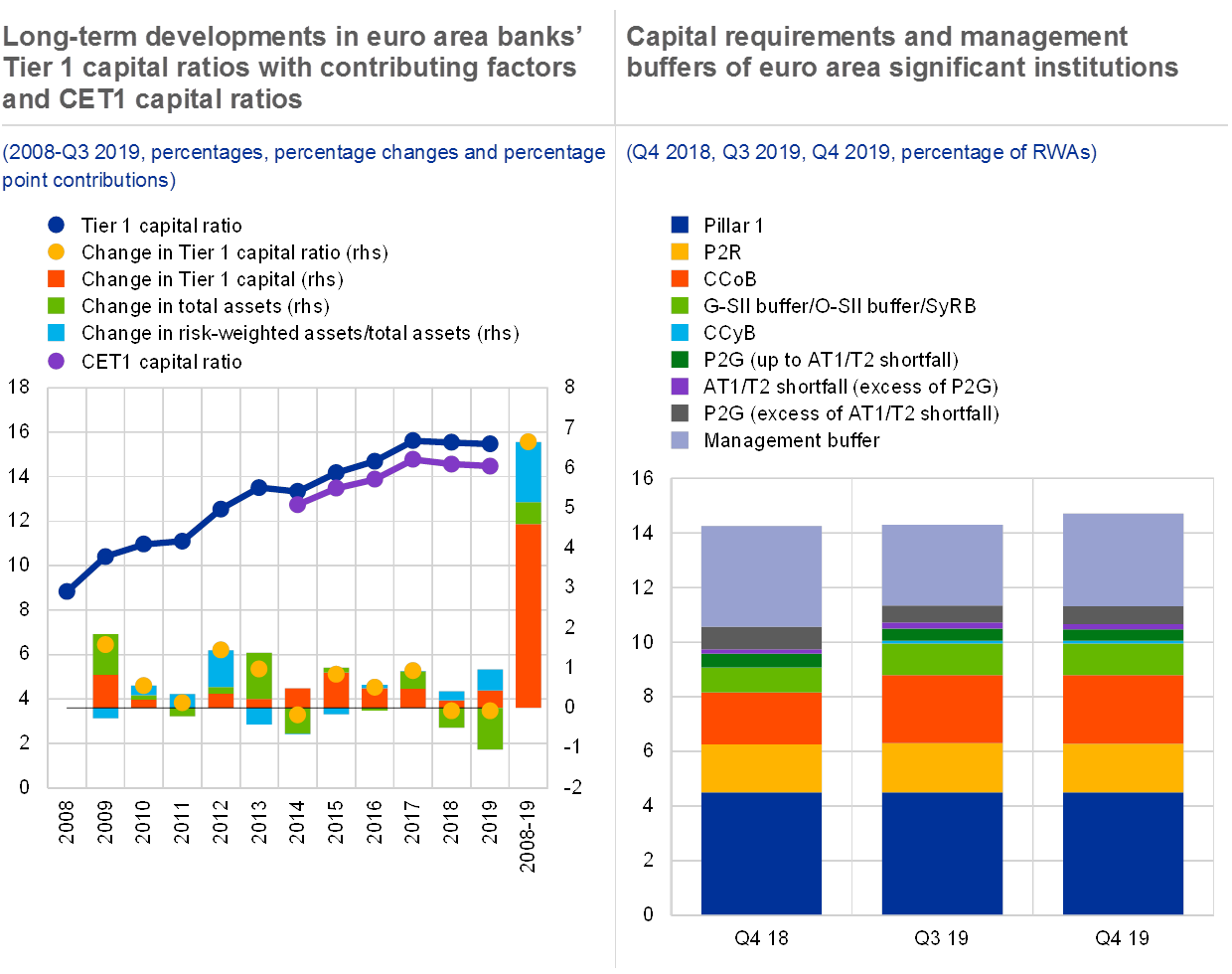

Euro area banks are supported by capital and liquidity buffers, but face even weaker profitability

Bank valuations fell to record lows and bank funding costs increased, despite the enhanced resilience since the global financial crisis. Importantly, euro area banks entered this stress episode with stronger capital levels, better liquidity positions and more stable funding structures than they had at the time of the global financial crisis a decade ago (see Chart 7, left panel). Even though banks were not at the epicentre of the pandemic, their price-to-book valuations fell to record lows of around 0.3 (see Chart 7, right panel), reflecting both the deteriorated economic outlook and considerably higher uncertainty about the prospects for euro area banks’ profits and asset quality. Market funding costs for banks also rose (see Chapter 3).

Chart 7

Despite increased resilience since the global financial crisis, bank valuations plunged

Sources: ECB supervisory statistics, Bloomberg Finance L.P. and ECB calculations.

Note: Left panel: for the liquidity coverage ratio (LCR), the figure for Q4 2015 reflects the earliest available value for Q3 2016.

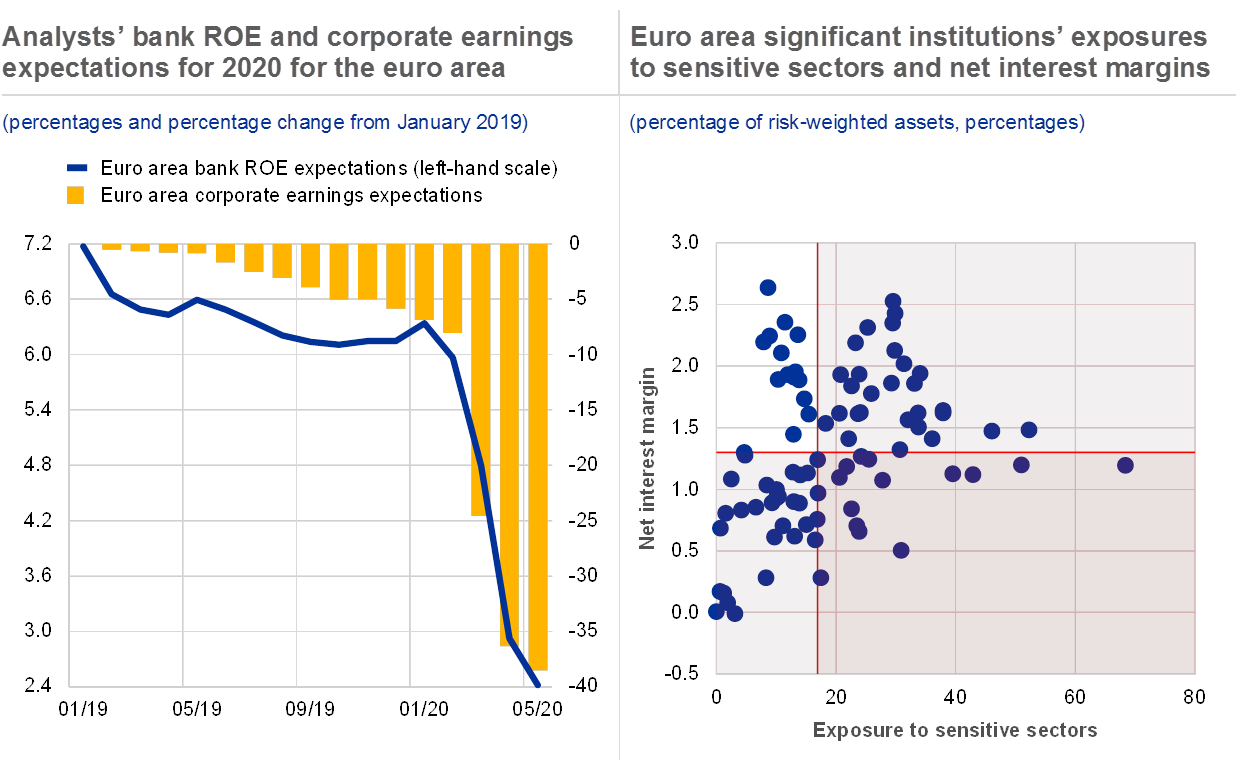

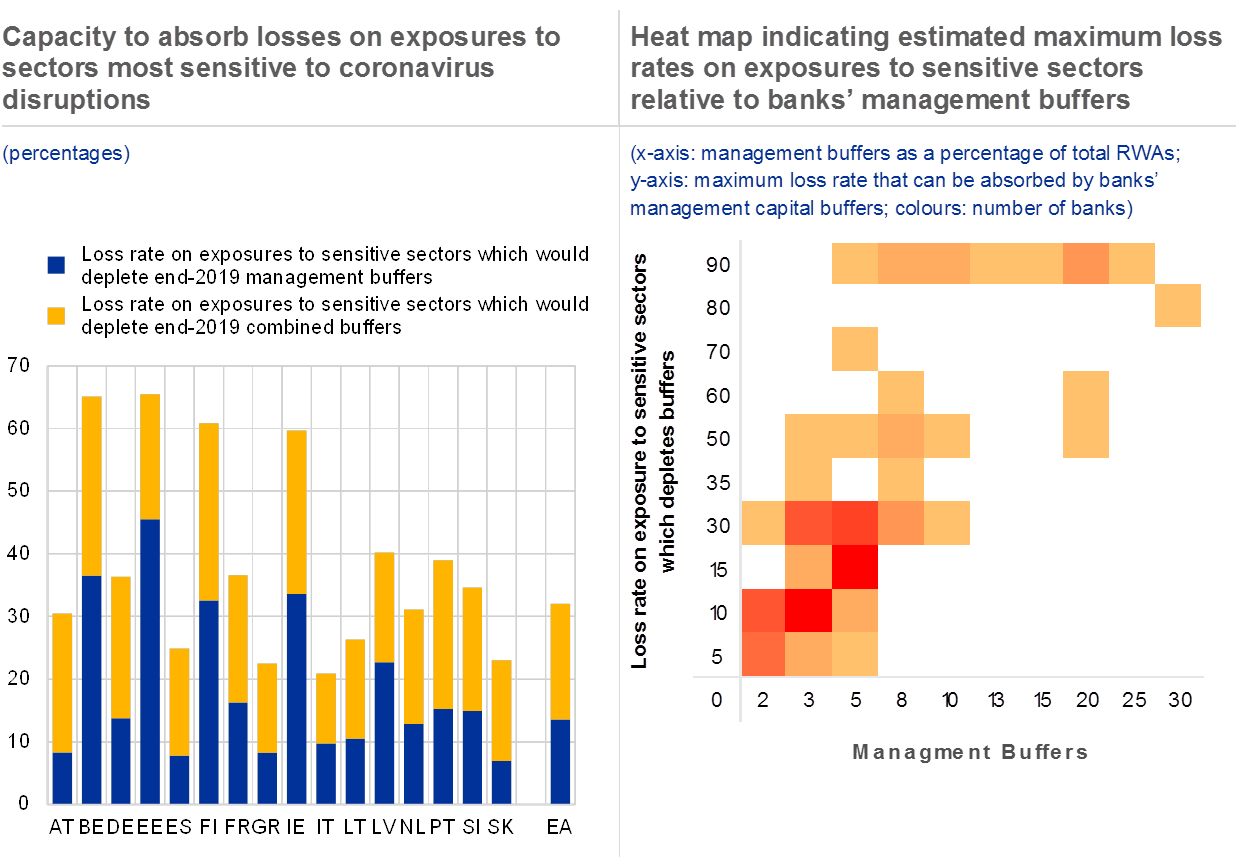

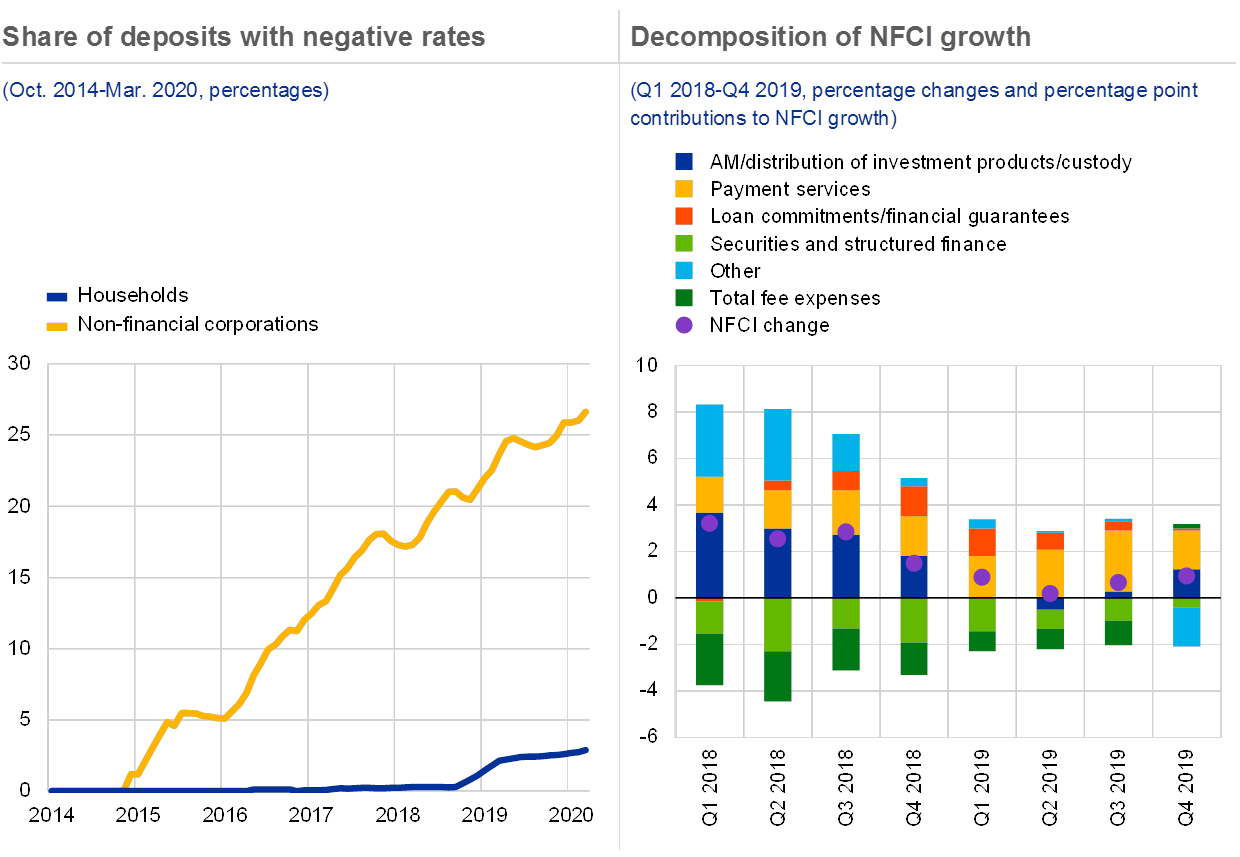

An expected increase in credit risk in the wake of the pandemic weakens the outlook for bank profitability, although in the near-term government schemes may offset some losses. Banks’ profitability prospects have weakened from already low levels. Mirroring changes in corporate earnings expectations, bank analysts have also revised down their 2020 return on equity (ROE) forecasts for euro area banks (see Chart 8, left panel). Income generation on new business is likely to be impaired, and credit losses are set to increase, as banks are increasingly confronted with missed payments and a growing number of corporate defaults. Banks with already squeezed pre-pandemic margins and high exposures to coronavirus-sensitive sectors appear particularly vulnerable in this environment (see Chart 8, right panel).

Euro area banks’ prospects are further hindered by continuing structural problems. Low cost-efficiency, limited revenue diversification and overcapacity continue to weigh on many banks’ profitability prospects. The pandemic could help accelerate change in the sector, for example by fostering digitalisation, although uncertainty and lower profit expectations might delay transformation plans. Furthermore, banks continue to face the challenges of operating in business continuity mode, including the associated increase in cyber risk. Banks also need to continue managing the implications of the transition to a greener economy (see Box 3).

Prudential authorities across the euro area acted to maintain the flow of credit to the economy, complementing monetary and fiscal measures. ECB Banking Supervision allowed banks to operate temporarily below certain liquidity and capital buffer requirements,[1] and granted them more operational flexibility to avoid, as much as possible, unintended procyclical consequences for the financial sector. This was complemented by macroprudential action, in the first test of the post-crisis framework. Several national authorities promptly decided to release the countercyclical capital buffer and other macroprudential buffers, or revoke earlier macroprudential decisions (see Chapter 5). These actions, which amount to around €140 billion of capital and complement fiscal and monetary policy measures by supporting loss absorption and reducing incentives to deleverage, were supported by the ECB. In addition, ECB Banking Supervision recommended that banks limit capital distribution by refraining from paying dividends or buying back shares (see Box 5). These capital measures are expected to remain in place until the economic recovery is well established.

Chart 8

Euro area banks’ profitability outlook has deteriorated further amid gloomy corporate earnings prospects, low interest rates and looming asset quality problems

Sources: Bloomberg Finance L.P., ECB supervisory statistics and ECB calculations.

Notes: Left panel: values for May 2020 are as at 19 May 2020. Right panel: sensitive sectors comprise mining, manufacturing, retail and wholesale trade, transport, accommodation and food services as well as arts and entertainment. The red horizontal and vertical lines represent the median values for euro area significant institutions.

Policy measures alleviate near-term risks to financial stability, but medium-term vulnerabilities have risen

The euro area financial system has weathered much of the recent stress with the help of policy measures, but the lost economic output and higher debt burdens increase the medium-term risks to euro area financial stability. Looking ahead, four key vulnerabilities for euro area financial stability have increased: (i) tighter financial conditions and fragile functioning in some markets; (ii) a significant increase in debt burdens, especially public debt; (iii) weaker bank intermediation capacity and profitability; and (iv) amplification of market dynamics by the non-bank financial sector. The potential of these vulnerabilities to materialise simultaneously further increases the risks to financial stability.

1 Macro-financial and credit environment

1.1 Sharp deterioration of near-term economic outlook

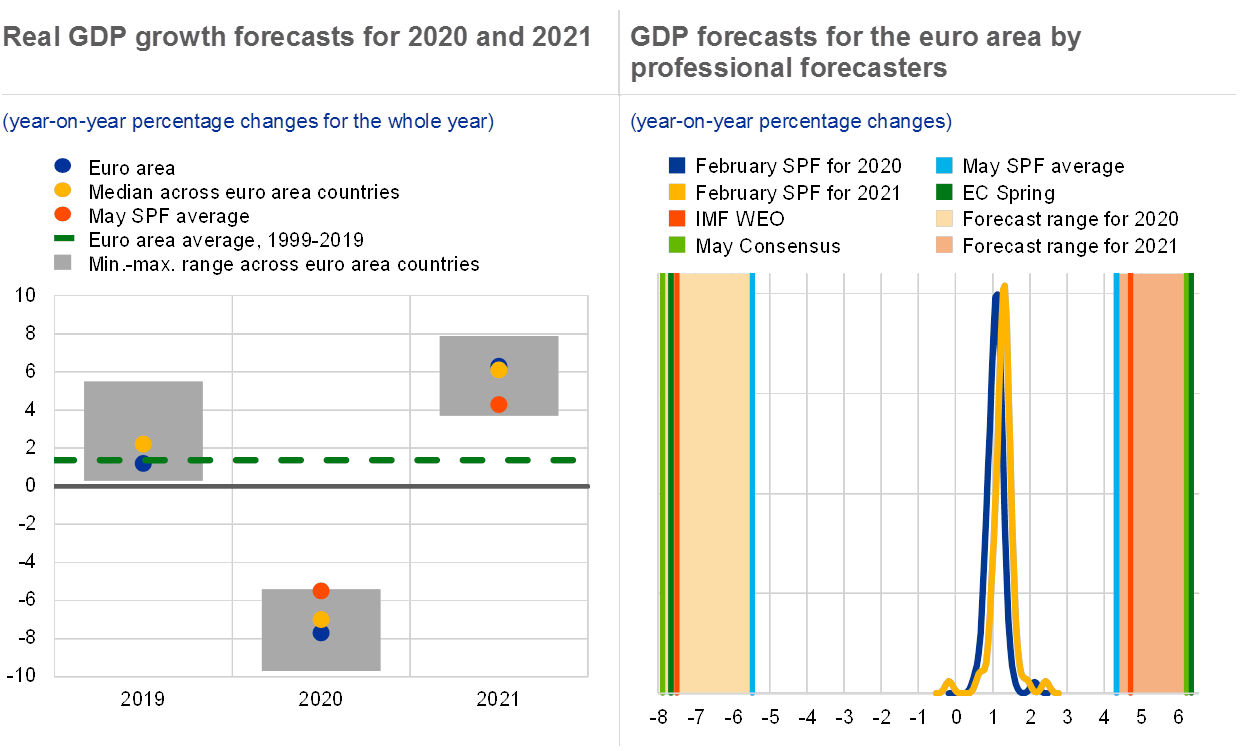

The global and euro area economies have faced one of the largest and fastest contractions on record, with an uncertain recovery ahead. In the first quarter of the year, euro area real GDP declined by 3.8% quarter on quarter according to preliminary flash estimates. Economic projections for all euro area countries for 2020, which are surrounded by a high degree of uncertainty, suggest substantial declines in output, with annual rates of decline ranging between -6% and -9.2% (see Chart 1.1, left panel). Preliminary scenario analysis by ECB staff suggests a decrease in euro area GDP of between 5% and 12% this year. This contraction reflects the impact of the public health measures to contain the spread of the coronavirus, which curtailed demand and production, in turn weighing on cash flows of firms and incomes of households. This decline in activity is expected to be even sharper in the second quarter of the year because lockdown measures were in full force in April. The pace of recovery will depend on the ability of governments to ease containment measures and the effectiveness of the implemented fiscal and monetary policy measures. Euro area growth projections by professional forecasters suggest a strong rebound in 2021 of between 4 and 6 percentage points, but are very uncertain given the exceptional nature of the shock. The recent growth forecasts for both this and next year lie well beyond what could have been foreseen in February (see Chart 1.1, right panel).

Chart 1.1

Expected contraction in 2020 well beyond what could have been foreseen in February

Sources: Consensus Economics, ECB (Survey of Professional Forecasters ‒ SPF), European Commission, April 2020 IMF World Economic Outlook and ECB calculations.

Notes: Left panel: the blue and yellow dots refer to the outcome of the European Commission Spring 2020 Economic Forecast. The average growth rate is the compounded average annual growth rate of GDP for the period 1999-2019. Right panel: normal Kernel density estimates across 66 and 69 point forecasts of professional forecasters.

Governments have launched a range of fiscal relief measures to support companies and employment, in addition to automatic fiscal stabilisers. Beyond supporting health systems, national governments and the European Commission have also sought to mitigate the economic impact on households and companies. The European Commission launched a support scheme for short-time working, a pan-European guarantee fund to support small and medium-sized enterprises (SMEs) via the European Investment Bank, and pandemic crisis support for Member States via the European Stability Mechanism. In addition, a European recovery fund to increase the EU budget temporarily by €500 billion was proposed by the French and German Heads of State. Such a fund would make it possible for the European Commission to borrow funds over the long term allowing a substantial amount of direct support to be provided to the countries most affected by the pandemic. In addition, sovereign bond spreads could narrow as a higher share of aggregate sovereign debt would benefit from higher ratings (see Chapter 2). National governments have implemented or expanded schemes to support continued employment, such as wage subsidies or special temporary unemployment schemes. In addition, non-financial corporations (NFCs) have received short-term liquidity support via direct subsidies and tax relief, and loans backed by loan guarantee schemes (see Box 4). Discretionary fiscal measures communicated so far amount to 4% of euro area GDP, while nearly 20% of euro area GDP has already been committed to loan guarantee schemes that reduce banks’ credit risk.

In parallel, ECB monetary policy measures have supported liquidity in the euro area financial system and economy. These include the pandemic emergency purchase programme (PEPP), which ‒ together with the existing asset purchase programme ‒ will purchase more than €1 trillion of private and public bonds by the end of 2020. In addition, a large expansion of targeted longer-term refinancing operations (the TLTRO III programme) offers liquidity to banks at a rate that, depending on banks’ lending performance, can be as low as -1.0%. These instruments are accompanied by eased collateral requirements to facilitate an increase in bank funding against loans to corporates, in particular small businesses, self-employed individuals and households. In April, the ECB introduced an additional liquidity backstop – pandemic emergency longer-term refinancing operations (PELTROs) – allowing banks to borrow at a rate of up to 25 basis points below the main refinancing rate. Other major central banks have taken similar steps to support the macroeconomy. Micro- and macroprudential authorities have also acted to support continued bank lending with capital measures amounting to around €140 billion (see Chapter 5).

Chart 1.2

Near-term growth at risk has deteriorated substantially

Sources: ECB and ECB calculations.

Notes: Left panel: probability density centred around the ECB central scenario. Right panel: based on a country panel growth-at-risk estimation. Growth at risk is defined as the observation corresponding to the 5th quantile of the one-year-ahead annual GDP growth density given information in the fourth quarter of 2019 and the first quarter of 2020, respectively. The chart shows where the 5th quantile is positioned in the historical distribution of the 5th quantile estimates.

While the central expectation is for the pandemic’s economic fallout to be temporary, there are downside risks to the recovery despite the large-scale policy support. Based on growth-at-risk predictions, the 5th quantile of GDP growth one year ahead has dropped from -1% to around -11% (see Chart 1.2, left panel). Across euro area countries, dispersion is very wide, reflecting that countries have been impacted differently by the virus and the associated containment measures (see Chart 1.2, right panel). Several forces are behind the downside risks: first, not only countries but also economic sectors have been affected to different extents by the lockdown measures. Initial estimates suggest that the most affected sectors – those which faced significant closure of their business – are industry (except construction), manufacturing, non-food retail and wholesale trade, transport, hotels and restaurants, as well as arts and entertainment. These sectors account for about half of total gross value added in the euro area (see Chart 1.3, left panel). Second, some sectors, such as travel and tourism, may be affected for a longer period of time due to continued restrictions. Third, despite schemes to keep employees in the labour market, there is a risk that a significant number of workers could still lose their jobs if firms ultimately need to scale down their business in response to changes in demand. In some countries which have established schemes to subsidise short-time work, such as Germany, applications for such subsidies have increased sharply (see Chart 1.3, right panel). Fourth, consumption may remain subdued for some time not only because of lower incomes but also due to a general scarring effect impacting consumer behaviour. Finally, it is possible that infection numbers rise again, leading to a return of local or regional containment measures.

Chart 1.3

Sensitive sectors account for almost half of total gross value added and unemployment may rise substantially

Sources: Eurostat, German Federal Employment Agency and ECB calculations.

Notes: Left panel: “other, less sensitive sectors” comprises agriculture, construction, information and communication, financial and insurance activities, real estate activities, professional, scientific, administrative and technical activities and public administration. Right panel: number of firms that have issued applications for short-time work.

Weak global growth and protracted disruption of supply chains may also delay the recovery in the euro area. Emerging market economies (EMEs) have experienced sharp capital outflows since end-January (see Chart 1.4, left panel). Capital outflows and the depreciation of EME currencies against the US dollar are likely to depress economic activity in EMEs, and raise concerns about debt sustainability in a number of countries. As a first reaction, the leaders of the G20 agreed on debt moratoria for 77 low-income countries to last until end-2020 with the possibility of being extended. In addition, driven by supply chain disruptions and the massive demand shock, world trade is estimated to have fallen sharply in the first half of 2020 (see Chart 1.4, right panel). The International Monetary Fund (IMF) projects global activity (excluding the euro area) to contract by 2.3% in 2020. Assuming that containment measures are unwound gradually in the second half of this year, the global economy is projected to grow by 5.8% in 2021.

Chart 1.4

The global recovery is also uncertain, as EMEs experienced sharp capital outflows and world trade is expected to shrink

Sources: ECB, Haver Analytics, Institute for International Finance and ECB calculations.

Notes: Left panel: capital flows are cumulated daily. Reference shock dates are 20 January 2020 (coronavirus), 1 May 2018 (emerging market sell-off), 11 August 2015 (China’s currency devaluation), 22 May 2013 (“taper tantrum”) and 15 September 2008 (global financial crisis). Latest observation: 22 May 2020. Right panel: the tracker is based on a regression of world imports on a principal component of a small panel of weekly indicators of trade (including lags), a constant, some monthly indicators and lags of the dependent variable. The indicators featuring in the regression have been chosen on the basis of their correlation with world trade, their availability and timeliness. Latest observation: the fourth quarter of 2019 for world imports excluding the euro area and 9 May 2020 for the global trade tracker.

1.2 Substantial fiscal response to pandemic implies a large increase in sovereign debt

The fiscal policy response to the economic fallout of the coronavirus has softened the impact, and is expected to support economic recovery. Governments across all euro area countries and the European Commission have implemented many support measures in accordance with the temporary framework for State aid measures recently adopted by the Commission. These include direct spending measures and loan guarantees for the non-financial private sector (see Chart 1.5, left panel). The first category includes, for example, expenditure to expand medical capacity in response to the pandemic, as well as schemes aimed at supporting continued employment, such as wage subsidies or special temporary unemployment schemes. Furthermore, governments have directed subsidies towards SMEs to help them manage immediate liquidity shortages. Governments have also permitted deferrals of some taxes and social security contributions.

Guarantee schemes account for the largest part of governments’ support to the euro area economy. These measures include guarantees for export credit and for other liquidity assistance and credit lines via national development banks (see Box 4). Other off-budget vehicles are being used to support companies via guarantees on firms’ liabilities and capital support. Some of these measures improve the liquidity position of the private sector, but ‒ unlike deferrals which are automatic and apply generally to the target groups ‒ credit lines require action from the impacted companies and there remains uncertainty about the conditions under which banks can provide loans, even if the government guarantees cover the largest part of the loans.

Chart 1.5

Euro area governments have taken strong action to support the economy affecting budget deficits this year

Sources: 2020 National Government Stability Programmes, European Commission Spring 2020 Economic Forecast and ECB calculations.

Notes: Given the heterogeneity in the reporting of the data, the aggregate figure on discretionary measures could be distorted by the impact of automatic stabilisers. Figures are expressed as a percentage of 2019 GDP. Right panel: the budget deficit is not cyclically adjusted.

Governments face considerable near-term gross financing needs. These higher financing needs result from both the standard functioning of automatic fiscal stabilisers and the fiscal stimulus packages. Additional revenue shortfalls resulting from tax deferral schemes and the conventional channel of lower income leading to lower tax revenues add to this. The proportion of corporate sector guarantees called will depend on the depth and length of the recession and such calls will increase government financing needs. The overall projected headline effect on the change in the budget balance is significantly larger than during the global financial crisis, but relative to the decline in GDP growth the currently projected aggregated budget deficit is comparable (see Chart 1.5, right panel).

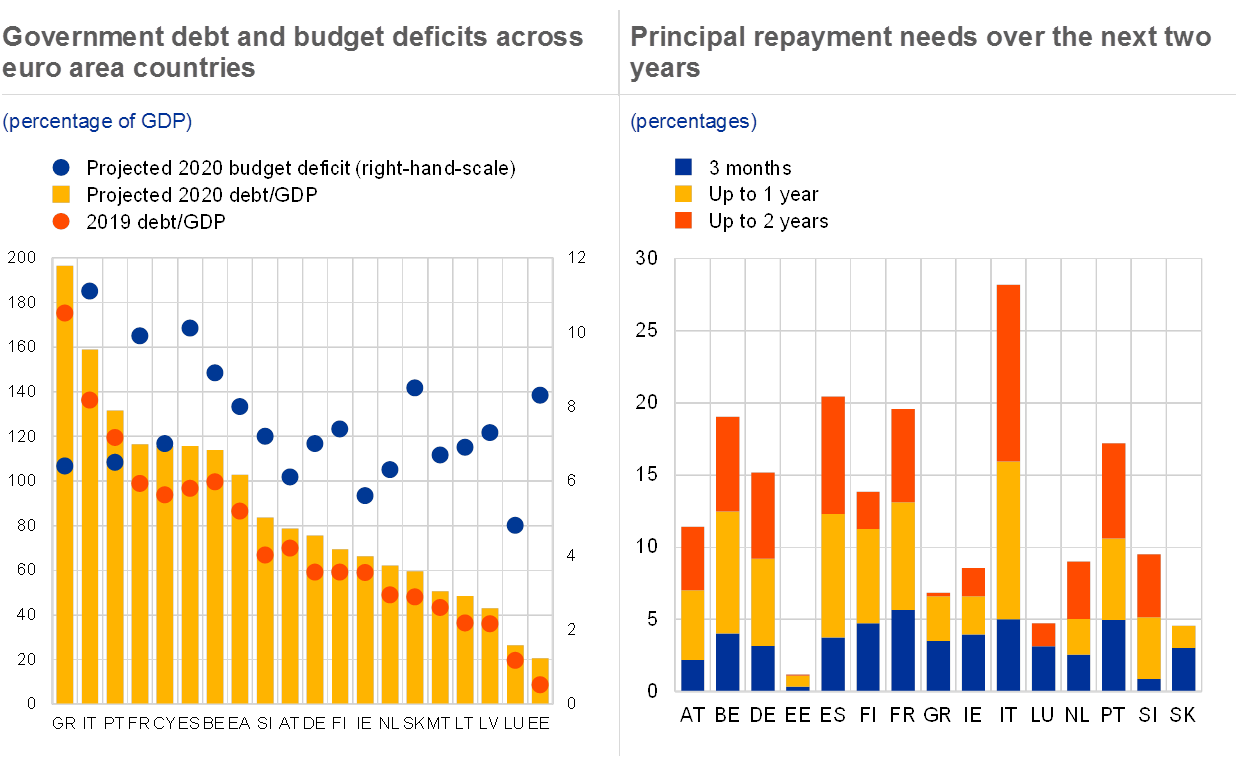

As a result, budget deficits and government debt levels are expected to increase, supporting activity in the near term. Debt levels across euro area countries are projected to increase significantly by between around 7 and 22 percentage points in 2020 (see Chart 1.6, left panel), pushing the aggregate euro area government debt-to-GDP ratio above 100%. Moreover, a number of countries are facing substantial debt repayment needs over the next two years (see Chart 1.6, right panel). While the large fiscal policy response mitigates the economic cost of the downturn, thereby providing a first line of defence against fiscal debt sustainability concerns, a more severe and protracted economic downturn could give rise to debt sustainability risks in the medium term.

Chart 1.6

Sovereign debt levels will rise in 2020

Sources: ECB, European Commission Spring 2020 Economic Forecast, Eurostat and ECB calculations.

Note: Left panel: budget deficit in absolute terms relative to 2019 nominal GDP.

1.3 Income declines and rising unemployment will test resilience of household balance sheets

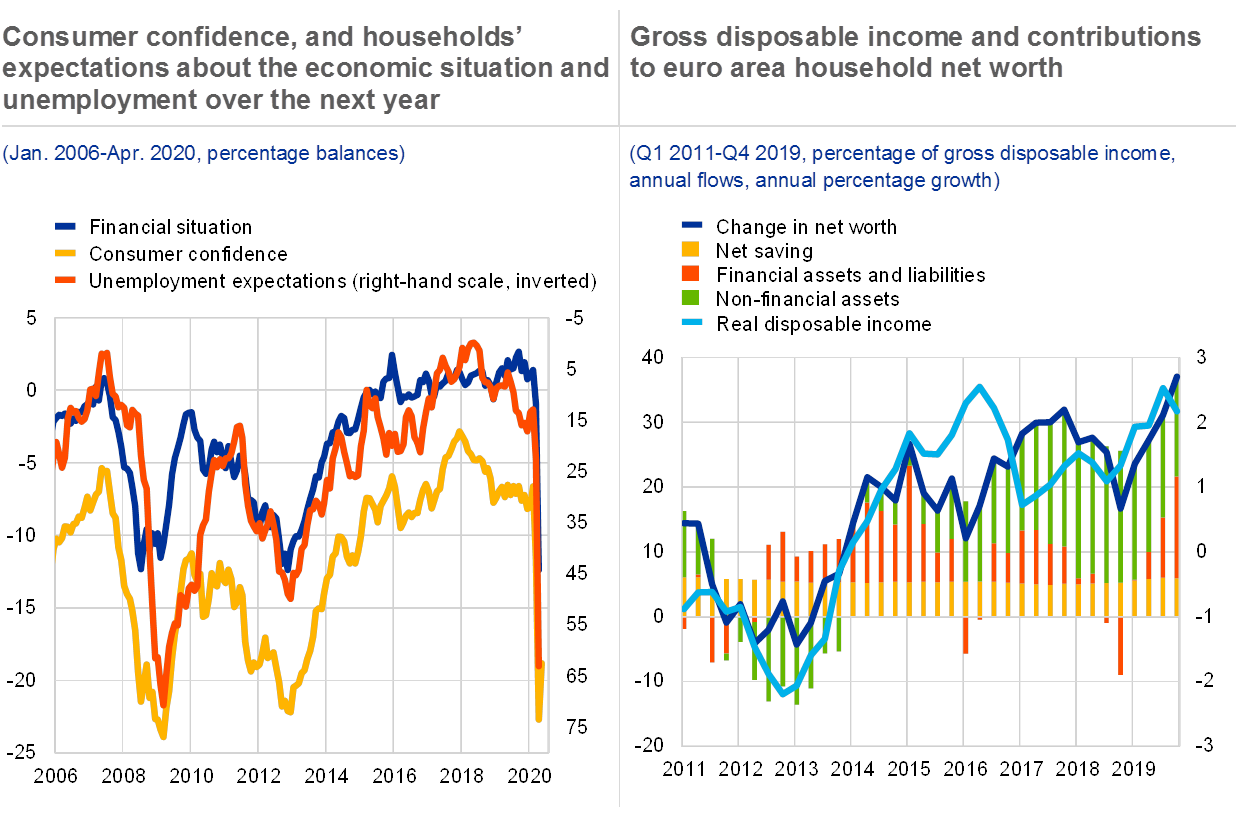

Consumer sentiment and unemployment expectations deteriorated sharply, with some improvement in May. Survey-based indicators point to a strong deceleration in employment across all business sectors led by the services and retail sectors (see Chart 1.7, left panel). These sectors were affected the most by the lockdown measures. Mirroring the bleaker employment expectations and generally elevated uncertainty, households assessed their financial situation as being much weaker and accordingly consumer confidence declined strongly.

On aggregate, euro area households entered the pandemic period with strong balance sheets. Household real disposable income had continued its expansion in 2019, underpinned by employment gains and robust wage growth (see Chart 1.7, right panel). Wage dynamics had remained solid, shaped by the still favourable labour market outlook. Furthermore, before the turmoil households’ balance sheets were strong. Deposit holdings on aggregate accounted for 4 ½ times their disposable income and net worth had benefited from substantial gains on financial asset and real estate holdings, following previous favourable stock and housing market developments (see Chart 1.7, right panel). However, the recent substantial decline in equity markets could weigh on households’ financial asset holdings and housing wealth might also decline. In addition, on aggregate households will face wage decreases owing to short-time work arrangements or because they will lose their jobs.

Chart 1.7

Households expect a significant deterioration in their economic situation although past income growth and savings can provide some buffer

Sources: ECB, European Commission and ECB calculations.

Notes: Left panel: last observation for consumer confidence is the flash estimate published on 20.05.20, unemployment expectations are presented using an inverted scale, i.e. an increase (decrease) of the indicator corresponds to more (less) optimistic expectations. Right panel: changes in non-financial assets mainly include holding gains and losses on real estate (including land). Changes in financial assets and liabilities mainly include holding gains and losses on shares and other equity, while the change in net worth due to net saving comprises net saving, net capital transfers received and the discrepancy between the non-financial and financial accounts.

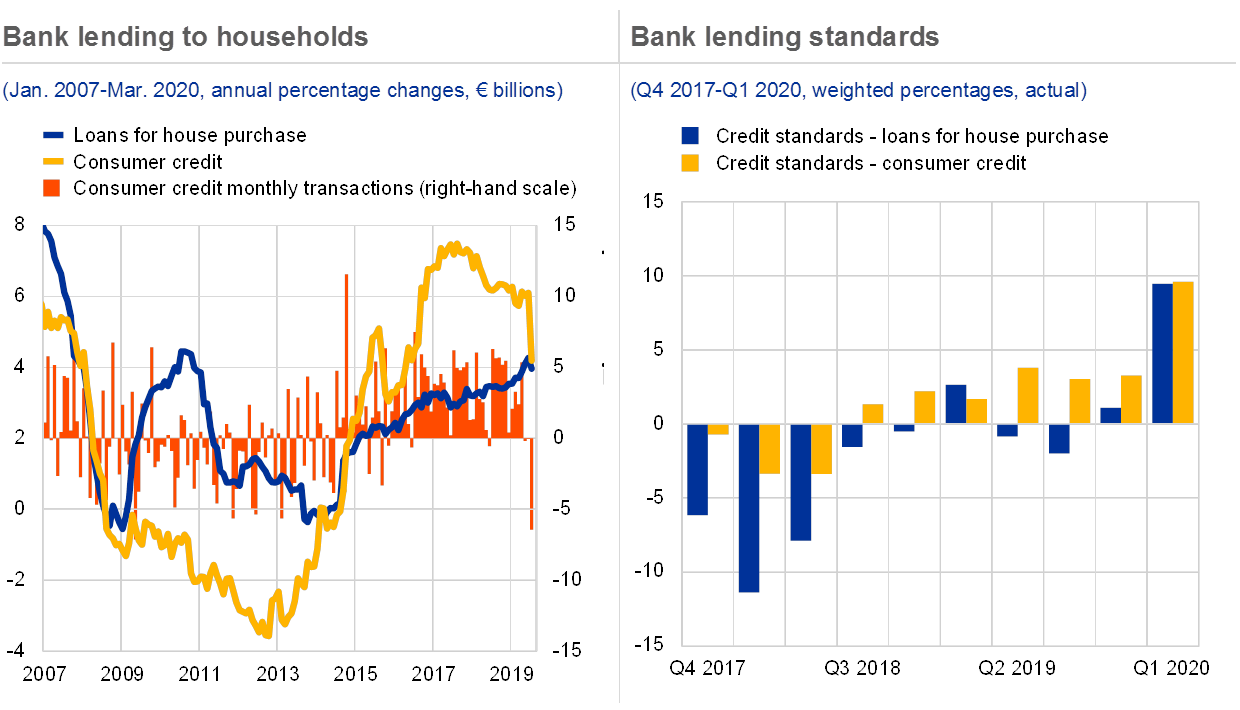

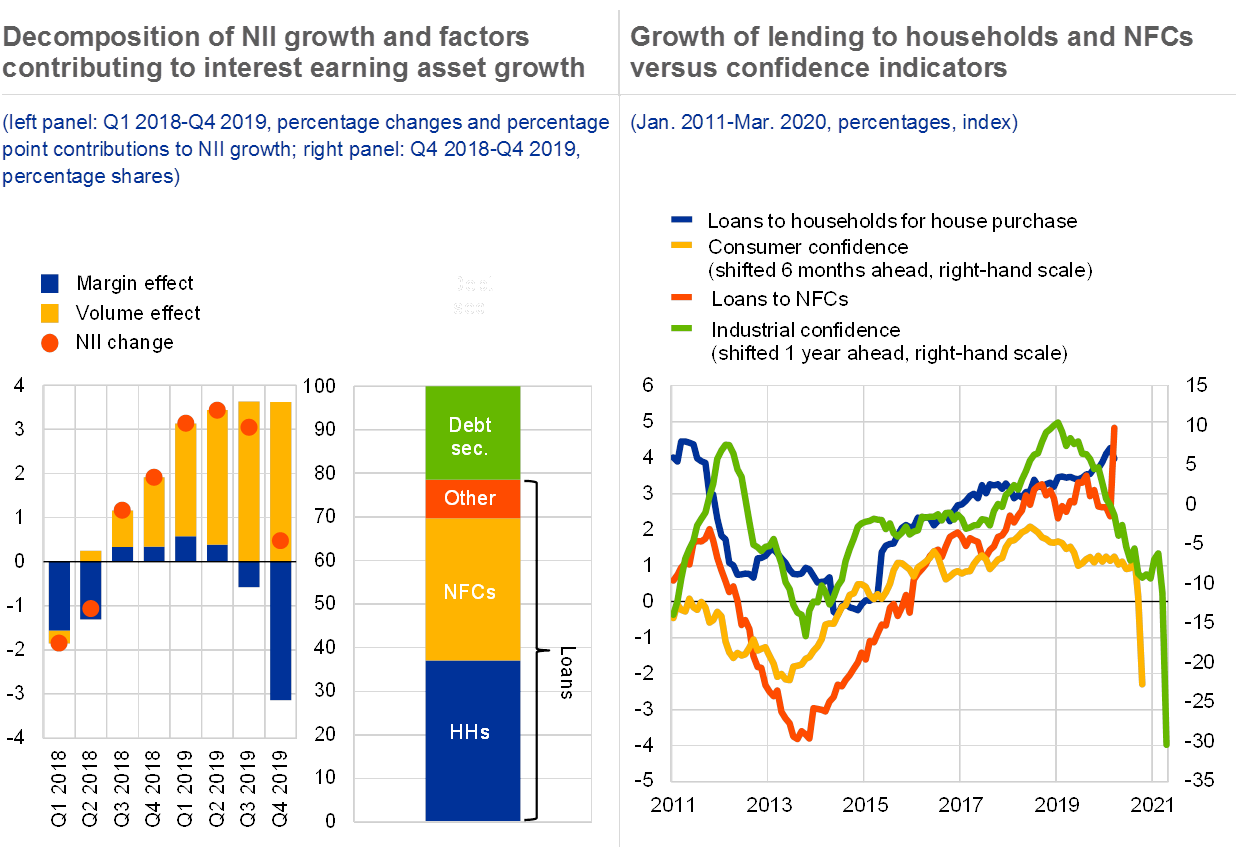

Bank lending standards for households have tightened and total lending to households declined in March. Before the coronavirus shock hit, aggregate bank loan growth had continued rising gradually, but with variation across euro area countries, reflecting different economic conditions and real estate cycles. Lending for house purchase in the euro area was supported by further improvements in labour markets, broadly resilient consumer confidence, and favourable financing conditions reflected in lower interest rates and supportive credit standards (see Chart 1.8, left panel). By contrast, growth of consumer credit had been gradually decelerating already, in line with slower economic growth and the associated lower spending on durable goods. In March, consumer lending declined sharply by €6.5 billion on account of the lockdown measures and elevated uncertainty, while banks considerably tightened their lending standards in the first quarter of the year (see Chart 1.8, right panel). The more uncertain economic situation also caused activity to stall in real estate markets, with a reduction in the amount of loans to households for house purchase of almost 80% compared with the monthly average over the previous 12 months. This may partly reflect capacity constraints of banks which were busy providing loans to NFCs, but was also due to lower loan demand. Households facing wage declines owing to a more precarious work situation and sole proprietors facing financing strains might have drawn on credit lines.

Chart 1.8

Consumer lending declined and bank lending standards tightened

Sources: ECB and ECB calculations.

Risks to household debt sustainability could arise as a result of the economic contraction and if the recovery is slow. Prior to the pandemic, household indebtedness and debt service burdens had been declining across euro area countries, with some exceptions mostly in countries featuring buoyant housing markets (see Chart 1.9). A protracted economic slowdown could weigh on household incomes or lead to a sharp correction in some countries’ property markets with heterogeneous effects across countries. This should also depend on the fraction of households that experience income declines, for example in the context of job losses or self-employed people who face substantial revenue losses. This could put pressure on households’ debt repayment capacity. A short-term mitigating effect should come from loan repayment holidays that have been offered in a number of countries by banks and even enforced by governments in some cases. In addition, the continued favourable financing conditions should mitigate some of the vulnerability.

Chart 1.9

Debt and debt service burdens had declined in most euro area countries prior to the pandemic

Sources: ECB and ECB calculations.

1.4 Widespread cash-flow challenges put the corporate sector under stress

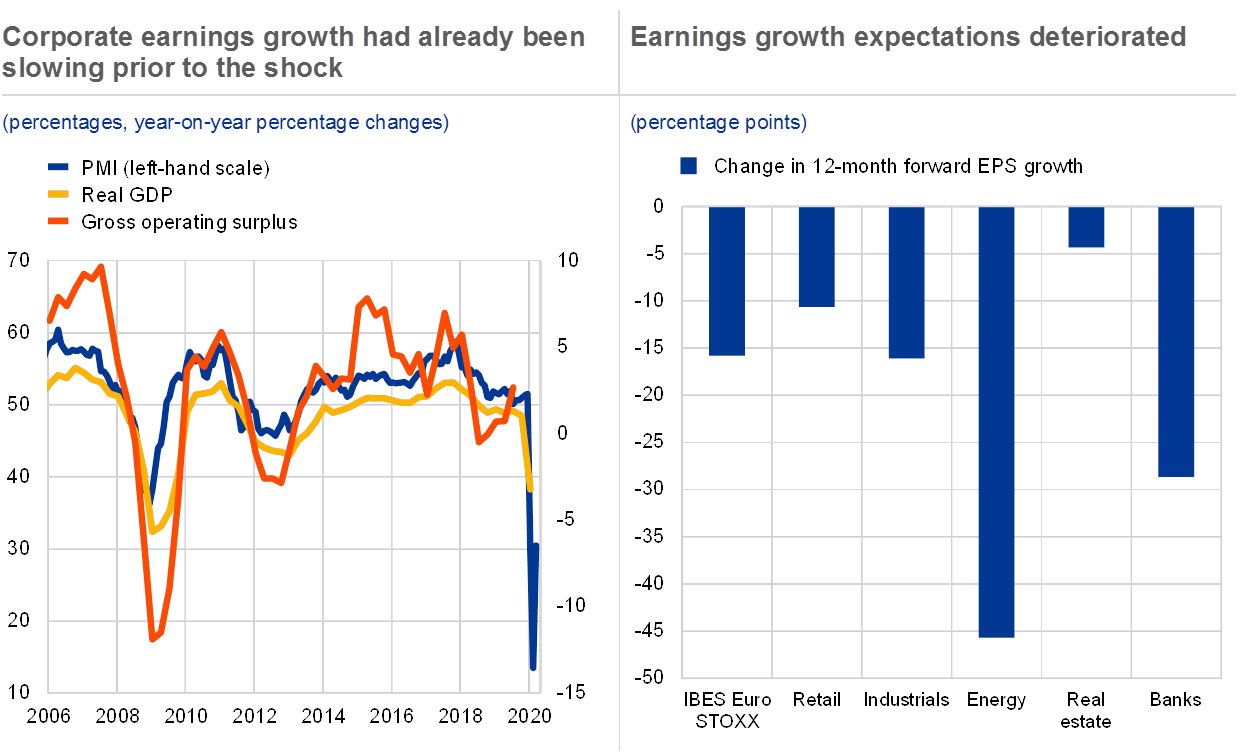

Vulnerabilities have increased considerably in the corporate sector due to the pandemic and related containment measures. A large share of euro area corporates had to stop production for some time during the first half of the year as a result of the economic lockdown, causing substantial revenue losses and large liquidity needs in many cases. Corporate profits on aggregate are expected to follow the large drop in economic activity (see Chart 1.10). A number of business models where the close contact of people is essential could be hampered for a longer period depending on the duration and extent of the containment measures. Flash PMI data for May provide first indications of some rebound in economic activity.

Chart 1.10

Downside risks to corporate earnings could unearth debt vulnerabilities

Sources: Bloomberg, Eurostat, Fitch Ratings, IBES via Eikon, Markit, Moody’s, Standard & Poor’s and ECB calculations.

Notes: In the left panel, the latest observation for gross operating surplus is the third quarter of 2019, for real GDP is the flash estimate of the first quarter of 2020, and for the Purchasing Managers’ Index (PMI) is the flash estimate for May 2020. The right panel shows the change in the 12-month forward earnings per share (EPS) growth between 2 March and 18 May 2020.

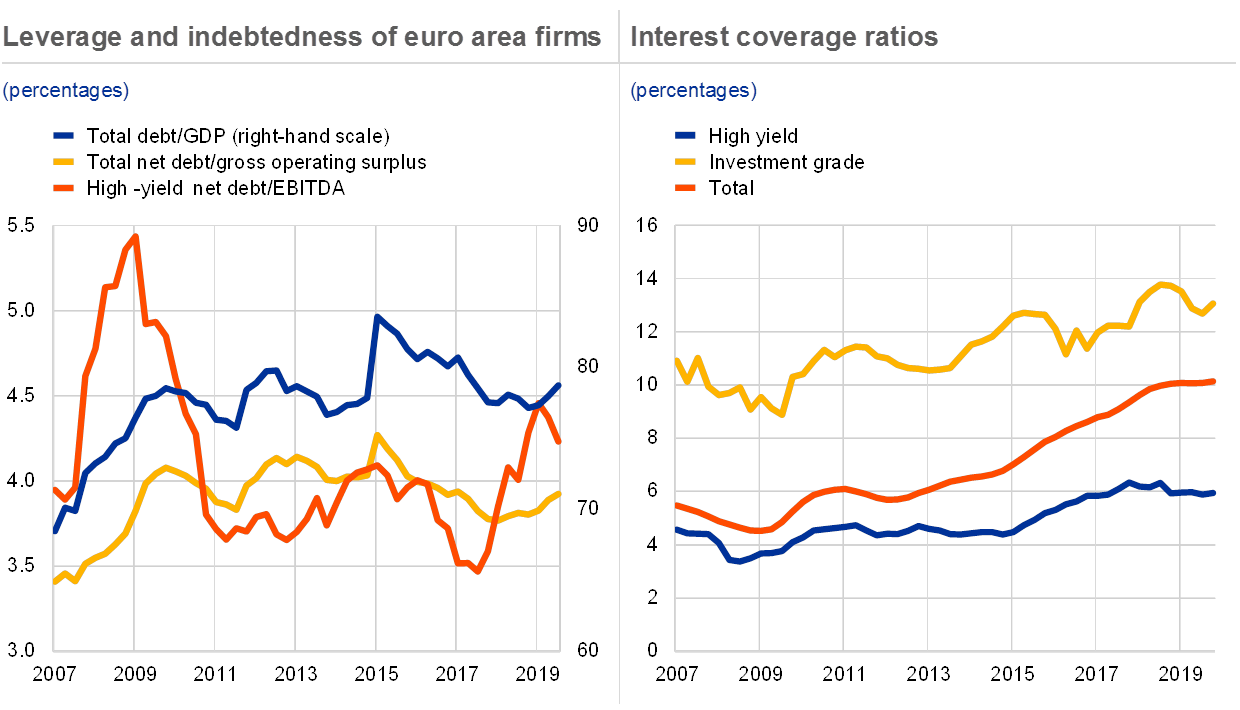

The worsened outlook has been reflected in higher market-based credit risk measures and rating agency downgrades of companies. Expected default frequencies and distance-to-default measures deteriorated sharply in March and April (see Chart 1.11, left panel). Credit risk measures have surpassed their average values since 2014, but remained below the levels that had been observed during the financial and sovereign debt crises. In addition, rating agencies have increased the number of downgrades, notably in the high-yield segment (see Chart 1.11, right panel). Downgrades in the first quarter of the year exceeded those in the 2008-09 financial crisis. The corporate sector had already seen a rising number of downgrades over the past two years, reflecting the pronounced increase in leverage over that period (see Chart 1.12, left panel and Box 1). Furthermore, among investment-grade corporates, BBB-rated entities had further increased their debt issuance prior to the recent turmoil. In the first months of the year, only a small number of these firms faced downgrades to high-yield grade, but various cliff effects associated with the loss of investment-grade status expose downgraded corporates to pronounced market-based funding risks (see Section 2.3).

Chart 1.11

Rapid increase in credit risk and in the number of corporate rating downgrades

Sources: Fitch Ratings, Moody’s, Standard & Poor’s and ECB calculations.

Notes: Left panel: the dashed lines show the averages for the period from January 2007 to December 2013 and for the period from January 2014 to April 2020. The latest observations are for 30 April 2020. Right panel: the number of firms with rating upgrades minus the number of firms with rating downgrades cumulated over each quarter. HY: high yield; IG: investment grade.

Chart 1.12

The risk posed by leverage of high-yield firms materialised

Sources: ECB, J.P. Morgan and ECB calculations.

Notes: Left panel: EBITDA: earnings before interest, tax, depreciation and amortisation. Net debt is computed as consolidated debt minus currency and deposits. Right panel: interest coverage ratio computed as gross operating surplus divided by gross interest payments before allocation of financial intermediation services indirectly measured (FISIM).

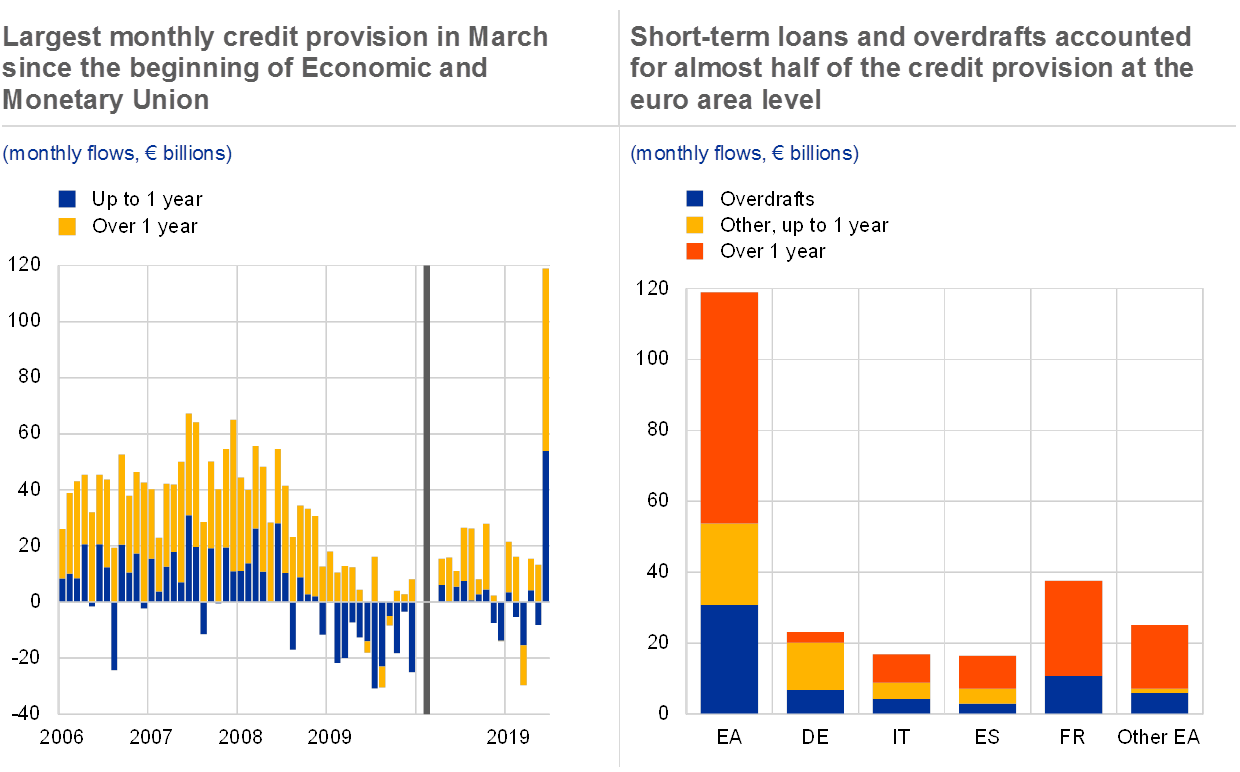

Many corporates have experienced liquidity shortages and have drawn down credit lines, increasing their leverage. Prior to the turmoil, many corporates had accumulated substantial liquidity buffers in the form of liquid assets, which ‒ together with the low debt servicing costs and high interest coverage ratios (see Chart 1.12, right panel) ‒ provided them with some resilience to withstand temporary funding stress without resorting to abrupt deleveraging. At the same time, in relation to the size and pace of the economic shock these liquidity buffers have proven insufficient in many cases. Notably SMEs and businesses that depend heavily on current cash flows, such as travel and tourism, quickly experienced liquidity shortages and funding constraints. Firm-level data suggest that a quarter of all firms would not have sufficient cash buffers to cover two months of payment obligations linked to their liabilities (see Chapter 3). In response, many firms drew on credit lines (see Chart 1.13, left panel) and loan provision in March increased by around €120 billion to the highest monthly level on record. Loan maturities up to one year accounted for almost half of the total amount, marking a significant shift towards shorter maturities, which was broad-based across euro area countries (see Chart 1.13, right panel).

Chart 1.13

Credit lines and government support schemes are the first source of external finance to address liquidity needs

Sources: ECB and ECB calculations.

Notes: Left panel: monthly transactions January 2006-December 2009 and January 2019-March 2020. Right panel: monthly transactions in March 2020.

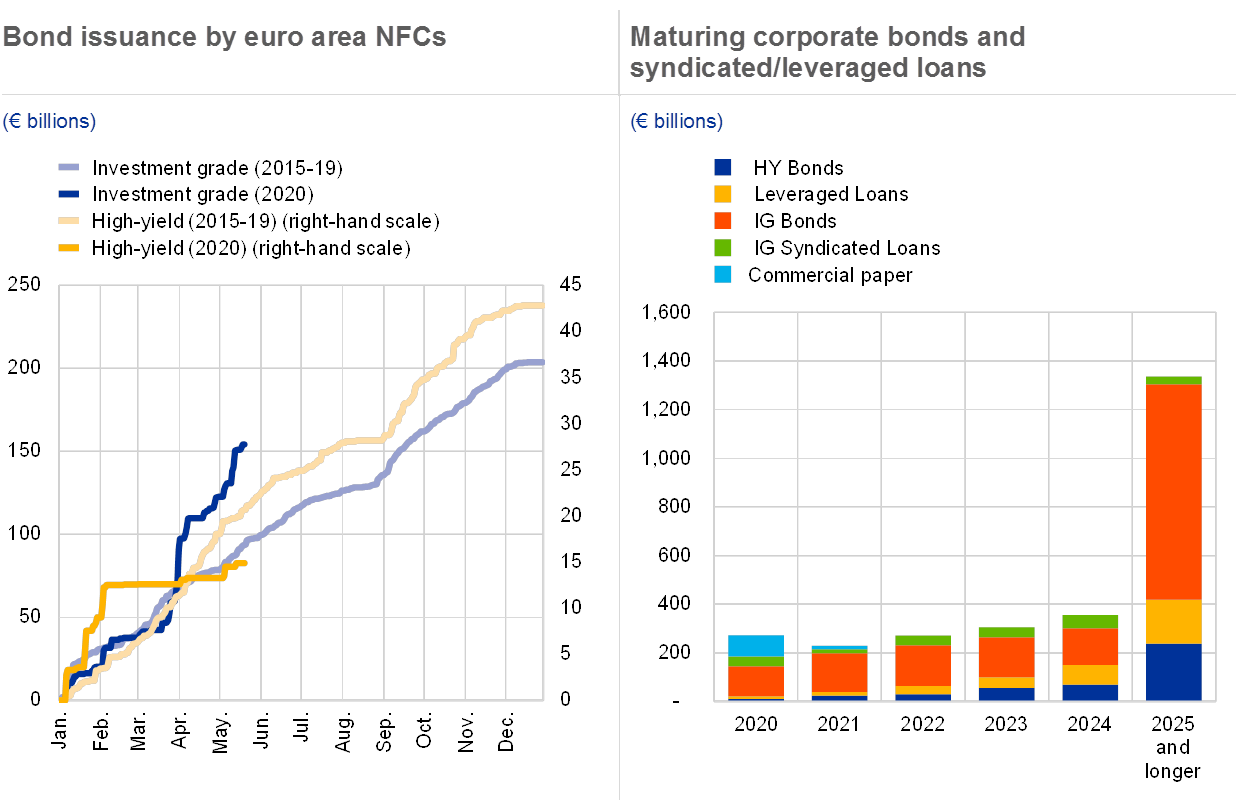

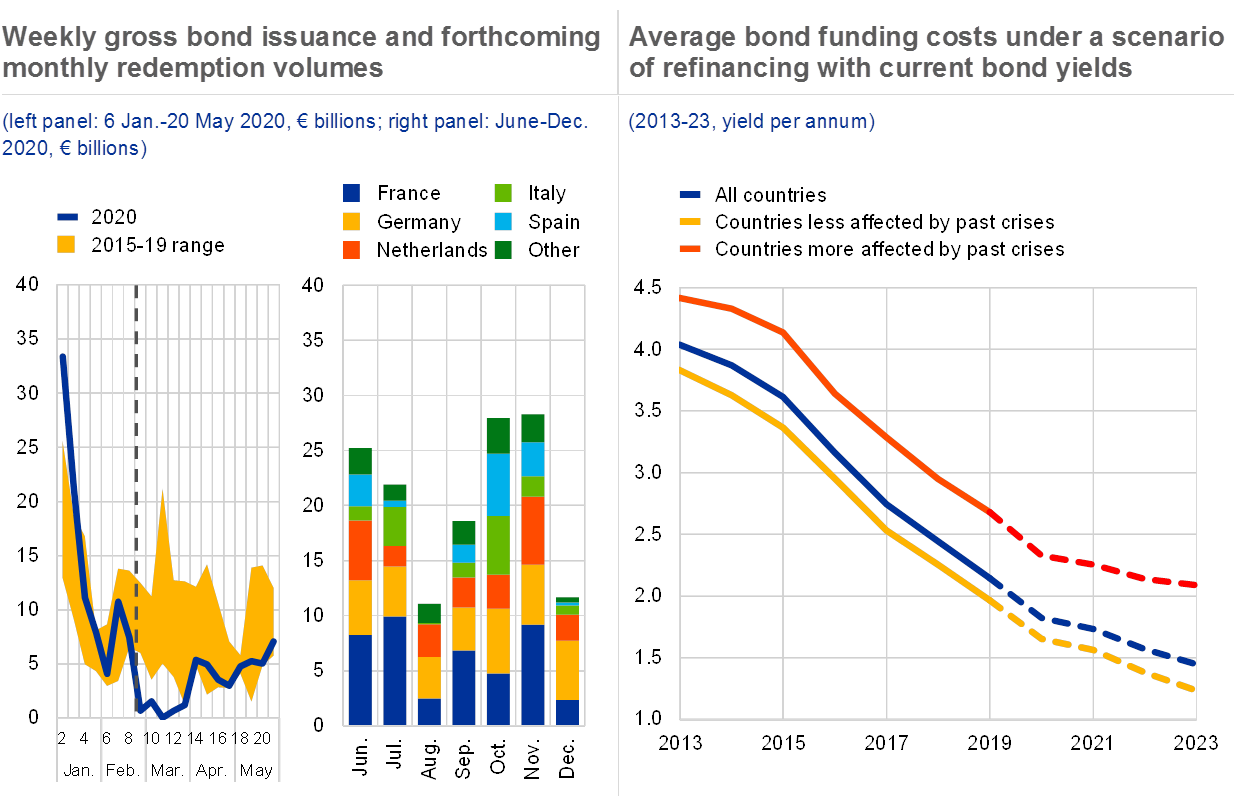

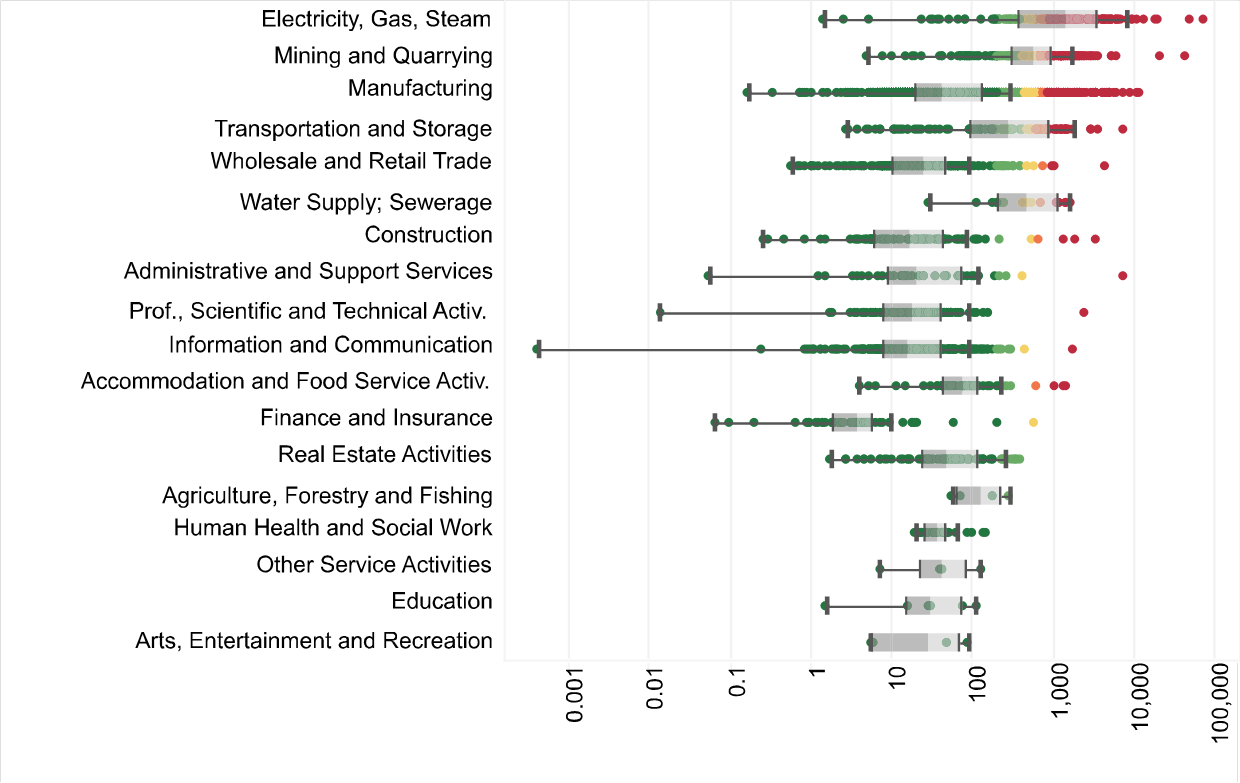

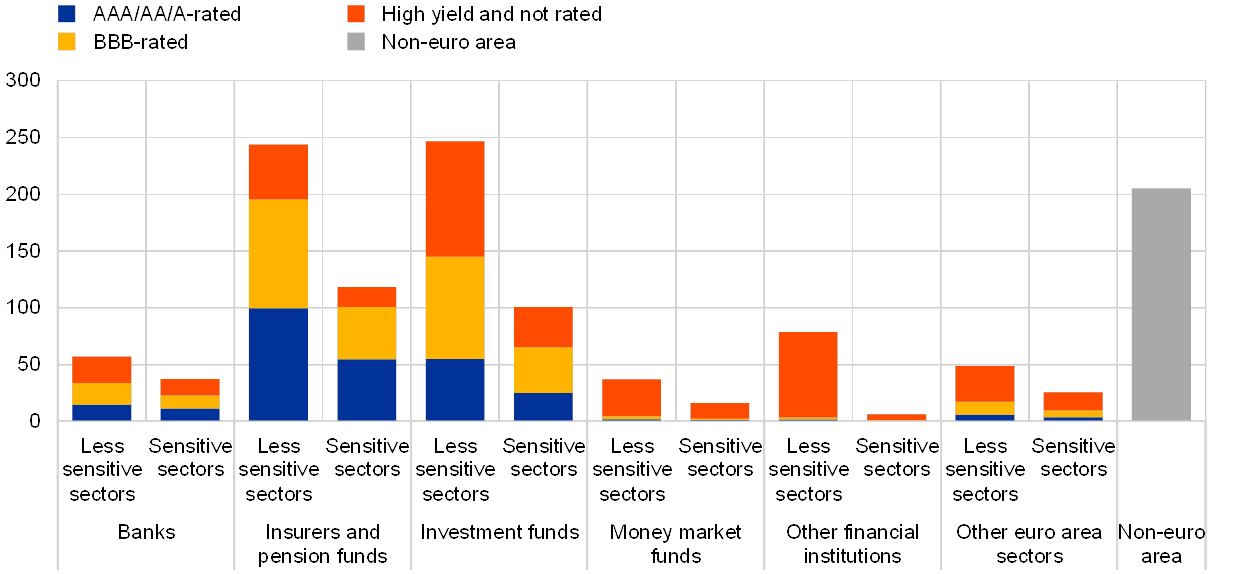

Over the next two years, corporates in sensitive sectors face significant debt refinancing needs. Gross issuance of corporate bonds was robust in early 2020, before stalling in mid-February and then resuming after 24 March, supported by the implemented policy measures and in particular by the PEPP, which along with the other measures improved risk sentiment (see Chapter 2). In addition to the short-term liquidity needs of corporates to finance working capital costs, corporates in sectors that are particularly sensitive to the containment measures will have to refinance a significant amount of their issued debt over the next years (see Chart 1.14). For some firms, challenges in refinancing debt could result in solvency problems, in particular in the event of a slow economic recovery and continued impediments to business models. While gross issuance of investment-grade bonds by NFCs in the euro area from January to April 2020 exceeded averages for the same months between 2016 and 2019, the market for high-yield issuers has remained limited since mid-February.

Chart 1.14

Sectors sensitive to the pandemic measures have substantial refinancing needs

Corporate refinancing needs in sensitive sectors over the next five years

(percentages, € billions)

Sources: Bloomberg and ECB calculations.

Note: The numbers on the right-hand scale are the cumulative refinancing needs over the next five years in € billions.

Box 1

Financial stability implications of private equity

Private equity (PE) funding, and buyout funds in particular, have grown rapidly as a form of corporate financing in recent years, as the search for yield intensified. The outstanding amount of PE managed by global funds amounted to close to USD 8 trillion in December 2019, of which buyout funds accounted for around a third. Buyout funds have grown faster than any other PE strategy over recent years, even as their managers have diversified their activities. Institutional investors’ demand for access to PE buyout funds has been reflected in increasing rates of oversubscription of buyout funds in the primary market (see Chart A, left panel). This box provides an overview of the main developments in the PE buyout market and assesses potential financial stability risks to both investors in PE funds and the overall financial system.

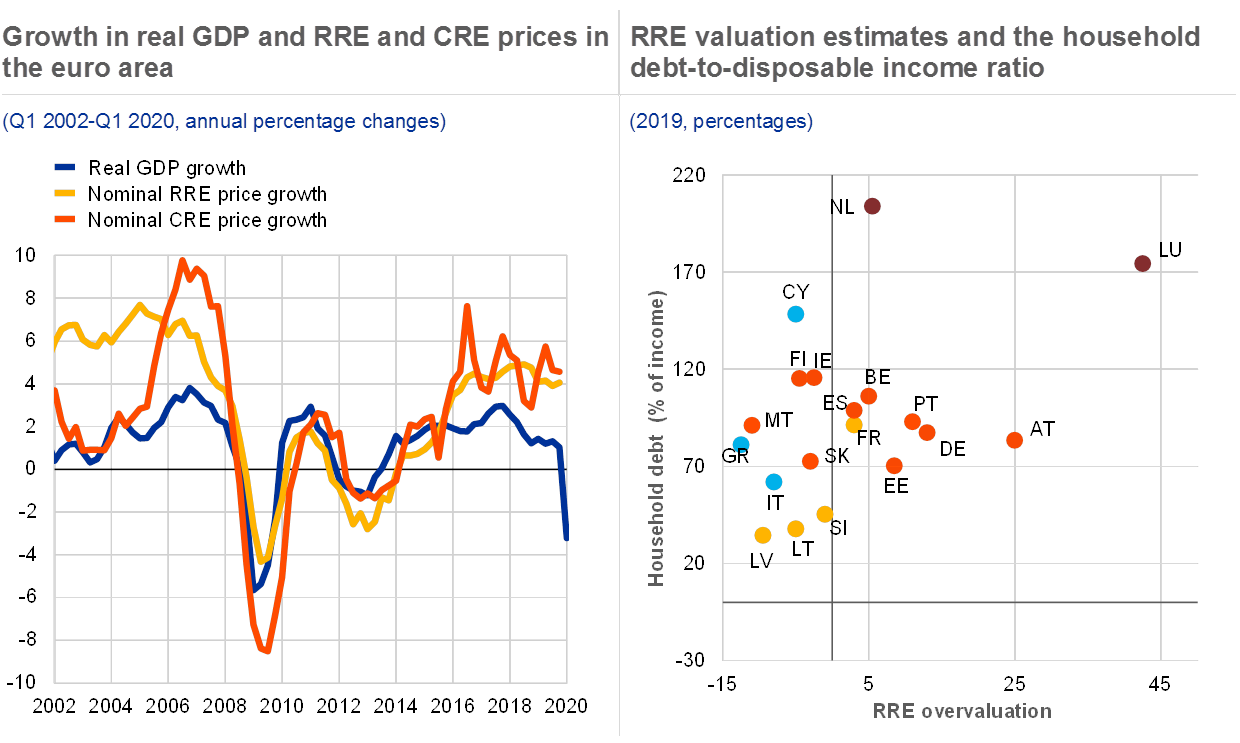

More1.5 Signs of slowing in real estate markets

Residential real estate (RRE) prices were continuing to rise towards the end of 2019, but are now expected to moderate. At the euro area level, nominal house prices rose by 4.1% in annual terms in the fourth quarter of 2019, continuing the deceleration in the growth rate that had been observed after the peak in 2018 (see Chart 1.15, left panel). However, valuation measures still suggest that RRE prices are higher than would be justified by fundamental data. While house prices had continued to rise in almost all euro area countries towards the end of 2019, growth rates displayed a wide dispersion across countries, reflecting the heterogeneity of euro area property markets.

A number of countries face structural vulnerabilities in their property markets. These countries feature household debt-to-income ratios at and above 100% in the presence of overvaluation (see Chart 1.15, right panel) and continued strong growth in mortgage loans that has often been driven by a loosening of lending standards (see Special Feature A). Accordingly, larger house price corrections would be more probable in countries where house prices show the strongest signs of overvaluation. In addition, high household indebtedness and debt service burdens in some countries might aggravate the adverse consumption shock.

The impact of the coronavirus shock on RRE markets depends on its persistence and its effects on employment and household income. While financing conditions are likely to further support demand for real estate, the negative impact of the shock on confidence and household disposable income and the possible negative repercussions on employment could strengthen the envisaged deceleration of the euro area housing cycle both in terms of prices and quantities. However, supply shortages resulting from delays in construction due to the absence of workers and the fact that intentions to buy and renovate properties remain at fairly elevated levels could also lead to upward price pressures.

Chart 1.15

Some moderation in RRE price growth

Sources: ECB and ECB calculations.

Notes: Right panel: the colours of the dots reflect the level of RRE risks: blue = no exposure; yellow = low exposure; red = medium exposure; brown = pronounced exposure. RRE overvaluation is the average of the price-to-income ratio and the output of an econometric model. Overall, estimates from the valuation models are subject to considerable uncertainty and should be interpreted with caution. Alternative valuation measures can point to lower/higher estimates of overvaluation.

Commercial real estate (CRE) markets entered the pandemic at the peak of a cycle, with tentative signs of moderation already showing. Annual CRE price growth picked up again in 2019 and has been fluctuating around 5% since 2016. By contrast, prime CRE price dynamics continued to moderate, and stood at 4% in annual terms in the third quarter of 2019, with an increasing number of countries observing price declines (see Chart 1.16, left panel). The overall developments masked diverging trends across the underlying market segments. Prices in the office segment grew at 8.8% annually, while the retail segment faced declining prices in real terms. In general, CRE prices appear to have grown faster in recent years than would be justified by fundamental data, resulting in potentially stretched current valuations, in particular in prime segments, also reflected in low CRE yields.

Transaction values increased slightly at the end of 2019 driven by price increases, as transaction numbers declined further. The fall in the number of transactions observed since end-2017 reflects the weakening macroeconomic environment. Commercial real estate tends to be sensitive to economic activity and to react strongly to a slowdown (see Chart 1.15, left panel), as lower profitability of NFCs likely results in a decreased demand for commercial leasable space. These effects are likely to be pronounced as a result of the pandemic, as also suggested by developments in the equity prices of CRE investment trusts in sectors where the impact has been the strongest (see Chart 1.16, right panel). Indeed, market intelligence points to a large drop in transactions already in March 2020. In addition, many firms have either reduced or temporarily stopped their rental payments, which could cause liquidity problems for the property owners. The negative effects of the shock are expected to be widespread as almost all sectors of the economy have been hit, but they are pronounced in the non-food retail, restaurant and hotel sectors.

Chart 1.16

Prime CRE price dynamics were moderating in line with the signs of a maturing cycle, while the stock market reaction to the pandemic in the CRE sector was strong

Sources: FTSE/EPRA/Nareit, Jones Lang LaSalle and ECB calculations.

Note: Right panel: CRE investment trust stock price developments are from the FTSE EPRA Nareit Global Real Estate Index Series.

Risks to financial stability stemming from real estate markets have increased. The risk of house and CRE price corrections is increasing, especially in countries where prices are stretched. The CRE sector has been affected by the shock faster than the RRE sector and may face structural changes over the longer term. For example, lower demand for office space due to different working arrangements and lower demand for hotel rooms as business travel might be reduced owing to new working technologies and methods. Furthermore, the demand for housing might slow down, leading to a further decline in the real estate cycle as a result of the drop in economic activity and employment. Against this background, the financial sector may be exposed to the risk of house and CRE price corrections, in particular where real estate exposures are significant, debt levels are elevated and prices are overvalued.

2 Financial markets

2.1 Coronavirus spread sparks extreme market volatility

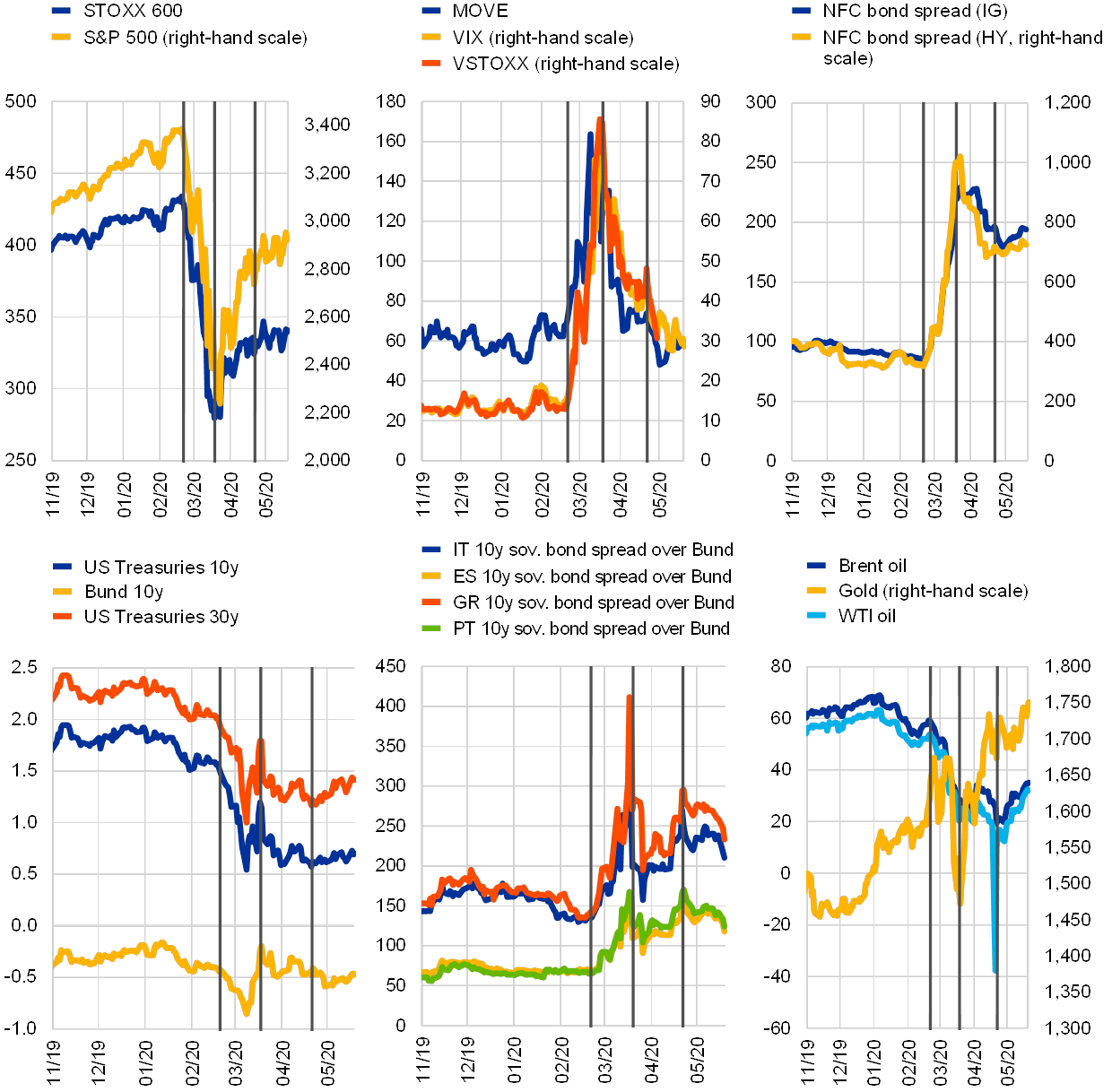

Riskier asset markets sold off rapidly in February and March as the coronavirus spread globally. Equity markets had recorded historical highs at the beginning of the year after global trade tensions had eased and global growth was widely projected to bottom out. But far-reaching public and economic lockdowns in many parts of the world to contain the spread of the virus triggered large and sudden price declines in global financial markets in February and March. Riskier asset classes, including equities and lower-rated debt, came under high selling pressure amid extreme levels of volatility (see Chart 2.1, first, second, third and fifth panels). The S&P 500 index recorded its fastest 20% decline in its history (16 trading days). Equity and bonds issued by the energy sector recorded some of the largest markdowns as extreme volatility extended to commodity prices (see Chart 2.1, sixth panel). In its initial phase, the market sell-off extended to several high-quality asset markets, including gold and top-rated government bonds (see Chart 2.1, fourth panel), as investors fled into liquidity.

Chart 2.1

Global financial markets responded to expected fallout from the coronavirus pandemic

Developments in major global financial asset markets

(first panel: index; second panel: volatility index; third panel: basis points; fourth panel: percentages per annum; fifth panel: basis points; sixth panel: US dollars per barrel (left-hand scale) and US dollars per ounce (right-hand scale))

Sources: Bloomberg and ECB calculations.

Notes: The black vertical lines mark the start of the global market correction (20 February 2020), the ECB’s announcement of the pandemic emergency purchase programme (PEPP) (18 March 2020), as well as the ECB’s decision to continue to accept downgraded bonds in its eligible collateral pool (22 April 2020). IG: investment grade; HY: high yield; NFC: non-financial corporate; WTI: West Texas Intermediate.

The extreme levels of market stress eased in late March when central banks and fiscal authorities across the world took extraordinary measures. Central banks engaged in asset purchases in primary and secondary securities markets and expanded collateral eligibility in the face of deteriorating market liquidity, which had undermined financial markets’ capacity to intermediate between the financial and non-financial sectors and, with it, the monetary policy transmission mechanism. The announcement by the ECB of the pandemic emergency purchase programme (PEPP) in particular contributed to reversing, at least temporarily, some of the previous widening of yields of both higher and lower-rated euro area sovereign bonds (see Chart 2.1, fourth and fifth panels). Moreover, the Governing Council’s decision to maintain collateral eligibility of bonds that had recently lost or would at some point lose investment-grade status helped to halt the widening of lower investment-grade sovereign spreads. Large fiscal stimulus measures (discussed in Chapter 1) also supported market sentiment and contributed to a rebound in riskier asset prices, while projected lower nominal growth and policy rates put downward pressure on benchmark bond yields on both sides of the Atlantic (see Chart 2.1, fourth panel).

Chart 2.2

Market volatility peaked across asset classes and regions

Realised volatility heat map

Source: Refinitiv.

Notes: Volatility estimates are derived from a non-overlapping quarterly sample of daily index returns. The colour code is based on the ranking of the estimates. Red, yellow and green indicate, respectively, high, medium and low volatility estimates compared with other periods. EMEs: emerging market economies; WTI: West Texas Intermediate.

Measures of market volatility, systemic stress and financial conditions reached historical highs. In March, the VIX index, gauging option-implied volatility in the US equity market, reached its highest level on record. Market volatility was also widespread across different regions and asset classes, resembling the pattern observed during the global financial crisis (see Chart 2.2). The parallel sell-off in different markets was also reflected in the sudden rise of the ECB’s composite indicator of systemic stress (CISS) for the euro area and the United States, in addition to a rapid tightening of measures of financial conditions for the non-financial sector (see Chart 2.3). Financial conditions tightened on account of both rising credit risk, as the macroeconomic and earnings outlook deteriorated, as well as higher risk premia (see Section 2.3). The CISS indices also surpassed the peak levels observed during the euro area sovereign debt crisis, although they remained below the record levels observed in 2008. This may in part reflect that, unlike in 2008, the financial sector was not at the core of the market turmoil. Unsecured and secured interbank markets proved overall resilient, with fewer signs of price dislocations than twelve years ago, as banks remained solvent and willing to lend to each other and the central counterparty clearing system provided stability in the derivatives market. That said, money and bond markets showed signs of tensions prior to central bank intervention (see Section 2.2).

Chart 2.3

Sharp movements in indices of financial conditions and systemic stress

Sources: Bloomberg, Refinitiv, Goldman Sachs and ECB calculations.

Notes: The chart on the left shows two financial conditions indices (FCIs), one constructed by the ECB (vector autoregression-based) and one by Goldman Sachs. They are constructed as weighted averages of different financial variables. For the ECB index, these variables include the one-year overnight index swap, the ten-year overnight index swap, the nominal effective exchange rate of the euro vis-à-vis 38 trading partners, and the EURO STOXX index. For the Goldman Sachs index, a broader set of variables is considered. The weight of each financial variable in the respective indices is based on its estimated relationship with key macroeconomic aggregates. The chart on the right shows a new daily version of the CISS that differs from the standard weekly CISS as shown in Chart 1 also in some computational aspects. The CISS captures stress symptoms (e.g. rising volatility, risk and liquidity spreads) in money, bond, equity and foreign exchange markets and by taking into account time-varying correlations across its 15 components it emphasises the pervasiveness of market stress. For more details about the CISS, see Holló, D., Kremer, M. and Lo Duca, M., “CISS – a composite indicator of systemic stress in the financial system”, Working Paper Series, No 1426, ECB, March 2012.

2.2 Central banks acted to restore liquidity in core market segments

Market stress in March was amplified by scarce liquidity across several asset classes. Market analysts reported that investors were seeking to liquidate positions across numerous asset classes in the first two weeks of March, partly resulting from investment fund share redemptions (see Chapter 4). During the most severe stress period in March, bid-ask spreads widened in most asset markets and dealers in various financial assets were increasingly unable or unwilling to absorb the sharply increasing supply of securities, including due to balance sheet constraints. Diverging corporate sector bond and credit default swap (CDS) spreads signalled difficulties in selling bonds as dealers were unwilling to absorb the large supply of bonds arising from rapid sales. The negative bases between the two assets suggest that investment-grade and high-yield bond spreads widened beyond the rise in perceived default risk and risk premia (see Chart 2.4, left panel). Although the bases narrowed in the course of March and April, they still ranged above the levels prevailing at the beginning of the year. Likewise, prices for exchange-traded funds (ETFs) tracking corporate bond indices fell below their net asset value (NAV) as authorised participants found it increasingly difficult to redeem shares by selling underlying bonds at the prices recorded by the index (see Chart 2.4, right panel). The widening in NAV spreads, which was the largest on record for these instruments, might have indicated that corporate bonds became even more illiquid than suggested by the CDS basis to the extent that bond prices temporarily became immeasurable. It might however also have reflected difficulties experienced by authorised participants in the ETF market in taking arbitrage opportunities (see Chapter 4).

Volatility-targeting and risk parity strategies might have procyclical effects on asset prices. Portfolio strategies based on volatility targets or risk parity may also have reinforced the market sell-off. Targeting a medium level of volatility, such strategies can afford a high degree of leverage during spells of low volatility. Conversely, the advent of high volatility and, in particular, the vanishing of diversification benefits have required such investors to rapidly unwind their leverage and to build up positive cash positions by selling large amounts of the bonds and equity in their portfolios, thereby likely reinforcing the initial market sell-off (see Box 2).

Chart 2.4

Typical market relationships broke down at the height of the market turmoil, resulting in a liquidity squeeze

Sources: Bloomberg and IHS Markit.

Notes: The CDS bond basis is defined as the difference between the ten-year senior CDS premium and the corporate bond option-adjusted spread. The NAV basis is defined as the difference between the ETF’s market price and its NAV. IG: investment grade; HY: high yield.

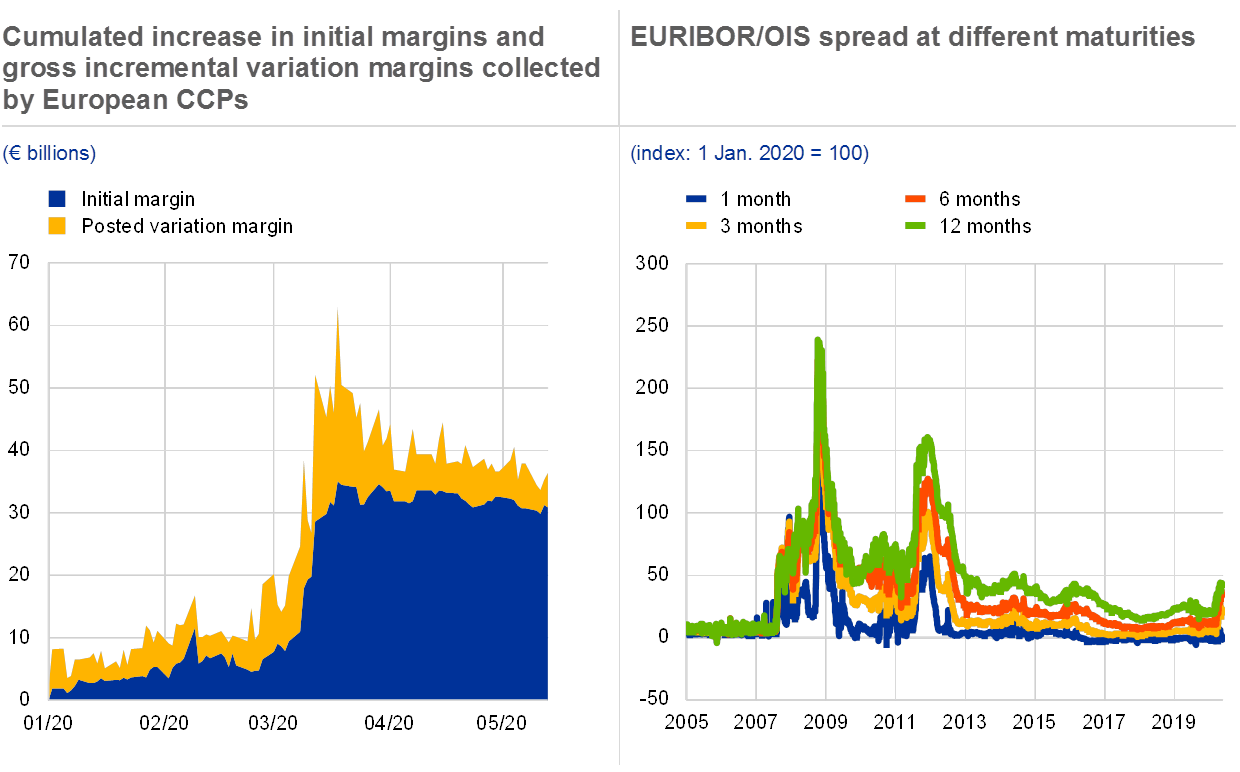

Higher margin calls for derivatives contracts added to the strong demand for cash. Central counterparties (CCPs) proved to be resilient to recent market stress. Volumes in some markets temporarily increased, as investors augmented their demand for hedging instruments in volatile markets. But rapid price movements and volatility in markets triggered considerable margin calls in March (see Chart 2.5, left panel, and Special Feature B). In order to meet such calls, investors may have liquidated some assets which could have added to the markdowns recorded in various asset markets. A lack of liquidity may have also prompted some investors to close highly leveraged positions, thereby also putting pressure on underlying asset prices. For instance, the temporary increase in long-term Treasury yields in early March was reportedly caused by arbitrageurs closing levered long positions in Treasury futures. The increase in initial margins stemmed from the recalibration of risk models to a higher-volatility environment. However, such models calibrated with buffers or subject to floors likely provided some cushion, which dampened the increase in initial margins. Looking ahead, corporate and sovereign downgrades may trigger renewed margin calls where those bonds are used as collateral. Market participants with deteriorating creditworthiness may face stricter trading or position limits as well as requests for dedicated margin add-ons by CCPs, possibly limiting the availability of market liquidity.

Peak demand for liquidity put strains on money markets. Money market funds (MMFs) came under severe liquidation pressure as financial and non-financial investors redeemed large amounts of shares. This is turn led to a freeze in demand and issuance of commercial paper, an important source of short-term funding for financial and non-financial corporates (see Box 7). High demand for precautionary cash buffers and a diminishing supply of term interbank loans have also increased funding costs in unsecured money markets, predominantly at longer maturities (see Chart 2.5, right panel).

Chart 2.5

Derivatives and money markets remained functional despite higher margin calls

Sources: ECB (EMIR data), Bloomberg.

Note: The left chart depicts an aggregate increase in initial margin relative to levels prevailing on 1 January 2020 and in variation margin posted by euro area clearing members of four EU and UK central counterparties. OIS: overnight index swap.

Central banks across the globe intervened swiftly to ensure liquidity in financial markets. Even securities deemed as highly liquid, such as commercial paper, were shed by MMFs to meet rising redemption pressure. In the United States, sovereign and sub-sovereign bonds as well as mortgage-backed securities (MBS) temporarily came under selling pressure, reflecting inter alia the winding-down of leveraged positions in these markets. Overall, the demand for cash was more pronounced in US markets as monetary conditions had been tighter going into the stress, and the banking system had not been as well equipped with reserves as in the euro area. The Federal Reserve, in turn, provided large amounts of liquidity by intervening in various securities markets, such as those for Treasuries, MBS, MMF shares as well as corporate bonds, including in the form of ETFs.

The Eurosystem also provided liquidity by means of various monetary policy measures. Most prominently, the Eurosystem contributed to easing scarcity in market liquidity by significantly expanding corporate and sovereign bond purchases under the asset purchase programme (APP) and the PEPP (see Chart 2.6, left panel).[2] The ECB’s Governing Council also extended its support to previously ineligible assets by including Greek government bonds and commercial paper in its asset purchases and collateral pool and by extending the eligibility of marketable collateral assets that are downgraded.[3] In addition, the additional flexibility with respect to sovereign issuer limits under the PEPP contributed to restoring market liquidity. The tensions in unsecured money markets eased after the announcement of the pandemic emergency longer-term refinancing operations (PELTROs), which act as a backstop to market funding needs. Finally, financial institutions’ increasing demand for US dollar liquidity, reflected in higher US dollar funding costs in the cross-currency swap market, was met by more frequent US dollar tender operations at more favourable terms and extended maturities (see Chart 2.6, right panel) provided by the Eurosystem in coordination with other central banks participating in the swap line network.[4]

Chart 2.6

Eurosystem provided liquidity in securities and US dollar markets

Sources: Bloomberg and ECB.

Box 2

Volatility-targeting strategies and the market sell-off

Low financial market volatility in the years prior to the coronavirus outbreak increased the popularity of investment strategies based on targeting volatility. Low volatility across major asset classes and regions had been a key feature of global asset price developments until recently.[5] Investments following strategies which are reliant on low market volatility have grown over recent years, with varying estimates. Globally, there may be funds with assets under management worth up to USD 2 trillion invested in some form of volatility strategies[6], with USD 300 billion invested in some 100 risk parity funds, a well-known hedge fund strategy for multi-asset funds.[7] Additional leverage deployed in these funds raises their market-moving capacity.

More2.3 Markets governed by increasing macro and credit risk

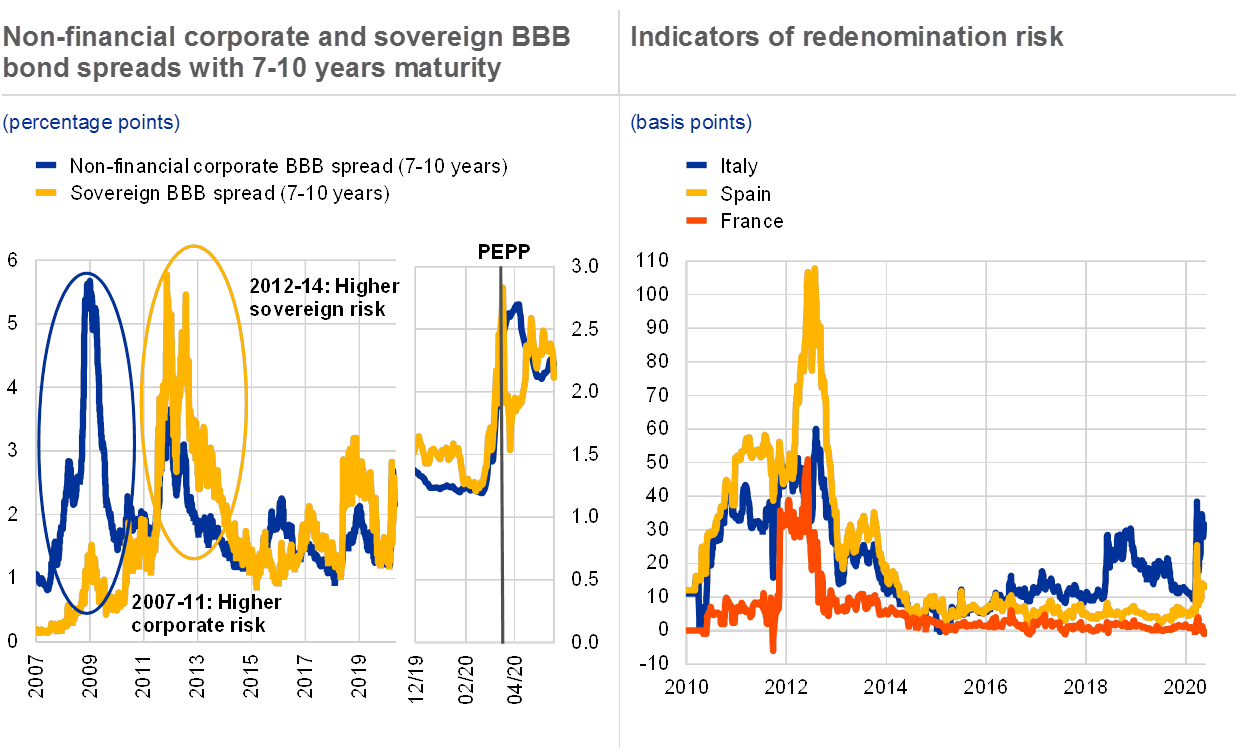

Sizeable revisions to near-term earnings expectations weighed on asset prices. Notwithstanding the various amplifying effects from scarce market liquidity, price declines in equity and credit markets first and foremost reflect lower expected earnings and elevated corporate default risk. Near-term earnings expectations for listed corporates have fallen sharply as they have drawn down on credit lines as cash flows evaporated which, in turn, raised corporate leverage ratios (see Chapter 1). Higher credit risk is mirrored in an acute increase in credit spreads of corporate as well as sovereign bonds with lower investment-grade and sub-investment-grade ratings. While previous systemic crises were characterised by a sharper rise in spreads in either the corporate (2008-09) or the sovereign (2011-12) sector, the current episode features a significant increase in both corporate and sovereign bond spreads (see Chart 2.7, left panel).

Sovereign credit spreads have been sensitive to policies at the European level. Sovereign spreads of euro area countries with lower credit ratings have risen as both the sharp decline in GDP and significant fiscal deficits may inflate debt-to-GDP ratios over the near-to-medium term. That said, the economic cost of and the adverse market impact associated with an inadequate fiscal response would likely have been more severe. The ECB’s announcements of significant and swift sovereign bond purchases under the public sector purchase programme (PSPP) and the PEPP helped to reverse the widening of sovereign spreads over the short term. Over the medium term, however, sovereign spreads might increase if investors assess that public debt sustainability has deteriorated. Higher sovereign spreads might, in turn, cascade to other market segments through banks’ sovereign exposures and through public guarantees on non-financial corporate debt. Yields in all jurisdictions may also rise if official and private demand do not keep up with the rapid increase in sovereign bond issuance. Fiscal policies that increase the supply of bonds issued by highly rated European entities relative to that of individual sovereigns will arguably reduce overall sovereign funding costs and, in some jurisdictions, decrease sovereign spreads via reduced fiscal debt levels, other things being equal. Should measures taken at the national or European level be deemed insufficient to preserve debt sustainability, the market assessment of redenomination risk might rise further (see Chart 2.7, right panel).

Chart 2.7

Increasing corporate and credit risk

Sources: IHS Markit and Refinitiv.

Notes: Italian, Cypriot and Portuguese sovereign bonds currently have a BBB rating on average. The right panel shows the redenomination risk in Italy, Spain and France at the three-year maturity in basis points. It is measured as the difference between the “quanto” CDS for Italy, Portugal and Spain and the “quanto” CDS for Germany. The “quanto” CDS is computed as the difference between the sovereign CDS quotes in US dollars and euro. For more details, see De Santis, R., “Redenomination risk”, Journal of Money, Credit and Banking, Vol. 51(8), pp. 2173-2206.

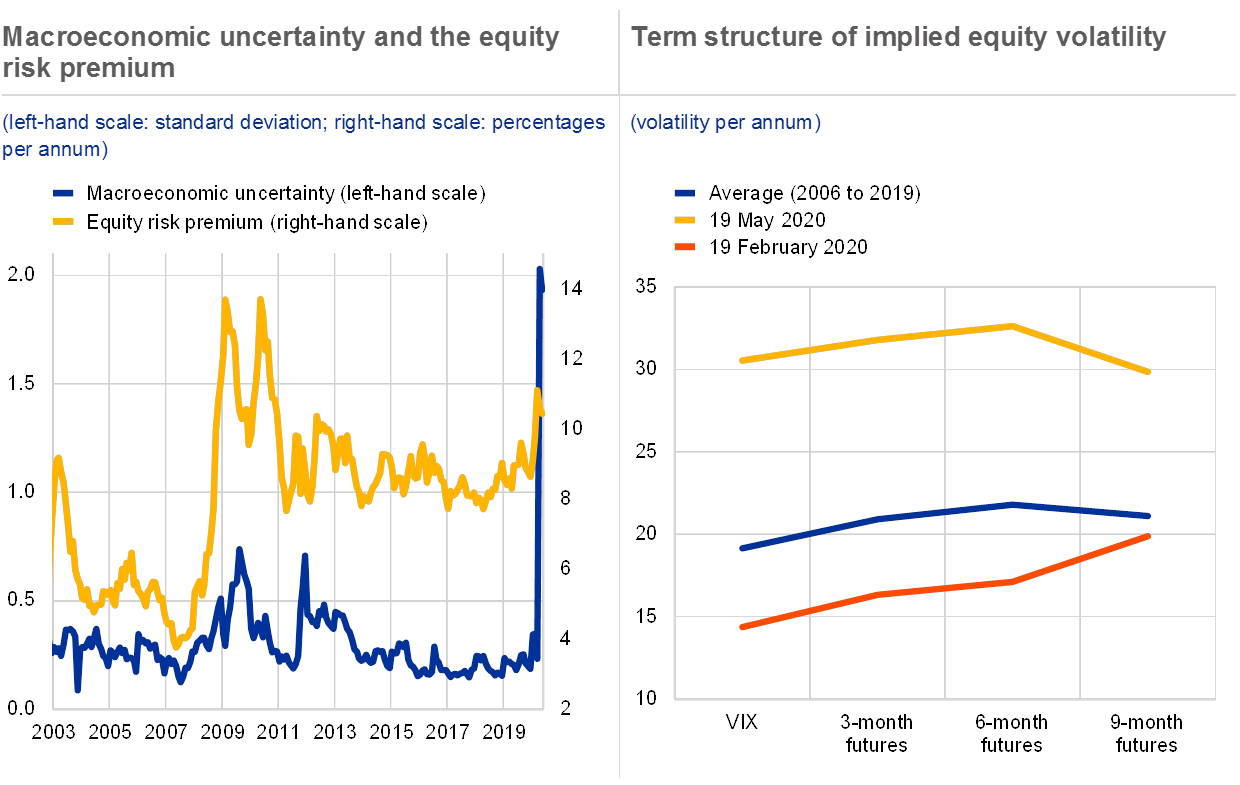

High uncertainty about future economic outcomes added to the widening of financial asset risk premia. Beyond the adverse economic shock itself, the high uncertainty surrounding the outlook for growth, corporate earnings and defaults has also weighed on asset prices. Investors are requiring higher risk premia to compensate for the increased downside risks to earnings and creditworthiness. The current extreme levels of macroeconomic uncertainty would even be consistent with a more pronounced widening of risk premia in equity markets (see Chart 2.8, left panel). Hence, a further sharp correction in asset prices may materialise if GDP and earnings growth outturns match the more pessimistic scenarios, which have become more probable. These extreme levels of economic uncertainty are also evident in market-implied projections of equity price volatility. While volatility is known to be mean reverting in normal times, it can become highly persistent in periods of extreme market stress.[8] This has been seen in large daily or intraday price fluctuations in the absence of major economic news as investors are very uncertain about the future path of earnings. Futures-implied forecasts of the VIX index indicate that the high-volatility regime could persist for several months (see Chart 2.8, right panel).

Chart 2.8

Rising macroeconomic and market uncertainty contributed to widening risk premia

Sources: Consensus Economics, Refinitiv and ECB.

Notes: Left panel: macroeconomic uncertainty is computed as the standard deviation across forecasts for next year’s euro area annual GDP growth by the participants in the Consensus Economics survey of forecasters. The equity risk premium is derived from a dividend discount model. The model includes share buybacks, discounts future cash flows with interest rates of appropriate maturity, and includes five expected dividend growth horizons. See Economic Bulletin, Issue 4, ECB, 2018, for more details. Right panel: the implied volatility term structure is based on the VIX index as well as futures on the VIX with three, six and nine-month maturities.